-Blackbox Stockholders to retain 26.7% of

the combined company’s 12,000,000 common shares post-merger plus

receive a Contingent Value Right (“CVR”) for current Blackbox

fintech operations-

-Blackbox has already acquired 13% of Sister

Company Evtec Automotive with $80 million in revenue and plans to

acquire the remainder of the company in parallel-

-Transaction expected to close in Q1

2024-

Blackboxstocks Inc. (NASDAQ: BLBX), (“Blackbox” or the

“Company”), a financial technology and social media hybrid platform

offering real-time proprietary analytics for stock and options

traders, announced today that on December 12, 2023 it executed a

definitive agreement to acquire Evtec Aluminium Limited (“Evtec”).

The transaction is expected to close in the first quarter of

2024.

Evtec is a supplier of proprietary mission critical parts for

the Electric Vehicle (“EV”), Hybrid, Performance and Luxury OEM

automotive markets to brands including JLR (formerly Jaguar Land

Rover), Aston Martin, Ford, Bentley, and auto suppliers including

Dana, American Axle, Cox Powertrain, among others. David Roberts, a

40-year veteran of the global automotive market and a UK Export

Ambassador, leads a team of seasoned executives with decades of

experience.

- Revenue estimates for Evtec Aluminum have now reached $52

million for fiscal 2024 ending June 30, an increase of over 60%

from the prior year.

- Evtec has record order demand in its pipeline with

approximately $778 million in existing orders scheduled for

delivery beginning in March 2024. The order book has increased by

approximately $430 million over the past eight (8) months and is

expected to increase by at least an additional $150 million by

March 2024.

- Evtec’s strategy includes both organic growth and growth

through acquisition. Evtec’s acquisition targets include companies

with strong order books for mostly single sourced parts at

attractive valuations. Currently, the Company has multiple targets

that are off-market, that can provide substantial growth

opportunities.

The Acquisition

- Post-closing, Blackbox and Evtec Aluminum common stockholders

will own 26.7% and 73.3% of the estimated 12,000,000 common shares

outstanding post-merger, respectively.

- Blackbox plans to acquire the remaining 87% of Evtec Automotive

in Q1 of 2024. Evtec Automotive’s inclusion in the merger would

result in Blackbox shareholders retaining 9.5% of the combined

companies.

- Blackbox common stockholders of record immediately prior to

closing of the transaction will receive a contingent value right

(“CVR") for the net proceeds received by the Company for the sale

or spin-off of the current Blackbox fintech operations within a

24-month period after the close of the merger. The current Blackbox

operations will be moved into a new subsidiary prior to the

closing.

- David Roberts will assume the roles of Chairman and CEO of the

parent Company post-closing. Gust Kepler will continue to serve as

the CEO of the Blackbox fintech operations and Robert Winspear will

remain a director and CFO of the parent Company, all post-closing.

Evtec will appoint three new independent directors to the Company’s

Board.

- The transaction is expected to close in the first quarter of

2024 and is subject to customary closing conditions including but

not limited to regulatory, lender and stockholder approval.

Blackbox and Evtec plan to file a joint Registration Statement and

proxy on Form S-4 as soon as practical.

Gust Kepler, Chief Executive Officer of Blackbox, commented,

“This is a great transaction that delivers outstanding value for

Blackbox stockholders. Not only will our stockholders retain the

current value of the Blackbox operations via a contingent value

right (CVR), but they will also receive a significant interest in

Evtec’s operations going forward. As a subsidiary of the parent

company, Blackbox’s fintech operations will continue to create and

provide innovative tools and analytics for traders. We look forward

to completing the transaction in Q1 2024 and delivering maximum

value to our shareholders.”

Evtec Operations and Strategy

Evtec, founded by leading entrepreneur David Roberts, seeks to

generate attractive long-term returns within the manufacturing

sector. Evtec’s objective is to push the boundaries of

manufacturing excellence through investing in promising companies,

clever technology, and market leading practices. They have built up

an impressive portfolio of private companies, located in the UK, in

a wide variety of sectors including luxury goods, automotive

vehicles and trucks, automotive parts and components, consumer

goods and industrial products, that complement each other in order

to provide the market with superior products and services.

Evtec focuses on the luxury, performance, hybrid and electric

vehicle (“EV”) automotive supply chain revolution. The business is

based upon streamlining the supply chain for their OEM customers

while targeting market segments with strong growth and more price

elasticity in order to generate higher margins. EV demand continues

to outpace the automotive industry and is expected to continue to

do so for the foreseeable future. The luxury segment of the

industry generates higher margins, thereby allowing manufacturers

to pay premium prices in order to improve supply chain operations

and efficiency.

Evtec’s strategy includes future acquisitions to augment its

strong organic growth. Leveraging its excellent track record for

delivering high quality parts on time, Evtec is well positioned to

acquire companies that have strong order books but lack Evtec’s

operational capabilities. Evtec currently has multiple targets for

potential acquisition.

Evtec’s U.S. strategy is to partner with established brands and

distribution to expand into higher margin opportunities driven by

Evtec’s relationships with well renowned global brands in the

industry, including the racing and performance segments. By

providing opportunities for higher margin revenues and new

distribution channels, Evtec anticipates its U.S. launch to drive

significant revenue growth in 2024 and beyond through organic and

acquisition growth.

David Roberts, Chairman and CEO of Evtec, added, “The market

opportunity to be a single-source, strategic supplier to global

OEMs in the EV and Hybrid automotive sector is significant and

growing exponentially. The global pressures on reducing supply

chain risk fragility, increasing localization and near-shoring,

combined with proven competency in complex assemblies and precision

parts, underpins the strong growth we are experiencing at Evtec.

Access to the public markets provided by this transaction is

compelling for all of our stakeholders as it supports our strategic

plan that includes expansion of our global footprint by both

organic growth and acquisition.”

James Whittle, Global Purchasing and Supplier Quality Director

for JLR (Jaguar Land Rover), said, “JLR is very supportive of Evtec

becoming a public company and moving ahead with its investment

programme to further increase its capacity and capability to supply

key components for our EV vehicles as they are a key strategic

partner for us and our growth strategy.”

About Evtec

Evtec is a UK-based business group providing complete assemblies

and complex engineered components to auto manufacturers,

simplifying sourcing, saving time on procurement, and increasing

production efficiency. Their pick and pack service supplies

aftermarket automotive products, as well as offering kitting and

fulfilment for non-automotive businesses. Their business focuses on

premium luxury brands and a market transition to electric vehicles

and includes Jaguar Land Rover Group as their largest customer. As

a result of significant change in the global supply chain for auto

manufacturing in Great Britain that places an increased need for

local sourcing of parts, Evtec is well positioned to expand both

organically and through acquisition. For more information, go to:

https://www.evtec-group.com/

About Blackboxstocks, Inc.

Blackboxstocks, Inc. is a financial technology and social media

hybrid platform offering real-time proprietary analytics and news

for stock and options traders of all levels. Our web-based software

employs "predictive technology" enhanced by artificial intelligence

to find volatility and unusual market activity that may result in

the rapid change in the price of a stock or option. Blackbox

continuously scans the NASDAQ, New York Stock Exchange, CBOE, and

all other options markets, analyzing over 10,000 stocks and up to

1,500,000 options contracts multiple times per second. We provide

our users with a fully interactive social media platform that is

integrated into our dashboard, enabling our users to exchange

information and ideas quickly and efficiently through a common

network. We recently introduced a live audio/screenshare feature

that allows our members to broadcast on their own channels to share

trade strategies and market insight within the Blackbox community.

Blackbox is a SaaS company with a growing base of users that spans

over 40 countries; current subscription fees are $99.97 per month

or $959.00 annually.

For more information, go to: https://blackboxstocks.com/

Safe Harbor Clause and Forward-Looking Statements

This press release includes forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding our future

results of operations and financial position, business strategy and

plans, and our objectives for future operations, are

forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “expose,” “intend,”

“may,” “might,” “opportunity,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar

expressions that convey uncertainty of future events or outcomes

are intended to identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements contained in this press release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. Future developments

affecting us may not be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control) and other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described under the heading “Risk

Factors” in our filings with the Securities and Exchange Commission

(the “SEC”), including our reports on Forms 10-K, 10-Q, 8-K and

other filings that we make with the SEC from time to time. Should

one or more of these risks or uncertainties materialize, or should

any of our assumptions prove incorrect, actual results may vary in

material respects from those projected in these forward-looking

statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws. These risks and others described under

“Risk Factors” in our SEC filings may not be exhaustive.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future

performance and that our actual results of operations, financial

condition and liquidity, and developments in the industry in which

we operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if our results or operations, financial condition

and liquidity, and developments in the industry in which we operate

are consistent with the forward-looking statements contained in

this press release, those results or developments may not be

indicative of results or developments in subsequent periods.

Disclosure Information

Blackboxstocks uses and intends to continue to use its Investors

website at https://blackboxstocks.com/company-overview as a means

of disclosing material nonpublic information and for complying with

its disclosure obligations under Regulation FD. Accordingly,

investors should monitor the Company’s Investors website, in

addition to following the Company’s press releases, SEC filings,

public conference calls, presentations and webcasts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231213868320/en/

Investors@blackboxstocks.com PCG Advisory Stephanie Prince (646)

863-6341 sprince@pcgadvisory.com

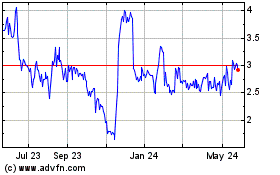

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Dec 2024 to Jan 2025

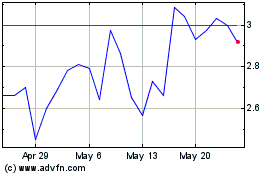

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Jan 2024 to Jan 2025