UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number: 001-38764

APTORUM GROUP LIMITED

17 Hanover Square

London W1S 1BN, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Following a comprehensive review of the trading

volume, costs and administrative requirements related to its listing on Euronext Paris, Aptorum Group Limited (the “Company”

or “Aptorum”) has decided to request the voluntary delisting of its Class A Ordinary Shares, par value $0.00001 per share

(the “Aptorum Shares”) (ISIN KYG6096M1226) from Euronext Paris. The Board of Euronext has approved this request.

Following the delisting from Euronext Paris, the

Aptorum Shares will remain listed on the NASDAQ (the “NASDAQ”), the Company’s primary listing exchange. Delisting

the Aptorum Shares from Euronext Paris has no impact on the NASDAQ listing of Aptorum Shares.

A voluntary sales facility procedure on Euronext

Paris will be implemented by the Company for the benefit of its shareholders holding their Aptorum Shares through Euroclear France (the

“Euronext Shareholders”), in accordance with Euronext rules (the “Sales Facility”). Accordingly,

the Euronext Shareholders will have the following options:

| ● | decide not to participate in the voluntary sales

facility and keep their Aptorum Shares, which they will be able to trade on Euronext Paris through and including the trading day prior

to the delisting date, and thereafter, only on the NASDAQ; or |

| ● | participate in the voluntary sales facility described

below and sell all or part of their Aptorum Shares on the NASDAQ. |

Euronext Shareholders not participating

Euronext Shareholders who do not wish to sell

their Aptorum Shares pursuant to the Sales Facility, or otherwise have taken no action to tender their Aptorum Shares in the Sales Facility

may only trade their Aptorum Shares on the NASDAQ following the delisting date. Any such holding and/or trade will be subject to the terms

applied by their financial intermediary who will take the necessary steps to move their Aptorum Shares from Euroclear France to the relevant

alternative central system for depositary.

Participating Euronext Shareholders

Euronext Shareholders who wish to sell their Aptorum

Shares on the NASDAQ pursuant to the Sales Facility must request their financial intermediaries to deliver their Aptorum Shares from June

15, 2023 to June 28, 2023 included, to Uptevia, acting as centralizing agent, pursuant to the procedure described in the applicable Euronext

notice expected to be published on June 12, 2023.

The Aptorum Shares delivered to Uptevia will be

sold on the NASDAQ, beginning on July 5, 2023, by a broker, at market prices prevailing at the time of the sale.

Uptevia will calculate the average sale price

of the Aptorum Shares and will be in charge of transferring the sale proceeds to the participating Euronext Shareholders, calculated on

the basis of the average sale price of the Aptorum Shares.

The Company will pay the fees for the centralization

and the brokerage fees related to the sale of Aptorum Shares on the NASDAQ delivered to Uptevia and sold pursuant to the Sales Facility.

Euronext Shareholders are reminded that they may

tender their Aptorum Shares in the Sales Facility on a voluntary basis.

No assurance can be given by the Company or Uptevia

as to the price at which the Aptorum Shares will actually be sold on the NASDAQ or the actual average sale price. This process is being

implemented solely as an option to Euronext Shareholders and participation is not mandatory. Individual investors may thus determine not

to participate in this process or may decide not to take any action in which case no assurance may be given as to the terms that will

be applied by their financial intermediary in connection with or after the delisting from Euronext Paris. Individual investors are invited

to consult their own investment advisors before making a decision to participate or not in this process.

The timetable of the Sales Facility and the delisting

described above may be summarized as follows (it being specified that the Company reserves the right to amend this timetable at any time,

in its sole discretion):

| Sales Facility | |

|

| Beginning of the Sales Facility | |

June 15, 2023 |

| End of the Sales Facility | |

June 28, 2023 |

| End of the centralization by Uptevia | |

June 30, 2023 |

| Sales on the NASDAQ of the Aptorum Shares tendered in the Sales Facility | |

as from July 5, 2023 |

| Proceeds of sale in USD converted into Euros | |

Upon receipt of the funds by the Broker |

Proceeds of sale distributed to the beneficiaries (i.e., holders of Aptorum Shares

having participated in the Sales Facility) | |

Upon receipt of the funds by the Broker |

| Delisting | |

|

| Last day of trading of Aptorum Shares on Euronext Paris | |

July 4, 2023 |

| Delisting Date of Aptorum Shares from Euronext Paris | |

July 5, 2023 |

Euronext Shareholders participating in the Sales

Facility acknowledge and agree to assume the risks associated with changes in the market price of Aptorum Shares and currency exchange

rates that may occur between the time Aptorum Shares are delivered to Uptevia and the sale of such Aptorum Shares on the NASDAQ, as well

as the date of conversion of the price into euros. All tender instructions of Aptorum Shares under the Sales Facility are irrevocable.

Aptorum Shares will be delisted from Euronext

Paris on July 5, 2023. Aptorum Shares will continue to be listed on the NASDAQ.

Shareholders are invited to contact their financial

intermediaries for any additional information.

On June 9, 2023, we issued a press release about

the Euronext delisting. A copy of the press releases is attached hereto as Exhibit 99.1.

Neither this report nor the exhibit constitutes

an offer to sell, or the solicitation of an offer to buy our securities, nor shall there be any sale of our securities in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such state or jurisdiction.

The information in this Form 6-K, including the

exhibits shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly

set forth by specific reference in such filing.

This Form 6-K is hereby incorporated by reference

into the registration statements of the Company on Form S-8 (Registration Number 333-232591) and Form F-3 (Registration Number 333-268873)

and into each prospectus outstanding under the foregoing registration statements, to the extent not superseded by documents or reports

subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as

amended.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Aptorum Group Limited |

| |

|

|

| Date: June 9, 2023 |

By: |

/s/ Darren Lui |

| |

|

Name: |

Darren Lui |

| |

|

Title: |

Chief Executive Officer |

EXHIBIT INDEX

4

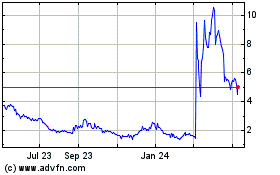

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Oct 2024 to Nov 2024

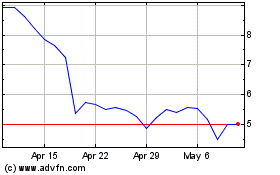

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Nov 2023 to Nov 2024