FALSE000077954400007795442023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2024

ARK RESTAURANTS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New York | 1-09453 | 13-3156768 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

85 Fifth Avenue

New York, New York 10003

(Address of principal executive offices, with zip code)

Registrant’s telephone number, including area code: (212) 206-8800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| [ ] | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | ARKR | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | |

Item 2.02 Results of Operations and Financial Condition. |

On February 12, 2024 Ark Restaurants Corp. (the “Company”) issued a press release announcing financial results for the first quarter of 2024. A copy of the press release titled “Ark Restaurants Announces Financial Results for the First Quarter of 2024 (the "Press Release") is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 of Form 8-K and the press release attached as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. Except for historical information contained in the press release as an exhibit hereto, the press release contains forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release regarding these forward-looking statements.

| | |

| Item 9.01 Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ARK RESTAURANTS CORP. |

| | | |

| | By: | /s/ Michael Weinstein |

| | | Name: Michael Weinstein |

| | | Title: Chief Executive Officer |

| | | |

Date: February 12, 2024

Exhibit 99.1

Ark Restaurants Announces Financial Results for the First Quarter of 2024

CONTACT:

Anthony J. Sirica

(212) 206-8800

ajsirica@arkrestaurants.com

NEW YORK, New York - February 12, 2024 -- Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial results for the first quarter ended December 30, 2023.

Financial Results

Total revenues for the 13 weeks ended December 30, 2023 were $47,487,000 versus $47,445,000 for the 13 weeks ended December 31, 2022.

The Company's EBITDA, excluding gains on the forgiveness of Paycheck Protection Program Loans (the "PPP Loan Forgiveness") and adjusted for other items all as set out in the table below, for the 13 weeks ended December 30, 2023 was $2,572,000 versus $3,018,000 for the 13 weeks ended December 31, 2022. Net income for the 13 weeks ended December 30, 2023 was $1,370,000 (which includes PPP Loan Forgiveness of $285,000), or $0.38 per basic and diluted share, compared to net income of $1,725,000 (which includes PPP Loan Forgiveness of $272,000), or $0.48 and $0.47 per basic and diluted share, respectively, for the 13 weeks ended December 31, 2022.

On February 6, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share to be paid on March 13, 2024 to shareholders of record of the Company's common stock at the close of business on February 29, 2024.

As of December 30, 2023, the Company had a cash balance of $12,122,000 and total outstanding debt of $6,742,000.

About Ark Restaurants Corp.

Ark Restaurants owns and operates 17 restaurants and bars, 16 fast food concepts and catering operations primarily in New York City, Florida, Washington, DC, Las Vegas, Nevada and the gulf coast of Alabama. Four restaurants are located in New York City, one is located in Washington, DC, five are located in Las Vegas, Nevada, one is located in Atlantic City, New Jersey, four are located on the east coast of Florida and two are located on the Gulf Coast of Alabama. The Las Vegas operations include four restaurants within the New York-New York Hotel & Casino Resort and operation of the hotel's room service, banquet facilities, employee dining room and six food court concepts and one restaurant within the Planet Hollywood Resort and Casino. In Atlantic City, New Jersey, the Company operates a restaurant in the Tropicana Hotel and Casino. The Florida operations include the Rustic Inn in Dania Beach, Shuckers in Jensen Beach, JB’s on the Beach in Deerfield Beach, Blue Moon Fish Company in Lauderdale-by-the-Sea and the operation of four fast food facilities in Tampa and six fast food facilities in Hollywood, each at a Hard Rock Hotel and Casino operated by the Seminole Indian Tribe at these locations. In Alabama, the Company operates two Original Oyster Houses, one in Gulf Shores and one in Spanish Fort.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this news release contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve unknown risks, and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. Important factors that might cause such differences are discussed in the Company's filings with the Securities and Exchange Commission. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Actual results could differ materially from those anticipated in these forward-looking statements, if new information becomes available in the future.

Non-GAAP Financial Information

This news release includes non-generally accepted accounting principles ("GAAP") performance measures. Although Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") is not a measure of performance or liquidity calculated in accordance with GAAP, the Company believes the use of this non-GAAP financial measure enhances an overall understanding of the Company's past financial performance as well as providing useful information to the investor because of its historical use by the Company as both a performance measure and measure of liquidity, and the use of EBITDA by virtually all companies in the restaurant sector as a measure of both performance and liquidity. However, investors should not consider this measure in isolation or as a substitute for net income (loss), operating income (loss), cash flows from operating activities or any other measure for determining the Company's operating performance or liquidity that is calculated in accordance with GAAP as it may not necessarily be comparable to similarly titled measure employed by other companies.

| | |

| ARK RESTAURANTS CORP. |

| Consolidated Condensed Statements of Income |

| For the 13-week periods ended December 30, 2023 and December 31, 2022 |

| (In Thousands, Except per share amounts) |

| | | | | | | | | | | | | | |

| | 13 Weeks Ended

December 30,

2023 | | 13 Weeks Ended

December 31,

2022 |

| | | | |

| TOTAL REVENUES | | $ | 47,487 | | | $ | 47,445 | |

| COSTS AND EXPENSES: | | | | |

| Food and beverage cost of sales | | 12,071 | | | 12,435 | |

| Payroll expenses | | 16,977 | | | 16,522 | |

| Occupancy expenses | | 6,332 | | | 6,183 | |

| Other operating costs and expenses | | 6,092 | | | 5,932 | |

| General and administrative expenses | | 3,320 | | | 3,137 | |

| Depreciation and amortization | | 1,092 | | | 1,033 | |

| Total costs and expenses | | 45,884 | | | 45,242 | |

| OPERATING INCOME | | 1,603 | | | 2,203 | |

| OTHER (INCOME) EXPENSE: | | | | |

| Interest expense, net | | 160 | | | 339 | |

| Other income | | (26) | | | — | |

| Gain on forgiveness of PPP Loans | | (285) | | | (272) | |

| Total other (income) expense, net | | (151) | | | 67 | |

| INCOME BEFORE PROVISION FOR INCOME TAXES | | 1,754 | | | 2,136 | |

| Provision for income taxes | | 158 | | | 114 | |

| CONSOLIDATED NET INCOME | | 1,596 | | | 2,022 | |

| Net income attributable to non-controlling interests | | (226) | | | (297) | |

| NET INCOME ATTRIBUTABLE TO ARK RESTAURANTS CORP. | | $ | 1,370 | | | $ | 1,725 | |

| | | | |

| NET INCOME ATTRIBUTABLE TO ARK RESTAURANTS CORP. PER COMMON SHARE: | | | | |

| Basic | | $ | 0.38 | | | $ | 0.48 | |

| Diluted | | $ | 0.38 | | | $ | 0.47 | |

| | | | |

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | | | | |

| Basic | | 3,604 | | | 3,600 | |

| Diluted | | 3,631 | | | 3,648 | |

| | | | |

| EBITDA Reconciliation: | | | | |

| Income before provision for income taxes | | $ | 1,754 | | | $ | 2,136 | |

| Depreciation and amortization | | 1,092 | | | 1,033 | |

| Interest expense, net | | 160 | | | 339 | |

| EBITDA (a) | | $ | 3,006 | | | $ | 3,508 | |

| EBITDA, adjusted: | | | | |

| EBITDA (as defined) (a) | | 3,006 | | | 3,508 | |

| Non-cash stock option expense | | 77 | | | 79 | |

| Gain of forgiveness of PPP Loans | | (285) | | | (272) | |

| Net income attributable to non-controlling interests | | (226) | | | (297) | |

| EBITDA, as adjusted | | $ | 2,572 | | | $ | 3,018 | |

(a)EBITDA is defined as earnings before interest, taxes, depreciation and amortization. A reconciliations of EBITDA to the most comparable GAAP financial measure, pre-tax income, is included above.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

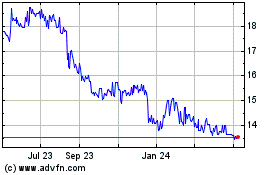

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Feb 2025 to Mar 2025

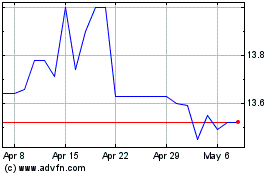

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Mar 2025