false

0001144879

0001144879

2024-09-23

2024-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

September

23, 2024

(Date

of earliest event reported)

APPLIED

DIGITAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31968 |

|

95-4863690 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

| 3811

Turtle Creek Blvd., Suite

2100, Dallas, TX |

75219 |

| (Address

of principal executive offices) |

(Zip

Code) |

214-427-1704

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

APLD |

|

Nasdaq

Global Select Market |

Item 1.01. Entry into a Material Definitive Agreement

Dealer

Manager Agreement

On

September 23, 2024, Applied Digital Corporation (the “Company”) entered into a Dealer Manager Agreement (the “Dealer

Manager Agreement”) with Preferred Capital Securities, LLC (the “Dealer Manager”), pursuant to which the Dealer Manager

has agreed to serve as the Company’s agent and dealer manager for the Company’s proposed offering (the “Offering”)

of up to 2,500,000 shares (the “Shares”) of Series E-1 Redeemable Preferred Stock, par value $0.001 per share (the “Series

E-1 Preferred Stock”), on substantially the same terms as the prior Series E Offering (as defined below) as will be set forth in

the Prospectus (as defined below). The Shares to be sold in the Offering will be issued pursuant to a Certificate of Designations of

the Powers, Preferences and Relative, Participating, Optional and Other Restrictions of the Series E-1 Redeemable Preferred Stock (the

“Certificate of Designations”) to be filed with the Secretary of State of the State of Nevada prior to the closing of the

Offering.

As

will be set forth in the Prospectus, the Series E-1 Preferred Stock will have substantially the same terms as the Series E Redeemable

Preferred Stock, par value $0.001 per share (the “Series E Preferred Stock”), previously issued to investors in several offerings

(collectively, the “Series E Offering”) pursuant to the prospectus supplement, dated May 16, 2024, and a base prospectus,

dated May 16, 2024, relating to the shelf registration statement on Form S-3 (File No. 333-279155) filed by the Company with the Securities

and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Act”). On September 23,

2024, the Company filed a registration statement on Form S-1 (File No. 333-282293) (the “Registration Statement”), including

a preliminary prospectus, with the SEC under the Act to register the offer and sale of the Shares. As of the date of this Current Report

on Form 8-K, the Registration Statement has not been declared effective by the SEC. If and when the Registration Statement has been declared

effective by the SEC, the Shares will be offered and sold pursuant to the final prospectus contained in the Registration Statement (the

“Prospectus”).

The

Dealer Manager Agreement requires the Dealer Manager to use its reasonable best efforts to sell the Shares in the Offering pursuant to

a subscription agreement or unit agreement as will be set forth in the Prospectus. Each Share will be sold at a public offering price

of $25.00 per share (the “Stated Value”), subject to adjustment as will be set forth in the Prospectus. Subject to the terms,

conditions and limitations described in the Dealer Manager Agreement, the Company will pay to the Dealer Manager a dealer manager fee

in an amount equal to 2% of the Stated Value per Share sold in the Offering and a selling commission of up to 6% of the Stated Value

per Share sold in the Offering. The Company may pay reduced selling commissions or may eliminate commissions or certain sales of the

Series E-1 Preferred Stock, including the reduction or elimination of selling commissions in accordance with, and on the terms that will

be set forth in, the Prospectus. The Company expects the Dealer Manager to authorize participating broker-dealers that are members of

the Financial Industry Regulatory Authority to sell the Shares. The Dealer Manager may reallow all or a portion of its selling commission

attributable to a participating broker-dealer. The Dealer Manager may also reallow a portion of its dealer manager fee earned on the

proceeds raised by a participating broker-dealer, to such participating broker-dealer as a marketing fee.

Pursuant

to the Dealer Manager Agreement, the Company has agreed to indemnify the Dealer Manager and participating broker-dealers, and the Dealer

Manager has agreed to indemnify the Company, against certain losses, claims, damages and liabilities, including, but not limited to,

those arising out of (i) untrue statements of a material fact contained in the Registration Statement,

Prospectus or any amendment or supplement thereto relating to the Offering or (ii) the omission or alleged omission to state a material

fact required to be stated in the Registration Statement, Prospectus or any amendment or supplement thereto relating to the Offering.

Services

Agreement

On

September 23, 2024, the Company entered into the Amended and Restated Services Agreement (the “Amended and Restated Services Agreement”)

with Preferred Shareholder Services, LLC (“PSS”), an affiliate of the Dealer Manager, pursuant to which PSS will provide

certain non-distribution related support

services to the Company relating to the Series E-1 Preferred Stock as well as certain services relating to the Series E Preferred Stock.

The Amended and Restated Services Agreement amends and restates the Services Agreement entered into between the Company and PSS on May

16, 2024. The Company is responsible for payments due under the Amended and Restated Services Agreement. The services to be provided

by PSS include, among other things, assistance with recordkeeping,

communications with the holders of Series E-1 Preferred Stock and Series E Preferred Stock dealing with administrative matters, oversight

and administration of an e-delivery program for communications to all affected parties, and facilitate and act as liaison to the transfer

agent and other service providers for the holders of Series E-1 Preferred Stock and Series E Preferred Stock.

The

foregoing descriptions of the Dealer Manager Agreement and the Amended and Restated Services Agreement are only summaries and are qualified

in their entireties by references to the full texts of the Dealer Manager Agreement and the Amended and Restated Services Agreement,

copies of which are filed as Exhibits 1.1 and 10.1, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Additional

Information

This

Current Report on Form 8-K does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities.

The Registration Statement, including a preliminary prospectus, relating to the Shares has been filed with the SEC but has not yet become

effective. The Shares may not be sold, nor may offers to buy be accepted, prior to the time the Registration Statement becomes effective.

A final prospectus relating to the Offering will be filed with the SEC. Electronic copies of the preliminary prospectus and the final

prospectus may be obtained, when available, on the SEC’s website at www.sec.gov or by contacting Preferred Capital Securities,

LLC at 3290 Northside Parkway, NW, Suite 800, Atlanta, Georgia 30327, by telephone at (855) 320-1414 or by e-mail at operations@pcsalts.com.

Forward-Looking

Statements

This

Current Report on Form 8-K and other reports filed by the Company from time to time with the SEC contains “forward-looking statements”

as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, future operating and financial performance,

product development, market position, business strategy and objectives and the closing of the transaction described herein. These statements

use words, and variations of words, such as “continue,” “build,” “future,” “increase,”

“drive,” “believe,” “look,” “ahead,” “confident,” “deliver,”

“outlook,” “expect,” “project” and “predict.” Other examples of forward-looking statements

may include, but are not limited to, (i) statements of Company plans and objectives, including the Company’s evolving business

model, or estimates or predictions of actions by suppliers, (ii) statements of future economic performance and (iii) statements of assumptions

underlying other statements and statements about the Company or its business. You are cautioned not to rely on these forward-looking

statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying

assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s

expectations and projections. These risks, uncertainties, and other factors include: decline in demand for our products and services;

the volatility of the crypto asset industry; the inability to comply with developments and changes in regulation; cash flow

and access to capital; and maintenance of third party relationships. Information in this release is as of the dates and time periods

indicated herein, and the Company does not undertake to update any of the information contained in these materials, except as required

by law.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 1.1 |

|

Dealer

Manager Agreement, dated as of September 23, 2024, by and between Applied Digital Corporation and Preferred Capital Securities, LLC

(incorporated by reference to Exhibit 10.70 of the Company’s Registration Statement on Form S-1, filed with the SEC on September

23, 2024). |

| 10.1 |

|

Amended

and Restated Services Agreement, dated as of September 23, 2024, by and between Applied Digital Corporation and Preferred Shareholder

Services, LLC (incorporated by reference to Exhibit 10.71 of the Company’s Registration Statement on Form S-1, filed with the

SEC on September 23, 2024). |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: |

September

27, 2024 |

|

By:

|

/s/

David Rench |

| |

|

|

Name: |

David

Rench |

| |

|

|

Title: |

Chief

Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

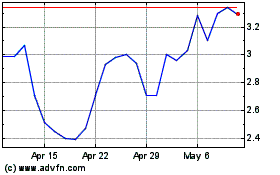

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Nov 2024 to Dec 2024

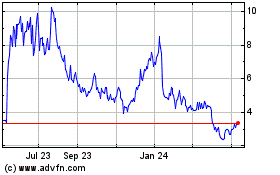

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Dec 2023 to Dec 2024