Aptorum Group Limited (NASDAQ: APM) (“Aptorum Group” or the

“Company”), a clinical stage biopharmaceutical company dedicated to

meeting unmet medical needs in oncology, autoimmune and infectious

diseases, today provided a business update and announced financial

results for the six months ended June 30, 2023.

“During the first half of 2023, we remained focused on advancing

the development of our therapeutic programs. We continue to work

towards advancing our ALS-4 and SACT-1 clinical programs and our

PathsDx liquid biopsy program through potential collaborations. In

light of the macroeconomic environment, we remain vigilant at

controlling costs and resources of the company whilst continuing to

advance our development objectives of the above programs as well,”

said Mr. Ian Huen, Chief Executive Officer and Executive Director

of Aptorum Group Limited.

Clinical Pipeline Update and Upcoming

Milestones

In January 2023, Aptorum Group announced publication of a

co-authored paper on one of its lead project, PathsDx Technology,

for assessing a rapid-turnaround low-depth unbiased metagenomics

sequencing workflow on Illumina platforms. PathsDx Test was shown

to be robust, rapid and sensitive for the diagnosis of infectious

diseases. The paper is titled, “Towards a rapid-turnaround

low-depth unbiased metagenomics sequencing workflow on the Illumina

platforms” and has been published online in Medrxiv, which can be

downloaded at the following website address:

https://medrxiv.org/cgi/content/short/2023.01.02.22283504v1.

In March 2023, Aptorum Group announced the completion of the

Pre-IND discussions with the US Food and Drug Administration (“US

FDA”) for ALS-4. ALS-4 is a first-in-class small molecule

anti-virulence drug targeting infections caused by Staphylococcus

aureus, including but not limited to Methicillin Resistant

Staphylococcus Aureus (“MRSA”). The Pre-IND discussions with US FDA

focused on overall development plan in preparation for the IND

application of ALS-4 that will initially target Acute Bacterial

Skin and Skin Structure Infections (ABSSSI). With the positive

feedback on the overall development strategy from the US FDA,

Aptorum is now proceeding towards the IND submission of ALS-4.

In June 2023, Aptorum Group announced the group has submitted

the relevant Phase 1b/2a clinical trial protocol of SACT-1, an

orally administered repurposed small molecule drug for the

treatment of neuroblastoma to US FDA. The Phase 1b/2a study of

SACT-1 submitted is for the combination with chemotherapy for first

relapse or refractory high risk neuroblastoma. The targeted

objectives of the Phase 1b part of the study based on neuroblastoma

patients to be enrolled is to determine the recommended phase 2

dose (RP2D) based on safety, pharmacokinetics and efficacy and the

Phase 2a part of the study based on neuroblastoma patients to be

enrolled will be used to assess the preliminary efficacy of

SACT-1.

Corporate Highlights

In May 2023, Aptorum Group announced that its subsidiary,

Aptorum Therapeutics Limited (“ATL”), a company incorporated under

the laws of Grand Cayman Islands, entered into a non-binding Letter

of Intent and Term Sheet (“Term Sheet”) to merge (“Transaction”)

its 100% subsidiary, Paths Innovation Limited and its underlying

business (collectively “PathsDx Group”) with Universal Sequencing

Technology Corporation (“UST”), a San Diego and Boston based US

company dedicated to the development and commercialization of

advanced proprietary DNA sequencing technologies. Paths Innovation

Limited currently holds, through its majority owned subsidiary

Paths Diagnostics Pte. Limited, the PathsDx technology – a liquid

biopsy NGS based technology for the diagnostics of infectious

diseases. As consideration of the transaction upon closing, ATL

will become a shareholder of the combined company. The Transaction

and other ancillary distributions, where relevant, remain subject

to, among other matters, the execution of a mutually agreeable

definitive agreement, completion of due diligence and subject to

several conditions including, but not limited to, director and

shareholder approvals.

In June 2023, the Company entered into securities purchase

agreements to sell $3,000,000 unsecured convertible notes to 4

investors (the “June 23 Notes”). All the June 23 Notes were

subsequently converted into an aggregate of 1,000,000 Class A

Ordinary Shares, par value $0.00001 per share. The whole proceeds

from the June 23 Note was used to settle a related party loan.

In September 2023, the Company entered into a securities

purchase agreement to sell a $3,000,000 unsecured convertible note

(“Sep 23 Note”) to Jurchen Investment Corporation, the largest

shareholder of the Group. The Sep 23 Note is convertible into the

Company’s Class A Ordinary Shares, and have a maturity date that is

24 months from the issuance date, although upon such date the

investor has the right to extend the term of the Note for twelve

(12) months or more or such term subject to mutual consent. The Sep

23 Note has an interest rate of 6% per annum and a conversion price

of $2.42 per share. The Sep 23 Note is secured by a first priority

lien and security interest on certain shares that the Company owns

(“Collateral”). Upon the Company’s disposal of all or a portion of

the Collateral, the investor has the right, to request that the

Company prepay the then-remaining outstanding balance of the Sep 23

Note, in part or in full and the Company can make that payment in

cash or in shares.

In November 2023, Aptorum Group announced the resignations of

Mr. Darren Lui and Dr. Clark Cheng from their positions as

executive directors and key officers. Concurrently, Mr. Ian Huen, a

current director of the Company, took on the role of Chief

Executive Officer. Mr. Huen previously served as the Company's

Chief Executive Officer from October 2017 until his prior

resignation in June 2022. With his extensive experience and

contributions to the Company during significant events, the Board

is confident that Mr. Huen will play a crucial role in realizing

the Company's full potential.

For the six months ended June 30, 2023, the Company raised

approximately $1,625,745 in gross proceeds pursuant to the issuance

of an aggregate of 215,959 Class A ordinary shares under the

Company’s $15 million at-the-market (“ATM”) program established on

March 26, 2021. The proceeds will be used for general corporate

purposes and the Company’s development programs.

Financial Results for the Six Months

Ended June 30, 2023

Aptorum Group reported a net loss of $6.6 million for the six

months ended June 30, 2023 compared to $2.7 million for the same

period in 2022. The increase in net loss in the current period was

driven by there was a gain on non-marketable investment of $5.6

million in 2022 while there was no such gain in the current period.

The increase is partly offset by the decrease in operating expenses

due to the implementation of stringent budgetary control measures,

as a result of the Company's exclusive emphasis on its lead

projects.

Research and development expenses were $3.2 million for the six

months ended June 30, 2023 compared to $4.5 million for the same

period in 2022. As a consequence of exclusive emphasis on its lead

projects and suspension of non-lead projects, there was a notable

decrease in the utilization of external consultants and full

impairment of patents related to these non-lead projects. Moreover,

the payroll expenses for research and development staff decreased

as a result of the reversal of deferred cash bonus payables to

employees and consultants during current period. The reversal was

due to the Group’s agreements with employees and consultants to

discharge the Group’s obligation to settle their outstanding

deferred cash bonus payables from previous years in exchange of

fully vested ordinary shares.

General and administrative fees were $1.3 million for the six

months ended June 30, 2023 compared to $2.4 million for the same

period in 2022. The decrease in general and administrative fees was

primary due to the reversal of deferred cash bonus payables to

employees during current period. The reversal was due to the

Group’s agreements with employees to discharge the Group’s

obligation to settle their outstanding deferred cash bonus payables

from previous years in exchange of fully vested ordinary

shares.

Legal and professional fees were $1.7 million for the six months

ended June 30, 2023 compared to $1.4 million for the same period in

2022. The increase in legal and professional fees was attributed

mainly to several non-routine activities undertaken during current

period, such as the implementation of a reverse stock split and

amendments to the memorandum and articles of association. These

exercises involved engaging legal and professional services beyond

regular operations, resulting in an increase in associated

fees.

As of June 30, 2023, cash and restricted cash totaled

approximately $0.5 million and total equity was approximately $12.8

million.

In September 2023, Aptorum Group received $3 million from the

issuance of a convertible note. Aptorum Group expects that its

existing cash and restricted cash together with undrawn line of

credit facility from related parties, will enable it to fund its

operating and capital expenditure requirements for at least the

next 12 months.

APTORUM GROUP LIMITED

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30, 2023 and December 31,

2022

(Stated in U.S.

Dollars)

June 30,

December 31,

2023

2022

(Unaudited)

ASSETS

Current assets:

Cash

$

340,306

$

1,882,545

Restricted cash

130,335

3,130,335

Accounts receivable

66,396

174,426

Inventories

-

27,722

Marketable securities, at fair value

-

102,481

Amounts due from related parties

95,768

129,677

Due from brokers

93,792

652

Loan receivable from a related party

422,800

875,956

Other receivables and prepayments

748,594

744,008

Total current assets

1,897,991

7,067,802

Property, plant and equipment, net

2,190,146

2,825,059

Operating lease right-of-use assets

311,639

347,000

Long-term investments

9,744,958

9,744,958

Intangible assets, net

166,566

752,705

Long-term deposits

100,741

129,847

Total Assets

$

14,412,041

$

20,867,371

LIABILITIES AND EQUITY

LIABILITIES

Current liabilities:

Amounts due to related parties

$

84,405

$

12,693

Accounts payable and accrued expenses

1,044,028

6,166,807

Operating lease liabilities, current

305,055

310,548

Bank loan

-

3,000,000

Convertible notes

-

3,013,234

Total current liabilities

1,433,488

12,503,282

Operating lease liabilities,

non-current

199,076

30,784

Loan payables to related parties

-

500,000

Total Liabilities

$

1,632,564

$

13,034,066

Commitments and contingencies

-

-

EQUITY

Class A Ordinary Shares ($0.00001 par

value, 9,999,996,000,000 shares authorized,

2,937,921 shares issued and outstanding as

of June 30, 2023; $10.00 par value,

6,000,000 shares authorized, 1,326,953

shares issued and outstanding as of

December 31, 2022(1))

$

31

$

13,269,528

Class B Ordinary Shares ($0.00001 par

value; 4,000,000 shares authorized,

2,243,776 shares issued and outstanding as

of June 30, 2023; $10.00 par value;

4,000,000 shares authorized, 2,243,776

shares issued and outstanding as of

December 31, 2022(1))

22

22,437,754

Additional paid-in capital

92,641,521

45,308,080

Accumulated other comprehensive income

26,322

33,807

Accumulated deficit

(70,824,179

)

(65,337,075

)

Total equity attributable to the

shareholders of Aptorum Group Limited

21,843,717

15,712,094

Non-controlling interests

(9,064,240

)

(7,878,789

)

Total equity

12,779,477

7,833,305

Total Liabilities and Equity

$

14,412,041

$

20,867,371

See accompanying notes to the condensed

consolidated financial statements.

(1) All per share amounts and shares outstanding for all periods

have been retroactively restated to reflect APTORUM GROUP LIMITED's

1 for 10 reverse stock split, which was effective on January 23,

2023.

APTORUM GROUP LIMITED

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For the six months ended June

30, 2023 and 2022

(Stated in U.S.

Dollars)

For the six months

ended

June 30,

2023

2022

(Unaudited)

(Unaudited)

Revenue

Healthcare services income

$

431,378

$

527,462

Operating expenses

Costs of healthcare services

(426,063

)

(529,991

)

Research and development expenses

(3,212,366

)

(4,509,303

)

General and administrative fees

(1,263,019

)

(2,400,418

)

Legal and professional fees

(1,738,566

)

(1,356,164

)

Other operating expenses

(330,212

)

(183,104

)

Total operating expenses

(6,970,226

)

(8,978,980

)

Other (expenses) income

Loss on investments in marketable

securities, net

(9,266

)

(82,710

)

Gain on non-marketable investment, net

-

5,588,078

Interest (expense) income, net

(93,478

)

149,734

Sundry income

36,803

66,628

Total other (expenses) income, net

(65,941

)

5,721,730

Net loss

$

(6,604,789

)

$

(2,729,788

)

Less: net loss attributable to

non-controlling interests

(1,117,685

)

(844,536

)

Net loss attributable to Aptorum Group

Limited

$

(5,487,104

)

$

(1,885,252

)

Net loss per share(1) – basic and

diluted

$

(1.43

)

$

(0.53

)

Weighted-average shares outstanding(1) –

basic and diluted

3,849,621

3,568,265

Net loss

$

(6,604,789

)

$

(2,729,788

)

Other comprehensive (loss)

income

Exchange differences on translation of

foreign operations

(7,485

)

31,346

Other comprehensive (loss) income

(7,485

)

31,346

Comprehensive loss

(6,612,274

)

(2,698,442

)

Less: comprehensive loss attributable to

non-controlling interests

(1,117,685

)

(844,536

)

Comprehensive loss attributable to the

shareholders of Aptorum Group Limited

(5,494,589

)

(1,853,906

)

See accompanying notes to the condensed

consolidated financial statements.

(1) All per share amounts and shares outstanding for all periods

have been retroactively restated to reflect APTORUM GROUP LIMITED's

1 for 10 reverse stock split, which was effective on January 23,

2023.

About Aptorum Group

Aptorum Group Limited (Nasdaq: APM) is a clinical stage

biopharmaceutical company dedicated to the discovery, development

and commercialization of therapeutic assets to treat diseases with

unmet medical needs, particularly in oncology (including orphan

oncology indications) and infectious diseases. The pipeline of

Aptorum is also enriched through (i) the establishment of drug

discovery platforms that enable the discovery of new therapeutics

assets through, e.g. systematic screening of existing approved drug

molecules, and microbiome-based research platform for treatments of

metabolic diseases; and (ii) the co-development of a novel

molecular-based rapid pathogen identification and detection

diagnostics technology with Accelerate Technologies Pte Ltd,

commercialization arm of the Singapore’s Agency for Science,

Technology and Research.

For more information about the Company, please visit

www.aptorumgroup.com.

Disclaimer and Forward-Looking

Statements

This press release does not constitute an offer to sell or a

solicitation of offers to buy any securities of Aptorum Group.

This press release includes statements concerning Aptorum Group

Limited and its future expectations, plans and prospects that

constitute “forward-looking statements” within the meaning of the

US Private Securities Litigation Reform Act of 1995. For this

purpose, any statements contained herein that are not statements of

historical fact may be deemed to be forward-looking statements. In

some cases, you can identify forward-looking statements by terms

such as “may,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue,” or

the negative of these terms or other similar expressions. Aptorum

Group has based these forward-looking statements, which include

statements regarding projected timelines for application

submissions and trials, largely on its current expectations and

projections about future events and trends that it believes may

affect its business, financial condition and results of

operations.

These forward-looking statements speak only as of the date of

this press release and are subject to a number of risks,

uncertainties and assumptions including, without limitation, risks

related to its announced management and organizational changes, the

continued service and availability of key personnel, its ability to

expand its product assortments by offering additional products for

additional consumer segments, development results, the company’s

anticipated growth strategies, anticipated trends and challenges in

its business, and its expectations regarding, and the stability of,

its supply chain, and the risks more fully described in Aptorum

Group’s Form 20-F and other filings that Aptorum Group may make

with the SEC in the future. As a result, the projections included

in such forward-looking statements are subject to change and actual

results may differ materially from those described herein.

Aptorum Group assumes no obligation to update any

forward-looking statements contained in this press release as a

result of new information, future events or otherwise.

This press release is provided “as is” without any

representation or warranty of any kind.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231221632368/en/

Aptorum Group Limited Investor Relations Department

investor.relations@aptorumgroup.com +44 20 80929299

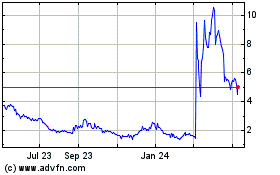

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Jan 2025 to Feb 2025

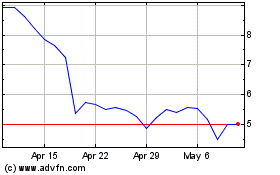

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Feb 2024 to Feb 2025