Better.com Expands Mortgage Offerings for Veterans through VA Interest Rate Reduction Refinance Loan (VA IRRRL)

12 November 2024 - 1:00AM

Business Wire

Better.com launches streamlined refinancing

solution to empower eligible veterans and active-duty service

members to reduce monthly payments

Better Home & Finance Holding Company (NASDAQ: BETR)

(“Better.com”), the leading digital homeownership company, today

announced the addition of VA Interest Rate Reduction Refinance Loan

(VA IRRRL) to their suite of mortgage products. VA IRRRL is a

streamlined refinancing solution designed specifically for eligible

veterans, active-duty service members, and surviving spouses. This

program, backed by the US Department of Veteran Affairs, allows

borrowers to refinance their existing VA loans with no appraisal,

asset or income verification requirements, and offers easier credit

qualifications allowing homeowners to secure lower interest rates

and reduce their monthly payments on an expedited timeline.

The VA IRRRL is a refinancing option available through the VA

loan program for eligible active-duty service members, veterans,

and their surviving spouses. This program simplifies the

refinancing process by reducing paperwork and eligibility

requirements, allowing you to lower monthly mortgage payments

through a reduced interest rate or to secure a fixed rate instead

of an adjustable or variable rate.

Better.com has digitized and automated the VA IRRRL process,

reducing time and costs—to deliver greater value to Veterans.

Whether you prefer a fully digital experience or want guidance from

a loan officer, Better.com adapts to your needs. This is especially

beneficial for active-duty service members and veterans, who can

complete the entire loan process online, close remotely whether

deployed overseas or at home, and take advantage of extended call

center hours. Additionally, they can access Betsy™, Better.com’s

voice-based AI loan assistant, with 24/7 support to answer loan

questions.

“At Better.com, we are committed to honoring veterans for their

service. The addition of VA IRRRL allows Better to give back to

veterans and their families through mortgage offerings that make

homeownership simpler and more affordable,” said Vishal Garg, CEO

of Better.com. “As we look ahead with optimism to a more favorable

interest rate environment, we are proud to simplify the refinancing

process for veterans, helping those who have served our country

save money and secure their financial future.”

This program is ideal for homeowners looking to lower their

monthly payments, lock in a better interest rate, or to switch to a

fixed rate from an ARM or variable rate. To qualify, borrowers must

currently hold a VA loan in good standing. The VA IRRRL features a

fixed-rate loan option and a reduced funding fee of 0.5%, which can

be waived for certain disabled veterans and surviving spouses.

Additionally, closing costs can be conveniently rolled into the new

loan, eliminating out-of-pocket expenses.

By accessing a proprietary marketplace of investors, Better.com

can offer competitive interest rates. Veterans, active-duty service

members, and qualifying spouses are encouraged to check their

eligibility and see how much they can save with a VA IRRRL at

www.better.com/va-irrrl.

About Better.com

Since 2017, Better Home & Finance Holding Company (NASDAQ:

BETR; BETRW) has leveraged its industry-leading technology

platform, Tinman™, to fund more than $100 billion in mortgage

volume. Tinman™ allows customers to see their rate options in

seconds, get pre-approved in minutes, lock in rates, and close

their loan in as little as three weeks. Better’s mortgage offerings

include GSE-conforming mortgage loans, FHA and VA loans, and jumbo

mortgage loans. Better launched its "One Day Mortgage" program in

January 2023, which allows eligible customers to go from click to

Commitment Letter within 24 hours. Better was named Best Online

Mortgage Lender by Forbes and Best Mortgage Lender for

Affordability by WSJ in 2023, ranked #1 on LinkedIn’s Top Startups

List for 2021 and 2020, #1 on Fortune’s Best Small and Medium

Workplaces in New York, #15 on CNBC’s Disruptor 50 2020 list, and

was listed on Forbes FinTech 50 for 2020. Better.com serves

customers in all 50 US states and the United Kingdom.

For more information, follow @betterdotcom.

Disclaimer: Refinancing may cause your finance charges to be

higher over the life of the loan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111551877/en/

Nneka Etoniru better@avenuez.com

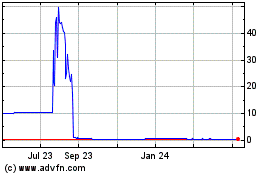

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Feb 2025 to Mar 2025

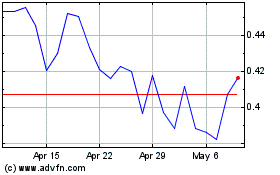

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Mar 2024 to Mar 2025