Bionomics Limited Announces Closing of US$5 Million Underwritten Offering of American Depositary Shares in the United States

22 November 2022 - 10:13AM

Bionomics Limited (ASX: BNO, Nasdaq: BNOX), (“Bionomics” or the

“Company”), a clinical-stage biopharmaceutical company developing

novel, allosteric ion channel modulators designed to transform the

lives of patients suffering from serious central nervous system

(“CNS”) disorders with high unmet medical need, today announced the

closing of an underwritten public offering in the United States

(the “Offering”) of 641,026 American Depositary Shares (“ADSs”),

each representing 180 ordinary shares of Bionomics, at a public

offering price of US$7.80 per ADS.

The offering price of US$7.80 per ADS (A$0.064

per ordinary share1) represented a 1.63% discount to the volume

weighted average price for the 15 days on which trades of the

Company’s shares were recorded on ASX ending on 16 November

2022.

Bionomics has granted the underwriters an option

to purchase up to an additional 96,153 ADSs within 30 days from the

closing date of the Offering at the public offering price, less

underwriting discounts and commissions. The gross proceeds of the

Offering, before deducting underwriting discounts and commissions

and other offering expenses payable by Bionomics, were

approximately US$5.0 million and would be approximately US$5.7

million, if the underwriters exercise their option to purchase

additional ADSs in full.

Aegis Capital Corp. and Berenberg acted

as joint book-running managers for the Offering.

This offering was made pursuant to an effective

registration statement on Form F-1 (No. 333-268314) previously

filed with, and declared effective by, the U.S. Securities and

Exchange Commission (“SEC”) on November 16, 2022. A final

prospectus relating to this Offering has been filed with the SEC

and is available on the SEC’s website located at

http://www.sec.gov. Copies of the final prospectus relating to and

describing the terms of the Offering may be obtained, when

available, from (i) Aegis Capital Corp., Attention: Syndicate

Department, 1345 Avenue of the Americas, 27th floor, New York, NY

10105, by telephone at (212) 813-1010 or by email at

syndicate@aegiscap.com; or (ii) Berenberg Capital Markets LLC,

Attention: Investment Banking, 1251 Avenue of the Americas, 53rd

Floor, New York, NY 10020, by telephone at 646-949-9000 or by email

at prospectusrequests@berenberg-us.com. Australian investors are

only eligible to invest under the prospectus if they are exempt

from disclosure as sophisticated or professional investors under

the Corporations Act 2001 (Cth).

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any state or jurisdiction in which such an offer, solicitation,

or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

FOR FURTHER INFORMATION PLEASE CONTACT:

|

General:Ms. Suzanne IrwinCompany Secretary+61 8

8150 7400CoSec@bionomics.com.au |

Investor Relations:Mr. Connor BernsteinVice

President, Strategy and Corporate Development+1 (831)

246-3642cbernstein@bionomics.com.au |

About Bionomics Limited

Bionomics Limited (ASX: BNO, Nasdaq: BNOX) is a

clinical-stage biopharmaceutical company developing novel,

allosteric ion channel modulators designed to transform the lives

of patients suffering from serious central nervous system (“CNS”)

disorders with high unmet medical need. Bionomics is advancing its

lead product candidate, BNC210, an oral, proprietary, selective

negative allosteric modulator of the α7 nicotinic acetylcholine

receptor, for the acute treatment of Social Anxiety Disorder

(“SAD”) and chronic treatment of Post-Traumatic Stress Disorder

(“PTSD”). Beyond BNC210, Bionomics has a strategic partnership with

Merck & Co., Inc (known as MSD outside the United States and

Canada) with two drugs in early-stage clinical trials for the

treatment of cognitive deficits in Alzheimer’s disease and other

central nervous system conditions.

Factors Affecting Future Performance

This announcement contains “forward-looking”

statements within the meaning of the U.S. federal securities laws.

Any statements contained in this announcement that relate to

prospective events or developments, including, without limitation,

statements related to the proposed Offering are deemed to be

forward-looking statements. Words such as “believes,”

“anticipates,” “plans,” “expects,” “projects,” “forecasts,” “will”

and similar expressions are intended to identify forward-looking

statements. There are a number of important factors that could

cause actual results or events to differ materially from those

indicated by these forward-looking statements, including market

conditions and uncertainties related to the satisfaction of

customary closing conditions and completion of the Offering. The

Company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events, or otherwise. Actual results could differ materially

from those discussed in this press release.

_________________________

1 Based on an US$:A$ exchange rate of

$1.48

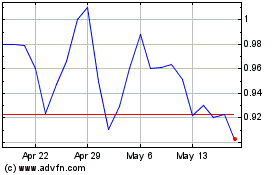

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Dec 2023 to Dec 2024