Biofrontera Inc. (Nasdaq: BFRI) (“Biofrontera” or the “Company”), a

biopharmaceutical company specializing in the development and

commercialization of photodynamic therapy (PDT), today reported

financial results for the three and nine months ended September 30,

2024 and provided a business update.

Hermann Luebbert, Chief Executive Officer and

Chairman of Biofrontera Inc., stated, “While we are pleased with

the third quarter results, we faced challenges from Hurricane

Milton that impacted our business and that of our customers in the

areas affected. The hurricane delayed the shipment of 4,640 tubes

of Ameluz, representing approximately $1.5 million in revenue. All

the tubes were shipped in October and will count towards Q4. As

reported, this reduced our quarterly growth to 1.5% and

year-to-date growth to 5.6%. Without this delay, quarterly growth

would have been 19% and year-to-date growth 12%.”

“We have made some important progress across our

business in 2024. We have seen very positive uptake of our products

throughout the United States, illustrated by the number of lamps

sold to dermatology offices. The transfer of clinical trial

activities from Biofrontera AG to Biofrontera Inc. was seamless,

with all trials progressing as planned. We continue to prepare our

FDA filing for the approval of Ameluz for the treatment of sBCC,

which we expect to submit in the 1st half of 2025. If that is the

case, we anticipate approval in early 2026. Furthermore, on October

4th the FDA approved an increase in the maximally approved dosage

from one to three tubes of Ameluz® per treatment. This approval

allows for larger field treatment of mild to moderate actinic

keratosis on the face and scalp with Ameluz®-PDT using the

BF-RhodoLED® or the RhodoLED® XL lamp. Based on the extended

approval we are rapidly implementing a comprehensive

update to our commercial strategy that we believe will drive

significant sales growth in the coming years,” concluded Prof.

Luebbert.

Third Quarter Financial

Results

Total revenues for the third quarter of 2024

were $9.0 million compared with $8.9 million for the third quarter

of 2023. This increase was driven by a $0.6 million increase from

sales of devices, offset by a net decrease in sales of Ameluz of

$0.5 million. The decline in Ameluz unit sales resulted from the

delayed delivery of 4,640 units in October 2024, as Hurricane

Milton caused office closures and shipping delays across the

Southeast.Total operating expenses were $14.0 million for the third

quarter of 2024 compared with $13.5 million for the third quarter

of 2023. Cost of revenues was $4.9 million for the third quarter of

2024 compared with $4.6 million for the prior-year quarter. This

was driven by an increase of $0.5 million due to higher COGS for

lamp revenue, partially offset by a decrease of $0.2 million due to

the decrease in sales of Ameluz®.

Selling, general and administrative expenses

were $8.4 million for the third quarter of 2024 compared with $8.6

million for the third quarter of 2023. The decrease was primarily

driven by a $0.5 million reduction in general business

administration expenses, as well as a decrease of non-personnel

sales and marketing expenses of $0.2 million, and a $0.3 million

decrease in personnel costs due to change in headcount and reduced

severance. This was offset by a $0.8 million increase in legal

expenses related to the competitor complaints at the International

Trade Commission (ITC) and the US District Court for the District

of Massachusetts.

The net loss for the third quarter of 2024 was

$5.7 million, compared with a net loss of $6.3 million for the

prior-year quarter. Adjusted EBITDA for the third quarter of 2024

was negative $4.6 million compared with negative $3.9 million for

the third quarter of 2023, reflecting our selling, general, and

administrative costs. We look at Adjusted EBITDA, a non-GAAP

financial measure, as a better indication of ongoing operations and

this measurement is defined as net income or loss excluding

interest income and expense, income taxes, depreciation and

amortization, and certain other non-recurring or non-cash items.

The primary driver of the lower Adjusted EBITDA was increased

R&D spend since we took over clinical operations for Ameluz as

of June 2024.

Please refer to the table below which presents a

GAAP to non-GAAP reconciliation of Adjusted EBITDA for the third

quarters of 2024 and 2023.

Nine Month Financial

Results

Total YTD revenues were $24.7, an increase of

$1.3 million, or 5.6% as compared to the same period last year.

This increase was driven by a higher unit sales price for Ameluz®

and a revenue increase in device sales due to the commercial launch

of the RhodoLED XL. After a revenue decline of 9% in Q1 followed by

8% growth for the first half of the year, we would now have seen

year-over-year growth of approximately 12% without the impact of

the shipping delays caused by Hurricane Milton.

Total operating expenses were $40.2 million for

the nine months ended September 30, 2024 compared with $42.3

million to the same period last year. Cost of revenues increased

from the prior year to $13.3 million for the nine months ended

September 30, 2024, compared to $12.1 million for the same period

last year. Selling, general and administrative expenses decreased

to $25.6 million compared to $29.9 million in the prior year.

Specifically, this decrease entails $1.7 million in legal costs for

the settlement with Biofrontera AG in April 2023, $1.3 million of

non-personnel sales and marketing expenses due to a lower level of

marketing activities in general, $0.6 million in general business

administration, and $0.6 million in personnel expenses, partially

offset by legal costs relating to the complaints filed by our

competitor.

Adjusted EBITDA was negative $13.9 million for

the nine months ended September 30, 2024 compared with negative

$15.8 million for the same period last year, primarily driven by

the lower SG&A costs mentioned above.

Conference Call Details

Conference call: Thursday, November 14,

2024 at 10:00 AM Eastern TimeToll Free: 1-877-877-1275

(U.S. toll-free)International: 1-412-858-5202Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=OvxLI2Kz

About Biofrontera Inc.

Biofrontera Inc. is a U.S.-based

biopharmaceutical company specializing in the treatment of

dermatological conditions with a focus on PDT. The Company

commercializes the drug-device combination Ameluz® with the

RhodoLED® lamp series for PDT of Actinic Keratosis (AK),

pre-cancerous skin lesions which may progress to invasive skin

cancers2. The Company performs clinical trials to extend the use of

the products to treat non-melanoma skin cancers and moderate to

severe acne. For more information, visit www.biofrontera-us.com and

follow Biofrontera on LinkedIn and Twitter.

1 -

https://www.skincancer.org/skin-cancer-information/actinic-keratosis/

Contacts Investor

RelationsAndrew Barwicki1-516-662-9461ir@bfri.com

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking statements” within the meaning of the

United States Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

relating to the Company’s revenue guidance, business and marketing

strategy, revenue growth, sales force productivity, growth

strategy, liquidity and cash flow, potential to expand the label of

Ameluz®, available market opportunities for Ameluz®, ongoing

clinical trials, educational outreach efforts, and other statements

that are not historical facts. The words “intends,” “may,” “will,”

“plans,” “expects,” “anticipates,” “projects,” “predicts,”

“estimates,” “aims,” “believes,” “hopes,” “potential”, “target”,

“goal”, “assume”, “would”, “could” or similar words are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. We have

based these forward-looking statements on our current expectations

and projections about future events; nevertheless, actual results

or events could differ materially from the plans, intentions and

expectations disclosed in, or implied by, the forward-looking

statements we make. These risks and uncertainties, many of which

are beyond our control, include, but are not limited to, our

reliance on sales of products we license from other companies as

our sole source of revenue; the success of our competitors in

developing generic topical dermatological products that

successfully compete with our licensed products; the success of our

principal licensed product, Ameluz®; the ability of the Company’s

licensors to establish and maintain relationships with contract

manufacturers that are able to supply the Company with enough of

the licensed products to meet our demand; the ability of our

licensors or their manufacturing partners to supply the licensed

products that we market in sufficient quantities and at acceptable

quality and cost levels, and to fully comply with current good

manufacturing practice or other applicable manufacturing

regulations; the ability of our licensors to successfully defend or

enforce patents related to our licensed products; the availability

of insurance coverage and medical expense reimbursement for our

licensed products; the impact of legislative and regulatory

changes; competition from other pharmaceutical and medical device

companies and existing treatments, such as simple curettage and

cryotherapy; the Company’s ability to achieve and sustain

profitability; the Company’s ability to obtain additional financing

as needed to implement its growth strategy; the Company’s ability

to retain and hire key personnel; and other factors that may be

disclosed in the Company’s filings with the Securities and Exchange

Commission (“SEC”), which can be obtained on the SEC website at

www.sec.gov. Readers are cautioned not to place undue reliance on

the forward-looking statements, which speak only as of the date on

which they are made and reflect management’s current estimates,

projections, expectations and beliefs. The Company does not

undertake to update any such forward-looking statements and

expressly disclaims any duty to update the information contained in

this press release, except as required by law.

BIOFRONTERA

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands, except par

value and share amounts)

|

|

|

September 30,2024 |

|

|

December 31,2023 |

|

|

|

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

2,873 |

|

|

$ |

1,343 |

|

| Investment, related party |

|

|

8 |

|

|

|

78 |

|

| Accounts receivable, net |

|

|

4,874 |

|

|

|

5,162 |

|

| Inventories, net |

|

|

6,526 |

|

|

|

10,908 |

|

| Prepaid expenses and other

current assets |

|

|

350 |

|

|

|

425 |

|

| Assets held for sale |

|

|

2,300 |

|

|

|

- |

|

| Other assets, related

party |

|

|

- |

|

|

|

5,159 |

|

| |

|

|

|

|

|

|

|

|

| Total current

assets |

|

|

16,931 |

|

|

|

23,075 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

82 |

|

|

|

134 |

|

| Operating lease right-of-use

assets |

|

|

1,081 |

|

|

|

1,612 |

|

| Intangible asset, net |

|

|

39 |

|

|

|

2,629 |

|

| Other assets |

|

|

383 |

|

|

|

482 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

18,516 |

|

|

$ |

27,932 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

2,027 |

|

|

|

3,308 |

|

| Accounts payable, related

parties |

|

|

3,680 |

|

|

|

5,698 |

|

| Operating lease

liabilities |

|

|

670 |

|

|

|

691 |

|

| Accrued expenses and other

current liabilities |

|

|

4,655 |

|

|

|

4,487 |

|

| Short term debt |

|

|

- |

|

|

|

3,904 |

|

| |

|

|

|

|

|

|

|

|

| Total current

liabilities |

|

|

11,032 |

|

|

|

18,088 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

liabilities: |

|

|

|

|

|

|

|

|

| Warrant liabilities |

|

|

1,601 |

|

|

|

4,210 |

|

| Operating lease liabilities,

non-current |

|

|

324 |

|

|

|

804 |

|

| Other liabilities |

|

|

29 |

|

|

|

37 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

12,986 |

|

|

|

23,139 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

|

| Series B Convertible Preferred

stock, $0.001 par value, 20,000,000 shares authorized, no Series

B-1, 4,695 Series B-2 and 7,093 Series B-3 shares issued and

outstanding as of September 30, 2024 and no shares issued and

outstanding as of December 31, 2023 |

|

|

- |

|

|

|

- |

|

| Common stock, $0.001 par

value, 35,000,000 shares authorized; 6,529,792 and 1,517,628 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively |

|

|

7 |

|

|

|

2 |

|

| Additional paid-in

capital |

|

|

121,536 |

|

|

|

104,441 |

|

| Accumulated deficit |

|

|

(116,013 |

) |

|

|

(99,650 |

) |

| |

|

|

|

|

|

|

|

|

| Total stockholders’

equity |

|

|

5,530 |

|

|

|

4,793 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

18,516 |

|

|

$ |

27,932 |

|

BIOFRONTERA

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except

per share amounts and number of

shares)(Unaudited)

|

|

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product revenues, net |

|

$ |

9,012 |

|

|

$ |

8,879 |

|

|

$ |

24,744 |

|

|

$ |

23,423 |

|

| Revenues, related party |

|

|

- |

|

|

|

17 |

|

|

|

18 |

|

|

|

52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues,

net |

|

|

9,012 |

|

|

|

8,896 |

|

|

|

24,762 |

|

|

|

23,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues, related

party |

|

|

4,801 |

|

|

|

4,495 |

|

|

|

12,839 |

|

|

|

11,814 |

|

| Cost of revenues, other |

|

|

76 |

|

|

|

95 |

|

|

|

496 |

|

|

|

262 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

|

8,425 |

|

|

|

8,619 |

|

|

|

25,589 |

|

|

|

29,874 |

|

| Selling, general and

administrative, related party |

|

|

1 |

|

|

|

74 |

|

|

|

30 |

|

|

|

193 |

|

| Research and development |

|

|

669 |

|

|

|

33 |

|

|

|

1,306 |

|

|

|

44 |

|

| Change in fair value of

contingent consideration |

|

|

- |

|

|

|

200 |

|

|

|

- |

|

|

|

100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

13,972 |

|

|

|

13,516 |

|

|

|

40,260 |

|

|

|

42,287 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(4,960 |

) |

|

|

(4,620 |

) |

|

|

(15,498 |

) |

|

|

(18,812 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of

warrants |

|

|

(680 |

) |

|

|

598 |

|

|

|

1,329 |

|

|

|

2,001 |

|

| Change in fair value of

investment, related party |

|

|

(2 |

) |

|

|

(2,212 |

) |

|

|

(12 |

) |

|

|

(6,635 |

) |

| Loss on debt

extinguishment |

|

|

- |

|

|

|

- |

|

|

|

(316 |

) |

|

|

- |

|

| Interest income (expense),

net |

|

|

8 |

|

|

|

(142 |

) |

|

|

(1,995 |

) |

|

|

(256 |

) |

| Other income (expense),

net |

|

|

(32 |

) |

|

|

35 |

|

|

|

154 |

|

|

|

65 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other

expense |

|

|

(706 |

) |

|

|

(1,721 |

) |

|

|

(840 |

) |

|

|

(4,825 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income

taxes |

|

|

(5,666 |

) |

|

|

(6,341 |

) |

|

|

(16,338 |

) |

|

|

(23,637 |

) |

| Income tax expense |

|

|

3 |

|

|

|

1 |

|

|

|

25 |

|

|

|

20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(5,669 |

) |

|

$ |

(6,342 |

) |

|

$ |

(16,363 |

) |

|

$ |

(23,657 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.98 |

) |

|

$ |

(4.64 |

) |

|

$ |

(3.39 |

) |

|

$ |

(17.57 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

5,773,993 |

|

|

|

1,366,842 |

|

|

|

4,833,091 |

|

|

|

1,346,264 |

|

BIOFRONTERA INC.GAAP TO

NON-GAAP ADJUSTED EBITDA

RECONCILIAITION(In thousands,

except per share amounts and number of

shares)(Unaudited)

|

|

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net loss |

|

$ |

(5,669 |

) |

|

$ |

(6,342 |

) |

|

$ |

(16,363 |

) |

|

$ |

(23,657 |

) |

| Interest expense, net |

|

|

(8 |

) |

|

|

142 |

|

|

|

1,995 |

|

|

|

256 |

|

| Income tax expenses |

|

|

3 |

|

|

|

1 |

|

|

|

25 |

|

|

|

20 |

|

| Depreciation and

amortization |

|

|

129 |

|

|

|

251 |

|

|

|

387 |

|

|

|

769 |

|

| EBITDA |

|

|

(5,545 |

) |

|

|

(5,948 |

) |

|

|

(13,956 |

) |

|

|

(22,612 |

) |

| Loss on debt

extinguishment |

|

|

- |

|

|

|

- |

|

|

|

316 |

|

|

|

- |

|

| Change in fair value of

contingent consideration |

|

|

- |

|

|

|

200 |

|

|

|

- |

|

|

|

100 |

|

| Change in fair value of

warrant liabilities |

|

|

680 |

|

|

|

(598 |

) |

|

|

(1,329 |

) |

|

|

(2,001 |

) |

| Change in fair value of

investment, related party |

|

|

2 |

|

|

|

2,212 |

|

|

|

12 |

|

|

|

6,635 |

|

| Legal settlement expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,225 |

|

| Stock based compensation |

|

|

288 |

|

|

|

207 |

|

|

|

720 |

|

|

|

817 |

|

| Expensed issuance costs |

|

|

- |

|

|

|

- |

|

|

|

354 |

|

|

|

- |

|

| Adjusted

EBITDA |

|

$ |

(4,575 |

) |

|

$ |

(3,927 |

) |

|

$ |

(13,883 |

) |

|

$ |

(15,836 |

) |

| Adjusted EBITDA

margin |

|

|

-50.8 |

% |

|

|

-44.1 |

% |

|

|

-56.1 |

% |

|

|

-67.5 |

% |

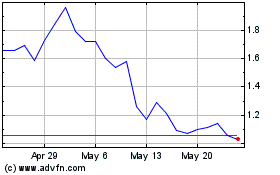

Biofrontera (NASDAQ:BFRI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Biofrontera (NASDAQ:BFRI)

Historical Stock Chart

From Feb 2024 to Feb 2025