Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269841

PROSPECTUS

Up to 2,016,129 shares of Class A Common

Stock

This prospectus relates to the resale of up to 2,016,129 shares of

Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), of AgileThought, Inc. (the “Company”,

“us” or “we”) which may be offered by MC Agent, LLC (“MC Agent” or the “Selling Securityholder”)

from time to time. The shares were issued pursuant to the equity issuance agreement, dated December 28, 2021, between the Company and

Monroe Capital Management Advisors, LLC (“Monroe”) (as amended, the “Equity Issuance Agreement”), and the amended

and restated credit agreement, dated as of July 18, 2019, by and among the Company, certain subsidiaries of the Company, the financial

institutions party thereto as lenders and Monroe, as administrative agent (as amended, the “First Lien Credit Facility”).

The shares of Class A Common Stock were subsequently transferred by Monroe to MC Agent.

We do not expect to receive

any cash proceeds from the sales of shares of our Class A Common Stock by MC Agent; however, the terms of the Equity Issuance Agreement

require MC Agent to apply 100% of the net proceeds from the sale of the shares to the Outstanding Fees (as defined below) owed by the

Company under the First Lien Credit Facility. In addition, if MC Agent’s net proceeds from sales of the shares exceed the Outstanding

Fees owed by the Company under the First Lien Credit Facility, MC Agent shall remit such excess cash proceeds to the Company. Upon payment

in full of the Outstanding Fees in cash by us or through sales of the shares by MC Agent, MC Agent shall return any of the unsold shares

to us. At December 31, 2022, fees payable by us on or before May 25, 2023 totaled approximately $3.45 million (the “Outstanding

Fees”). See “Selling Securityholder” for a description of the Equity Issuance Agreement and for additional information

regarding Monroe and MC Agent.

MC Agent may be deemed to

be an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the

“Securities Act”). MC Agent may offer the shares directly or through agents or to or through underwriters or dealers.

The shares may be offered and sold through public or private transactions at market prices prevailing at the time of sale, at a fixed

price or fixed prices, at negotiated prices, at various prices determined at the time of sale or at prices related to prevailing market

prices. The registration of the offering of the shares hereunder does not mean that MC Agent will actually offer or sell all 2,016,129

shares of Class A Common Stock. See “Plan of Distribution” for more information about how MC Agent may sell the shares

of Class A Common Stock being offered pursuant to this prospectus.

Our Class A Common Stock is

listed on the Nasdaq Capital Market under the symbol “AGIL.” On February 28, 2023, the Company had 50,032,843 shares issued

and outstanding and the last reported sale price of our Class A Common Stock was $4.30 per share.

Except for discounts, selling

commissions and stock transfer taxes applicable to the sale of the shares of our Class A Common Stock, we will pay the expenses incurred

in registering the shares, including legal and accounting fees. See “Plan of Distribution.”

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

on page 5 of this prospectus and under similar headings in any applicable prospectus supplement, any free writing prospectuses we have

authorized for use in connection with a specific offering and in the documents incorporated by reference herein and therein.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is February 28, 2023

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using the “shelf”

registration process. Under this process, the Selling Securityholder may from time to time, in one or more offerings, sell the shares

of Class A Common Stock described in this prospectus.

Neither

we nor the Selling Securityholder have authorized anyone to provide you with any information or to make any representations other than

those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of

us or to which we have referred you. Neither we nor the Selling Securityholder take responsibility for, or provide any assurance as to

the reliability of, any other information that others may give you. Neither we nor the Selling Securityholder will make an offer to sell

these securities in any jurisdiction where the offer or sale is not permitted.

The information contained

in this prospectus, any applicable prospectus supplement, any related free writing prospectus, and the documents incorporated by reference

herein and therein, are accurate only as of their respective dates, regardless of the time of delivery of this prospectus, any applicable

prospectus supplement or any related free writing prospectus, or any sale of a security. We urge you to read carefully this prospectus

(as supplemented and amended), together with the information incorporated herein by reference as described under the heading “Incorporation

of Certain Information by Reference” before deciding whether to invest in any of the Class A Common Stock being offered.

This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More

Information.”

Unless

the context indicates otherwise, references in this prospectus to the “Company,” “AgileThought,” “we,”

“us,” “our” and similar terms refer to AgileThought, Inc., a Delaware corporation.

SUMMARY

This

summary highlights information contained elsewhere in this prospectus or incorporated by reference herein and does not contain all of

the information that you should consider in making your investment decision. Before investing in our securities, you should carefully

read this entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing

in our securities discussed under the heading “Risk Factors” herein and under similar headings in the applicable prospectus

supplement, any related free writing prospectus and the documents incorporated by reference herein and therein. You should also carefully

read the information incorporated by reference in this prospectus, including our financial statements, and the exhibits to the registration

statement of which this prospectus is a part.

Business Overview

Our mission is to fundamentally

change the way people and organizations view, approach and achieve digital transformation. We help our clients transform their businesses

by innovating, building, continually improving and running new technology solutions at scale. Our services enable our clients to more

effectively leverage technology, optimize cost, grow, and compete.

We combine our agile-first

approach with expertise in next-generation technologies to help our clients overcome the challenges of digital transformation to innovate,

build, run and continually improve solutions at scale using DevOps tools and methodologies. We offer client-centric, onshore and nearshore

digital transformation services that include consulting, design and user experience, custom enterprise application development, DevOps,

cloud computing, mobile, data management, advanced analytics and automation expertise. Our professionals have direct industry operating

expertise that allows them to understand the business context and the technology pain points that enterprises encounter. We leverage this

expertise to create customized frameworks and solutions throughout clients’ digital transformation journeys. We invest in understanding

the specific needs and requirements of our clients and tailor our services for them. We believe our personalized, hands-on approach allows

us to demonstrate our differentiated capabilities and build trust and confidence with new clients and strengthen relationships with current

ones, which enables a trusted client advisor relationship. By leveraging our AgileThought Scaled Framework and our industry expertise,

we rapidly and predictably deliver enterprise-level software solutions at scale. Our deep expertise in next-generation technologies facilitates

our ability to provide enterprise-class capabilities in key areas of digital transformation.

History of the Company

We offer client-centric, onshore

and nearshore agile-first digital transformation services that help our clients transform by building, improving and running new solutions

at scale. Our services enable our clients to leverage technology more effectively to focus on better business outcomes. From consulting

to application development and cloud services to data management and automation, we strive to create a transparent, collaborative, and

responsive experience for our clients.

Prior to our incorporation

in Delaware, we were a variable stock corporation organized under the laws of Mexico. We filed a Certificate of Domestication and a Certificate

of Incorporation to become a Delaware corporation in February 2019 and changed our name to AN Global Inc. On October 23, 2019, we filed

a Certificate of Amendment to our Certificate of Incorporation to change our name to AgileThought, Inc.

Since our inception, we have

added a variety of services, acquired several businesses and expanded our operations throughout North America:

| ● | 2000: Founded in Mexico. |

| ● | 2015 – 2016: Partnered with Nexxus, completed five acquisitions and established capabilities in

digital transformation, cloud solutions, advanced analytics and digital marketing. Also launched digital transformation services. |

| ● | 2017:

Partnered with Credit Suisse, completed three acquisitions and established capabilities in

ecommerce. |

| ● | 2018:

Acquired 4th Source, expanded U.S. footprint and enhanced presence with clients from the

healthcare industry. |

| ● | 2019:

Acquired AgileThought, LLC, expanded U.S. footprint, enhanced delivery capabilities

and presence with large clients within the professional services industry, relocated global

headquarters to Dallas, Texas and changed name to AgileThought, Inc. |

On August 23, 2021 (“Closing

Date”), LIV Capital Acquisition Corp. (“LIVK”), a special purpose acquisition company, and AgileThought, Inc. (“Legacy

AgileThought”) consummated the transactions contemplated by the definitive agreement and plan of merger (“Merger Agreement”),

dated May 9, 2021 (“Business Combination”). Pursuant to the terms of the Merger Agreement, Legacy AgileThought merged with

and into LIVK, whereupon the separate corporate existence of Legacy AgileThought ceased, with LIVK surviving such merger (the “Surviving

Company”). On the Closing Date, the Surviving Company changed its name to AgileThought, Inc., under which we operate today.

Emerging Growth Company Status

We are an “emerging

growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). As an emerging growth company,

we are exempt from certain requirements related to executive compensation, including the requirements to hold a nonbinding advisory vote

on executive compensation, to provide information relating to the ratio of total compensation of our Chief Executive Officer to the median

of the annual total compensation of all of our employees and to disclose information reflecting

the relationship between executive compensation actually paid by us and our financial performance, each as required by the Investor

Protection and Securities Reform Act of 2010, which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Section 102(b)(1) of

the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until

private companies are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company

can choose not to take advantage of the extended transition period and comply with the requirements that apply to non-emerging growth

companies, and any such election to not take advantage of the extended transition period is irrevocable.

Our

predecessor (LIV Capital Acquisition Corp.) elected to avail itself of the extended transition period, and following the

consummation of the Business Combination, we remain an emerging growth company and are taking advantage of the benefits of the

extended transition period that emerging growth company status permits. During the extended transition period, it may be difficult

or impossible to compare our financial results with the financial results of another public company that complies with public

company effective dates for accounting standard updates because of the potential differences in accounting standards used.

We will remain an emerging

growth company under the JOBS Act until the earliest of (a) December 31, 2024, (b) the last date of our fiscal year in which

we have a total annual gross revenue of at least $1.07 billion, (c) the date on which we are deemed to be a “large accelerated

filer” under the rules of the SEC with at least $700.0 million of outstanding securities held by non-affiliates or

(d) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the previous

three years.

Risks Associated with our Business

Our business is subject to

numerous risks, as described under the heading “Risk Factors” and under similar headings in the applicable prospectus

supplement, any related free writing prospectus and the documents incorporated by reference herein and therein.

Corporate Information

Our principal executive offices

are located at 222 W. Las Colinas Blvd. Suite 1650E, Irving, Texas 75039, and our telephone number is (971) 501-1440. Our corporate

website address is www.agilethought.com. Information contained on or accessible through our website is not a part of this

prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

“AgileThought”

and our other registered and common law trade names, trademarks and service marks are property of AgileThought, Inc. This prospectus contains,

and any applicable prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein and therein

may contain, additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely

for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols.

The Offering

| Class A Common Stock offered by the Selling Securityholder |

|

Up to 2,016,129 shares that the

Selling Securityholder may sell from time to time after the date of this prospectus. |

| |

|

|

| Class A Common Stock outstanding |

|

50,032,843 shares as of February 28, 2023*. |

| |

|

|

| Use of proceeds |

|

We do not expect to receive any cash proceeds from the sales of shares

of our Class A Common Stock by MC Agent; however, the terms of the Equity Issuance Agreement require MC Agent to apply 100% of the net

proceeds from the sale of the shares to the Outstanding Fees owed by us under the First Lien Credit Facility. In addition, if MC Agent’s

net proceeds from sales of the shares exceed the Outstanding Fees owed by us under the First Lien Credit Facility, MC Agent shall remit

such excess cash proceeds to us. Upon payment in full of the Outstanding Fees in cash by us or through sales of the shares by MC Agent,

MC Agent shall return any of the unsold shares to us. At December 31, 2022, Outstanding Fees payable by us on or before May 25, 2023 totaled

approximately $3.45 million. See “Selling Securityholder” for a description of the Equity Issuance Agreement.

|

| |

|

|

| Market for Class A Common Stock |

|

Our Class A Common Stock is currently traded on The Nasdaq Capital Market under the symbol “AGIL.” |

| |

|

|

| Risk factors |

|

This investment involves a high degree of risk. Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” beginning on page 5. |

| * |

The number of shares of our Class A Common Stock outstanding

excludes (1) shares reserved for issuance upon settlement of restricted stock units outstanding, (2) shares reserved for future grant

or issuance under our 2021 Equity Incentive Plan, (3) shares issuable upon the exercise of outstanding public and private warrants, (4)

shares issuable upon conversion of our second lien facility with Nexxus Capital and Credit Suisse (both of which are existing shareholders

and have representation on our board of directors), Manuel Senderos, Chief Executive Officer and Chairman of the Board of Directors,

and Kevin Johnston, Chief Operating Officer and (5) shares issuable upon the exercise of the First Lien Warrants (as defined herein). |

For additional information concerning the offering, see “Plan

of Distribution.”

Risk

Factors

Investing

in our Class A Common Stock involves a high degree of risk. You should carefully consider the risks and uncertainties in the documents

incorporated by reference into this prospectus (including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form

10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC) and in any accompanying prospectus supplement and

any related free writing prospectus, together with other information contained and incorporated by reference in the foregoing. The risks

and uncertainties described in these documents are not the only ones we face. Additional risks and uncertainties not presently known

to us or that we currently believe to be immaterial may also adversely affect our business. If any of the events or developments described

in these documents were to occur, our business, prospects, operating results and financial condition could suffer materially, the trading

price of our Class A Common Stock could decline, and you could lose all or part of your investment. Please also read carefully the section

below entitled “Cautionary Note Regarding Forward-Looking Statements.”

The following additional risk relates to the sale of shares of Class

A Common Stock hereunder by MC Agent:

Sales of shares by MC Agent may affect

the price of our Class A Common Stock and make it more difficult for us to raise additional equity capital.

Subject to the terms and conditions of the Equity Issuance Agreement,

up to 2,016,129 shares registered hereunder may be sold by MC Agent to apply 100% of the net proceeds from the sale of the shares to the

Outstanding Fees owed by the Company under the First Lien Credit Facility. At December 31, 2022, fees payable by us on or before May 25,

2023 totaled approximately $3.45 million (the “Outstanding Fees”). If MC Agent’s net proceeds from sales of the shares

exceed the Outstanding Fees owed by us under the First Lien Credit Facility, MC Agent shall remit such excess cash proceeds to us. In

addition, upon payment in full of the Outstanding Fees in cash by us or through sales of the shares by MC Agent, MC Agent shall return

any of the unsold shares to us. The sale by MC Agent of a substantial number of shares of our Class A Common Stock in the public market

could occur at any time from the date of effectiveness of the registration statement of which this prospectus forms a part and until the

total Outstanding Fees are paid in full. These sales, or the perception in the market that MC Agent intends to sell shares, could reduce

the market price of our Class A Common Stock, or cause the market for our Class A Common Stock to be highly volatile. MC Agent may ultimately

sell all, some or none of the shares of Class A Common Stock registered in this prospectus. If MC Agent sells a substantial number of

shares of our Class A Common Stock, or if investors expect that MC Agent will do so, the actual sales of shares or the expectation that

MC Agent may sell shares may make it more difficult for us to sell equity or equity-related securities in the future at a time and at

a price that we might otherwise wish to effect such sales.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, the applicable prospectus supplement and any free writing prospectus, including the documents we incorporate by reference

herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these forward-looking statements

on our current expectations and projections about future events. All statements, other than statements

of present or historical fact included in this prospectus, our future financial performance, strategy, future operations, future operating

results, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements.

Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such

as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “will,” “would” or the negative of such terms or other similar expressions.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our

actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements.. We caution you that these forward-looking statements

are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

Forward-looking

statements contained in this prospectus, the applicable prospectus supplement and any free writing prospectus, including the documents

we incorporate by reference herein and therein include, but are not limited to, statements regarding:

| ● | the

financial and business performance of the Company; |

| ● | our

ability to repay and/or continue to service our indebtedness; |

| ● | our

future capital requirements and sources and uses of cash; |

| ● | our

ability to obtain funding for our future operations; |

| ● | our

business, expansion plans and opportunities; |

| ● | changes

in our strategy, future operations, financial position, estimated revenues and losses, projected

costs, prospects and plans; |

| ● | our

ability to develop, maintain and expand client relationships, including relationships with

our largest clients; |

| ● | changes

in domestic and foreign business, market, financial, political, regulatory and legal conditions; |

| ● | our

ability to recognize the anticipated benefits of the business combination, which may be affected

by, among other things, competition and our ability to grow and manage growth profitably; |

| ● | costs

related to the business combination; |

| ● | our

ability to successfully identify and integrate any future acquisitions; |

| ● | our

ability to attract and retain highly skilled information technology professionals; |

| ● | our

ability to maintain favorable pricing, utilization rates and productivity levels for our

information technology professionals and their services; |

| ● | our

ability to innovate successfully and maintain our relationships with key vendors; |

| ● | our

ability to provide our services without security breaches and comply with changing regulatory,

legislative and industry standard developments regarding privacy and data security matters; |

| ● | our

ability to operate effectively in multiple jurisdictions in Latin America and in the United

States in the different business, market, financial, political, legal and regulatory conditions

in the different markets; |

| ● | developments

and projections relating to our competitors and industry; |

| ● | the

impact of health epidemics, including the COVID-19 pandemic, on our business and the actions

we may take in response thereto; |

| ● | expectations

regarding the time during which we will be an emerging growth company under the Jumpstart

Our Business Startups Act of 2012, as amended; |

| ● | changes

in applicable laws or regulations; |

| ● | the

outcome of any known and unknown litigation or legal proceedings and regulatory proceedings

involving us; and |

| ● | our

ability to maintain the listing of our securities. |

We

caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus, the applicable prospectus

supplement and any free writing prospectus, including the documents we incorporate by reference herein and therein. The forward-looking

statements made in these documents relate only to events as of the date on which the statements are made. We may not actually achieve

the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking

statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law.

USE

OF PROCEEDS

This prospectus relates to

shares of our Class A Common Stock that may be offered and sold from time to time by MC Agent.

We do not expect to receive

any cash proceeds from the sales of shares of our Class A Common Stock by MC Agent in this offering; however, the terms of the Equity

Issuance Agreement require MC Agent to apply 100% of the net proceeds from the sale of the shares to the Outstanding Fees owed by us under

the First Lien Credit Facility. If MC Agent’s net proceeds from sales of the shares of Class A Common Stock exceed the Outstanding

Fees owed by us under the First Lien Credit Facility, MC Agent shall remit such excess cash proceeds to us. In addition, upon payment

in full of the Outstanding Fees in cash by us or through sales of the shares by MC Agent, MC Agent shall return any of the unsold shares

to us. At December 31, 2022, Outstanding Fees payable by us on or before May 25, 2023 totaled approximately $3.45 million.

See

“Selling Securityholder” for a description of the Equity Issuance Agreement.

DETERMINATION

OF OFFERING PRICE

We

cannot currently determine the price or prices at which shares of our Class A Common Stock may be sold by the Selling Securityholder

under this prospectus.

SELLING

SECURITYHOLDER

This prospectus relates to

sales by MC Agent, the Selling Securityholder, of up to 2,016,129 of shares of our Class A Common Stock issued pursuant to the Equity

Issuance Agreement. We are filing the registration statement of which this prospectus forms a part pursuant to the provisions of the registration

rights agreement, dated December 28, 2021, between us and Monroe (the “Registration Rights Agreement”), in which we agreed

to provide certain registration rights with respect to sales of the shares of our Class A Common Stock covered by this prospectus. We

currently have no other agreements, arrangements or understandings with the Selling Securityholder regarding the sale of any of the shares,

other than the Selling Securityholder’s agreement under the Equity Issuance Agreement to return to us any of the shares that have

not been sold upon repayment of the Outstanding Fees owed by us under the First Lien Credit Facility and remit excess cash proceeds to

us to the extent the net proceeds from sales of the shares by the Selling Securityholder exceed the Outstanding Fees. See “The

Equity Issuance Agreement,” below.

The following table presents information regarding the Selling Securityholder

and the shares that it may offer and sell from time to time under this prospectus. The table is prepared based on information supplied

to us by the Selling Securityholder, and reflects its holdings as of February 28, 2023. The applicable

percentage ownership of Class A Common Stock is based on 50,032,843 shares of Class A Common

Stock outstanding as of February 28, 2023. We have determined beneficial ownership in accordance with the rules of the SEC.

The

number of shares beneficially owned after this offering assumes the sale of all of the shares offered by the Selling Securityholder pursuant

to this prospectus. However, because the Selling Securityholder may sell all or some of their shares under this prospectus from time

to time, or in another permitted manner, we cannot assure you as to the actual number of shares that will be sold by the Selling Securityholder.

We do not know how long the Selling Securityholder will hold the shares before selling them. See “Plan of Distribution.”

Shares

of Class A Common Stock issuable upon the exercise of the First Lien Warrant (as defined below) are not included in the table below and

are not being offered under this prospectus.

| |

|

Shares Beneficially

Owned

Prior to Offering |

|

|

Maximum

Number of

Shares to be

Sold

Pursuant to

this

|

|

|

Shares

Beneficially

Owned

After Offering |

|

| Name of Selling Securityholder |

|

Number |

|

|

Percent |

|

|

Prospectus |

|

|

Number |

|

|

Percent |

|

| MC Agent, LLC(1) |

|

|

2,016,129 |

|

|

4.0 |

% |

|

|

2,016,129 |

|

|

|

0 |

|

|

|

0.00 |

% |

| (1) |

All investment decisions over the shares of Class A Common Stock held

by MC Agent are made by unanimous vote of Monroe’s investment committee which is comprised of ten members, and no single member

has any ability to make any such decisions unilaterally. Such investment committee members expressly disclaim beneficial ownership of

all shares held by MC Agent. The address of MC Agent is 311 South Wacker Drive, Suite 6400, Chicago, Illinois 60606. MC Agent is not a

licensed broker dealer or an affiliate of a licensed broker dealer. |

The

Equity Issuance Agreement

In 2018, we entered into the

First Lien Credit Facility pursuant to which Monroe served as the administrative agent to the lenders and the lead arranger. In connection

with certain amendments to the First Lien Credit Facility, we (1) issued to Monroe, in its capacity as the agent for the lenders, 4,439,333

shares of Class A Common Stock on December 29, 2021 pursuant to the Equity Issuance Agreement (the “First Lien Shares”) and

(2) will issue to Monroe or any one or more lender(s) under the First Lien Credit Facility a warrant to purchase shares of Class A Common

Stock (the “First Lien Warrant”) upon the earlier of repayment of the Outstanding Fees owed by us under the First Lien Credit

Facility and August 29, 2023. The number of shares of Class A Common Stock underlying the First

Lien Warrant will equal $7.0 million divided by the average closing price per share of our Class A Common Stock on The Nasdaq Capital

Market for the 20 consecutive trading days preceding the warrant issuance date. The First Lien Warrant, when issued, shall be immediately

exercisable at $0.0001 per share and shall have a term of five years. Upon issuance of the First

Lien Warrant, we will be required to file a registration statement with respect to the resale of the shares underlying the First Lien

Warrant.

On May 27, 2022, we refinanced

the First Lien Credit Facility and repaid approximately $40.2 million of outstanding principal, interest, and a portion of the fees owed

on the First Lien Credit Facility. In addition, we and Monroe entered into an amendment to the Equity Issuance Agreement pursuant

to which Monroe returned 2,423,204 First Lien Shares to us and retained 2,016,129 First Lien Shares as security for the unpaid Outstanding

Fees. Monroe transferred the First Lien Shares and assigned all of its rights, duties and obligations under the Equity Issuance Agreement

and the Registration Rights Agreement to MC Agent on February 14, 2023. Pursuant to the terms of the amended Equity Issuance Agreement,

MC Agent may sell the remaining First Lien Shares and apply 100% of the net proceeds to the Outstanding Fees owed by us under the First

Lien Credit Facility. If MC Agent’s net proceeds from sales of the First Lien Shares exceed the Outstanding Fees owed by us, MC

Agent shall remit such excess cash proceeds to us. In addition, upon payment in full of the Outstanding Fees in cash by us or through

sales of the First Lien Shares by MC Agent, MC Agent shall return any of the unsold First Lien Shares to us.

At December 31, 2022, Outstanding

Fees payable by us on or before May 25, 2023 totaled approximately $3.45 million.

Neither Monroe, MC Agent nor

any of their respective affiliates has held a position or office, or had any other material relationship, with us or any of our predecessors

or affiliates, other than Monroe’s role as administrative agent to the lenders and lead arrangers under the First Lien Credit Facility.

Monroe made an independent investment decision to enter into the First Lien Credit Facility, Equity Issuance Agreement and Registration

Rights Agreement.

DESCRIPTION

OF CLASS A COMMON STOCK

The

following description of our Class A Common Stock and certain provisions of our amended and restated certificate of incorporation (the

“charter”) and bylaws (the “bylaws”), are summaries and are qualified in their entirety by reference to the full

text of the charter and bylaws, copies of which have been filed with the SEC, and applicable provisions of the General Corporation Law

of the State of Delaware (the “DGCL”).

General

Our

charter authorizes the issuance of 220,000,000 shares of capital stock, consisting of (x) 210,000,000 shares of Class A Common Stock,

par value $0.0001 per share, and (y) 10,000,000 shares of our preferred stock, par value $0.0001 per share.

As of February 28, 2023, there

were 50,032,843 shares of our Class A Common Stock outstanding and no shares of preferred stock outstanding.

Class

A Common Stock

Listing

Our

Class A Common Stock is listed on The Nasdaq Capital Market under the symbol “AGIL.”

Voting

Rights

Each

holder of the shares of Class A Common Stock is entitled to one vote for each share of Class A Common Stock held of record by such holder

on all matters properly submitted to the stockholders for their vote; provided, however, that except as otherwise required by applicable

law, holders of Class A Common Stock shall not be entitled to vote on any amendment to the proposed charter that relates solely to the

terms of one or more outstanding series of preferred stock if the holders of such affected series are entitled, either separately or

together as a class with the holders of one or more other such series, to vote thereon pursuant to applicable law or the proposed charter

(including any certificate of designation filed with respect to any one or more series of preferred stock). The holders of the shares

of Class A Common Stock do not have cumulative voting rights in the election of directors. Generally, all matters to be voted on by stockholders

must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all stockholders

present in person or represented by proxy, voting together as a single class.

Dividend

Rights

Subject

to preferences that may be applicable to any outstanding preferred stock, the holders of shares of Class A Common Stock are entitled

to receive ratably such dividends, if any, as may be declared from time to time by our board of directors of out of funds legally available

therefor.

Rights

upon Liquidation, Dissolution and Winding-Up

In

the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders of the shares of Class A

Common Stock are entitled to share ratably in all assets remaining after payment of our debts and other liabilities, subject to prior

distribution rights of preferred stock or any class or series of stock having a preference over the shares of Class A Common Stock, then

outstanding, if any.

Preemptive

or Other Rights

The

holders of shares of Class A Common Stock have no preemptive or conversion rights or other subscription rights. There are no redemption

or sinking fund provisions applicable to the shares of Class A Common Stock.

Dividends

We

have not paid any cash dividends on our Class A Common Stock to date. The payment of cash dividends in the future will be dependent upon

our revenues and earnings, if any, capital requirements and general financial condition. The payment of any cash dividends is within

the discretion of our board of directors. In addition, our board of directors is not currently contemplating and does not anticipate

declaring any share dividends in the foreseeable future.

Certain

Anti-Takeover Provisions of Delaware Law, Our Charter and Our Bylaws

We

are a corporation incorporated under the laws of the State of Delaware, subject to the provisions of Section 203 of the DGCL, which we

refer to as “Section 203,” regulating corporate takeovers.

Section

203 prevents certain Delaware corporations, under certain circumstances, from engaging in a “business combination” with:

| |

● |

a stockholder

who owns fifteen percent or more of our outstanding voting stock (otherwise known as an “interested stockholder”); |

| |

● |

an affiliate

of an interested stockholder; or |

| |

● |

an associate

of an interested stockholder, for three years following the date that the stockholder became an interested stockholder. |

A

“business combination” includes a merger or sale of more than ten percent of our assets.

However,

the above provisions of Section 203 do not apply if:

| |

● |

our board

of directors approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the

transaction; |

| |

● |

after

the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at

least 85% of our voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of common

stock; or |

| |

● |

on or

subsequent to the date of the transaction, the business combination is approved by our board of directors and authorized at a meeting

of our stockholders, and not by written consent, by an affirmative vote of at least two-thirds of the outstanding voting stock not

owned by the interested stockholder. |

Our

charter, our bylaws and the DGCL contain provisions that could have the effect of rendering more difficult, delaying, or preventing an

acquisition deemed undesirable by our board of directors. These provisions could also make it difficult for stockholders to take certain

actions, including electing directors who are not nominated by the members of our board of directors or taking other corporate actions,

including effecting changes in our management. For instance, our charter does not provide for cumulative voting in the election of directors

and provides for a classified board of directors with three-year staggered terms, which could delay the ability of stockholders to change

the membership of a majority of our board of directors. Our board of directors are empowered to elect a director to fill a vacancy created

by the expansion of the board of directors or the resignation, death, or removal of a director in certain circumstances; and our advance

notice provisions in our bylaws require that stockholders must comply with certain procedures in order to nominate candidates to our

board of directors or to propose matters to be acted upon at a stockholders’ meeting.

Our

authorized but unissued common stock and preferred stock will be available for future issuances without stockholder approval and could

be utilized for a variety of corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit

plans. The existence of authorized but unissued and unreserved common stock and preferred stock could render more difficult or discourage

an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Charter

and Bylaws

Among

other things, our charter and our bylaws:

| |

● |

do not

provide for cumulative voting in the election of directors; |

| |

● |

provides

for the exclusive right of the board of directors to elect a director to fill a vacancy created by the expansion of the board of

directors or the resignation, death, or removal of a director by stockholders; |

| |

● |

permits

the board of directors to determine whether to issue shares of our preferred stock and to determine the price and other terms of

those shares, including preferences and voting rights, without stockholder approval; |

| |

● |

prohibits

stockholder action by written consent; |

| |

● |

requires

that a special meeting of stockholders may be called only by the chairperson of the board of directors, the chief executive officer

or the board of directors; |

| |

● |

limits

the liability of, and providing indemnification to, our directors and officers; |

| |

● |

controls

the procedures for the conduct and scheduling of stockholder meetings; |

| |

● |

provides

for a classified board, in which the members of the board of directors are divided into three classes to serve for a period of three

years from the date of their respective appointment or election; |

| |

● |

grants

the ability to remove directors with cause by the affirmative vote of 66 2⁄3% in voting power of the then outstanding shares

of capital stock of the Company entitled to vote at an election of directors; |

| |

● |

requires

the affirmative vote of at least 66 2⁄3% of the voting power of the outstanding shares of our capital stock entitled to vote

generally in the election of directors, voting together as a single class, to amend the bylaws or Articles V, VI, VII and VIII of

the charter; and |

| |

● |

provides

for advance notice procedures that stockholders must comply with in order to nominate candidates to the board of directors or to

propose matters to be acted upon at a stockholders’ meeting. |

The

combination of these provisions will make it more difficult for our existing stockholders to replace our board of directors as well as

for another party to obtain control of us by replacing our board of directors. Since our board of directors has the power to retain and

discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change

in management. In addition, the authorization of undesignated preferred stock makes it possible for our board of directors to issue preferred

stock with voting or other rights or preferences that could impede the success of any attempt to change our control.

These

provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies

and to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability

to hostile takeovers and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect

of discouraging others from making tender offers for our shares of Class A Common Stock and may have the effect of delaying changes in

our control or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our Class A Common

Stock.

Our

charter provides that the Court of Chancery of the State of Delaware will be the exclusive forum for actions or proceedings brought under

Delaware statutory or common law: (1) any derivative claim or cause of action brought on behalf of the Company; (B) any claim or cause

of action for breach of a fiduciary duty owed by any current or former director, officer or other employee of the Company, to the Company

or the Company’s stockholders; (C) any claim or cause of action against the Company or any current or former director, officer

or other employee of the Company, arising out of or pursuant to any provision of the DGCL, the charter or the bylaws of the Company (as

each may be amended from time to time); (D) any claim or cause of action seeking to interpret, apply, enforce or determine the validity

of the charter or the bylaws of the Company (as each may be amended from time to time, including any right, obligation, or remedy thereunder);

(E) any claim or cause of action as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware; and (F)

any claim or cause of action against the Company or any current or former director, officer or other employee of the Company, governed

by the internal-affairs doctrine, in all cases to the fullest extent permitted by law and subject to the court having personal jurisdiction

over the indispensable parties named as defendants. Our charter further provides that the federal district courts of the United States

of America will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act or Exchange

Act.

Section

27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the

Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision of our charter will not apply to suits

brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

Although

we believe this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits

to which it applies, a court may determine that this provision is unenforceable, and to the extent it is enforceable, the provision may

have the effect of discouraging lawsuits against our directors and officers, although our stockholders will not be deemed to have waived

our compliance with federal securities laws and the rules and regulations thereunder and therefore bring a claim in another appropriate

forum. Additionally, we cannot be certain that a court will decide that this provision is either applicable or enforceable, and if a

court were to find the choice of forum provision contained in our charter to be inapplicable or unenforceable in an action, we may incur

additional costs associated with resolving such action in other jurisdictions, which could harm our business, operating results and financial

condition.

Transfer

Agent

The

transfer agent for Class A Common Stock is Continental Stock Transfer & Trust Company.

PLAN

OF DISTRIBUTION

We

are registering the resale by MC Agent from time to time of up to 2,016,129 shares of Class A Common Stock.

MC

Agent will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made

on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related

to the then current market price or in negotiated transactions. MC Agent may sell the shares by one or more of, or a combination of, the

following methods:

| |

● |

purchases

by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| |

● |

ordinary

brokerage transactions and transactions in which the broker solicits purchasers; |

| |

● |

block

trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the

block as principal to facilitate the transaction; |

| |

● |

an over-the-counter

distribution in accordance with the rules of The Nasdaq Stock Market; |

| |

● |

through trading plans entered into by MC Agent pursuant to Rule 10b5-1

under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement

hereto that provide for periodic sales of the shares on the basis of parameters described in such trading plans; |

| |

● |

distribution to employees, members, limited partners or stockholders

of MC Agent; |

| |

● |

through

the writing or settlement of options or other hedging transaction, whether through an options exchange or otherwise; |

| |

● |

by pledge

to secured debts and other obligations; |

| |

● |

delayed

delivery arrangements; |

| |

● |

to or

through underwriters or broker-dealers; |

| |

● |

in “at

the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time

of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or

sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| |

● |

in privately

negotiated transactions; |

| |

● |

in options

transactions; |

| |

● |

through

a combination of any of the above methods of sale; or |

| |

● |

any other

method permitted pursuant to applicable law. |

In

addition, any securities that qualify for sale pursuant to Rule 144 or another exemption from registration under the Securities Act or

other such exemption may be sold under Rule 144 rather than pursuant to this prospectus.

We

do not expect to receive any cash proceeds from the sales of shares of our Class A Common Stock by MC Agent; however, the terms of the

Equity Issuance Agreement require MC Agent to apply 100% of the net proceeds from the sale of the shares to the Outstanding Fees (as defined

herein) owed by us under the First Lien Credit Facility. In addition, if MC Agent’s net proceeds from sales of the shares exceed

the Outstanding Fees owed by us under the First Lien Credit Facility, MC Agent shall remit such excess cash proceeds to us. Upon payment

in full of the Outstanding Fees in cash by us or through sales of the shares by MC Agent, MC Agent shall return any of the unsold shares

to us. See “Selling Securityholder” for a description of the Equity Issuance Agreement and for additional information

regarding Monroe and MC Agent. The aggregate net proceeds to MC Agent will be the purchase price

of the securities less any discounts, selling commissions and stock transfer taxes borne by MC Agent.

MC

Agent has informed us that it intends to use an unaffiliated broker-dealer to effectuate all sales, if any, of the Class A Common Stock

that it holds pursuant to the Equity Issuance Agreement. Such sales will be made at prices and at terms then prevailing or at prices related

to the then current market price. MC Agent and any broker-dealers or agents that are involved in selling the shares may be deemed to be

“underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received

by such broker-dealers or agents may be deemed to be underwriting commissions or discounts under the Securities Act. MC Agent has informed

the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute

the common stock.

In

effecting sales, broker-dealers or agents engaged by MC Agent may arrange for other broker-dealers to participate. Brokers, dealers, underwriters

or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or

concessions from MC Agent and/or purchasers of the Class A Common Stock for whom the broker-dealers may act as agent. Neither we nor MC

Agent can presently estimate the amount of compensation that any agent will receive.

In

order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed

brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale

in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

Other

than as described above, we know of no existing arrangements between MC Agent or any other stockholder, broker, dealer, underwriter or

agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made,

a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters or dealers and any

compensation from MC Agent, and any other required information.

We

have advised MC Agent that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation

M precludes the Selling Securityholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution

from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution

until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a

security in connection with the distribution of that security. All of the foregoing may affect the marketability of the securities offered

by this prospectus.

Except

for discounts, selling commissions and stock transfer taxes applicable to the sale of the shares of our Class A Common Stock, we will

pay the expenses incurred in registering the shares, including legal and accounting fees.

We

have agreed to indemnify MC Agent and certain other persons against certain liabilities in connection with the offering of shares of Class

A Common Stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute

amounts required to be paid in respect of such liabilities. MC Agent has agreed to indemnify us against liabilities under the Securities

Act that may arise from certain written information furnished to us by MC Agent specifically for use in this prospectus or, if such indemnity

is unavailable, to contribute amounts required to be paid in respect of such liabilities.

This

offering will terminate upon the date that all shares offered by this prospectus have been sold by MC Agent or upon return of any remaining

shares after payment in full of the Outstanding Fees.

LEGAL MATTERS

The validity of any securities

offered by this prospectus will be passed upon for us by Mayer Brown LLP.

EXPERTS

The consolidated financial

statements of AgileThought, Inc. as of December 31, 2021 and 2020, and for each of the years then ended, have been incorporated by reference

herein and in the registration statement in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated

by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

This prospectus is part of

a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in the registration

statement and the exhibits to the registration statement. For further information with respect to the Company and the securities the Selling

Securityholder is offering under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a

part of the registration statement. Neither we nor any agent, underwriter or dealer has authorized any person to provide you with different

information. Neither we nor the Selling Securityholder are making an offer of these securities in any state where the offer is not permitted.

You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this

prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We are subject to the information

reporting requirements of the Exchange Act, and we file reports, proxy statements and other information with the SEC. These reports, proxy

statements and other information will be available for review at the SEC’s website at www.sec.gov. We also maintain a website at

www.AgileThought.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically

filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of this prospectus.

INCORPORATION OF

CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with it, which means that we can disclose important information to you by referring you to

those documents instead of having to repeat the information in this prospectus. The information incorporated by reference is considered

to be part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information.

We incorporate by reference the documents listed below and any future filings (including those made after the initial filing of the registration

statement of which this prospectus is a part and prior to the effectiveness of such registration statement) we will make with the SEC

under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act until the termination of the offering of the shares covered by this prospectus

(other than information furnished under Item 2.02 or Item 7.01 of Form 8-K):

| ● | our Annual Report on Form 10-K for the year ended December

31, 2021 filed with the SEC on March 31, 2022; |

| ● | our Quarterly Reports on Form 10-Q filed with the SEC on May

13, 2022, August 12, 2022, and November 14, 2022; |

| ● | our Current Reports on Form 8-K filed with the SEC on January

11, 2022, March 28,

2022, May 2, 2022, May

23, 2022, June 3,

2022, November 22,

2022, and February 1, 2023; and |

| ● | the description of our Class A Common Stock, which is contained

in Exhibit 4.5 to our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 31, 2022. |

You can request a copy of

these filings, at no cost, by writing or telephoning us at the following address or telephone number:

AgileThought, Inc.

222 W. Las Colinas Blvd.

Suite 1650E

Irving, Texas 75039

Attn: Diana Abril

Chief Legal Officer

(971) 501-1440

This prospectus is part of

a registration statement we filed with the SEC. That registration statement and the exhibits filed along with the registration statement

contain more information about us and the shares in this offering. Because information about documents referred to in this prospectus

is not always complete, you should read the full documents which are filed as exhibits to the registration statement. You may read and

copy the full registration statement and its exhibits at the SEC’s website.

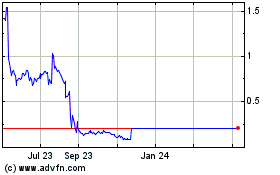

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Dec 2024 to Jan 2025

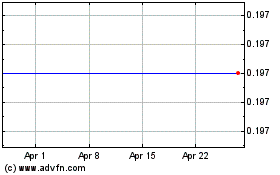

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Jan 2024 to Jan 2025