0001377789false00013777892024-09-112024-09-110001377789us-gaap:CommonStockMember2024-09-112024-09-110001377789us-gaap:PreferredStockMember2024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

Form 8-K

______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2024

_______________________

AVIAT NETWORKS, INC.

(Exact name of registrant as specified in its charter)

______________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-33278 | | 20-5961564 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

200 Parker Dr., Suite C100A, Austin, Texas 78728 |

| (Address of principal executive offices, including zip code) |

| | | | |

| | (408)-941-7100 | | |

| Registrant’s telephone number, including area code | |

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AVNW | | NASDAQ Stock Market LLC |

| Preferred Share Purchase Rights | | | | NASDAQ Stock Market LLC |

☐ Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition

On September 11, 2024, Aviat Networks, Inc. (the “Company”) issued a press release announcing the filing of Form 12b-25 to extend time for filing its Annual Report on Form 10-K for the fiscal year ended June 28, 2024, and provided preliminary financial results for the fiscal year ended June 28, 2024. These figures are preliminary, unaudited and subject to change pending the filing of the Annual Report on Form 10-K for the fiscal year ended June 28, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 of Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | |

| | | | |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | | | |

| * Furnished herewith. | | |

Forward-Looking Statements

Certain matters discussed in this Current Report on Form 8-K constitute forward-looking statements within the meaning of the federal securities laws. All statements contained in this notification that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the potential revision or restatement of certain of the Company’s historical financial statements, the material weaknesses in the Company’s internal control over financial reporting as of June 28, 2024, and the Company’s expectations regarding the timing of the filing of the Form 10-K. These forward-looking statements are based on management’s current expectations.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from expectations include, but are not limited to the effectiveness of the Company’s internal control over financial reporting and disclosure controls and procedures; the potential for additional material weaknesses in the Company’s internal controls over financial reporting or other potential control deficiencies of which the Company is not currently aware or which have not been detected; the risk that the completion and filing of the Form 10-K will take longer than expected; additional information that may arise during the finalization of the Form 10-K; and the risks discussed in detail in “Item 1A. Risk Factors” of the Company’s most recent Annual Report on Form 10-K, as updated by its other filings with the SEC. The Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise, except as required by law.

SIGNATURE

| | | | | | | | | | | | | | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | |

| | AVIAT NETWORKS, INC. |

| | |

| Date: September 11, 2024 | | By: | | /s/ Michael Connaway |

| | | | Name: | | Michael Connaway |

| | | | Title: | | Senior Vice President and Chief Financial Officer |

Aviat Networks to Delay Form 10-K Filing for Fiscal Year 2024

AUSTIN, Texas, September 11, 2024 -- Aviat Networks, Inc. (“Aviat Networks,” “Aviat,” or the “Company”), (Nasdaq: AVNW), the leading expert in wireless transport and access solutions, announced today that it has filed a Notification of Late Filing on Form 12b-25 with respect to the Annual Report on Form 10-K for the fiscal year ended June 28, 2024.

Aviat has determined that it is unable to file, without unreasonable effort or expense, its Annual Report on Form 10-K for the fiscal year ended June 28, 2024 by the prescribed filing due date because the Company requires additional time to finalize its assessment of internal control over financial reporting and to complete certain closing processes and procedures. The Company is working diligently and expects to file the Form 10-K on or before the expiration of the fifteen calendar day extension period.

Management has identified certain material weaknesses in its preliminary assessment of internal control over financial reporting for the fiscal year ended June 28, 2024. The Company has initiated and will continue to implement measures designed to improve its internal control over financial reporting to remediate these material weaknesses with oversight from the Audit Committee of the Board of Directors and assistance from its external advisors.

In connection with the preparation of the Company’s annual financial statements for the fiscal year ended June 28, 2024, the Company identified certain errors impacting previously reported financial information for the fiscal years 2024 and 2023. While the Company currently believes the effects are not material to the previously issued consolidated financial statements for any of its prior reporting periods, it continues to evaluate to determine whether revision or restatement of prior periods is required.

The Company estimates the following results for the fiscal year ended June 28, 2024:

Revenues

•The Company estimates revenues for the year ended June 28, 2024 between $400 million and $409 million, compared to revenues of $347 million reported in the prior year ended June 30, 2023.

Operating income

•The Company estimates operating income for the year ended June 28, 2024 between $15 million and $20 million, compared to operating income of $26 million reported in the prior year ended June 30, 2023.

Net income

•The Company estimates net income for the year ended June 28, 2024 between $8 million and $12 million, compared to net income of $12 million reported in the prior year ended June 30, 2023.

Cash and cash equivalents

•The Company estimates cash and cash equivalents for the year ended June 28, 2024 of approximately $65 million compared to cash and cash equivalents of $22 million reported in the prior year ended June 30, 2023.

Debt

•The Company estimates total outstanding debt for the year ended June 28, 2024 of approximately $48 million. The company had no debt outstanding in the prior year ended June 30, 2023.

These figures are preliminary, unaudited and subject to change pending the filing of the 2024 Form 10-K.

Forward-Looking Statements

Certain matters discussed constitute forward-looking statements within the meaning of the federal securities laws. All statements contained in this notification that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the potential revision or restatement of certain historical financial statements, the material weaknesses in the Company’s internal control over financial reporting as of June 28, 2024, and the Company’s expectations regarding the timing of the filing of the Form 10-K. These forward-looking statements are based on management’s current expectations.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from expectations include, but are not limited to the effectiveness of the Company’s internal control over financial reporting and disclosure controls and procedures; the potential for additional material weaknesses in the Company’s internal controls over financial reporting or other potential control deficiencies of which the Company is not currently aware or which have not been detected; the risk that the completion and filing of the Form 10-K will take longer than expected; additional information that may arise during the finalization of the Form 10-K; and the risks discussed in detail in “Item 1A. Risk Factors” of the Company’s most recent Annual Report on Form 10-K, as updated by its other filings with the SEC. The Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise, except as required by law.

About Aviat Networks, Inc.

Aviat Networks, Inc. is the leading expert in wireless transport and access solutions and works to provide dependable products, services and support to its customers. With more than one million systems sold into 170 countries worldwide, communications service providers and private network operators including state/local government, utility, federal government and defense organizations trust Aviat with their critical applications. Coupled with a long history of microwave innovations, Aviat provides a comprehensive suite of localized professional and support services enabling customers to drastically simplify both their networks and their lives. For more than 70 years, the experts at Aviat have delivered high performance products, simplified operations, and the best overall customer experience. Aviat is headquartered in Austin, Texas. For more information, visit www.aviatnetworks.com or connect with Aviat Networks on Facebook and LinkedIn.

Investor Relations:

Andrew Fredrickson

Director, Corporate Development & Investor Relations

Phone: (512) 582-4626

Email: andrew.fredrickson@aviatnet.com

v3.24.2.u1

Cover

|

Sep. 11, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Registrant Name |

AVIAT NETWORKS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33278

|

| Entity Tax Identification Number |

20-5961564

|

| Entity Address, Address Line One |

200 Parker Dr., Suite C100A

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78728

|

| City Area Code |

(408)

|

| Local Phone Number |

941-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001377789

|

| Amendment Flag |

false

|

| Common Stock |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AVNW

|

| Security Exchange Name |

NASDAQ

|

| Preferred Stock |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Preferred Share Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

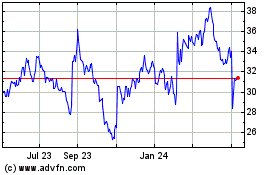

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Dec 2024 to Jan 2025

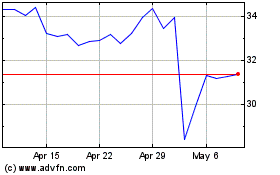

Aviat Networks (NASDAQ:AVNW)

Historical Stock Chart

From Jan 2024 to Jan 2025