Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-266722

AMENDMENT

NO. 1 TO PROSPECTUS SUPPLEMENT

(to

prospectus supplement dated September 10, 2024, which is a supplement to prospectus dated August 18, 2022)

Common

Stock

AgriForce

Growing Systems, Ltd.

$2,116,746

This

Amendment No. 1 to prospectus supplement relates to the prospectus supplement (dated September 10, 2024) to Registration Statement on

Form S-3 (File No. 333-266722) declared effective by the Securities and Exchange Commission on or about August 18, 2022 and does not

cover securities beyond those covered by the existing Registration Statement. There are no additional securities being offered under

this Amendment No. 1 to prospectus supplement – this is merely a document required under the securities laws to update information

previously filed in the original prospectus and prior prospectus supplement thereto.

We

are filing this prospectus supplement to supplement and amend the information previously included in the prospectus supplement. You should

read this Amendment No. 1 to prospectus supplement together with the prospectus supplement and prospectus.

We

have entered into an Equity Distribution Agreement, or sales agreement, with Maxim Group LLC, or Maxim, relating to shares of our common

stock offered by this prospectus supplement. In accordance with the terms of the sales agreement, we may offer and sell shares of our

common stock having an aggregate offering price of up to $3,080,000 from time to time through or to Maxim acting as our sales agent or

principal pursuant to this prospectus supplement and the accompanying prospectus. We have provided this Amendment No. 1 to prospectus

supplement to update availability under the prospectus supplement to $2,116,746.

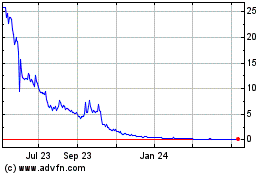

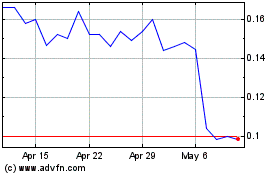

Our

common stock is traded on the Nasdaq Capital Market, or Nasdaq, under the symbol “AGRI.” The last reported sale price of

our common stock on October 25, 2024 was $0.0592 per share.

We

are currently subject to General Instruction I.B.6 of Form S-3, which limits the amounts of securities that we may sell under the registration

statement of which the prospectus supplement and the accompanying prospectus form a part. The aggregate market value of our outstanding

common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3, or public float, is $8,750,240, which is based

on 116,472,642 shares of our outstanding common stock held by non-affiliates as of the date of this prospectus supplement, at a price

of $0.075127 per share, which was the average of the bid and ask price of one share of our common stock on Nasdaq on August 28, 2024.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus supplement with a value

of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period. We have not offered

any securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period, except for our $800,000 registered

direct offering on October 15, 2024.

Sales

of our common stock, if any, under this prospectus supplement will be made by any method permitted that is deemed an “at the market

offering” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly

on or through Nasdaq or any other existing trading market in the United States for our common stock, directly to Maxim as principal,

and/or in any other method permitted by law. If we and Maxim agree on any method of distribution other than sales of shares of our common

stock on or through Nasdaq or another existing trading market in the United States at market prices, we will file a further prospectus

supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. Maxim is not required to

sell any specific number or dollar amount of securities, but will act as our sales agent using commercially reasonable efforts consistent

with its normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Maxim

will be entitled to compensation at a commission rate equal to 3.0% of the gross sales price per share sold. In connection with the sale

of the common stock on our behalf, Maxim will be deemed to be an “underwriter” within the meaning of the Securities Act and

the compensation of Maxim will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification

and contribution to Maxim with respect to certain liabilities, including liabilities under the Securities Act or the Exchange Act of

1934, as amended, or the Exchange Act.

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading

“Risk Factors” beginning on page S-12 of this prospectus supplement, and under similar headings in other documents

filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined

if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

MAXIM

GROUP LLC

The

date of this Amendment No. 1 to prospectus supplement is October 28, 2024.

TABLE

OF CONTENTS

Prospectus

Supplement

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this

offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may

add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement or the accompanying prospectus. By using a shelf registration statement, we may offer shares of our common stock having an

aggregate offering price of up to $800,000 under this prospectus supplement at $0.05 per share.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us,

the securities being offered and other information you should know before investing in our securities. You should also read and consider

information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find

More Information” and “Incorporation by Reference.”

You

should rely only on this prospectus supplement, the accompanying prospectus, the documents incorporated or deemed to be incorporated

by reference herein or therein and any free writing prospectus prepared by us or on our behalf. We have not, authorized

anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus

supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on

it. We are not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not

assume that the information contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus, or incorporated

by reference herein, is accurate as of any date other than as of the date of this prospectus supplement or the accompanying prospectus

or any free writing prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents

regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business,

financial condition, liquidity, results of operations and prospects may have changed since those dates.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

Unless

otherwise indicated in this prospectus supplement or the context otherwise requires, all references to “we,” “us,”

“our,” “the Company,” and “AgriFORCE” refer to AgriFORCE Growing Systems, Ltd. and its subsidiaries.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution

of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus

supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe

any restrictions as to this offering and the distribution of this prospectus supplement or the accompanying prospectus applicable to

that jurisdiction.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere or incorporated by reference in this prospectus supplement. This summary does

not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire

prospectus supplement and accompanying base prospectus carefully, including the “Risk Factors” section contained in this

prospectus, the accompanying base prospectus and under the section “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023, and any amendment or update thereto reflected in subsequent filings with the SEC, along with our consolidated

financial statements and the related notes thereto and the other documents incorporated by reference in this prospectus supplement and

accompanying base prospectus.

Overview

AgriFORCE™

was incorporated as a private company by Articles of Incorporation issued pursuant to the provisions of the Business Corporations Act

(British Columbia) on December 22, 2017. The Company’s registered and records office address is at 800 – 525 West 8th

Avenue, Vancouver, BC, Canada, V5Z 1C6.

Our

Business

AgriFORCE™

is an “Ag-Tech” company with a primary focus to developing and utilizing our intellectual property assets for improvements

dedicated to the agricultural industry. We believe that this goal is best achieved by using our proprietary IP for solutions in the agricultural

industry as well as seeking development of new IP to both enhance the technology which we already retain in house as well as development

of new technologies which can increase our footprint in the Ag-Tech space with expansion into other areas which have ESG ramifications.

Our

AgriFORCE™ Brands division is focused on the development and commercialization of plant-based ingredients and products that deliver

more nutritious food. We will market and commercialize ingredient supplies, like our Awakened Flour™ and Awakened Grains ™.

The

AgriFORCE™ Solutions division is dedicated to transforming modern agriculture through our controlled environment agriculture (“CEA”)

equipment, including our FORCEGH+™” solution. We are continuing to modify our business plan to accommodate

artificial intelligence and blockchain in the development and implementation of FinTech systems to commercial farmers, and advancing

on the commercialization of our Hydroxyl clean room systems to greatly reduce the spread of pathogens, mold and disease at processing

facilities worldwide.

AgriFORCE™

Brands

UN(THINK)™

Foods

The

Company purchased Intellectual Property (“IP”) from Manna Nutritional Group, LLC (“Manna”), a privately

held firm based in Boise, Idaho on September 10, 2021. The IP encompasses a granted patent to naturally process and convert grain, pulses

and root vegetables, resulting in low-starch, low-sugar, high-protein, fiber-rich baking flour as well as produces a natural sweetener

juice. The core process is covered under Patent Nr. 11,540,538 in the U.S. and key international markets. The all-natural process is

designed to unlock nutritional properties, flavors, and other qualities in a range of modern, ancient and heritage grains, pulses and

root vegetables to create specialized all-natural baking and all-purpose flours, sweeteners, juices, naturally sweet cereals and other

valuation products, providing numerous opportunities for dietary nutritional, performance and culinary applications.

During

the year ended December 31, 2023, the Company has achieved milestones towards the commercialization of our UN(THINK) Awakened

Flour™ flour, the Company’s first line of products to utilize the IP. Management has defined and tested its quality controls

and safety protocols for production, and produced several multi-ton batches of germinated grains, refining and scaling production processes

with our partners in Canada. We are also in the process of qualifying partners in the US to establish additional production hubs –

at no additional CAPEX - which will support growth and reduce logistics costs for customers in the region. Additionally, we have established

our supply chain logistics with a contracted shipping company and two warehouses in Canada and the US. Our commercial team made progress

in defining pricing and is starting to approach US and Canadian Bakeries and Baked Goods Companies who are now testing our new flours

for integration into their manufacturing operations and innovation pipeline. Online sales logistics and advertising materials were developed

during the period to support the establishment of the direct-to-consumer sales channel which will be started once the Business to Business

channel sales will ramp up. Lastly, the Company has developed an extensive number of recipes for the application of Awakened Flour™

product line for both customers and consumers.

The

Company is developing several finished product prototypes including a line of pancake mixes, which are ready for consumer testing.

Wheat

and Flour Market

Modern

diet is believed to be a contributor to health risks such as heart disease, cancer, diabetes and obesity, due in part to the consumption

of highly processed foods that are low in natural fiber, protein and nutrition; and extremely high in simple starch, sugar and calories.

These “empty carbs” produce glycemic swings that may cause overeating by triggering cravings for food high in sugar, salt

and starch. As an example, conventional baking flour is low in natural fiber (~ 2-3%), low-to-average in protein (~ 9%), and very high

in starch (~ 75%)(1). Apart from dietary fiber, whole flour is only marginally better in terms of these macronutrients (2).

In

contrast, foods high in fiber help to satiate hunger, suppress cravings and raise metabolism(3). They also assist in weight

loss, lower cholesterol, and may reduce the risk of cancer, heart disease and diabetes(4).

Advantages

of the UN(THINK)™ Foods IP

Our

Controlled Enzymatic Reaction & Endothermic Saccharification with Managed Natural Germination (“CERES-MNG”) patented

process allows for the development and manufacturing of all-natural flours that are significantly higher in fibers, nutrients and proteins

and significantly lower in carbohydrates and calories than standard baking flour.

CERES-MNG

baking flour produced from soft white wheat has 40 times more fiber, three (3) times more protein and 75% less net carbohydrates than

regular all- purpose flour(5).

Source:

Independent analysis by Eurofins Food Chemistry Testing Madison, Inc, February 2022

The

CERES-MNG patent will help develop new flours and products from modern, ancient and heritage grains, seeds, legumes and tubers/root vegetables.

Products

that AgriFORCE™ intends to develop for commercialization from the CERES-MNG patented process under the UN(THINK)™ foods brand:

| |

- |

High protein,

high fiber, low carb modern, heritage and ancient grain flours (for use in breads, baked goods, doughs, pastry, snacks, and pasta) |

| |

- |

Protein flours and protein

additives |

| |

- |

High protein, high fiber,

low carb cereals and snacks |

| |

- |

High protein, high fiber,

low carb oat based dairy alternatives |

| |

- |

Better tasting, cleaner

label, high protein, high fiber, low carb nutrition bars |

| |

- |

High protein, high fiber,

low carb nutrition juices |

| |

- |

Sweeteners – liquid

and granulated |

| |

- |

High protein, high fiber,

low carb pet foods and snacks |

(1)

Based on protein, fiber, and starch content results from a nationally certified independent laboratory, as compared to standard all-purpose

flour.

(2)

https://www.soupersage.com/compare-nutrition/flour-vs-whole-wheat-flour

(3)

https://my.clevelandclinic.org/health/articles/14400-improving-your-health-with-fiber

(4)

https://www.health.harvard.edu/blog/fiber-full-eating-for-better-health-and-lower-cholesterol-2019062416819

(5)

Based on protein, fiber, and starch content results from a nationally certified independent laboratory, as compared to standard all-purpose

flour.

We

intend to commercialize these products behind two (2) main sales channels:

| |

- |

Branded ingredients (B2B) |

| |

- |

Consumer branded products (B2B and B2C) |

Successful

commercialization of premium specialized products from the UN(THINK)™ foods IP and the capture of a small percentage share of the

category is a notable business opportunity for AgriFORCE™.

| | |

Breads & Bakery (2) | | |

Whole Wheat Flours (1) | | |

Pulse Flours (3) | | |

Dairy Alternatives | | |

Cereal Bars (4) | | |

Total | |

| Global market size of target categories | |

$ | 235 | B | |

$ | 72 | B | |

$ | 19 | B | |

$ | 23 | B | |

$ | 23 | B | |

| | |

| Potential market share | |

| 0.1 | % | |

| 0.2 | % | |

| 1 | % | |

| 0.01 | % | |

| 0.01 | % | |

| | |

| AgriFORCE™ potential net revenues | |

$ | 200 | M | |

$ | 140 | M | |

$ | 190 | M | |

$ | 20 | M | |

$ | 20 | M | |

$ | 560 | M |

Sources:

Future Market Insights Reports, June 2022 (2), October 2022 (1), January 2023 (3) and October 2022 (4)

To

produce the UN(THINK)™ power wheat flour, we are using our patented process to develop a new germinated whole grain wheat flour,

which we have qualified and made available for sale through November 2023 in Canada and the USA, under the UN(THINK)™ Awakened

Flour™ brand. This new Awakened Grains™ flour – available in 3 types: hard white wheat and hard red wheat for breads

and soft white wheat for bakery and pastries – will provide enhanced nutrition with over five times more fiber, up to two times

more protein and 23% less net carbs versus conventional all-purpose flour (source: Eurofins Food Chemistry Madison, Inc, December 2022).

GROWTH

PLAN

AgriFORCE™’s

organic growth plan is to actively establish and deploy the commercialization of products in four distinct phases:

PHASE

1 (COMPLETED):

| |

● |

Product and process testing and

validation. (completed) |

| |

● |

Filing of US and international patents. (completed) |

| |

● |

Creation of the UN(THINK)™ foods brand. (completed) |

| |

● |

Qualification and operational and commercial set up

of the Awakened Grains™ line of products. (completed) |

PHASE

2:

| |

● |

Launch of the UN(THINK)™ Awakened

Flour™ lightly germinated flour range of products in business to business (“B2B”) channel. (completed) |

| |

● |

Develop range of finished products behind the wheat

grain flours, qualify patented process for pulse/legume, and rice-based protein flours |

| |

● |

Drive business as ingredients for bakery, snack and

plant-based protein products manufacturers. |

| |

● |

Develop relationships with universities, nonprofit

organizations and civic organizations focused on health in underserved communities to research impact of patented flour on nutrition. |

PHASE

3:

| |

● |

Develop range of finished products

behind the wheat grain flours, qualify patented process for pulse/legume, and rice-based protein flours. |

| |

● |

Drive business as ingredients for bakery, snack and

plant-based protein products manufacturers. |

| |

● |

Develop manufacturing base through partnerships and

licensing. |

PHASE

4:

| |

● |

Expand product range in US/Canada. |

| |

● |

Expand business to other geographies internationally. |

AgriFORCE

Solutions

Understanding

Our Approach –Bringing Cutting Edge Technology to Enhance and Modernize Agriculture

Traditional

farming includes three fundamental approaches: outdoor, greenhouse and indoor. We are taking modern technologies such as artificial intelligence

(“AI”) and blockchain–based advances to bring what is traditionally a low technology industry into the 21st century.

This approach means that we are able to reach into areas not readily available to agricultural businesses in the past, such as advanced

Fintech to enhance financing capabilities for these businesses and more readily provide advanced intelligence for farmers. These technologies

can also be applied to worldwide sourcing and matching food producers to consumers in an efficient manner.

Our

intellectual property combines a patented uniquely engineered facility design and automated growing system to solve excessive

water loss and high energy consumption, two problems plaguing nearly all controlled environment agriculture systems. FORCEGH+ delivers

a patented clean, sealed, self-contained micro-environment that maximizes natural sunlight and offers supplemental LED lighting. It limits

human intervention and is designed to provide superior quality control through AI optical technology. It was also created to drastically

reduce environmental impact, substantially decrease utility demands, conserving water, while delivering customers daily harvests

and higher crop yields.

The

Ag-Tech sector is severely underserved by the capital markets, and we see an opportunity to acquire global companies who have provided

solutions to the industry and are leading innovation moving forward. The robustness of our engagement with potential targets has confirmed

our belief and desire to be part of a larger integrated Ag-Tech solutions provider, where each separate element of the business has its

existing legacy business and can leverage across areas of expertise to expand their business footprint.

The

Company intends to continue development and license its technology to existing farmers in the plant based pharmaceutical, nutraceutical,

and high value crop markets using its unique patented facility design and hydroponics based automated growing system that enable farmers

to effectively grow crops in a sealed controlled environment (“FORCEGH+™”). The Company has designed FORCEGH+™

facilities to produce crops in virtually any environmental condition and to optimize crop yields to as near their full genetic potential possible while substantially eliminating the need for the use of pesticides, fungicides and/or irradiation. The Company continues

to develop its solution for fruits and vegetables focusing on the integration of its current structure with a new form of vertical grow

technology.

BUSINESS

PLAN

The

Company will launch a full line up of Hydroxyl Devices and start commercializing the Hydroxyl Devises into the US market of CEA and Food

Manufacturing. The Company will identify and establish exclusive distribution agreement for the EMEA region as well Expand

Distribution Network into Latin America and Asia. The Company will also advance on the commercialization of our Hydroxyl clean room

systems to greatly reduce the spread of pathogens, mold and disease at processing facilities worldwide.

The

Company is exploring opportunities to utilize its patented FORCEGH+™ structure and its related technologies in joint ventures and

licensing. The Company is also studying the utilization of FORCEGH+ technologies in arctic, tropical and desert environments. The Company

intends to continue development of and license of its technology to existing farmers in the plant based pharmaceutical, nutraceutical,

and high value crop markets using its unique patented facility design and hydroponics based automated growing system that enable farmers

to effectively grow crops in a sealed controlled environment (“FORCEGH+™”).

The

Company also looks to expand its efforts into development of blockchain solutions and the implementation of these solutions into FinTech

systems to allow quicker and less costly transactions between commercial farmers.

The

Company is exploring opportunities to utilize its patented FORCEGH+™ structure and its related technologies in joint ventures and

licensing. The Company is also studying the utilization of FORCEGH+ technologies in arctic, tropical and desert environments and artificial

intelligence and blockchain in the development and implementation of FinTech systems to commercial farmers, and advancing on the commercialization

of our Hydroxyl clean room systems to greatly reduce the spread of pathogens, mold and disease at processing facilities worldwide.

The

AgriFORCE Clean Solutions

The

Company’s Solutions division is charged with the commercialization of our FORCEGH+ technology and our RCS clean room systems. The

Company has also begun to advance its initiative to integrate blockchain in the development and implementation of FinTech systems for

commercial farmers.

We

have a worldwide license to commercialize the proprietary hydroxyl generating devices of Radical Clean Solutions, Inc. (“RCS”)

for the CEA and food manufacturing industries. The RCS technology is a product line consisting of patent-pending “smart hydroxyl

generation systems” focused on numerous industry verticals that is proven to eliminate 99.99+% of all major pathogens, virus,

mold, volatile organic compounds (VOCs) and allergy triggers(6).

On

October 1, 2023, the Company signed a definitive agreement to purchase a 14% ownership stake in RCS.

The

Company generated its first revenue from the sale of RCS devices in late 2023. During 2023, the Company signed an exclusive distribution

agreement with a leading distributor of air conditioning and heating solutions in Mexico for the representation and sale of the AgriFORCE/RCS

hydroxyl generating devices for greenhouses and food manufacturing facilities for the territory of Mexico. The first products

were delivered in October 2023 pursuant to purchase orders for the products.

The

Company will continue to expand sales into Mexico through its distributor, Commercializadora DESICO. Based on its sale into the poultry

industry in Mexico, the Company is expanding its distribution of its Clean System solutions into other Latin American markets and the

United States.

BUSINESS

PLAN

2024

| |

● |

Continue

introduction into the Mexico market with our exclusive distributor |

| |

● |

Identify

and set up exclusive distribution agreements for the EMEA region |

| |

● |

Start

commercializing the Hydroxyl Devices into the US market of CEA and Food Manufacturing |

| |

● |

Launch

full line up of Hydroxyl Devices : in-Duct HVAC unit, Portable Industrial QuadPro Unit, Small Rooms Wall-Mount unit |

2025

| |

● |

Expand

Distribution Network into Latin America and Asia. |

Merger

and Acquisition (“M&A”)

The

Company plans to evaluate accretive M&A opportunities of an appropriate scale as it progresses with its ongoing business plans surrounding

its already owned IP and improvements thereto. Any M&A propositions must be of a size and scale which works to complement the Company’s

ongoing business in terms of allocation of resources.

The

Company intends to focus any M& A activity to targets which are focused in the Ag-Tech space with emphasis on businesses which can

also increase our ESG footprint. This refocused M&A strategy will ensure that proper personnel and economic resources are allocated

to the Company’s ongoing businesses, while refocusing efforts on synergistic opportunities which work to enhance the Company’s

existing assets.

(6)

BCI Labs, Gainesville Florida, February 2022; and various institutional studies.

Recent

Developments

Management

Restructuring

On

January 25, 2024, Troy McClellan, President of AgriFORCE Solutions, submitted a letter of resignation to the Company. On January 25,

2024, the Company accepted his resignation and deemed it effective immediately pursuant to Section 7.3 of his employment agreement with

the Company which permits waiver by the Company of Mr. McClellan’s notice period (through March 31, 2024) and corresponding acceleration

of the resignation date.

On

February 10, 2024, Richard Wong resumed his original role as Chief Financial Officer in order to focus on finance and accounting matters

for the Company. Effective as of the same day, Jolie Kahn was appointed Executive Turnaround Consultant to support the Company’s

operational growth and expansion efforts. On June 4, 2024, the Board Directors appointed Jolie Kahn as Chief Executive Officer.

Jolie Kahn shall report to David Welch, Chairman of the Board of Directors of the Company, who shall act as Executive Chairman until

such time as a permanent Chief Executive Officer is appointed.

On

February 19, 2024, Margaret Honey resigned as a Director of (the “Company”) to pursue other interests. The resignation is

not the result of any disagreement with the Company.

On

June 4, 2024, the Board of Directors of the Company appointed Jolie Kahn as Chief Executive Officer. Previously, on February 10, 2024,

Jolie Kahn was appointed Executive Turnaround Consultant to support the Company’s operational growth and expansion efforts. Jolie

Kahn will continue to support these efforts and to report to David Welch, Chairman of the Board of Directors of the Company, who shall

act as executive chairman.

Share

Repurchase Program

On

June 17, 2024, the Company’s Board of Directors authorized a share repurchase program (the “Repurchase Program”) under

which the Company may repurchase up to $1 million of its outstanding common shares, for a period of six months, subject to contractual

requirements. The Board will periodically review the Company’s Repurchase Program and may decide to extend its term or increase

the authorized amount.

RCS

Acquisition

On

August 19, 2024, AgriForce Growing Systems, Inc. (the “Company”) entered into an asset purchase agreement (the “Agreement”)

to purchase the assets (the “Assets”) of Radical Clean Solutions Limited (the “Seller”). The Company previously

had procured a license for the RCS patented technology in the agricultural industry. The purchase price for the assets is a combination

of cash and stock and assumption of liabilities as follows: (i) $200,000 (which was previously given to Seller as a loan, and

which was deemed satisfied as of closing (the “Closing”) which took place on August 20, 2024); (ii) five million restricted

common shares of the Company (valued at market price); and (iii) assumption of liabilities consisting of $135,000 principal amount

of notes issued by Seller and operating liabilities of Seller in an amount equal to $57,000. The Company has agreed to fund up to $100,000

per month for the operations of the RCS business. The Agreement contains customary commercial terms as to representations and warranties,

termination events and the like.

In

conjunction with the asset purchase, the Company has entered into a two year consulting agreement with Roger Slotkin, the CEO of the

Seller. Under the consulting agreement, Mr. Slotkin is to be paid a fee of $15,000 per month. He is also entitled to further payments

in cash and/or restricted stock upon the occurrence of certain events: a commission on certain sales of RCS units, and upon completion

of certain milestones, Mr. Slotkin will receive 25,000 restricted common shares.

All

stock issuances described in this Item 1.01 are in the form of private placement transactions pursuant to Section 4(a)(2) of the Securities

Act of 1933, as amended.

Status

as an Emerging Growth Company

On

April 5, 2012, the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, was enacted. Section 107 of the JOBS Act provides that

an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. In other words, an “emerging

growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting

standards on the relevant dates on which adoption of such standards is required for private companies.

We

are in the process of evaluating the benefits of relying on other exemptions and reduced reporting requirements provided by the JOBS

Act. Subject to certain conditions set forth in the JOBS Act, as an “emerging growth company,” we intend to rely on certain

of these exemptions from, without limitation, (i) providing an auditor’s attestation report on our system of internal controls

over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act and (ii) complying with any requirement that may be adopted

by the Public Company Accounting Oversight Board (PCAOB) regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements, known as the auditor discussion and analysis. We

will remain an “emerging growth company” until the earliest of (a) the last day of our fiscal year following the fifth anniversary

of the closing of the initial public offering, (b) the last day of the first fiscal year in which our annual gross revenues exceed $1.07

billion, (c) the last day of our fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule

12b-2 under the Securities Exchange Act of 1934, or Exchange Act (which would occur if the market value of our equity securities that

is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter), or

(d) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act of 1934, as amended, as our public float

as of June 28, 2024 was approximately $7.3 million and have elected to follow certain scaled disclosure requirements available to smaller

reporting companies.

THE

OFFERING

| Common

stock offered by us pursuant to this prospectus |

|

16,000,000

shares of our common stock having an aggregate

offering price of $800,000, or a price of $.05 per common share. |

| |

|

|

| Common

stock to be outstanding after this offering |

|

117,343,337

shares. |

| |

|

|

| Manner

of offering |

|

Registered

direct offering to two institutional investors.

See the section entitled “Plan of Distribution” on page S-14 of this prospectus supplement. |

| |

|

|

| Use

of proceeds |

|

We

intend to use all proceeds of this offering for general corporate purposes. See the section entitled “Use of Proceeds”

on page S-13 of this prospectus supplement. |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” beginning on page S-12 of this prospectus supplement and the other information included in, or incorporated

by reference into, our prospectus for a discussion of certain factors you should carefully consider before deciding to invest in

shares of our common stock. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

AGRI

(for common stock) |

The

number of shares of our common stock to be outstanding immediately after this offering is based on 101,343,337 shares of common

stock outstanding as of October 14, 2024, and excludes the following:

| |

● |

13,761,493

Warrants outstanding to purchase common stock, 61,567 stock options, and $1,798,500 of convertible debentures convertible

at a strike price of $0.10 per share (as of the date of this offering). |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the documents incorporated by reference herein contain forward-looking statements. Such statements include

statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding

our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance

with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from

those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements

include the risks described in greater detail in the following paragraphs and in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on April 1, 2024. All forward-looking statements in this document are made as of the

date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

Market data used throughout this prospectus supplement is based on published third party reports or the good faith estimates of management,

which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

You

should review carefully the section entitled “Risk Factors” within this prospectus supplement for a discussion of these and

other risks that relate to our business and investing in shares of our common stock.

All

forward-looking statements speak only as of the date of this prospectus supplement. We disclaim any obligation to update or revise these

statements unless required by law, and you should not place undue reliance on these forward-looking statements. Although we believe that

our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this prospectus supplement

are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved. We disclose important factors

that could cause our actual results to differ materially from our expectations under “Risk Factors” and elsewhere in this

prospectus supplement. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our

behalf.

RISK

FACTORS

Investment

in our common stock involves risks. Before deciding whether to invest in our common stock, you should consider carefully the risk factors

discussed below and those contained in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for

the year ended December 31, 2023, as filed with the SEC on April 1, 2024, which is incorporated herein by reference in its entirety,

as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. If any of the risks or uncertainties

described in our SEC filings actually occurs, our business, financial condition, results of operations or cash flow could be materially

and adversely affected. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your

investment. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our business operations.

Risks

Associated with this Offering

We

have broad discretion in the use of the net proceeds of this offering and may not use them effectively.

We

intend to use the net proceeds of this offering for general corporate purposes. Our management will have broad discretion in the application

of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance

the value of our common stock. The failure by management to apply these funds effectively could result in financial losses that could

have a material adverse effect on our business or cause the price of our common stock to decline.

You

will experience immediate and substantial dilution.

The

offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this

offering. Assuming that an aggregate of 16,000,000 shares of our common stock are sold at a price of $0.05 per share for aggregate

gross proceeds of $800,000, and after deducting commissions and estimated offering expenses payable by us, you will experience immediate

dilution of $.049 per share, representing the difference between our as adjusted net tangible book value per share of $0.001

after giving effect to this offering and the assumed offering price. The exercise of outstanding stock options and warrants, or the

conversion of outstanding preferred stock into common stock, will result in further dilution of your investment. See the section entitled

“Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

You

may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or

other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per

share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future

transactions may be higher or lower than the price per share paid by investors in this offering.

USE

OF PROCEEDS

We

are issuing shares of our common stock having aggregate sales proceeds of $800,000 hereunder.

We

intend to use to use all proceeds for general corporate purposes.

Each institutional investor

(“Purchaser”) is entering into a securities purchase agreement for $400,000 or 8,000,000 common shares at $0.05 per share.

Pursuant to those agreements, the Right of Participation held by Purchaser under Section 4.12 of that certain Securities Purchase Agreement

dated June 30, 2022 between the Company and the Purchaser is hereby extended to and including December 31, 2025. If the Company shall

sell any shares of its Common Stock pursuant to any at-the-market offering or equity line of credit (however denominated), the Company

shall use 25% of the net proceeds from any such sales to repay the principal on any outstanding Debentures (as such term is defined in

the June 30, 2022 Securities Purchase Agreement) in accordance with the terms of such Debentures.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings and do not expect

to declare or pay any cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of

our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, capital requirements,

general business conditions and other factors that our board of directors considers relevant.

DILUTION

If

you invest in our common stock, your interest will be diluted to the extent of the difference between the price per share you pay in

this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value

deficit of our common stock as of June 30, 2024 was approximately $0.7 million, or approximately $0.01 per share of common stock based

upon 84,333,892 shares outstanding. Net tangible book value per share is equal to our total tangible assets, less our total liabilities,

divided by the total number of shares outstanding.

After

giving effect to the sale of our common stock in the aggregate amount of $800,000 at an offering price of $0.05 per share, the price

negotiated between the parties, and our net tangible book value as of June 30, 2024 would have been $0.1 million, or $0.001 per share

of common stock. This represents an immediate increase in net tangible book value of $[0.001] per share to our existing stockholders

and an immediate dilution in net tangible book value of $0.049 per share to new investors in this offering.

The

following table illustrates this calculation on a per share basis:

| Offering price per share |

|

$ |

0.05 |

|

| Net

tangible book value per share as of June 30, 2024 |

|

$ |

[0.01] |

|

| Increase

in net tangible book value per share attributable to the offering |

|

$ |

0.001 |

|

| As-adjusted

net tangible book value per share after giving effect to the offering |

|

$ |

0.001 |

|

| Dilution

in net tangible book value per share to new investors |

|

$ |

0.049 |

|

The

foregoing table does not give effect to the exercise of any outstanding options or warrants or the conversion of indebtedness to common

stock. To the extent options and warrants are exercised, or to the extent preferred stock is converted to common stock, there may be

further dilution to new investors.

The

table above assumes for illustrative purposes that an aggregate of 16,000,000 shares of our common stock are sold at a price of

$0.05 per share, for aggregate gross proceeds of $800,000.

PLAN

OF DISTRIBUTION

The

16 million shares are being issued in a registered direct offering to two institutional investors directly by the Company.

LEGAL

MATTERS

The

validity of the common stock offered hereby will be passed upon as stated in the Current Report on Form 8-K, to be filed in connection

herewith no later than October 16, 2024.

EXPERTS

The

consolidated financial statements incorporated in this Prospectus Supplement by reference to the Annual Report on Form 10-K for the year

ended December 31, 2023 have been audited by Marcum, LLP, an independent registered public accounting firm, as stated in their report

incorporated by reference herein,

and have been so incorporated in this prospectus supplement in reliance upon such report and upon the authority of such firm as experts

in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file reports with the SEC on an annual basis using Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. You may

read and copy any such reports and amendments thereto at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C.

20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. Please call the SEC at 1-800-SEC-0330 for information on

the Public Reference Room. Additionally, the SEC maintains a website that contains annual, quarterly, and current reports, proxy statements,

and other information that issuers (including us) file electronically with the SEC. The SEC’s website address is http://www.sec.gov.

You can also obtain copies of materials we file with the SEC from our Internet website found at www.agriforcegs.com. Our stock is quoted

on the Nasdaq Capital Market under the symbol “AGRI.”

This

prospectus supplement is only part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and

therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration

statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description

of any statement referring to any contract or other document. You may inspect a copy of the registration statement, including the exhibits

and schedules, without charge, at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed by the

SEC.

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this

prospectus the information that we file with them, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file

later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and

made a part of this prospectus:

| ● |

Annual

Report on Form 10-K for the year ended December 31, 2023 filed on April 1, 2024 and Quarterly Reports on Form 10-Q for the quarter

ended March 31, 2024, filed on 4 and for the quarter ended June 30, 2024, filed on August 13, 2024; |

| |

|

| ● |

Our

Definitive Proxy Statement on Schedule 14A and accompanying additional proxy materials filed with the SEC on August 20, 2024; |

| |

|

| ● |

Current

Reports on Form 8-K (excluding any reports or portions thereof that are deemed to be furnished and not filed) filed on January

12, 2024, January

30, 2024, February

13, 2024, February

20, 2024, February

23, 2024, February

29, 2024, April

12, 2024, June

10, 2024, June

28, 2024, July

8, 2024, August

5, 2024, August

23, 2024, September 16, 2024, September 27, 2024 and October 3, 2024; and |

| |

|

| ● |

Our

registration statement on Form 8-A filed on July 2, 2021. |

We

also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms of Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the date of the initial registration statement but prior to effectiveness

of the registration statement and after the date of this prospectus supplement but prior to the termination of the offering of the securities

covered by this prospectus supplement. We are not, however, incorporating, in each case, any documents or information that we are deemed

to furnish and not file in accordance with Securities and Exchange Commission rules.

You

may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (604) 757-0952 or by writing to us at

the following address:

AgriFORCE

Growing Systems Ltd.

800-525 West 8th Avenue

Vancouver,

BC V5Z 1C6

Canada

|

|

|

AGRIFORCE

GROWING SYSTEMS, LTD.

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell common

stock, preferred stock, warrants, units or a combination of these securities for an aggregate initial offering price of up to $150,000,000.

This prospectus provides you with a general description of the securities we may offer, which is not meant to be a complete description

of each of the securities. Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain

specific information about the terms of that offering. Any prospectus supplement may also add, update, or change information contained

in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated

or deemed to be incorporated by reference in this prospectus and the applicable prospectus supplement before you purchase any of the

securities offered.

This

prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our

common stock is currently traded on the Nasdaq Capital Market under the symbol “AGRI”, and our Series A Warrants are currently

traded on the Nasdaq Capital Market under the symbol “AGRIW”. On August 8, 2022, the last reported sales price for

our common stock was $1.78 per share. We will apply to list any shares of common stock sold by us under this prospectus and any

prospectus supplement on the Nasdaq Capital Market. The prospectus supplement will contain information, where applicable, as to any other

listing of the securities on the Nasdaq Capital Market or any other securities market or exchange covered by the prospectus supplement.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved

in the sale of the securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among

them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. We can sell

the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing the method and terms

of the offering of such securities. See “Plan of Distribution” section of this prospectus for further information.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” section of this prospectus.

We may also include specific risk factors in an applicable prospectus supplement under the heading “Risk Factors.” You should

carefully review these Risk Factors prior to investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 9, 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”),

using a “shelf” registration process. Under this shelf registration statement, we may sell securities from time to time and

in one or more offerings up to a total dollar amount of $150,000,000, subject to limitations as set forth in General Instruction I.B.6.

of Form S-3, until such time as our unaffiliated market capitalization reaches $75 million. As allowed by SEC rules, this prospectus

does not contain all of the information included in the registration statement, including its exhibits. For further information, we refer

you to the registration statement, including its exhibits, the documents incorporated by reference therein and herein as well as any

accompanying prospectus supplements or any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

Statements contained in this prospectus and any accompanying prospectus supplement or in any applicable free writing prospectus about

the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations

require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for

a complete description of these matters.

You

should rely only on the information incorporated by reference or provided in this prospectus, any accompanying prospectus supplement

or any applicable free writing prospectuses prepared by or on behalf of us or to which we have referred you. We have not authorized anyone

else to provide you with any other information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

THIS

PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

Neither

we, nor any agent, underwriter or dealer has authorized any person to give any information or to make any representation other than those

contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any related free writing prospectus

prepared by us or on our behalf or to which we have referred you. This prospectus, any applicable supplement to this prospectus or any

related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the

registered securities to which they relate, nor does this prospectus, any applicable supplement to this prospectus or any related

free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person

to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information contained in this prospectus, any applicable prospectus supplement or any related free writing

prospectus is accurate on any date subsequent to the date set forth on the front of the applicable document. You should also not assume

that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus, any applicable prospectus supplement or any related free writing prospectus is delivered, or

securities are sold, on a later date.

This

prospectus and the information incorporated by reference in this prospectus contain summaries of provisions of certain other documents,

but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual

documents. Copies of some of the documents referred to in this prospectus have been filed, will be filed or will be incorporated by reference

as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described

below under the heading “Where You Can Find More Information.”

You

should only rely on the information contained or incorporated by reference in this prospectus, any prospectus supplement or any related

free writing prospectus. We have not authorized anyone to provide you with information different from what is contained or incorporated

by reference into this prospectus, applicable prospectus supplement or any related free writing prospectus. If any person does provide

you with information that differs from what is contained or incorporated by reference in this prospectus, applicable prospectus supplement

or any related free writing prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus, applicable prospectus supplement or any related free writing prospectus. You

should assume that the information contained in this prospectus, any prospectus supplement or any related free writing prospectus is

accurate only as of the date on the front of the document and that any information contained in any document we have incorporated by

reference therein is accurate only as of the date on its face, regardless of the time of delivery of this prospectus, any prospectus

supplement, any related free writing prospectus or any sale of a security under this registration statement. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is

unlawful.

SUMMARY

This

summary highlights selected information from this prospectus and does not contain all of the information that you should consider in

making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related

free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained

in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the documents that are

incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus,

including our financial statements, and the exhibits to the registration statement of which this prospectus is a component.

The

terms “AgriForce,” the “Company,” “we,” “our” or “us” in this prospectus

refer to AgriForce Growing Systems, Ltd. and its wholly-owned subsidiaries, unless the context suggests otherwise.

OUR

BUSINESS

Overview

AgriFORCE

Growing Systems Ltd. was incorporated as a private company by Articles of Incorporation issued pursuant to the provisions of the Business

Corporations Act (British Columbia) on December 22, 2017. The Company’s registered and records office address is at 300

– 2233 Columbia Street, Vancouver, BC, Canada, V5Y 0M6. On February 13, 2018, the Company changed its name from 1146470

B.C. Ltd to Canivate Growing Systems Ltd. On November 22, 2019 the Company changed its name from Canivate Growing Systems Ltd. to AgriFORCE

Growing Systems Ltd.

At

AgriFORCE, our purpose is clear: to positively transform farm, food, and family every day, everywhere. With years of in-depth research

and development experience, we are pioneers, ready to deliver integrated, practical, and sustainable solutions that can be applied throughout

multiple verticals in AgTech. We drive our business through two operating divisions, AgriFORCE Solutions and AgriFORCE Brands.

Our

two divisions—AgriFORCE Solutions and AgriFORCE Brands—work in partnership to address some of the existential challenges

being faced by the world today—climate change, extreme weather, food security and sovereignty, the environmental impact of industrial

and commercial farming—working towards providing better tasting, more nutritious plant-based foods and other products to consumers

on a global level.

AgriFORCE

Solutions:

AgriFORCE

Solutions provides consulting services for AgTech knowledge, operational solutions, and research and development (R&D), which is

augmented with patented and patent pending controlled-environment agriculture (CEA) and additional agriculture facilities and platforms.

We

have taken a strategic and holistic view of agriculture to provide solutions that address the key challenges facing this important industry.

We develop and acquire innovative intellectual property (IP) and technology to improve farming. Our expertise goes from seed to table

and ranges through the life cycle of a plant—from micropropagation and tissue culture to cultivation—with a proprietary approach

that brings together all of the elements, including crops, operations, facilities, systems, and environment designed to allow the plant

to reach its full genetic potential.

From

consulting to our innovative foundational intellectual property—our proprietary facility and growing systems—to the technology

and know-how that we have in our group of companies, we have integrated the key aspects of AgTech to create an outcome that is Clean.

Green. Better.

AgriFORCE

Brands:

AgriFORCE

Brands division is focused on the development and commercialization of plant-based ingredients and products that deliver healthier and

more nutritious solutions. We will market and commercialize both branded consumer product offerings and ingredient supply. This started

with the acquisition of the MNG (Manna) intellectual property which is a patent-pending technology to naturally process and convert grains,

pulses, and root vegetables. The process results in low-starch, low-sugar, high-protein, fiber-rich baking flour products, and nutrition

liquid. The nutrition values of the flour have the potential to transform consumers’ diet in multiple verticals.

MNG

Wheat flour has 30 times more fibers, up to 3 times more proteins and less than 15% of the starch as Regular All-Purpose Baking flour

as independently tested and conducted by Eurofins Food Chemistry Testing Madison, Inc.

DIVISIONS:

AgriFORCE

Solutions

Understanding

Our Approach – The AgriFORCE Precision Growth Method

Traditional

farming includes three fundamental approaches: outdoor, greenhouse and indoor. AgriFORCE introduces a unique fourth method, the AgriFORCE

precision growth method, which is informed by cutting-edge science and leveraging the latest advances in artificial intelligence (AI)

and Internet of Things (IoT).

With

a carefully optimized approach to facility design, IoT, AI utilization, nutrient delivery, and micro-propagation, we have devised an

intricate, scientific and high success-oriented approach designed to produce greater yields using fewer resources. This method is intended

to outperform traditional growing methods using a specific combination of new and traditional techniques required to attain this efficiency.

We call it precision growth. The AgriFORCE precision growth method focuses on addressing some of the most important legacy challenges

in agriculture: environmental impact, operational efficiency and yield volumes.

The

AgriFORCE precision growth method presents a tremendous opportunity to positively disrupt all corners of the industry. The size of just

the nutraceutical and plant-based pharmaceutical and vaccine/therapeutics market is over $500 billion. Including the traditional hydroponics

high value crops and controlled-environment food markets, the addressable market approaches nearly $1 trillion.(1)(2)(3).

While

our patent pending intellectual property initially targeted the hydroponics sector of our customers high value crops to showcase its

efficacy in a growing market, we are currently expanding operations to refine our technology and methodology for vegetables and fruit

food crops. Hydroponics was identified as an ideal sector to demonstrate proof of concept However, management has decided that the Company

focus on evolving our intellectual property and applying our precision growth method to other agricultural areas so that we can be a

part of the solution in fixing the severe issues with the global food supply chain.

The

AgriFORCE Model – Managing the Difficulties of Agricultural Verticals with Modern Technology and Innovation

Our

intellectual property combines a uniquely engineered facility design and automated growing system to provide a clear solution to the

biggest problems plaguing most agricultural verticals. It delivers a clean, self-contained environment that maximizes natural sunlight

and offers near ideal supplemental lighting. It also limits human intervention and – crucially – it was designed to provide

superior quality control. It was also created to drastically reduce environmental impact, substantially decrease utility demands, as

well as lower production costs, while delivering customers daily harvests and higher crop yields.

Plants

grow most robustly and flavorfully in full natural sunlight. While it may seem counterintuitive to some, even the clearest of glass greenhouses

inhibit the full light spectrum of the sun. However, new translucent and transparent membrane materials have emerged that enable the

near-full-transmission of the sun’s light spectrum.

(1)

https://home.kpmg/pl/en/home/insights/2015/04/nutraceuticals-the-future-of-intelligent-food.html

(2)

https://link.springer.com/article/10.1057/jcb.2010.37

(3)

https://medium.com/artemis/lets-talk-about-market-size-316842f1ab27

Unlike

plastic or glass, these new transparent membranes can help crops achieve their full genetic (and flavor) potential. Natural light also

warms the microclimate, when necessary, dramatically reducing heating energy requirements. At times when natural light is not available,

advances in supplemental grow lighting can extend the plants’ photoperiod – to maximize crop growth, quality, and time to

harvest by up to 50% better.

Greenhouses

and vertical farms are also compromised by outdoor and human-introduced contamination. The new model relies on creating a sealed, cleanroom-like

microclimate that keeps pests, pesticides, and other pollutants outside.

Thanks

to AI, the IoT, and similar advances, farmers can now benefit from highly automated growing systems that reduce human intervention and

its associated costs. Finely tuned convective air circulation systems enable the microclimate to remain sealed and protected. Natural

temperature regulation using sunlight and organic foam-based clouds can significantly reduce air-conditioning electricity requirements.

Highly automated hydration, fertilization, and lighting are all continuously optimized by machine learning.

This

new AgriFORCE model, which has been designed with more than four years of ongoing research and development, is set to be put into large

scale practice when the first of three new grow facilities complete construction in Coachella, California. This unique approach, which

included contributions from lighting experts who had previously worked at NASA sending plants into space, was developed to significantly

improve local food security in an environmentally friendly way. It uses the best aspects of the facility’s operator’s current

growing methods – outdoor, greenhouse and indoor – and replaces their shortcomings with better technology and processes.

Any

solution whether in agriculture, industry, or consumer goods is typically the integration of various disparate parts which, in and of

themselves, require independent skill sets and levels of expertise to bring together the desired outcome. Controlled environment agriculture

solutions such as our patent pending proprietary facility and automated grow system are no different. Centered around four pillars: facility

and lighting; automation and AI; nutrients and fertigation and micropropagation and genetics, our business not only has a tremendous

opportunity to grow organically by virtue of our future pipeline of Growhouse contracts;, but also through accretive acquisitions for

our Agtech platform.

Our

Position in the Ag-Tech Sector

The

Ag-Tech sector is severely underserved by the capital markets, and we see an opportunity to acquire global companies who have provided

solutions to the industry and are leading innovation moving forward. We are creating a separate corporate office to aggressively pursue

such acquisitions. The robustness of our engagement with potential targets has confirmed our belief and desire to be part of a larger

integrated Ag-Tech solutions provider, where each separate element of the business has its existing legacy business and can leverage

across areas of expertise to expand their business footprint. We believe that there is currently no one that we are aware of who is pursuing

this model in the US capital markets environment at this time.

The

AgriFORCE Grow House

The

Company is an agriculture-focused technology company that delivers innovative and reliable, financially robust solutions for high value

crops through our proprietary facility design and automation IP to businesses and enterprises globally. The Company intends to operate

in the plant based pharmaceutical, nutraceutical, and high value crop markets using its unique proprietary facility design and hydroponics

based automated growing system that enable cultivators to effectively grow crops in a controlled environment. The Company calls its facility

design and automated growing system the “AgriFORCE grow house”. The Company has designed its AgriFORCE grow house to produce

in virtually any environmental condition and to optimize crop yields to as near their full genetic potential possible while substantially

eliminating the need for the use of pesticides, fungicides and/or irradiation. The Company is positioning itself to deliver solutions

to a growing industry where end users are demanding environmentally friendly and sustainable, controlled growing environments and processes.

The initial market focus is the cultivation of food and other high value crops in California, and proof of concept may apply the IP to

biomass production of plant based vaccine materials. The Company believes that its IP may provide a lower cost cultivation solution for

the indoor production of crops due to a combination of higher crop quality and yields, and reduced operating costs. The Company has designed

its AgriFORCE grow house as a modular growing facility that it plans to build and license to licensed operators for the cultivation of

food and high value crops. The AgriFORCE grow house incorporates a design and technology that is the subject of a provisional patent

that the Company has submitted to the United States Patent and Trademark Office on March 7, 2019. On March 6, 2020, a New International

Patent Application No. PCT/CA2020/050302 Priority Claim United States 62/815, 131 was filed. The Company’s IP can be adapted to

a multitude of crops and required growing conditions where exacting environmental control and pharma grade equivalent cleanliness and

processes are required to meet the highest cultivation standards. By delivering the first facility, the Company should be in a position

to demonstrate the performance and to target Good Manufacturing Practices standards compliance necessary to engage the pharma industry