0001144879FALSE00011448792024-06-072024-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 7, 2024

(Date of earliest event reported)

APPLIED DIGITAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | 001-31968 | 95-4863690 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 3811 Turtle Creek Blvd., | Suite 2100, | Dallas, | TX | 75219 |

| (Address of principal executive offices) | (Zip Code) |

214-427-1704

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

o Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | APLD | Nasdaq Global Select Market |

Item 1.01 Entry into a Material Definitive Agreement.

On June 7, 2024, APLD Holdings 2 LLC (the “Borrower”), a Delaware limited liability company and a subsidiary of Applied Digital Corporation, a Nevada corporation (the “Company”) entered into a promissory note (the “Promissory Note”) with CIM APLD Lender Holdings, LLC, a Delaware limited liability company (the “Lender”). The Promissory Note provides for an initial borrowing of $15 million (the “First Borrowing”), which was drawn on June 7, 2024, and subsequent borrowings of up to $110 million (the “Subsequent Tranches”) will be available subject to the satisfaction of certain conditions, including entry into certain account control agreements and the assignment of certain project contracts to the Borrower or affiliate of the Borrower as requested by the Lender. There may not be more than two borrowings for Subsequent Tranches in any calendar month and there must be at least ten Business Days (as defined in the Promissory Note) between each borrowing for Subsequent Tranches. The final $40 Million of the Subsequent Tranche will be funded when, among other conditions, (a) the Borrower has entered into (i) the Long Form Credit Documentation (as defined in the Promissory Note) and (ii) has entered into a hyperscale lease agreement acceptable to the Lenders with respect to the ELN-02 Project (as defined in the Promissory Note), and (b) the Company has issued certain additional common stock purchase warrants to the Lender. The Promissory Note includes an accordion feature that permits up to an additional $75 million of borrowings subject to the mutual agreement of the Borrower and Lender (the “Accordion”). Principal amounts repaid under the Promissory Note will not be available to be re-borrowed.

The Company has provided a guarantee (the “Parent Guaranty”) in favor of the Lender that includes certain covenants that limit the Company’s ability to grant certain liens or, during events of default, pay dividends, repurchase stock or sell assets, subject to certain specified exceptions in each case. In addition, certain subsidiaries of the Company (the “Grantors”) have entered into a guarantee and collateral agreement in favor of the Lender (the “Guarantee and Collateral Agreement”) in which each Grantor pledged a continuing security interest in substantially all of its respective assets except for Excluded Assets (as defined in the Guarantee and Collateral Agreement). Each of the Grantors will also grant first or second priority mortgages, as applicable, to the Lender over certain properties and request and enter into lender consents with the existing secured parties of such Grantors with respect to this new financing, including relating to subordination and shared collateral.

As partial consideration for the loans under the Promissory Note, the Company will issue to the Lender warrants to purchase up to 9,265,366 shares of common stock of the Company, par value $.001 (the “Common Shares”) (the “Warrants”). The Warrants will be issuable in two tranches for the purchase of up to 6,300,449 Common Shares and 2,964,917 Common Shares, respectively. The first tranche will be issued no later than June 17, 2024 in a registered direct issuance. The second tranche will be issued in connection with the Lender’s funding of the final $110 million available under the Subsequent Tranche (the “Private Placement Warrants”) and will be issued in a private placement pursuant to Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”). In addition, to the extent the Borrower makes drawings under the Accordion, the Company will issue to the Lender an additional warrant to purchase up to 5,559,220 Common Shares.

The Warrants will be exercisable upon issuance and will have a five-year term. The Warrants will have an exercise price of $4.8005 per share, which exercise price may be paid in cash, by net settlement or by a combination of cash and net settlement but must be exercised by net settlement if no registration covering the exercise of the Warrants remains effective. The Warrants contain customary anti-dilution provisions for corporate actions such as stock dividends and stock splits.

The Company will also enter into a registration rights agreement (the “Registration Rights Agreement”) with the Lender, pursuant to which the Company will register the resale of the Common Shares underlying the Private Placement Warrants on Form S-1, to be declared effective by the Securities and Exchange Commission prior to the 90th day after the issuance of the Private Placement Warrants.

The Company also entered into a Consent, Waiver and First Amendment to Prepaid Advance Agreements (the “Consent”) with YA II PN, LTD. (“YA”). In exchange for giving its consent to the transaction with the Lender, the Company agreed to issue an aggregate of 100,000 Common Shares to YA and to conditionally lower the floor price from $3.00 to $2.00 if the daily VWAP is less than $3.00 per Common Share for five out of seven trading days. The Company further agreed to deliver a security agreement whereby its subsidiary, Applied Digital Cloud Corporation, would grant a springing lien on substantially all of its assets subject to customary carve-outs to secure the promissory notes issued in favor of YA. Pursuant to the Consent, YA also consented to future project-level financing at the Ellendale Campus.

In addition, pursuant to the terms of the Consent, certain provisions of the Prepaid Advance Agreement dated as of March 27, 2024 by and between YA and the Company (the “March PAA”) and the Prepaid Advance Agreement dated as of May 24, 2024 by and between YA and the Company (the “May PAA”) were amended as follows: if (i) the Registration Statement on Form S-3 filed by the Company on April 15, 2024 (the “April Registration Statement”) becomes ineffective, (ii) the Registration Statement on Form S-1 filed by the Company on May 31, 2024 (the “May Registration Statement”) is not declared effective by the Securities and Exchange Commission (the “SEC”) by July 8, 2024 (the “Effectiveness Deadline”), or (iii) the May Registration Statement becomes ineffective, then starting on the Effectiveness Deadline and continuing until the earlier of (i) the date on which the Yorkville Promissory Notes are no longer outstanding, and (ii) the date on which (A) if the May Promissory Note is outstanding, the May Registration Statement is effective, and (B) if the March Promissory Note and the April Promissory Note are outstanding, the April Registration Statement is effective, , the Company is obligated to prepay the promissory notes issued in connection with the March PAA and May PAA (on a pro rata basis) in equal weekly installments of either $2.5 million in cash or $5.0 million in Common Shares as determined by YA in its sole discretion. If YA elects to make such prepayments in Common Shares, YA will receive a number of Common Shares equal to (x) $5 million, divided by (y) an amount equal to 95% of the lowest daily VWAP during the five trading day period ending on the trading day immediately before the payment date.

The foregoing descriptions of the terms and conditions of the Promissory Note, Parent Guaranty and the Guarantee and Collateral Agreement, and the Consent are qualified in their entirety by reference to the full text of such documents.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in “Item 1.01 Entry into a Material Definitive Agreement” is incorporated by reference herein in its entirety.

Item 3.02 Unregistered Sales of Equity Securities

The information set forth in “Item 1.01 Entry into a Material Definitive Agreement” relating to the issuance of the Private Placement Warrants and the underlying Common Shares is incorporated by reference herein in its entirety.

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of any offer to buy the Common Shares, nor shall there be an offer, solicitation or sale of the Common Shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state.

Item 7.01 Regulation FD Disclosure.

On June 7, 2024, the Company issued a press release (the “Press Release”) announcing the entry into the Promissory Note, which Press Release is attached as Exhibit 99.1 hereto and incorporated by reference into this Item 7.01.

Item 8.01 Other Events.

The information set forth in “Item 7.01 Regulation FD Disclosure” is incorporated by reference herein in its entirety.

Forward-Looking Statements

This Current Report on Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, future operating and financial performance, product development, market position, business strategy and objectives and the closing of the transaction described herein. These statements use words, and variations of words, such as “continue,” “build,” “future,” “increase,” “drive,” “believe,” “look,” “ahead,” “confident,” “deliver,” “outlook,” “expect,” “project” and “predict.” Other examples of forward-looking statements may include, but are not limited to, (i) statements of Company plans and objectives, including our evolving business model, or estimates or predictions of actions by suppliers, (ii) statements of future economic performance and (iii) statements of assumptions underlying other statements and statements about the Company or its business. You are cautioned not to rely on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. These risks, uncertainties, and other factors include: decline in demand for our products and services; the volatility of the crypto asset industry; the inability to

comply with developments and changes in regulation; cash flow and access to capital; and maintenance of third party relationships. Information in this release is as of the dates and time periods indicated herein, and the Company does not undertake to update any of the information contained in these materials, except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | |

| Dated: | June 7, 2024 | | By: | /s/ David Rench |

| | | Name: | David Rench |

| | | Title: | Chief Financial Officer |

| | | | |

Applied Digital Secures Private Debt Facility of up to $200 million to Accelerate HPC Data Center Project in Ellendale, North Dakota

•Applied Digital secures a $125 million initial commitment to fund ongoing construction costs associated with its HPC Campus in Ellendale, ND, which can be upsized upon mutual agreement by both parties up to $200 million

•This financing completes the Company's near-term capital needs and positions it to secure project-level financing to fund the remaining costs to complete the first HPC building

•Financing provides the Company with a clear path to solidifying its position as a leading HPC datacenter owner and operator

DALLAS, TX – June 7, 2024 -- Applied Digital Corporation (Nasdaq: APLD) ("Applied Digital" or the "Company"), a designer, builder, and operator of next-generation digital infrastructure designed for High-Performance Computing (“HPC”) applications, announced today that the Company has secured private financing from CIM Group, a leading investment firm and alternative asset manager with extensive experience in top-tier datacenter finance and development. APLD Holdings 2, LLC, a subsidiary of the Company (the “Borrower”), has issued a Promissory Note (the “Note”) for commitments that total $125 million at close (“Initial Commitments”). Of the Initial Commitments, $15 million will be drawn on the date hereof, and the remaining will be drawn subject to the satisfaction of certain conditions outlined in the Note. In addition to the Initial Commitments, the Note includes an accordion feature that allows for up to an additional $75 million of borrowings, subject to the mutual agreement of the Borrower and lender. Principal amounts repaid under the Note will not be available for reborrowing. In total, this financing provides the Company with up to $200 million to be used solely towards the buildout of its HPC Campus in Ellendale, ND.

“We believe this financing with CIM Group represents a transformative step in the Company’s journey to secure both project financing and a long-term lease with a hyperscaler at our HPC Campus in Ellendale, ND. With this financing, we believe we are able to keep our buildout plan on track and hope to finalize optimal terms for project financing concurrently with or shortly after the signing of a long-term lease,” said Wes Cummins, Applied Digital’s CEO. “We now believe we have line of sight to finalize the build-out of our Ellendale Campus, positioning Applied Digital as a leader in the datacenter infrastructure sector. We distinguish ourselves not merely by owning clusters of GPUs, but also by designing and operating large-scale, top-tier datacenters for world-class customers driving the AI revolution. We believe our Ellendale Campus will be a leading HPC datacenter, representing a significant advancement in the industry.”

“CIM Group is excited to support Applied Digital’s growth in cloud and hosting services for some of the world’s top companies,” said Avi Shemesh, Co-Founder and Principal, CIM Group. “CIM will continue to invest in digital infrastructure, providing solutions to companies building the AI ecosystem.”

The Note will have a three-year term and bear interest at an initial rate of 12.0% per annum, payable quarterly in arrears. The Company may prepay the Note in full at any time, subject to certain defined prepayment penalties, which increase if the Note remains outstanding for longer than six months. In connection with the financing, the lender will receive warrants for 6,300,449 shares of common stock of the Company with a strike price of $4.8005 per share (a premium of 10% to the 10 day VWAP). The lender will receive a warrant to purchase up to an additional 2,964,917 shares of common stock of the Company at the same strike price, subject to the Company meeting certain conditions. This second tranche of warrants will be issued only after the borrowing of the full $125 million is made available and will be issued in a private placement.

Amidst the surging AI revolution, management believes Applied Digital is uniquely positioned, offering cutting-edge solutions in Datacenters and Cloud as a Service. Our purpose-built datacenters are strategically designed to maximize efficiency for HPC needs. Applied Digital Cloud delivers cost-effective GPU computer solutions tailored for AI, ML, rendering, and other HPC workloads. We believe Applied Digital’s state-of-the-art infrastructure offers high performance at a low cost, empowering clients to thrive in this era of exponential technological advancement. With a commitment to innovation and exceptional customer support, we aim to facilitate businesses in harnessing the transformative power of AI.

Simpson Thacher & Bartlett LLP acted as legal counsel to lender. Milbank LLP and Lowenstein Sandler LLP acted as legal counsel to the Company.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Applied Digital

Applied Digital (Nasdaq: APLD) designs, develops, and operates next-generation data centers across North America to provide digital infrastructure solutions to the rapidly growing high-performance computing (HPC) industry. Find more information at www.applieddigital.com. Follow us on X (formerly Twitter) at @APLDdigital.

Forward-Looking Statements

This release contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, future operating and financial performance, product development, market position, business strategy and objectives and the closing of the transaction described herein. These statements use words, and variations of words, such as "continue," "build," "future," "increase," "drive," "believe," "look," "ahead," "confident," "deliver," "outlook," "expect," “intend,” “hope,” “project” and "predict." Other examples of forward-looking statements may include, but are not limited to, (i) statements of Company plans and objectives, including advancement in our construction phase of the HPC data center in Ellendale, North Dakota, our evolving business model and a shift in our business strategy towards our HPC data centers, or estimates or predictions of actions by suppliers, (ii) statements of future economic performance, and (iii) statements of assumptions underlying other statements and statements about the Company or its business. You are cautioned not to rely on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the Company's expectations and projections. These risks, uncertainties, and other factors include: decline in demand for our products and services; the volatility of the crypto asset industry; the inability to comply with developments and changes in regulation; cash flow and access to capital; and maintenance of third-party relationships. Information in this release is as of the dates and time periods indicated herein, and the Company does not undertake to update any of the information contained in these materials, except as required by law.

Investor Relations Contacts

Matt Glover or Alex Kovtun

Gateway Group, Inc.

(949) 574-3860

APLD@gateway-grp.com

Media Contact

Brenlyn Motlagh or Diana Jarrah

Gateway Group, Inc.

(949) 899-3135

APLD@gateway-grp.com

About CIM Group

CIM is a leading investment firm and alternative asset manager. Since 1994, CIM has sought to create value in projects and positively impact the lives of people in communities across the Americas by delivering more than $60 billion of essential real estate and infrastructure projects. CIM’s diverse team of experts applies its broad knowledge and disciplined approach through hands-on management of real assets to deliver excellence to our clients, stakeholders, and the communities we serve. For more information, visit www.cimgroup.com.

v3.24.1.1.u2

Cover

|

Jun. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 07, 2024

|

| Entity Registrant Name |

APPLIED DIGITAL CORPORATION

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-31968

|

| Entity Tax Identification Number |

95-4863690

|

| Entity Address, Address Line One |

3811 Turtle Creek Blvd.,

|

| Entity Address, Address Line Two |

Suite 2100,

|

| Entity Address, City or Town |

Dallas,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75219

|

| City Area Code |

214

|

| Local Phone Number |

427-1704

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

APLD

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001144879

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

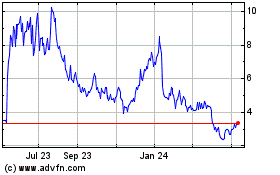

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From May 2024 to Jun 2024

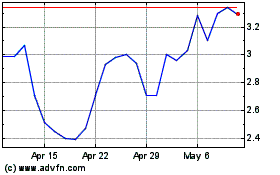

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Jun 2023 to Jun 2024