ASP Isotopes Inc. NASDAQ: ASPI (“ASP Isotopes” or the “Company”),

an advanced materials company dedicated to the development of

technology and processes for the production of isotopes for use in

multiple industries, today issued the following statement in

response to short seller Fuzzy Panda’s purported “report” published

on November 26, 2024.

Executive Chairman and Chief Executive Officer,

Paul Mann, stated: “Fuzzy Panda is known for these types of short

attacks, which are designed to allow short sellers to profit from a

declined stock price. Tellingly, as the so-called “research report”

states in its “disclaimer,” Fuzzy Panda and affiliates are short

the Company’s stock and “therefore stand to realize significant

gains in the event” the Company’s stock price declines, while also

disclaiming that “the information it has relied upon” may be

inaccurate. The Company’s management believes this short seller’s

report contains incomplete and inaccurate information, distortions

of facts, flawed analyses, and misleading conclusions. By way of

one of many examples, Fuzzy Panda purports to summarize the

Company’s “key technology,” but omits any mention of the Company’s

aerodynamic separation process technology, which is currently

deployed at the Company’s Silicon-28 and Carbon-14 enrichment

facilities in Pretoria, South Africa. In addition, we believe Fuzzy

Panda’s criticisms of the Company’s laser-based quantum enrichment

technology is based upon a comparison to outdated AVLIS technology

from the 1990s, which we view to be, at best, misleading. The

Company announced recently that it had demonstrated proof of

concept using quantum enrichment technology to enrich

Ytterbium-176. Once further refinement has been completed, the

Company expects to supply enriched Ytterbium-176 to customers from

a facility being commissioned in Pretoria, South Africa

(anticipated during the course of 2025). Following the signing of

an agreement with NECSA (Nuclear Energy Corporation of South

Africa) we plan to apply quantum enrichment technology to the

enrichment of uranium at Pelindaba in Pretoria, South Africa. We

believe the Company’s significant progress in these and other

respects is a more reliable indicator of the Company’s prospects

than the “inferences and deductions” upon which Fuzzy Panda’s

report is based.

ASP Isotopes is exploring its options in

response to this attack while continuing to focus on our business,

growing revenues and executing on our strategic plan.”

The Company provides this statement to address

certain areas of confusion among investors and customers arising

from the Fuzzy Panda report and does not purport to respond to all

of Fuzzy Panda’s assertions.

The Company’s Quantum Enrichment

Technology and ASP Technology

Fuzzy Panda states that “ASPI Tech is Failed

1990s Tech,” claiming “this is the key technology ASPI is hyping.”

In support, Fuzzy Panda asserts that the Company uses outdated

AVLIS laser enrichment technology to enrich its isotopes. The

Company’s quantum enrichment technology is substantially different

from AVLIS, a laser enrichment technique that has been experimented

with over the past 40 years. Key differences between the Company’s

quantum enrichment technology and AVLIS include a more advanced

spectroscopy, different lasers and more advanced beam shaping. The

Company is developing quantum enrichment technology to produce

enriched Ytterbium-176 (“Yb-176”), Nickel-64, Lithium 6,

Lithium-7 and Uranium-235 (“U-235”). The construction of the

Company’s first quantum enrichment facility was completed in August

2024, and the Company produced the first semi-finished material of

enriched Yb-176 during the commissioning phase of the plant in

October 2024. The Company expects to be able to achieve a 99.75%

enrichment for Yb-176 and offer highly enriched Yb-176 for

commercial sale during 2025.

Appendix B of the Fuzzy Panda “report” includes

some basic laser mathematics, suggesting that the lasers that the

Company will be using in its quantum enrichment technology as

applied to the enrichment of uranium are not powerful enough.

First, assuming the Company did intend to use this technology

(AVLIS), the analysis in Appendix B is wrong because the excitation

of an atom is driven by the difference in energies of a number of

photons applied in series, not a single difference in energy.

Second, the author of the report has incorrectly deduced that the

lasers the Company is currently using for Ytterbium enrichment will

also be used for uranium enrichment and will therefore not be

capable of supplying enough power. During quantum enrichment,

different metals require different combinations of wavelengths,

different photon energies, and different beam shapes. Therefore,

the laser system for each isotope will be different and specific

for that isotope. Wavelengths of light, the photon energies and the

beam shaping characteristics for any isotope is highly confidential

and proprietary. We believe that Fuzzy Panda’s analysis is based

upon erroneous assumptions and, accordingly, results in false or

misleading characterizations of the Company’s enrichment

technology.

We believe Fuzzy Panda’s conclusions and

characterizations of ASP Isotopes’ technology are also misleading

by omission. For example, the Company’s aerodynamic separation

process technology (“ASP technology”) is designed to enable the

production of isotopes used in several industries and is currently

deployed in enrichment facilities in South Africa for Carbon-14 and

Silicon-28. Notably, the Company’s ASP technology is not even

mentioned in the report.

Initiative to Commence Uranium

Enrichment in South Africa

In October 2024, we entered into a term sheet

with TerraPower, LLC related to the construction of a uranium

enrichment facility capable of producing HALEU and the future

supply of HALEU to TerraPower. Fuzzy Panda claims that the term

sheet “came at Zero Cost to TerraPower,” which is factually

incorrect because ASP Isotopes has already invoiced TerraPower

following the signing of the term sheet with TerraPower. Fuzzy

Panda describes the term sheet as “likely Non-Binding” as if that

fact were hidden, when in reality the Company had previously

publicly disclosed in its SEC filings that, with certain

exceptions, “the term sheet is non-binding and there is no

assurance that the parties will enter into definitive

agreements.”

The Company nonetheless believes the term sheet

with TerraPower is valuable because it represents the first step

towards a two-fold definitive agreement with TerraPower. The term

sheet with TerraPower contemplates the parties entering into a

definitive agreement, pursuant to which TerraPower would provide

funding for the construction of a HALEU production facility. In

addition, the parties anticipate entering into a long-term supply

agreement for HALEU expected to be produced at this facility,

pursuant to which the customer would purchase all HALEU produced at

the facility over a 10-year period after the expected completion of

the facility in 2027.

The term sheet with TerraPower preceded the

signing in November 2024 of a memorandum of understanding (“MOU”)

with The South African Nuclear Energy Corporation (Necsa) to

collaborate on the research, development and ultimately the

commercial production of advanced nuclear fuels. The proposed

structure under discussion for the delivery of the objectives of

the MOU contemplates the formation of a new entity in South Africa

with a board of directors consisting of at least two

representatives from ASPI and Necsa. Subject to the receipt of all

required permits and licenses to begin enrichment of U-235 in South

Africa, it is anticipated that the research, development and

ultimate construction of a HALEU production facility will take

place at Pelindaba in Pretoria, South Africa’s main nuclear

research center and the home of the 20MW research nuclear reactor,

SAFARI-1.

Finally, the Report states that, according to an

unidentified “former” TerraPower executive, TerraPower rates ASPI

“at the bottom in terms of quality.” In TerraPower’s public

announcement regarding the term sheet, a current TerraPower

executive, Chris Levesque, TerraPower President and CEO, was quoted

as saying, “We are optimistic about ASP Isotopes’ enrichment

capabilities and planned timeline to help ensure advanced nuclear

energy can achieve its necessary role in meeting climate energy

targets.”

Regulatory Approvals Required for

Enrichment of Uranium

One of Fuzzy Panda’s headlines claims that ASP

Isotopes lacks a license to enrich uranium from the U.S. Nuclear

Regulatory Commission (NRC) and that the licensing process could

take 10-15 years. As described herein, the Company’s strategy

involves the formation of a new entity in South Africa with The

South African Nuclear Energy Corporation (Necsa) to undertake the

research, development and ultimate construction of a HALEU

production facility at Pelindaba in Pretoria, South Africa’s main

nuclear research center. Necsa is a state-owned company established

by the Republic of South Africa Nuclear Energy Act in 1999 with a

mandate to undertake and promote research and development in the

field of nuclear energy and radiation sciences. The NRC would not

be the licensing authority for a uranium enrichment facility in

South Africa. Therefore, the Company would not need to apply for an

NRC license in the United States for such a facility operated by a

South African affiliate of the Company. The South Africa nuclear

regulatory licensing regime will apply to the Company’s uranium

enrichment activities, and the Company will apply for all required

permits and licenses to enrich U-235 in South Africa.

Intellectual Property

Fuzzy Panda’s report criticizes the Company

because it currently has no patents. Enrichment is among the most

sensitive nuclear technologies because it can produce weapons-grade

materials. To the extent the Company’s technology developed for the

purposes of producing enriched isotopes for use in nuclear medicine

or concentrating uranium in the isotope uranium-235 for use in

nuclear energy can be applied to the creation or development of

weapons-grade materials, then that technology would be highly

controlled and subject to limitations on public disclosure or

export. Accordingly, patent protection in the United States for

such sensitive nuclear technology developed in South Africa would

be, in the view of the Company’s management, unusual, if even

possible.

As noted in the Company’s SEC filings, the

Company has relied exclusively on trade secrets and other

intellectual property laws, non-disclosure agreements with our

respective employees, consultants, vendors, potential customers and

other relevant persons and other measures to protect our

intellectual property, and intends to continue to rely on these and

other means. While pursuing patents remains part of the Company’s

intellectual property protection philosophy and strategy, the

advisability of establishing provisional patent rights is

continuously assessed on a case-by-case basis in respect of both

conceptual aspects and the specific applications thereof. Such

assessments are made in consultation with regulatory bodies and

with due consideration to the prospects of successfully obtaining

patent protection in light of any disclosure constraints that are

imposed by such bodies. To date, the Company has not determined

that patent protection is appropriate or viable in light of these

considerations.

PET Labs Financial Track

Record

Fuzzy Panda also incorrectly asserts that PET

Labs has annual losses of ~$19.5 - 20 million a year. PET Labs has

generated positive EBITDA for the last several years. Fuzzy Panda

also incorrectly claims that at the time PET Labs was acquired by

the Company (in 4Q 2023) the $2 million paid for the

acquisition was likely made to a related party, which is incorrect.

At the time of the acquisition, the CEO and owner of PET Labs was

not a related party.

The Company’s U.S. Offices

Fuzzy Panda criticizes that ASP Isotopes’

headquarters in the United States was once a virtual office and

then a co-working space. ASP Isotopes has had since its

inception a minimal physical presence in the United States because

it has relied upon external consultants and professional advisors

and currently permits remote work arrangements for a limited number

of recent hires in the United States. ASP Isotopes has not

entered into any lease agreement for executive offices in the

United States.

The Company’s South African Enrichment

Facilities

Fuzzy Panda states that the “primary location”

of the Company’s South African subsidiaries is “1 Melrose

Blvd- Unit 19, Johannesburg, South Africa,” but “ASP Isotopes’s SA

subsidiaries were NOT actually there.” The cited address is that of

the Company’s South African subsidiaries utilized for

correspondence, and of Jaltech Pty Ltd, which has been engaged by

ASP Isotopes South Africa (Pty) Ltd to provide certain corporate

advisory operations for the Company’s South African subsidiaries,

including local accounting, tax and payroll services. It is not the

address of the Company’s core business operations.

The Company’s core business operations are

located in South Africa (as specified below) where, as of

November 30, 2024, there are approximately 126 employees,

including 26 employees in Research and Development, 50 employees

are in construction and manufacturing and 14 employees in general

management. The Company is currently in the process of

commissioning three isotope enrichment facilities in South Africa.

The “multi-isotope” facility, located at 33 Eland Street,

Koedoespoort Industrial, Pretoria, has its initial production run

designated for enriched Silicon-28. The facility located at

Building 29, CSIR Campus, Meiring Naude Road, Brummeria, Pretoria

is scheduled to enrich Carbon-14 for use in healthcare and

agrochemicals. The facility located at Building 46, CSIR Campus,

Meiring Naude Road, Brummeria, Pretoria is scheduled to enrich

Ytterbium-176, a critically important raw material for use in the

production of radio-oncology therapies. The Company has hosted a

group of significant investors and several commercial partners at

its facilities in South Africa as recently as November, 2024.

ASP Isotopes Inc. Stockholder

Base

One of Fuzzy Panda’s headlines claims that ASP

Isotopes has ties to “microcap fraudsters” who are “behind the

scenes” or “hiding” in the capital structure. The basic premise is

that among the Company’s numerous pre-IPO investors are entities

affiliated with family members of individuals who have been subject

to SEC charges for violations of securities laws or entities

formerly affiliated with such individuals. None of the individuals

named in the report or their family members has ever been an

officer, director or employee of the Company. The Company regards

each of its pre-IPO investors who are not directors or executive

officers as passive investors who do not, and have never had, any

control or influence over management of the Company. Barry Honig,

John Stetson, Jonathan Honig and Titan Multi-Strategy Fund I, Ltd

have no role in the management of the Company and Fuzzy Panda’s

referencing securities enforcement matters concerning them glosses

over that those matters did not involve ASP Isotopes. As of

December 11, 2024, the Company’s stockholder base is comprised

of approximately 31% institutional and other reputable investors

introduced to the Company by leading investment banks and placement

agents.

As previously stated in our press release dated

December 2, 2024, we value transparency and open communication. We

look forward to hosting as many investors as possible at our

Investor Access Event in South Africa from January 14-16, 2025.

Should you be interested in attending, please email Viktor Petkov

at vpetkov@aspisotopes.com as soon as possible to complete the

registration process.

ASP Isotopes remains focused on our business and

growing revenues, and executing on our strategic plan. We look

forward to continuing to drive positive momentum in 2025. The

Company believes this short seller’s report is an attempt to profit

from a deliberately false picture of our Company, and we encourage

our stockholders, customers, counterparties and stakeholders to

look past the factual errors, misrepresentations,

mischaracterizations and misleading claims.

About ASP Isotopes Inc.

ASP Isotopes Inc. is a development stage

advanced materials company dedicated to the development of

technology and processes to produce isotopes for use in multiple

industries. The Company employs proprietary technology, the

Aerodynamic Separation Process (“ASP technology”). The Company’s

initial focus is on producing and commercializing highly enriched

isotopes for the nuclear medicine and technology industries. The

Company also plans to enrich isotopes for the nuclear energy sector

using Quantum Enrichment technology that the Company is developing.

The Company has isotope enrichment facilities in Pretoria, South

Africa, dedicated to the enrichment of isotopes of elements with a

low atomic mass (light isotopes).

There is a growing demand for isotopes such as

Silicon-28 for enabling quantum computing; Molybdenum-100,

Molybdenum-98, Zinc-68, Ytterbium-176, and Nickel-64 for new,

emerging healthcare applications, as well as Chlorine-37,

Lithium-6, Lithium-7 and Uranium-235 for green energy applications.

The ASP Technology (Aerodynamic Separation Process) is ideal for

enriching low and heavy atomic mass molecules. For more

information, please visit www.aspisotopes.com.

Forward Looking Statements

This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations, and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy, and other future

conditions. Forward-looking statements can be identified by words

such as “believes,” “plans,” “anticipates,” “expects,” “estimates,”

“projects,” “will,” “may,” “might,” and words of a similar nature.

Examples of forward-looking statements include, among others but

are not limited to, statements relating to the Company’s ability to

produce highly enriched Ytterbium-176 and commence supply of

enriched Ytterbium-176 to customers, the formation of a new project

company with Necsa and the outcome of the project contemplated by

the MOU with Necsa, the outcome of the proposed transaction

contemplated by the term sheet with TerraPower, the future of the

Company’s initiative to commence enrichment of uranium in South

Africa, and the future of the Company’s enrichment technologies as

applied to uranium enrichment, statements we make regarding

expected operating results, such as future revenues and prospects

from the potential commercialization of isotopes, future

performance under contracts, and our strategies for product

development, engaging with potential customers, market position,

and financial results. Because forward-looking statements relate to

the future, they are subject to inherent uncertainties, risks, and

changes in circumstances that are difficult to predict, many of

which are outside our control. Our actual results, financial

condition, and events may differ materially from those indicated in

the forward-looking statements based upon a number of factors.

Forward-looking statements are not a guarantee of future

performance or developments. Investors are strongly cautioned that

reliance on any forward-looking statements involves known and

unknown risks and uncertainties. Therefore, you should not rely on

any of these forward-looking statements. There are many important

factors that could cause our actual results and financial condition

to differ materially from those indicated in the forward-looking

statements, including the outcomes of various strategies and

projects undertaken by the Company; the potential impact of laws or

government regulations or policies in South Africa, the United

Kingdom or elsewhere; our reliance on the efforts of third parties;

our ability to complete the construction and commissioning of our

enrichment plants or to commercialize isotopes using the ASP

technology or the Quantum Enrichment Process; our ability to obtain

regulatory approvals for the production and distribution of

isotopes; the financial terms of any current and future commercial

arrangements; our ability to complete certain transactions and

realize anticipated benefits from acquisitions; contracts,

dependence on our Intellectual Property (IP) rights, certain IP

rights of third parties; the competitive nature of our industry;

and the factors disclosed in Part I, Item 1A. “Risk Factors” of the

company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and any amendments thereto and in the company’s

subsequent reports and filings with the U.S. Securities and

Exchange Commission. Any forward-looking statement made by us in

this press release is based only on information currently available

to us and speaks only as of the date on which it is made. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise. No information in this press release

should be interpreted as an indication of future success, revenues,

results of operation, or stock price. All forward-looking

statements herein are qualified by reference to the cautionary

statements set forth herein and should not be relied upon.

Contacts

Jason Assad– Investor

relationsEmail: Jassad@aspisotopes.comTelephone:

561-709-3043

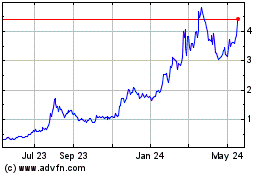

ASP Isotopes (NASDAQ:ASPI)

Historical Stock Chart

From Nov 2024 to Dec 2024

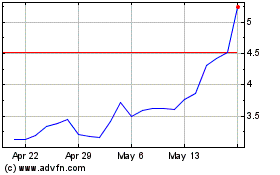

ASP Isotopes (NASDAQ:ASPI)

Historical Stock Chart

From Dec 2023 to Dec 2024