0001808665false00018086652024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 6, 2024

ASSERTIO HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 01-39294 | | 85-0598378 |

(State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

100 S. Saunders Road, Suite 300, Lake Forest, IL 60045

(Address of Principal Executive Offices; Zip Code)

(224) 419-7106

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| Common Stock, $0.0001 par value | | ASRT | | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition. |

On May 6, 2024, Assertio Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended March 31, 2024. The press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in Item 2.02 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. The information contained herein shall not be incorporated by reference into any filing with the Securities and Exchange Commission (the "SEC") made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| | | | | | | | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | | | |

| (d) | | Exhibits |

| | | | |

| | 99.1 | | |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ASSERTIO HOLDINGS, INC. |

| | | |

Date: May 6, 2024 | By: | /s/ Heather L. Mason |

| | | Heather L. Mason |

| | | Interim Chief Executive Officer

(Principal Executive Officer) |

Exhibit 99.1

Assertio Reports First Quarter 2024 Financial Results

First Quarter Net Product Sales of $31.9 Million

Rolvedon Growth Continues, with $14.5 million in Net Product Sales

$7.5 Million in Cash Flow from Operations Increases Cash to $80.7 Million

LAKE FOREST, IL. – May 6, 2024 – Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq: ASRT), a pharmaceutical company with comprehensive commercial capabilities offering differentiated products to patients, today reported financial results for the first quarter ended March 31, 2024.

“We are pleased to report a strong first quarter as our team continues to diligently execute our business plan and seeks to grow Assertio for the benefit of our stockholders,” said Heather Mason, interim Chief Executive Officer. “Rolvedon generated its fifth consecutive quarter of demand growth since launch, driven by continued market penetration in the clinic setting. Additionally, we completed enrollment of Rolvedon’s same-day dosing trial, and expect the data readout by year-end, providing a potential opportunity for differentiation through medical society guidelines. We remain committed to our lean promotion platform and steadfast in our business development efforts as we work to secure additional new assets to fuel both sales growth and incremental cash flow generation.”

“We are reiterating our guidance for 2024, calling for net product sales of $110 million to $125 million and adjusted EBITDA1 of $20 million to $30 million,” concluded Mason.

Financial Highlights (unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| (in millions, except per share amounts) | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | | | |

| Net Product Sales (GAAP) | $ | 31.9 | | | $ | 32.5 | | | $ | 41.8 | | | | | | | |

| | | | | | | | | | | |

| Net Loss (GAAP) | $ | (4.5) | | | $ | (57.4) | | | $ | (3.5) | | | | | | | |

| Loss Per Share (GAAP) | $ | (0.05) | | | $ | (0.61) | | | $ | (0.07) | | | | | | | |

| Adjusted EBITDA (Non-GAAP)2 | $ | 7.4 | | | $ | 4.5 | | | $ | 25.6 | | | | | | | |

Adjusted Earnings Per Share (Non-GAAP)2 | $ | 0.04 | | | $ | 0.11 | | | $ | 0.29 | | | | | | | |

First quarter results included the following highlights (our discussion below focuses on a comparison of first quarter 2024 to fourth 2023 given the acquisition of Spectrum and the generic competition of Indocin in third quarter 2023):

▪Rolvedon net product sales increased to $14.5 million in the first quarter 2024, from $11.0 million in the fourth quarter 2023, (the first full quarter of Rolvedon sales at Assertio) driven by volume growth.

▪Indocin net product sales in the first quarter 2024 were $8.7 million, decreased from $10.8 million in the fourth quarter 2023, driven by generic competition that affected both volume and pricing.

•Gross margin3 in the first quarter 2024 was 65% and included $4.1 million of amortization of Rolvedon purchase accounting inventory step-up amortization. Excluding step-up amortization, gross margin in the first quarter was 78% compared to 79% in fourth quarter 2023.

•SG&A expense in the first quarter 2024 was $18.5 million, decreased from $24.0 million in the fourth quarter 2023, benefiting from actions the Company has taken to reduce and align expenses to its current portfolio.

•Adjusted EBITDA was $7.4 million in the first quarter 2024, increased from $4.5 million in the fourth quarter 2023, primarily due to the impact of lower SG&A expense.

1 See “Non-GAAP Financial Measures” below for information about reconciling our Adjusted EBITDA guidance to Net Loss.

2 Non-GAAP measures are reconciled to the corresponding GAAP measures in the schedules attached.

3 Gross margin represents the ratio of net product sales less cost of sales to net product sales.

Balance Sheet and Cash Flow

•Assertio generated approximately $7.5 million in cash flow from operations in the first quarter of 2024.

•For the quarter ended March 31, 2024, cash and cash equivalents totaled $80.7 million,

•Convertible debt outstanding principal balance at March 31, 2024 was $40 million and does not mature until September 2027.

2024 Full Year Financial Guidance

Assertio reiterated its 2024 operating guidance as announced on March 11, 2024:

| | | | | |

| Net Product Sales (GAAP) | $110.0 Million to $125.0 Million |

| Adjusted EBITDA (Non-GAAP)4 | $20.0 Million to $30.0 Million |

Conference Call and Investor Presentation Information

Assertio’s management will host a conference call to discuss its first quarter 2024 financial results today:

| | | | | |

| Date: | Monday, May 6, 2024 |

| Time: | 4:30 p.m. Eastern Time |

| Webcast (live and archive): | http://investor.assertiotx.com/overview/default.aspx (Events & Webcasts, Investor Page) |

| Dial-in numbers: | 1-646-307-1963, Conference ID 4502314 |

To access the live webcast, the recorded conference call replay, and other materials, please visit Assertio’s investor relations website at http://investor.assertiotx.com/overview/default.aspx. Please connect at least 15 minutes prior to the live webcast to ensure adequate time for any software download that may be needed to access the webcast. The replay will be available approximately two hours after the call on Assertio’s investor website.

About Assertio

Assertio is a commercial pharmaceutical company with comprehensive commercial capabilities offering differentiated products to patients. We have built our commercial portfolio through acquisition or licensing of approved products. Our commercial capabilities include marketing through both a sales force and a non-personal promotion model, market access through payor contracting, and trade and distribution. To learn more about Assertio, visit www.assertiotx.com.

Investor Contact

Matt Kreps, Managing Director

Darrow Associates

M: 214-597-8200

mkreps@darrowir.com

4 See “Non-GAAP Financial Measures” below for information about reconciling our Adjusted EBITDA guidance to Net Loss.

Forward Looking Statements

The statements in this communication include forward-looking statements. Forward-looking statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs. Forward-looking statements speak only as of the date they are made or as of the dates indicated in the statements and should not be relied upon as predictions of future events, as there can be no assurance that the events or circumstances reflected in these statements will be achieved or will occur. Forward-looking statements can often, but not always, be identified by the use of forward-looking terminology including such as “anticipate,” “approximate”, “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “opportunity,” “plan,” “potential,” “project,” “prospective,” “pursue,” “seek,” “should,” “strategy,” “target,” “will,” or the negative of these words and phrases, other variations of these words and phrases or comparable terminology. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those contemplated by the statements, including: Assertio’s ability to grow sales of Rolvedon and the commercial success and market acceptance of Rolvedon and Assertio’s other products; Assertio’s ability to successfully develop and execute its sales, marketing and promotion strategies using its sales force and non-personal promotion model capabilities; the impact on sales and profits from the entry and sales of generics of Assertio’s products and/or other products competitive with any of Assertio’s products (including indomethacin suppositories compounded by hospitals and other institutions including a 503B compounder which we believe to be violation of certain provisions of the Food, Drug and Cosmetic Act); the timing and impact of additional generic approvals and uncertainty around the recent approvals and launches of generic Indocin products (which are not patent protected and now face generic competition as a result of the August 2023 approval and launch of generic indomethacin suppositories and January 2024 approval and subsequent launch of a generic indomethacin oral suspension product); risks that any new businesses will not be integrated successfully or that the combined company will not realize estimated cost savings, value of certain tax assets, synergies and growth, or that such benefits may take longer and/or cost more to realize than expected; expected industry trends, including pricing pressures and managed healthcare practices; Assertio’s ability to attract and retain executive leadership and key employees, including in connection with our ongoing search for a permanent CEO; the ability of Assertio’s third-party manufacturers to manufacture adequate quantities of commercially salable inventory and active pharmaceutical ingredients for each of Assertio’s products on commercially reasonable terms and in compliance with their contractual obligations to Assertio, and Assertio’s ability to maintain its supply chain which relies on single-source suppliers; the outcome of, and Assertio’s intentions with respect to, any litigation or government investigations, including pending and potential future shareholder litigation relating to the Spectrum Merger and/or the recent approval and launch of generic indomethacin suppositories, antitrust litigation, opioid-related government investigations and opioid-related litigation, as well as Spectrum’s legacy shareholder and other litigation and, and other disputes and litigation, and the costs and expenses associated therewith; Assertio’s financial cost and outcomes of clinical trials, including the extent to which data from the Rolvedon same-day dosing trial, if and when completed, may support ongoing commercialization efforts; Assertio’s compliance with legal and regulatory requirements related to the development or promotion of its products; variations in revenues obtained from commercialization agreements and the accounting treatment with respect thereto; Assertio’s common stock maintaining compliance with The Nasdaq Capital Market’s minimum closing bid requirement of at least $1.00 per share, particularly in light of Assertio’s stock trading below or only slight above $1.00 per share recently; and Assertio’s ability to obtain and maintain intellectual property protection for its products and operate its business without infringing the intellectual property rights of others. For a discussion of additional factors that could cause actual results to differ materially from those contemplated by forward-looking statements, see the risks described in Assertio’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission. Many of these risks and uncertainties may be exacerbated by public health emergencies and general macroeconomic conditions. Assertio does not assume, and hereby disclaims, any obligation to update forward-looking statements, except as may be required by law.

Non-GAAP Financial Measures

To supplement the Company’s financial results presented on a U.S. generally accepted accounting principles (“GAAP”) basis, the Company has included information about non-GAAP measures of EBITDA, adjusted EBITDA, adjusted earnings, and adjusted earnings per share as useful operating metrics. The Company believes that the presentation of these non-GAAP financial measures, when viewed with results under GAAP and the accompanying reconciliation, provides supplementary information to analysts, investors, lenders, and the Company’s management in assessing the Company’s performance and results from period to period. The Company uses these non-GAAP measures internally to understand, manage and evaluate the Company’s performance, and in part, in the determination of bonuses for executive officers and employees. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net income or other financial measures calculated in accordance with GAAP. Non-GAAP financial measures used by us may be calculated differently from, and therefore may not be comparable to, non-GAAP measures used by other companies.

This release also includes estimated full-year non-GAAP adjusted EBITDA information, which the Company believes enables investors to better understand the anticipated performance of the business, but should be considered a supplement to, and not as a substitute for or superior to, financial measures calculated in accordance with GAAP. No reconciliation of estimated non-GAAP adjusted EBITDA to estimated net income is provided in this release because some of the information necessary for estimated net income such as income taxes, fair value change in contingent consideration, and stock-based compensation is not yet ascertainable or accessible and the Company is unable to quantify these amounts that would be required to be included in estimated net income without unreasonable efforts.

Specified Items

Non-GAAP measures presented within this release exclude specified items. The Company considers specified items to be significant income/expense items not indicative of current operations. Specified items may include adjustments to interest expense and interest income, income tax expense (benefit), depreciation expense, amortization expense, sales reserves adjustments for products the Company is no longer selling, stock-based compensation expense, fair value adjustments to contingent consideration or derivative liability, restructuring charges, amortization of fair value inventory step-up as a result of purchase accounting, transaction-related costs, gains, losses or impairments from adjustments to long-lived assets and assets not part of current operations, changes in valuation allowances on deferred tax assets, and gains or losses resulting from debt refinancing or extinguishment.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | | | | | |

| Revenues: | | | | | | | | | | | | | |

| Product sales, net | $ | 31,862 | | | $ | 32,462 | | | $ | 41,769 | | | | | | | | | |

| Royalties and milestones | 586 | | | 523 | | | 697 | | | | | | | | | |

| | | | | | | | | | | | | |

| Total revenues | 32,448 | | | 32,985 | | 42,466 | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | | |

| Cost of sales | 11,177 | | | 9,721 | | | 5,467 | | | | | | | | | |

| Research and development expenses | 733 | | | 1,024 | | | — | | | | | | | | | |

| Selling, general and administrative expenses | 18,524 | | | 23,958 | | | 16,904 | | | | | | | | | |

| Change in fair value of contingent consideration | — | | | (17,414) | | | 9,167 | | | | | | | | | |

| Amortization of intangible assets | 5,631 | | | 4,775 | | | 6,284 | | | | | | | | | |

| Loss on impairment of intangible assets | — | | | 40,808 | | | — | | | | | | | | | |

| Restructuring charges | 720 | | | 2,442 | | | — | | | | | | | | | |

| Total costs and expenses | 36,785 | | | 65,314 | | | 37,822 | | | | | | | | | |

| (Loss) income from operations | (4,337) | | | (32,329) | | | 4,644 | | | | | | | | | |

| Other (expense) income: | | | | | | | | | | | | | |

| Debt-related expenses | — | | | — | | | (9,918) | | | | | | | | | |

| Interest expense | (757) | | | (755) | | | (1,122) | | | | | | | | | |

| Other gain | 716 | | | 1,179 | | | 802 | | | | | | | | | |

| Total other expense (income) | (41) | | | 424 | | | (10,238) | | | | | | | | | |

| Net loss before income taxes | (4,378) | | | (31,905) | | | (5,594) | | | | | | | | | |

| Income tax (expense) benefit | (132) | | | (25,479) | | | 2,110 | | | | | | | | | |

| Net loss and comprehensive loss | $ | (4,510) | | | $ | (57,384) | | | $ | (3,484) | | | | | | | | | |

| | | | | | | | | | | | | |

| Basic and diluted net loss per share | $ | (0.05) | | | $ | (0.61) | | | $ | (0.07) | | | | | | | | | |

| | | | | | | | | | | | | |

| Shares used in computing basic and diluted net loss per share | 94,980 | | | 94,669 | | 51,005 | | | | | | | | | |

| | | | | | | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| (unaudited) | | |

| March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 80,743 | | | $ | 73,441 | |

| Accounts receivable, net | 42,610 | | | 47,663 | |

| Inventories, net | 38,602 | | | 37,686 | |

| Prepaid and other current assets | 10,519 | | | 12,272 | |

| Total current assets | 172,474 | | | 171,062 | |

| Property and equipment, net | 704 | | | 770 | |

| Intangible assets, net | 105,701 | | | 111,332 | |

| | | |

| | | |

| Other long-term assets | 3,086 | | | 3,255 | |

| Total assets | $ | 281,965 | | | $ | 286,419 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 15,650 | | | $ | 13,439 | |

| Accrued rebates, returns and discounts | 57,870 | | | 58,137 | |

| Accrued liabilities | 15,401 | | | 18,213 | |

| | | |

| Contingent consideration, current portion | 2,700 | | | 2,700 | |

| Other current liabilities | 823 | | | 954 | |

| Total current liabilities | 92,444 | | | 93,443 | |

| Long-term debt | 38,621 | | | 38,514 | |

| | | |

| Other long-term liabilities | 16,406 | | | 16,459 | |

| Total liabilities | 147,471 | | | 148,416 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

Common stock, $0.0001 par value, 200,000,000 shares authorized; 95,115,452 and 94,668,523 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. | 9 | | | 9 | |

| Additional paid-in capital | 790,538 | | 789,537 | |

| Accumulated deficit | (656,053) | | | (651,543) | |

| Total shareholders’ equity | 134,494 | | | 138,003 | |

| Total liabilities and shareholders' equity | $ | 281,965 | | | $ | 286,419 | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating Activities | | | |

| Net loss | $ | (4,510) | | | $ | (3,484) | |

| Adjustments to reconcile net loss to net cash from operating activities: | | | |

| Depreciation and amortization | 5,696 | | | 6,484 | |

| Amortization of debt issuance costs and Royalty Rights | 107 | | | 147 | |

| | | |

| Recurring fair value measurements of assets and liabilities | — | | | 9,167 | |

| Debt-related expenses | — | | | 9,918 | |

| Provisions for inventory and other assets | 1,428 | | | 1,072 | |

| Stock-based compensation | 1,207 | | | 2,446 | |

| Deferred income taxes | — | | | (1,367) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 5,054 | | | (1,109) | |

| Inventories | (2,344) | | | (3,602) | |

| Prepaid and other assets | 1,921 | | | 1,824 | |

| Accounts payable and other accrued liabilities | (134) | | | (290) | |

| Accrued rebates, returns and discounts | (267) | | | 2,887 | |

| Interest payable | (650) | | | (1,376) | |

| Net cash provided by operating activities | 7,508 | | | 22,717 | |

| Investing Activities | | | |

| | | |

| Purchase of Sympazan | — | | | (105) | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | — | | | (105) | |

| Financing Activities | | | |

| | | |

| Payments in connection with 2027 Convertible Notes | — | | | (10,500) | |

| | | |

| Payment of direct transaction costs related to convertible debt inducement | — | | | (1,119) | |

| | | |

| Payment of contingent consideration | — | | | (6,609) | |

| | | |

| | | |

| Payments related to the vesting and settlement of equity awards, net | (206) | | | (722) | |

| | | |

| | | |

| Net cash used in financing activities | (206) | | | (18,950) | |

| Net increase in cash and cash equivalents | 7,302 | | | 3,662 | |

| Cash and cash equivalents at beginning of year | 73,441 | | | 64,941 | |

| Cash and cash equivalents at end of period | $ | 80,743 | | | $ | 68,603 | |

| Supplemental Disclosure of Cash Flow Information | | | |

| Net cash paid for income taxes | $ | 11 | | | $ | 29 | |

| Cash paid for interest | $ | 1,300 | | | $ | 2,351 | |

| | | |

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP EBITDA and ADJUSTED EBITDA

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | | | | | | | Financial Statement Classification |

| GAAP Net Loss | | $ | (4,510) | | | $ | (57,384) | | | $ | (3,484) | | | | | | | | | | | |

| Interest expense | | 757 | | | 755 | | | 1,122 | | | | | | | | | | | Interest expense |

| Income tax expense (benefit) | | 132 | | | 25,479 | | | (2,110) | | | | | | | | | | | Income tax (expense) benefit |

| Depreciation expense | | 65 | | | 132 | | | 200 | | | | | | | | | | | Selling, general and administrative expenses |

| Amortization of intangible assets | | 5,631 | | | 4,775 | | | 6,284 | | | | | | | | | | | Amortization of intangible assets |

| EBITDA (Non-GAAP) | | $ | 2,075 | | | (26,243) | | | $ | 2,012 | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Stock-based compensation | | 1,207 | | | 2,642 | | | 2,446 | | | | | | | | | | | Selling, general and administrative expenses |

Change in fair value of contingent consideration (1) | | — | | | (17,414) | | | 9,167 | | | | | | | | | | | Change in fair value of contingent consideration |

Debt-related expenses (2) | | — | | | — | | | 9,918 | | | | | | | | | | | Debt-related expenses |

Transaction-related expenses (3) | | — | | | 361 | | | 2,355 | | | | | | | | | | | Selling, general and administrative expenses |

Loss on impairment of intangible assets (4) | | — | | | 40,808 | | | — | | | | | | | | | | | Loss on impairment of intangible assets |

Restructuring costs(5) | | 720 | | | 2,442 | | | — | | | | | | | | | | | Restructuring charges |

Other (6) | | 3,377 | | | 1,855 | | | (295) | | | | | | | | | | | Multiple |

| Adjusted EBITDA (Non-GAAP) | | $ | 7,379 | | | $ | 4,451 | | | $ | 25,603 | | | | | | | | | | | |

(1)The fair value of the contingent consideration is remeasured each reporting period, with changes in the fair value resulting from changes in the underlying inputs being recognized as a benefit or expense in operating expenses until the contingent consideration arrangement is settled.

(2)Debt-related expenses in the three months ended March 31, 2023 consist of an induced conversion expense of approximately $8.8 million and direct transaction costs of approximately $1.1 million incurred as a result of the privately negotiated exchange of $30.0 million principal amount of the Company’s 6.5% Convertible Senior Notes due 2027.

(3)Represents transaction-related expenses associated with the acquisition of Spectrum, which closed effective July 31, 2023.

(4)Represents the loss recognized in the period for the impairment of intangible assets.

(5)Restructuring costs represent non-recurring costs associated with the Company’s announced restructuring plans.

(6)Other for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023 represents the following adjustments (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | | | Financial Statement Classification |

| Amortization of inventory step-up | | $ | 4,088 | | | $ | 3,001 | | | $ | 164 | | | | | | | Cost of sales |

| Interest income on cash equivalents | | (711) | | | (690) | | | (459) | | | | | | | Other gain (loss) |

| Derivative fair value adjustment | | — | | | (456) | | | — | | | | | | | Other gain (loss) |

| Total Other | | $ | 3,377 | | | $ | 1,855 | | | $ | (295) | | | | | | | |

RECONCILIATION OF GAAP NET LOSS and NET LOSS PER SHARE TO

NON-GAAP ADJUSTED EARNINGS and ADJUSTED EARNINGS PER SHARE (1)

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Amount | | Diluted EPS (2) | | Amount | | Diluted EPS (2) | | Amount | | Diluted EPS (2) |

Net loss (GAAP)(2) | $ | (4,510) | | | $ | (0.05) | | | $ | (57,384) | | | $ | (0.61) | | | $ | (3,484) | | | $ | (0.07) | |

| | | | | | | | | | | |

Add: Convertible debt interest expense and other income statement impacts, net of tax(2) | — | | | | | 566 | | | | | 842 | | | |

| Adjustments: | | | | | | | | | | | |

| Amortization of intangible assets | $ | 5,631 | | | | | 4,775 | | | | | $ | 6,284 | | | |

| | | | | | | | | | | |

| Stock-based compensation | 1,207 | | | | | 2,642 | | | | | 2,446 | | | |

| Debt-related expenses, net | — | | | | | — | | | | | 9,639 | | | |

| Change in fair value of contingent consideration | — | | | | | (17,414) | | | | | 9,167 | | | |

Contingent consideration cash payable (3) | — | | | | | (2,170) | | | | | (2,069) | | | |

| Transaction-related expenses | — | | | | | 361 | | | | | 2,355 | | | |

| Loss on impairment of intangible assets | — | | | | | 40,808 | | | | | — | | | |

| Restructuring costs | 720 | | | | | 2,442 | | | | | — | | | |

| Other | 3,377 | | | | | 1,855 | | | | | (295) | | | |

Increase in deferred tax asset valuation allowance (4) | — | | | | | 33,165 | | | | | — | | | |

Income tax benefit expense, as adjusted (5) | (2,734) | | | | | 1,877 | | | | | (4,472) | | | |

| Adjusted earnings (Non-GAAP) | $ | 3,691 | | | $ | 0.04 | | | $ | 11,523 | | | $ | 0.11 | | | $ | 20,413 | | | $ | 0.29 | |

| | | | | | | | | | | |

Diluted shares used in calculation (GAAP)(2) | 94,980 | | | | | 94,669 | | | | | 51,005 | | | |

Add: Dilutive effect of stock-based awards and equivalents(2) | 271 | | | | | 325 | | | | | 4,436 | | | |

Add: Dilutive effect of 2027 Convertible Notes(2) | — | | | | | 9,768 | | | | | 14,489 | | | |

Diluted shares used in calculation (Non-GAAP)(2) | 95,251 | | | | | 104,762 | | | | | 69,930 | | | |

(1)Certain adjustments included here are the same as those reflected in the Company’s reconciliation of GAAP net loss to non-GAAP adjusted EBITDA and therefore should be read in conjunction with that reconciliation and respective footnotes.

(2)The Company uses the if-converted method with respect to its convertible debt to compute GAAP and Non-GAAP diluted earnings per share when the effect is dilutive. Under the if-converted method, the Company assumes the 2027 Convertible Notes were converted at the beginning of each period presented and outstanding. As a result, interest expense, net of tax, and any other income statement impact associated with the 2027 Convertible Notes, net of tax, is added back to net income used in the diluted earnings per share calculation.

For the three months ended March 31, 2024, the Company’s potentially dilutive convertible debt under the if-converted method and stock-based awards under the treasury-stock method were not included in the computation of GAAP net loss diluted net loss per share, and the potentially dilutive convertible debt under the if-converted method were not included in non-GAAP adjusted earnings and adjusted earnings per share, because to do so would be anti-dilutive. However, the potentially dilutive stock-based awards under the treasury-stock method were included in the computation of non-GAAP adjusted earnings and adjusted earnings per share because the effect was dilutive.

For both the three months ended December 31, 2023 and the three months ended March 31, 2023, the Company’s potentially dilutive convertible debt under the if-converted method and potentially dilutive stock-based awards under the treasury-stock method were not included in the computation of GAAP diluted net loss per share, because to do so would be anti-dilutive. However, the Company’s potentially dilutive convertible debt under the if-converted method and the potentially dilutive stock-based awards under the treasury-stock method were included in the computation of non-GAAP adjusted earnings and adjusted earnings per share because their effect was dilutive.

(3)Represents the accrued cash payable, if any, of the INDOCIN contingent consideration for the respective period based on 20% royalty for annual INDOCIN net sales over $20.0 million.

(4)For the three months ended December 31, 2023, represents the amount of income tax expense related to the recognition of a full valuation allowance against deferred tax assets.

(5)Represents the Company’s income tax expense adjustment from the tax effect of pre-tax adjustments excluded from adjusted earnings. The tax effect of pre-tax adjustments excluded from adjusted earnings is computed at the blended federal and state statutory rate of 25%.

v3.24.1.u1

Cover

|

May 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 06, 2024

|

| Entity Registrant Name |

ASSERTIO HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

01-39294

|

| Entity Tax Identification Number |

85-0598378

|

| Entity Address, Address Line One |

100 S. Saunders Road

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Lake Forest

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60045

|

| City Area Code |

224

|

| Local Phone Number |

419-7106

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

ASRT

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001808665

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

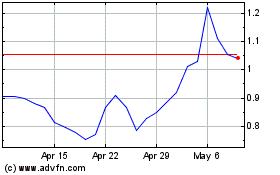

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Nov 2023 to Nov 2024