AquaBounty Technologies, Inc. (NASDAQ: AQB) (“AquaBounty” or the

“Company”), a land-based aquaculture company utilizing technology

to enhance productivity and sustainability, today announced the

Company’s financial results for the fourth quarter and full year

ended December 31, 2022.

Fourth Quarter and Full Year 2022 Highlights and Recent

Developments

- Generated $451

thousand in product revenue in the fourth quarter, a year-over-year

increase of 8% as compared to $418 thousand in the fourth quarter

of 2021. For the year ended December 31, 2022, product revenue

totaled $3.14 million, a year-over-year increase of 167% as

compared to $1.17 million in 2021.

- Net loss in the

fourth quarter was flat at $6.07 million for both 2022 and 2021.

For the year ended December 31, 2022, net loss decreased slightly

to $22.16 million, as compared to $22.32 million in 2021.

- Construction

activities for the Pioneer, Ohio farm site continued to progress

throughout the year:

- Phase 1 construction

activities are well underway in the hatchery and early rearing

areas

- Receipt of a new

Withdrawal and Consumptive Use Permit enables expanded water access

for the site

- Regular aerial video updates on the

farm are available on the AquaBounty website

- Received approval

from the Board of the Toledo Lucas County Port Authority to

increase the amount of bonds for the construction of the Pioneer,

Ohio farm up to $425 million.

- Cash, cash

equivalents, marketable securities and restricted cash totaled

$102.6 million as of December 31, 2022, as compared to $191.2

million as of December 31, 2021.

Management Commentary

“Our fourth quarter performance was indicative of the expertise

and determination of our team members, as the quarter began with a

challenge to our daily operations, as the roof of the processing

building at our Indiana farm required extensive repairs,” said

Sylvia Wulf, Chief Executive Officer of AquaBounty. “Through the

efforts of the farm team, not only did we not lose a single fish,

but they were able to complete the planned harvest of the fish in

the building. It was an example of their dedication to the company,

to the farm and to the fish in their care. Even with the

interruption to our operation, our fourth quarter revenue increased

by 8% over the prior year and our full year revenue increased by

167% over the prior year. Our Indiana farm continues to be a

valuable learning environment for our operations team, helping us

to refine the efficiency of our production processes, while aiding

in design improvements for our farm in Pioneer, Ohio.

“AquaBounty’s vertical integration through each phase of our

salmon lifecycle, from control of egg and broodstock production

through grow-out and harvest, allows us a unique degree of insight

and control over every aspect of our operations. We believe that

this is a competitive advantage and so during the year, we began

the process to convert our small Canadian grow-out facility on

Prince Edward Island to exclusively focus on egg production,

ensuring that we not only have a sufficient supply of GE eggs for

our internal needs, but that we will also have a supply available

of non-GE eggs to meet the growing demand in the North American

market.

“This past year was marked both by the considerable progress

made on the construction of our farm in Pioneer, Ohio, and by the

impact of inflation on our construction cost estimates. We

temporarily paused the project during Q3 to fully investigate the

drivers of the cost increases and resumed once we had a clear view

of what could and couldn’t be mitigated through design changes. We

are utilizing a phased approach to the construction and progress is

visible, particularly in the hatchery and early rearing areas where

crews have laid piping, tanks and other critical infrastructure. We

expect both Phase 1 and Phase 2 to be completed in the first half

of 2025.

“The debt portion of the project financing for the Ohio farm

continues to move forward. Led by the efforts of Wells Fargo

Corporate and Investment Banking, we plan to place a mix of taxable

and tax-exempt bonds with the transaction targeted to close in

mid-2023.

“Looking ahead, we anticipate markets being increasingly

receptive to our plan to bring our land-based salmon to more

customers. Protein that is produced efficiently and sustainably is

in demand and I look forward to delivering our product in greater

quantities and creating long-term value for our shareholders and

their communities,” concluded Wulf.

About AquaBounty

At AquaBounty Technologies, Inc. (NASDAQ: AQB), we believe we

are a leader in land-based aquaculture leveraging decades of

technology expertise to deliver disruptive solutions that address

food insecurity and climate change issues. We are committed to

feeding the world efficiently, sustainably and profitably.

AquaBounty provides fresh Atlantic salmon to nearby markets by

raising its fish in carefully monitored land-based fish farms

through a safe, secure and sustainable process. The Company’s

land-based Recirculating Aquaculture System (“RAS”) farms, located

in Indiana, United States and Prince Edward Island, Canada, are

close to key consumption markets and are designed to prevent

disease and to include multiple levels of fish containment to

protect wild fish populations. AquaBounty is raising nutritious

salmon that is free of antibiotics and contaminants and provides a

solution resulting in a reduced carbon footprint and no risk of

pollution to marine ecosystems as compared to traditional sea-cage

farming. For more information on AquaBounty, please visit

www.aquabounty.com or follow us on Facebook, Twitter, LinkedIn and

Instagram.

Forward-Looking Statements

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995, as

amended, including regarding the timing of the contemplated bond

financing; production capacity; timing of construction, permits,

regulatory approvals; sustainability claims; technological

capabilities; cost of construction; future revenue streams; pricing

and profitability. The forward-looking statements in this press

release are neither promises nor guarantees, and you should not

place undue reliance on these statements because they involve

significant risks and uncertainties about AquaBounty. AquaBounty

may use words such as “expect,” “anticipate,” “project,” “intend,”

“slated to,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,”

“focus,” “will,” “may,” the negative forms of these words and

similar expressions to identify such forward-looking statements.

Among the important factors that could cause actual results to

differ materially from those indicated by such forward-looking

statements are risks relating to, among other things, whether

AquaBounty and its partners will consummate the proposed bond

financing; the final terms of the financing, market and other

conditions; the satisfaction of closing conditions; the impact of

the bond offering on AquaBounty’s financial condition, credit

rating and stock price; whether AquaBounty will need to and be able

to raise additional equity capital; whether AquaBounty will be able

to service the bond commitments, be able to secure required

regulatory approvals and permits, be able to profitably construct

and operate the Pioneer, Ohio farm; AquaBounty’s business and

financial condition, and the impact of general economic, public

health, industry or political conditions in the United States and

internationally. Forward-looking statements speak only as of the

date hereof, and, except as required by law, AquaBounty undertakes

no obligation to update or revise these forward-looking statements.

For additional information regarding these and other risks faced by

us, please refer to our public filings with the Securities and

Exchange Commission (“SEC”), available on the Investors section of

our website at www.aquabounty.com and on the SEC’s website at

www.sec.gov.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the bonds described herein, nor

shall there be any sale of these bonds in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful.

Company Contact:AquaBounty TechnologiesDave

ConleyCorporate Communications(613) 294-3078

Media Contact:Vince McMorrowFahlgren

Mortine(614) 906-1671vince.mcmorrow@Fahlgren.com

Investor Relations:Lucas A. ZimmermanMZ Group -

MZ North America(949) 259-4987AQB@mzgroup.us

AquaBounty Technologies,

Inc.Condensed Consolidated Balance

Sheets

| |

|

|

|

|

|

| |

|

As of December 31, |

|

|

2022 |

|

|

2021 |

|

|

Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

101,638,557 |

|

|

$ |

88,454,988 |

|

|

Marketable securities |

|

— |

|

|

|

101,773,781 |

|

|

Inventory |

|

2,276,592 |

|

|

|

1,259,910 |

|

|

Prepaid expenses and other current assets |

|

2,133,583 |

|

|

|

1,536,484 |

|

|

Total current assets |

|

106,048,732 |

|

|

|

193,025,163 |

|

| |

|

|

|

|

|

| Property, plant and equipment,

net |

|

106,286,186 |

|

|

|

33,815,119 |

|

| Right of use assets, net |

|

222,856 |

|

|

|

284,320 |

|

| Intangible assets, net |

|

218,139 |

|

|

|

231,842 |

|

| Restricted cash |

|

1,000,000 |

|

|

|

1,000,000 |

|

| Other

assets |

|

64,859 |

|

|

|

79,548 |

|

|

Total assets |

$ |

213,840,772 |

|

|

$ |

228,435,992 |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

12,000,592 |

|

|

$ |

4,317,615 |

|

|

Accrued employee compensation |

|

1,021,740 |

|

|

|

874,589 |

|

|

Current debt |

|

2,387,231 |

|

|

|

627,365 |

|

|

Other current liabilities |

|

20,830 |

|

|

|

66,269 |

|

|

Total current liabilities |

|

15,430,393 |

|

|

|

5,885,838 |

|

| |

|

|

|

|

|

| Long-term lease

obligations |

|

203,227 |

|

|

|

224,058 |

|

|

Long-term debt, net |

|

6,286,109 |

|

|

|

8,523,333 |

|

|

Total liabilities |

|

21,919,729 |

|

|

|

14,633,229 |

|

| |

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

| |

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

Common stock, $0.001 par value, 150,000,000 and 80,000,000 shares

authorized at |

|

|

|

|

|

|

December 31, 2022 and 2021, respectively; 71,110,713 and 71,025,738

shares |

|

|

|

|

|

|

outstanding at December 31, 2022 and 2021, respectively |

|

71,111 |

|

|

|

71,026 |

|

|

Additional paid-in capital |

|

385,388,684 |

|

|

|

384,852,107 |

|

|

Accumulated other comprehensive loss |

|

(516,775 |

) |

|

|

(255,588 |

) |

|

Accumulated deficit |

|

(193,021,977 |

) |

|

|

(170,864,782 |

) |

|

Total stockholders' equity |

|

191,921,043 |

|

|

|

213,802,763 |

|

|

|

|

|

|

|

|

| Total

liabilities and stockholders' equity |

$ |

213,840,772 |

|

|

$ |

228,435,992 |

|

AquaBounty Technologies,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive Loss

| |

|

|

|

|

|

| |

Twelve Months EndedDecember

31, |

|

|

2022 |

|

|

2021 |

|

|

Revenues |

|

|

|

|

|

|

Product revenues |

$ |

3,136,954 |

|

|

$ |

1,174,832 |

|

| |

|

|

|

|

|

| Costs and

expenses |

|

|

|

|

|

|

Product costs |

|

13,630,911 |

|

|

|

10,786,072 |

|

|

Sales and marketing |

|

1,138,781 |

|

|

|

1,261,764 |

|

|

Research and development |

|

903,981 |

|

|

|

2,145,548 |

|

|

General and administrative |

|

9,786,819 |

|

|

|

9,103,213 |

|

|

Total costs and expenses |

|

25,460,492 |

|

|

|

23,296,597 |

|

|

|

|

|

|

|

|

| Operating

loss |

|

(22,323,538 |

) |

|

|

(22,121,765 |

) |

| |

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

Interest expense |

|

(291,177 |

) |

|

|

(316,442 |

) |

|

Other income, net |

|

457,520 |

|

|

|

115,619 |

|

|

Total other income (expense) |

|

166,343 |

|

|

|

(200,823 |

) |

|

|

|

|

|

|

|

|

Net loss |

$ |

(22,157,195 |

) |

|

$ |

(22,322,588 |

) |

|

|

|

|

|

|

|

| Other comprehensive

(loss) income: |

|

|

|

|

|

|

Foreign currency translation (loss) gain |

|

(301,288 |

) |

|

|

51,771 |

|

|

Unrealized gain on marketable securities |

|

40,101 |

|

|

|

(40,101 |

) |

|

Total other comprehensive (loss) income |

|

(261,187 |

) |

|

|

11,670 |

|

|

|

|

|

|

|

|

|

Comprehensive loss |

$ |

(22,418,382 |

) |

|

$ |

(22,310,918 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Basic and diluted net loss per

share |

$ |

(0.31 |

) |

|

$ |

(0.32 |

) |

| Weighted average number of

Common Shares - |

|

|

|

|

|

|

basic and diluted |

|

71,068,515 |

|

|

|

69,428,061 |

|

AquaBounty Technologies,

Inc.Condensed Consolidated Statements of Cash

Flows

| |

|

|

|

|

|

| |

Years Ended December 31, |

|

|

2022 |

|

|

2021 |

|

|

Operating activities |

|

|

|

|

|

| Net loss |

$ |

(22,157,195 |

) |

|

$ |

(22,322,588 |

) |

| Adjustment to reconcile net

loss to net cash used in |

|

|

|

|

|

|

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

2,024,783 |

|

|

|

1,787,564 |

|

|

Share-based compensation |

|

535,123 |

|

|

|

394,237 |

|

|

Other non-cash charge |

|

22,983 |

|

|

|

17,386 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

Inventory |

|

(1,027,650 |

) |

|

|

267,833 |

|

|

Prepaid expenses and other assets |

|

(550,120 |

) |

|

|

(1,138,691 |

) |

|

Accounts payable and accrued liabilities |

|

(1,905 |

) |

|

|

230,712 |

|

|

Accrued employee compensation |

|

147,151 |

|

|

|

291,288 |

|

|

Net cash used in operating activities |

|

(21,006,830 |

) |

|

|

(20,472,259 |

) |

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Purchases of and deposits on

property, plant and equipment |

|

(67,476,327 |

) |

|

|

(5,713,807 |

) |

| Maturities of marketable

securities |

|

149,435,173 |

|

|

|

86,488,271 |

|

| Purchases of marketable

securities |

|

(47,621,291 |

) |

|

|

(188,302,153 |

) |

| Other

investing activities |

|

12,500 |

|

|

|

(11,010 |

) |

|

Net cash provided by (used in) investing activities |

|

34,350,055 |

|

|

|

(107,538,699 |

) |

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Proceeds from issuance of

debt |

|

476,228 |

|

|

|

606,453 |

|

| Repayment of term debt |

|

(640,170 |

) |

|

|

(272,102 |

) |

| Proceeds from the issuance of

common stock, net |

|

— |

|

|

|

119,120,437 |

|

|

Proceeds from the exercise of stock options and warrants |

|

1,538 |

|

|

|

1,723,846 |

|

|

Net cash (used in) provided by financing activities |

|

(162,404 |

) |

|

|

121,178,634 |

|

|

|

|

|

|

|

|

| Effect

of exchange rate changes on cash, cash equivalents and restricted

cash |

|

2,748 |

|

|

|

36,152 |

|

|

Net change in cash, cash equivalents and restricted cash |

|

13,183,569 |

|

|

|

(6,796,172 |

) |

| Cash,

cash equivalents and restricted cash at beginning of period |

|

89,454,988 |

|

|

|

96,251,160 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

$ |

102,638,557 |

|

|

$ |

89,454,988 |

|

|

|

|

|

|

|

|

| Reconciliation of

cash, cash equivalents and restricted cash reported |

|

|

|

|

|

|

in the consolidated balance sheet: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

101,638,557 |

|

|

$ |

88,454,988 |

|

|

Restricted cash |

|

1,000,000 |

|

|

|

1,000,000 |

|

|

Total cash, cash equivalents and restricted cash |

$ |

102,638,557 |

|

|

$ |

89,454,988 |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information and non-cash

transactions: |

|

|

|

|

|

|

Interest paid in cash |

$ |

274,562 |

|

|

$ |

299,056 |

|

|

Property and equipment included in accounts payable and accrued

liabilities |

$ |

10,565,820 |

|

|

$ |

2,926,016 |

|

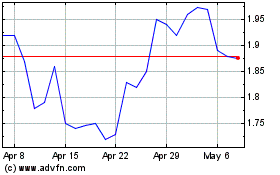

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Jan 2025 to Feb 2025

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Feb 2024 to Feb 2025