false

--12-31

0001845942

0001845942

2024-02-08

2024-02-08

0001845942

BNIX:CommonStockParValue0.01PerShareMember

2024-02-08

2024-02-08

0001845942

BNIX:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2024-02-08

2024-02-08

0001845942

BNIX:OneRightToReceive110thOfOneShareOfCommonStockMember

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

Bannix Acquisition Corp.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

1-40790 |

|

86-1626016 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

1063 North Spaulding

West Hollywood, CA |

|

90046 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (323) 682-8949

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

BNIX |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

BNIXW |

|

The Nasdaq Stock Market LLC |

| One Right to receive 1/10th of one share of Common Stock |

|

BNIXR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.03 Amendments to

Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 8, 2024,

Bannix Acquisition Corp. (the “Company”) filed a Certificate of Correction to its Certificate of Amendment to

its Amended and Restated Certificate of Incorporation (the “Certificate of Correction”) filed with the Secretary

of State of the State of Delaware on March 9, 2023 (the “Certificate of Amendment”). The Certificate of Amendment

inadvertently removed the provisions relating to the Company’s obligation to wind up and liquidate the Company and

redeem the public shares if the Company has not consummated an initial business combination

within the specified

time. The Certificate of Correction corrects this error to the Certificate of Amendment. The

corrections made by the Certificate of Correction are retroactively effective as of March 9, 2023, the original filing date of

the Certificate of Amendment.

The foregoing description of the Certificate

of Correction is qualified in its entirety by reference to the full text of the Certificate of Correction attached as Exhibit 3.1

hereto.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed

with this Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 8, 2024 |

|

| |

|

| BANNIX ACQUISITION CORP. |

|

| |

|

| By: |

/s/ Douglas Davis |

|

| Name: |

Douglas Davis |

|

| Title: |

Chief Executive Officer |

|

EXHIBIT 3.1

CERTIFICATE OF

CORRECTION

OF THE CERTIFICATE

OF AMENDMENT TO THE

AMENDED AND RESTATED

CERTIFICATE OF

INCORPORATION OF

BANNIX ACQUISIUTION

CORP.

Pursuant to the provisions

of § 103(f) of the General

Corporation Law of

the State of Delaware

FIRST:

The name of the corporation is Bannix Acquisition Corp. (the “Corporation”).

SECOND:

The Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation was filed in the office

of the Secretary of State of the State of Delaware on March 9, 2023.

THIRD:

The Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation so filed incorrectly removed

a provision relating to the actions to be taken by the Corporation in the event a Business Combination is not closed by the applicable

deadline.

FOURTH:

The Certificate of Amendment to the Amended and Restated Certificate of Incorporation is corrected so that Section 9.2(d)

of Article IX shall read in its entirety as follows:

“In

the event that the Corporation has not consummated an initial Business Combination within 15 months from the closing of the Offering,

the Sponsor may request that the Board extend the period of time to consummate an initial Business Combination by two additional

3 month periods (each, an “Extension Period”), for a total of 21 months to consummate an initial Business

Combination (the “Deadline Date”); provided, that for each such Extension Period: (i) the Sponsor or

its affiliates or designees has deposited into the Trust Account an amount equal to $600,000, or $690,000 if the underwriters’

over-allotment option is exercised in full ($0.10 per share in either case) on or prior to the date of the applicable deadline,

up to an aggregate of $1,200,000 (or $1,380,000 if the underwriters’ over-allotment option is exercised in full), or approximately

$0.20 per share; and (ii) there has been compliance with any applicable procedures relating to the Extension Period in the trust

agreement and in the letter agreement, both of which are described in the Registration Statement, provided, further in the event

that the Corporation has not consummated an initial Business Combination within 21 months from the closing of the Offering, the

Board of Directors, in its discretion and without another stockholder vote, if requested by the Sponsor, upon five days prior written

notice to the Corporation, may extend the Deadline Date by one month each on up to twelve occasions, up to an additional twelve

months (each such month being part of the “Additional Extension Period”), but in no event to a date later

than 31 months from the closing of the Offering or 33 months from the closing of the Offering in the event the Automatic Extension

has been implemented (or, if the Office of the Delaware Division of Corporations shall not be open for business (including filing

of corporate documents) on such date the next date upon which the Office of the Delaware Division of Corporations shall be open),

provided that (i) for each one-month Extension Period the Sponsor (or its affiliates or its permitted designees) has deposited

into the Trust Account an amount equal to the lesser of (x) $75,000 or (y) $0.07 for each Offering Share that is not redeemed by

the last day immediately preceding such Additional Extension Period, in exchange for a non-interest bearing, unsecured promissory

note. If the Sponsor requests the Extension Period or any Additional Extension Period,

as applicable, then the following applies:

(A) the gross proceeds from the issuance of such promissory note referred to in (i) above will be added to the offering proceeds

in the Trust Account and shall be used to fund the redemption of the Offering Shares in accordance with this Article IX; (B) if

the Corporation completes its initial Business Combination, it will, at the option of the Sponsor, repay the amount loaned under

the promissory note out of the proceeds of the Trust Account released to it or issue securities of the Corporation in lieu of repayment

in accordance with the terms of the promissory note; and (C) if the Corporation does not complete a Business Combination by the

Deadline Date, the Corporation will not repay the amount loaned under the promissory note until 100% of the Offering Shares have

been redeemed and only in connection with the liquidation of the Corporation to the extent funds are available outside of the Trust

Account. In the event that the Corporation has not consummated an initial Business Combination by the Deadline Date or such applicable

Additional Extension Period, the Corporation shall (i) cease all operations except for the purpose of winding up, (ii) as

promptly as reasonably possible but not more than ten business days thereafter subject to lawfully available funds therefor, redeem

100% of the Offering Shares in consideration of a per-share price, payable in cash, equal to the quotient obtained by dividing

(A) the aggregate amount then on deposit in the Trust Account, including interest not previously released to the Corporation

to pay its taxes (less up to $100,000 of interest to pay dissolution expenses), by (B) the total number of then outstanding

Offering Shares, which redemption will completely extinguish rights of the Public Stockholders (including the right to receive

further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following

such redemption, subject to the approval of the remaining stockholders and the Board in accordance with applicable law, dissolve

and liquidate, subject in each case to the Corporation’s obligations under the DGCL to provide for claims of creditors and

other requirements of applicable law.”

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Correction this 8th day of February, 2024.

| |

Bannix Acquisition Corp. |

| |

|

| |

By: |

/s/Douglas Davis |

| |

Name: |

Douglas Davis |

| |

Title: |

Chief Executive Officer |

v3.24.0.1

Cover

|

Feb. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

1-40790

|

| Entity Registrant Name |

Bannix Acquisition Corp.

|

| Entity Central Index Key |

0001845942

|

| Entity Tax Identification Number |

86-1626016

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1063 North Spaulding

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90046

|

| City Area Code |

(323)

|

| Local Phone Number |

682-8949

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

BNIX

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

BNIXW

|

| Security Exchange Name |

NASDAQ

|

| One Right to receive 1/10th of one share of Common Stock |

|

| Title of 12(b) Security |

One Right to receive 1/10th of one share of Common Stock

|

| Trading Symbol |

BNIXR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_OneRightToReceive110thOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

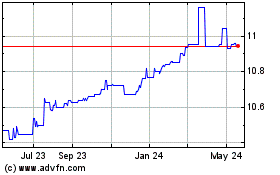

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From Dec 2024 to Jan 2025

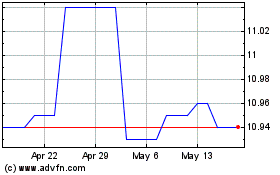

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From Jan 2024 to Jan 2025