Total revenues in 3Q24 were $84.0

million

3Q24 GAAP net income was $9.8 million and

adjusted EBITDA1 was $21.1 million

Bioceres Crop Solutions Corp. (Bioceres) (NASDAQ:

BIOX), a leader in the development and commercialization of

productivity solutions designed to regenerate agricultural

ecosystems while making crops more resilient to climate change,

announced financial results for the fiscal third quarter ended

March 31, 2024. Financial results are expressed in U.S. dollars and

are presented in accordance with International Financial Reporting

Standards. All comparisons in this announcement are year-over-year

(YoY), unless otherwise noted.

FINANCIAL & BUSINESS HIGHLIGHTS

- Total revenues in 3Q24 were $84.0 million compared to

$93.6 million in the same quarter last year. Operational growth in

the business was offset by a $15.7 million accrual of the

compensatory payment from Syngenta, in comparison to a $32.9

million accrual in 3Q23.

- Operating profit was $13.2 million with GAAP net income at

$9.8 million.

- Adjusted EBITDA1 for the quarter was $21.1 million,

compared to $35.8 million in the year ago quarter. The decrease was

driven by the lower compensatory payment accrual, partially

softened by improved operational performance.

- Regulatory clearance in Brazil unlocks

bio-insecticidal/bio-nematicidal solutions, expanding Bioceres’

biologicals portfolio in this geography.

- HB4 Soy varieties showed satisfactory performance at

farmer level in Brazil, with an average yield improvement of 7%

against non-HB4 varieties.

____________

1

Adjusted EBITDA is a non-GAAP measure. See

“Use of non-IFRS financial information” for information regarding

our use of Adjusted EBITDA and its reconciliation from the most

comparable financial measure.

MANAGEMENT REVIEW

Mr. Federico Trucco, Bioceres' Chief Executive Officer,

commented: “We are generally satisfied with our third quarter

results, despite some delayed sales in our bio-nutrition segment in

Argentina and Brazil, which we now expect to realize in our fourth

and final fiscal quarter. As anticipated, our third quarter growth

is disfavored when compared to the year before, given the

disproportional weight of the Syngenta distribution agreement,

whose contribution is now more evenly distributed throughout the

year. From a qualitative point of view, we continue to see positive

developments in Brazil, which we expect to translate into

quantitative milestones in one or two seasons. One of these

developments was the first regulatory approval for our inactivated

Burkholderia bio-control solutions, which we announced last week.

This approval creates an immediate opportunity in high value

bio-insecticidal markets as well as in our Generation HB4 channel,

and ― in one or two seasons ― in broader row-crop markets once our

lowest rate formulations are included in the portfolio. Another

positive development in Brazil comes from the performance of our

first two HB4 soy varieties, where we received favorable feedback

from key farmers and expect to increase the current pace of growth.

Looking ahead and despite the industry-wide headwinds persisting

from last year, we are confident on the attractiveness of our value

propositions and the capabilities of our teams to achieve the

double-digit growth we are known to deliver.”

Mr. Enrique Lopez Lecube, Bioceres' Chief Financial Officer,

noted: “This year’s third fiscal quarter was marked by a difficult

comparison against last year´s third quarter, in which the

compensatory payment from the Syngenta agreement drove a

substantial portion of sales and explained our profits almost in

full. In a scenario of slower-than-expected market dynamics for

fertilizers and inoculants in South America and persisting

suboptimal conditions for crop protection in the US and Brazil, we

were still able to partially offset the $17 million year-over-year

difference from the Syngenta agreement by growing the rest of our

business’ top line by roughly $8 million. As we head into the last

quarter of our fiscal year, we are confident that with a normalized

crop nutrition market we will be in good shape to deliver our

annual goals of achieving double-digit growth in EBITDA.”

KEY FINANCIAL METRICS

Table 1: 3Q24 Key Financial Metrics

(In millions of U.S. dollars)

3Q23

3Q24

% Change

Revenue by Segment

Crop Protection

44.3

46.8

6%

Seed and Integrated Products

5.9

8.6

46%

Crop Nutrition

43.4

28.6

(34%)

Total Revenue

93.6

84.0

(10%)

Gross Profit

57.5

42.6

(26%)

Gross Margin

61.4%

50.8%

(1,062 bps)

3Q23

3Q24

% Change

GAAP net income or loss

27.5

9.8

(64%)

Adjusted EBITDA1

35.8

21.1

(41%)

3Q24 Summary: Total revenues were $84.0 million in 3Q24,

compared to $93.6 million for the same quarter last year. The

decline is fully explained by a ~$17 million decrease in the

accrual of the Syngenta compensatory payment, which was $15.7

million this year, compared to $32.9 million in the year-ago

quarter. Excluding these accruals, the business generated $68.3

million in revenues, compared to $60.7 million last year, with

modest growth in Crop Protection and Crop Nutrition, the two main

business segments contributing material sales during the

quarter.

Gross profit for the quarter was $42.6 million, a decline

compared to the $57.5 million in 3Q23. As with revenues, the

reduction was entirely due to the lower accrual of the compensatory

payment this quarter compared to last year. Excluding this, gross

profit increased ― although proportionally less than revenues due

to product mix ― and overall gross margin remained practically

flat.

GAAP net income and adjusted EBITDA1 for the quarter were $9.8

million and $21.1 million, respectively, compared to $27.5 million

and $35.8 million, respectively. The decrease in the compensatory

payment translates directly into the bottom line, partially offset

by an improved underlying business performance.

For a full version of Bioceres’ third quarter fiscal 2024

earnings release, click here.

THIRD QUARTER 2024 EARNINGS CONFERENCE CALL

Management will host a conference call and question-and-answer

session, which will be accompanied by a presentation available

during the webcast or accessed via the investor relations section

of the company’s website.

To access the call, please use the following information:

Date:

Tuesday, May 14, 2024

Time:

8:30 a.m. ET, 5:30 a.m. PT

US Toll Free dial-in number:

1-833-470-1428

International dial-in numbers:

Click here

Conference ID:

391060

Webcast:

Click here

Please dial in 5-10 minutes prior to the start time to register

and join.

The conference call will be broadcast live and available for

replay here and via the investor relations section of the company’s

website here.

A replay of the call will be available through June 6, 2024,

following the conference.

Toll Free Replay Number:

1-866-813-9403

International Replay Number:

+44 204 525 0658

Replay ID:

206193

About Bioceres Crop Solutions Corp.

Bioceres Crop Solutions Corp. (NASDAQ: BIOX) is a leader in the

development and commercialization of productivity solutions

designed to regenerate agricultural ecosystems while making crops

more resilient to climate change. To do this, Bioceres’ solutions

create economic incentives for farmers and other stakeholders to

adopt environmentally friendlier production practices. The company

has a unique biotech platform with high-impact, patented

technologies for seeds and microbial ag-inputs, as well as next

generation Crop Nutrition and Protection solutions. Through its

HB4® program, the company is bringing digital solutions to support

growers’ decisions and provide end-to-end traceability for

production outputs. For more information, visit here.

Forward-Looking Statements

This communication includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,”

“expect,” “estimate,” “plan,” “outlook,” and “project” and other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. Such

forward-looking statements include estimated financial data, and

any such forward-looking statements involve risks, assumptions and

uncertainties. These forward-looking statements include, but are

not limited to, whether (i) the health and safety measures

implemented to safeguard employees and assure business continuity

will be successful and (ii) we will be able to coordinate efforts

to ramp up inventories. Such forward-looking statements are based

on management’s reasonable current assumptions, expectations, plans

and forecasts regarding the company’s current or future results and

future business and economic conditions more generally. Such

forward-looking statements involve risks, uncertainties and other

factors, which may cause the actual results, levels of activity,

performance or achievement of the company to be materially

different from any future results expressed or implied by such

forward-looking statements, and there can be no assurance that

actual results will not differ materially from management’s

expectations or could affect the company’s ability to achieve its

strategic goals, including the uncertainties relating to the other

factors that are described in the sections entitled “Risk Factors”

in the company's Securities and Exchange Commission filings updated

from time to time. The preceding list is not intended to be an

exhaustive list of all of our forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements as predictions of future events. All forward-looking

statements contained in this release are qualified in their

entirety by this cautionary statement. Forward-looking statements

speak only as of the date they are or were made, and the company

does not intend to update or otherwise revise the forward-looking

statements to reflect events or circumstances after the date of

this release or to reflect the occurrence of unanticipated events,

except as required by law.

Unaudited Consolidated Statement of

Comprehensive Income

(Figures in million of U.S. dollars)

Three-month period ended

03/31/2024

Three-month period ended

03/31/2023

Revenues from contracts with customers

84.0

93.0

Initial recognition and changes in the

fair value of biological assets at the point of harvest

(0.1)

0.6

Cost of sales

(41.3)

(36.1)

Gross profit

42.6

57.5

% Gross profit

51%

61%

Operating expenses

(30.7)

(27.9)

Share of profit of JV

0.9

0.4

Change in net realizable value of

agricultural products

0.2

(1.1)

Other income or expenses, net

0.2

1.0

Operating profit

13.2

29.9

Financial result

(4.4)

(7.6)

Profit/(loss) before income tax

8.8

22.3

Income tax

1.0

5.2

Profit/(loss) for the period

9.8

27.5

Other comprehensive profit

0.2

(0.1)

Total comprehensive

profit/(loss)

10.0

27.4

Profit/(loss) for the period

attributable to:

Equity holders of the parent

9.3

28.1

Non-controlling interests

0.5

(0.7)

9.8

27.5

Total comprehensive profit/(loss)

attributable to:

Equity holders of the parent

9.5

28.2

Non-controlling interests

0.5

(0.8)

10.0

27.4

Weighted average number of

shares

Basic

62.8

62.0

Diluted

66.8

63.1

Unaudited Consolidated Statement of

Financial Position

(Figures in million of U.S. dollars)

ASSETS

03/31/2024

06/30/2023

CURRENT ASSETS

Cash and cash equivalents

16.4

48.1

Other financial assets

16.5

12.1

Trade receivables

212.1

158.0

Other receivables

30.7

28.8

Income and minimum presumed recoverable

income taxes

1.4

9.4

Inventories

129.2

140.4

Biological assets

1.9

0.1

Total current assets

408.1

397.1

NON-CURRENT ASSETS

Other financial assets

0.4

0.4

Other receivables

2.1

2.5

Income and minimum presumed recoverable

income taxes

0.0

0.0

Deferred tax assets

9.7

7.3

Investments in joint ventures and

associates

42.3

39.3

Investment properties

0.6

3.6

Property, plant and equipment

74.6

67.9

Intangible assets

174.5

173.8

Goodwill

112.2

112.2

Right-of-use leased asset

12.7

13.9

Total non-current assets

428.9

420.9

Total assets

837.0

818.1

LIABILITIES

CURRENT LIABILITIES

Trade and other payables

167.5

150.8

Borrowings

144.2

107.6

Employee benefits and social security

7.8

9.6

Deferred revenue and advances from

customers

5.5

24.9

Income tax payable

4.0

0.5

Consideration for acquisition

2.9

1.4

Lease liabilities

3.5

3.9

Total current liabilities

335.4

298.7

NON-CURRENT LIABILITIES

Borrowings

18.9

60.7

Deferred revenue and advances from

customers

2.8

2.1

Joint ventures and associates

0.0

0.6

Deferred tax liabilities

39.4

35.8

Provisions

0.8

0.9

Consideration for acquisition

2.7

3.6

Secured notes

79.7

75.2

Lease liabilities

24.4

10.0

Total non-current liabilities

153.0

188.9

Total liabilities

488.5

487.6

EQUITY

Equity attributable to owners of the

parent

313.4

298.6

Non-controlling interests

35.2

31.9

Total equity

348.5

330.5

Total equity and liabilities

837.0

818.1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513598564/en/

Bioceres Crop Solutions Paula Savanti Head of Investor Relations

investorrelations@biocerescrops.com

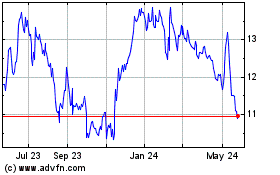

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Dec 2024 to Jan 2025

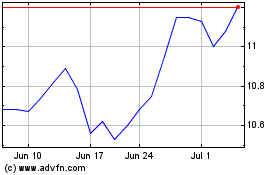

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Jan 2024 to Jan 2025