0001633070FALSEP.O. Box 1270LittletonMassachusetts00016330702023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

_____________________

AXCELLA HEALTH INC.

(Exact name of registrant as specified in its charter)

________________________

| | | | | | | | | | | | | | |

|

| | | | |

| Delaware | | 001-38901 | | 26-3321056 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | |

|

| |

P.O. Box 1270 Littleton, Massachusetts | 01460 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (857) 320-2200

Not Applicable

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below): | | | | | |

|

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

|

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

|

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

|

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

|

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | AXLA | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On August 3, 2023, Axcella Health Inc., doing business as “Axcella Therapeutics,” announced its financial results for the second quarter ended June 30, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

|

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

| | | | | | |

| | | | AXCELLA HEALTH INC. |

| | | |

| Date: August 3, 2023 | | | | By: | | /s/ William R. Hinshaw, Jr. |

| | | | | | William R. Hinshaw, Jr. |

| | | | | | President, Chief Executive Officer and Director |

Axcella Reports Second Quarter Financial Results and Provides Business Update

•AXA1125 remains the most advanced product to help patients experiencing fatigue post acute COVID-19

•The Company continues to pursue a strategic alternative for stakeholders

Cambridge, Mass., August 3, 2023 – Axcella Therapeutics (Nasdaq: AXLA), a clinical-stage biotechnology company focused on pioneering a new approach to address the biology of complex diseases using compositions of endogenous metabolic modulators (EMMs), today announced financial results for the second quarter ended June 30, 2023 and provided a business update.

“Patients are seeking relief from Long COVID fatigue. Axcella’s proprietary composition of amino acids in AXA1125 in Long COVID fatigue is potentially an important step to help people maintain health after recovering from acute COVID-19,” said Bill Hinshaw, President and Chief Executive Officer of Axcella. “Axcella remains committed to helping people suffering from fatigue after acute viral infection, such as with SARS-CoV-2.”

The Company has continued its efforts to progress its development program of AXA1125 and achieve a strategic alternative to maximize stakeholder value. With respect to the Company’s plans, no assurances can be made as to whether a strategic transaction will be recommended by the Board of Directors, and the Company does not intend to discuss developments with respect to the evaluation process unless a transaction is approved or disclosure otherwise becomes appropriate. If a strategic process is unsuccessful, the Company may be unable to continue operations at planned levels and be forced to further reduce or terminate operations.

Financial Results

Cash Position: As of June 30, 2023, cash and cash equivalents totaled $8.9 million, compared to $17.1 million as of December 31, 2022.

R&D Expenses: Research and development expenses for the quarter and six months ended June 30, 2023 were $1.2 million and $2.7 million, respectively. Research and development expenses for the same periods ended June 30, 2022 were $16.9 million and $30.4 million, respectively. These decreases are the result of the Company’s decision to lay off 85% of its employees and terminate all research and development activity effective December 15, 2022.

G&A Expenses: General and administrative expenses for the quarter and six months ended June 30, 2023 were $2.3 million and $5.1 million, respectively. General and administrative expenses for the same periods ended June 30, 2022 were $3.8 million and $8.5 million, respectively. These decreases are due to the reduction in force on December 15, 2022.

Other (expense) income: Other income for the quarter and six months ended June 30, 2023 was $0.1 million and $0.3 million, respectively, and consisted of interest income on our cash balances. Other expense for the same periods ended June 30, 2022 were $0.7 million and $1.4 million, respectively, and consisted of interest expense on the loan and security agreement with SLR Investment Corp. We repaid the loan in full in December 2022.

Net Loss: Net loss for the quarter and six months ended June 30, 2023 was $3.4 million, or $0.05 per basic and diluted share, and $7.4 million, or $0.10 per basic and diluted share. This compares with a net loss of $21.3 million, or $0.40 per basic and diluted share, and $40.3 million, or $0.86 per basic and diluted share for the quarter and six months ended June 30, 2022.

Internet Posting of Information

Axcella uses the “Investors and News” section of its website, www.axcellatx.com, as a means of disclosing material nonpublic information, to communicate with investors and the public, and for complying with its disclosure obligations under Regulation FD. Such disclosures include, but may not be limited to, investor presentations and FAQs, Securities and Exchange Commission filings, press releases, and public conference calls and webcasts. The information that we post on our website could be deemed to be material information. As a result, we encourage investors, the media and others interested to review the information that we post there on a regular basis. The contents of our website shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

About Axcella Therapeutics (Nasdaq: AXLA)

Axcella is a clinical-stage biotechnology company focused on pioneering a new approach to address the biology of complex diseases using compositions of endogenous metabolic modulators (EMMs). The company’s unique model allows for the evaluation of its EMM compositions through non-IND clinical studies or IND clinical trials. For more information, please visit www.axcellatx.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, statements regarding the timing of the company’s clinical trial data readouts, the outcome of strategic alternatives, restructuring the company to advance AXA1125 in Long COVID Fatigue and its financial condition and expected cash runway into the third quarter of 2023. The words “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this press release are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, those related to the potential impact of COVID-19 on the company’s ability to conduct and complete its ongoing or planned clinical studies and clinical trials in a timely manner or at all due to patient or principal investigator recruitment or availability challenges, clinical trial site shutdowns or other interruptions and potential limitations on the quality, completeness and interpretability of data the company is able to collect in its clinical trials of AXA1125, other potential impacts of COVID-19 on the company’s business and financial results, including with respect to its ability to raise additional capital and operational disruptions or delays, changes in law, regulations, or interpretations and enforcement of regulatory guidance, whether data readouts support the company’s clinical trial plans and timing, clinical trial design and target indications for AXA1125, the clinical development and safety profile of AXA1125 and its therapeutic potential, whether and when, if at all, the company’s product candidates will receive approval from the FDA or other comparable regulatory authorities, potential competition from other biopharma companies in the company’s target indications, and other risks identified in the company’s SEC filings, including Axcella’s Annual Report on Form 10-K, Quarterly Report on Form 10-Q and subsequent filings with the SEC. The company cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. Axcella disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. Any forward-looking statements contained in this press release represent the company’s views only as of the date hereof and should not be relied upon as representing its views as of any subsequent date. The company explicitly disclaims any obligation to update any forward-looking statements.

| | | | | | | | | | | | | | |

| Axcella Therapeutics |

| Unaudited Condensed Consolidated Balance Sheets |

| (in thousands) |

| | | | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| Assets: | | | | |

| Cash and cash equivalents | | $ | 8,884 | | | $ | 17,147 | |

| | | | |

| Other assets | | 398 | | | 1,780 | |

| Total assets | | $ | 9,282 | | | $ | 18,927 | |

| Liabilities and stockholders' equity: | | | | |

| Accounts payable | | $ | 8,395 | | | $ | 4,707 | |

| Accrued expenses and other current liabilities | | 1,754 | | | 7,849 | |

| Current portion of operating lease liability | | 1,391 | | | 1,592 | |

| Total current liabilities | | 11,540 | | | 14,148 | |

| Operating lease liability | | — | | | 569 | |

| Other non-current liabilities | | — | | | 46 | |

| Total liabilities | | 11,540 | | | 14,763 | |

| Stockholders' equity (deficit) | | (2,258) | | | 4,164 | |

| Total liabilities and stockholders' equity | | $ | 9,282 | | | $ | 18,927 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Axcella Therapeutics |

| Unaudited Condensed Consolidated Statements of Operations |

| (in thousands, except share and per share data) |

| | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating expenses: | | | | | | | |

| Research and development | $ | 1,224 | | | $ | 16,866 | | | $ | 2,657 | | | $ | 30,410 | |

| General and administrative | 2,319 | | | 3,753 | | | 5,069 | | | 8,539 | |

| | | | | | | |

| Total operating expenses | 3,543 | | | 20,619 | | | 7,726 | | | 38,949 | |

| Loss from operations | (3,543) | | | (20,619) | | | (7,726) | | | (38,949) | |

| Other income (expense): | | | | | | | |

| | | | | | | |

Interest income (expense) and other income (expense), net | 130 | | | (687) | | | 337 | | | (1,396) | |

| Total other income (expense), net | 130 | | | (687) | | | 337 | | | (1,396) | |

| Net loss | $ | (3,413) | | | $ | (21,306) | | | $ | (7,389) | | | $ | (40,345) | |

| Net loss per share, basic and diluted | $ | (0.05) | | | $ | (0.40) | | | $ | (0.10) | | | $ | (0.86) | |

| Weighted average common shares outstanding, basic and diluted | 73,688,558 | | | 52,616,279 | | | 73,678,881 | | | 47,052,105 | |

| | | | | | | | |

| Company Contact | | |

ir@axcellatx.com | | |

| (857) 320-2200 | | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

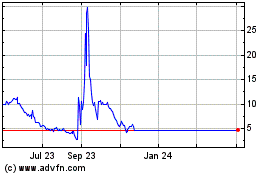

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Feb 2025 to Mar 2025

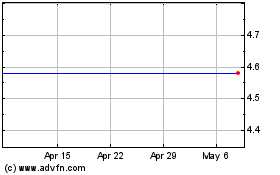

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Mar 2024 to Mar 2025