A CLOSED - END FUND LISTED ON NASDAQ (TICKER: BANX) QUARTERLY UPDATE | 3Q 2024 Filed Pursuant to Rule 497(a) Registration No. 333 - 197689 Rule 497ad

2 ARROWMARK FINANCIAL CORP. (BANX) Disclaimers & Disclosures Forward - Looking Statements This presentation, and all oral statements made regarding the subject matter of this communication, contain forward - looking statements, including statements regarding the matters described in this presentation . Such forward - looking statements reflect current views with respect to future events and financial performance . Statements that include the words “should,” “would,” “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” and similar statements of a future or forward - looking nature identify forward - looking statements in this material . All such forward - looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements . Actual future results may differ significantly from those stated in any forward - looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of shares of common stock, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in ArrowMark Financial Corp . ’s (NASDAQ : BANX) (“Fund”) filings with the SEC, which are available at the SEC’s website http : //www . sec . gov . Any forward - looking statements speak only as of the date of this communication . The Fund undertakes no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . You are cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof . About ArrowMark Financial Corp . ArrowMark Financial Corp . is an SEC registered non - diversified, closed - end fund listed on the NASDAQ Global Select Market under the symbol “BANX . ” Its investment objective is to provide shareholders with current income . BANX’s primary investment objective is to provide stockholders with current income . We attempt to achieve our investment objectives through investments in preferred equity, subordinated debt, convertible securities, regulatory capital relief securities and, to a lesser extent, common equity . Together with banks, we refer to these types of companies as banking - related and intend, under normal circumstances, to invest at least 80 % of the value of our net assets plus the amount of any borrowings for investment purposes in such businesses . There is no guarantee that we will achieve our investment objective . The Fund is managed by ArrowMark Asset Management LLC (“ArrowMark”) . ArrowMark Asset Management, LLC is majority owned by ArrowMark Colorado Holdings LLC (“ArrowMark Partners”) . ArrowMark Partners is a registered investment adviser . ArrowMark has entered into a staffing agreement (the “Staffing Agreement”) with its parent company, ArrowMark Partners and several of its affiliates . Under the Staffing Agreement, ArrowMark Partners provides experienced investment professionals to ArrowMark and provides access to their senior investment personnel . ArrowMark capitalizes on the significant deal origination, credit underwriting, due diligence, investment structuring, execution, portfolio management and monitoring of ArrowMark Partners’ investment professionals . About Destra Capital Advisors Founded in 2008 , Destra Capital Advisors LLC (“ Destra ”) was built to help independent thought leaders achieve better wealth outcomes by sourcing the next generation of investment solutions . Destra provides secondary market services for eleven listed closed - end funds by responding to investor inquiries, providing information about the Funds and their portfolios, assisting with communication efforts, and speaking with institutional investors and financial advisors . Destra Capital Advisors LLC, a registered investment advisor, is providing secondary market servicing for the Fund . To learn more, visit ir . arrowmarkfinancialcorp . com or contact Destra Capital Advisors at 877 - 855 - 3434 or BANX@destracapital . com .

ArrowMark Financial Corp. (BANX) Portfolio and Performance Regulatory Capital Relief Overview Financials Key Personnel

4 ARROWMARK FINANCIAL CORP. (BANX) ArrowMark Financial Corp. (NASDAQ: BANX) Overview ArrowMark Financial Corp. (BANX) (the “Fund”) SEC registered closed - end investment management fund Inception Date November 13, 2013 Investment Objective Provide shareholders with current income. The Fund’s strategy has a focus on income generation, capital preservation, and providing risk - adjusted rates of return. Investment Adviser ArrowMark Asset Management LLC (“ ArrowMark ”) and its affiliates are one of the largest and longest - tenured investors in the regulatory capital relief or risk - sharing market, with a 14 - year track record of partnering with the leading global bank issuers. Investment Positioning Meaningful floating rate assets (approximately 87%) positions well in an elevated interest rate environment and can be considered as a potential hedge to inflation. History ArrowMark was appointed investment advisor to the Fund in February 2020. Subsequently, the Fund changed its name from StoneCastle Financial Corp. to ArrowMark Financial Corp. Total Assets 1 $211 million Historical Distribution Rate 2 9.1% Premium / (Discount) to NAV ( 4.8 %) Data as of 9 / 30 / 2024 unless otherwise indicated . Source : ArrowMark Financial Corp . Past performance is no guarantee of future results . 1 Total Gross Assets . 2 Distribution yield calculation based on last four quarters and includes quarterly and special income distributions but excludes $ 0 . 42 long term capital gains distribution, divided by closing share price as of 11 / 22 / 2024 . Di stributions from net investment income, if any, are declared and paid quarterly . Distributions, if any, of net short - term capital gain and net capital gain (the excess of net long - term capital gain over the short - term capital loss) realized by t he Fund, after deducting any available capital loss carryovers, are declared and paid to shareholders at least annually . Income distributions and capital gain distributions are determined in accordance with U . S . federal income tax regulations, which may differ from U . S . GAAP . These differences include the treatment of non - taxable distributions, losses deferred due to wash sales and excise tax regulations . Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications within the components of net assets .

5 ARROWMARK FINANCIAL CORP. (BANX) 9.1% Distribution Yield 2 RCRS typically issued by large, global banks 11 Industry Focused Credit Analysts 14.0% Q3 2024 Portfolio Investment Yield 3 Differentiated Closed - End Fund 1 with a Strong Track Record 1 Data as of 9 / 30 / 2024 unless otherwise noted . Source : ArrowMark Financial Corp . 2 Distribution yield calculation based on last four quarters and includes quarterly and special income distributions but excludes $ 0 . 42 long term capital gains distribution, divided by closing share price as of 11 / 22 / 2024 . 3 Portfolio investment yield is calculated as annualized income from long term investments held at quarter end divided by total assets . 4 Year end distributions include declared, special, but excludes capital gains distributions . 5 ArrowMark acquired the management rights to BANX on February 12 , 2020 . Comparisons under ArrowMark leadership is vs either year end 2019 or fourth quarter 2019 performance . Unique investment vehicle dedicated to investments in regulatory capital relief securities (86.8% of Total Assets) ▪ Majority of BANX regulatory capital relief securities issued by banks with Total Assets > $500 billion (e.g. global money center banks) and rank as senior unsecured obligations ▪ Reference loan portfolios consist of strong credit quality loans, with a dollar weighted average rating typically ranging from BB+ to BBB - ▪ Reference loan portfolios benefit from strong borrower, geographic, and sector diversification ▪ Regulatory capital relief securities coupons float using a base rate plus contractual spread Fund supported by established investment firm & seasoned leadership team ▪ ArrowMark Partners manages $20.3bn platform with proprietary investment sourcing and significant resources including 46 investment professionals with an average of 18 years of experience ▪ BANX benefits from an experienced senior management team with decades of experience as credit and risk managers ▪ Disciplined investment approval process focused on asymmetric, risk - adjusted returns. Regulatory capital relief securities reference loans are individually analyzed by our 11 industry focused credit analysts Strong earning performance under ArrowMark leadership 4 ▪ BANX has consistently outearned its distribution with quarterly EPS having increased by +73% (Q3 2024 vs Q4 2019) 4 . For Q3 2024, EPS of $0.70 exceeded the declared distribution of $0.45 per share ▪ Distributions increased by +25.0% (LTM Q3 2024 vs YE 2019) 4,5 . The Q32024 distribution represents a yield of approximately 9.1%. 2 All distributions during this period have come from net income or realized long - term capital gains ▪ Net asset value has remained relatively stable since Q4 2019 ▪ Q3 2024 portfolio investment yield increased to 14.0% from ~9.6% (Q4 2019) 3

6 ARROWMARK FINANCIAL CORP. (BANX) Founded in 2007 by investment professionals with a proven track record of delivering strong returns and preserving client capital $20.3 billion in Assets Under Management 1 ArrowMark Partners At - A - Glance ArrowMark Partners has significant capabilities and expertise as a well - established investment manager ▪ Active investment process, driven by fundamental research and analysis ▪ Specialized expertise in nuanced credit and inefficient equity markets ▪ Manage alternative, traditional, and customized investment strategies in public and private vehicles ▪ 100 employees ▪ 46 tenured investment professionals ▪ 100% employee - owned ▪ 50% of firm partners are women and/or minorities ▪ Headquartered in Denver, CO with presence in California, London, and New York As of 9/30/202 4 . 1 CRE AUM includes real estate related assets originated and/or currently managed or advised by ArrowMark or its affiliate. Oth er includes sovereign wealth, not - for - profit institutions, union, multi - employer and internal capital. Firm level track record is available upon request. Equity , $8.0 Credit & Multi - Asset , $5.5 CLO Funds , $4.6 Commercial Real Estate , $2.2 By Asset Type ($B) By Investor Type ($B) CLO Funds , $4.6 Sub - Advisory , $4.0 Corporate / Public , $3.8 Family Office / HNW , $3.1 Insurance , $2.3 Retail / Intermediary , $1.5 Other , $1.0

7 ARROWMARK FINANCIAL CORP. (BANX) Partnership with an Experienced, Senior Investment Team R EGULATORY C APITAL R ELIEF T EAM BANX I NVESTMENT C OMMITTEE Kaelyn Abrell Partner 26 Years’ Experience Karen Reidy, CFA Partner 36 Years’ Experience Sanjai Bhonsle Partner ArrowMark Partners’ 46 Investment Professionals Average 18 Years’ Experience and have a presence in Denver, London, New York, and San Francisco As of 9/30/2024. 12 Corporate Credit Investment Professionals 2 CRE Investment Professionals & 14 Originators/Underwriters 4 Additional Investment Professionals 19 Equity Investment Professionals L EVERAGED C REDIT T EAM Dana Staggs 22 Years’ Experience AJ Somers 18 Years’ Experience Sanjai Bhonsle 30 Years’ Experience Nine Denver - and London - Based Investment Analysts Average 15 Years’ Experience

ArrowMark Financial Corp. (BANX) Portfolio and Performance Regulatory Capital Relief Overview Financials Key Personnel

9 ARROWMARK FINANCIAL CORP. (BANX) BANX has produced a relatively stable and consistent NAV from a high - quality investment portfolio NAV and Market Price Over Time (As of 9/30/2024) Total Return Based on NAV (As of 9/30/2024) 1 Year 3 Year 5 Year 10 Year BANX 14.03% 10.59% 9.75% 8.93% Bloomberg Aggregate 1 11.57% - 1.39% 0.33% 1.84% Bloomberg High Yield 2 15.74% 3.10% 4.72% 5.04% Data as of 9 / 30 / 2024 . Past performance is no guarantee of future results . ArrowMark Financial Corp . commenced operations on November 13 , 2013 . Source : BNY, ArrowMark Financial Corp . NAV calculation includes management fee and all other expenses paid by the Fund . Dividends are reinvested in accordance with the Fund’s Dividend Reinvestment Plan . Market Price calculation based on share market price and reinvestment of distributions at the price obtained under the Dividend Reinvestment Plan . Total return does not include sales load and offering expenses . 1 Bloomberg U . S . Aggregate Bond Index (“Bloomberg Aggregate”) (including interest income) covers the U . S . dollar - denominated, investment - grade, fixed - rate, taxable bond market of SEC - registered securities . The index includes bonds from the Treasury, government agency, corporate, plus mortgage - and asset - backed sectors . 2 Bloomberg U . S . Corporate High Yield Index (“Bloomberg High Yield”) represents the U . S . dollar denominated, non - investment grade, fixed - rate, taxable corporate bond market . $21.73 $20.69 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 12/31/2013 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 09/30/15 12/31/15 03/31/16 6/30/2016 09/30/16 12/31/16 03/31/17 6/30/2017 09/30/17 12/31/17 3/31/2018 6/30/2018 09/30/18 12/31/18 03/31/19 06/30/19 09/30/19 12/31/19 03/31/20 06/30/20 09/30/20 12/31/20 03/31/21 06/30/21 09/30/21 12/31/21 03/31/22 06/30/22 09/30/22 12/31/22 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 NAV Market Price

10 ARROWMARK FINANCIAL CORP. (BANX) Historically provided relatively stable declared distribution Data as of 12/4/2024. Source: ArrowMark Financial Corp. 1 Distributions from net investment income, if any, are declared and paid quarterly. Distributions, if any, of net short - term capital gain and net capital gain (the excess of net long - term capital gain over the short - term capital loss) realized by the Fu nd, after deducting any available capital loss carryovers are declared and paid to shareholders at least annually. Income distributions and capital gain distributions are determined i n a ccordance with U.S. federal income tax regulations, which may differ from U.S. GAAP. These differences include the treatment of non - taxable distributions, losses deferred due to wa sh sales and excise tax regulations. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications within the components of net as sets. 1 Per the 12/4/2024 press release, a $0.45 per share quarterly distribution and a $0.20 per share special distribution will be payable 1/3/2025 to shareholders of record on 12/26/2024. 6+ Years of Consistent Distributions 1 ( As of 1 /1/2018 – 12/4/2024) Distribution per share $1.52 $1.52 $1.52 $1.52 $1.56 $1.68 $1.35 $0.14 $0.05 $0.10 $0.10 $0.10 $0.42 $0.45 $0.20 $- $0.50 $1.00 $1.50 $2.00 $2.50 2018 2019 2020 2021 2022 2023 2024 YTD Declared Distributions Special Distributions Long Term Capital Gain Distribution Declared Dividend Not Paid Yet Special Distributions Not Paid Yet 1 1

11 ARROWMARK FINANCIAL CORP. (BANX) $0.38 $0.38 $0.38 $0.38 $0.38 $0.38 $0.38 $0.38 $0.39 $0.39 $0.39 $0.39 $0.39 $0.39 $0.45 $0.45 $0.45 $0.45 $0.45 $0.39 $0.41 $0.42 $0.46 $0.40 $0.40 $0.40 $0.41 $0.42 $0.43 $0.46 $0.53 $0.62 $0.62 $0.72 $0.67 $0.70 $0.70 $0.70 – $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Per Share Declared Distribution Per Share (Excl. Special and Capital Gains) Net Investment Income Per Share BANX has consistently out - earned its quarterly distribution Data as of 9/30/2024. Source: ArrowMark Financial Corp. Income distributions and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP. These differences include the treatment of non - taxable distributions, losses deferred due to wa sh sales and excise tax regulations. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications within the components of net as sets. Quarterly Declared Distributions (Excl. Special and Capital gains) and Net Investment Income All quarterly declared distributions (excluding special and long - term capital gains distributions) have been more than covered by net investment income ▪ Net investment income growth has ramped since Q 3 2022 , benefiting from : ▪ Percentage mix shift of portfolio to higher yielding regulatory capital relief securities ▪ Rising interest rate environment, benefits from floating rate assets ▪ ArrowMark raised declared distributions to $ 0 . 39 and $ 0 . 45 per share in Q 1 2022 and Q 3 2023 , respectively ▪ Some of the excess earnings over declared distributions have been returned to shareholders in the form of Special Distributions ArrowMark acquired management rights to BANX on Feb 12, 2020

12 ARROWMARK FINANCIAL CORP. (BANX) ArrowMark Financial Corp Bloomberg US Treasury Bills TR USD Bloomberg US Agg Bond TR USD Bloomberg Global Aggregate TR USD Bloomberg US Corporate High Yield TR USD FTSE WGBI NonUSD USD Credit Suisse Leveraged Loan USD ICE BofA Fxd Rate Pref TR USD S&P 500 TR USD S&P 500 Sec/Financials TR USD MSCI EAFE GR USD MSCI EM GR USD FTSE Nareit All Equity REITS TR USD Bloomberg Commodity TR USD LBMA Gold Price PM USD ArrowMark Financial Corp 1 Bloomberg US Treasury Bills TR USD - 0.05 1 Bloomberg US Agg Bond TR USD 0.11 0.24 1 Bloomberg Global Aggregate TR USD 0.23 0.23 0.95 1 Bloomberg US Corporate High Yield TR USD 0.05 0.61 0.7 0.7 1 FTSE WGBI NonUSD USD 0.23 0.9 0.99 0.7 0.7 1 Credit Suisse Leveraged Loan USD - 0.03 0.21 0.32 - 0.08 0.31 0.31 1 ICE BofA Fxd Rate Pref TR USD 0.37 0.1 0.72 0.81 0.85 0.68 0.56 1 S&P 500 TR USD 0.38 0 0.55 0.63 0.84 0.63 0.61 0.77 1 S&P 500 Sec/Financials TR USD 0.47 - 0.05 0.37 0.49 0.78 0.5 0.64 0.71 0.87 1 MSCI EAFE GR USD 0.41 0.06 0.57 0.7 0.78 0.7 0.61 0.76 0.89 0.87 1 MSCI EM GR USD 0.52 0.05 0.54 0.67 0.73 0.67 0.61 0.69 0.71 0.66 0.79 1 FTSE Nareit All Equity REITS TR USD 0.02 0.61 0.67 0.81 0.64 0.61 0.77 0.87 0.78 0.84 0.68 0.65 1 Bloomberg Commodity TR USD 0.42 - 0.26 - 0.03 0.13 0.47 0.17 0.26 0.41 0.5 0.47 0.48 0.39 0.39 1 LBMA Gold Price PM USD 0.13 0.2 0.41 0.53 0.22 0.57 0.12 0.21 0.16 0.02 0.2 0.36 0.22 0.14 1 BANX NAV shows low correlation with key asset classes BANX Net Asset Value (“NAV”) Correlation (October 2019 – September 2024) Data as of 9/30/2024 per Morningstar. Past performance is no guarantee of future results. ArrowMark Financial Corp. commenced operations on November 13, 2013. Source: BNY, ArrowMark Financial Corp. NAV calculation includes management fee and all other expenses paid by the Fund. Dividends are rein ves ted in accordance with the Fund’s Dividend Reinvestment Plan. Market Price calculation based on share market price and reinvestment of distributions at the price obtain ed under the Dividend Reinvestment Plan. Total return does not include sales load and offering expenses. Bloomberg U.S. Aggregate Bond Index (including interest income) covers the U. S. dollar - denominated, investment - grade, fixed - rate, taxable bond market of SEC - registered securities. The index includes bonds from the Treasury, government agency, corporate, plus mortgage - and asset - backed sectors. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index is an index that measures the performance of high yield, non - investment grade c orporate bonds, with a maximum allocation of 2% to any one issuer. BANX Monthly NAV Correlation vs other Asset Classes

13 ARROWMARK FINANCIAL CORP. (BANX) GSIB , 78% Non - GSIB; Total Assets >$750B , 17% Non - GSIB; Total Assets $500B to $750B , 3% Non - GSIB; Total Assets $150B to $500B , 2% Fund Exposure (9/30/2024) Regulatory capital relief securities comprise majority of total assets Diversification does not eliminate the risk of experiencing investment loss. Regulatory Capital Relief Issuers by Bank Type 1 (9/30/2024) G - SIBs (Globally Systemic Important Banks) are large, global banking institutions subject to more stringent regulatory oversight G - SIB: Globally Systemic Important Banks per Financial Stability Board as of 11/27/2023. As of 9/30/2024, BANX G - SIB issuers consist of banks with >$800 billion in Total Assets with a median and mean Total Assets of over $1.6 trillion in assets Regulatory Capital Relief Securities , 87% Structured Debt , 5% Term Loans , 5% Money Market , 2% Trust Preferred and Preferred Securities , 1%

ArrowMark Financial Corp. (BANX) Portfolio and Performance Regulatory Capital Relief Overview Financials Key Personnel

15 ARROWMARK FINANCIAL CORP. (BANX) Past performance is no guarantee of future results. Diversification does not eliminate the risk of experiencing investment loss. Please review the “Certain Risk Factors” and “Po ten tial Conflicts of Interest” sections in the Partnership’s Memorandum for a more complete description of the risks and conflicts of in terest associated with investing in the Partnership. Income - Driven Returns with Low Correlation ▪ Performance primarily driven by income from f loating - rate coupons ▪ Historical returns characterized by resilience during periods of market and/or macroeconomic stress ▪ Low historical correlation to most traditional and alternative asset classes Diversified Pools of P erforming Reference Loans ▪ Credit risk from a portfolio of loans and revolving lines of credit (“reference portfolio”) extended to investment grade and near investment grade borrowers is transferred to holders of regulatory capital relief securities ▪ Performance of regulatory capital relief securities is underpinned by the performance of these loans ▪ Reference loans are originated with the intention to be held on the balance sheet as part of the issuing bank’s core lending book ▪ Geographic, sector, and individual borrower diversification enforced by transaction guidelines Structural Alignment with Issuing Banks ▪ Issuers service loans and retain material exposure to underlying reference loans through the transaction structure ▪ Loan officers and account managers are typically unaware of any regulatory capital relief securities risk transfer of loans they manage. Banks and their employees are incentivized to maintain underwriting discipline in an effort to minimize defaults and, if defaults occur, maximize recoveries ▪ Investors benefit from the issuing bank’s borrower relationships as well as their underwriting, monitoring, and workout resources Effective Tool for Large, Global Bank Issuers ▪ Transactions are a core balance sheet optimization tool and complement other efforts to optimize capital levels, reduce balance sheet concentrations, manage lending capacity, and respond to regulatory and/or accounting changes ▪ Enable banks to maintain core lending activities that are often prerequisites to gaining investment and commercial banking business ▪ Benefits reinforced by issuance growth and issuer expansion across the U.K., Europe, Canada, U.S., and Asia What are regulatory capital relief securities?

16 ARROWMARK FINANCIAL CORP. (BANX) Security Reference Portfolio 1 1 The investments described herein are noted for illustration purposes only. It should not be assumed that this example or futu re investments will be profitable. If any assumptions used do not prove to be true, results may vary substantially. Diversification does not eliminate the risk of experiencing investment los s. Characteristics are based on the composition of the loan pool at issuance in 2023. 2 Credit quality based on issuing bank’s internal rating methodology. Typical Reference Portfolio Characteristics Reference Loans Description ▪ Originated with the intention to be held on the issuing bank’s balance sheet ▪ Performing at the time of security issuance ▪ Remain part of the bank’s core loan portfolio after issuance Credit Quality ▪ Investment grade / near investment grade weighted average ▪ Individual exposures range from AA to B - ; nothing below B - at issuance ▪ Limits on the size of individual and aggregate exposures to sub - investment grade borrowers Diversification Guidelines ▪ Geographic ▪ Sector ▪ Borrower BBB - Weighted Average Credit Quality Large Corporate Security 2023 58% Revolvers as % of Portfolio 0.28% Average Borrower Exposure $24bn Average Market Capitalization 3.3x Average Net Leverage 91% Borrowers Domiciled in North America & Developed Europe Regulatory capital relief securities offer investors a diversified pool of performing reference loans with strong credit quality

17 ARROWMARK FINANCIAL CORP. (BANX) Regulatory Capital Relief Security Unhedged Exposure (retained by issuer) Security Reference Portfolio Equity and/or mezzanine tranche(s) (external investors) Senior tranche (retained by issuer) Denotes the regulatory capital relief security The above characteristics are hypothetical and do not represent a particular investment. Security Attributes Align with Investors’ Objectives Coupon ▪ Floating rate ▪ Base rate plus a contractual spread ▪ Paid/distributed quarterly ▪ Not subject to potential discretionary suspension Duration ▪ 0.25 years Expected Maturity ▪ 3 to 5 years for new issues Issuer ▪ Established global financial institutions in the U.K., Europe, Canada, U.S., and Asia Banks are Incentivized to Maintain Disciplined Underwriting Processes and Standards Issuing Bank Retention ▪ Unhedged exposure outside the security structure ▪ Senior tranche ▪ Equity tranche of mezzanine - only tranche issuances Unique issuer alignment and investment characteristics

18 ARROWMARK FINANCIAL CORP. (BANX) Under Basel II ($mm) Under Basel III ($mm) Under Basel III with a Regulatory Capital Relief Transaction ($mm) Reference Portfolio $1,000 $1,000 $1,000 Risk - Weighted Assets $1,000 $1,000 $500 Portfolio Yield to the Bank (assumes 5% weighted average coupon) $50 $50 $50 Coupon Paid to Investors n/a n/a - $9 Bank Cost of Capital - $34.8 - $42.6 - $36.3 Net Interest Margin $15.2 $7.4 $4.7 Tier 1 Capital Ratio 4.0% 10.5% 10.5% Required Tier 1 Capital $40 $105 $52.5 Return on Tier 1 Capital 38.0% 7.0% 9.0% Risk sharing an effective tool for Banks’ balance sheet management Reduced by 50% 160%+ increase in required tier 1 capital negatively impacts a bank’s return on capital ▪ Return on Tier 1 Capital increases +27% from 7.0% to 9.0% ▪ $52.5mm of Tier 1 Capital can be redeployed The above example is hypothetical and does not represent the economics of a particular bank . Small changes to any of the assumptions incorporated in the example may lead to a significant change in outputs . Assumptions in the example include : 1 ) 100 % risk weighting for exposures to corporate credit ; 2 ) 50 % reduction in risk weighted assets for the bank through the issuance of a regulatory capital relief security with a $ 90 mm equity tranche and 10 % coupon ; 3 ) 5 % weighted average coupon for the reference portfolio ; 4 ) 3 % debt cost of capital and 15 % equity cost of capital .

ArrowMark Financial Corp. (BANX) Portfolio and Performance Regulatory Capital Relief Overview Financials Key Personnel

20 ARROWMARK FINANCIAL CORP. (BANX) Statement of Assets and Liabilities (unaudited) September 30, 2024 June 30, 2024 Assets Unaffiliated Investments in securities, at fair value cost: $197,882,783 and $202,773,752 respectively) $ 194,138,087 $ 196,381,090 Affiliated Investments in securities, at fair value cost: $14,714,671 and $14,706,678 respectively) 11,182,150 11,091,504 Receivable for Investments sold - - Interest and dividends receivable 3,723,786 4,041,128 Foreign cash (cost: $361,055 and $986,210 respectively) 404,202 985,893 Cash 1,147,021 790,655 Unrealized appreciation on forward currency exchange contracts 208,068 11,336 Prepaid assets 470,125 541,294 Total assets 211,273,439 213,842,900 Liabilities Loan payable 55,500,000 58,800,000 Investment Payable - - Dividends payable 41 37 Investment advisory fee payable 926,787 932,544 Loan interest payable 20,807 59,210 Unrealized depreciation on forward currency exchange contracts - 95,917 Payable for securities purchased 8,408 8,408 Delaware franchise tax payable - 42,364 Accrued expenses payable 98,897 295,986 Total liabilities 56,554,940 60,234,466 Net Assets $ 154,718,499 $ 153,608,434 Net Assets consist of: Common stock at par ($0.001 per share) $ 7,121 $ 7,119 Paid - in - Capital 156,439,968 156,401,818 Total distributable earnings / (loss) (1,728,590) (2,800,503) Net Assets $ 154,718,499 $ 153,608,434 Net Asset Value Per Share: Common Stock Shares Outstanding 7,120,782 7,118,920 Net asset value per common share $ 21.73 $ 21.58 Market price per share $ 20.69 $ 18.44 Market price premium/(discount) to net asset value per share - 4.79% - 14.55%

21 ARROWMARK FINANCIAL CORP. (BANX) Statement of Operations (unaudited) For The Three Months Ended September 30, 2024 For The Three Months Ended June 30, 2024 Interest from unaffiliated investments $ 7,310,819 $ 7,130,256 Interest from affiliated investments 315,940 323,946 Dividends 3,934 1,121 Origination fee income 32,277 32,130 Other income (service fees and due diligence fees) 22,517 30,662 Total Investment Income 7,685,486 7,518,115 Expenses Investment advisory fees 926,787 932,544 Interest expense 1,119,307 1,045,715 Directors' fees 53,541 52,960 Transfer agent, custodian fees and administrator fees 79,231 76,376 Bank administration fees 74,205 73,398 Professional fees 217,137 182,337 Investor relations fees 50,166 49,227 Delaware franchise tax 23,913 21,182 Insurance expense 19,481 19,270 Valuation fees 51,507 47,486 Printing - - Miscellaneous fees (proxy etc.) 90,865 85,547 Total expenses 2,706,140 2,586,042 Less: Advisory fee waiver (20,734) (20,734) Net expenses after waivers ` 2,685,406 2,565,308 Net Investment Income 5,000,080 4,952,807 Realized and Unrealized Gain / (Loss) on Investments and Foreign Currency Transactions Net realized gain / (loss) on investments (843,829) 1,054,910 Net realized gain from forward foreign currency contracts (2,602,984) 216,111 Net realized gain / (loss) from foreign currency translations (318,281) 347,966 Net change in net unrealized appreciation / (depreciation) on unaffiliated investments 2,647,966 (761,596) Net change in net unrealized appreciation / (depreciation) affiliated on investments 82,653 (376) Net change in unrealized appreciation / (depreciation) on forward currency contracts 292,648 (213,499) Net change in unrealized appreciation / (depreciation) on foreign currency translations 17,173 5,703 Net realized and unrealized gain/(loss) on investments, forward foreign currency contracts and foreign currency translations (724,654) 649,219 Net Increase in Net Assets Resulting From Operations $ 4,275,426 $ 5,602,026

22 ARROWMARK FINANCIAL CORP. (BANX) Financial Highlights (unaudited) (1) Based on the average shares outstanding during quarter. (2) Reflects reinvestment of distributions at the price obtained under the Dividend Reinvestment Plan. Total return does not inc lude sales load and offering expenses and are not annualized. (3) Excluding interest expense, the ratio would have been 4.05% and 3.85%. (4) Ratio of expenses before waivers to average managed assets equals 5.05% and 4.88%. (5) Ratio of expenses after waivers to average managed assets equals 5.09% and 4.84%. (6) Ratio of net investment income to average managed assets equals 9.40% and 9.81%. (7) Calculated by subtracting the Company's total liabilities (excluding the loan) from the Company's total assets and dividi ng the amount by the loan outstanding in 000's. * Annualized **Not - annualized For The Three Months Ended September 30, 2024 For The Three Months Ended June 30, 2024 Per Share Operating Performance Net Asset Value, beginning of period $ 21.58 $ 21.24 Net investment income (1) 0.70 0.70 Net realized and unrealized gain (loss) on investments (0.10) 0.09 Total from investment operations 0.60 0.79 Less distributions to shareholders From net investment income (0.45) (0.45) Total distributions (0.45) (0.45) Net asset value, end of period $ 21.73 $ 21.58 Per share market value, end of period $ 20.69 $ 18.44 Total Investment Return (2) Based on market value 14.67% - 0.53% Based on net asset value 2.91% 4.13% Ratios and Supplemental Data Net assets, end of period (in millions) $ 154.7 $ 153.6 Ratios (as a percentage to average net assets): Expenses before waivers (3)(4) * 6.99% 6.21% Expenses after waivers (5) * 6.94% 6.16% Net investment income (6) * 12.92% 13.11% Portfolio turnover rate ** 3% 4% Revolving Credit Agreement Total revolving credit agreement outstanding (000's) $ 55,500 $ 58,800 Asset coverage per $1,000 for revolving credit agreement (7) 3,788 3,612

ArrowMark Financial Corp. (BANX) Portfolio and Performance Regulatory Capital Relief Overview Financials Key Personnel

24 ARROWMARK FINANCIAL CORP. (BANX) Key Fund Personnel SANJAI BHONSLE | CHAIRMAN & CEO Mr . Bhonsle was elected Chairman & CEO of ArrowMark Financial Corp . in February 2020 . Mr . Bhonsle joined ArrowMark Partners in October 2012 and serves as Partner and Portfolio Manager for ArrowMark’s Partners leveraged loan investments and collateralized loan obligation funds . Prior to joining the firm, he founded MB Consulting Partners in 2009 , where he specialized in financial and operational restructuring advisory to stressed and distressed middle - market companies . With decades of restructuring experience, he has led numerous assignments across various industries . Sanjai was a Senior Portfolio Manager at GSO Capital Partners, a subsidiary of The Blackstone Group, and member of the Investment and Management Committee ( 2005 - 2009 ) . Prior to joining GSO Capital Partners, Sanjai was an Assistant Portfolio Manager for RBC Capital Partners’ debt investment group and was a member of the Investment Committee ( 2001 - 2005 ) . He also led the group’s restructuring efforts related to distressed investments and represented the firm’s interests on creditor committees . From 1999 - 2001 , Sanjai was a Senior Investment Analyst at Indosuez Capital Partners . Sanjai received a bachelor’s degree in Mechanical Engineering from the University of Wisconsin - Madison and an MBA from the Eli Broad Graduate School of Management at Michigan State University . DANA STAGGS | PRESIDENT Mr . Staggs was elected President of ArrowMark Financial Corp in June 2022 . Mr . Staggs joined ArrowMark in June of 2017 and is a team member of ArrowMark’s Private Capital Solutions group where he sources, structures, and manages private debt and non - control private equity investments . Prior to joining ArrowMark Partners in 2017 , he worked in similar capacities at firms to include Goldman Sachs & Co . , Barclays Private Credit Partners LLC and GE Capital . Mr . Staggs previously served over 10 years as a surface warfare officer in the U . S . Navy, having attained the rank of Lieutenant Commander . He earned a Bachelor of Science degree in Physics from the United States Naval Academy and an MBA from The Mason School of Business at the College of William and Mary .

25 ARROWMARK FINANCIAL CORP. (BANX) Key Fund Personnel PATRICK J . FARRELL | CHIEF FINANCIAL OFFICER Mr . Farrell was re - elected as ArrowMark Financial Corp . ’s Chief Financial Officer in February 2020 . He has served in this role since April 2014 . Mr . Farrell is responsible for all financial and accounting activities at ArrowMark Financial . Mr . Farrell has served as Chief Financial Officer at StoneCastle Partners, LLC since 2014 . Mr . Farrell has served as a Director of StoneCastle Trust Co . since January 2021 . He has over forty years of hands - on management experience in finance and accounting, specifically focused on domestic and off - shore mutual funds, bank deposit account programs, investment advisory and broker dealer business . Previously, Mr . Farrell was CFO/COO of the Emerging Managers Group, LP, a specialty asset management firm focused on offshore mutual funds . Prior to that, Pat was CFO at Reserve Management . Earlier in his career, Pat held financial positions at Lexington Management, Drexel Burnham Lambert, Alliance Capital and New York Life Investment Management, all focused on investment advisory activities . He began his career as an auditor at Peat Marwick Mitchell & Co . in New York . Pat holds a BS in Business Administration - Accounting from Manhattan College . Mr . Farrell is a Certified Public Accountant in New York State and a member of the American Institute of Certified Public Accountants . RICK GROVE | CHIEF COMPLIANCE OFFICER Mr . Grove was elected Chief Compliance Officer of ArrowMark Financial Corp . in February 2020 . He is a Principal and Chief Compliance Officer at ArrowMark Partners . He is also the Vice President, Chief Compliance Officer and Secretary for Meridian Fund, Inc . Before joining ArrowMark Partners in 2008 , he was Vice President and Chief Compliance Officer for Black Creek Global Advisors ( 2007 - 2008 ) . Prior to that position, Rick served as Vice President and Chief Compliance Officer for Madison Capital Management ( 2005 - 2007 ), Assistant Vice President and Director of Compliance at Janus Capital Group ( 1993 - 2005 ), and Fund Accountant for Oppenheimer Funds ( 1992 - 1993 ) . Rick graduated from the University of Wyoming with a bachelor’s degree in Accounting .

26 ARROWMARK FINANCIAL CORP. (BANX) Risk Considerations Risks are inherent in all investing. The following summarizes some, but not all, of the risks that should be considered for t he Company. For additional information about the risks associated with investing in the Company, please see the Company’s prospectus as well as other Co mpa ny regulatory filings. Investment and Market Risk: An investment in the Company’s common shares (“Common Shares”) is subject to investment risk, including the possible loss of the entire principal invested. Common Shares at any point in time may be worth less than the original investment, eve n a fter taking into account the reinvestment of Company dividends and distributions. The Company expects to utilize leverage, which will magnify investment r isk . Regulatory Capital Relief Securities Risk: Regulatory capital relief securities are subject to several risks. In particular, to all capital securities, banking regulators could change or amend existing banking regulations which could affect the regulatory treatment of regulatory capit al relief securities, where stricter regulation could make regulatory capital relief securities less desirable, or undesirable, for banks to issue, reduc ing the supply of new investments. Should an adverse regulatory development occur in the future, it would likely result in the bank issuer of such securities be ing able to redeem an investment early, which subjects the Company to reinvestment risk. Regulatory capital relief securities remain subject to the same secto r s pecific and other risks as any banking - related investment that the Company may acquire, including, but not limited to, credit risk, interest rate risk, prepaym ents, adverse changes in market value or liquidity and the quality of the loans extended by each bank to its clients. Preferred and Debt Securities Risk: Preferred and debt securities in which the Company invests are subject to various risks, including credit risk, interest rate risk, call/prepayment risk and reinvestment Annual Report | ArrowMark Financial Corp. 28 risk. In addition, preferred se cur ities are subject to certain other risks, including deferral and omission risk, subordination risk, limited voting rights risk and special redemption righ ts risk. Credit Risk: The Company is subject to credit risk, which is the risk that an issuer of a security may be unable or unwilling to make divi de nd, interest and principal payments when due and the related risk that the value of a security may decline because of concerns about the issue r’s ability or willingness to make such payments. Leverage Risk: The use of leverage by the Company can magnify the effect of any losses. If the income and gains from the securities and inve stm ents purchased with leverage proceeds do not cover the cost of leverage, the return on the Common Shares will be less than if leve rag e had not been used. Moreover, leverage involves risks and special considerations for holders of Common Shares including the likelihood of greater vo latility of net asset value and market price of the Common Shares than a comparable portfolio without leverage, and the risk that fluctuations in interes t r ates on reverse repurchase agreements, borrowings and short - term debt or in the dividend rates on any preferred shares issued by the Company will reduce th e return to the holders of Common Shares or will result in fluctuations in the dividends paid on the Common Shares. There is no assurance that a leverag ing strategy will be successful. Call/Prepayment and Reinvestment Risk : If an issuer of a security exercises an option to redeem its issue at par or prepay principal earlier than scheduled, the Company may be forced to reinvest in lower yielding securities. A decline in income could affect the Common Sh are s’ market price or the overall return of the Company.

27 ARROWMARK FINANCIAL CORP. (BANX) Risk Considerations Risks of Concentration in the Banking industry/Financial Sector: Because the Company concentrates in the banking industry and may invest up to 100% of its managed assets in the banking industry and financials sector, it will be more susceptible to adverse economic or reg ulatory occurrences affecting the banking industry and financials sector, such as changes in interest rates, loan concentration and competition. Regulatory Risk: Financial institutions, including community banks, are subject to various state and federal banking regulations that impact h ow they conduct business, including but not limited to how they obtain funding. Changes to these regulations could have an adverse ef fec t on their operations and operating results and our investments. We expect to make long - term investments in financial institutions that are subject to var ious state and federal regulations and oversight. Congress, state legislatures and the various bank regulatory agencies frequently introduce proposa ls to change the laws and regulations governing the banking industry in response to the Dodd - Frank Act, Consumer Financial Protection Bureau (the “CFPB”) rulemaking or otherwise. The likelihood and timing of any proposals or legislation and the impact they might have on our investments in financial inst itu tions affected by such changes cannot be determined and any such changes may be adverse to our investments. Federal banking regulators recently proposed ame nde d regulatory capital regulations in response to The Dodd - Frank Wall Street Reform and Consumer Protection Act (the “Dodd - Frank Act”) and Basel III pr otocols which would impose even more stringent capital requirements. In the event that a regulated bank falls below certain capital adequacy stan dar ds, it may become subject to regulatory intervention including, but not limited to, being placed into a Federal Deposit Insurance Corporation (FDIC) - admin istered receivership or conservatorship. The effect of inadequate capital can have a potentially adverse consequence on the institution’s financial c ond ition, its ability to operate as a going concern and its ability to operate as a regulated financial institution and may have a material adverse impact on our in vestments. Interest Rate Risk: The market value of convertible securities tends to decline as interest rates increase and, conversely, tends to increase as int erest rates decline. In addition, because of the conversion feature, the market value of convertible securities tends to vary with fluctu ati ons in the market value of the underlying common stock. Contingent convertible securities provide for mandatory conversion into common stock of the issuer u nde r certain circumstances. Since the common stock of the issuer may not pay a dividend, investors in these instruments could experience a reduced income ra te, potentially to zero; and conversion would deepen the subordination of the investor, hence worsening standing in a bankruptcy. In addition, so me s uch instruments have a set stock conversion rate that would cause a reduction in value of the security if the price of the stock is below the conversion pr ice on the conversion date. Convertible Securities/Contingent Convertible Securities Risk: The Company is subject to credit risk, which is the risk that an issuer of a security may be unable or unwilling to make dividend, interest and principal payments when due and the related risk that the value of a se cur ity may decline because of concerns about the issuer’s ability or willingness to make such payments. Illiquid and Restricted Securities Risk: Investment of the Company’s assets in illiquid and restricted securities may restrict the Company’s ability to take advantage of market opportunities. Illiquid and restricted securities may be difficult to dispose of at a fair price at the t ime s when the Company believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liqui d s ecurities, which may adversely affect the price that the Company pays for or recovers upon the sale of such securities. Illiquid and restricted securities a re also more difficult to value, especially in challenging markets. The risks associated with illiquid and restricted securities may be particularly acute in sit uations in which the Company’s operations require cash and could result in the Company borrowing to meet its short - term needs or incurring losses on the sale o f illiquid or restricted securities.

28 ARROWMARK FINANCIAL CORP. (BANX) NASDAQ: BANX 100 Fillmore Street, Suite 325 Denver, Colorado 80206 303.398.2929 MAIN ir.arrowmarkfinancialcorp.com Contact Information 443 N. Willson Avenue, Bozeman, Montana 59715 877.855.3434 www.destracapital.com

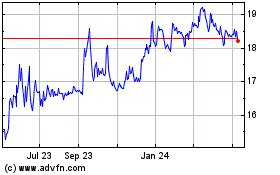

ArrowMark Financial (NASDAQ:BANX)

Historical Stock Chart

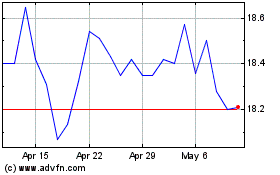

From Nov 2024 to Dec 2024

ArrowMark Financial (NASDAQ:BANX)

Historical Stock Chart

From Dec 2023 to Dec 2024