Filed Pursuant to Rule 424B3

File No. 333-257265

PROSPECTUS

4,403,000 Ordinary Shares underlying Warrants

This prospectus relates to

the offer and sale of up to 4,403,000 ordinary shares, par value $0.001 per share, of Blue Hat Interactive Entertainment Technology, a

Cayman Islands corporation, issuable upon exercise of certain warrants currently held by such selling shareholders as follows: (i) 4,088,500

ordinary shares underlying 4,088,500 warrants issued to the selling shareholders on May 6, 2021 and (ii) 314,500 ordinary shares underlying

the placement agent warrants issued in connection with the private placement of the ordinary shares on May 6, 2021. The warrants are exercisable

for one ordinary share at an initial exercise price of $1.12 per share.

This prospectus covers any

additional ordinary share that may become issuable by reason of stock splits, stock dividends, and other events described therein.

The selling shareholders

may offer their shares from time to time directly or through one or more underwriters, broker-dealers or agents, in the over-the-counter

market at market prices prevailing at the time of sale, in one or more privately negotiated transactions at prices acceptable to the selling

shareholder, or otherwise, so long as our ordinary shares are trading on the Nasdaq Capital Market or the OTCQB, and if they are not trading

on the OTCQB, OTCQX or a listed exchange, sales may only take place at fixed prices.

We are registering these

ordinary shares for resale by the selling shareholders named in this prospectus, or their transferees, pledgees, donees or assigns or

other successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. We will not receive

any proceeds from the sale of shares by the selling shareholders. These shares are being registered to permit the selling shareholders

to sell shares from time to time, in amounts, at prices and on terms determined at the time of offering. The selling shareholders may

sell these ordinary shares through ordinary brokerage transactions, directly to market makers of our shares or through any other means

described in the section entitled “Plan of Distribution.” In connection with any sales of the ordinary shares offered hereunder,

the selling shareholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will pay the expenses

related to the registration of the shares covered by this prospectus. The selling shareholders will pay any commissions and selling expenses

they may incur.

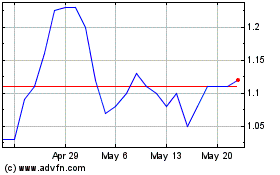

Our ordinary shares trade

on the Nasdaq Capital Market under the symbol “BHAT”. The closing sale price on the Nasdaq Capital Market on June 14,

2021, was $0.903 per share.

Our principal executive offices are located at 7th

Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009.

Investing in our ordinary

shares involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing

in our ordinary shares in “Risk Factors” beginning on page 13 of this prospectus and in the documents incorporated by reference

in this prospectus.

Neither the Securities and

Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June

29, 2021.

TABLE OF CONTENTS

We are responsible for the information contained

in this prospectus, in the documents incorporated herein by reference and any free writing prospectus we prepare or authorize. We have

not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give

you. We are not making an offer to sell our ordinary shares in any jurisdiction where the offer or sale is not permitted. You should not

assume that the information contained in this prospectus or in any document incorporated herein by reference is accurate as of any date

other than the date on the front cover of this prospectus or such document, as applicable, regardless of the time of delivery of this

prospectus, the sale of any ordinary shares or the date of any document incorporated herein by reference.

For investors outside the United States: We have not

done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United

States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must

inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus

outside the United States.

We are incorporated

under the laws of the Cayman Islands as an exempted company with limited liability and a majority of our outstanding securities are owned

by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or the SEC, we currently qualify for treatment

as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial

statements with the Securities and Exchange Commission, or the SEC, as frequently or as promptly as domestic registrants whose securities

are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Conventions that Apply to this

Prospectus

Unless otherwise

indicated or the context otherwise requires, all references in this prospectus to the terms “Blue Hat,” the “Company,”

“we,” “us” and “our” refer to Blue Hat Interactive Entertainment Technology and

its subsidiaries, its variable interest entity and the subsidiaries of its variable interest entity.

“PRC” or “China” refers to

the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan, Hong Kong and Macau. “RMB” or

“Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars” refers to the legal currency

of the United States.

We have made rounding adjustments to some of the figures

included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the

figures that preceded them.

Unless the context indicates otherwise, all information

in this prospectus assumes no exercise by the underwriters of their over-allotment option.

PROSPECTUS SUMMARY

This

summary is not complete and does not contain all of the information that you should consider before investing in the securities offered

by this prospectus. You should read this summary together with the entire prospectus, including our risk factors (as provided for herein

and incorporated by reference), Operating and Financial Review and Prospects (as provided for herein and incorporated by reference) financial

statements, the notes to those financial statements and the other documents that are incorporated by reference in this prospectus, before

making an investment decision. You should carefully read the information described under the heading “Where You Can Find More Information.”

We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any

sale of our securities.

Unless

the context otherwise requires, the terms “BHAT,” “the Company,” “we,” “us,” and “our”

in this prospectus each refer to Blue Hat Interactive Entertainment Technology, our subsidiaries, and our consolidated entities. “China”

and the “PRC” refer to the People’s Republic of China.

Overview

We are a producer, developer

and operator of augmented reality, or AR, interactive entertainment games and toys in China, including interactive educational materials,

mobile games, toys with mobile game features, and Immersive Education Classes and recently we expanded into the Internet Data Center (IDC)

business. Our mobile-connected entertainment platform enables us to connect physical items to mobile devices through wireless technologies,

creating a unique interactive user experience. Our goal is to create a rich visual and interactive environment for users through the integration

of real objects and virtual scenery. We believe this combination provides users with a more natural form of human-computer interaction

and enhances users’ perception of reality, thus providing a more diversified entertainment experience. By leveraging our strong

technological capabilities and infrastructure, we believe we are able to deliver a superior user experience and conduct our operations

in a highly efficient manner.

The core of our business is our

proprietary technology. Our patents, trademarks, copyrights, and other intellectual property rights serve to distinguish our

products, protect our products from infringement, and contribute to our competitive advantages. To secure the value of our technology

and developments, we are aggressive in pursuing a combination of patent, trademark and copyright protection for our proprietary technologies.

As of June 9, 2021, our intellectual property portfolio included 207 authorized patents, 14 applications for PCT international patents,

738 artistic copyrights, 62 patents pending in various stages of the application process, 13 applications for PCT international patents,

90 registered trademarks and 28 software copyrights.

We strive to create an engaging,

interactive and immersive community for users of our products. The majority of our users are among the young Chinese generation between

the ages of 3 and 23, although many of our products appeal to users outside of this demographic. We intend to further penetrate the Chinese

market with new products that will target users ages 14 and above. Specifically, our strategies include marketing Fidolle, a ball-jointed

“smart doll”, and QI, a gaming and entertainment platform designed for both family home use and amusement arcades. We believe

our high-quality content is a magnet for users with common interests to connect, interact and share their passions on our platform, which

helps to cultivate a strong sense of belonging, effectively strengthening our user retention. In the meantime, we are licensed to sell

products with “WUHUANGWANSHUI” brand images. We are also developing our IDC business. As for educational products, we provide

our Augmented Reality Immersive Classes (“ARIC”) to pre-schools and plan to work closely with these schools to integrate our

digital solutions with a new STEAM-focused curriculum for young students. We believe our high-quality content attracts users with common

interests to connect and share their passion on our platform, which cultivates a strong sense of belonging and effectively strengthens

our user retention.

Our products resemble traditional

children’s toys - including cars, ladybugs, picture books, and dolls - which are enabled with wireless technology to facilitate

a broad variety of interactive functions. The interactive functionality of our products broadens the user experience, creates a communicative

environment, and facilitates an ongoing relationship between us and our end users and between our end users and our products. We believe

such an immersive entertainment experience allows our users to build strong emotional connections to our products, resulting in our products

typically having longer life cycles than traditional toys.

Our proprietary technology, product

research and development, marketing channels and brand operation are the cornerstones of our business. We focus on the combination of

“online” and “offline” activity and the interaction between “entertainment” and “product”

to create a high-tech entertainment platform combining mobile games and AR. With the help of computer graphics and visualization technologies,

we are able to accurately “place” virtual objects into the physical world, thus creating a new and stimulating visual environment

for our users.

For information on our financial

performance, see “Operating and Financial Review and Prospects.”

Our Products

We currently offer the following

primary AR interactive product lines: AR Racer, AR Crazy Bug, AR 3D Magic Box, AR Dinosaur, “Talking Tom and Friends” Bouncing

Bubble, AR Shake Bouncing Bubble, “WUHUANGWANSHUI” authorized products, Immersive Education Classes and IDC business.

AR Racer

AR Racer is a car-racing mobile

game played using a physical toy car stuck onto the user’s mobile device screen using non-adhesive materials. Blue Hat’s photosensitive

recognition technology allows the toy car to be used as a controller, so that users can virtually race one another via the simulated racing

track, as well as engage in individual races. In addition, we developed a new generation product, the “Mini Car” series, that

retains the car model attributes and the original AR interactive function, while upgrading the gameplay, structure and aesthetics of the

game.

AR Crazy Bug

AR Crazy Bug is an exciting combat

game played using a ladybug-shaped electronic toy. Blue Hat’s infrared induction technology allows the user to control the toy’s

movement via their mobile device for game play in battle dynamics, while simultaneously moving the toy in reality. The mobile device shows

virtual enemies while also capturing the position of the toy in the real world, allowing the user to approach or escape its combatants.

AR 3D Magic Box

AR 3D Magic Box has the unique

ability to transport children’s drawings into diverse backgrounds, giving the user a discovery-based experience. AR 3D Magic Box

uses AR recognition technology to allow children to draw shapes or objects onto a physical card while the mobile game captures the drawings

and animates them onto a set background, for example, under the sea.

AR Dinosaur

AR Dinosaur is an educational

toy that comes in a variety of five different types of dinosaur, each of which has their own personality and emotions. Through interacting

with the toy and its accompanying mobile app, children can learn a wealth of information about dinosaurs. The product comes with five

physical “AR cards”, which when placed under the toy will activate its AR features.

“Talking Tom and Friends” Bouncing

Bubble

Bouncing Bubble is a product

designed using environmentally-friendly and toxic-free liquid, allowing for larger, stronger bubbles that won’t easily pop. Children

can bounce these bubbles using a paddle or gloves as if they were ping pong balls. The new “Talking Tom and Friends” Bouncing

Bubble product range features images of characters from the universe of the globally renowned “Talking Tom and Friends” media

franchise.

AR Shake Bouncing Bubble

AR Shake Bouncing Bubble is a

product developed in 2020. The product is known for its soothing interface and magical background music. It contains an exclusive structural

design of Blue Hat. The AR interactive software has been shown to help to improve children’s concentration and reaction. Children

can also use regular bubble liquid to blow bubbles.

WUHUANGWANSHUI Authorized Products

“WUHUANGWANSHUI”

is a famous brand for Chinese cartoon images that consist of a cat (Wu Huang) and a dog (Ba Zahey). The brand is owned by Cup of Cosmo

Studio (Beijing) Culture Co., Ltd., and is easily recognizable in Chinese popular culture. Primarily seen in cartoon images, comics, animations

and emoticon packages, “WUHUANGWANSHUI” has over 30 million followers online, which brings over RMB2 billion in licensed product

sales. We are licensed to use “WUHUANGWANSHUI” images on our products and our e-commerce website. We expect to launch approximately

20 interactive toys with the licensed images in the near future.

Immersive Education Classes

Immersive Education Classes is

Blue Hat’s range of immersive educational products that utilize AR technology to create a dynamic and engaging model for teaching

in China’s preschools, including “Smart Screen Immersive Education Classes”, “Smart Immersive Physical Education

Classes” and “Smart Immersive Cognitive Education Classes.” The three products are suitable for different teaching

scenarios and can be used independently or together with one another to promote children’s overall development.

“Smart Screen Immersive

Education Classes” use a projector to cast education-related content and games onto the classroom wall. Activities featured

within the product aim to improve students’ hand-eye coordination and analytical abilities, and students are guided by teachers

trained in the product’s use. After students have completed a task, their results are shown on the screen and specific feedback

for improvement is provided.

“Smart Immersive Physical

Education Classes” integrate a projector and motion-capture system to project activities and games onto the floor of the

teaching area. Students who participate in activities are required to imitate movements and react in time, while competing or coordinating

with others for the best score. Data is analyzed simultaneously for each student, with feedback, including scores and suggestions for

improvement, that can be reviewed by teachers and parents. All activities are carefully guided by teachers trained in the product’s

use.

“Smart Immersive Cognitive

Education Classes” offer a wide variety of AR-enabled tasks designed to exercise the cognitive abilities of children between

the ages of three and six years old by projecting images and activities onto a classroom tabletop. As the images projected on the tabletop

react to children’s movements, they can learn for themselves, with feedback, including scores and suggestions for improvement, projected

onto the table after completion. A tabletop can be used by up to six children at one time, supporting both independent learning and group

activities or competitions. The product’s content has been designed by our in-house team of educational experts and all activities

are carefully guided by teachers trained in the product’s use.

“AR Immersive Class”

(“ARIC”) offers full collection of our immersive educational products that utilize AR technology to create a dynamic

and engaging model to teach preschoolers in China. With our proprietary AR technology, the ARIC greatly enriches children’s learning

experience and enables educators to track and analyze students’ progress.

IDC Business

Xunpusen, a subsidiary of our

company, recently signed a cooperation agreement with China Mobile Communications Group Guangdong Co., Ltd. (“China Mobile”)

for a series of telecom value-added services relating to Internet Data Center (“IDC”). IDC hosts a group of hosting

providers, merchants, or web servers. It is an infrastructure that ensures e-commerce websites operate securely. It also helps businesses

and their alliances to implement value chain management for their distributors, suppliers and customers. Namely, IDC related services

enable big companies to promote and sell products with Xunpusen’s message marketing services and integrated solutions.

Corporate History and Structure

Our company, Blue Hat Interactive

Entertainment Technology, or Blue Hat, is a holding company incorporated on June 13, 2018 under the laws of the Cayman Islands.

We have no substantive operations

other than holding all of the issued and outstanding shares of Brilliant Hat Limited, or Blue Hat BVI, established under the laws of the

British Virgin Islands on June 26, 2018.

Blue Hat BVI is also a holding

company holding all of the outstanding equity of Blue Hat Interactive Entertainment Technology Limited, or Blue Hat HK, which was established

in Hong Kong on June 26, 2018. Blue Hat HK is also a holding company holding all of the outstanding equity of Xiamen Duwei Consulting

Management Co., Ltd., or Blue Hat WFOE, which was established on July 26, 2018 under the laws of the PRC.

We, through our variable interest

entity, or VIE, Fujian Blue Hat Interactive Entertainment Technology Ltd., or Blue Hat Fujian, a PRC company, and through its wholly owned

subsidiaries, including Hunan Engaomei Animation Culture Development Co., Ltd., or Blue Hat Hunan, and Shenyang Qimengxing Trading Co.,

Ltd., or Blue Hat Shenyang, each a PRC company, engage in designing, producing, promoting and selling animated toys with mobile games

features, original intellectual property and peripheral derivatives features worldwide.

On September 18, 2017, Blue Hat

Fujian formed a joint venture with Xiamen Youth Education Development Co., Ltd. and Youying Wang, contributing a 48.5% equity interest

in Fujian Youth Hand in Hand Educational Technology Co., Ltd., or Fujian Youth, a PRC company. As of December 31, 2020, Fujian Youth had

normal operations. And on March 24, 2021, Fujian Youth Hand in Hand Educational Technology Co., Ltd controlled 100% equity interest in

Fuzhou Qiande Educational Technology Co., Ltd.

On January 25, 2018, Blue Hat

Fujian established its wholly owned subsidiary, Chongqing Lanhui Technology Co. Ltd., or Blue Hat Chongqing, a PRC company. As of December

31, 2019, Blue Hat Chongqing had no operations. On December 14, 2020, it deregistered Chongqing Lanhui Technology Co. Ltd.

On September 10, 2018, Blue Hat

Fujian established its wholly owned subsidiary, Pingxiang Blue Hat Technology Co. Ltd., or Blue Hat Pingxiang, a PRC company. Blue Hat

Pingxiang also engages in designing, producing, promoting and selling interactive toys with mobile games features, original intellectual

property and peripheral derivatives features worldwide.

On September 20, 2018, Blue Hat

Fujian formed a joint venture with Fujian Jin Ge Tie Ma Information Technology Co., contributing a 15.0% equity interest in Xiamen Blue

Wave Technology Co. Ltd., or Xiamen Blue Wave, a PRC company.

On October 16, 2018, Blue Hat

Fujian formed a joint venture with Renchao Huyu (Shanghai) Culture Development Co. Ltd., contributing a 49% ownership interest in Renchao

Huyu (Shanghai) Culture Propagation Co. Ltd., or Renchao Huyu, with the remaining 51% ownership owned by Renchao Huyu (Shanghai) Culture

Development Co. Ltd.

On November 13, 2018, Blue Hat

completed a reorganization of entities under common control of its then existing shareholders, who collectively owned a majority of the

equity interests of Blue Hat prior to the reorganization. Blue Hat, Blue Hat BVI, and Blue Hat HK were established as the holding companies

of Blue Hat WFOE. Blue Hat WFOE is the primary beneficiary of Blue Hat Fujian and its subsidiaries, and all of these entities included

in Blue Hat are under common control which results in the consolidation of Blue Hat Fujian and subsidiaries which have been accounted

for as a reorganization of entities under common control at carrying value. The consolidated financial statements are prepared on the

basis as if the reorganization became effective as of the beginning of the first period presented in the consolidated financial statements.

On March 31, 2020, the Company

established its wholly owned subsidiary, Xiamen Jiuqiao Technology Co.,Ltd. (“Jiuqiao”), a PRC company. Jiuqiao engages in

designing, producing, producing, promoting and selling interactive toys with mobile games features, original intellectual property, peripheral

derivatives features worldwide and also providing consultation service.

On August 3, 2020, the Company

acquired 60% of Xunpusen (Xiamen) Technology Co.,Ltd. which provides telecommunication service and internet access. On March 9, 2021,

Xunpusen (Xiamen) Technology Co., Ltd which it acquired 100% equity interestes of Xingjuyun (Xiamen) Technology Co., Ltd.

On January 25, 2021, Blue Hat

Cayman closed an acquisition pursuant to which it acquired 100% equity interests of Fresh Joy. Fresh joy, through its affiliated Hong

Kong Xinyou Entertainment Company and Fujian Xinyou Technology Co., Ltd., signed a series of VIE agreements with Fujian Roar Game Technology

Co., Ltd. (“Fujian Roar Game”). Fujian Roar Game holds 51% equity of Fuzhou CSFCTECH Co., Ltd and 100% equity of Fuzhou UC71

Co., Ltd.

On February 20, 2021, the Company

establised its wholly owned subsidiary, Xiamen Bluehat Research Institution of Education Co., Ltd.

Blue Hat Interactive Entertainment Technology

VIE Structure

The charts below summarize our

corporate legal structure and identify our subsidiaries, our VIE and its subsidiaries:

|

Name

|

|

Background

|

|

Ownership

|

|

Brilliant Hat Limited

|

|

● A British Virgin Islands company

● Incorporated on June 26, 2018

● A holding company

|

|

100% owned by Blue Hat Interactive Entertainment Technology

|

|

|

|

|

|

|

|

Blue Hat Interactive Entertainment Technology Limited

|

|

● A Hong Kong company

● Incorporated on June 26, 2018

● A holding company

|

|

100% owned by Brilliant Hat Limited

|

|

|

|

|

|

|

|

Xiamen Duwei Consulting Management Co., Ltd.

|

|

● A PRC limited liability company

and deemed a wholly foreign owned enterprise, or WFOE

● Incorporated on July 26, 2018

● Registered capital of $ 736,073

(RMB 5,000,000)

● A holding company

|

|

100% owned by Blue Hat Interactive Entertainment Technology Limited

|

|

|

|

|

|

|

|

Fresh Joy Entertainment Ltd

|

|

● A holding company

|

|

100% owned by Blue Hat Interactive Entertainment Technology Limited

|

|

|

|

|

|

|

|

Fujian Blue Hat Interactive Entertainment Technology Ltd.

|

|

● A PRC limited liability company

● Incorporated on January 7, 2010

● Registered capital of $4,697,526

(RMB 31,054,000)

● Designing, producing, promoting

and selling animated toys with mobile games features, original intellectual property and peripheral derivatives features.

|

|

VIE of Blue Hat Xiamen Duwei Consulting Management Co., Ltd.

|

|

|

|

|

|

|

|

Hunan Engaomei Animation Culture Development Co., Ltd.

|

|

● A PRC limited liability company

● Incorporated on October 19,

2017

● Registered capital of $302,540

(RMB 2,000,000)

● Designing, producing, promoting

and selling animated toys with mobile games features, original intellectual property and peripheral derivatives features.

|

|

100% owned by Fujian Blue Hat Interactive Entertainment Technology Ltd.

|

|

|

|

|

|

|

|

Shenyang Qimengxing Trading Co.Ltd.(China)

|

|

● A PRC limited liability company

● Incorporated

on October 19, 2017

|

|

100% owned by Fujian Blue Hat Interactive Entertainment Technology Ltd.

|

|

|

|

|

|

|

|

Fuzhou Csfctech Co., Ltd.

|

|

● A PRC limited liability company

● Incorporated on August 5, 2011

● Registered capital of $ (RMB

20,000,000)

● Developing and distributing network games in China. Csfctech also

promotes diversified development and brings together the latest popular games, including 2D and 3D games, integrating role-playing, casual,

real-time, horizontal fighting, card, strategy and other types of game products in a comprehensive layout.

|

|

51% controlled by Fresh Joy Entertainment Ltd via VIE

|

|

|

|

|

|

|

|

Fuzhou UC71 Co., Ltd.

|

|

● A PRC limited liability company

|

|

100% controlled by Fresh Joy Entertainment Ltd via VIE

|

|

|

|

|

|

|

|

Pingxiang Blue Hat Technology Co. Ltd.

|

|

● A PRC limited liability company

● Incorporated on September 10,

2018

● Registered capital of $302,540

(RMB 2,000,000)

● Designing, producing, promoting

and selling animated toys with mobile games features, original intellectual property and peripheral derivatives features.

|

|

|

|

|

|

|

|

|

|

Xiamen Jiuqiao Technology Co. Ltd.

|

|

● A PRC limited liability company

● Incorporated on March 31, 2020

● Registered capital of $15,325,905

(RMB 100,000,000)

● Designing, producing, promoting

and selling animated toys with mobile games features, original intellectual property and peripheral derivatives features, and consultation

service.

|

|

40% owned controlled by Fujian Blue Hat Interactive Entertainment Technology Ltd. 60% owned by Duwei Consulting Management Co. Ltd

|

|

|

|

|

|

|

|

Fujian Youth Hand in Hand Educational Technology Co., Ltd

|

|

● A PRC limited liability company

● Incorporated on September 18,

2017

|

|

48.5% owned controlled by Fujian Blue Hat Interactive Entertainment Technology

Ltd.

51.5% owned by Duwei Consulting Management Co. Ltd

|

|

|

|

|

|

|

|

Fuzhou Qiande Educational Technology Co., Ltd

|

|

● A PRC limited liability company

● Incorporated on September 18,

2017

|

|

100% controlled by Fujian Youth Hand in Hand Educational Technology Co., Ltd

|

|

|

|

|

|

|

|

Xiamen Bluehat Research Institution of Education Co.,Ltd

|

|

● A PRC limited liability company

● Incorporated on February 20,

2021

|

|

100% owned by Blue Hat Interactive Entertainment Technology

|

|

|

|

|

|

|

|

Xunpusen (Xun Pu Sen) Technology Co., Ltd.

|

|

● A PRC limited liability company

|

|

60% controlled by Fujian Blue Hat Interactive Entertainment Technology Ltd.

|

|

|

|

|

|

|

|

Xingjuyun (Xiamen) Technology Co., Ltd.

|

|

● A PRC limited liability company

● Incorporated on March , 2021

● On

May 19, 2021, Xingwangyun Technology Co., Ltd changed the name to Xingjuyun (Xiamen)Technology

Co., Ltd.

|

|

100% controlled by Xunpusen (Xun Pu Sen) Technology Co., Ltd.

|

Recent Developments

On November 30, 2020, the Company,

Joyful Castale International Limited, Chief Choice Global Limited, Fresh Joy Entertainment Ltd. (“Fresh Joy”), Fujian Roar

Game Technology Co., Ltd. (the “Target Company”), the shareholders of the Target Company and certain other parties entered

into an Agreement on Transfer of Shares of Fresh Joy and Realization of Actual Control over Fujian Roar Game Technology Co., Ltd. (the

“Acquisition Agreement”), pursuant to which the Company shall acquire 100% of the equity shares of Fresh Joy, a Cayman Islands

company (the transaction, the “Acquisition”).

As of the date of the Acquisition

Agreement, Joyful Castale International Limited and Chief Choice Global Limited (collectively, the “Transferors”) together

owned 100% of the equity shares of Fresh Joy, which, through its affiliate companies, Hong Kong Xinyou Entertainment Company and Fujian

Xinyou Technology Co., Ltd., entered into a series of structured contracts with the Target Company. The Target Company is a limited liability

company formed under the laws of the People’s Republic of China and holds 51% of the equity interest of Fuzhou Csfctech Co., Ltd.

(“Csfctech”) and 100% of the equity interest of Fuzhou UC71 Co., Ltd. (“UC71”).

Pursuant to the Acquisition Agreement,

the Company shall acquire 100% of the equity shares of Fresh Joy from the Transferors for an aggregated purchase price of $7.7736 million

(the “Purchase Price”), of which 50% shall be paid in cash (which percentage could be increased subject to the Transferors’

intention according to the actual circumstances) and the other half shall be paid in the Company’s restricted ordinary shares (the

“Ordinary Shares”) at a per share price of the higher of the weighted average volume price of the 20 trading days prior to

the issuance of such Ordinary Shares, or $4, the IPO price of the Company’s Ordinary Shares, subject to certain performance targets.

The Acquisition closed on January 25, 2021.

Subsequent to the above acquisition,

the Company entered into information services and communication services. IDC business can enable larger companies to promote and sell

products using Xunpusen’s expertise in message marketing and integrated solutions.

Corporate Information

Our principal executive office is

located at 7th Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009. Our telephone number is 86-592-2280081.

Our registered office in the Cayman Islands is located at the office of Walkers Corporate Limited, Cayman

Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands.

Our agent for service of process

in the United States is Puglisi & Associates, located at 850 Library Ave., Suite 204, Newark, DE 19711. Our website is located at http://www.bluehatgroup.net. Information

contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

Contractual Arrangements

Due to legal restrictions on

foreign ownership and investment in, among other areas, the production, development and operation of AR interactive entertainment games

and toys in China, including interactive educational materials, mobile games, and toys with mobile game features, we operate our businesses

in which foreign investment is restricted or prohibited in the PRC through certain PRC domestic companies. As such, Blue Hat Fujian is

controlled through contractual arrangements in lieu of direct equity ownership by us or any of our subsidiaries. Such contractual arrangements

consist of a series of three agreements, along with shareholders’ POAs and irrevocable commitment letters, or collectively, the

Contractual Arrangements, which were signed on November 13, 2018.

The significant terms of the

Contractual Arrangements are as follows:

Exclusive Business Cooperation Agreement

Pursuant to the exclusive business

cooperation agreement between Blue Hat WFOE and Blue Hat Fujian, Blue Hat WFOE has the exclusive right to provide Blue Hat Fujian with

technical support services, consulting services and other services, including technical support, technical assistance, technical consulting,

and professional training necessary for Blue Hat Fujian’s operation, network support, database support, software services, business

management consulting, grant use rights of intellectual property rights, lease hardware and device, provide system integration service,

research and development of software and system maintenance, provide labor support and to develop the related technologies based on Blue

Hat Fujian’s needs. In exchange, Blue Hat WFOE is entitled to a service fee that equals to all of the consolidated net income after

offsetting previous year’s loss (if any) of Blue Hat Fujian. The service fee may be adjusted by Blue Hat WFOE based on the actual

scope of services rendered by Blue Hat WFOE and the operational needs and expanding demands of Blue Hat Fujian.

Pursuant to the exclusive business

cooperation agreement, Blue Hat WFOE has the unilateral right to adjust the service fee at any time, and Blue Hat Fujian has no right

to adjust the service fee. We believe that such conditions under which the service fee may be adjusted will be primarily based on the

needs of Blue Hat Fujian to operate and develop its business in the AR market. For example, if Blue Hat Fujian needs to expand its business,

increase research input or consummate mergers or acquisitions in the future, Blue Hat WFOE has the right to decrease the amount of the

service fee, which would allow Blue Hat Fujian to have additional capital to operate and develop its business in the AR market.

The exclusive business cooperation

agreement remains in effect until November 13, 2028 and shall be automatically renewed for one year at the expiration date of the validity

term. However, Blue Hat WFOE has the right to terminate this agreement upon giving 30 days’ prior written notice to Blue Hat Fujian

at any time.

Call Option Agreements

Pursuant to the call option agreements,

among Blue Hat WFOE, Blue Hat Fujian and the shareholders who collectively owned all of Blue Hat Fujian, such shareholders jointly and

severally grant Blue Hat WFOE an option to purchase their equity interests in Blue Hat Fujian. The purchase price shall be the lowest

price then permitted under applicable PRC laws. Blue Hat WFOE or its designated person may exercise such option at any time to purchase

all or part of the equity interests in Blue Hat Fujian until it has acquired all equity interests of Blue Hat Fujian, which is irrevocable

during the term of the agreements.

The call option agreements remain

in effect until November 13, 2028 and shall be automatically renewed for one year at the expiration date of the validity term. However,

Blue Hat WFOE has the right to terminate these agreements upon giving 30 days’ prior written notice to Blue Hat Fujian at any time.

Equity Pledge Agreement

Pursuant to the equity pledge

agreement among the shareholders who collectively owned all of Blue Hat Fujian, such shareholders pledge all of the equity interests in

Blue Hat Fujian to Blue Hat WFOE as collateral to secure the obligations of Blue Hat Fujian under the exclusive business cooperation agreement

and call option agreements. These shareholders are prohibited or may not transfer the pledged equity interests without prior consent of

Blue Hat WFOE unless transferring the equity interests to Blue Hat WFOE or its designated person in accordance to the call option agreements.

The equity pledge agreement shall

come into force the date on which the pledged interests is recorded, which is three days after signing of the Agreement on November 13,

2018, under Blue Hat Fujian’s register of shareholders and is registered with competent administration for industry and commerce

of Blue Hat Fujian until all of the liabilities and debts to Blue Hat WFOE have been fulfilled completely by Blue Hat Fujian. Blue Hat

Fujian and the shareholders who collectively owned all of Blue Hat Fujian shall not terminate these agreements in any circumstance for

any reason. However, Blue Hat WFOE has the right to terminate these agreements upon giving 30 days’ prior written notice to Blue

Hat Fujian at any time.

Shareholders’ POAs

Pursuant to the shareholders’

POAs, the shareholders of Blue Hat Fujian give Blue Hat WFOE an irrevocable proxy to act on their behalf on all matters pertaining to

Blue Hat Fujian and to exercise all of their rights as shareholders of Blue Hat Fujian, including the right to attend shareholders meetings,

to exercise voting rights and all of the other rights, and to sign transfer documents and any other documents in relation to the fulfillment

of the obligations under the call option agreements and the equity pledge agreement. The POAs shall remain in effect while the shareholders

of Blue Hat Fujian hold the equity interests in Blue Hat Fujian.

Irrevocable Commitment Letters

Pursuant to the irrevocable commitment

letters, the shareholders of Blue Hat Fujian commit that their spouses or inheritors have no right to claim any rights or interest in

relation to the shares that they hold in Blue Hat Fujian and have no right to impose any impact on the daily managing duties of Blue Hat

Fujian, and commit that if any event which refrains them from exercising shareholders’ rights as a registered shareholder, such

as death, incapacity, divorce or any other event, could happen to them, the shareholders of Blue Hat Fujian will take corresponding measures

to guarantee the rights of other registered shareholders and the performance of the Contractual Arrangements. The letters are irrevocable

and shall not be withdrawn without the consent of Blue Hat WFOE.

Based on the foregoing contractual

arrangements, which grant Blue Hat WFOE effective control of Blue Hat Fujian and enable Blue Hat WFOE to receive all of their expected

residual returns, we account for Blue Hat Fujian as a VIE. Accordingly, we consolidate the accounts of Blue Hat Fujian for the periods

presented herein, in accordance with Regulation S-X-3A-02 promulgated by the SEC, and ASC 810-10, Consolidation.

On July 30, 2019, we completed

our initial public offering, and since July 26, 2019, our ordinary shares have been listed on the Nasdaq Capital Market under the symbol

“BHAT”.

Our principal executive office

is located at 7th Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009. Our telephone number is 86-592-228-0081.

Our registered office in the Cayman Islands is located at the offices of Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital

Road, George Town, Grand Cayman KY1-9008, Cayman Islands.

The SEC maintains a website that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC on www.sec.gov.

You can also find information on our website located at http://www.irbluehatgroup.com. Information contained on, or that can be accessed

through, our website is not a part of, and shall not be incorporated by reference into, this annual report.

We have not had any material commitments for capital

expenditures for the last three financial years.

The Offering

This prospectus relates to

the offer and resale by the selling shareholders of an aggregate of 4,403,000 ordinary shares issuable upon the exercise of the warrants.

All of the ordinary shares underlying the warrants, when sold, will be sold by the selling shareholders. The selling shareholders may

sell the ordinary shares underlying the warrants from time to time at prevailing market prices or at privately negotiated prices.

|

Issuer:

|

|

Blue Hat Interactive Entertainment Technology

|

|

|

|

|

|

Ordinary shares offered by the selling shareholders:

|

|

4,403,000 ordinary shares, consisting of (i) 4,088,500 ordinary shares issuable upon exercise of certain warrants issued to the selling shareholders on May 10, 2021 and (ii) 314,500 ordinary shares underlying the placement agent warrants issued in connection with the registered direct offering closed on May 10, 2021.

|

|

|

|

|

|

Ordinary shares outstanding (1):

|

|

53,417,200 shares

|

|

|

|

|

|

Use of proceeds:

|

|

We will not receive any proceeds from the offer and resale of the ordinary shares underlying the Warrants by the selling shareholders. We intend to use the net proceeds we may receive from the cash exercise of the Warrants by the selling shareholders for working capital and other general corporate purposes. There is no assurance that any of the Warrants will ever be exercised for cash, if at all. See “Use of Proceeds” on page 15.

|

|

|

|

|

|

Risk factors:

|

|

You should read the “Risk Factors” section beginning on page 13 of this prospectus, and the “Risk Factors” section in our Annual Report for the year ended December 31, 2020 on Form 20-F incorporated herein by reference for a discussion of factors to consider before deciding to purchase our securities.

|

|

|

|

|

|

Transfer agent and registrar:

|

|

The transfer agent and registrar for our ordinary shares is VStock Transfer, LLC, with an address at 18 Lafayette Place, Woodmere, NY 11598.

|

|

|

|

|

|

NASDAQ Capital Market Symbol:

|

|

Our ordinary shares are quoted and traded on the NASDAQ Capital Market under the symbol “BHAT.”

|

|

|

(1)

|

The number of ordinary shares currently outstanding is based on the actual number of shares outstanding as of June 9, 2021, which was 53,417,200, and does not include:

|

|

|

●

|

the 4,403,000 ordinary shares offered

hereby;

|

|

|

●

|

784,000 ordinary shares issuable to investors upon the exercise of warrants to purchase ordinary shares at an exercise price of $1.25 per share;

|

|

|

●

|

521,380 ordinary shares issuable to the placement agent upon the exercise of warrants to purchase ordinary shares at an exercise price of $1.25 per share;

|

|

|

●

|

288,462 ordinary shares issuable upon the conversion of convertible promissory notes in the aggregate principal amount of $75,000 at a conversion floor price of $0.26 per share;

|

|

|

●

|

971,700 ordinary shares in connection with the closing of Fuzhou Csfctech Co., Ltd on January 25, 2021; and

|

|

|

●

|

6,000,000 ordinary shares reserved under the Company’s 2020 Equity Incentive Plan.

|

Unless

otherwise stated, outstanding share information throughout this prospectus excludes the above.

Risks Associated with Our Business

Our business is subject to a

number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial

condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our ordinary

shares. These risks are discussed more fully in “Risk Factors” beginning on page 13

of this prospectus and in our Annual Report on Form 20-F for the year ended December 31, 2020, which is incorporated by reference

into this prospectus. These risks include, but are not limited to, the following:

|

|

●

|

We depend upon the Contractual Arrangements in conducting our business in China, which may not be as effective as direct ownership;

|

|

|

●

|

We operate in a highly competitive market and the size and resources of many of our competitors may allow them to compete more effectively than we can, preventing us from achieving profitability;

|

|

|

●

|

Issues with products may lead to product liability, personal injury or property damage claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities that could divert resources, affect business operations, decrease sales, increase costs, and put us at a competitive disadvantage, any of which could have a significant adverse effect on our financial condition;

|

|

|

●

|

As a developer and seller of consumer products, we are subject to various government regulations and may be subject to additional regulations in the future, violation of which could subject us to sanctions or otherwise harm our business;

|

|

|

●

|

If we are not able to adequately protect our proprietary intellectual property and information, and protect against third party claims that we are infringing on their intellectual property rights, our results of operations could be adversely affected; and

|

|

|

●

|

Uncertainties with respect to China’s legal system could adversely affect us.

|

Implications of Being an Emerging Growth Company and a Foreign Private

Issuer

As a company with less than $1.07

billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our

Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise

applicable to public companies. These provisions include, but are not limited to:

|

|

●

|

being permitted to present only two years of audited financial statements and only two years of related Operating and Financial Review and Prospects in our filings with the SEC;

|

|

|

●

|

not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

|

|

|

●

|

reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and

|

|

|

●

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

|

We may take advantage of these

provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our ordinary shares

pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large

accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in

any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the

JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section

7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We

have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge

such election is irrevocable pursuant to Section 107 of the JOBS Act. We are a “foreign private issuer,” as defined by the

SEC. As a result, in accordance with the rules and regulations of The Nasdaq Stock Market LLC, or Nasdaq, we may comply with home country

governance requirements and certain exemptions thereunder rather than complying with Nasdaq corporate governance standards. We may choose

to take advantage of the following exemptions afforded to foreign private issuers:

|

|

●

|

Exemption from filing quarterly reports on Form 10-Q or provide current reports on Form 8-K disclosing significant events within four days of their occurrence.

|

|

|

●

|

Exemption from Section 16 rules regarding sales of ordinary shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act.

|

|

|

●

|

Exemption from the Nasdaq rules applicable to domestic issuers requiring disclosure within four business days of any determination to grant a waiver of the code of business conduct and ethics to directors and officers. Although we will require board approval of any such waiver, we may choose not to disclose the waiver in the manner set forth in the Nasdaq rules, as permitted by the foreign private issuer exemption.

|

|

|

●

|

Exemption from the requirement that our board of directors have a remuneration committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

|

|

|

●

|

Exemption from the requirements that director nominees are selected, or recommended for selection by our board of directors, either by (1) independent directors constituting a majority of our board of directors’ independent directors in a vote in which only independent directors participate, or (2) a committee comprised solely of independent directors, and that a formal written charter or board resolution, as applicable, addressing the nominations process is adopted.

|

Furthermore, Nasdaq Rule 5615(a)(3)

provides that a foreign private issuer, such as us, may rely on our home country corporate governance practices in lieu of certain of

the rules in the Nasdaq Rule 5600 Series and Rule 5250(d), provided that we nevertheless comply with Nasdaq’s Notification of Noncompliance

requirement (Rule 5625), the Voting Rights requirement (Rule 5640) and that we have an audit committee that satisfies Rule 5605(c)(3),

consisting of committee members that meet the independence requirements of Rule 5605(c)(2)(A)(ii). If we rely on our home country corporate

governance practices in lieu of certain of the rules of Nasdaq, our shareholders may not have the same protections afforded to shareholders

of companies that are subject to all of the corporate governance requirements of Nasdaq. If we choose to do so, we may utilize these exemptions

for as long as we continue to qualify as a foreign private issuer.

The Company’s corporate

governance practices do not differ from those followed by domestic companies listed on the NASDAQ Capital Market other than disclosed

below. NASDAQ Listing Rule 5635 generally provides that shareholder approval is required of U.S. domestic companies listed on the NASDAQ

Capital Market prior to issuance (or potential issuance) of securities (i) equaling 20% or more of the company’s common stock or

voting power for less than the greater of market or book value (ii) resulting in a change of control of the company; and (iii) which is

being issued pursuant to a stock option or purchase plan to be established or materially amended or other equity compensation arrangement

made or materially amended. Notwithstanding this general requirement, NASDAQ Listing Rule 5615(a)(3)(A) permits foreign private issuers

to follow their home country practice rather than these shareholder approval requirements. The Cayman Islands do not require shareholder

approval prior to any of the foregoing types of issuances. The Company, therefore, is not required to obtain such shareholder approval

prior to entering into a transaction with the potential to issue securities as described above. The Board of Directors of the Company

has elected to follow the Company’s home country rules as to such issuances and will not be required to seek shareholder approval

prior to entering into such a transaction.

SUMMARY

CONSOLIDATED FINANCIAL AND OPERATING DATA

The

following summary consolidated statements of operations and comprehensive income data for the years ended December 31, 2019 and 2020,

summary consolidated balance sheet data as of December 31, 2019 and 2020 have been derived from our audited consolidated financial statements

incorporated by reference into this prospectus. You should read this Summary Consolidated Financial and Operating Data section together

with our consolidated financial statements and the related notes and “Operating and Financial Review and Prospects” incorporated

by reference in this prospectus. Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP. Our historical

results are not necessarily indicative of results expected for future periods.

The

following table shows our summary consolidated statements of operations and comprehensive income data for the years ended December 31,

2019 and 2020.

CONSOLIDATED BALANCE SHEETS

|

|

|

December

31,

2020

|

|

December

31,

2019

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current

assets:

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

15,800,563

|

|

|

$

|

10,478,587

|

|

|

Inventories

|

|

|

117,075

|

|

|

|

125,264

|

|

|

Accounts

receivable, net

|

|

|

16,594,533

|

|

|

|

13,631,359

|

|

|

Accounts

receivables - related party

|

|

|

1,906,101

|

|

|

|

—

|

|

|

Other

receivables, net

|

|

|

14,350,223

|

|

|

|

13,182,529

|

|

|

Prepayments,

net

|

|

|

1,917,780

|

|

|

|

299,577

|

|

|

Restricted

cash

|

|

|

—

|

|

|

|

5,000,000

|

|

|

Total

current assets

|

|

|

50,686,275

|

|

|

|

42,717,316

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Operating

lease, right-of-use asset

|

|

|

290,410

|

|

|

|

679,850

|

|

|

Prepayments

|

|

|

4,164,274

|

|

|

|

4,425,849

|

|

|

Property,

plant and equipment, net

|

|

|

4,258,121

|

|

|

|

2,324,823

|

|

|

Intangible

assets, net

|

|

|

14,252,575

|

|

|

|

6,758,316

|

|

|

Long-term investments

|

|

|

1,914,668

|

|

|

|

1,727,301

|

|

|

Deferred

tax assets

|

|

|

119,127

|

|

|

|

182,234

|

|

|

Total

non-current assets

|

|

|

24,999,175

|

|

|

|

16,098,373

|

|

|

Total

assets

|

|

$

|

75,685,450

|

|

|

$

|

58,815,689

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND EQUITY

|

|

|

|

|

|

|

|

|

|

Current

liabilities:

|

|

|

|

|

|

|

|

|

|

Short-term

loans - banks

|

|

$

|

5,129,295

|

|

|

$

|

5,819,787

|

|

|

Current

maturities of long-term loans - third party

|

|

|

14,117

|

|

|

|

77,493

|

|

|

Taxes

payable

|

|

|

6,802,454

|

|

|

|

3,525,153

|

|

|

Accounts

payable

|

|

|

935,588

|

|

|

|

293,985

|

|

|

Other

payables and accrued liabilities

|

|

|

1,846,917

|

|

|

|

3,628,809

|

|

|

Other

payables - related party

|

|

|

25,837

|

|

|

|

21,341

|

|

|

Operating

lease liabilities - current

|

|

|

300,468

|

|

|

|

313,460

|

|

|

Customer

deposits

|

|

|

941,877

|

|

|

|

—

|

|

|

Convertible

bonds payable

|

|

|

739,189

|

|

|

|

—

|

|

|

Total

current liabilities

|

|

|

16,735,742

|

|

|

|

13,680,028

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Operating

lease liability

|

|

|

—

|

|

|

|

372,051

|

|

|

Long-term

loans - third party

|

|

|

—

|

|

|

|

13,328

|

|

|

Total

other liabilities

|

|

|

—

|

|

|

|

385,379

|

|

|

Total

liabilities

|

|

|

16,735,742

|

|

|

|

14,065,407

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder’s

equity

|

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.001

par value, 100,000,000 shares authorized, 38,553,694 shares issued and outstanding as of December 31, 2020 35,141,114 shares issued

and outstanding as of December 31, 2019

|

|

|

38,554

|

|

|

|

35,141

|

|

|

Additional

paid-in capital

|

|

|

23,466,482

|

|

|

|

20,771,849

|

|

|

Statutory

reserves

|

|

|

2,204,174

|

|

|

|

1,289,765

|

|

|

Retained

earnings

|

|

|

31,387,398

|

|

|

|

24,132,194

|

|

|

Accumulated

other comprehensive loss

|

|

|

1,741,696

|

|

|

|

(1,478,667

|

)

|

|

Total

Blue Hat Interactive Entertainment Technology shareholders’ equity

|

|

|

58,838,304

|

|

|

|

44,750,282

|

|

|

Non-controlling interests

|

|

|

111,404

|

|

|

|

—

|

|

|

Total

Equity

|

|

|

58,949,708

|

|

|

|

—

|

|

|

Total

liabilities and shareholders’ equity

|

|

$

|

75,685,450

|

|

|

$

|

58,815,689

|

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE

INCOME

|

|

|

Year ended

|

|

Year ended

|

|

|

|

December

31,

2020

|

|

December

31,

2019

|

|

Revenues

|

|

$

|

30,191,069

|

|

|

$

|

23,834,129

|

|

|

Cost of revenue

|

|

|

(16,206,823

|

)

|

|

|

(7,531,800

|

)

|

|

Gross

profit

|

|

|

13,984,246

|

|

|

|

16,302,329

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

expenses:

|

|

|

|

|

|

|

|

|

|

Selling

|

|

|

(522,168

|

)

|

|

|

(928,680

|

)

|

|

Research

and development

|

|

|

(281,618

|

)

|

|

|

(1,031,204

|

)

|

|

General

and administrative expenses

|

|

|

(3,613,361

|

)

|

|

|

(4,860,189

|

)

|

|

Total

operating expenses

|

|

|

(4,417,147

|

)

|

|

|

(6,820,073

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income

from operations

|

|

|

9,567,099

|

|

|

|

9,482,256

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

income (expense)

|

|

|

|

|

|

|

|

|

|

Interest

income

|

|

|

147,840

|

|

|

|

629

|

|

|

Interest

expense

|

|

|

(439,607

|

)

|

|

|

(171,938

|

)

|

|

Other

finance expenses

|

|

|

(82,338

|

)

|

|

|

(4,415

|

)

|

|

Other

income, net

|

|

|

864,198

|

|

|

|

221,146

|

|

|

Total

other income, net

|

|

|

490,093

|

|

|

|

45,422

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

before income taxes

|

|

|

10,057,192

|

|

|

|

9,527,678

|

|

|

Provision

for income taxes

|

|

|

1,776,175

|

|

|

|

453,724

|

|

|

Net income

|

|

|

8,281,017

|

|

|

|

9,073,954

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

comprehensive (loss) income Foreign currency translation adjustment

|

|

|

(3,220,363

|

)

|

|

|

(521,738

|

)

|

|

Comprehensive

income

|

|

$

|

5,060,654

|

|

|

$

|

8,552,216

|

|

|

Less:

Comprehensive income attributable to non-controlling interests

|

|

|

(111,404

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive

income attributable to Blue Hat Interactive Entertainment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number

of ordinary shares

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

38,553,694

|

|

|

|

35,141,114

|

|

|

Diluted

|

|

|

39,859,074

|

|

|

|

35,141,114

|

|

|

Earnings per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.21

|

|

|

$

|

0.26

|

|

|

Diluted

|

|

|

0.21

|

|

|

|

0.26

|

|

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should carefully consider the risks described under the heading “Risk Factors” in our

Annual Report on Form 20-F for the fiscal year ended December 31, 2020, which is incorporated by reference into this prospectus, as well

as the other information in this prospectus or incorporated by reference into this prospectus (including our financial statements and

the related notes), before deciding whether to invest in our securities. Investment risks can be market-wide as well as unique to a specific

industry or company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair

our business operations. The occurrence of any of the risks described here or in our Annual Report could harm our business, financial

condition, results of operations or growth prospects. In that case, the trading price of our securities could decline, and you may lose

all or part of your investment.

Risks Related to this Offering

Sales

of substantial amounts of our ordinary shares by the selling shareholders, or the perception that these sales could occur, could adversely

affect the price of our ordinary shares.

The sale by the selling shareholders

of a significant number of ordinary shares could have a material adverse effect on the market price of our ordinary shares. In addition,

the perception in the public markets that the selling shareholders may sell all or a portion of their shares as a result of the registration

of such shares pursuant to the Registration Statement could also in and of itself have a material adverse effect on the market price of

our ordinary shares. We cannot predict the effect, if any, that market sales of those ordinary shares or the availability of those ordinary

shares for sale will have on the market price of our ordinary shares.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and our SEC filings that are incorporated

by reference into this prospectus contain or incorporate by reference forward-looking statements that involve substantial risks and uncertainties.

In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue” and “ongoing,”

or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve

known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance

or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking

statements and opinions contained or incorporated by reference in this prospectus are based upon information available to us as of the

date of this prospectus and, while we believe such information forms a reasonable basis for such statements, such information may be limited

or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all

potentially available relevant information. Forward-looking statements include statements about:

|

|

●

|

our ability to develop and market new products;

|

|

|

●

|

the continued market acceptance of our products;

|

|

|

●

|

exposure to product liability and defect claims;

|

|

|

●

|

protection of our intellectual property rights;

|

|

|

●

|

changes in the laws that affect our operations;

|

|

|

●

|

inflation and fluctuations in foreign currency exchange rates;

|

|

|

●

|

our ability to obtain all necessary government certifications, approvals, and/or licenses to conduct our business;

|

|

|

●

|

continued development of a public trading market for our securities;

|

|

|

●

|

the cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; and

|

|

|

●

|

managing our growth effectively;

|

|

|

●

|

fluctuations in operating results;

|

|

|

●

|

dependence on our senior management and key employees; and

|

|

|

●

|

other factors set forth under “Risk Factors.”

|

You should refer to the section titled “Risk

Factors” contained or incorporated by reference in this prospectus for a discussion of important factors that may cause our actual

results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot

assure you that the forward-looking statements in or incorporated by reference into this prospectus will prove to be accurate. Furthermore,

if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in

these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that

we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this prospectus and the documents

that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus forms a part,

completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of

our forward-looking statements by these cautionary statements.

INDUSTRY AND MARKET DATA

This prospectus includes statistical and other industry

and market data that we obtained from industry publications and research, surveys and studies conducted by third parties, as well estimates

by our management based on such data. The market data and estimates used in this prospectus involve a number of assumptions and limitations,

and you are cautioned not to give undue weight to such data and estimates. While we believe that the information from these industry publications,

surveys and studies is reliable, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety

of important factors, including those described in the section titled “Risk Factors.” These and other factors could cause

results to differ materially from those expressed in the estimates made by the independent parties and by us.

USE OF PROCEEDS

We are not selling

any of the ordinary shares being offered by this prospectus and will receive no proceeds from the sale of the shares by the selling shareholders.

All of the proceeds from the sale of ordinary shares offered by this prospectus will go to the selling shareholders at the time they offer

and sell such shares. We will bear all costs associated with registering the ordinary shares offered by this prospectus.

CAPITALIZATION

The following table sets forth

our capitalization as of April 30, 2021:

|

|

●

|

on a pro forma, as adjusted basis to give effect to the issuance and sale of 4,403,000 ordinary shares at the average offering price of $1.12 per share in this offering, after deducting the estimated offering expenses payable by us;

|

|

|

|

As of

|

|

|

|