UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 7)

| BEACON ROOFING SUPPLY, INC. |

| (Name of Subject Company) |

| |

QUEEN MERGERCO, INC.

(Name of Filing

Person (Offeror))

QXO, INC.

(Name of Filing

Person (Parent of Offeror))

QUEEN HOLDCO, LLC

QUEEN TOPCO, LLC

|

| (Name of Filing Persons (Other)) |

| |

| Common Stock, par value $0.01 per share |

| (Title of Class of Securities) |

| |

| 073685109 |

| (CUSIP Number of Class of Securities) |

| |

Christopher Signorello

Chief Legal Officer

Five American Lane

Greenwich, CT 06831

(888) 998-6000 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices

and Communications on Behalf of Filing Persons) |

| |

Copies

to:

Scott A. Barshay

Nickolas Bogdanovich

Stan Richards

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

(212) 373-3000

|

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the

appropriate boxes below to designate any transactions to which the statement relates:

| |

☒ |

third-party tender offer subject to Rule 14d-1. |

| |

☐ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the

following box if the filing is a final amendment reporting the results of the tender offer. ☐

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment No. 7 (this “Amendment”) amends and supplements

the Tender Offer Statement on Schedule TO (together with any amendments and supplements thereto, this “Schedule TO”), filed

with the Securities and Exchange Commission (the “SEC”) on January 27, 2025 by QXO, Inc., a Delaware corporation (“QXO”),

and Queen MergerCo, Inc., a Delaware corporation (the “Purchaser”) and a wholly owned subsidiary of QXO. This Schedule TO

relates to the offer by the Purchaser to purchase all of the outstanding shares of common stock, par value $0.01 per share (the “Shares”),

of Beacon Roofing Supply, Inc., a Delaware corporation (“Beacon”), at $124.25 per Share, to the seller in cash, without interest

and less any required withholding taxes, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated January

27, 2025 (together with any amendments or supplements thereto, the “Offer to Purchase”) and in the related Letter of Transmittal,

copies of which are attached to this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, which, together with any amendments

or supplements thereto, collectively constitute the “Offer”.

Except as otherwise set forth in this Amendment,

the information set forth in this Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the

items in this Amendment. Capitalized terms used but not defined herein have the meanings assigned to such terms in the Offer to Purchase.

Items 11. Additional Information.

Item 11 of the Schedule TO (and Items 1 through

11 of the Schedule TO, to the extent such items incorporate by reference the information contained in the Offer to Purchase) and the disclosure

under Section 11 “Background of the Offer” of the Offer to Purchase, are hereby amended and supplemented by adding the following

disclosure at the end of Section 11:

“On February 20, 2025, we launched

an online portal on our website dedicated to our previously announced offer to purchase all of the outstanding shares of common stock

of Beacon.”

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended

and supplemented by adding the following exhibit:

| (a)(5)(G) |

QXO’s offer to purchase Beacon website, launched by QXO, Inc. on

February 20, 2025. |

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 21, 2025

| |

QXO, INC. |

|

| |

|

|

|

| |

By: |

/s/ Christopher Signorello |

|

| |

Name: |

Christopher Signorello |

|

| |

Title: |

Chief Legal Officer |

|

| |

|

|

|

| |

QUEEN MERGERCO, INC. |

|

| |

|

|

|

| |

By: |

/s/ Christopher Signorello |

|

| |

Name: |

Christopher Signorello |

|

| |

Title: |

Secretary |

|

| |

|

|

|

| |

QUEEN HOLDCO, LLC |

|

| |

|

|

|

| |

By: |

/s/ Christopher Signorello |

|

| |

Name: |

Christopher Signorello |

|

| |

Title: |

Secretary |

|

| |

|

|

|

| |

QUEEN TOPCO, LLC |

|

| |

|

|

|

| |

By: |

/s/ Christopher Signorello |

|

| |

Name: |

Christopher Signorello |

|

| |

Title: |

Secretary |

|

| |

|

|

|

Exhibit (a)(5)(G)

Home

Team Newsroom Our offer to buy Beacon SWK Technologies Investors Our offer to buy Beacon “Our highly attractive offer provides

Beacon’s shareholders with immediate cash at a significant premium to the unaffected share price—without regulatory delays,

financing risks, or due diligence conditions.” – Brad Jacobs, QXO chairman and chief executive officer QXO's offer What experts

are saying Debunking Beacon’s misleading claims Press releases QXO’s offer QXO’s $124.25 per share all-cash offer to

acquire Beacon Roofing Supply is highly compelling. The offer represents: A 37% premium to Beacon’s 90-day unaffected VWAP of $91.02

per share as of November 15, 2024; A 3.0x premium to Beacon’s historical next-twelve-months EBITDA multiple;1 and A higher price

than Beacon’s stock has ever traded. In addition, since November 15, 2024, Beacon’s peers have lost 8.8% in value,2 making

QXO’s offer even more attractive: A 38% premium to an implied spot share price of $90.06;3 and A 50% premium to the peer-adjusted

90-day VWAP of $83.00.3 Despite the strength of this offer, Beacon has repeatedly used delay tactics and adopted a shareholder-unfriendly

poison pill. Beacon flatly refused to engage unless QXO signed a standstill agreement—one that would have barred QXO from informing

Beacon’s shareholders about the offer. After QXO formally launched its tender offer, Beacon implemented a poison pill to obstruct

the proposal. Consensus analyst estimates indicate that Beacon will: Miss its 2025 gross margin target by 127 bps;4 Miss its 2025 EBITDA

margin target by 112 bps;4 and Report EBITDA margins 18 bps lower in 2025 than when the Ambition 2025 plan was introduced.4 Beacon insiders

recently sold shares at prices far below QXO’s offer. Since early 2024: Chairman Stuart Randle sold 21% of his shares at $94.80;5

CEO Julian Francis sold 10% of his shares at $97.91;6 and CD&R, one of the most sophisticated financial sponsors in the distribution

space, exited its position in Beacon at $83.16 per share. Beacon announced it will host an investor day on March 13, shortly after QXO

revealed its intention to engage directly with shareholders. Beacon’s newly constructed projections won’t be revealed until

more than three months after its Board first rejected QXO’s offer. The projections were undoubtedly designed to justify a higher

price, and we suspect they are based on unrealistic assumptions. If Beacon has strong, credible projections, why delay releasing them?

Beacon’s disclosures indicate that no viable competing offer was available as of February 6, 2025. Beacon’s recent filings

indicate there is no viable third-party alternative to QXO’s premium offer. Beacon’s 14D-9 filing did not report any competing

offers, or even a single NDA being signed. What experts are saying “The price Jacobs has proposed would be an all-time high and

it does top the sell side’s consensus price target for Beacon. It also looks relatively better when you factor in the losses that

Beacon’s peers have suffered since November.” — Gordon Haskett, “Event-Driven Research” (1/15/2025) “When

we first learned QXO was willing to pay $124.25, we gave that proposal a B+ grade. Today, we’re raising that to an A.” —

Gordon Haskett, “A Beacon peer taps the brakes” (2/20/2025) “Now, shareholders will have to decide to take the money

or back current management, risking a drop in the share price toward $100. The average share price last year was about $93.” —

Bloomberg Opinion, “When Brad Jacobs Talks, Investors Should Pay Attention” by Thomas Black (1/16/2025) “It seems unlikely

to us that investors will vote against the cash offer regardless of what information is given at the upcoming Beacon analyst day.”

— Truist, “QXO Continues Beacon Pressure; Still Waiting for Competing Bids” (2/10/2025) “We believe QXO’s

offer to buy Beacon for $124.25 per share in cash is compelling, and we see a high likelihood the deal gets done.” — William

Blair, “Thoughts on QXO’s $11 Billion Offer to Acquire Beacon” (1/15/2025) “Now that QXO is going public with

their bid, we would think that there would be more pressure on Beacon to sell, as the purchase price range appears fair to us in comparison

to Beacon’s historical valuation and when compared to peer multiples.” — Loop Capital, “QXO Makes Bid for Beacon

Public, PT to $127” (1/15/2025) “Though our fundamental outlook suggests a $115 target price, we believe the absence of takeout

speculation could suggest Beacon shares drop into the $90s over the near term.” — Stifel, “QXO Offer Prospects Likely

to Dictate Near-term Performance: Downgrade to Hold” (2/6/2025) “Feedback from investors so far suggests to us that Beacon

will potentially face an uphill battle convincing shareholders that its standalone path is compelling enough to forego a QXO deal.”

— RBC Capital Markets, “Beacon Response to QXO Takeout Disclosures and Initial Investor Feedback” (1/15/2025) “QXO’s

offer price appears reasonable based on peers’ valuations.” — Bloomberg Law, “Beacon Roofing, UniFirst, Sage

Among Top US M&A Targets: Survey” by Yiqin Shen (1/28/2025) QXO is “offering a 37% premium for a company that just hasn’t

done well.” — Steve Weiss, CNBC’s Halftime Report (1/15/2025) “Should QXO pull out, Beacon shares could very

likely go back down below $100.” — Loop Capital, “QXO Makes Bid for Beacon Public, PT to $127” (1/15/2025) “Prior

to the WSJ report in November, Beacon was trading at ~8.8X our 2024 EBITDA estimate, a modest discount to Beacon’s long-term 9.2X

multiple but a premium to the 7.3X average over the past 3 years as the industry continues comping strong storm demand, and well below

the ~11.5X multiple implied by QXO’s bid.” — Wolfe Research, “QXO Announces Bid for Beacon at $124.25 Per Share”

(1/15/2025) “Beacon shareholders can get a fair value and choose to buy QXO for exposure to roofing distribution and a leadership

team with a long record of value creation.” — William Blair, “Thoughts on QXO’s $11 Billion Offer to Acquire

Beacon” (1/15/2025) “[The HD/SRS] multiple does not consider any control premium for the Pool and Landscape businesses or

the rapid growth of SRS’ Pool and Landscaping businesses. Assuming a 30% control premium for those businesses, implies HD paid

closer to 12X for SRS’ Roofing business.” — Wolfe Research, “QXO Announces Bid for Beacon at $124.25 Per Share”

(1/15/2025) “Our general sense has been QXO is “winning” the “hearts and minds” campaign so far.”

— RBC Capital Markets, “The Saga Continues” (2/10/2025) “Are there any other potential bidders? Our initial sense

is the company has effectively been for sale for at least the last couple months, and no one has emerged, with a somewhat limited pool

of potential alternatives.” — RBC Capital Markets, “Beacon Response to QXO Takeout Disclosures and Initial Investor

Feedback” (1/15/2025) “[QXO's Board nominees] appear to be an extremely strong and well qualified independent slate with

extensive experience, including several nominees who have shepherded companies through transformative deals. Of note, 100% of nominees

have industrial experience, 80% have public board experience, 70% have building products distribution experience, 70% have been either

CEOs of CFOs, and 90% have M&A experience. We also note that 4 of the 10 have a roofing background with experience at OC [Owens Corning].”

— RBC Capital Markets, “QXO Formally Proposes Slate of Directors for Beacon’s AGM” (2/12/2025) “Beacon’s

long-term targets need to be taken with a grain of salt.” — RBC Capital Markets, “What is Beacon Thinking?” (2/4/2025)

“Beacon’s apparent reticence to sell is also not all that surprising: (1) insider stock ownership at Beacon is nearly de

minimis, including at the Board level; (2) it appears half of Beacon’s 10 Board members are retired, including chairman Randle

(optically suggesting increased personal incentive to retain Board membership for annual income purposes and/or “extra attention”

to personal reputational risk of being out-negotiated); (3) CD&R (private equity) no longer has Board representation, having exited

its position; and (4) senior management’s change of control payouts appear modest.” — Raymond James, “QXO Attempting

to Acquire Beacon in Hostile $124.25 per Share Bid” (1/15/2025) “Beacon’s relatively paltry change of control compensation

to management and its Board composition are such that Beacon is disincentivized to accept a takeout (by QXO or anyone else).” —

Raymond James, “The QXO/Beacon Saga Continues; Beacon Adopts Poison Pill” (1/28/2025) QXO neither requested nor received

permission to use these quotes. Debunking Beacon’s misleading claims Beacon's fiction: “Ambition 2025 has delivered above-market

growth.” Fact: Beacon’s growth has significantly lagged its peers. From 2019 through LTM September 2024, Beacon’s ~8%

revenue CAGR is the lowest of its peer group and well below the peer median of ~12%.7 Beacon's fiction: “Ambition 2025 is responsible

for Beacon’s 11 straight quarters of record net sales.” Fact: This can be attributed nearly entirely to extraordinary inflation,

aided by taking on significant debt for M&A transactions and greenfields. Importantly, Beacon is on track to miss all its Ambition

2025 margin targets. Acquiring low margin sales is not a sustainable strategy for long-term value creation. Beacon's fiction: “Beacon’s

total shareholder return of more than 200% during the past five years show Ambition 2025 has been successful.” Fact: Beacon’s

total shareholder return (TSR) numbers are not impressive in the context of the performance of its peers. Over the past five years, Beacon’s

total shareholder return has trailed its Building Products Proxy Peers by 86% and trailed those peers by 140% since CEO Julian Francis

took over as CEO in August 2019.8 Moreover, the valuation gap between Beacon’s Enterprise Value-to-EBITDA multiple and those of

its Building Products Proxy Peers has widened by 1.3x over the last three years.9 Beacon's fiction: “Continuing to run the Company’s

standalone plan will deliver substantially greater value for the Company’s stockholders than QXO’s offer.” Fact: Beacon

is tracking to miss its Ambition 2025 plan, with consensus analyst estimates indicating that Beacon will: Miss its 2025 gross margin

target by 127 bps; Miss its 2025 EBITDA margin target by 112 bps; and Report EBITDA margins 18 bps lower in 2025 than when the Ambition

2025 plan was introduced.10 Beacon’s Investor Day was announced only after QXO emphasized to Beacon that it was ready to approach

shareholders directly, and it has made shareholders wait another two months for its projections. Such a delay in disclosure suggests

the company lacks credible projections and requires the lengthy interim period to formulate them from scratch. Management itself acknowledged

in its filings that its upcoming 2028 targets are “ambitious,” implying they may not be realistic. Assuming an average historical

trading multiple of 8.1x, illustrative discount rate of 13% and 2026 consensus margins, Beacon would require extraordinary growth to

achieve $124.25 on a present value basis: ~17% implied 2024-2026 revenue CAGR,11 four times consensus revenue growth of ~4%;10 and ~21%

implied 2024-2026 EBITDA CAGR,11 compared to ~7% consensus EBITDA growth.10 Beacon's fiction: “Beacon’s Board has a firm

and demonstrated commitment to acting in the best interests of Beacon and all its shareholders.” Fact: QXO made an offer of $124.25,

which is higher than the stock has ever traded and a 37% premium to the undisturbed 90-day VWAP. Still, the company sought to try to

prevent QXO from publicizing this offer to shareholders. Beacon's Board has ignored shareholders' interests by refusing to meet with

QXO unless we agreed to a standstill agreement, preventing us from presenting this offer directly to shareholders. Beacon’s entire

Board and management team collectively own only 1.3%12 of Beacon's outstanding shares, raising questions about whether the company and

Board have the best interests of shareholders in mind. Beacon’s Board and insiders have been sellers of the stock well below $124.25.

Beacon’s chairman recently sold 21% of his shares at $94.80 and Beacon’s CEO recently sold 10% of his shares at $97.91, a

24% discount and 21% discount to QXO’s $124.25 per share offer price, respectively.5,6 Beacon's fiction: “QXO’s offer

is not compelling and is an opportunistic attempt to acquire Beacon at a discount, especially when considered against recent industry

deals, like Home Depot buying SRS Distribution.” Fact: Our offer is a 37% premium to Beacon’s unaffected 90-day VWAP and

higher than Beacon’s stock has ever traded. The offer is full and fair—and even fuller and fairer than the day we first conveyed

it, because peers have traded off. SRS does not present an accurate "apples-to-apples” comparison: SRS has generated significantly

stronger organic growth than Beacon. From 2018-2023, SRS delivered an approximately 30% revenue CAGR, far outpacing Beacon’s 5%.13

Even more impressively, over a very long period of time (2010-2022), SRS’s organic growth was dramatically higher, averaging ~20%

annually, well above ~5% for Beacon.13 There was a similarly sharp disparity in 2018-2023 EBITDA CAGR during this period, ~35% for SRS

vs. 12% for Beacon.13 At the outset of this decade, SRS generated an average ROIC of 40%. Beacon’s 2023 ROIC was 14%.13, 14 SRS

has meaningful exposure to high-growth adjacencies outside of roofing distribution, in pool and landscaping distribution; the publicly

traded industry leaders in each of these categories trade at premium multiples, and have for some time. A notional sum-of-the-parts valuation

applying Pool Corp’s and SiteOne’s multiples (inclusive of a customary control premium) reveals that SRS’s core roofing

distribution business was effectively acquired at 12x EBITDA—approximately the same multiple implied by our $124.25 offer for Beacon.15

Beacon's fiction: “Each Beacon Board member brings the skills, knowledge, experience and tenure necessary to guide the company’s

strategic and operational direction.” Fact: Beacon’s Board has limited operational and managerial experience in building

products distribution. Beacon’s current Board seems to be clinging to their seats as evidenced by excessive tenure and limited

other public directorships. Among Beacon’s current Board members: 60% have no other public directorships. Beacon’s chairman

has remained on the Board for over 18 years. The majority of Beacon’s independent directors have remained on the Board for more

than nine years. Among QXO’s slate of nominees: 80% have public board experience. 100% have experience in the industrial sector.

70% have building products distribution sector experience. 90% have M&A experience. 70% have CEO or CFO experience. Beacon's fiction:

“QXO’s offer has a high degree of conditionality.” Fact: QXO’s offer has a high degree of certainty: Committed

financing in place; Regulatory approvals secured; No due diligence conditions; and Ability to close quickly. Beacon's fiction: “QXO’s

nominations are an attempt to pressure the Board into accepting its offer.” Fact: QXO’s slate is an impressive group of accomplished

senior executives and directors from some of the best companies in the world—with significant, relevant experience. If elected,

QXO’s nominees will provide Beacon’s shareholders with an experienced Board that will independently evaluate QXO’s

offer. We have deep respect for Beacon’s shareholders—it is their company, and they deserve a Board that will represent their

interests. Press releases 2/12/2025 QXO Proposes Full Slate of Independent Directors for Election at Beacon Roofing Supply’s 2025

Annual Meeting Read more 2/12/2025 QXO Receives Antitrust Clearance for Acquisition of Beacon Roofing Supply Read more 2/10/2025 With

No Competing Offers, Beacon Roofing’s Board Stalls and Misleads Read more 2/6/2025 QXO Urges Beacon Roofing Supply to Let Shareholders

Decide on Premium All-Cash Offer of $124.25 per Share Read more 1/28/2025 QXO Comments on Beacon Roofing Supply’s Adoption of Shareholder-Unfriendly

Poison Pill Read more 1/27/2025 QXO Launches $11 Billion Tender Offer to Acquire Beacon Roofing Supply for $124.25 Per Share in Cash

Read more 1/15/2025 QXO Proposes to Acquire Beacon Roofing Supply for $124.25 Per Share in Cash Read more 1 As of November 15, 2024;

historical multiple represents three-year average through November 15, 2024; next-twelve-months EBITDA calculated using calendarized

annual broker EBITDA estimates for Beacon 2 Market data as of February 19, 2025. Average of building products subset of the peer list

presented in Beacon’s April 2024 Proxy Statement; includes: Builders FirstSource, Boise Cascade, GMS, Pool Corp, SiteOne, WATSCO,

Wesco (“Building Products Proxy Peers”) 3 Based on Beacon’s unaffected share price as of November 15, 2024 and the

average share price performance since November 15, 2024 for the Building Products Proxy Peers 4 Based on median 2025E Wall Street research

estimates, sourced from Capital IQ as of February 19, 2025 5 As per Mr. Randle’s Form 4 filed with the SEC on May 28, 2024. According

to Mr. Randle’s Form 4, this sale was not made pursuant to a Rule 10b5-1 plan or to pay any exercise price or tax liability incident

to the receipt, exercise or vesting of equity awards 6 As per Mr. Francis’s Form 4 filed with the SEC on May 22, 2024. According

to Mr. Francis’s Form 4, this sale was not made pursuant to a Rule 10b5-1 plan or to pay any exercise price or tax liability incident

to the receipt, exercise or vesting of equity awards 7 Reported revenues for Beacon and Building Products Proxy Peers 8 Market data as

of November 15, 2024. Total shareholder return reflects stock price performance adjusted for cash dividends paid, stock splits, rights

offerings and spin-offs during the period 9 As per Capital IQ as of November 15, 2024 10 Based on median 2025E Wall Street research estimates,

sourced from Capital IQ as of February 19, 2025 11 Calculated as 2025E Implied Future Share Price discounted to February 19, 2025. Assumes

cost of equity of 13.2% derived via the Capital Asset Pricing Model: Risk-Free Rate = 4.4%, Beta per Barra = 1.46, Market Risk Premium

= 6.0%. Assumes Beacon balance sheet assumptions per broker consensus estimates: 2025E Net Debt: $2.2 billion, Q3’ 2024 Fully Diluted

Shares Outstanding: 64 million. Assumes Next-Twelve-Months EBITDA multiple of 8.1x, consistent with last-three-year historical average.

QXO’s offer implied Revenue assumes 2026E consensus EBITDA margin 12 As per Schedule 14D-9 filed with the SEC on February 6, 2025

13 SRS statistics as per industry sources; Beacon statistics as per public filings 14 ROIC defined as tax-effected EBIT divided by invested

capital, with invested capital reflecting book equity and debt 15 Wolfe Research, “QXO Announces Bid for Beacon at $124.25 Per

Share” (1/15/2025) 2025 QXO, Inc. All rights reserved. Disclaimer The information contained herein (this “Site”) is

being made available to all investors. Except as otherwise stated on this Site, the claims made on this Site are based on publicly available

information about Beacon Roofing Supply, Inc. (“Beacon”). QXO, Inc. (“QXO”) disclaims any obligation to update

the information contained on this Site, except as may be required by applicable law. Certain statements made on this Site may have been

derived or obtained from filings made with the U.S. Securities and Exchange Commission (the “SEC”), other regulatory authorities

or other third party reports or sources. QXO has neither sought nor obtained consent from any third party to use any statements or information

indicated herein as having been obtained or derived from statements made or published by third parties. Although QXO believes the statements

made on this Site are accurate in all material respects and do not omit to state material facts necessary to make those statements not

misleading, QXO makes no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any

other written or oral communication it makes with respect to Beacon or otherwise. Investors should conduct their own independent investigation

and analysis of those statements and communications. The materials on this Site are provided solely for informational purposes and are

not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security. Moreover, nothing

herein should be construed as legal, tax, investment or financial advice. This Site may contain links to articles and/or videos; the

views and opinions expressed therein are those of the author(s)/speaker(s) referenced or quoted therein, unless specifically noted otherwise,

and do not necessarily represent the opinions of QXO or its affiliates. All registered or unregistered service marks, trademarks and

trade names referred to on this Site are the property of their respective owners, and QXO’s use herein does not imply an affiliation

with or endorsement by, the owners of these service marks, trademarks and trade names. Forward-Looking Statements The information herein

contains forward-looking statements. Statements that are not historical facts, including statements about beliefs, expectations, targets,

goals, regulatory approval timing and nominating directors are forward-looking statements. These statements are based on plans, estimates,

expectations and/or goals at the time the statements are made, and readers should not place undue reliance on them. In some cases, readers

can identify forward-looking statements by the use of forward-looking terms such as “may,” “will,” “should,”

“expect,” “opportunity,” “intend,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “target,” “goal,” or “continue,”

or the negative of these terms or other comparable terms. Forward-looking statements involve inherent risks and uncertainties and readers

are cautioned that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking

statements. Such factors include but are not limited to: the ultimate outcome of any possible transaction between QXO and Beacon, including

the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement

will be materially different from those proposed; uncertainties as to whether Beacon will cooperate with QXO regarding the proposed transaction;

the ultimate result should QXO commence a proxy contest for election of directors to Beacon’s Board of Directors; QXO’s ability

to consummate the proposed transaction with Beacon; the conditions to the completion of the proposed transaction, including the receipt

of any required shareholder approvals and any required regulatory approvals; QXO’s ability to finance the proposed transaction;

the substantial indebtedness QXO expects to incur in connection with the proposed transaction and the need to generate sufficient cash

flows to service and repay such debt; that operating costs, customer loss and business disruption (including, without limitation, difficulties

in maintaining relationships with employees, customers or suppliers) may be greater than expected following the proposed transaction

or the public announcement of the proposed transaction; QXO’s ability to retain certain key employees; and general economic conditions

that are less favorable than expected. QXO cautions that forward-looking statements should not be relied on as predictions of future

events, and these statements are not guarantees of performance or results. Forward-looking statements herein speak only as of the date

each statement is made. QXO does not assume any obligation to update any of these statements in light of new information or future events,

except to the extent required by applicable law. Important Additional Information and Where to Find It The information herein is

for informational purposes only and does not constitute a recommendation, an offer to purchase or a solicitation of an offer to sell

Beacon securities. QXO and Queen MergerCo, Inc. (the “Purchaser”) filed a Tender Offer Statement on Schedule TO with the

SEC on January 27, 2025, and Beacon filed a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer

with the SEC on February 6, 2025. Investors and security holders are urged to carefully read the Tender Offer Statement (including the

Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as each may be amended or supplemented

from time to time) and the Solicitation/Recommendation Statement as these materials contain important information that investors and

security holders should consider before making any decision regarding tendering their common stock, including the terms and conditions

of the tender offer. The Tender Offer Statement, Offer to Purchase, Solicitation/Recommendation Statement and related materials are filed

with the SEC, and investors and security holders may obtain a free copy of these materials and other documents filed by QXO and Beacon

with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Tender Offer Statement and other documents that QXO

and the Purchaser file with the SEC will be made available to all investors and security holders of Beacon free of charge from the information

agent for the tender offer: Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, NY 10022, toll-free telephone:

+1 (888) 750-5834. QXO and the other participants intend to file a preliminary proxy statement and accompanying WHITE universal proxy

card with the SEC to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2025

Annual Meeting of stockholders of Beacon. QXO strongly advises all stockholders of Beacon to read the preliminary proxy statement, any

amendments or supplements to such proxy statement, and other proxy materials filed by QXO with the SEC as they become available because

they will contain important information. Such proxy materials will be available at no charge on the SEC’s website at www.sec.gov

and at QXO’s website at investors.qxo.com. In addition, the participants in this proxy solicitation will provide copies of the

proxy statement, and other relevant documents, without charge, when available, upon request. Requests for copies should be directed to

the participants’ proxy solicitor. Certain Information Concerning the Participants The participants in the proxy solicitation are

anticipated to be QXO, Brad Jacobs, Ihsan Essaid, Matt Fassler, Mark Manduca, Sheree Bargabos, Paul Camuti, Karel Czanderna, Jonathan

Foster, Mauro Gregorio, Michael Lenz, Teresa May, Stephen Newlin, Joseph Reitmeier and Wendy Whiteash. As of the date hereof, QXO owns

100 shares of common stock of Beacon in record name and Ms. Czanderna may be deemed to beneficially own 10 shares of common stock of

Beacon held in a trust, for which Ms. Czanderna’s husband serves as trustee. As of the date hereof, none of the other participants

has any direct or indirect interest, by security holdings or otherwise, in Beacon.

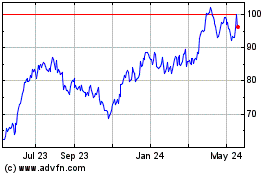

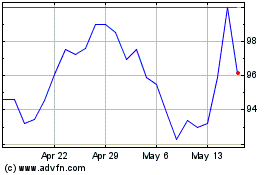

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Feb 2024 to Feb 2025