reAlpha Tech Corp. (Nasdaq: AIRE) (“reAlpha” or the “Company”), a

real estate technology company developing and commercializing

artificial intelligence (“AI”) technologies, today announced the

appointment of William Brent Miller as the Company’s Chief

Financial Officer (“CFO”), effective as of August 19, 2024,

replacing Michael J. Logozzo from his role as Interim Chief

Financial Officer. Mr. Miller will assume responsibility for all

financial and accounting functions of the Company and will report

directly to its President and Chief Operating Officer, Mr. Logozzo.

Mr. Miller brings over 20 years of finance

reporting and leadership skills. Before joining the Company, from

January 2019 to March 2024, Mr. Miller served as Chief Accounting

Officer of Sunlight Financial Holdings Inc. (“Sunlight”), a

previously publicly traded technology-enabled point-of-sale finance

company that provides homeowners with financing for the

installation of residential solar systems and other home

improvements. Mr. Miller managed Sunlight’s financial reporting,

accounting policy and procedures and internal controls.

Prior to Sunlight, from October 2015 to March

2018, Mr. Miller served as Chief Financial Officer and Treasurer of

KKR Real Estate Finance Trust Inc., a commercial mortgage real

estate investment trust (“REIT”) externally managed by Kohlberg

Kravis Roberts & Co. Inc. (“KKR”), a global investment firm,

where he oversaw all aspects of the REIT’s financial and

organizational strategy involving capital raises, capital structure

and financial and regulatory reporting. From January 2009 to August

2015, Mr. Miller served in a variety of roles with Fortress

Investment Group LLC, a diversified global investment management

firm, including Controller of New Residential Investment Corp., a

REIT primarily focused on investing in residential mortgage related

assets, and Vice President of Finance, where he led accounting,

finance and treasury operations. Mr. Miller received a B.S.B.A in

Accounting and Finance and a B.S. in Computer Information Science

from the Ohio State University.

Giri Devanur, Chief Executive Officer of

reAlpha, commented, “We are thrilled to welcome Brent Miller to the

reAlpha team. His experience, particularly during his tenure at

KKR, will be instrumental as we continue to execute our strategic

vision and bring the reAlpha platform to market. Brent’s proven

leadership in financial management and his deep understanding of

the real estate investment landscape makes him the ideal person to

help guide reAlpha’s financial strategy moving forward.”

Mr. Miller added, “I'm incredibly excited to

join the reAlpha team. reAlpha’s innovative approach to overcoming

affordability barriers to home ownership and simplifying real

estate investment using AI technology is truly inspiring. I look

forward to contributing to its continued growth and success.”

The Company will file a Current Report on Form

8-K with the Securities and Exchange Commission (“SEC”) today

disclosing Mr. Miller’s appointment and related compensation

arrangement.

About reAlpha

reAlpha (previously called

“Claire”), announced on April 24, 2024, is reAlpha’s

generative AI-powered, commission-free, homebuying platform. The

tagline: No fees. Just keys.TM – reflects reAlpha’s dedication

to eliminating traditional barriers and making homebuying more

accessible and transparent.

reAlpha’s introduction aligns with major shifts

in the real estate sector after the NAR agreed to settle certain

lawsuits upon being found to have violated antitrust laws,

resulting in inflated fees paid to buy-side agents. This

development is expected to result in the end of the standard six

percent sales commission, which equates to approximately $100

billion in realtor fees paid annually. reAlpha offers a cost-free

alternative for homebuyers by utilizing an AI-driven workflow that

assists them through the homebuying process.

Homebuyers using reAlpha’s conversational

interface will be able to interact with Claire, reAlpha’s AI

buyer’s agent, to guide them through every step of their homebuying

journey, from property search to closing the deal. By offering

support 24/7, Claire is poised to make the homebuying process more

efficient, enjoyable, and cost-efficient. Claire matches buyers

with their dream homes using over 400 data attributes and provides

insights into market trends and property values. Additionally,

Claire can assist with questions, booking property tours,

submitting offers, and negotiations.

Currently, reAlpha is under limited availability

for homebuyers located in 20 counties in Florida, but reAlpha is

actively seeking new MLS and brokerage licenses that will enable

expansion into more U.S. states.For more information, please

visit www.reAlpha.com.

About reAlpha Tech Corp.

reAlpha Tech Corp. (Nasdaq: AIRE) is a real

estate technology company developing an end-to-end commission-free

homebuying platform. Utilizing the power of AI and an

acquisition-led growth strategy, reAlpha’s goal is to offer a more

affordable, streamlined experience for those on the journey to

homeownership. For more information,

visit www.reAlpha.com.

Forward-Looking Statements

The information in this press release includes

“forward-looking statements”. Forward-looking statements include,

among other things, statements about the NAR rule changes; the

anticipated consequences of the NAR rule changes; statements about

the reAlpha platform; reAlpha’s ability to anticipate the future

needs of the short-term rental market; future trends in the real

estate, technology and artificial intelligence industries,

generally; and reAlpha’s future growth strategy and growth rate. In

some cases, you can identify forward-looking statements by

terminology such as “may”, “should”, “could”, “might”, “plan”,

“possible”, “project”, “strive”, “budget”, “forecast”, “expect”,

“intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”,

“potential” or “continue”, or the negatives of these terms or

variations of them or similar terminology. Factors that may cause

actual results to differ materially from current expectations

include, but are not limited to: reAlpha’s limited operating

history and that reAlpha has not yet fully developed its AI-based

technologies; reAlpha’s ability to commercialize its developing

AI-based technologies; whether reAlpha’s technology and products

will be accepted and adopted by its customers and intended users;

reAlpha’s ability to capitalize on the NAR rules change development

to create more demand for its products and services, including the

reAlpha platform; reAlpha’s ability to generate revenues through

the reAlpha platform and services provided therein; reAlpha’s

ability to acquire, collaborate with and/or partner with mortgage

brokerage firms and home insurance providers, as well as other

service providers to further enhance the reAlpha platform’s

capabilities and services provided therein; reAlpha’s ability to

generate revenue through its title services and any other services

it may offer to reAlpha’s users in the future, both in mobile

devices and online; the inability to maintain and strengthen

reAlpha’s brand and reputation; the inability to accurately

forecast demand for short-term rentals and AI-based real estate

focused products; the inability to execute business objectives and

growth strategies successfully or sustain reAlpha’s growth; the

inability of reAlpha’s customers to pay for reAlpha’s services;

changes in applicable laws or regulations, and the impact of the

regulatory environment and complexities with compliance related to

such environment; and other risks and uncertainties indicated in

reAlpha’s SEC filings. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

statements. Although reAlpha believes that the expectations

reflected in the forward-looking statements are reasonable, there

can be no assurance that such expectations will prove to be

correct. reAlpha’s future results, level of activity, performance

or achievements may differ materially from those contemplated,

expressed or implied by the forward-looking statements, and there

is no representation that the actual results achieved will be the

same, in whole or in part, as those set out in the forward-looking

statements. For more information about the factors that could cause

such differences, please refer to reAlpha’s filings with the SEC.

Readers are cautioned not to put undue reliance on forward-looking

statements, and reAlpha does not undertake any obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

Investor Relations

Contactinvestorrelations@realpha.com

Mediairlabs on behalf of

reAlphaFatema Bhabrawalafatema@irlabs.ca

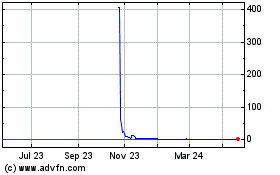

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

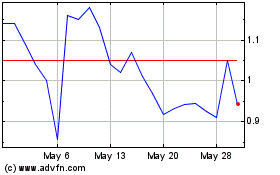

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Nov 2023 to Nov 2024