Wall Street Dividends on the Upswing -- American Capital Agency and Chimera Investment Look to Lead

17 January 2012 - 12:20AM

Marketwired

Dividend payments throughout Wall Street are expected to skyrocket

in the coming months according to a research note from Standard

& Poor's. With annual reports being printed and shareholder

meetings coming up, Howard Silverblatt, senior index analyst at

Standard & Poor's Indices believes that dividend payments could

post a double-digit increase during the mid-January through

February season, setting a new record for the S&P 500. Five

Star Equities examines the outlook for diversified REITs and

provides investment research on American Capital Agency Corporation

(NASDAQ: AGNC) and Chimera Investment Corporation (NYSE: CIM).

Access to the full company reports can be found at:

www.fivestarequities.com/AGNC

www.fivestarequities.com/CIM

Real Estate Investment Trusts (REITs) pay some of the largest

dividends on Wall Street, which is by design. To be a REIT, a

company must distribute at least 90 percent of its taxable income

to shareholders annually in the form of dividends.

REIT earnings could be in for a haircut, however. Philadelphia

Fed President Charles Plosser argues that the U.S. Federal Reserve

may need to raise interest rates before the middle of 2013, despite

the central bank's repeated forecasts that it expected to keep

rates ultra-low until at least then.

Five Star Equities releases regular market updates on

diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.fivestarequities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

Mortgage REITs (mREITs) invest in mortgages rather than

buildings, for example. Most mREITS do so mostly with borrowed

money. As reported on CNN Money, mREITs make their money off the

difference between their borrowing costs and the yield on their

portfolio. "Unlike banks in recent years, they've performed well:

The Dow Jones U.S. Mortgage REITs index has a three-year average

annual return of 19%," John Birger, contributor at CNN Money

reports.

Presently American Capital Agency pays an annual dividend of

$5.60 per share for an impressive yield of nearly 20 percent.

Chimera Investment Corporation pays an annual dividend of 44 cents

for a yield of around 16.7 percent.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

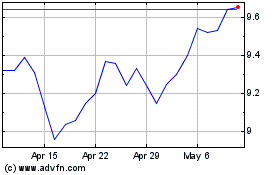

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jul 2023 to Jul 2024