false 0000894081 0000894081 2023-09-27 2023-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2023

AIR TRANSPORT SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| DE |

|

000-50368 |

|

26-1631624 |

| (State or other jurisdiction of incorporation) |

|

Commission File Number: |

|

(IRS Employer Identification No.) |

|

| 145 Hunter Drive, Wilmington, Ohio 45177 |

| (Address of Principal Executive Offices, Including Zip Code) |

(937) 382-5591

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

ATSG |

|

NASDAQ Stock Market LLC |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On September 27, 2023, Air Transport Services Group, Inc. (“ATSG”) is hosting an Investor Day at the Nasdaq MarketSite in New York, New York, during which members of the leadership team will provide an update on the Company’s vision, strategic plan, long-term growth strategy, as well as multi-year financial targets, utilizing the written presentation attached hereto as Exhibit 99.1 and incorporated herein by reference.

ATSG is furnishing the information contained herein, including Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated by the Securities and Exchange Commission (the “SEC”). This information shall not be deemed to be “filed” with the SEC or incorporated by reference into any other filing with the SEC.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

| AIR TRANSPORT SERVICES GROUP, INC. |

|

|

| By: |

|

/s/ W. Joseph Payne |

|

|

W. Joseph Payne |

|

|

Chief Legal Officer & Secretary |

|

|

| Date: |

|

September 27, 2023 |

3

Exhibit 99.1 ATSG INVESTOR DAY 2023 Slide l 1

AIR TRANSPORT SERVICES GROUP SAFE HARBOR STATEMENT Except for historical

information contained herein, the matters discussed in this release contain forward-looking statements that involve risks and uncertainties. A number of important factors could cause Air Transport Services Group, Inc.'s ( ATSG's ) actual results to

differ materially from those indicated by such forward-looking statements. Such factors include, but are not limited to: (i) unplanned changes in the market demand for our assets and services, including the loss of customers or a reduction in the

level of services we perform for customers; (ii) our operating airlines' ability to maintain on-time service and control costs; (iii) the cost and timing with respect to which we are able to purchase and modify aircraft to a cargo configuration;

(iv) fluctuations in ATSG's traded share price and in interest rates, which may result in mark-to-market charges on certain financial instruments; (v) the number, timing, and scheduled routes of our aircraft deployments to customers; (vi) our

ability to remain in compliance with key agreements with customers, lenders and government agencies; (vii) the impact of current supply chain constraints both within and outside the United States, which may be more severe or persist longer than we

currently expect; (viii) the impact of a competitive labor market, which could restrict our ability to fill key positions; (ix) changes in general economic and/or industry-specific conditions, including inflation; (x) the impact of geographical

events or health epidemics such as the COVID-19 pandemic. and (xi) other factors that are contained from time to time in our filings with the U.S. Securities and Exchange Commission, including our annual report on Form 10-K and quarterly reports on

Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this

presentation. Except as may be required by applicable law, ATSG undertakes no obligation to update any forward- looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. We use

non-GAAP measures in this presentation including adjusted EBITDA and Free Cash Flow. Management believes these metrics are useful to investors in assessing ATSG’s financial position and results. Non-GAAP measures are not meant to be a

substitute for ATSG’s GAAP financials. Please refer to the reconciliations to the GAAP measures in the accompany appendix. Slide l 2

INVESTOR DAY SPEAKERS Paul Chase Rich Corrado Mike Berger Joe Payne

Quint Turner President & Chief Strategy Officer Chief Commercial Officer Chief Legal Officer Chief Financial Officer Chief Executive Officer Slide l 3

Slides Presenter INVESTOR DAY Welcome ATSG Overview & Strategy 5-16

Rich Corrado AGENDA Aircraft Leasing Segment 17-26 Paul Chase Flying Segment 27-34 Mike Berger Support Services 35-37 Mike Berger Customer Relationships 38-39 Paul Chase Sustainability 40-43 Joe Payne Break 10 minutes Financial Outlook 45-61 Quint

Turner Closing Remarks 62-63 Rich Corrado Q&A 64-65 Slide l 4

ATSG OVERVIEW & STRATEGY Slide l 5

-ATSG WHY WE ARE HERE We believe we represent an attractive

differentiated value and investment proposition synergizing leasing, air operations, and support services We believe our stock is significantly undervalued and represents an opportunity for investors to realize significant appreciation While we have

no direct peers for the full breadth of services our model offers, we will show you a sum of the parts valuation which supports a much higher stock price We will share our projections for free cash flow generation after growth capex investment and

update guidance through 2025 Slide l 6

WORLD'S LARGEST FREIGHTER LESSOR BOEING 767F AIRBUS A321F AIRBUS A330F

GLOBAL RECURRING TOP FREIGHTER TOP PROVIDER OF LEASING STRONG CASH LESSOR U.S. E-COMMERCE Top 5 Global Freighter NETWORK FLOW FLYING 92 Lessors 6/2023 80 41 33 30 Currently leasing Growing portfolio of Currently flying 63 freighter aircraft in

multi-year freighter freighter aircraft in DHL leases & operating nine countries and Amazon Air networks agreements Slide l 7 Source: Trade and Transport Group 06/2023

-ATSG HERITAGE DRIVES CURRENT CULTURE 2003 - 2009 2010 Forward Founded

1980 - 2003 DHL Cost-Plus Differentiated, Lease First Model 3rd Largest Express Company Operated via Airborne Express DHL Cost Plus Model Pioneered A+CMI 2003 Fleet - 115 2009 Fleet - 62 2022 Fleet - 128 LEASING FLYING SUPPORT SERVICES HEAVY &

LINE POSTAL & GATEWAY CMI SERVICES DRY LEASING MAINTENANCE OPERATIONS COMPONENT SERVICES ACMI SERVICES ENGINE LEASING GROUND SERVICES ENGINEERING SERVICES WET2DRY TRANSITIONING ENGINE PBC SERVICES MHE DESIGN & SERVICE P2F CONVERSIONS CHARTER

Slide l 8

-ATSG MARKET STRATEGY LEASING FLYING SUPPORT SERVICES WE ARE the

world’s largest WE ARE the backbone of WE ARE a provider of freighter aircraft lessor to our customers’ U.S. critical ancillary services companies that support express networks and that add incremental express networks around the largest

commercial returns and differentiate the world mover of troops for the us from any lessor DoD Capital investments to Capital-light model operating Incremental services help secure acquire and convert aircraft to aircraft for customers under CMI,

initial aircraft lease and renewals freighters for lease ACMI, and charter services Provides incremental returns above Revenue from multi-year lease Multi-year agreements provide and beyond the lease revenues agreements support strong strong

predictable cash flow Seamless full-service option for Adj. EBITDA margins customers Slide l 9 UNIQUE BUSINESS MODEL AND MARKET LEADERSHIP POSITIONS

-ATSG COMPELLING VALUE PROPOSITION MARKET REALITY ATSG CAPABILITIES

Mid-size freighters are the asset of choice for express Focus on mid-size converted freighters. Existing lease and e-commerce driven regional air networks portfolio that generates strong cash flow and returns Global demand for e-commerce expected to

ATSG’s global offering and customer base well grow 38% through 2027 positioned to meet this demand growth Additional aircraft types will be needed to meet the ATSG already delivering A321s, and first A330 to begin forecasted demand growth

freighter conversions in October 2023 Conversion economics better than acquiring new Managed more passenger-to-freighter freighter aircraft conversions at 260+ than any other company A leader in securing future A321/A330 conversion Conversion

feedstock and slots are limited slots Slide l 10

-ATSG CUSTOMERS EMBRACE LEASE PLUS SOLUTIONS MODEL ATSG provides

customers a holistic solution across leasing, flying and value-added support services Slide l 11

-ATSG CUSTOMERS Slide l 12

-ATSG LEASING MARKET DOMINANCE TOTAL EXTERNALLY LEASED FREIGHTERS

Cargojet Airways 96 91 85 73 62 59 51 DHL - ME 41 2016 2017 2018 2019 2020 2021 2022 2023E We are global! Over 2/3 market share in the B767-leasing Currently lease to 13 customers into 9 different countries and 75% of our 2023-2024 leases market are

expected to be outside the US Largest freighter lessor to both DHL and Amazon Most of our leasing customers fly in at 12 and 37 B767s, respectively Integrator/e-commerce networks for UPS, FedEx, DHL or Amazon Slide l 13

-ATSG FLYING MARKET LEADERSHIP CMI AIRCRAFT IN RELATION TO LEASED

Capital-light airline operations contract flying services to customers through a Crew, Maintenance, 71% 66% 66% 68% and Insurance (CMI) structure 65% 60% 58% Customers provide owned and leased aircraft to 53% ATSG totaling 16 aircraft by year end

2023 96 91 85 73 Customer fills the aircraft, pays for ancillary costs, 65 63 62 and fuel 59 56 51 42 41 37 Largest airline service provider to Amazon, with 33 31 28 46 aircraft flying, ~3x more than the next competitor Largest airline service

provider to DHL in their US network 2016 2017 2018 2019 2020 2021 2022 2023E Airline ACMI/CMI Total Leased % ACMI to Lease We fly over half of our leased aircraft Slide l 14

($ in millions) -ATSG FY 2022 FINANCIALS BY SEGMENT REVENUE* ADJ.

EBITDA** SUPPORT SUPPORT SERVICES LEASING SERVICES (OTHER) (CAM) (OTHER) LEASING 20% 19% 1% (CAM) 66% FLYING (ACMI SERVICES) FLYING 33% (ACMI SERVICES) 61% Total = $641 Total* = $2,269 Leasing drives 2/3 of our Adj. EBITDA Flying is a strong driver

of revenue and represents 1/3 of our Adj. EBITDA Our segments are highly synergistic with significant contribution from each segment Slide l 15 * Segment revenue before elimination of internal revenues on FY 2022 results ** Non-GAAP measure, please

see enclosed GAAP reconciliation

No other company in the world bundles aircraft leasing, airline

solutions, engine power, maintenance, and logistics solutions. Slide l 16

ATSG AIRCRAFT LEASING SEGMENT Slide l 17

WORLD'S LARGEST FREIGHTER LESSOR ENGINE LEASING 137 B767 A321 OWNED

FLEET SIZE 6/30/23 MULTIPLE POWER BY THE CYCLE PROGRAMS FOR PRATT AND GE ENGINES B767-300 FLEET GLOBAL LEASING 5 YEARS OUT OF CONVERSION ON AVERAGE PORTFOLIO WITH A 20+ YEAR EXPECTED LIFE SPAN SUPPORTS CUSTOMER CONVERSION PORTFOLIO LEASING CHOICE

ATSG HAS CONVERTED MORE THAN 260 AIRCRAFT Slide l 18

-LEASING THE VALUE OF A CONVERSION New Cargo Lining and Ceiling

Installed 20+Year Aircraft Life Expected After Floor Beams Replaced Conversion Engine Inspection Rerouting of Control and Overhaul Cables (ceiling) Install an upper deck cargo 9G Rigid Barrier door Modified Systems: Install a cargo loading Oxygen

System; ECS Modification; system Venting Decompression; Water, Waste & Drain Maintenance Completed including: Slide l 19 C-Check and Required Directives

-LEASING YOUNG FLEET POST-CONVERSION 20+ year expected life span after

conversion After Conversion 20+ years After Conversion 20+ years After Conversion 20+ years expected lifespan expected lifespan expected lifespan A321-200 A330-300 767-300 Freighter Freighter Freighter 2 75 In service today In service today 0 In

service today Month to first Avg. years in conversion Year in service <1 5 1 service induction Slide l 20 Current airframe average life out of conversion

Source: Airbus Global Market Forecast 2023, Boeing Commercial Market

Outlook June 2023, Trade & Transport -LEASING Group US Trade Monitor, IATA Cargo Market Analysis April 2023, World ACD, emarketer June 2023 MARKET OUTLOOK OPPORTUNITY ($ in trillions) SOLUTION Boeing Freighter Forecast 50.0% $40.0 $34.9

2022-2042 $33.7 45.0% $32.5 $35.0 $31.1 $29.7 40.0% $28.1 $30.0 650 $26.4 Large Widebody 35.0% $25.0 30.0% 23.0% Medium Widebody 22.2% $20.0 21.2% 25.0% 20.3% 19.5% 18.9% 18.9% 20.0% 1290 2,825 $15.0 Standard-body 15.0% $8.0 New Freighters $10.0

$7.5 $6.9 $6.3 $5.3 $5.8 10.0% $5.0 $5.0 5.0% $0.0 0.0% 720 2021 2022 2023 2024 2025 2026 2027 885 Global ecommerce Sales Global Retail Sales 1240 2,510 ecommerce as a % of Retail Sales Growth and TOTAL RETAIL & ECOMMERCE SALES WORLDWIDE Airbus

Freighter Forecast Replacement Total 2020-2042 Grow Replace Retain E-commerce growth will continue to outperform brick-and- 1270 mortar. E-commerce growth is expected to outpace in-person 1,590 shopping by nearly 2x through 2024. Slide l 21 of new

freighters are conversions

-LEASING B767 FREIGHTER DOMINANCE OWNED FLEET 6/30/23 ATSG currently

dominates the leasing ($ in thousands) market for the Boeing 767 freighter Freighter Fleet 767-200 Freighter 22 Preferred airframe of the e-commerce 767-300 Freighter 70 3 and express market offering 15,634 ft 767-300 Freighter (IC) 20 of cargo

volume A321-200 Freighter (IC) 9 767-300 staging for lease 2 Five of the Top Ten 767-300 leased freighter operators are ATSG customers IC=in or awaiting conversion 123 18 conversion slots for delivery Passenger Fleet 14 2024-2025 Total 137 The B767

freighter is not only the flagship of the ATSG fleet, but it also represents over 57% of all medium widebody cargo operations globally Slide l 22

-LEASING NEW FREIGHTER OFFERINGS A321-200 FREIGHTER A330-300 FREIGHTER

Adequate feedstock allowing ATSG to enter the Logical alternative for the 767-300, the A330-300 is narrowbody freighter leasing market about 20% larger Natural replacement for the 757-200 freighter and Significant feedstock availability targets

operators of B737F Target Operators – 767, 777 operators, European and About 95% of the cubic volume of the 757 with an Pacific markets for medium range air cargo delivery 18% fuel burn advantage and lower maintenance costs A330s selected for

network operations by DHL and Amazon Flightdeck commonality with the A330 Slide l 23

-LEASING PROVEN LEASING MODEL LEASE PROFILE TYPICAL PROFILE OF A

FREIGHTER LESSEE Typical initial term of 7 to 10 years Experienced aircraft operators and/or blue chip, multi-national corporations with strong safety Major maintenance events are customarily pre- cultures paid by customers with reserves Operate in

the e-commerce and express Most leases contain like-for-like provisions network requiring lessees to return assets in the same condition as at delivery Time definite deliveries drive aircraft capacity requirements Customers typically extend their

aircraft leases Operate as regional support to major carriers beyond initial lease term including UPS, Amazon and DHL Slide l 24

-LEASING GLOBAL LEASING FOOTPRINT ~75% OF 2023 LEASE DEPLOYMENTS WILL

BE WITH CUSTOMERS OUTSIDE THE U.S. & EXPECT THE TREND TO CONTINUE AFRICA AMERICAS EUROPE ASIA PACIFIC Cargojet Airways DHL - ME Slide l 25

ATSG FLYING SEGMENT Slide l 26

-FLYING BUSINESS OVERVIEW Wet2 Dry Our capital-light CMI flying allows

us to separate ourselves from any other lessor and provides incremental returns on top of the lease Our unique A+CMI model leverages our deep Our airlines fly for customers as an ACMI experience in express/e-commerce operations carrier to prove

leasing concept Airline provides aircraft in addition Our Cargo Wet2Dry model allows us to grow our to CMI model leasing business Flies the routing provided by the customer so that the customer can build the lane Our passenger ACMI operations with

heavy Customer can test the economics emphasis on government flying represents of the aircraft prior to lease reliable revenue and cash flow less impacted by DHL, Amazon, Amerijet, Northern, Raya were all Wet2Dry customers global trade and global

business cycles. Slide l 27

-FLYING CMI CAPITAL-LIGHT VALUE STRUCTURE Minimizes risk while

affording customer flexibility CUSTOMER ROLE AIR OPERATIONS ROLE Customer leases the aircraft from Airline is responsible for safety of flight CAM, generally 7-10 years Customer then sub-leases the aircraft to one of Airline provides the flight

crews and insurance our cargo airlines to fly CMI agreements generally run 4-6 years with Customer may also add their own or other renewal options leased aircraft to the CMI Agreement Customer responsible for filling the payload plus Airline

provides ground training for loading determines the routing personnel Customer responsible for the heavy Airline provides the line maintenance and parts maintenance on the airframe and engines Airline flies the schedule provided by the Customer pays

for fuel and ancillary fees customer Slide l 28

($ in millions) -FLYING FY 2022 SEGMENT CONTRIBUTION ADJ. EBITDA**

REVENUE* SUPPORT SUPPORT SERVICES LEASING SERVICES (OTHER) (CAM) (OTHER) LEASING 20% 19% 1% (CAM) 66% FLYING (ACMI SERVICES) FLYING 33% (ACMI SERVICES) 61% Total = $641 Total = $2,269 The ACMI Segment represents 61% of our revenue, and 33% of our

EBITDA Slide l 29 * Segment revenue before elimination of internal revenues on FY 2022 results ** Non-GAAP measure, please see enclosed GAAP reconciliation

-FLYING AIRLINE FACT SHEET OMNI AIR INTERNATIONAL ABX AIR AIR TRANSPORT

INTERNATIONAL All-cargo airline flying Passenger airline Predominately cargo offering ACMI and 767s airline Charter Services CMI contracts with DHL CMI contract with 75% of revenue is from and Amazon Amazon, Combi the US Government contract with the

U.S. Largest airline for DHL DoD Largest commercial in their USA network mover of U.S. troops 48 total aircraft 44 - 24 Total Aircraft – all 767s and 4 -757 Combi 14 total aircraft, 3 -777s 767s Aircraft and 11 - 767s Slide l 30

-FLYING FULFILLING DEMAND CMI network flying is more Our Cargo Airlines

target CMI flying for large e- resilient than general cargo commerce networks point to point flying due to the Our cargo airlines are the largest CMI providers for the Amazon and DHL USA networks, the need to service specific largest outsourced

networks in the US geographies with time Our passenger airline is the largest commercial definite commitments mover of US troops around the world and the leader of the Patriot Team, one of two CRAF AIRLINE CMI BUSINESS* teams 65 63 56 42 37 Our

heritage has allowed us to excel in this 33 31 28 space due to our deep understanding of air operations and our cultural understanding of 2016 2017 2018 2019 2020 2021 2022 2023E our customers' business *Includes CAM leased and customer provided

freighter aircraft Slide l 31

-FLYING AIRLINE PERFORMANCE History of executing at a high level

Performance measured on every flight through controllable delays Historical overall performance for flying is in the TH 90 percentile for on-time and reliability Best in Class among ACMI/CMI cargo competition Omni is frequently the US Government

choice for challenging assignments Strong airline leadership experience Slide l 32

-FLYING UNDERLYING ECONOMICS $1.4 $209 18 68 BILLION MILLION AIRCRAFT

AIRCRAFT 2022 TOTAL 2022 TOTAL SERVICING FLYING SEGMENT FLYING SEGMENT SERVICING CARGO PASSENGER AND REVENUE ADJ. EBITDA CMI BUSINESS COMBI BUSINESS ($ in millions) REVENUE $1,404 More resilient than general air cargo $1,185 $1,147 Disruption

creates opportunity $1,078 Adj. EBITDA margins remain consistently in the low teens 2019 2020 2021 2022 Slide l 33

ATSG SUPPORT SERVICES Slide l 34

-SUPPORT SERVICES BUSINESS OVERVIEW AVIATION MAINTENANCE &

LOGISTICS SERVICES CONVERSION SERVICES Heavy and Line Maintenance Sort Operations Component Services Ground Support Equipment Leasing Engineering Services Facility Support Services Passenger to Freighter Conversions Material Handling Design and

Service Boeing and Airbus Capability Strong network of MRO facilities and established relationship with major US and global carriers STRONG ARRAY OF CAPABILITLIES TO COMPLEMENT LEASING AND FLYING SERVICES Slide l 35

-SUPPORT SERVICES ENHANCE CUSTOMER VALUE Support Raya Airways, DHL uses

Best E-Commerce Services support Logistics Carrier of the Year Amazon Support Services –Asia Pacific at operations at for Material the Payload Asia their Wilmington Handling Awards, first A321 Air Park Hub Equipment freighter was Maintenance

converted by MRO (Conversion) MRO Support Support Services Services Logistics Support Services operated provided cockpit gateway package flat panel operations for upgrades for UPS Amazon & USPS Slide l 36

ATSG CUSTOMER RELATIONSHIPS Slide l 37

-CUSTOMER RELATIONSHIPS KEY CUSTOMER OVERVIEW Began with ACMI agreement

for five Boeing 767 aircraft in 2015 Long-term contracts since August 2003 Amazon business has expanded to Providing service to the DoD for over 20 currently leasing 37 aircraft The total of leased aircraft is twelve 767 years through ATI and since

1995 with freighters Omni Air International Our airlines operate a total of 41 aircraft in addition to ancillary services procured by CMI agreement has a total operated Leading provider of CRAF passenger airlift Amazon under that agreement is ten

plus an services to the U.S. DoD and additional additional six customer provided aircraft cargo services Uses our MRO for maintenance, gateway freight operations, and material handling Utilizes our MRO for heavy and line Our government services

expand beyond equipment service and engineering maintenance plus component services; the DoD to other agencies for passenger they have a multi-location agreement for lift, cargo lift, plus maintenance and Currently largest shareholder with ~19.5%

material handling equipment service engineering services 34% of FY22 Revenue 30% of FY22 Revenue 12% of FY22 Revenue Slide l 38

ATSG SUSTAINABILITY Slide l 39

-SUSTAINABILITY ENVIRONMENTAL RESOURCE CONSERVATION ENERGY EFFICIENCY

FUEL BURN/CO2 REDUCTION AND FLEET MODERNIZATION Installed fleet monitoring Extend aircraft useful life Installed energy efficient equipment on our aircraft to through passenger to freighter lighting and HVAC systems in track and reduce fuel

conversions hangars and offices reducing burn through predictive CO2 emissions by 4,612 tons Adding the A321 and A330 to our maintenance practices annually fleet, which are newer, more Expanded the use of flight fuel-efficient aircraft Installed

electric vehicle planning software that utilizes Partnered with our customers to charging stations to make real time weather conditions to make Sustainable Aviation Fuel optimize flight altitudes and recharging more convenient more available at our

largest speeds and affordable for our operating airline location in employees at our office Continued to adopt best northern Kentucky locations in Ohio and Oklahoma practices in our daily operations Resulted in a reduction of fuel burn of 23.14

million gallons; reduced CO2 emissions by Slide l 40 216,983 tons from 2020 to 2022

-SUSTAINABILITY SOCIAL ATSG CAREER AND COMMUNITY WORKFORCE INVESTMENT

COMMUNITY OUTREACH OUTREACH On-site Health Clinic for Career exploration Support for charitable causes employees at the Wilmington opportunities and tours for exceeded $850,000 during Air Park more than 2,500 students 2022, an increase of more than

65% over the prior year Employee Fitness Center at ATSG Aviation Camp five-day the Wilmington Air Park that immersive aviation career Girls In Aviation Day is available 24 hours experience for grades 6-12 developed aviation patch program with

regional Girl Launched a company-wide Highlights careers in Scout organization Diversity and Inclusion Manufacturing, Flight, Engineering, Inspection, ATSG continued outreach to campaign Aviation Maintenance, Airport our Veteran workforce raising

Paid parental leave available Operations, and Safety awareness of issues facing to all eligible employees, this community such as regardless of gender for birth, increased suicide rates adoption, and foster care Slide l 41

-SUSTAINABILITY GOVERNANCE BOARD TENURE & DIVERSITY CORPORATE

GOVERNANCE CORPORATE GOVERNANCE Board delegated to Increased stock ownership the Nominating and requirements for directors and Governance Committee officers to further align (N&G) responsibility for the with stockholders' interests oversight and

review of ESG Created Management matters Sustainability Committee Amended the N&G Committee Formalized a Human Rights Charter to require that initial Statement to address list of director candidates issues relevant to the include qualified

under- company and our industry represented candidates, taking into account factors such as gender, race and Increased size of Board to ethnicity 10 directors, increasing both gender and racial diversity of the Board by 20% Slide l 42

ATSG BREAK ~10 MINUTES Slide l 43

ATSG FINANCIAL OUTLOOK Slide l 44

-FINANCIAL FINANCIAL OUTLOOK DISCUSSION Historical consolidated and

segment performance Consolidated and segment outlook Capital spending and free cash flow outlook Cash flow visibility and capital allocation priorities Strong balance sheet and access to debt capital Understated Asset Value Valuation Upside Slide l

45

($ in millions) -FINANCIAL RESILIENT FINANCIAL PERFORMANCE Track record

of strong Revenue and Adj. EBITDA* growth, with consistent margins Resilient business model delivered strong performance through pandemic years ATSG HISTORICAL PERFORMANCE 12% 3-Year $2,500 Revenue $2,045 CAGR $2,000 $1,734 $1,571 $1,452 $1,500

$1,000 $641 $541 $497 $452 $500 $0 2019 2020 2021 2022 Slide l 46 Revenue Adj. EBITDA* * Non-GAAP measure, please see enclosed GAAP reconciliation

($ in millions) -FINANCIAL SEGMENT ADJ. EBITDA* EVOLUTION Leasing

business a large and growing contributor to Adj. EBITDA* over time 2022 2021 2020 2019 34% 32% 38% 38% 62% 62% 68% 66% Total = $452 Total = $497 Total = $541 Total = $641 ACMI** + Other Services*** CAM Leasing * Non-GAAP measure, please see enclosed

GAAP reconciliation Slide l 47 ** ACMI 2020 and 2021 excludes the benefit of $47M and $112M respectively from government grants *** Results of non-reportable businesses and reconciling items; See appendix for non-GAAP reconciliation

($ in millions) -FINANCIAL LEASING SEGMENT PERFORMANCE Strong growth

from record deployment of converted freighters supporting e-commerce growth ADJ. EBITDA* PERFORMANCE $500 $426 $368 $400 $307 15% 3-Year $282 $300 EBITDA CAGR $200 $100 $0 2019 2020 2021 2022 CAM OWNED 94 100 107 111 Slide l 48 IN-SERVICE FLEET (YE)

* Non-GAAP measure, please see enclosed GAAP reconciliation

($ in millions) -FINANCIAL FLYING + SUPPORT SERVICES PERFORMANCE Strong

historical revenue growth and consistent adj. EBITDA margin performance across varying economic environments HISTORICAL PERFORMANCE* $2,000 30% $1,728 10% 3-Year $1,461 Revenue $1,366 $1,500 $1,284 CAGR 20% 13% 14% $1,000 12% 12% 10% $500 $215 $190

$170 $173 $0 0% 2019 2020 2021 2022 Revenue Adj. EBITDA** Adj. EBITDA %** Slide l 49 * Combined ACMI + Other Services results ** Non-GAAP measure, please see enclosed GAAP reconciliation

($ in millions) -FINANCIAL STRONG LEASING GROWTH OUTLOOK Expect to

deploy 43 newly converted freighters to lease customers in 2023 through 2025 LEASING ADJ. EBITDA OUTLOOK $525 - $530 $465 - $470 $426 $430 - $435 2022 2023E 2024E 2025E Slide l 50

($ in millions) -FINANCIAL STABLE FLYING OUTLOOK Performance trends

back toward pre-COVID levels Consistently high service performance creates opportunities for provider replacement and additional growth with customers ACMI + OTHER SERVICES ADJ. EBITDA OUTLOOK $215 $180 - $185 $180 - $185 $175 - $180 2022 2023E

2024E 2025E Slide l 51

($ in millions) -FINANCIAL FUTURE SUCCESS Strong existing customer

base, and delivery of additional converted freighters, expected to drive strong Adj. EBITDA growth through 2025 Leasing grows to approximately 75% of Adj. EBITDA in 2025E Adj. EBITDA CAGR of 7.7% since 2019-2025 CONSOLIDATED ADJ. EBITDA* OUTLOOK

$700 - $710 $645 - $655 $641 $610 - $620 $541 $497 $452 Slide l 52 2019 2020 2021 2022 2023E 2024E 2025E * Non-GAAP measure, please see enclosed GAAP reconciliation

($ in millions) -FINANCIAL HISTORICAL CAPEX AND ADJ. FREE CASH Capital

Spending Cost of planned airframe SUSTAINING maintenance, engine CAPITAL $718 overhauls, technology, EXPENDITURES and other property and $599 $510 $505 equipment. $454 $510 $412 GROWTH Cost of aircraft $322 $353 $328 CAPITAL acquisitions and

EXPENDITURES freighter modifications. $208 $183 $187 $157 $126 2019 2020 2021 2022 TTM 2Q23 Sustaining Growth Adj. Free Cash Flow in 2022 negatively impacted by timing of a fuel receivable, Adj. Free Cash Flow* which was collected in 2023 $423 $400

$355 Trailing Twelve Month Adj. Free Cash flow $285 $271 has consistently been $375 - $400 million range 2019 2020 2021 2022 TTM 2Q23 Slide l 53 * Adj. Free Cash Flow is Non-GAAP measure defined as Net Cash from Operations minus Sustaining

Capital

($ in millions) -FINANCIAL PATH TO STRONG FREE CASH GENERATION Capital

Spending LEASE DEPLOYMENTS 2023 2024 2025 B767-300 14 9 5 $785 A330-300 0 3 3 $599 $605 A321-200 5 4 0 $545 $320 $412 $440 TOTAL 19 16 8 $170 IN/AWAITING CONVERSION AT $240 $187 $165 $150 19 13 7 YEAR END 2022 2023E 2024E 2025E Sustaining Growth FCF

outlook calls for improving trend Free Cash Flow* through 2025 as focus is narrowed to key customer demand $210 Retain flexibility to increase converted ($55) freighter deployments if outlook warrants 2022 2023E 2024E 2025E ($127) ($193) Slide l 54

* Free Cash Flow is a Non-GAAP measure defined as Net Cash from Operations minus Capital Spending

-FINANCIAL STRATEGIC CAPITAL ALLOCATION Business model generates strong

recurring cash flow Invest to maintain existing fleet, engines, facilities, and other Sustaining Capex services portfolio Fund feedstock purchases and conversions to support lease Growth Capex portfolio growth at attractive returns Available when

the market is not reflecting appropriate value Share Buy Back for our unique strategy and asset base Maintain conservative leverage profile of under 3.0x debt to Debt Paydown EBITDA under bank agreement History of successful and synergistic

acquisitions (e.g., Omni, Strategic M&A CHI, Pemco ) Slide l 55

-FINANCIAL CASH FLOW VISIBILITY FY 2023E REVENUE BY TYPE* Recurring

revenue streams, multi-year agreements account for >80% of current revenue; NON- majority from investment grade credits RECURRING <20% Growth capital is discretionary and based on expected future returns RECURRING Non-discretionary sustaining

capex is expected to > 80% decline and is not impacted by additional owned aircraft as leased freighter maintenance is responsibility of lessees Slide l 56 *Recurring revenue includes revenues under customer agreements with more than 12 months in

duration.

($ in millions) -FINANCIAL STRONG BALANCE SHEET WITH Funded fleet

expansion of ACCESS TO DEBT CAPITAL 33 owned aircraft with minimal increased debt TOTAL DEBT $1,527 $1,518 $1,319 $1,459 $1,640 MATURITY VALUES LEVERAGE RATIO Currently >$1.5 billion of 3.6X 2.8X 2.0X 2.2X 2.7X BANK AGREEMENT available

unencumbered OWNED AIRCRAFT INCLUDING IN- aircraft collateral 104 108 121 133 137 CONVERSION Low debt leverage ratio $259 allowed for opportunistic share repurchase $759 $1,035 $839 75% of 2023PF total debt $959 maturity is at a fixed interest

$1,268 rate $759 $620 $605 Rated just below investment $360 grade by Moody’s(Ba1) and S&P (BB+) 2019 2020 2021 2022 2023PF Slide l 57 Secured Unsecured

($ in millions) -FINANCIAL STRONG UNDERLYING ASSET VALUE Book Value of

B767-300 freighters below market value by ~$350 million $20.0 Average Book Value per 767-300 75 $350 767-300 Estimated Market freighters Value less currently in $24.8 Carrying Value service Estimated Market Value* Slide l 58 * Based on an estimated

replacement cost to place a new 767-300 in service of $33 million; adjusted for life since conversion, or $4.8 million per plane more than carrying value; approximately $350 million total above carrying value

-FINANCIAL REDUCTION IN SHARE COUNT 9.4 million shares repurchased

since October 2022 (12.6% of shares outstanding at 9/30/22) Board share repurchase authorization of $103 million remaining August 2023 convert financing resulted in repurchase of 5.4 million shares and retirement of $204 million of the convertible

issued 2017, resulting in a further reduction of 6.4 million in the diluted share count GAAP Diluted Share Count 86.4 83.1 79.5 73.0 67.0 4Q22 1Q23 2Q23 3Q23E 4Q23E Slide l 59

-FINANCIAL SIGNIFICANT VALUATION UPSIDE ATSG trades at a significant

discount on a sum-of-the-parts basis; Current stock price of ~$21 reflects a multiple of only 6x Leasing EBITDA, while valuing the rest of the business at $0 CURRENT INDICATIVE 2023 2023E ADJ. EBITDA EV/EBITDA MULTIPLES FLYING & SUPPORT SVS 5

– 8x $180-185 AIRLINE PEERS 9 – 10x LEASING LEASING PEERS $430-435 5x CURRENT ATSG MULTIPLE TOTAL: $610-620 Slide l 60

ATSG CLOSING REMARKS Slide l 61

-ATTRACTIVE INVESTMENT OPPORTUNITY Strong balance Strong existing sheet

and base of emerging free leased aircraft ATSG has a best-in-class value cash flow proposition for investors to a well-positioned global e- Conversion slot and feedstock E-commerce commerce enabler. Our position a demand outlook competitive remains

positive bundled solutions, including advantage leasing, flying, and support New aircraft services offers higher returns for Bundled platforms build solution set on midsize shareholders, opportunities for unmatched in credibility our people, and

flexible the industry looking toward the future solutions for our customers. Slide l 62

ATSG QUESTION AND ANSWER Slide l 63

ATSG GUESTS Ed Koharik Chris Teets Joe Hete Jeff Dominick Chief

Operating Officer Board of Directors, Chairman Board of Directors Board of Directors Todd France Matt Fedders Russ Smethwick Kym Cooper Parks Trisha Frank President, CAM VP, Controller VP, Treasury & Corporate VP, Government Programs Director,

Marketing Slide l 64 Development

ATSG APPENDIX Slide l 65

($ in millions) -FINANCIAL FINANCIAL DETAILS METRIC 2022 2023E 2024E

2025E CAM ADJ. EBITDA* 426 430-435 465-470 525-530 ACMI+OTHER ADJ. EBITDA* 215 180-185 180-185 175-180 ATSG ADJ. EBITDA* 641 610-620 645-655 700-710 CAPEX (599) (785) (605) (320) GROWTH CAPEX (412) (545) (440) (170) SUSTAINING CAPEX (187) (240)

(165) (150) Adj. FCF* 285 371 385 380 FREE CASH FLOW* (127) (193) (55) 210 Slide l 66 * Non-GAAP measure, please see enclosed GAAP reconciliation

($ in thousands) -SEGMENT ADJUSTED EARNINGS BEFORE INTEREST, TAXES,

DEPRECIATION AND AMORTIZATION NON-GAAP RECONCILIATION 2019 2020 2021 2022 Other and Other and Other and Other and CAM ACMI Reconciling CAM ACMI Reconciling CAM ACMI Reconciling CAM ACMI Reconciling Leasing Services Items Total Leasing Services Items

Total Leasing Services Items Total Leasing Services Items Total Segment Earnings (GAAP) 68,643 32,055 (29,126) 71,572 77,424 114,128 (150,159) 41,393 106,161 158,733 36,311 301,205 143,008 95,198 22,292 260,498 Remove: Government grants - - - - -

(47,231) - (47,231) - (111,673) - (111,673) - - - - Add: lease incentive amortization 16,708 470 - 17,178 18,509 2,162 - 20,671 20,040 3,054 - 23,094 20,118 3,145 - 23,263 Add: charges for non-consolidated affiliates - - 17,445 17,445 - - 13,587

13,587 - - 2,577 2,577 - - 7,607 7,607 Add: net loss (gain) on financial instruments - - 12,302 12,302 - - 100,771 100,771 - - (29,979) (29,979) - - (9,022) (9,022) Add: debt issuance costs - - - - - - - - - - 6,505 6,505 - - - - Add: transaction

fees - - 373 373 - - - - - - - - - - - - Add: other non-service components of retiree - - 9,404 9,404 - - (12,032) (12,032) - - (17,827) (17,827) - - (20,046) (20,046) benefit costs, net Add: impairment of aircraft and related assets - - - - - -

39,075 39,075 - - - - - - - - Add: net charges for hangar foam incident - - - - - - - - - - - - - 53 925 978 Adjusted Pretax Earnings 85,351 32,525 10,398 128,274 95,933 69,059 (8,758) 156,234 126,201 50,114 (2,413) 173,902 163,126 98,396 1,756

263,278 Add: net interest expense 38,300 24,950 3,024 66,274 39,304 20,542 2,825 62,671 38,160 18,066 2,525 58,751 30,880 13,818 1,748 46,446 Add: Depreciation and amortization 158,470 96,191 2,871 257,532 172,003 101,748 4,316 278,067 203,675

101,541 3,232 308,448 231,663 96,996 2,405 331,064 Adjusted EBITDA 282,121 153,666 16,293 452,080 307,240 191,349 (1,617) 496,972 368,036 169,721 3,344 541,101 425,669 209,210 5,909 640,788 This presentation, including the attached non-GAAP

reconciliation tables, contains financial measures that are not calculated and presented in accordance with generally accepted accounting principles in the United States ( non-GAAP financial measures ). Management uses these non-GAAP financial

measures to evaluate historical results and project future results. Management believes that these non-GAAP financial measures assist in highlighting operational trends, facilitating period-over-period comparisons, and providing additional clarity

about events and trends affecting core operating performance and cash flows. Disclosing these non-GAAP financial measures provides insight to investors about additional metrics that management uses to evaluate past performance and prospects for

future performance. Non-GAAP measures should not be considered in isolation or as a substitute for analysis of the Company's results as reported under GAAP and may be calculated differently by other companies. Slide l 67

($ in thousands) -ADJUSTED FREE CASH FLOW AND FREE CASH FLOW NON-GAAP

RECONCILIATION 2019 2020 2021 2022 TTM 2Q23 Cost of planned airframe SUSTAINING maintenance, engine Net Cash Provided by Operating Activities (GAAP) 396,938 512,302 583,557 472,120 630,487 CAPITAL overhauls, technology, EXPENDITURES Less Sustaining

Capital Expenditures (125,464) (156,990) (1 83,104) (186,836) (207,680) and other property and equipment. Adj Free Cash Total (Non GAAP) 2 71,474 3 55,312 40 0,453 285,284 422,807 GROWTH Cost of aircraft Less Growth Capital Expenditures (32 8,038)

(353,427) (321,644) (412,595) (510,466) CAPITAL acquisitions and EXPENDITURES freighter modifications. Free Cash (Non GAAP) (56,564) 1,885 78,809 (127,311) (87,659) These measures facilitate the comparison of financial results among periods.

Presenting these measures provides investors with comparative metrics of net cash generated from operations compared to capital expenditures and should not be considered an alternative to Net cash provided by operating actives or other GAAP cash

flow metrics. This presentation, including the attached non-GAAP reconciliation tables, contains financial measures that are not calculated and presented in accordance with generally accepted accounting principles in the United States ( non-GAAP

financial measures ). Management uses these non-GAAP financial measures to evaluate historical results and project future results. Management believes that these non-GAAP financial measures assist in highlighting operational trends, facilitating

period-over-period comparisons, and providing additional clarity about events and trends affecting core operating performance and cash flows. Disclosing these non-GAAP financial measures provides insight to investors about additional metrics that

management uses to evaluate past performance and prospects for future performance. Non-GAAP measures should not be considered in isolation or as a substitute for analysis of the Company's results as reported under GAAP and may be calculated

differently by other companies. Slide l 68

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

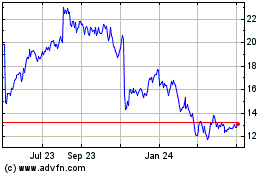

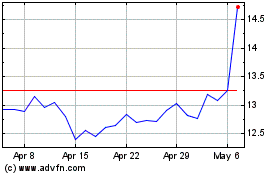

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Jul 2023 to Jul 2024