false000128005800012800582024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 000-50600 | 11-2617163 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer ID Number) |

65 Fairchild Street, Charleston, South Carolina 29492

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (843) 216-6200

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, $0.001 Par Value | BLKB | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 30, 2024, Blackbaud, Inc. (the "Company") issued a press release reporting unaudited financial results for the quarter ended September 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The information in this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Press release dated October 30, 2024 reporting unaudited financial results for the quarter ended September 30, 2024. |

| 101.INS | | Inline XBRL Instance Document - the Instance Document does not appear in the interactive data file because its XBRL tags are embedded within the Inline XBRL Document. |

| | |

| | |

| 101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document. |

| 101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | | BLACKBAUD, INC. |

| | | | |

| Date: | October 30, 2024 | | | /s/ Anthony W. Boor |

| | | | Anthony W. Boor |

| | | | Executive Vice President and Chief Financial Officer |

| | | | (Principal Financial and Accounting Officer) |

| | | | | | | | |

| | Exhibit 99.1 |

| | | |

| |

| | |

| PRESS RELEASE | | |

Blackbaud Announces 2024 Third Quarter Results

At bbcon® 2024, Blackbaud Launched Its Most Aggressive Innovation Plans Yet

Charleston, S.C. (October 30, 2024) — Blackbaud (NASDAQ: BLKB), the leading provider of software for powering social impact, today announced financial results for its third quarter ended September 30, 2024.

"Blackbaud is a clear market leader with a path to penetrate even further into a rich market opportunity while empowering our existing customers through continued innovation. In September at our annual tech conference, bbcon, we introduced six waves of innovation that were met with overwhelming enthusiasm from our customers," said Mike Gianoni, president, CEO and vice chairman of the board of directors, Blackbaud. "Blackbaud remains focused on our operating plan and delivering an attractive multi-year financial profile of balanced mid single-digit plus organic revenue growth and improving profitability and cash flows. We plan to put our strong cash flow to work in a purposeful capital allocation strategy that benefits our stockholders. I continue to be excited about the company's mid- and long-term future."

Third Quarter 2024 Results Compared to Third Quarter 2023 Results:

•GAAP total revenue was $286.7 million, up 3.3% and non-GAAP organic revenue increased 4.3%.

•GAAP recurring revenue was $280.0 million, up 4.1% and represented 98% of total revenue. Non-GAAP organic recurring revenue increased 4.1%.

•GAAP income from operations was $43.8 million, with GAAP operating margin of 15.3%, an increase of 740 basis points.

•Non-GAAP income from operations was $78.9 million, with non-GAAP operating margin of 27.5%, a decrease of 120 basis points.

•GAAP net income was $20.5 million, with GAAP diluted earnings per share of $0.40, up $0.23 per share.

•Non-GAAP net income was $51.1 million, with non-GAAP diluted earnings per share of $0.99, down $0.13 per share.

•Non-GAAP adjusted EBITDA was $95.2 million, down $1.9 million, with non-GAAP adjusted EBITDA margin of 33.2%, a decrease of 180 basis points.

•GAAP net cash provided by operating activities was $104.0 million, a decrease of $24.0 million, with GAAP operating cash flow margin of 36.3%, a decrease of 980 basis points.

•Non-GAAP free cash flow was $88.3 million, a decrease of $22.3 million, with non-GAAP free cash flow margin of 30.8%, a decrease of 900 basis points.

•Non-GAAP adjusted free cash flow was $97.6 million, a decrease of $20.3 million, with non-GAAP adjusted free cash flow margin of 34.0%, a decrease of 850 basis points.

"The revision of our FY24 guide is a direct result of continued underperformance of EVERFI," said Tony Boor, executive vice president and CFO, Blackbaud. “We’ve spoken in the past about improving EVERFI’s performance and evaluating strategic options. We've hired a strategic advisor to assist us in evaluating options and have recently rightsized the business to better align costs to revenues. We plan to continue to update you as appropriate in this area.”

"However, we remain confident that our underlying business and our future opportunities remain strong. In the third quarter, our Social Sector, representing 89% of total revenue, grew at 6.6%. Non-GAAP adjusted EBITDA margin was 33.2% and the business generated $97.6 million in adjusted free cash flow for the quarter. We remain

committed to our stock repurchase program and as of today have repurchased approximately 8% of the common stock outstanding as of year-end 2023. We plan to continue to be purposeful about buying back our stock as well as investing in product innovation to deliver a compelling investment thesis to new and existing shareholders. We remain committed to delivering an attractive financial investment balanced between top-line growth, profitability, and cash flow, all of which are supported by our proven operating plan."

An explanation of all non-GAAP financial measures referenced in this press release, including the Rule of 40, is included below under the heading "Non-GAAP Financial Measures." A reconciliation of the company's non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included below in this press release.

Recent Company Highlights

•At bbcon 2024, Blackbaud showcased the future of AI-powered fundraising and financial management for social impact organizations, rolling out six waves of innovation to build connection between solutions and teams while delivering contextual intelligence.

•Blackbaud and Microsoft announced upcoming product innovations that will enable Blackbaud customers to soon benefit from deeper integration of Microsoft AI and analytics into Blackbaud software, enabling them to achieve greater impact, gain in-depth insights and increase efficiency.

•The company released Blackbaud Donation Forms to U.S. Blackbaud CRM™ and Blackbaud Altru® customers to help social impact organizations raise more, streamline the donor experience, simplify administrative tasks, and reduce processing costs, enabling them to sustain and grow their missions.

•G2 recognized Blackbaud Raiser’s Edge NXT® in its Summer 2024 Reports across 11 different categories and as an overall leader in the Donor Management, Nonprofit CRM, and Donor Prospect Research categories, based on user ratings.

•Blackbaud also celebrated the achievements of its community during the quarter, recognizing Blackbaud Partner Network Awards winners helping bring more flexibility and value to customers, celebrating customers achieving the most with their technology through the Blackbaud Impact Awards, and honoring standout fundraisers in the JustGiving Awards.

Visit www.blackbaud.com/newsroom for more information about Blackbaud’s recent highlights.

Financial Outlook

Blackbaud today revised its 2024 full year financial guidance:

•GAAP revenue of $1.150 billion to $1.160 billion

•Non-GAAP adjusted EBITDA margin of 33.0% to 34.0%

•Non-GAAP earnings per share of $3.98 to $4.16

•Non-GAAP adjusted free cash flow of $235 million to $245 million

Included in its 2024 full year financial guidance are the following updated assumptions:

•Non-GAAP annualized effective tax rate is expected to be approximately 24.5%

•Interest expense for the year is expected to be approximately $53 million to $57 million

•Fully diluted shares for the year are expected to be approximately 51.0 million to 52.0 million

•Capital expenditures for the year are expected to be approximately $65 million to $75 million, including approximately $60 million to $70 million of capitalized software and content development costs

Blackbaud has not reconciled forward-looking full-year non-GAAP financial measures contained in this news release to their most directly comparable GAAP measures, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K.

Such reconciliations would require unreasonable efforts at this time to estimate and quantify with a reasonable degree of certainty various necessary GAAP components, including for example those related to compensation, acquisition transactions and integration, tax items or others that may arise during the year. These components and other factors could materially impact the amount of the future directly comparable GAAP measures, which may differ significantly from their non-GAAP counterparts.

In order to provide a meaningful basis for comparison, Blackbaud uses non-GAAP adjusted free cash flow in analyzing its operating performance. Non-GAAP adjusted free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, capital expenditures for property and equipment, plus cash outflows related to the previously disclosed Security Incident discovered in May 2020 (the "Security Incident"). Total costs related to the Security Incident exceeded the limit of our insurance coverage during the first quarter of 2022. For full year 2024, Blackbaud currently expects net cash outlays of $8 million to $13 million for ongoing legal fees related to the Security Incident. In line with the company's policy, all associated costs due to third-party service providers and consultants, including legal fees, are expensed as incurred. Please refer to the section below titled "Non-GAAP Financial Measures" for more information on Blackbaud's use of non-GAAP financial measures.

Stock Repurchase Program

As of September 30, 2024, Blackbaud had approximately $737 million remaining under its common stock repurchase program that was expanded, replenished and reauthorized in July 2024.

Conference Call Details

What: Blackbaud's 2024 Third Quarter Conference Call

When: October 30, 2024

Time: 8:00 a.m. (Eastern Time)

Live Call: 1-877-407-3088 (US/Canada)

Webcast: Blackbaud's Investor Relations Webpage

About Blackbaud

Blackbaud (NASDAQ: BLKB) is the leading software provider exclusively dedicated to powering social impact. Serving the nonprofit and education sectors, companies committed to social responsibility and individual change makers, Blackbaud's essential software is built to accelerate impact in fundraising, nonprofit financial management, digital giving, grantmaking, corporate social responsibility and education management. With millions of users and over $100 billion raised, granted or managed through Blackbaud platforms every year, Blackbaud's solutions are unleashing the potential of the people and organizations who change the world. Blackbaud has been named to Newsweek’s list of America’s Most Responsible Companies, Quartz’s list of Best Companies for Remote Workers and Forbes’ list of America’s Best Employers. A remote-first company, Blackbaud has operations in the United States, Australia, Canada, Costa Rica, India and the United Kingdom, supporting users in 100+ countries. Learn more at www.blackbaud.com, or follow us on X/Twitter, LinkedIn, Instagram, and Facebook.

| | | | | | | | | | | |

| Investor Contact | | | |

| IR@blackbaud.com | | | |

| | | |

| Media Contact | | | |

| media@blackbaud.com | | | |

| | | |

Forward-Looking Statements

Except for historical information, all of the statements, expectations, and assumptions contained in this news release are forward-looking statements which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the predictability of our financial condition and results of operations. These statements involve a number of risks and uncertainties. Although Blackbaud attempts to be accurate in making these forward-looking statements, it is possible that future circumstances might differ from the assumptions on which such statements are based. In addition, other important factors that could cause results to differ materially include the following: management of integration of acquired companies; uncertainty regarding increased business and renewals from existing customers; a shifting revenue mix that may impact gross margin; continued success in sales growth; cybersecurity and data protection risks and related liabilities; potential litigation involving us; and the other risk factors set forth from time to time in the SEC filings for Blackbaud, copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from Blackbaud's investor relations department. Blackbaud assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Trademarks

All Blackbaud product names appearing herein are trademarks or registered trademarks of Blackbaud, Inc.

Non-GAAP Financial Measures

Blackbaud has provided in this release financial information that has not been prepared in accordance with GAAP. Blackbaud uses non-GAAP financial measures internally in analyzing its operational performance. Accordingly, Blackbaud believes these non-GAAP measures are useful to investors, as a supplement to GAAP measures, in evaluating its ongoing operational performance and trends and in comparing its financial results from period-to-period with other companies in Blackbaud's industry, many of which present similar non-GAAP financial measures to investors. However, these non-GAAP financial measures may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies.

The non-GAAP financial measures discussed above exclude the impact of certain transactions that Blackbaud believes are not directly related to its operating performance in any particular period, but are for its long-term benefit over multiple periods. Blackbaud believes these non-GAAP financial measures reflect its ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of trends in its business.

While Blackbaud believes these non-GAAP measures provide useful supplemental information, non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures.

As previously disclosed, beginning in 2024, we apply a non-GAAP effective tax rate of 24.5% when calculating non-GAAP net income and non-GAAP diluted earnings per share. The non-GAAP tax rate utilized in future periods will be reviewed annually to determine whether it remains appropriate in consideration of our financial results including our periodic effective tax rate calculated in accordance with GAAP, our operating environment and related tax legislation in effect and other factors deemed necessary. All 2023 measures of non-GAAP net income and non-GAAP diluted earnings per share included in this news release are calculated under Blackbaud's historical non-GAAP effective tax rate of 20.0%.

Non-GAAP free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, and capital expenditures for property and equipment. In addition, and in order to provide a meaningful basis for comparison, Blackbaud also uses non-GAAP adjusted free cash flow in analyzing its operating performance. Non-GAAP adjusted free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, and capital expenditures for property and equipment, plus cash outflows related to the Security Incident. Blackbaud believes non-GAAP free cash flow and non-GAAP adjusted free cash flow provide useful measures of the company's operating performance. Non-GAAP free cash flow and Non-GAAP adjusted free cash flow are not intended to represent and should not be viewed as the amount of residual cash flow available for discretionary expenditures.

In addition, Blackbaud uses non-GAAP organic revenue growth, non-GAAP organic revenue growth on a constant currency basis, non-GAAP organic recurring revenue growth and non-GAAP organic recurring revenue growth on a constant currency basis, in analyzing its operating performance. Blackbaud believes that these non-GAAP measures are useful to investors, as a supplement to GAAP measures, for evaluating the periodic growth of its business on a consistent basis. Each of these measures excludes incremental acquisition-related revenue attributable to companies, if any, acquired in the current fiscal year. For companies acquired in the immediately preceding fiscal year, each of these measures reflects presentation of full-year incremental non-GAAP revenue derived from such companies as if they were combined throughout the prior period. In addition, each of these measures excludes prior period revenue associated with divested businesses. The exclusion of the prior period revenue is to present the results of the divested businesses within the results of the combined company for the same period of time in both the prior and current periods. Blackbaud believes this presentation provides a more comparable representation of its current business’ organic revenue growth and revenue run-rate.

Rule of 40 is defined as non-GAAP organic revenue growth plus non-GAAP adjusted EBITDA margin. Non-GAAP adjusted EBITDA is defined as GAAP net income plus interest, net; income tax provision (benefit); depreciation; amortization of intangible assets from business combinations; amortization of software and content development costs; stock-based compensation; employee severance; acquisition and disposition-related costs; restructuring and other real estate activities; Security Incident-related costs; and impairment of capitalized software development costs.

Blackbaud, Inc.

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | |

| (dollars in thousands, except per share amounts) | September 30,

2024 | December 31,

2023 |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 34,633 | | $ | 31,251 | |

| Restricted cash | 428,095 | | 697,006 | |

Accounts receivable, net of allowance of $6,307 and $6,907 at September 30, 2024 and December 31, 2023, respectively | 97,988 | | 101,862 | |

| Customer funds receivable | 7,343 | | 353 | |

| Prepaid expenses and other current assets | 87,499 | | 99,285 | |

| Total current assets | 655,558 | | 929,757 | |

| Property and equipment, net | 95,053 | | 98,689 | |

| Operating lease right-of-use assets | 27,522 | | 36,927 | |

| Software and content development costs, net | 169,507 | | 160,194 | |

| Goodwill | 1,056,882 | | 1,053,738 | |

| Intangible assets, net | 536,008 | | 581,937 | |

| Other assets | 60,444 | | 51,037 | |

| Total assets | $ | 2,600,974 | | $ | 2,912,279 | |

| Liabilities and stockholders’ equity | | |

| Current liabilities: | | |

| Trade accounts payable | $ | 43,983 | | $ | 25,184 | |

| Accrued expenses and other current liabilities | 48,745 | | 64,322 | |

| Due to customers | 434,093 | | 695,842 | |

| Debt, current portion | 23,830 | | 19,259 | |

| Deferred revenue, current portion | 411,554 | | 392,530 | |

| Total current liabilities | 962,205 | | 1,197,137 | |

| Debt, net of current portion | 977,019 | | 760,405 | |

| Deferred tax liability | 68,196 | | 93,292 | |

| Deferred revenue, net of current portion | 1,705 | | 2,397 | |

| Operating lease liabilities, net of current portion | 35,218 | | 40,085 | |

| Other liabilities | 12,304 | | 10,258 | |

| Total liabilities | 2,056,647 | | 2,103,574 | |

| Commitments and contingencies | | |

| Stockholders’ equity: | | |

Preferred stock; 20,000,000 shares authorized, none outstanding | — | | — | |

Common stock, $0.001 par value; 180,000,000 shares authorized, 70,955,940 and 69,188,304 shares issued at September 30, 2024 and December 31, 2023, respectively; 50,869,218 and 53,625,440 shares outstanding at September 30, 2024 and December 31, 2023, respectively | 71 | | 69 | |

| Additional paid-in capital | 1,227,198 | | 1,203,012 | |

Treasury stock, at cost; 20,086,722 and 15,562,864 shares at September 30, 2024 and December 31, 2023, respectively | (922,516) | | (591,557) | |

| Accumulated other comprehensive loss | (6,887) | | (1,688) | |

| Retained earnings | 246,461 | | 198,869 | |

| Total stockholders’ equity | 544,327 | | 808,705 | |

| Total liabilities and stockholders’ equity | $ | 2,600,974 | | $ | 2,912,279 | |

Blackbaud, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (dollars in thousands, except per share amounts) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenue | | | | | |

| Recurring | $ | 280,018 | | $ | 269,001 | | | $ | 832,912 | | $ | 784,139 | |

| One-time services and other | 6,709 | | 8,625 | | | 20,351 | | 26,282 | |

| Total revenue | 286,727 | | 277,626 | | | 853,263 | | 810,421 | |

| Cost of revenue | | | | | |

| Cost of recurring | 122,646 | | 114,132 | | | 361,644 | | 342,558 | |

| Cost of one-time services and other | 4,871 | | 7,634 | | | 16,779 | | 23,795 | |

| Total cost of revenue | 127,517 | | 121,766 | | | 378,423 | | 366,353 | |

| Gross profit | 159,210 | | 155,860 | | | 474,840 | | 444,068 | |

| Operating expenses | | | | | |

| Sales, marketing and customer success | 49,454 | | 52,462 | | | 147,400 | | 160,038 | |

| Research and development | 39,368 | | 37,965 | | | 121,238 | | 114,702 | |

| General and administrative | 25,645 | | 42,596 | | | 106,842 | | 154,582 | |

| Amortization | 918 | | 793 | | | 2,724 | | 2,355 | |

| | | | | |

| Total operating expenses | 115,385 | | 133,816 | | | 378,204 | | 431,677 | |

| Income from operations | 43,825 | | 22,044 | | | 96,636 | | 12,391 | |

| Interest expense | (14,140) | | (9,620) | | | (40,131) | | (31,449) | |

| Other income, net | 2,997 | | 5,662 | | | 9,654 | | 10,447 | |

| Income (loss) before provision (benefit) for income taxes | 32,682 | | 18,086 | | | 66,159 | | (8,611) | |

| Income tax provision (benefit) | 12,140 | | 9,069 | | | 18,567 | | (5,032) | |

| Net income (loss) | $ | 20,542 | | $ | 9,017 | | | $ | 47,592 | | $ | (3,579) | |

| Earnings (loss) per share | | | | | |

| Basic | $ | 0.41 | | $ | 0.17 | | | $ | 0.93 | | $ | (0.07) | |

| Diluted | $ | 0.40 | | $ | 0.17 | | | $ | 0.91 | | $ | (0.07) | |

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | 50,409,292 | | 52,704,974 | | | 51,067,255 | | 52,495,556 | |

| Diluted weighted average shares | 51,632,569 | | 54,089,897 | | | 52,107,147 | | 52,495,556 | |

| Other comprehensive loss | | | | | |

| Foreign currency translation adjustment | $ | 6,463 | | $ | (4,794) | | | $ | 5,617 | | $ | 419 | |

| Unrealized (loss) gain on derivative instruments, net of tax | (13,525) | | 4,093 | | | (10,816) | | (1,216) | |

| Total other comprehensive loss | (7,062) | | (701) | | | (5,199) | | (797) | |

| Comprehensive income (loss) | $ | 13,480 | | $ | 8,316 | | | $ | 42,393 | | $ | (4,376) | |

Blackbaud, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | |

| Nine months ended

September 30, |

| (dollars in thousands) | 2024 | 2023 |

| Cash flows from operating activities | | |

| Net income (loss) | $ | 47,592 | | $ | (3,579) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | |

| Depreciation and amortization | 91,618 | | 81,627 | |

| Provision for credit losses and sales returns | 1,721 | | 4,815 | |

| Stock-based compensation expense | 76,430 | | 95,668 | |

| Deferred taxes | (21,776) | | (31,163) | |

| Amortization of deferred financing costs and discount | 1,786 | | 1,388 | |

| Loss on disposition of business | 1,561 | | — | |

| Other non-cash adjustments | 2,462 | | 5,106 | |

| Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | | |

| Accounts receivable | 918 | | (4,757) | |

| Prepaid expenses and other assets | (873) | | 14,488 | |

| Trade accounts payable | 18,322 | | (3,362) | |

| Accrued expenses and other liabilities | (16,373) | | 9,073 | |

| Deferred revenue | 18,998 | | 33,679 | |

| Net cash provided by operating activities | 222,386 | | 202,983 | |

| Cash flows from investing activities | | |

| Purchase of property and equipment | (7,235) | | (4,243) | |

| Capitalized software and content development costs | (42,882) | | (44,664) | |

| Purchase of net assets of acquired companies, net of cash and restricted cash acquired | — | | (13) | |

| Net cash used in disposition of business | (1,179) | | — | |

| Other investing activities | (5,029) | | (250) | |

| Net cash used in investing activities | (56,325) | | (49,170) | |

| Cash flows from financing activities | | |

| Proceeds from issuance of debt | 1,303,400 | | 175,800 | |

| Payments on debt | (1,080,192) | | (293,957) | |

| Debt issuance costs | (6,458) | | — | |

| | |

| Employee taxes paid for withheld shares upon equity award settlement | (55,950) | | (35,568) | |

| Change in due to customers | (263,732) | | (339,735) | |

| Change in customer funds receivable | (6,777) | | (3,286) | |

| Purchase of treasury stock | (325,408) | | — | |

| Net cash used in financing activities | (435,117) | | (496,746) | |

| Effect of exchange rate on cash, cash equivalents and restricted cash | 3,527 | | (311) | |

| Net decrease in cash, cash equivalents and restricted cash | (265,529) | | (343,244) | |

| Cash, cash equivalents and restricted cash, beginning of period | 728,257 | | 733,931 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 462,728 | | $ | 390,687 | |

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown above in the consolidated statements of cash flows:

| | | | | | | | |

| (dollars in thousands) | September 30,

2024 | December 31,

2023 |

| Cash and cash equivalents | $ | 34,633 | | $ | 31,251 | |

| Restricted cash | 428,095 | | 697,006 | |

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 462,728 | | $ | 728,257 | |

Blackbaud, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (dollars in thousands, except per share amounts) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | 2023 | | 2024 | 2023 |

| GAAP Revenue | $ | 286,727 | | $ | 277,626 | | | $ | 853,263 | | $ | 810,421 | |

| | | | | |

| GAAP gross profit | $ | 159,210 | | $ | 155,860 | | | $ | 474,840 | | $ | 444,068 | |

| GAAP gross margin | 55.5 | % | 56.1 | % | | 55.6 | % | 54.8 | % |

| Non-GAAP adjustments: | | | | | |

| Add: Stock-based compensation expense | 2,915 | | 4,145 | | | 10,066 | | 12,242 | |

| Add: Amortization of intangibles from business combinations | 14,667 | | 13,117 | | | 43,969 | | 39,364 | |

| Add: Employee severance | — | | — | | | — | | 797 | |

| | | | | |

| Subtotal | 17,582 | | 17,262 | | | 54,035 | | 52,403 | |

| Non-GAAP gross profit | $ | 176,792 | | $ | 173,122 | | | $ | 528,875 | | $ | 496,471 | |

| Non-GAAP gross margin | 61.7 | % | 62.4 | % | | 62.0 | % | 61.3 | % |

| | | | | |

| GAAP income from operations | $ | 43,825 | | $ | 22,044 | | | $ | 96,636 | | $ | 12,391 | |

| GAAP operating margin | 15.3 | % | 7.9 | % | | 11.3 | % | 1.5 | % |

| Non-GAAP adjustments: | | | | | |

Add: Stock-based compensation expense | 18,574 | | 32,379 | | | 76,430 | | 95,668 | |

Add: Amortization of intangibles from business combinations | 15,585 | | 13,910 | | | 46,693 | | 41,719 | |

Add: Employee severance | — | | 140 | | | — | | 5,094 | |

Add: Acquisition and disposition-related costs | 246 | | 7,029 | | | 4,899 | | 6,799 | |

| | | | | |

Add: Security Incident-related costs(1) | 637 | | 4,086 | | | 12,782 | | 48,646 | |

| | | | | |

| Subtotal | 35,042 | | 57,544 | | | 140,804 | | 197,926 | |

| Non-GAAP income from operations | $ | 78,867 | | $ | 79,588 | | | $ | 237,440 | | $ | 210,317 | |

| Non-GAAP operating margin | 27.5 | % | 28.7 | % | | 27.8 | % | 26.0 | % |

| | | | | |

| GAAP income (loss) before provision (benefit) for income taxes | $ | 32,682 | | $ | 18,086 | | | $ | 66,159 | | $ | (8,611) | |

| GAAP net income (loss) | $ | 20,542 | | $ | 9,017 | | | $ | 47,592 | | $ | (3,579) | |

| | | | | |

| Shares used in computing GAAP diluted earnings (loss) per share | 51,632,569 | | 54,089,897 | | | 52,107,147 | | 52,495,556 | |

| GAAP diluted earnings (loss) per share | $ | 0.40 | | $ | 0.17 | | | $ | 0.91 | | $ | (0.07) | |

| | | | | |

| Non-GAAP adjustments: | | | | | |

| Add: GAAP income tax provision (benefit) | 12,140 | | 9,069 | | | 18,567 | | (5,032) | |

| Add: Total non-GAAP adjustments affecting income from operations | 35,042 | | 57,544 | | | 140,804 | | 197,926 | |

| Non-GAAP income before provision for income taxes | 67,724 | | 75,630 | | | 206,963 | | 189,315 | |

Assumed non-GAAP income tax provision(2) | 16,592 | | 15,126 | | | 50,706 | | 37,863 | |

| Non-GAAP net income | $ | 51,132 | | $ | 60,504 | | | $ | 156,257 | | $ | 151,452 | |

| | | | | |

| Shares used in computing non-GAAP diluted earnings per share | 51,632,569 | | 54,089,897 | | | 52,107,147 | | 53,469,768 | |

| Non-GAAP diluted earnings per share | $ | 0.99 | | $ | 1.12 | | | $ | 3.00 | | $ | 2.83 | |

(1)Includes Security Incident-related costs incurred during the three months ended September 30, 2024 which were insignificant, during the nine months ended September 30, 2024 of $12.8 million, which included approximately $6.8 million in recorded liabilities for loss contingencies, and during the three and nine months ended September 30, 2023 of $4.1 million and $48.6 million, respectively, which included approximately $0.0 million and $30.0 million, respectively, in recorded aggregate liabilities for loss contingencies. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. For full year 2024, we currently expect pre-tax expenses of approximately $5 million to $10 million and cash outlays of approximately $8 million to $13 million for ongoing legal fees related to the Security Incident. Not included in these ranges are our previous settlements or current accruals for loss contingencies related to the matters discussed below. In line with our policy, legal fees are expensed as incurred. As of September 30, 2024, we have recorded approximately $0.7 million in aggregate liabilities for loss contingencies based primarily on recent negotiations with certain customers related to the Security Incident that we believe we can reasonably estimate. During the third quarter of 2024, we paid $6.8 million in connection with our settlement with the Attorney General of the State of California (as previously disclosed on June 14, 2024). It is reasonably possible that our estimated or actual losses may change in the near term for those matters and be materially in excess of the amounts accrued, but we are unable at this time to reasonably estimate the possible additional loss. There are other Security Incident-related matters, including customer claims, customer constituent class actions and governmental investigations, for which we have not recorded a liability for a loss contingency as of September 30, 2024 because we are unable at this time to reasonably estimate the possible loss or range of loss. Each of these matters could, separately or in the aggregate, result in an adverse judgment, settlement, fine, penalty or other resolution, the amount, scope and timing of which we are currently unable to predict, but could have a material adverse impact on our results of operations, cash flows or financial condition.

(2)Beginning in 2024, we now apply a non-GAAP effective tax rate of 24.5% when calculating non-GAAP net income and non-GAAP diluted earnings per share. For the three and nine months ended September 30, 2023, the tax impact related to non-GAAP adjustments is calculated under our historical non-GAAP effective tax rate of 20.0%.

Blackbaud, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | 2023 | | 2024 | 2023 |

GAAP revenue(1) | $ | 286,727 | | $ | 277,626 | | | $ | 853,263 | | $ | 810,421 | |

| GAAP revenue growth | 3.3 | % | | | 5.3 | % | |

| | | | | |

Less: Non-GAAP revenue from divested businesses(2) | — | | (2,692) | | | — | | (5,189) | |

| | | | | |

Non-GAAP organic revenue(2) | $ | 286,727 | | $ | 274,934 | | | $ | 853,263 | | $ | 805,232 | |

| Non-GAAP organic revenue growth | 4.3 | % | | | 6.0 | % | |

| | | | | |

Non-GAAP organic revenue(3) | $ | 286,727 | | $ | 274,934 | | | $ | 853,263 | | $ | 805,232 | |

Foreign currency impact on non-GAAP organic revenue(4) | (1,024) | | — | | | (2,130) | | — | |

Non-GAAP organic revenue on constant currency basis(4) | $ | 285,703 | | $ | 274,934 | | | $ | 851,133 | | $ | 805,232 | |

| Non-GAAP organic revenue growth on constant currency basis | 3.9 | % | | | 5.7 | % | |

| | | | | |

| GAAP recurring revenue | $ | 280,018 | | $ | 269,001 | | | $ | 832,912 | | $ | 784,139 | |

| GAAP recurring revenue growth | 4.1 | % | | | 6.2 | % | |

| | | | | |

Less: Non-GAAP recurring revenue from divested businesses(2) | — | | — | | | — | | — | |

| | | | | |

Non-GAAP organic recurring revenue(3) | $ | 280,018 | | $ | 269,001 | | | $ | 832,912 | | $ | 784,139 | |

| Non-GAAP organic recurring revenue growth | 4.1 | % | | | 6.2 | % | |

| | | | | |

Non-GAAP organic recurring revenue(2) | $ | 280,018 | | $ | 269,001 | | | $ | 832,912 | | $ | 784,139 | |

Foreign currency impact on non-GAAP organic recurring revenue(4) | (1,005) | | — | | | (2,070) | | — | |

Non-GAAP organic recurring revenue on constant currency basis(4) | $ | 279,013 | | $ | 269,001 | | | $ | 830,842 | | $ | 784,139 | |

| Non-GAAP organic recurring revenue growth on constant currency basis | 3.7 | % | | | 6.0 | % | |

(1)Includes EVERFI revenue of $19.4 million and $26.2 million for the three months ended September 30, 2024 and 2023, respectively, and $66.8 million and $80.4 million for the nine months ended September 30, 2024 and 2023, respectively.

(2)Non-GAAP revenue from divested businesses excludes revenue associated with divested businesses. The exclusion of the prior period revenue is to present the results of the divested business with the results of the combined company for the same period of time in both the prior and current periods.

(3)Non-GAAP organic revenue and non-GAAP organic recurring revenue for the prior year periods presented herein may not agree to non-GAAP organic revenue and non-GAAP organic recurring revenue presented in the respective prior period quarterly financial information solely due to the manner in which non-GAAP organic revenue growth and non-GAAP organic recurring revenue growth are calculated.

(4)To determine non-GAAP organic revenue growth and non-GAAP organic recurring revenue growth on a constant currency basis, revenues from entities reporting in foreign currencies were translated to U.S. Dollars using the comparable prior period's quarterly weighted average foreign currency exchange rates. The primary foreign currencies creating the impact are the Australian Dollar, British Pound, Canadian Dollar and Euro.

Blackbaud, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | 2023 | | 2024 | 2023 |

| GAAP net income (loss) | $ | 20,542 | | $ | 9,017 | | | $ | 47,592 | | $ | (3,579) | |

| Non-GAAP adjustments: | | | | | |

Add: Interest, net | 11,022 | | 6,608 | | | 32,150 | | 24,893 | |

Add: GAAP income tax provision (benefit) | 12,140 | | 9,069 | | | 18,567 | | (5,032) | |

Add: Depreciation | 3,293 | | 3,293 | | | 9,621 | | 9,901 | |

Add: Amortization of intangibles from business combinations | 15,585 | | 13,910 | | | 46,693 | | 41,719 | |

Add: Amortization of software and content development costs(1) | 13,186 | | 11,573 | | | 37,915 | | 33,113 | |

| Subtotal | 55,226 | | 44,453 | | | 144,946 | | 104,594 | |

| Non-GAAP EBITDA | $ | 75,768 | | $ | 53,470 | | | $ | 192,538 | | $ | 101,015 | |

Non-GAAP EBITDA margin(2) | 26.4 | % | | | 22.6 | % | |

| | | | | |

| Non-GAAP adjustments: | | | | | |

Add: Stock-based compensation expense | $ | 18,574 | | $ | 32,379 | | | $ | 76,430 | | $ | 95,668 | |

Add: Employee severance | — | | 140 | | | — | | 5,094 | |

Add: Acquisition and disposition-related costs(3) | 246 | | 7,029 | | | 4,899 | | 6,799 | |

| | | | | |

Add: Security Incident-related costs(3) | 637 | | 4,086 | | | 12,782 | | 48,646 | |

| | | | | |

| Subtotal | 19,457 | | 43,634 | | | 94,111 | | 156,207 | |

| Non-GAAP adjusted EBITDA | $ | 95,225 | | $ | 97,104 | | | $ | 286,649 | | $ | 257,222 | |

Non-GAAP adjusted EBITDA margin(4) | 33.2 | % | | | 33.6 | % | |

| | | | | |

Rule of 40(5) | 37.5 | % | | | 39.6 | % | |

| | | | | |

| Non-GAAP adjusted EBITDA | $ | 95,225 | | $ | 97,104 | | | $ | 286,649 | | $ | 257,222 | |

Foreign currency impact on Non-GAAP adjusted EBITDA(6) | (556) | | (1,162) | | | (1,059) | | 709 | |

Non-GAAP adjusted EBITDA on constant currency basis(6) | $ | 94,669 | | $ | 95,942 | | | $ | 285,590 | | $ | 257,931 | |

| Non-GAAP adjusted EBITDA margin on constant currency basis | 33.1 | % | | | 33.6 | % | |

| | | | | |

Rule of 40 on constant currency basis(7) | 37.0 | % | | | 39.3 | % | |

(1)Includes amortization expense related to software and content development costs, and amortization expense from capitalized cloud computing implementation costs.

(2)Measured by GAAP revenue divided by non-GAAP EBITDA.

(3)See additional details in the reconciliation of GAAP to Non-GAAP operating income above.

(4)Measured by non-GAAP organic revenue divided by non-GAAP adjusted EBITDA.

(5)Measured by non-GAAP organic revenue growth plus non-GAAP adjusted EBITDA margin. See Non-GAAP organic revenue growth table above.

(6)To determine non-GAAP adjusted EBITDA on a constant currency basis, non-GAAP adjusted EBITDA from entities reporting in foreign currencies were translated to U.S. Dollars using the comparable prior period's quarterly weighted average foreign currency exchange rates. The primary foreign currencies creating the impact are the Australian Dollar, British Pound, Canadian Dollar and Euro.

(7)Measured by non-GAAP organic revenue growth on constant currency basis plus non-GAAP adjusted EBITDA margin on constant currency basis.

| | | | | | | | |

| (dollars in thousands) | Nine months ended

September 30, |

| 2024 | 2023 |

| GAAP net cash provided by operating activities | $ | 222,386 | | $ | 202,983 | |

| GAAP operating cash flow margin | 26.1 | % | 25.0 | % |

| Non-GAAP adjustments: | | |

| Less: purchase of property and equipment | (7,235) | | (4,243) | |

| Less: capitalized software and content development costs | (42,882) | | (44,664) | |

| Non-GAAP free cash flow | $ | 172,269 | | $ | 154,076 | |

| Non-GAAP free cash flow margin | 20.2 | % | 19.0 | % |

| Non-GAAP adjustments: | | |

| Add: Security Incident-related cash flows | 15,081 | | 23,100 | |

| Non-GAAP adjusted free cash flow | $ | 187,350 | | $ | 177,176 | |

| Non-GAAP adjusted free cash flow margin | 22.0 | % | 21.9 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

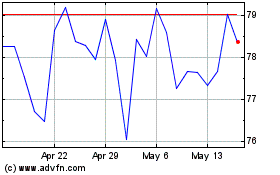

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Nov 2023 to Nov 2024