− Achieved Second Quarter 2024 Global Net

Product Revenues of $410 Million, Representing 34% Year-Over-Year

Growth Compared to Q2 2023, Driven by Continued Momentum from TTR

Business, Which Delivered 37% Year-Over-Year Growth –

− Reported Positive Topline Results from

HELIOS-B Phase 3 Study of Vutrisiran, Achieving Statistical

Significance on Primary and All Secondary Endpoints in Both Overall

and Monotherapy Populations –

− Updated 2024 Financial Guidance, Including

Increased Combined Net Product Revenue Guidance from $1,400 Million

- $1,500 Million to $1,575 Million - $1,650 Million –

Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi

therapeutics company, today reported its consolidated financial

results for the second quarter ended June 30, 2024 and reviewed

recent business highlights.

“Alnylam delivered strong results across the business in the

second quarter. We achieved a robust 34% year-over-year growth,

with global net product revenues of $410 million, primarily driven

by our TTR business, leading to an upward revision of our combined

net product revenue guidance for the year. On the clinical side, we

announced positive topline results from the HELIOS-B Phase 3 study

of vutrisiran, showing that it improved cardiovascular outcomes,

including an impressive 35-36% mortality benefit, in patients with

ATTR cardiomyopathy,” said Yvonne Greenstreet, MBChB, Chief

Executive Officer of Alnylam. “With these outstanding results in

hand, and assuming successful regulatory review and approval, we

believe we are positioned to deliver significant long-term topline

growth, providing the capacity for strategic investment in our

highly productive organic R&D platform, and further advancing

us toward our Alnylam P5x25 goals and becoming a leading global

biotech company.”

Second Quarter 2024 and Recent Significant Corporate

Highlights

Commercial Performance

Total TTR: ONPATTRO® (patisiran) & AMVUTTRA®

(vutrisiran)

- Continued growth momentum in total TTR, achieving global net

product revenues for ONPATTRO and AMVUTTRA for the second quarter

of $77 million and $230 million, respectively, representing 16%

total TTR quarterly growth compared to Q1 2024, and 37% annual

growth compared to Q2 2023, including 40% annual growth in the

U.S.

Total Rare: GIVLAARI® (givosiran) & OXLUMO®

(lumasiran)

- Achieved global net product revenues for GIVLAARI and OXLUMO

for the second quarter of $62 million and $41 million,

respectively, representing 2% total Rare quarterly growth compared

to Q1 2024, and 25% annual growth compared to Q2 2023.

R&D Highlights

- Announced positive topline results from the HELIOS-B Phase 3

study of vutrisiran in patients with ATTR amyloidosis with

cardiomyopathy (ATTR-CM).

- The study met the primary endpoint, demonstrating statistically

significant reductions of 28% and 33% in the composite of all-cause

mortality and recurrent cardiovascular events in the overall and

monotherapy populations, respectively.

- Reduced all-cause mortality by 36% and 35% in the overall and

monotherapy populations, respectively, in a pre-specified secondary

endpoint.

- Demonstrated clinically significant improvements vs. placebo on

key measures of disease progression, including functional capacity,

quality of life, and physician assessment of disease severity.

- Observed consistent effects in all key subgroups, including

baseline tafamidis use.

- Demonstrated encouraging safety, consistent with vutrisiran’s

established profile.

- Reported positive results from the KARDIA-2 Phase 2 study of

investigational zilebesiran added to standard-of-care

antihypertensives in patients with inadequately controlled

hypertension.

- Initiated dosing in the cAPPricorn-1 Phase 2 study of

investigational mivelsiran (ALN-APP) in patients with

cerebral amyloid angiopathy (CAA).

- Initiated Part B of the Phase 1 study of ALN-KHK, in

development for the treatment of Type 2 diabetes mellitus.

- Our collaboration partner, Sanofi, submitted regulatory filings

for the investigational agent for hemophilia, fitusiran, in

China, Brazil, and the U.S., with an FDA target action date of

March 28, 2025.

- Our collaboration partner, Vir Biotechnology, reported new data

for investigational elebsiran at the European Association

for the Study of the Liver (EASL) Congress 2024. Vir also received

Fast Track Designation for tobevibart and elebsiran for the

treatment of hepatitis delta infection.

Additional Business Updates

- Updated collaboration agreements with Regeneron.

- Amended license agreement under which Regeneron gains exclusive

rights to cemdisiran as a monotherapy in exchange for a $10

million upfront payment, certain regulatory milestones, and low

double-digit royalties on sales of cemdisiran as a

monotherapy.

- Alnylam now has full global development and commercialization

rights to mivelsiran in all indications, as Regeneron opted

out of further co-development and co-commercialization of

mivelsiran, in development for CAA and Alzheimer's disease.

Regeneron will be eligible to receive low double-digit royalties on

sales of mivelsiran, if approved.

- Published 2023 Corporate Responsibility Report

Upcoming Events

Alnylam announced today that detailed results from the HELIOS-B

Phase 3 study of vutrisiran will be presented as a Hot Line

Oral Presentation at the European Society of Cardiology (ESC)

Congress on Friday, August 30, 2024, at 11:00 am BST (6:00 am ET)

in London, UK. The Company will host a webcast to discuss the

results at 1:00 pm BST (8:00 am ET).

The Company also announced today that it will host a TTR

Investor Day on October 9, 2024 in New York City. This event will

feature presentations from Alnylam senior leaders and external

experts related to the Company’s TTR business. A live webcast of

the event will also be available.

In mid- and late 2024, Alnylam intends to:

- Submit a supplemental New Drug Application (sNDA) for

vutrisiran to the FDA using a Priority Review Voucher.

- Initiate a Phase 3 study of ALN-TTRsc04 in patients with

ATTR-CM at or around year-end.

- Report interim results from Part B of the Phase 1 study of

mivelsiran (ALN-APP) in patients with Alzheimer’s

disease.

- Initiate a Phase 2 study of mivelsiran in patients with

Alzheimer’s disease at or around year-end.

- Initiate a Phase 1 study of ALN-BCAT, in development for

the treatment of hepatocellular carcinoma.

- File 3 Investigational New Drug (IND) applications by

year-end.

Financial Results for the Quarter Ended June 30, 2024

Three Months Ended June

30,

(In thousands, except per share

amounts)

2024

2023

Net product revenues

$

410,088

$

305,705

Net revenue from collaborations

$

227,338

$

5,844

Royalty revenue

$

22,399

$

7,205

GAAP Operating income (loss)

$

48,614

$

(229,831

)

Non-GAAP Operating income (loss)

$

137,902

$

(154,029

)

GAAP Net loss

$

(16,889

)

$

(276,024

)

Non-GAAP Net income (loss)

$

73,766

$

(201,622

)

GAAP Net loss per common share - basic and

diluted

$

(0.13

)

$

(2.21

)

Non-GAAP Net income (loss) per common

share - basic

$

0.58

$

(1.62

)

Non-GAAP net income (loss) per common

share - diluted

$

0.56

$

(1.62

)

For an explanation of our use of non-GAAP

financial measures refer to the “Use of Non-GAAP Financial

Measures” section later in this press release and for a

reconciliation of each non-GAAP financial measure to the most

comparable GAAP measure, see the tables at the end of this press

release.

Net Product Revenues

Three Months Ended June

30,

Year over Year %

Growth

(In thousands, except percentages)

2024

2023

As Reported

At CER*

ONPATTRO net product revenues

$

77,244

$

91,458

(16

)%

(15

)%

AMVUTTRA net product revenues

230,109

132,136

74

%

77

%

Total TTR net product revenues

307,353

223,594

37

%

39

%

GIVLAARI net product revenues

62,127

57,899

7

%

8

%

OXLUMO net product revenues

40,608

24,212

68

%

68

%

Total Rare net product revenues

102,735

82,111

25

%

26

%

Total net product revenues

$

410,088

$

305,705

34

%

35

%

* CER = Constant Exchange Rate,

representing growth calculated as if the exchange rates had

remained unchanged from those used in the second quarter 2023. CER

is a non-GAAP measure.

- Total net product revenues increased 34% and 35% at actual

currency and CER, respectively, during the three months ended June

30, 2024, as compared to the same period in 2023, due to strong

growth from AMVUTTRA driven by increased patient demand, as well as

increased patients on GIVLAARI and OXLUMO.

Net Revenues from Collaborations

- Net revenues from collaborations during the three months ended

June 30, 2024, included approximately $185 million of revenue,

which was previously deferred, upon modifying our collaboration

agreement with Regeneron. As part of the modification to the

collaboration agreement, we granted Regeneron exclusive license

rights to cemdisiran monotherapy.

Operating Expenses

Three Months Ended June

30,

(In thousands, except percentages)

2024

2023

Cost of goods sold

$

67,271

$

75,336

Cost of goods sold as a percentage of net

product revenues

16.4

%

24.6

%

Cost of collaborations and royalties

$

1,401

$

10,034

GAAP research and development expenses

$

294,142

$

248,526

Non-GAAP research and development

expenses

$

246,027

$

215,725

GAAP selling, general and administrative

expenses

$

248,397

$

214,689

Non-GAAP selling, general and

administrative expenses

$

207,224

$

171,688

Cost of Goods Sold

- Cost of goods sold as a percentage of net product revenues

decreased during the three months ended June 30, 2024, as compared

to the same period in 2023, primarily due to higher costs in 2023

associated with cancelled manufacturing commitments for ONPATTRO

and other adjustments to inventory, for which similar expenses did

not occur in 2024.

Research & Development (R&D) Expenses

- GAAP and non-GAAP R&D expenses increased during the three

months ended June 30, 2024, as compared to the same period in 2023,

primarily due to increased costs associated with our preclinical

activities, increased clinical research expenses associated with

startup activities for the zilebesiran and mivelsiran clinical

studies, and increased employee compensation expenses. GAAP R&D

expenses further increased in the second quarter of 2024, compared

with 2023, due to increased stock-based compensation expense.

Selling, General & Administrative (SG&A) Expenses

- GAAP and non-GAAP SG&A expenses increased during the three

months ended June 30, 2024, as compared to the same period in 2023,

primarily due to increased marketing investment associated with

promotion of our TTR therapies and increased employee compensation

expenses.

Other Financial Highlights

- Cash, cash equivalents and marketable securities were $2.62

billion as of June 30, 2024, as compared to $2.44 billion as of

December 31, 2023, with the increase primarily due to increased net

product revenues and increased net proceeds from the issuance of

common stock in connection with stock option exercises.

A reconciliation of our GAAP to non-GAAP results for the quarter

is included in the tables at the end of this press release.

2024 Financial Guidance

Full year 2024 financial guidance has been updated as

follows:

Provided 2/15/2024

Updated 8/1/2024

Combined net product revenues for

ONPATTRO, AMVUTTRA, GIVLAARI and OXLUMO1

$1,400 million - $1,500

million

$1,575 million - $1,650

million

Net Product Revenue Growth vs. 2023 at

reported FX rates1

13% to 21%

27% to 33%

Net Product Revenue Growth vs. 2023 at

CER*

13% to 21%

28% to 34%

Net revenues from collaborations and

royalties

$325 million - $425 million

$575 million - $650 million

GAAP R&D and SG&A expenses

$1,900 million - $2,050

million

$2,000 million - $2,150

million

Non-GAAP R&D and SG&A

expenses2

$1,675 million - $1,775

million

$1,775 million - $1,875

million

1 Uses June 30, 2024 FX rates including: 1

EUR = 1.07 USD and 1 USD = 161 JPY

2 Primarily excludes $225 - $275 million

of stock-based compensation expense from estimated GAAP R&D and

SG&A expenses

*CER = Constant Exchange Rate,

representing growth calculated as if the exchange rates had

remained unchanged from those used in the twelve months ended

December 31, 2023. CER is a non-GAAP measure.

Use of Non-GAAP Financial Measures

This press release contains non-GAAP financial measures,

including expenses adjusted to exclude certain non-cash expenses

and non-recurring gains outside the ordinary course of the

Company’s business. These measures are not in accordance with, or

an alternative to, GAAP, and may be different from non-GAAP

financial measures used by other companies.

The items included in GAAP presentations but excluded for

purposes of determining non-GAAP financial measures for the periods

presented in this press release are stock-based compensation

expenses and realized and unrealized losses on marketable equity

securities. The Company has excluded the impact of stock-based

compensation expense, which may fluctuate from period to period

based on factors including the variability associated with

performance-based grants for stock options and restricted stock

units and changes in the Company’s stock price, which impacts the

fair value of these awards. The Company has excluded the impact of

the realized and unrealized losses on marketable equity securities

because the Company does not believe these adjustments accurately

reflect the performance of the Company’s ongoing operations for the

period in which such gains or losses are reported, as their sole

purpose is to adjust amounts on the balance sheet.

Percentage changes in revenue growth at CER are presented

excluding the impact of changes in foreign currency exchange rates

for investors to understand the underlying business performance.

The current period’s foreign currency revenue values are converted

into U.S. dollars using the average exchange rates from the prior

period.

The Company believes the presentation of non-GAAP financial

measures provides useful information to management and investors

regarding the Company’s financial condition and results of

operations. When GAAP financial measures are viewed in conjunction

with non-GAAP financial measures, investors are provided with a

more meaningful understanding of the Company’s ongoing operating

performance and are better able to compare the Company’s

performance between periods. In addition, these non-GAAP financial

measures are among those indicators the Company uses as a basis for

evaluating performance, allocating resources and planning and

forecasting future periods. Non-GAAP financial measures are not

intended to be considered in isolation or as a substitute for GAAP

financial measures. A reconciliation between GAAP and non-GAAP

measures is provided later in this press release.

Conference Call Information

Management will provide an update on the Company and discuss

second quarter 2024 results as well as expectations for the future

via conference call on Thursday, August 1, 2024 at 8:30 am ET. A

live audio webcast of the call will be available on the Investors

section of the Company’s website at investors.alnylam.com/events.

An archived webcast will be available on the Alnylam website

approximately two hours after the event.

About ONPATTRO® (patisiran)

ONPATTRO is an RNAi therapeutic that is approved in the United

States and Canada for the treatment of adults with hATTR

amyloidosis with polyneuropathy. ONPATTRO is also approved in the

European Union, Switzerland and Brazil for the treatment of hATTR

amyloidosis in adults with Stage 1 or Stage 2 polyneuropathy, and

in Japan for the treatment of hATTR amyloidosis with

polyneuropathy. ONPATTRO is an intravenously administered RNAi

therapeutic targeting transthyretin (TTR). It is designed to target

and silence TTR messenger RNA, thereby reducing the production of

TTR protein before it is made. Reducing the pathogenic protein

leads to a reduction in amyloid deposits in tissues. For more

information about ONPATTRO, including full Prescribing Information,

visit ONPATTRO.com.

About AMVUTTRA® (vutrisiran)

AMVUTTRA (vutrisiran) is an RNAi therapeutic approved in the

United States for the treatment of adults with hATTR amyloidosis

with polyneuropathy. It is a double-stranded small interfering RNA

(siRNA) that targets mutant and wild-type transthyretin (TTR)

messenger RNA (mRNA). Using Alnylam’s Enhanced Stabilization

Chemistry (ESC)-GalNAc-conjugate delivery platform, AMVUTTRA is

designed for increased potency and high metabolic stability to

allow for subcutaneous injection once every three months

(quarterly). Results from the pivotal HELIOS-A Phase 3 study

demonstrate AMVUTTRA rapidly reduces serum TTR levels, has the

potential to reverse neuropathy impairment relative to baseline and

improves other key measures of disease burden relative to external

placebo in patients with the polyneuropathy of hATTR amyloidosis.

For more information about AMVUTTRA, including the full U.S.

Prescribing Information, visit AMVUTTRA.com.

About GIVLAARI® (givosiran)

GIVLAARI (givosiran) is an RNAi therapeutic targeting

aminolevulinic acid synthase 1 (ALAS1) approved in the United

States and Brazil for the treatment of adults with acute hepatic

porphyria (AHP). GIVLAARI is also approved in the European Union

for the treatment of AHP in adults and adolescents aged 12 years

and older. In the pivotal study, GIVLAARI was shown to

significantly reduce the rate of porphyria attacks that required

hospitalizations, urgent healthcare visits or intravenous hemin

administration at home compared to placebo. GIVLAARI is Alnylam’s

first commercially available therapeutic based on its Enhanced

Stabilization Chemistry ESC-GalNAc conjugate technology to increase

potency and durability. GIVLAARI is administered via subcutaneous

injection once monthly at a dose based on actual body weight and

should be administered by a healthcare professional. GIVLAARI works

by specifically reducing elevated levels of ALAS1 messenger RNA

(mRNA), leading to reduction of toxins associated with attacks and

other disease manifestations of AHP. For more information about

GIVLAARI, including the full U.S. Prescribing Information, visit

GIVLAARI.com.

About OXLUMO® (lumasiran)

OXLUMO (lumasiran) is an RNAi therapeutic targeting hydroxyacid

oxidase 1 (HAO1). HAO1 encodes glycolate oxidase (GO). Thus, by

silencing HAO1 and depleting the GO enzyme, OXLUMO inhibits

production of oxalate – the metabolite that directly contributes to

the pathophysiology of PH1. OXLUMO utilizes Alnylam’s Enhanced

Stabilization Chemistry (ESC)-GalNAc-conjugate technology, which

enables subcutaneous dosing with increased potency and durability

and a wide therapeutic index. OXLUMO has received regulatory

approvals from the U.S. Food and Drug Administration (FDA) for the

treatment of primary hyperoxaluria type 1 (PH1) to lower urinary

and plasma oxalate levels in pediatric and adult patients and from

the European Medicines Agency (EMA) for the treatment of PH1 in all

age groups. In the pivotal ILLUMINATE-A study, OXLUMO was shown to

significantly reduce levels of urinary oxalate relative to placebo,

with the majority of patients reaching normal or near-normal

levels. In the ILLUMINATE-B pediatric Phase 3 study, OXLUMO

demonstrated an efficacy and safety profile consistent to that

observed in ILLUMINATE-A. In the ILLUMINATE-C study, OXLUMO

resulted in substantial reductions in plasma oxalate in patients

with advanced PH1. Across all three studies, injection site

reactions (ISRs) were the most common drug-related adverse

reaction. OXLUMO is administered via subcutaneous injection once

monthly for three months, then once quarterly beginning one month

after the last loading dose at a dose based on actual body weight.

For patients who weigh less than 10 kg, ongoing dosing remains

monthly. OXLUMO should be administered by a healthcare

professional. For more information about OXLUMO, including the full

U.S. Prescribing Information, visit OXLUMO.com.

About LNP Technology

Alnylam has licenses to Arbutus Biopharma lipid nanoparticle

(LNP) intellectual property for use in RNAi therapeutic products

using LNP technology.

About RNAi

RNAi (RNA interference) is a natural cellular process of gene

silencing that represents one of the most promising and rapidly

advancing frontiers in biology and drug development today. Its

discovery has been heralded as “a major scientific breakthrough

that happens once every decade or so,” and was recognized with the

award of the 2006 Nobel Prize for Physiology or Medicine. By

harnessing the natural biological process of RNAi occurring in our

cells, a new class of medicines known as RNAi therapeutics is now a

reality. Small interfering RNA (siRNA), the molecules that mediate

RNAi and comprise Alnylam’s RNAi therapeutic platform, function

upstream of today’s medicines by potently silencing messenger RNA

(mRNA) – the genetic precursors – that encode for disease-causing

or disease pathway proteins, thus preventing them from being made.

This is a revolutionary approach with the potential to transform

the care of patients with genetic and other diseases.

About Alnylam Pharmaceuticals

Alnylam Pharmaceuticals (Nasdaq: ALNY) has led the translation

of RNA interference (RNAi) into a whole new class of innovative

medicines with the potential to transform the lives of people

afflicted with rare and prevalent diseases with unmet need. Based

on Nobel Prize-winning science, RNAi therapeutics represent a

powerful, clinically validated approach yielding transformative

medicines. Since its founding in 2002, Alnylam has led the RNAi

Revolution and continues to deliver on a bold vision to turn

scientific possibility into reality. Alnylam’s commercial RNAi

therapeutic products are ONPATTRO® (patisiran), AMVUTTRA®

(vutrisiran), GIVLAARI® (givosiran), OXLUMO® (lumasiran), and

Leqvio® (inclisiran), which is being developed and commercialized

by Alnylam’s partner, Novartis. Alnylam has a deep pipeline of

investigational medicines, including multiple product candidates

that are in late-stage development. Alnylam is executing on its

“Alnylam P5x25” strategy to deliver transformative medicines in

both rare and common diseases benefiting patients around the world

through sustainable innovation and exceptional financial

performance, resulting in a leading biotech profile. Alnylam is

headquartered in Cambridge, MA. For more information about our

people, science and pipeline, please visit www.alnylam.com and

engage with us on X (formerly Twitter) at @Alnylam, or on LinkedIn,

Facebook, or Instagram.

Alnylam Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements

other than historical statements of fact regarding Alnylam’s

expectations, beliefs, goals, plans or prospects including, without

limitation, statements regarding Alnylam’s aspiration to become a

leading global biotech company, the potential for Alnylam to

identify new potential drug development candidates and advance its

research and development programs, Alnylam’s ability to obtain

approval for new commercial products or additional indications for

its existing commercial products, and Alnylam’s projected

commercial and financial performance, including the expected range

of net product revenues and net revenues from collaborations and

royalties for 2024, the expected range of aggregate annual GAAP and

non-GAAP R&D and SG&A expenses for 2024, the potential

submission of a sNDA for AMVUTTRA for patients with ATTR

amyloidosis with cardiomyopathy by mid- to late 2024 for FDA

review, the use of a Priority Review Voucher in connection with the

submission of a sNDA for AMVUTTRA for patients with ATTR

amyloidosis with cardiomyopathy, and the advancement towards its

“Alnylam P5x25” strategy, should be considered forward-looking

statements. Actual results and future plans may differ materially

from those indicated by these forward-looking statements as a

result of various important risks, uncertainties and other factors,

including, without limitation, risks and uncertainties relating to:

Alnylam’s ability to successfully execute on its “Alnylam P5x25”

strategy; Alnylam’s ability to discover and develop novel drug

candidates and delivery approaches and successfully demonstrate the

efficacy and safety of its product candidates; the pre-clinical and

clinical results for Alnylam’s product candidates, including

vutrisiran, zilebesiran and mivelsiran; actions or advice of

regulatory agencies and Alnylam’s ability to obtain and maintain

regulatory approval for its product candidates, including

vutrisiran, as well as favorable pricing and reimbursement;

successfully launching, marketing and selling Alnylam’s approved

products globally; delays, interruptions or failures in the

manufacture and supply of Alnylam’s product candidates or its

marketed products; obtaining, maintaining and protecting

intellectual property; Alnylam’s ability to successfully expand the

approved indications for AMVUTTRA in the future; Alnylam’s ability

to manage its growth and operating expenses through disciplined

investment in operations and its ability to achieve a

self-sustainable financial profile in the future without the need

for future equity financing; Alnylam’s ability to maintain

strategic business collaborations; Alnylam’s dependence on third

parties for the development and commercialization of certain

products, including Roche, Novartis, Sanofi, Regeneron and Vir; the

outcome of litigation; the risk of future government

investigations; and unexpected expenditures; as well as those risks

and uncertainties more fully discussed in the “Risk Factors” filed

with Alnylam’s 2023 Annual Report on Form 10-K filed with the

Securities and Exchange Commission (SEC), as may be updated from

time to time in Alnylam’s subsequent Quarterly Reports on Form

10-Q, and in other filings that Alnylam makes with the SEC. In

addition, any forward-looking statements represent Alnylam’s views

only as of today and should not be relied upon as representing its

views as of any subsequent date. Alnylam explicitly disclaims any

obligation, except to the extent required by law, to update any

forward-looking statements.

This release discusses investigational RNAi therapeutics and

uses of previously approved RNAi therapeutics in development and is

not intended to convey conclusions about efficacy or safety as to

those investigational therapeutics or uses. Vutrisiran has not been

approved by any regulatory agency for the treatment of ATTR

amyloidosis with cardiomyopathy. No conclusions can or should be

drawn regarding its safety or effectiveness in treating

cardiomyopathy in this population. There is no guarantee that any

investigational therapeutics or expanded uses of commercial

products will successfully complete clinical development or gain

health authority approval.

ALNYLAM PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share amounts)

June 30, 2024

December 31, 2023

ASSETS

(Unaudited)

Current assets:

Cash and cash equivalents

$

968,492

$

812,688

Marketable debt securities

1,646,268

1,615,516

Marketable equity securities

9,889

11,178

Accounts receivable, net

309,481

327,787

Inventory

83,981

89,146

Prepaid expenses and other current

assets

154,745

126,382

Total current assets

3,172,856

2,982,697

Property, plant and equipment, net

517,159

526,057

Operating lease right-of-use assets

198,303

199,732

Restricted investments

49,391

49,391

Other assets

71,925

72,003

Total assets

$

4,009,634

$

3,829,880

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Accounts payable

$

73,980

$

55,519

Accrued expenses

808,643

713,013

Operating lease liability

41,656

41,510

Deferred revenue

69,009

102,753

Liability related to the sale of future

royalties

61,963

54,991

Total current liabilities

1,055,251

967,786

Operating lease liability, net of current

portion

239,352

243,101

Deferred revenue, net of current

portion

2,402

188,175

Convertible debt

1,022,688

1,020,776

Liability related to the sale of future

royalties, net of current portion

1,342,580

1,322,248

Other liabilities

350,428

308,438

Total liabilities

4,012,701

4,050,524

Commitments and contingencies (Note

13)

Stockholders’ deficit:

Preferred stock, $0.01 par value per

share, 5,000 shares authorized and no shares issued and outstanding

as of June 30, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value per share,

250,000 shares authorized; 128,021 shares issued and outstanding as

of June 30, 2024; 125,794 shares issued and outstanding as of

December 31, 2023

1,281

1,259

Additional paid-in capital

7,122,704

6,811,063

Accumulated other comprehensive loss

(34,637

)

(23,375

)

Accumulated deficit

(7,092,415

)

(7,009,591

)

Total stockholders’ deficit

(3,067

)

(220,644

)

Total liabilities and stockholders’

deficit

$

4,009,634

$

3,829,880

This selected financial information should

be read in conjunction with the consolidated financial statements

and notes thereto included in Alnylam’s Annual Report on Form 10-K

which includes the audited financial statements for the year ended

December 31, 2023.

ALNYLAM PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Statements of Operations

Revenues:

Net product revenues

$

410,088

$

305,705

$

775,251

$

582,033

Net revenues from collaborations

227,338

5,844

345,886

42,306

Royalty revenue

22,399

7,205

33,021

13,705

Total revenues

659,825

318,754

1,154,158

638,044

Operating costs and expenses:

Cost of goods sold

67,271

75,336

121,884

116,768

Cost of collaborations and royalties

1,401

10,034

12,764

23,471

Research and development

294,142

248,526

555,137

479,095

Selling, general and administrative

248,397

214,689

459,194

398,348

Total operating costs and expenses

611,211

548,585

1,148,979

1,017,682

Income (loss) from operations

48,614

(229,831

)

5,179

(379,638

)

Other (expense) income:

Interest expense

(33,258

)

(30,035

)

(68,511

)

(58,990

)

Interest income

29,182

21,075

58,827

39,730

Other expense, net

(55,705

)

(35,418

)

(70,249

)

(47,673

)

Total other expense, net

(59,781

)

(44,378

)

(79,933

)

(66,933

)

Loss before income taxes

(11,167

)

(274,209

)

(74,754

)

(446,571

)

Provision for income taxes

(5,722

)

(1,815

)

(8,070

)

(3,554

)

Net loss

$

(16,889

)

$

(276,024

)

$

(82,824

)

$

(450,125

)

Net loss per common share - basic and

diluted

$

(0.13

)

$

(2.21

)

$

(0.66

)

$

(3.62

)

Weighted-average common shares used to

compute basic and diluted net loss per common share

126,733

124,659

126,435

124,387

ALNYLAM PHARMACEUTICALS,

INC.

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

June 30, 2024

June 30, 2023

Reconciliation of GAAP to Non-GAAP

Research and development:

GAAP Research and development

$

294,142

$

248,526

Less: Stock-based compensation

expenses

(48,115

)

(32,801

)

Non-GAAP Research and development

$

246,027

$

215,725

Reconciliation of GAAP to Non-GAAP

Selling, general and administrative:

GAAP Selling, general and

administrative

$

248,397

$

214,689

Less: Stock-based compensation

expenses

(41,173

)

(43,001

)

Non-GAAP Selling, general and

administrative

$

207,224

$

171,688

Reconciliation of GAAP to Non-GAAP

Operating income (loss):

GAAP Operating income (loss)

$

48,614

$

(229,831

)

Add: Stock-based compensation expenses

89,288

75,802

Non-GAAP Operating income (loss)

$

137,902

$

(154,029

)

Reconciliation of GAAP Net loss to

Non-GAAP Net income:

GAAP Net loss

$

(16,889

)

$

(276,024

)

Add: Stock-based compensation expenses

89,288

75,802

Add (Less): Realized and unrealized loss

(gain) on marketable equity securities

1,367

(1,400

)

Non-GAAP Net income (loss)

$

73,766

$

(201,622

)

Reconciliation of GAAP Net loss to

Non-GAAP Net income (loss) per common share- basic:

GAAP Net loss per common share - basic

$

(0.13

)

$

(2.21

)

Add: Stock-based compensation expenses

0.70

0.61

Add (Less): Realized and unrealized loss

(gain) on marketable equity securities

0.01

(0.01

)

Non-GAAP Net income (loss) per common

share - basic

$

0.58

$

(1.62

)

Reconciliation of GAAP Net loss to

Non-GAAP Net income (loss) per common share- diluted:

GAAP net loss per common share -

diluted

$

(0.13

)

$

(2.21

)

Add: Stock-based compensation expenses

0.70

0.61

Add (Less): Realized and unrealized loss

(gain) on marketable equity securities

0.01

(0.01

)

Less: Impact to earnings per common share

as a result of diluted weighted-average common shares outstanding

during the period*

(0.02

)

—

Non-GAAP net income (loss) per common

share - diluted*

$

0.56

$

(1.62

)

*Diluted non-GAAP net income per share is

calculated by dividing the non-GAAP net income by the

weighted-average number of common shares and dilutive potential

common share equivalents then outstanding during the period. The

diluted weighted-average common shares outstanding for the

three-months ended June 30, 2024 would be 132,061,000.

Please note that the figures presented above

may not sum exactly due to rounding

ALNYLAM PHARMACEUTICALS,

INC.

RECONCILIATION OF GAAP TO

NON-GAAP

PRODUCT REVENUE GROWTH AT

CONSTANT CURRENCY

(Unaudited)

June 30, 2024

Three Months Ended

ONPATTRO net product revenue growth, as

reported

(16

)%

Add: Impact of foreign currency

translation

1

ONPATTRO net product revenue growth at

constant currency

(15

)%

AMVUTTRA net product revenue growth, as

reported

74

%

Add: Impact of foreign currency

translation

3

AMVUTTRA net product revenue growth at

constant currency

77

%

Total TTR net product revenue growth, as

reported

37

%

Add: Impact of foreign currency

translation

2

Total TTR net product revenue growth at

constant currency

39

%

GIVLAARI net product revenue growth, as

reported

7

%

Add: Impact of foreign currency

translation

1

GIVLAARI net product revenue growth at

constant currency

8

%

OXLUMO net product revenue growth, as

reported

68

%

Add: Impact of foreign currency

translation

—

OXLUMO net product revenue growth at

constant currency

68

%

Total net product revenue growth, as

reported

34

%

Add: Impact of foreign currency

translation

1

Total net product revenue growth at

constant currency

35

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801842774/en/

Alnylam Pharmaceuticals, Inc. Christine Regan Lindenboom

(Investors and Media) 617-682-4340

Josh Brodsky (Investors) 617-551-8276

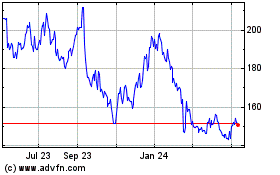

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Oct 2024 to Nov 2024

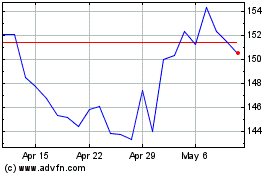

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Nov 2023 to Nov 2024