via NewMediaWire -- Applied UV, Inc. (NASDAQ: AUVI), a leader in

global food security, air quality, and intelligent building

solutions today announced its financial results for the second

quarter 2022. For the quarter, revenues were $10.8 million,

increasing 83.6%, compared with $5.9 million in the second quarter

of 2022. Gross profit for the second quarter of 2023 increased to

$2.4 million, up 84.8%, compared with $1.3 million in the second

quarter of 2022.

Q2 2023 and Recent Business Highlights

- Expanded its

strategic relationship with Canon U.S.A., Inc. to now

include Canon Financial Services, Inc., a wholly owned

subsidiary of, to provide leasing services for Applied UV’s four

operating subsidiaries. The Canon group company, Canon Virginia,

Inc., is contracted for the manufacturing of both product

segments.

- Renewed its

agreement with mfPHD, LLC, for installation of its

PURONet UV Disinfection Control System in 16 operating rooms

at the University of Texas, San Antonio hospital.

- LED Supply Co.,

and its FORTUNE 500 technology partner awarded approximately $0.8

million contract for comprehensive lighting & building controls

solution for global auto manufacturer's U.S. facility.

- PURO, and Its

Partner Academy Energy Groups Selected as a finalist for the GSA's

Green Proving Ground (GPG) Program to demonstrate capability of

next-generation LEDs and Far-UVC light to disinfect air without the

need to increase ventilation.

- Sterilumen

received its first purchase order for its disinfecting mirrors from

Mt. Sinai Hospital in New York. This significant milestone

represents the successful culmination of three years of research,

investment, and intellectual property development by Applied

UV.

- Received over $2

million cash deposits on a significant $4 million order from hotel

and multi-family developers for interior furnishings, validating

strategy of expansion of domestic production facilities.

“We believe the continued increase in

our customer commitments to engage Applied UV as their trusted

resource across all of our businesses supports our long-term growth

strategy. The expansion of our backlog also reflects the success we

are experiencing in winning new customers nationwide,” said Max

Munn, CEO of Applied UV. “We believe our robust growth in backlog,

together with our strategic acquisitions, provides a positive

outlook for the remainder of this year and that our strategies for

profitable growth in 2024 and beyond are gaining momentum.”

Brian Stern, President of Puro

Lighting, commented, “The second quarter has been a truly

significant period for the Intelligent Building Solutions division

of Applied UV Inc., marked by our selection for the General

Services Administration GPG Competition, our pioneering research

partnership on Far UV with Johnson Controls and USHIO, and expanded

growth in the multifamily sector. Our continued advancements in

technologies to enhance food security and produce shelf life,

coupled with sales synergies and expense improvements across

divisions, demonstrate our drive towards innovation and increased

operating efficiency. These collective achievements represent our

commitment to enhancing shareholder value, as we continue to lead

in sustainable and intelligent building solutions.”

Q2 2023 Summary Financial

Results

Net Sales

Net sales of $10.8 million represented

an increase of $4.9 million, or 83.6% for the three months ended

June 30, 2023, as compared to net sales of $5.9 million for the

three months ended June 30, 2022. The Disinfection/Healthy Building

Technologies segment increased $4.0 million, primarily due to the

acquisition of Puro Lighting and LED Supply Co. on January 26,

2023. Additionally, the Hospitality segment increased $0.9 million

as that market is steadily improving.

Gross Profit

Gross profit increased $1.1 million,

or 84.8%, to $2.4 million for the three months ended June 30, 2023,

as compared to $1.3 million for the three months ended June 30,

2023, driven by increased sales in the Disinfection/Healthy

Building Technologies segment and improved margins in the

Hospitality segment.

Selling, General, and

Administrative (SG&A) Expense

SG&A costs for the three months

ended June 30, 2023, increased to $4.9 million as compared to $4.0

million for the three months ended June 30, 2022. The increase of

approximately $0.9 million was driven primarily by the acquisitions

of Puro Lighting and LED Supply Co., which accounted for an

increase of approximately $1.7 million, but was offset by a

reduction in other SG&A of approximately $0.7 million and a

reduction in corporate expenses.

Other Expense

Other expense was $0.3 million for the

three months ended June 30, 2023, which includes $0.5 million in

interest expense, offset by a $0.2 million gain on the change in

fair market value of contingent consideration. This compares to

other expense of $0.1 million for the three months ended June 30,

2022.

Net Loss

The Company recorded a net loss of

$3.0 million for the three months ended June 30, 2023, compared to

a net loss of $2.9 million for the three months ended June 30,

2022. The increase in net loss of $0.1 million was mainly due to

the increase in costs related to the acquisitions of Puro Lighting

and LED Supply Co., offset by improved profitability in the

Hospitality segment.

Total cash and equivalents as of June 30, 2023 were $3.3

million, compared to $2.7 million as of June 30, 2022.

Conference Call/Webcast

Information

Applied UV's management team will host

an investor conference call and live webcast on August 21, 2023, at

9:00 am ET. Investors can access the live webcast via a link on

Applied UV's website or at

https://www.webcaster4.com/Webcast/Page/2626/48955.

For those planning to participate in

the call, please dial +1-888-506-(for domestic calls), or

+1-973-528-0011 (for international calls), passcode 350611. A

replay of the conference call will be available online on the

Applied UV web site, and a dial-in replay will be available for one

week following the call at +1-877-481-4010 (for domestic calls) or

+1-919-882-2331 (for international calls), replay passcode

48955.

About Applied UV

Applied UV, Inc. engages in the pursuit of technologies focused

on global food security, air quality, and intelligent building

solutions tailored for the commercial and hospitality sectors. More

details about Applied UV, Inc., and its subsidiaries can be found

at https://www.applieduvinc.com.

For more on the latest developments and other exciting news,

follow us on Twitter.

Forward-Looking Statements

The information contained herein may contain “forward‐looking

statements.” Forward‐looking statements reflect the current view

about future events. When used in this press release, the words

“anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan,” or the negative of these terms and similar expressions, as

they relate to us or our management, identify forward‐looking

statements. Such statements include, but are not limited to,

statements contained in this press release relating to the view of

management of Applied UV concerning the Company’s preliminary

second quarter 2023 financial results, its business strategy,

future operating results and liquidity and capital resources

outlook. Forward‐looking statements are based on the Company’s

current expectations and assumptions regarding its business, the

economy and other future conditions. Because forward–looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. The Company’s actual results may differ

materially from those contemplated by the forward‐looking

statements. They are neither statements of historical fact nor

guarantees of assurance of future performance. We caution you

therefore against relying on any of these forward‐looking

statements. Factors or events that could cause the Company’s actual

results to differ may emerge from time to time, and it is not

possible for the Company to predict all of them. The Company cannot

guarantee future results, levels of activity, performance, or

achievements. Except as required by applicable law, including the

securities laws of the United States, the Company does not intend

to update any of the forward‐looking statements. References and

links to websites have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this press release.

|

Applied UV, Inc. and

Subsidiaries Unaudited Condensed Interim

Consolidated Statements of OperationsFor the Three

and Six Months Ended June 30, 2023 and 2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net Sales |

|

$ |

10,843,686 |

|

|

$ |

5,907,646 |

|

|

$ |

21,498,169 |

|

|

$ |

9,263,736 |

|

| Cost of Goods Sold |

|

|

8,433,992 |

|

|

|

4,603,854 |

|

|

|

17,166,089 |

|

|

|

6,810,845 |

|

| Gross Profit |

|

|

2,409,694 |

|

|

|

1,303,792 |

|

|

|

4,332,080 |

|

|

|

2,452,891 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

180,293 |

|

|

|

82,049 |

|

|

|

369,503 |

|

|

|

141,363 |

|

| Selling General and

Administrative Expenses |

|

|

4,922,119 |

|

|

|

4,031,215 |

|

|

|

10,186,498 |

|

|

|

7,132,441 |

|

| Loss on impairment of goodwill

and intangibles |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,138,203 |

|

| Total Operating Expenses |

|

|

5,102,412 |

|

|

|

4,113,264 |

|

|

|

10,556,001 |

|

|

|

8,412,007 |

|

| Operating Loss |

|

|

(2,692,718) |

|

|

|

(2,809,472) |

|

|

|

(6,223,921) |

|

|

|

(5,959,116) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in Fair Market Value of

Warrant Liability |

|

|

(1,384) |

|

|

|

(32,111) |

|

|

|

918 |

|

|

|

11,717 |

|

| Interest expense |

|

|

(483,122) |

|

|

|

(49,020) |

|

|

|

(876,061) |

|

|

|

(53,076) |

|

| Gain (Loss) on change in Fair

Market Value of Contingent Consideration |

|

|

186,000 |

|

|

|

— |

|

|

|

(433,999) |

|

|

|

(240,000) |

|

| Gain on Settlement of

Contingent Consideration (Note 2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,700,000 |

|

| Other Income |

|

|

— |

|

|

|

1,948 |

|

|

|

— |

|

|

|

1,948 |

|

| Total Other Income

(Expense) |

|

|

(298,506) |

|

|

|

(79,183) |

|

|

|

(1,309,142) |

|

|

|

1,420,589 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss Before Provision for

Income Taxes |

|

|

(2,991,224) |

|

|

|

(2,888,655) |

|

|

|

(7,533,063) |

|

|

|

(4,538,527) |

|

| Benefit from Income Taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net Loss |

|

$ |

(2,991,224) |

|

|

$ |

(2,888,655) |

|

|

$ |

(7,533,063) |

|

|

$ |

(4,538,527) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss attributable to

common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends to preferred

shareholders |

|

|

(407,231) |

|

|

|

(362,250) |

|

|

|

(769,481) |

|

|

|

(724,500) |

|

| Net Loss attributable to

common stockholders |

|

|

(3,398,455) |

|

|

|

(3,250,905) |

|

|

|

(8,302,544) |

|

|

|

(5,263,027) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Loss Per

Common Share |

|

$ |

(0.77) |

|

|

$ |

(1.28) |

|

|

$ |

(2.10) |

|

|

$ |

(2.06) |

|

| Weighted Average Shares

Outstanding - basic and diluted |

|

|

4,434,036 |

|

|

|

2,533,077 |

|

|

|

3,949,211 |

|

|

|

2,559,957 |

|

|

Applied UV, Inc. and SubsidiariesUnaudited

Condensed Consolidated Balance SheetsAs of June

30, 2023 and December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31. |

|

|

|

2023 |

|

2022 |

| Assets |

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

3,333,544 |

|

|

$ |

2,734,485 |

|

| Accounts receivable, net of

allowance for doubtful accounts |

|

|

5,049,906 |

|

|

|

1,508,239 |

|

| Costs and estimated earnings

in excess of billings |

|

|

2,435,960 |

|

|

|

1,306,762 |

|

| Inventory, net |

|

|

8,207,895 |

|

|

|

5,508,086 |

|

| Vendor deposits |

|

|

1,149,385 |

|

|

|

75,548 |

|

| Prepaid expense and other

current assets |

|

|

2,011,189 |

|

|

|

1,187,223 |

|

| Total Current Assets |

|

|

22,187,879 |

|

|

|

12,320,343 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment, net of

accumulated depreciation |

|

|

1,166,507 |

|

|

|

1,133,468 |

|

| Other assets |

|

|

— |

|

|

|

153,000 |

|

| Goodwill |

|

|

17,809,235 |

|

|

|

3,722,077 |

|

| Other intangible assets, net

of accumulated amortization |

|

|

28,000,601 |

|

|

|

11,354,430 |

|

| Right of use assets |

|

|

3,807,834 |

|

|

|

4,044,109 |

|

| Total Assets |

|

$ |

72,972,056 |

|

|

$ |

32,727,427 |

|

| Liabilities, Redeemable

Preferred Stock and Stockholders' Equity |

|

|

|

|

| Current Liabilities |

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

8,862,351 |

|

|

$ |

2,982,760 |

|

| Contingent consideration |

|

|

18,809,672 |

|

|

|

— |

|

| Deferred revenue |

|

|

5,406,083 |

|

|

|

4,730,299 |

|

| Due to landlord (Note 2) |

|

|

189,182 |

|

|

|

229,234 |

|

| Warrant liability |

|

|

9,069 |

|

|

|

9,987 |

|

| Financing lease

obligations |

|

|

41,632 |

|

|

|

33,712 |

|

| Operating lease liability |

|

|

1,689,127 |

|

|

|

1,437,308 |

|

| Notes payable, net |

|

|

4,999,257 |

|

|

|

2,098,685 |

|

| Total Current Liabilities |

|

|

40,006,373 |

|

|

|

11,521,985 |

|

| Long-Term Liabilities |

|

|

|

|

|

|

|

|

| Due to landlord - less current

portion (Note 2) |

|

|

325,557 |

|

|

|

393,230 |

|

| Notes payable, net - less

current portion |

|

|

5,323,659 |

|

|

|

765,144 |

|

| Financing lease obligations -

less current portion |

|

|

155,360 |

|

|

|

158,070 |

|

| Operating lease liability -

less current portion |

|

|

2,190,159 |

|

|

|

2,655,103 |

|

| Total Long-Term

Liabilities |

|

|

7,994,735 |

|

|

|

3,971,547 |

|

| Total Liabilities |

|

|

48,001,108 |

|

|

|

15,493,532 |

|

| |

|

|

|

|

|

|

|

|

| Redeemable Preferred

Stock |

|

|

|

|

|

|

|

|

| Preferred Stock, Series B

Cumulative Perpetual, $0.0001 par value, 1,250,000 shares

authorized, 1,250,000 shares issued and outstanding as of June 30,

2023 and no shares issued and outstanding as of December 31,

2022 |

|

|

3,712,500 |

|

|

|

— |

|

| Preferred Stock, Series C

Cumulative Perpetual, $0.0001 par value, 2,500,000 shares

authorized, 399,996 shares issued and outstanding as of June 30,

2023 and no shares issued and outstanding as of December 31,

2022 |

|

|

1,063,989 |

|

|

|

— |

|

| Total Redeemable Preferred

Stock |

|

|

4,776,489 |

|

|

|

— |

|

| Equity |

|

|

|

|

|

|

|

|

| Preferred Stock, Series A

Cumulative Perpetual, $0.0001 par value, 1,250,000 shares

authorized, 552,000 shares issued and outstanding as of June 30,

2023 and December 31, 2022 |

|

|

55 |

|

|

|

55 |

|

| Preferred Stock, Series X,

$0.0001 par value, 10,000 shares authorized, 10,000 shares issued

and outstanding as of June 30, 2023 and December 31, 2022,

respectively |

|

|

1 |

|

|

|

1 |

|

| Common Stock $0.0001 par

value, 150,000,000 shares authorized 8,928,330 shares issued and

8,905,633 outstanding as of June 30, 2023 and 2,735,290 shares

issued and 2,712,593 outstanding as of December 31, 2022,

respectively |

|

|

893 |

|

|

|

274 |

|

| Additional paid-in

capital |

|

|

56,883,253 |

|

|

|

45,620,764 |

|

| Treasury stock at cost,

22,697, respectively |

|

|

(149,686) |

|

|

|

(149,686) |

|

| Accumulated deficit |

|

|

(36,540,057) |

|

|

|

(28,237,513) |

|

| Total Equity |

|

|

20,194,459 |

|

|

|

17,233,895 |

|

| Total Liabilities, Redeemable

Preferred Stock and Stockholders' Equity |

|

$ |

72,972,056 |

|

|

$ |

32,727,427 |

|

|

Applied UV, Inc. and SubsidiariesCondensed

Interim Consolidated Statements of Cash FlowsFor

the Six Months Ended June 30, 2023 and 2022 |

| |

|

|

|

|

|

|

|

|

| |

|

2023 |

|

2022 |

| Cash flows from Operating

Activities |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(7,533,063 |

) |

|

$ |

(4,538,527 |

) |

| Adjustments to Reconcile Net

Loss to Net Cash Used in Operating Activities |

|

|

|

|

|

|

|

|

| Stock based compensation |

|

|

384,809 |

|

|

|

400,450 |

|

| Bad debt (recovery)

expense |

|

|

(135,467 |

) |

|

|

55,226 |

|

| Change in fair market value of

warrant liability |

|

|

(918 |

) |

|

|

(11,717 |

) |

| Change in fair market value of

contingent consideration |

|

|

433,999 |

|

|

|

240,000 |

|

| Gain on settlement of

contingent consideration |

|

|

— |

|

|

|

(1,700,000 |

) |

| Loss on impairment of goodwill

and intangible assets |

|

|

— |

|

|

|

1,138,203 |

|

| Amortization of right-of-use

asset |

|

|

236,275 |

|

|

|

462,832 |

|

| Depreciation and

amortization |

|

|

1,418,127 |

|

|

|

978,495 |

|

| Amortization of debt

discount |

|

|

399,129 |

|

|

|

53,646 |

|

| Changes in operating assets

and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(1,670,165 |

) |

|

|

(402,965 |

) |

| Cost and estimated earnings

excess of billings |

|

|

(595,560 |

) |

|

|

(262,420 |

) |

| Inventory |

|

|

1,311,288 |

|

|

|

(2,855,073 |

) |

| Vendor deposits |

|

|

(698,165 |

) |

|

|

494,888 |

|

| Prepaid expenses and other

current assets |

|

|

(194,044 |

) |

|

|

(62,600 |

) |

| Accounts payable and accrued

expenses |

|

|

2,088,635 |

|

|

|

768,872 |

|

| Billings in excess of costs

and earnings on uncompleted contracts |

|

|

— |

|

|

|

(616,475 |

) |

| Deferred revenue |

|

|

(1,622,314 |

) |

|

|

687,494 |

|

| Due to landlord |

|

|

(186,344 |

) |

|

|

(93,172 |

) |

| Operating lease payments |

|

|

(213,125 |

) |

|

|

(449,388 |

) |

| Net Cash Used in Operating

Activities |

|

|

(6,576,903 |

) |

|

|

(5,712,231 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows From Investing

Activities |

|

|

|

|

|

|

|

|

| Cash paid for patent

costs |

|

|

(51,077 |

) |

|

|

(682 |

) |

| Purchase of machinery and

equipment |

|

|

(75,959 |

) |

|

|

(26,043 |

) |

| Acquisitions, net of cash

acquired (Note 2) |

|

|

(4,115,709 |

) |

|

|

(10 |

) |

| Payments on notes payable |

|

|

(166,262 |

) |

|

|

— |

|

| Net Cash Used in Investing

Activities |

|

|

(4,409,007 |

) |

|

|

(26,735 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows From Financing

Activities |

|

|

|

|

|

|

|

|

| Payments on financing

leases |

|

|

(20,022 |

) |

|

|

(3,493 |

) |

| Shares repurchased |

|

|

— |

|

|

|

(149,686 |

) |

| Dividends to preferred

shareholders |

|

|

(769,481 |

) |

|

|

(724,500 |

) |

| Payments on note payable |

|

|

(16,438,782 |

) |

|

|

— |

|

| Proceeds from equity raises,

net |

|

|

6,630,799 |

|

|

|

1,092,000 |

|

| Proceeds from note payable,

net |

|

|

22,182,455 |

|

|

|

— |

|

| Net Cash Provided by Financing

Activities |

|

|

11,584,969 |

|

|

|

214,321 |

|

| |

|

|

|

|

|

|

|

|

| Net Increase (Decrease) in

Cash and equivalents |

|

|

599,059 |

|

|

|

(5,524,645 |

) |

| Cash and cash equivalents at

January 1, |

|

|

2,734,485 |

|

|

|

8,768,156 |

|

| Cash and cash equivalents at

June 30, |

|

$ |

3,333,544 |

|

|

$ |

3,243,511 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental Disclosures of

Cash Flow Information: |

|

|

|

|

|

|

|

|

| Cash paid during the year

for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

308,955 |

|

|

$ |

4,102 |

|

| Supplemental Non-Cash

Disclosures of Investing and Financing Activities |

|

|

|

|

|

|

|

|

| Conversion of debt into common

stock |

|

$ |

217,500 |

|

|

$ |

— |

|

| Recognition of right of use

asset and corresponding lease liability |

|

$ |

563,315 |

|

|

$ |

1,380,658 |

|

For Additional Company Information:

Applied UV, Inc. Max Munn Applied UV Founder, CEO & Director

Max.munn@applieduvinc.com

Investor Relations Contact:TraDigital IR Kevin McGrath

+1-646-418-7002 kevin@tradigitalir.com

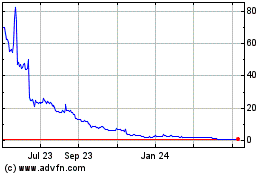

Applied UV (NASDAQ:AUVI)

Historical Stock Chart

From Dec 2024 to Jan 2025

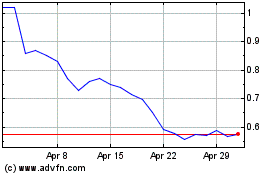

Applied UV (NASDAQ:AUVI)

Historical Stock Chart

From Jan 2024 to Jan 2025