false

0000738214

0000738214

2024-08-01

2024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Aemetis, Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

001-36475

|

|

26-1407544

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification

No.)

|

20400 Stevens Creek Blvd., Suite 700

Cupertino, CA 95014

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(408) 213-0940

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

AMTX

|

NASDAQ Stock Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

☐ Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Aemetis, Inc. (the “Company”) issued a press release announcing its earnings for the three and six months ended June 30, 2024.

The press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

This Form 8-K and Exhibit 99.1 hereto shall be deemed “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any registration statement of the issuer.

Item 7.01 Regulation FD Material.

On August 1, 2024, the Company issued a press release, posted to its web site at www.aemetis.com, announcing its earnings for the three and six months ended June 30, 2024, a copy of which is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| |

| |

|

|

|

EXHIBIT NUMBER

|

|

DESCRIPTION

|

| |

|

|

|

Exhibit 99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| |

AEMETIS, INC.

|

| |

|

| August 1, 2024 |

By:

|

/s/ Eric A. McAfee

|

|

| |

Name:

|

Eric A. McAfee

|

| |

Title:

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

Exhibit 99.1

|

External Investor Relations Contact:

Kirin Smith

PCG Advisory Group

(646) 863-6519

ksmith@pcgadvisory.com

|

|

|

Company Investor Relations/

Media Contact:

Todd Waltz

(408) 213-0940

investors@aemetis.com

|

Aemetis Reports Revenues of $66 Million for the Second Quarter 2024

Revenues increased 48% over the Second Quarter of 2023

CUPERTINO, Calif. – August 1, 2024 - Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable fuels company focused on low and negative carbon intensity products that replace fossil fuels, today announced its financial results for the three and six months ended June 30, 2024.

Revenues of $66.6 million for the second quarter of 2024 reflect strong execution by all three of the company’s operating segments, with the California Ethanol business generating $40.1 million in revenues, the India Biodiesel business generating $28.8 million in revenues, and the Dairy Renewable Natural Gas (RNG) business generating $1.6 million in revenues.

“The ongoing construction and operation of dairy digesters with the current capacity to produce more than 300,000 MMBtu of renewable natural gas annually by the Dairy RNG business marks an important cash flow milestone for Aemetis, representing a reliable source of increased future revenues,” stated Todd Waltz, Chief Financial Officer of Aemetis. “We anticipate substantial additional revenues from the operational dairies and those dairies under construction when we receive LCFS provisional pathway approvals and when we receive the federal Inflation Reduction Act Section 45Z production tax credits for RNG production beginning in January 2025,” added Waltz.

The California Ethanol business commissioned a new Solar Microgrid with battery storage that will strengthen future cash flows by reducing electric utility costs and optimizing storage and load shedding during peak rate hours.

The Ethanol business also received an allocation of $10.5 million of IRA tax credits from the U.S. Department of Energy and the Internal Revenue Service under the first phase of IRA Section 48C awards to support the installation of a Mechanical Vapor Recompression system that is expected to reduce the Keyes facility natural gas usage by approximately 80%, significantly reducing the carbon intensity of the fuel ethanol produced and generating an associated increase in revenues. Detailed engineering for MVR is completed, and the company has begun procurement of the MVR equipment.

“Complementing the revenue growth in our US businesses, our India Biofuel business announced the appointment of a Managing Director and Chief Executive Officer demonstrating our commitment to the expansion of the India business and our pursuit of an IPO of this subsidiary,” said Eric McAfee, Chairman and CEO of Aemetis.

We invite investors to review the Aemetis Corporate Presentation on the Aemetis home page prior to the earnings call.

Today, Aemetis will host an earnings review call at 11:00 a.m. Pacific time (PT).

Live Participant Dial In (Toll Free): +1-888-506-0062 entry code 807848

Live Participant Dial In (International): +1-973-528-0011 entry code 807848

Webcast URL: https://www.webcaster4.com/Webcast/Page/2211/50872

For details on the call, please visit http://www.aemetis.com/investors/conference-calls/

Financial Results for the Three Months Ended June 30, 2024

Revenues during the second quarter of 2024 were $66.6 million compared to $45.1 million for the second quarter of 2023. Our Keyes plant operated during the entire quarter compared to its extended maintenance cycle during a portion of the second quarter of 2023. Our Dairy Natural Gas segment produced 89,400 MMBtu from eight operating dairy digesters and reported $1.6 million of revenue, and our ninth digester began producing biogas at the end of the second quarter. Our India Biodiesel business recognized $24.8 million of revenue primarily from sales to the India Oil Marketing Companies.

Gross loss for the second quarter of 2024 was $1.8 million, compared to a $2.0 million profit during the second quarter of 2023.

Selling, general and administrative expenses were $11.8 million during the second quarter of 2024 from $9.7 million during the same period in 2023, driven primarily by the recognition of a loss on asset disposals of $3.6 million.

Operating loss was $13.6 million for the second quarter of 2024, compared to operating loss of $7.8 million for the same period in 2023.

Interest expense, excluding accretion of Series A preferred units in the Aemetis Biogas LLC subsidiary, increased to $11.7 million during the second quarter of 2024 compared to $9.6 million during the second quarter of 2023. Additionally, Aemetis Biogas recognized $3.5 million of accretion of Series A preferred units during the second quarter of 2024 compared to $6.9 million during the second quarter of 2023.

Net loss was $29.2 million for the second quarter of 2024, compared to $25.3 million for the second quarter of 2023.

Cash at the end of the second quarter of 2024 was $234 thousand compared to $2.7 million at the close of the fourth quarter of 2023. We recorded investments in capital projects related to the reduction of the carbon intensity of Aemetis ethanol and construction of dairy digesters of $5.4 million for the second quarter of 2024.

Financial Results for the Six Months Ended June 30, 2024

Revenues were $139.2 million for the first half of 2024, compared to $47.3 million for the first half of 2023, primarily occurring from our 2023 extended maintenance cycle which allowed for the acceleration of the implementation of several important efficiency upgrades at the Keyes plant.

Gross loss for the first half of 2023 was $2.4 million, compared to a gross profit of $0.7 million during the first half of 2023.

Selling, general and administrative expenses were $20.7 million during the first half of 2024, compared to $20.6 million during the first half of 2023, including $4.0 million of fixed costs of goods sold charged to selling, general and administrative during the Keyes plant maintenance period during the first half of 2023 and the recognition of a loss on asset disposals of $3.6 million during the first half of 2024.

Operating loss was $23.1 million for the first half of 2024, compared to $19.9 million for the first half of 2023.

Interest expense was $22.2 million during the first half of 2024, excluding accretion and other expenses of Series A preferred units in our Aemetis Biogas LLC subsidiary, compared to interest expense of $18.7 million during the first half of 2023. Additionally, our Aemetis Biogas LLC subsidiary recognized $6.8 million of accretion and other expenses in connection with preference payments on its preferred stock during the first half of 2024 compared to $12.4 million during the first half of 2023.

Net loss for the first half of 2024 was $53.4 million, compared to a net loss of $51.7 million during the same period of 2023.

Investments in capital projects of $9.0 million were made during the first half of 2024, including investments in capital projects related to Aemetis Biogas of $7.1 million.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable natural gas, renewable fuel and biochemicals company focused on the operation, acquisition, development and commercialization of innovative technologies that replace petroleum-based products and reduce greenhouse gas emissions. Founded in 2006, Aemetis is operating and actively expanding a California biogas digester network and pipeline system to convert dairy waste gas into Renewable Natural Gas. Aemetis owns and operates a 65 million gallon per year ethanol production facility in California’s Central Valley near Modesto that supplies about 80 dairies with animal feed. Aemetis owns and operates a 60 million gallon per year production facility on the East Coast of India producing high quality distilled biodiesel and refined glycerin for customers in India and Europe. Aemetis is developing a sustainable aviation fuel (SAF) and renewable diesel fuel biorefinery in California to utilize renewable hydrogen, hydroelectric power, and renewable oils to produce low carbon intensity renewable jet and diesel fuel. For additional information about Aemetis, please visit www.aemetis.com.

Non-GAAP Financial Information

We have provided non-GAAP measures as a supplement to financial results based on GAAP. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is included in the accompanying supplemental data. Adjusted EBITDA is defined as net income/(loss) plus (to the extent deducted in calculating such net income) interest expense, income tax expense, intangible and other amortization expense, accretion expense, depreciation expense, and share-based compensation expense.

Adjusted EBITDA is not calculated in accordance with GAAP and should not be considered as an alternative to net income/(loss), operating income or any other performance measures derived in accordance with GAAP or to cash flows from operating, investing or financing activities as an indicator of cash flows or as a measure of liquidity. Adjusted EBITDA is presented solely as a supplemental disclosure because management believes that it is a useful performance measure that is widely used within the industry in which we operate. In addition, management uses Adjusted EBITDA for reviewing financial results and for budgeting and planning purposes. EBITDA measures are not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure for comparison.

Safe Harbor Statement

This news release contains forward-looking statements, including statements regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events or other statements that are not historical facts. Forward-looking statements in this news release include, without limitation, statements relating to our five-year growth plan, future growth in revenue, expansion into new markets, our ability to commercialize our development projects, the ability to obtain sufficiently low Carbon Intensity scores to achieve below zero carbon intensity transportation fuels, the development of the Aemetis Biogas Dairy project, the development of the Aemetis Sustainable Aviation Fuel plant in Riverbank, the upgrades to the Aemetis Keyes ethanol plant, the development of the Aemetis Carbon Capture projects, and the ability to access the funding required to execute on project development, construction, and operations. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “showing signs,” “targets,” “will likely result,” “will continue” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, competition in the ethanol, biodiesel and other industries in which we operate, commodity market risks including those that may result from current weather conditions, financial market risks, customer adoption, counter-party risks, risks associated with changes to federal policy or regulation, and other risks detailed in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 and in our subsequent filings with the SEC. We are not obligated, and do not intend, to update any of these forward-looking statements at any time unless an update is required by applicable securities laws.

(Tables follow)

|

AEMETIS, INC.

|

|

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

|

|

(unaudited, in thousands, except per share data)

|

| |

|

For the three months ended

June 30,

|

|

|

For the six months ended

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues

|

|

$ |

66,561 |

|

|

$ |

45,112 |

|

|

$ |

139,195 |

|

|

$ |

47,263 |

|

|

Cost of goods sold

|

|

|

68,367 |

|

|

|

43,156 |

|

|

|

141,613 |

|

|

|

46,602 |

|

|

Gross profit (loss)

|

|

|

(1,806 |

) |

|

|

1,956 |

|

|

|

(2,418 |

) |

|

|

661 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

11,800 |

|

|

|

9,746 |

|

|

|

20,650 |

|

|

|

20,574 |

|

|

Operating loss

|

|

|

(13,606 |

) |

|

|

(7,790 |

) |

|

|

(23,068 |

) |

|

|

(19,913 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense (income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest rate expense

|

|

|

9,904 |

|

|

|

8,299 |

|

|

|

18,996 |

|

|

|

15,377 |

|

|

Debt related fees and amortization expense

|

|

|

1,820 |

|

|

|

1,330 |

|

|

|

3,241 |

|

|

|

3,299 |

|

|

Accretion and other expenses of Series A preferred units

|

|

|

3,477 |

|

|

|

6,885 |

|

|

|

6,788 |

|

|

|

12,449 |

|

|

Other income/expense

|

|

|

(18 |

) |

|

|

(91 |

) |

|

|

49 |

|

|

|

(167 |

) |

|

Loss before income taxes

|

|

|

(28,789 |

) |

|

|

(24,213 |

) |

|

|

(52,142 |

) |

|

|

(50,871 |

) |

|

Income tax expense

|

|

|

385 |

|

|

|

1,066 |

|

|

|

1,263 |

|

|

|

818 |

|

|

Net loss

|

|

$ |

(29,174 |

) |

|

$ |

(25,279 |

) |

|

$ |

(53,405 |

) |

|

$ |

(51,689 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.66 |

) |

|

$ |

(0.68 |

) |

|

$ |

(1.24 |

) |

|

$ |

(1.40 |

) |

|

Diluted

|

|

$ |

(0.66 |

) |

|

$ |

(0.68 |

) |

|

$ |

(1.24 |

) |

|

$ |

(1.40 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

44,417 |

|

|

|

37,179 |

|

|

|

43,153 |

|

|

|

36,804 |

|

|

Diluted

|

|

|

44,417 |

|

|

|

37,179 |

|

|

|

43,153 |

|

|

|

36,804 |

|

|

AEMETIS, INC.

|

|

CONSOLIDATED CONDENSED BALANCE SHEETS

|

|

(in thousands)

|

| |

|

June 30, 2024

|

|

|

December 31, 2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

234 |

|

|

$ |

2,667 |

|

| Accounts receivable |

|

|

8,764 |

|

|

|

8,633 |

|

| Inventories |

|

|

10,244 |

|

|

|

18,291 |

|

| Prepaid and other current assets |

|

|

4,613 |

|

|

|

6,809 |

|

|

Total current assets

|

|

|

23,855 |

|

|

|

36,400 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

|

194,042 |

|

|

|

195,108 |

|

| Other assets |

|

|

14,191 |

|

|

|

11,898 |

|

|

Total assets

|

|

$ |

232,088 |

|

|

$ |

243,406 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' deficit

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

28,769 |

|

|

$ |

32,132 |

|

| Current portion of long term debt |

|

|

55,766 |

|

|

|

13,585 |

|

| Short term borrowings |

|

|

18,822 |

|

|

|

23,443 |

|

| Other current liabilities |

|

|

17,496 |

|

|

|

15,229 |

|

|

Total current liabilities

|

|

|

120,853 |

|

|

|

84,389 |

|

| |

|

|

|

|

|

|

|

|

|

Total long term liabilities

|

|

|

360,187 |

|

|

|

375,994 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' deficit:

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

46 |

|

|

|

41 |

|

| Additional paid-in capital |

|

|

285,519 |

|

|

|

264,058 |

|

| Accumulated deficit |

|

|

(528,810 |

) |

|

|

(475,405 |

) |

| Accumulated other comprehensive loss |

|

|

(5,707 |

) |

|

|

(5,671 |

) |

|

Total stockholders' deficit

|

|

|

(248,952 |

) |

|

|

(216,977 |

) |

|

Total liabilities and stockholders' deficit

|

|

$ |

232,088 |

|

|

$ |

243,406 |

|

|

RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME/(LOSS)

|

|

(unaudited, in thousands)

|

| |

|

For the three months ended

June 30,

|

|

|

For the six months ended

June 30,

|

|

|

EBITDA Calculation

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(29,174 |

) |

|

$ |

(25,279 |

) |

|

|

(53,405 |

) |

|

|

(51,689 |

) |

|

Adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and amortization expense

|

|

|

11,724 |

|

|

|

9,629 |

|

|

|

22,237 |

|

|

|

18,676 |

|

|

Depreciation expense

|

|

|

2,049 |

|

|

|

1,671 |

|

|

|

3,847 |

|

|

|

3,461 |

|

|

Accretion of Series A preferred units

|

|

|

3,477 |

|

|

|

6,885 |

|

|

|

6,788 |

|

|

|

12,449 |

|

|

Loss on asset disposal

|

|

|

3,644 |

|

|

|

- |

|

|

|

3,644 |

|

|

|

- |

|

|

Share-based compensation

|

|

|

1,977 |

|

|

|

1,755 |

|

|

|

4,946 |

|

|

|

4,417 |

|

|

Intangibles amortization expense

|

|

|

12 |

|

|

|

11 |

|

|

|

24 |

|

|

|

23 |

|

|

Income tax expense

|

|

|

385 |

|

|

|

1,066 |

|

|

|

1,263 |

|

|

|

818 |

|

|

Total adjustments

|

|

|

23,268 |

|

|

|

21,017 |

|

|

|

42,749 |

|

|

|

39,844 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$ |

(5,906 |

) |

|

$ |

(4,262 |

) |

|

|

(10,656 |

) |

|

|

(11,845 |

) |

|

PRODUCTION AND PRICE PERFORMANCE

|

|

(unaudited)

|

| |

|

Three Months ended

June 30,

|

|

|

Six Months ended

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Ethanol

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gallons sold (in millions)

|

|

|

14.8 |

|

|

|

2.8 |

|

|

|

28.9 |

|

|

|

2.9 |

|

|

Average sales price/gallon

|

|

$ |

1.99 |

|

|

$ |

3.12 |

|

|

$ |

1.89 |

|

|

$ |

3.08 |

|

|

Percent of nameplate capacity

|

|

|

108 |

% |

|

|

20 |

% |

|

|

105 |

% |

|

|

11 |

% |

|

WDG

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons sold (in thousands)

|

|

|

105 |

|

|

|

24.3 |

|

|

|

199 |

|

|

|

24.3 |

|

|

Average sales price/ton

|

|

$ |

89 |

|

|

$ |

105 |

|

|

$ |

93 |

|

|

$ |

105 |

|

|

Delivered Cost of Corn

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bushels ground (in millions)

|

|

|

5.2 |

|

|

|

1.4 |

|

|

|

10.1 |

|

|

|

1.4 |

|

|

Average delivered cost / bushel

|

|

$ |

6.36 |

|

|

$ |

6.84 |

|

|

$ |

6.35 |

|

|

$ |

7.17 |

|

|

Dairy Renewable Natural Gas

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MMBtu produced (in thousands)

|

|

|

89.4 |

|

|

|

54.1 |

|

|

|

149.7 |

|

|

|

75.4 |

|

|

MMBtu stored as inventory (in thousands)

|

|

|

80.7 |

|

|

|

86.7 |

|

|

|

80.7 |

|

|

|

77.7 |

|

|

MMBtu sold (in thousands)

|

|

|

88.0 |

|

|

|

54.1 |

|

|

|

148.8 |

|

|

|

75.4 |

|

|

Biodiesel

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metric tons sold (in thousands)

|

|

20.4

|

|

|

|

25.7 |

|

|

|

47.5 |

|

|

|

26.7 |

|

|

Average Sales Price/Metric ton

|

|

$ |

1,162 |

|

|

$ |

1,276 |

|

|

$ |

1,150 |

|

|

$ |

1,210 |

|

|

Percent of Nameplate Capacity

|

|

|

54.4 |

% |

|

|

68.6 |

% |

|

|

63.4 |

% |

|

|

35.5 |

% |

|

Refined Glycerin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metric tons sold (in thousands)

|

|

|

1.5 |

|

|

|

1.1 |

|

|

|

3.9 |

|

|

|

1.5 |

|

|

Average Sales Price/Metric ton

|

|

$ |

635 |

|

|

$ |

662 |

|

|

$ |

584 |

|

|

$ |

676 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Aemetis, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 01, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36475

|

| Entity, Tax Identification Number |

26-1407544

|

| Entity, Address, Address Line One |

20400 Stevens Creek Blvd.

|

| Entity, Address, City or Town |

Cupertino

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95014

|

| City Area Code |

408

|

| Local Phone Number |

213-0940

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

AMTX

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000738214

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

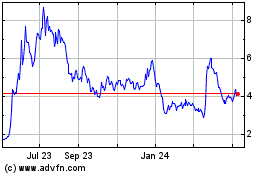

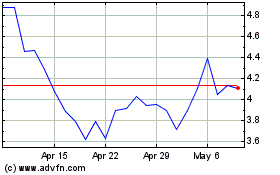

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Nov 2023 to Nov 2024