0000926617false00009266172024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

Aspira Women’s Health Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

001-34810 |

33-0595156 |

(State or other jurisdiction |

(Commission |

(IRS Employer |

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

|

12117 Bee Caves Road, Building III, Suite 100, Austin, Texas |

|

78738 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (512) 519-0400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

AWH |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions.

On May 15, 2024, Aspira Women’s Health Inc. (the “Company”) issued a press release reporting financial results for the three months ended March 31, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information provided in this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Such information shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ASPIRA WOMEN’S HEALTH INC. |

|

|

|

Date: May 15, 2024 |

By: |

/s/ Torsten Hombeck |

|

|

Torsten Hombeck |

|

|

Chief Financial Officer |

Aspira Women’s Health Reports First Quarter 2024 Financial Results

Q1 2024 OvaSuiteSM revenue of $2.2 million and volume of 5,829 units

Q1 2024 cash utilization of $4.4 million, a decrease of 22% compared to Q1 2023

Conference Call and Webcast scheduled for today at 8:30 am ET

AUSTIN, Texas, May 15, 2024 (GLOBE NEWSWIRE) -- Aspira Women’s Health Inc. (“Aspira” or the “Company”) (Nasdaq: AWH), a bio-analytical based women’s health company focused on the development of gynecologic disease diagnostic tools, today reported its financial results for the first quarter ended March 31, 2024.

“Our continued focus on growth, innovation and operational excellence has positioned us for an exciting year,” said Nicole Sandford, Chief Executive Officer of Aspira. “We saw OvaWatch®volume grow 114% this quarter when compared to the first quarter of last year, and we continued our two-year trend of cost reductions across the company. Moreover, the price volatility we anticipated following the introduction of OvaWatch in 2022 never materialized, and our gross margin remains strong.”

“OvaWatch offers an incredible opportunity for our growth, especially now that its features have been expanded to allow for repeat testing at provider-prescribed intervals. Moreover, clinical evidence to support the use of OvaWatch is stronger than ever. Recent publications showed that clinicians may have been able to avoid surgery for a majority of women with low- or indeterminate ovarian cancer risk if OvaWatch had been used as part of clinical decision-making. This one-of-a-kind tool offers clear benefits to patients, providers and payers alike, and is poised to improve outcomes for patients that choose to delay or avoid surgery in favor of a watchful waiting approach.”

“Our team is more prepared than ever to take advantage of the expanded commercially available OvaSuite test portfolio. We saw very strong signs of a return to growth now that our commercial strategy has reached the execution phase. March was the strongest month of the first quarter and that momentum carried into April, the second largest volume month in company history.”

Recent Corporate Highlights

•Published a study that demonstrated OvaWatch significantly improves patient selection for surgery in ovarian cancer management. The study entitled: “Ovarian Cancer Surgical Consideration is Markedly Improved by the Neural Network Powered-MIA3G Multivariate Index Assay,” evaluated 785 surgical results in women with an adnexal mass. Results demonstrated that the use of OvaWatch would have reduced the number of surgeries by 62% overall, and by 77% in pre-menopausal women. Had physicians utilized OvaWatch scores for surgery selection, results demonstrated a 431% improvement in the ability to predict malignancy.

•Published a study of 500 women validating the use of OvaWatch as a tool to monitor adnexal masses over time. The study, entitled “Neural Network-derived Multivariate Index Assay Demonstrates Effective Clinical Performance in Longitudinal Monitoring of Ovarian Cancer Risk,” found serial testing with OvaWatch to be a useful clinical tool in monitoring cancer risk of an adnexal mass.

•Enhanced the Company’s commercial offering with the formal launch of the longitudinal monitoring feature of OvaWatch. The new feature offers physicians a tool for assessing malignancy risk over time and determining the appropriate personalized treatment path. OvaWatch utilizes an AI-powered algorithm to assess malignancy risk of adnexal masses when initial clinical assessment indicates the mass is indeterminant or low-risk.

•Announced a new agreement with Anthem Blue Cross in California for reimbursement coverage of the Company’s OvaSuite portfolio of risk assessment tests effective June 1, 2024. Anthem Blue Cross will provide coverage for its commercial and government lines of business, including Medicare Advantage and Medicaid, which represents a total of approximately six million covered lives in California. The Company was credentialed by Anthem during the first quarter of 2024, allowing for its affiliates to partner with Aspira, and more contracts are expected to follow.

First Quarter 2024 Financial Highlights

•Product revenue was $2.2 million for the three months ended March 31, 2024, compared to $2.3 million for the same period in 2023. The number of OvaSuite tests performed was approximately 5,829 during the three months ended March 31, 2024, a 7% decrease compared to the approximately 6,259 OvaSuite tests for the same period in 2023. The average unit price (AUP) for the Company’s OvaSuite tests was $369 for the three months ended March 31, 2024, compared to $370 for the same period in 2023. Sales efficiency, as measured by volume per full-time sales representative, increased 22% in the first quarter compared to the same period in 2023.

•Gross profit margin was 56% for the three months ended March 31, 2024, compared to 51% for the same period in 2023.

•Research and development expenses for the three months ended March 31, 2024, were $0.9 million, a decrease of 28% compared to $1.3 million for the same period in 2023. This decrease was primarily due to decreases in personnel costs.

•Sales and marketing expenses for the three months ended March 31, 2024, were $1.9 million, a decrease of 27%, compared to $2.6 million for the same period in 2023. This decrease was primarily due to decreased consulting, personnel, and travel costs.

•General and administrative expenses for the three months ended March 31, 2024, were $3.1 million, a decrease of 13%, compared to $3.6 million for the same period in 2023. This decrease was primarily due to a decrease in personnel costs, as well as outside accounting and consulting costs.

Balance Sheet Highlights

As of March 31, 2024, Aspira had $3.7 million in cash, including restricted cash, up from $2.9 million in cash, including restricted cash as of December 31, 2023. Aspira raised $5.6 million in gross proceeds in a registered direct offering during the first quarter 2024. Cash used in operating activities was $4.4 million for the three months ended March 31, 2024, compared to $5.7 million in the same period in 2023, a 22% decrease. The Company’s operating cash utilization target for 2024 remains between $15 million and $18 million.

Conference Call and Webcast Details

Aspira’s management team will host a conference call beginning at 8:30 am ET today, May 15, 2024. Investors and other interested parties may participate in the conference call by dialing 1-877-407-4018. The call will be available via webcast by clicking HERE or on the events page of the Company’s website after the conclusion of the call.

About Aspira Women’s Health Inc.

Aspira Women’s Health Inc. is dedicated to the discovery, development, and commercialization of noninvasive, AI-powered tests to aid in the diagnosis of gynecologic diseases.

OvaWatch® and Ova1Plus® are offered to clinicians as OvaSuiteSM. Together, they provide the only comprehensive portfolio of blood tests to aid in the detection of ovarian cancer for the 1.2+ million American women diagnosed with an adnexal mass each year. OvaWatch provides a negative predictive value of 99% and is used to assess ovarian cancer risk for women where initial clinical assessment indicates the mass is indeterminate or benign, and thus surgery may be premature or unnecessary. Ova1Plus is comprised of two FDA-cleared tests, Ova1®and Overa®, to assess the risk of ovarian malignancy in women planned for surgery.

Our in-development test pipeline is designed to expand our ovarian cancer portfolio and addresses the tremendous need for noninvasive diagnostics for endometriosis, a debilitating disease that impacts millions of women worldwide. In ovarian cancer, our OvaMDxSM risk assessment is designed to combine microRNA and protein biomarkers with patient data to further enhance the sensitivity and specificity of our current tests. In endometriosis, EndoCheckSM is the first-ever noninvasive test designed to identify endometriomas, one of the most commonly occurring forms of endometriosis. The EndoMDxSM test is designed to combine microRNA and protein biomarkers with patient data to identify all endometriosis.

Forward-Looking Statements

This press release may contain forward-looking statements that are made pursuant to the safe harbor provisions of the federal securities laws, including those relating to the timing and completion of any products in the pipeline development and other statement that are predictive in nature. Actual results could differ materially from those discussed due to known and unknown risks, uncertainties, and other factors. These forward-looking statements generally can be

identified by the use of words such as “designed to,” “expect,” “plan,” “anticipate,” “could,” “may,” “intend,” “will,” “continue,” “future,” other words of similar meaning and the use of future dates. Forward-looking statements in this press release and other factors that may cause such differences include the satisfaction of customary closing conditions related to the offering and the expected timing of the closing of the offering. These and additional risks and uncertainties are described more fully in the company’s filings with the SEC, including those factors identified as “risk factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. We are providing this information as of the date of this press release and do not undertake any obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

Torsten Hombeck, Ph.D.

Chief Financial Officer

Aspira Women’s Health

Investors@aspirawh.com

Aspira Women’s Health Inc.

Condensed Consolidated Balance Sheets (unaudited)

(Amounts in Thousands, Except Share and Par Value Amounts)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

Assets |

(Unaudited) |

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

|

3,413 |

|

|

$ |

|

2,597 |

|

Accounts receivable, net of reserves of $2 and $15, as of March 31, 2024 and December 31, 2023, respectively |

|

|

1,531 |

|

|

|

|

1,459 |

|

Prepaid expenses and other current assets |

|

|

942 |

|

|

|

|

997 |

|

Inventories |

|

236 |

|

|

|

227 |

|

Total current assets |

|

|

6,122 |

|

|

|

|

5,280 |

|

Property and equipment, net |

|

131 |

|

|

|

165 |

|

Right-of-use assets |

|

620 |

|

|

|

528 |

|

Restricted cash |

|

260 |

|

|

|

258 |

|

Other assets |

|

|

31 |

|

|

|

31 |

|

Total assets |

$ |

|

7,164 |

|

|

$ |

|

6,262 |

|

Liabilities and Stockholders’ Deficit |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

$ |

|

1,643 |

|

|

$ |

|

1,261 |

|

Accrued liabilities |

|

|

2,797 |

|

|

|

|

2,863 |

|

Current portion of long-term debt |

|

249 |

|

|

|

166 |

|

Short-term debt |

|

|

416 |

|

|

|

670 |

|

Current maturities of lease liabilities |

|

188 |

|

|

|

159 |

|

Total current liabilities |

|

|

5,293 |

|

|

|

|

5,119 |

|

Non-current liabilities: |

|

|

|

|

|

|

|

Long-term debt |

|

|

1,347 |

|

|

|

|

1,430 |

|

Non-current maturities of lease liabilities |

|

487 |

|

|

|

427 |

|

Warrant liabilities |

|

|

1,400 |

|

|

|

|

1,651 |

|

Total liabilities |

|

|

8,527 |

|

|

|

|

8,627 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

|

Common stock, par value $0.001 per share, 200,000,000 and 150,000,000 shares authorized at March 31, 2024 and December 31, 2023, respectively; 12,344,104 and 10,645,049 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively |

|

|

12 |

|

|

|

11 |

|

Additional paid-in capital |

|

|

521,557 |

|

|

|

|

515,927 |

|

Accumulated deficit |

|

|

(522,932 |

) |

|

|

|

(518,303 |

) |

Total stockholders’ deficit |

|

|

(1,363 |

) |

|

|

|

(2,365 |

) |

Total liabilities and stockholders’ deficit |

$ |

|

7,164 |

|

|

$ |

|

6,262 |

|

Aspira Women’s Health Inc.

Condensed Consolidated Statements of Operations (unaudited)

(Amounts in Thousands, Except Share and Per Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

Product |

$ |

|

2,153 |

|

|

$ |

|

2,315 |

|

Genetics |

|

|

- |

|

|

|

|

1 |

|

Total revenue |

|

|

2,153 |

|

|

|

|

2,316 |

|

Cost of revenue: |

|

|

|

|

|

|

|

Product |

|

|

939 |

|

|

|

|

1,130 |

|

Total cost of revenue |

|

|

939 |

|

|

|

|

1,130 |

|

Gross profit |

|

|

1,214 |

|

|

|

|

1,186 |

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

906 |

|

|

|

|

1,267 |

|

Sales and marketing |

|

|

1,889 |

|

|

|

|

2,595 |

|

General and administrative |

|

|

3,129 |

|

|

|

|

3,604 |

|

Total operating expenses |

|

|

5,924 |

|

|

|

|

7,466 |

|

Loss from operations |

|

|

(4,710 |

) |

|

|

|

(6,280 |

) |

Other income (expense), net: |

|

|

|

|

|

|

|

Change in fair value of warrant liabilities |

|

|

251 |

|

|

|

|

(24 |

) |

Interest (expense) income, net |

|

|

(5 |

) |

|

|

|

26 |

|

Other expense, net |

|

|

(165 |

) |

|

|

|

(300 |

) |

Total other income (expense), net |

|

|

81 |

|

|

|

|

(298 |

) |

Net loss |

$ |

|

(4,629 |

) |

|

$ |

|

(6,578 |

) |

Net loss per share - basic and diluted |

$ |

|

(0.39 |

) |

|

$ |

|

(0.79 |

) |

Weighted average common shares used to compute basic and diluted net loss per common share |

|

|

11,846,075 |

|

|

|

|

8,313,091 |

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

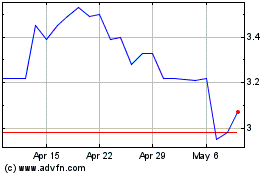

Aspira Womans Health (NASDAQ:AWH)

Historical Stock Chart

From Apr 2024 to May 2024

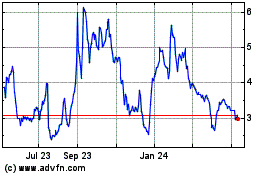

Aspira Womans Health (NASDAQ:AWH)

Historical Stock Chart

From May 2023 to May 2024