ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) (“ANI” or the “Company”)

and Alimera Sciences, Inc. (Nasdaq: ALIM) (“Alimera”) today

announced they have signed a definitive agreement pursuant to which

ANI will acquire Alimera for $5.50 per share in cash at closing and

one non-tradable contingent value right (CVR) representing the

right to receive up to $0.50 per share upon the achievement of

certain net revenue targets in 2026 and 2027. The transaction,

which values Alimera at approximately $381 million in up front

consideration, has been approved by both the ANI and Alimera Boards

of Directors and is expected to close late in the third quarter of

2024, as further described below.

Alimera is a global pharmaceutical company whose mission is to

be invaluable to patients, physicians and partners concerned with

maintaining better vision longer. Alimera’s two commercial products

treat diabetic macular edema (DME) and chronic non-infectious

uveitis affecting the posterior segment (NIU-PS) of the eye.

ILUVIEN (fluocinolone acetonide intravitreal implant 0.19mg) is

indicated for DME in the U.S., Europe and the Middle East as well

as for NIU-PS in Europe and the Middle East. YUTIQ (fluocinolone

acetonide intravitreal implant 0.18mg) is available in the U.S.

only and is indicated for the treatment of chronic NIU-PS.

Nikhil Lalwani, President and CEO of ANI, stated, “We believe

this is a transformational acquisition for ANI, and one that aligns

with our strategy to expand our Rare Disease business and deliver

on our purpose of ‘Serving Patients, Improving Lives’. Late last

year, we identified ophthalmology as a key strategic therapeutic

area for the Company and, in the first quarter of 2024, expanded

our Rare Disease team to promote Purified Cortrophin® Gel

(Cortrophin Gel) to ophthalmologists. Alimera represents what we

believe is a highly synergistic complement to this newly

established specialty and will leverage our existing Rare Disease

infrastructure. We believe ANI’s proven commercial execution

capabilities can further unlock ILUVIEN and YUTIQ, two growing and

durable assets that would add approximately $105 million in pro

forma 2024 revenues to our Company. The transaction is expected to

drive substantial shareholder value creation through high

single-digit to low double-digit accretion in adjusted Non-GAAP EPS

in 2025 and a substantial increase in accretion thereafter.”

Rick Eiswirth, President and CEO of Alimera, commented, “We are

pleased to have reached this agreement with ANI, which we believe

recognizes the value we have created at Alimera and creates

compelling value for our shareholders. ANI and Alimera share a

common mission of putting patients first, and this complementary

transaction creates a bigger platform to leverage our global

infrastructure and outstanding team. I would like to thank Alimera

employees, past and present, for always finding a way to help

patients maintain better vision longer. We look forward to working

with ANI to complete this transaction and help grow its presence in

the ophthalmology segment.”

Transaction Rationale

- Further strengthens ANI’s Rare Disease business as the

largest driver of future growth: The combination with

Alimera will create an attractive Rare Disease growth platform

which is expected to account for approximately 45% of pro forma

2024 revenues with robust growth potential. The transaction also

expands ANI’s footprint beyond the U.S. with the addition of

Alimera’s direct marketing operations located in Germany, the

United Kingdom, Portugal, and Ireland, as well as its partnerships

in Europe, Asia, and the Middle East.

- The addition of two durable commercial products with

significant growth potential that leverage the Company’s existing

Rare Disease infrastructure: ILUVIEN and YUTIQ are durable

assets with high barriers to genericization which the Company

believes have a clear role for patients in need of other

therapeutic options. The Company believes there is significant

growth potential for both ILUVIEN and YUTIQ that it can unlock

through commercial synergies and execution.

- Expands foothold in ophthalmology and accelerates

growth of Cortrophin Gel in this key therapeutic area:

During the first quarter of 2024, ANI launched a targeted

ophthalmology-focused sales force for Cortrophin Gel. The

transaction will expand the reach of the ophthalmology sales team

to over 3,600 physicians. Importantly, the Company estimates that

there is over 50% overlap between high potential prescribers of

Cortrophin Gel and ILUVIEN / YUTIQ.

- Potential for substantial shareholder value

creation: ANI expects high single-digit to low

double-digit accretion in adjusted non-GAAP EPS in 2025 and

substantial accretion thereafter. The transaction is anticipated to

deliver additional $35 - $38 million in 2025 adjusted non-GAAP

EBITDA inclusive of approximately $10 million in identified cost

synergies with additional EBITDA contribution expected from

accelerated growth of Cortrophin Gel within ophthalmology. The

Company anticipates 3.2x pro-forma leverage upon closing and

significant organic de-levering in 2025.

Terms of the Transaction & Financing

Under the terms of the merger agreement, ANI will acquire all of

the outstanding shares of Alimera for $5.50 per share, which

represents a 75% premium to Alimera’s closing share price of $3.15

on June 21, 2024 and 82% premium to Alimera’s 30-day volume

weighted average price of $3.03. ANI will also repay $72.5 million

of Alimera debt.

Alimera investors will also be entitled to a CVR for up to $0.50

per share, based on achieving net revenue in excess of specified

thresholds in 2026 and 2027:

- Up to $0.25 per share upon achieving net revenues in excess of

$140M in 2026 (sliding scale for net revenues of up to $150M)

- Up to $0.25 per share upon achieving net revenues in excess of

$160M in 2027 (sliding scale for net revenues of up to $175M)

The transaction is not subject to a financing condition. ANI

intends to finance the transaction using a combination of cash on

hand and debt financing. ANI has obtained $280M of committed

financing from J.P. Morgan and Blackstone Credit &

Insurance.

Timing to Close

The transaction has been approved by the Boards of Directors of

both companies. The transaction is expected to close late in the

third quarter of 2024, subject to customary closing conditions,

including receipt of required regulatory approvals and approval by

Alimera’s shareholders.

Advisors

Guggenheim Securities, LLC is acting as lead financial advisor

to ANI and Raymond James & Associates, Inc. is also acting as

financial advisor. Hughes Hubbard & Reed LLP is acting as legal

advisor to ANI. Centerview Partners LLC is acting as lead financial

advisor to Alimera, with Perella Weinberg Partners also acting as a

financial advisor to Alimera. DLA Piper is acting as legal advisor

to Alimera.

Conference Call

The Company’s management will host a conference call today to

discuss this transaction.

|

Date Time Toll free (U.S.) |

Monday, June 24, 20248:30 ET800-225-9448 |

|

|

|

This conference call will also be webcast and can be accessed

from the “Investors” section of ANI’s website at

www.anipharmaceuticals.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A replay of the conference call will also be available within

two hours of the call’s completion and will remain accessible for

two weeks by dialing 877-856-8965 and entering access code

4630647.

About ANI Pharmaceuticals, Inc.

ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) is a diversified

biopharmaceutical company serving patients in need by developing,

manufacturing, and marketing high-quality branded and generic

prescription pharmaceutical products, including for diseases with

high unmet medical need. The Company is focused on delivering

sustainable growth by scaling up its Rare Disease business through

its lead asset Purified Cortrophin® Gel, strengthening its Generics

business with enhanced research and development capabilities,

delivering innovation in Established Brands, and leveraging its

U.S. based manufacturing footprint. For more information, visit our

website www.anipharmaceuticals.com.

About Alimera Sciences, Inc.

Alimera Sciences is a global pharmaceutical company whose

mission is to be invaluable to patients, physicians and partners

concerned with retinal health and maintaining better vision longer.

For more information, please visit www.alimerasciences.com.

ANI Forward-Looking Statements

This press release contains not only historical information, but

also forward-looking statements made pursuant to the safe-harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements represent the Company’s and

Alimera’s expectations or beliefs concerning future events,

including the timing of the transaction and other information

relating to the proposed transactions including statements

regarding the benefits of proposed transaction and the anticipated

timing of the Proposed Transactions. These forward-looking

statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,”

“continue,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “shall,” “would” other words of similar meaning,

derivations of such words and the use of future dates.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties.

The following factors, among others, could cause actual results

to differ materially from those described in these forward-looking

statements: (i) the risk that the proposed transaction may not be

completed in a timely manner or at all, (ii) the failure to satisfy

the conditions to the consummation of the proposed transaction,

(iii) the occurrence of any event, change or other circumstance

that could give rise to the delay or termination of the proposed

transaction, (iv) the inability to complete the proposed

transaction due to the failure of a party or parties to satisfy

conditions to completion of the proposed transaction, including the

receipt on a timely basis or at all of any required regulatory

clearances and receipt by Alimera of stockholder approval, (v) the

failure of the contemplated debt financing or any alternative

financing to be obtained on a timely basis or at all, (vi) the

effect of the announcement or pendency of the proposed transaction

on the Company’s and/or Alimera’s business relationships, operating

results, and business generally, (vii) risks that the proposed

transaction may disrupt current plans and operations of the Company

and/or Alimera and potential difficulties of Alimera in retaining

employees as a result of the proposed transaction, (viii) the

outcome of any legal proceedings that may be instituted in

connection with the proposed transaction, (ix) volatility in the

price of the Company’s and/or Alimera’s stock, including as a

result of the proposed transaction, (x) changes in competitive and

regulated industries in which the Company operates, variations in

operating performance across competitors, changes in laws and

regulations affecting the Company’s business and changes in the

combined capital structure, (xi) the ability to implement business

plans, forecasts, and other expectations after the completion of

the proposed transaction, and identify and realize additional

opportunities and, in particular, failure to achieve anticipated

synergies, (xii) costs and regulatory requirements relating to

contract manufacturing arrangements, (xiii) delays or failure in

obtaining product approvals from the FDA, (xiv) general business

and economic conditions, (xv) market trends for the Company’s

and/or Alimera’s products, including but not limited to, ILUVIEN,

YUTIQ and Cortrophin Gel, and the ability to achieve anticipated

sales for such products, (xvi) regulatory environment and changes,

(xvii) regulatory and other approvals relating to product

development and manufacturing, and (xviii) costs related to the

proposed transaction and the failure to realize anticipated

benefits of the proposed transactions or to realize estimated pro

forma results and underlying assumptions.

This press release refers to financial measures that are not in

accordance with U.S. generally accepted accounting principles

(“GAAP”). Because the non-GAAP financial measures are not

calculated in accordance with GAAP, they should not be considered

superior to or as a substitute for the related financial measures

that are prepared in accordance with GAAP and are not intended to

be considered in isolation and may not be the same as or comparable

to similarly titled measures presented by other companies due to

possible differences in method and in the items being adjusted. A

reconciliation of the forward-looking non-GAAP measures presented

in this communication is not provided due to the inherent

difficulty in forecasting and quantifying items that are necessary

for such reconciliation. In addition, the Company believes such a

reconciliation would imply a degree of precision and certainty that

could be confusing to investors. The variability of the specified

items may have a significant and unpredictable impact on future

financial performance. The financial guidance is subject to risks

and uncertainties applicable to all forward-looking statements as

described elsewhere in this communication.

More detailed information on these and additional factors that

could affect the Company’s actual results are described in the

Company’s filings with the Securities and Exchange Commission

(SEC), including its most recent annual report on Form 10-K and

quarterly reports on Form 10-Q, as well as other filings with the

SEC. All forward-looking statements in this news release speak only

as of the date of this news release and are based on the Company’s

current beliefs, assumptions, and expectations. The Company

undertakes no obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Alimera Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

regarding, among other things, Alimera’s expectations with respect

to the timing of the transaction and other information relating to

the transaction, Alimera’s growth opportunities, the commencement,

enrollment, timing and outcome of its and others' clinical studies,

the effect of an expanded label, demand for its product, its

business strategy, future operations, future financial position,

including future non-GAAP and incremental EBITDA, future revenues,

projected costs, prospects, plans and objectives. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,”

“plan,” “contemplates,” “predict,” “project,” “target,” “likely,”

“potential,” “continue,” “ongoing,” “will,” “would,” “should,”

“could,” or the negative of these terms and similar expressions or

words, identify forward-looking statements. Forward-looking

statements are based on current expectations and involve inherent

risks and uncertainties (some of which are beyond Alimera’s

control), including factors that could delay, divert or change any

of them, and could cause actual results to differ materially from

those projected in these forward-looking statements. These risks

and uncertainties include, but are not limited to, (i) the risk

that the transaction may not be completed in a timely manner or at

all, which may adversely affect Alimera’s business, (ii) the

failure to satisfy the conditions to the consummation of the

transaction, including the adoption of the merger agreement by the

stockholders of Alimera and the receipt of regulatory approvals

from various governmental entities (including any conditions,

limitations or restrictions placed on these approvals) and the risk

that one or more governmental entities may deny approval, (iii) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the merger agreement, (iv) the risk

that the definitive merger agreement may be terminated in

circumstances that require Alimera to pay a termination fee; (v)

risks regarding the failure to obtain the necessary financing to

complete the merger, (vi) the effect of the announcement or

pendency of the transaction on Alimera’s business relationships,

operating results and business generally, (vii) risks that the

proposed transaction disrupts current plans and operations, (viii)

risks related to diverting management’s attention from Alimera’s

ongoing business operations, (ix) the outcome of any legal

proceedings that may be instituted against Alimera related to the

merger agreement or the transaction, and (x) those factors

discussed in the “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections

of Alimera’s most recently filed Annual Report on Form 10-K, most

recently filed Quarterly Report on Form 10-Q, and any of Alimera’s

subsequent filings with the U.S. Securities and Exchange Commission

(SEC) and available on the SEC’s website at www.sec.gov.

All forward-looking statements contained in this press release

are expressly qualified by the cautionary statements contained or

referred to herein. Alimera cautions investors not to rely on the

forward-looking statements Alimera makes or that are made on its

behalf as predictions of future events. These forward-looking

statements speak only as of the date of this press release. Alimera

undertakes no obligation to publicly update or revise any of the

forward-looking statements made in this press release, whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities laws.

Additional Information and Where to Find It

In connection with the proposed transaction, Alimera intends to

file a preliminary and definitive proxy statement. The definitive

proxy statement and proxy card will be delivered to Alimera’s

stockholders in advance of the special meeting relating to the

proposed acquisition. Each of the Company and Alimera also plan to

file other relevant materials with the SEC in connection with the

proposed transaction. INVESTORS IN AND SECURITY HOLDERS OF ALIMERA

ARE URGED TO READ THE DEFINITIVE PROXY IN ITS ENTIRETY WHEN IT

BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS THAT ARE

FILED OR FURNISHED OR WILL BE FILED OR WILL BE FURNISHED BY EACH OF

THE COMPANY AND ALIMERA WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION, RELATED MATTERS AND THE

PARTIES TO THE PROPOSED TRANSACTION. Materials filed by the Company

and Alimera can be obtained free of charge at the SEC’s

website, www.sec.gov. In addition, materials filed by the Company

can be obtained free of charge at the Company’s website,

www.anipharmaceuticals.com, and materials filed by Alimera can be

obtained free of charge at Alimera’s website,

www.alimerasciences.com.

For ANI:Lisa M. Wilson, In-Site Communications,

Inc. 212-452-2793lwilson@insitecony.com

For Alimera:Scott Gordonscottg@coreir.com

SOURCE: ANI Pharmaceuticals, Inc.

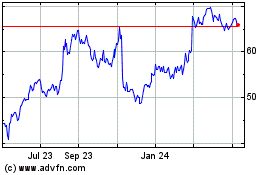

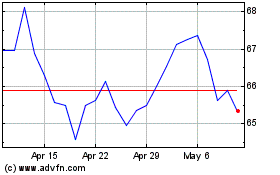

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Jan 2025 to Feb 2025

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Feb 2024 to Feb 2025