As filed with the Securities and Exchange Commission

on December 17, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

F-3

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

BRENMILLER

ENERGY LTD.

(Exact

name of registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s Name into English)

| State

of Israel |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification No.) |

13

Amal St. 4th Floor, Park Afek

Rosh

Haayin

4809249

Israel

+972-77-6935140

(Address

and telephone number of registrant’s principal executive offices)

Puglisi

& Associates

850

Library Ave., Suite 204

Newark,

DE 19711

Tel:

302.738.6680

(Name,

address, and telephone number of agent for service)

Copies

to:

Oded

Har-Even, Esq.

Eric

Victorson, Esq.

Sullivan

& Worcester LLP

1251

Avenue of the Americas

New

York, NY 10020

Tel:

(212) 660-3000 |

Reut

Alfiah, Adv.

Gal

Cohen, Adv.

Sullivan

& Worcester Tel Aviv (Har-Even & Co.)

28

HaArba’a St. HaArba’a Towers

North

Tower, 35th floor

Tel

Aviv, Israel 6473925

Tel:

+972 74-758-0480 |

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The

term “new or revised financial accounting standard” refers to any update issued

by the Financial Accounting Standards Board to its Accounting Standards Codification after

April 5, 2012. |

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated December 17, 2024

PROSPECTUS

BRENMILLER

ENERGY LTD.

Up

to 1,000,000 Ordinary Shares

This

prospectus relates to the resale, by the selling shareholder identified in this prospectus, of up to 1,000,000 ordinary shares, no par

value per share, or the Ordinary Shares. This prospectus describes the general manner in which the Ordinary Shares may be offered and

sold by the selling shareholder. If necessary, the specific manner in which the Ordinary Shares may be offered and sold will be described

in a prospectus supplement to this prospectus. No Ordinary Shares are being registered hereunder for sale by us. We will not receive

any proceeds from the sale of the Ordinary Shares by the selling shareholder. See “Use of Proceeds”. The selling shareholder

may sell all or a portion of the Ordinary Shares from time to time in market transactions through any market on which our Ordinary Shares

are then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market

price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such

methods of sale. See “Plan of Distribution”.

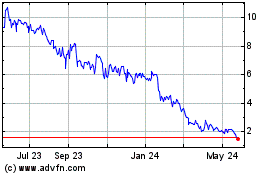

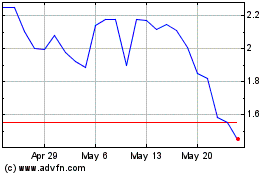

Our Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “BNRG.” The last reported sale price of our Ordinary Shares on December 16,

2024 was $0.72 per share.

We

are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign

private issuer”, as defined in Rule 405 under the U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible

for reduced public company reporting requirements.

AN

INVESTMENT IN OUR SECURITIES INVOLVES RISKS. SEE THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 3 AND IN OUR ANNUAL

REPORT ON FORM 20-F FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023, which was filed on March 18, 2024, or the 2023 Annual Report.

Neither

the Securities and Exchange Commission, or the SEC, nor any state or other securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus, including information incorporated by reference herein, and prospectus

supplement or any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling

shareholder have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities

offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation

of an offer in such jurisdiction. The information in this prospectus is accurate only as of the date of this prospectus, regardless of

the time of delivery of this prospectus or any sale of our securities.

For

investors outside of the United States: Neither we nor any of the selling shareholder have done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of

this prospectus. In this prospectus, unless otherwise indicated, all references to the “Company,” “we,” “our”

and “Brenmiller” refer to Brenmiller Energy Ltd. and its subsidiaries, Brenmiller Energy

(Rotem) Ltd., a company incorporated under the laws of the State of Israel, Brenmiller Energy Inc., a company incorporated under the

laws of Delaware, United States, Brenmiller Energy NL B.V., a company incorporated under the laws of the Netherlands, and Brenmiller

Europe S.L., a company incorporated under the laws of the Kingdom of Spain, or Brenmiller Europe.

OUR

COMPANY

Overview

We

are a technology company that develops, produces, markets and sells thermal energy storage, or TES, systems based on our proprietary

and patented bGen™ technology. Our technology enables the electrification and decarbonization of the industrials sector, resulting

in better integration with renewable energy sources and a reduction in carbon emissions.

We

believe that climate change is the greatest challenge of our times. A major contributor to climate change is carbon emissions being emitted

to the atmosphere. To combat this, countries and organizations have set and are continuing to set targets for themselves and various

industries to reduce their carbon emissions. In order to meet such carbon emission targets, we believe that we can contribute to expediting

the transition from fossil fuels to a widescale adoption of renewable energy, including renewable energy support efforts such as carbon

capture, efficient energy storage and recovery, and benefitting from the reuse of wasted heat. Our bGen™ TES system stores energy

can, amongst other things, recover wasted heat from available energy resources to provide one consistent energy output. By doing so,

the bGen™ TES system can precisely match energy supplies with the demand and bridge the gap between renewable energy and conventional

power sources. Accordingly, we believe TES systems such as our bGen™ system have become essential to the renewable energy market

to ensure the reliability and stability of energy supplies.

We

have developed our bGen™ technology over the last twelve years and have tested it across three generations of demonstration units

at various sites globally. Our bGen™ technology uses crushed rocks to store heat at temperatures of up to 1,400 degrees Fahrenheit

and is comprised of several key elements inside one unit: thermal storage, electric heaters, heat exchangers, electricity conversion

to high temperature heat and a steam generator. The use of crushed rock as a means of storage results in no hazardous challenges to the

environment and enhances system durability so that even after tens of thousands of charge and discharge cycles, the storage material

does not degrade and so there is no need to replace the storage media. Additionally, the bGen™ technology can be charged with multiple

heat sources, such as residual heat, and renewables, as well as from electrical sources using electric heaters which are embedded within

the TES system. The TES system dispatches thermal energy on demand in the form of steam, which can be saturated for industrial use, or

in the form of a superheated steam, which can be used to activate steam turbines.

Recent

Developments

August

2024 Private Placement

On

August 4, 2024, we entered into a definitive securities purchase agreement with Alpha Capital Anstalt, or Alpha, for a private placement

of 1,000,000 Ordinary Shares at a price of $1.05 per share, or the August 2024 Private Placement. The closing of the August 2024 Private

Placement was subject to certain conditions, including us obtaining consent from an existing lender. On November 27, 2024, we received

the required approval from the lander and on December 4, 2024, the offering was closed. Under the terms of the securities purchase agreement,

Alpha will also have the right to make a further investment for 1,000,000 additional Ordinary Shares (or ordinary share equivalents)

in the event that our Ordinary Shares close at or above $2.50 per share within the next 12 months. The securities purchase agreement

provides for registration rights for the Ordinary Shares and we have agreed to file this registration statement with the SEC to register

the resale of the Ordinary Shares within thirty (30) days of closing on December 4, 2024. The private placement to resulted in gross

proceeds of $1.05 million. We intend to use the net proceeds from the private placement for general corporate purposes, including working

capital.

ABOUT

THIS OFFERING

This

prospectus relates to the resale by the selling shareholder identified in this prospectus of up to 1,000,000 Ordinary Shares. All of

the Ordinary Shares, when sold, will be sold by the selling shareholder. The selling shareholder may sell the Ordinary Shares from time

to time at prevailing market prices. We will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholder.

| Ordinary Shares currently outstanding |

|

8,094,791 Ordinary

Shares |

| |

|

|

| Ordinary Shares offered by the Selling Shareholder |

|

Up to 1,000,000 Ordinary

Shares |

| |

|

|

| Use of proceeds: |

|

We

will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholder. All net proceeds from the sale of Ordinary

Shares covered by this prospectus will go to the selling shareholder. |

| |

|

|

| Risk factors: |

|

You should read the “Risk

Factors” section starting on page 3 of this prospectus and “Item 3. Key Information – D. Risk Factors”

in our most recent annual report on Form 20-F, incorporated by reference herein, and other information included or incorporated by

reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| |

|

|

| Nasdaq Capital Market symbol: |

|

“BNRG” |

The number of Ordinary Shares

to be outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby are sold and is

based on 8,094,791 Ordinary Shares outstanding as of December 17, 2024. This number excludes:

| ● | an

aggregate of 455,951 Ordinary Shares issuable upon the exercise of outstanding options to

purchase Ordinary Shares, at exercise prices ranging between $0.01 to $247.1 per Ordinary

Share, issued to directors, officers, service providers and employees; and |

| | | |

| ● | an

aggregate of 1,386,317 Ordinary Shares issuable upon the exercise of outstanding warrants

to purchase Ordinary Shares, at exercise prices ranging between $5.0 to $16.66 per

Ordinary Share, issued to certain investors in connection with private placements and public

offerings. |

RISK

FACTORS

Investing

in our securities involves risks. Please carefully consider the risk factors described below and those contained in our periodic reports

filed with the Securities and Exchange Commission, or SEC, including those set forth under the caption “Summary Risk Factors”

and “Item 3. Key Information – D. Risk Factors” in our 2023 Annual Report, which is incorporated by reference into

this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include

or incorporate by reference in this prospectus. You should be able to bear a complete loss of your investment.

Risks

Related to Our Business and Industry

Our

field of business is generally new, and we may not be aware of all of the risks that we will face.

The

field of TES is comprised of technologies that are still in their early stages with limited implementations and track record. While we

attempt to anticipate the risks, we and holders of our Ordinary Shares may face resulting from our operations, there may be certain risks

specific to our sector to which we have yet to be exposed or made aware. Further, there may be certain risks that will develop depending

on the manner in which the field develops. For example, because TES is comprised of new technologies, the terms of commercial engagement

with our customers require finding solutions to finance the working capital and collateral required for the establishment of a particular

project. Unless we find the required financing, we may have difficulty entering into new commercial contracts. Accordingly, holders of

our Ordinary Shares may be unable to anticipate all of the risks that are associated with the Company.

In

addition, our relatively new HaaS offering may pose risks due to the evolving nature of the HaaS business model, which requires expertise

that is still being developed internally and could introduce operational challenges. Our management has limited prior experience in HaaS

business operations. There can be no assurance that we will be able to successfully implement and manage this new business model. Our

business, results of operations, financial condition and cash flows could be materially adversely affected if we are unable to successfully

integrate our HaaS business model into our existing operations and any inability to do so may also hinder our ability to grow,

divert the attention of management and our key personnel, disrupt our business and impair our financial results.

Our

international activities expose us to operational risks in new territories, which includes navigating unfamiliar regulatory environments

and may lead to compliance and financial exposure.

Expansion

of our operations outside of our existing markets will require management attention and resources, involves additional risks, and may

be unsuccessful, which could harm our future business development and existing operations. Our international expansion includes new potential

risks that we must navigate. Our international operations complicate and extend our supply chains and present additional logistical concerns.

The ability to source raw materials and deliver our products in a timely manner and on budget requires capable and reliable distribution

channels. Disruptions caused by uncontrollable events, such as natural disasters, geopolitical actions or pandemics, can lead to delays

in production and distribution.

Our

business operations in multiple international jurisdictions creates a myriad of regulatory concerns. These arise from the need to comply

with diverse and, often, complex regulatory frameworks in various countries. There are many types of regulatory risks, but some of the

most common involve environmental regulations, local content requirements, labor laws and taxes, may impact our business models and local

filing and permitting can be costly, lengthy and unpredictable. Investing time and resources in establishing the necessary local infrastructure

that complies with local requirements may lead to compliance and financial exposure.

We

have recently expanded our operations in certain European territories through our joint venture company, Brenmiller Europe, and plan

to further expand into other markets in Europe and in the U.S. These expansion plans will require management attention and resources

and may be unsuccessful. In certain markets, we may have limited or no operating experience, may not benefit from any first-to-market

advantages and may have to compete with local companies that have developed a strong understanding of the local market and TES needs.

We have limited experience entering into new markets Because we do not have experience in this regard, we may not be able to accurately

predict the costs of, or anticipate and manage potential challenges in, establishing distribution efforts and operations in such markets.

Furthermore, to deliver satisfactory performance for customers in new markets, it may be necessary to locate physical facilities, and

establish logistics networks to and from such markets. We have limited experience establishing such procurement networks to and from

other countries. We may not be successful in expanding into additional international markets or in generating revenue or profits from

such operations. Furthermore, laws and regulations in countries we enter may increase our costs or interfere with our business in these

countries.

Operating

internationally requires significant management attention and financial resources. We cannot be certain that the investment and additional

resources required to establish and expand our operations will produce desired levels of revenues or profitability. If we invest substantial

time and resources to establish and expand our operations and are unable to do so successfully and in a timely manner, our business,

financial condition and operating results may be materially and adversely affected.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some

of the statements made under “Risk Factors,” “Use of Proceeds,” and elsewhere in this prospectus, including in

our 2023 Annual Report, incorporated by reference herein, and other information included or incorporated by reference in this prospectus,

constitute forward-looking statements. Forward-looking statements are often characterized by the use of forward-looking terminology such

as “may,” “will,” “expect,” “anticipate,”, “plan,” “estimate,”

“continue,” “believe,” “should,” “intend,” “project,” “predict,”

“potential” or other similar words, but are not the only way these statements are identified.

These

forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements

that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating

to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that

address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking

statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements

on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current

conditions, expected future developments and other factors they believe to be appropriate.

Important

factors that could cause actual results, developments and business decisions to differ materially from

those anticipated in these forward-looking statements include, among other things:

| ● | our

planned level of revenues and capital expenditures; |

| ● | our

ability to market and sell our products; |

| ● | our

plans to continue to invest in research and development to develop technology for both existing

and new products; |

| ● | our

ability to maintain our relationships with suppliers, manufacturers, and other partners; |

| ● | our

ability to maintain or protect the validity of our European, U.S., and other patents and

other intellectual property; |

| ● | our

ability to retain key executive members; |

| ● | our

ability to internally develop and protect new inventions and intellectual property; |

| ● | our

ability to expose and educate the industry about the use of our products; |

| ● | our

expectations regarding our tax classifications; |

| ● | interpretations

of current laws and the passages of future laws; and |

| ● | general

market, political, and economic conditions in the countries in which we operate including

those related to recent unrest and actual or potential armed

conflict in Israel and other parts of the Middle East, such as the multi-front war Israel

is facing. |

These

statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our

or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated

by the forward-looking statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk

Factors” and elsewhere in this prospectus. You should not rely upon forward-looking statements as predictions of future events.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking

statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the Ordinary Shares by the selling shareholder. All net proceeds from the sale of the

Ordinary Shares covered by this prospectus will go to the selling shareholder.

capitalization

The

following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2024:

| ● | on

a pro forma basis to give effect to: (i) the issuance and sale of 914,000 Ordinary Shares

from June 30, 2024 to the date of this prospectus under a sales agreement pursuant to an “at-the-market” offering,

(ii) the issuance of an aggregate of 222,034 Ordinary Shares with respect to 222,034 restricted share units we have granted to employees,

and (iii) the issuance of 1,000,000 Ordinary Shares in the August 2024 Private Placement for the aggregate gross proceeds of $1.05 million,

as if such issuance had occurred on June 30, 2024. |

The

following table should be read in conjunction with “Use of Proceeds,” our Condensed Consolidated Financial Statements as

of and for the Six-Month Period Ended June 30, 2024 (Unaudited) and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” attached as exhibits 99.2 and 99.3, respectively, to our Report of Foreign Private Issuer on Form 6-K,

filed with the SEC on August 28, 2024 that are incorporated by reference into this form, and the other financial information included

or incorporated by reference into this form.

| | |

As

of June 30, 2024 | |

| U.S.

dollars in thousands | |

Actual | | |

Pro

forma | |

| Cash

and cash equivalents | |

$ | 6,966 | | |

$ | 9,952 | |

| Debt: | |

| | | |

| | |

| European

Investment Bank (“EIB”) loan | |

| 4,345 | | |

| 4,345 | |

| Warrants’

liability | |

| 11 | | |

| 11 | |

| Total

debt | |

$ | 4,356 | | |

$ | 4,356 | |

| Shareholders’

equity: | |

| | | |

| | |

| Ordinary

Shares 15,000,000 Ordinary Shares authorized, 5,958,757 shares issued and 2,151,745 outstanding, as of June 30, 2024 and December

31, 2023, respectively, actual; 15,000,000 Ordinary Shares authorized 8,094,791 shares issued outstanding, pro forma. | |

| 124 | | |

| 124 | |

| Additional

paid in capital | |

| 105,474 | | |

| 108,460 | |

| Foreign

currency cumulative translation reserve | |

| (2,053 | ) | |

| (2,053 | ) |

| Accumulated

deficit | |

| (97,009 | ) | |

| (97,009 | ) |

| Total

equity | |

| 6,536 | | |

| 9,522 | |

| Total

capitalization | |

| 10,892 | | |

| 13,878 | |

SELLING

SHAREHOLDER

On

August 4, 2024, we entered into definitive securities purchase agreements with Alpha in connection with the August 2024 Private Placement.

The up to 1,000,000 Ordinary Shares being offered by the selling shareholder, is the aggregate of the Ordinary Shares previously issued

to the selling shareholder in the August 2024 Private Placement. For additional information regarding the August 2024 Private Placement,

see “Prospectus Summary–Recent Developments—August 2024 Private Placement.” We are registering the Ordinary Shares

in order to permit the selling shareholder to offer the Ordinary Shares for resale from time to time.

Other

than the relationships described herein, to our knowledge, the selling shareholder has not had any material relationship with us within

the past three years.

Any

selling shareholder that is an affiliate of broker-dealers and any participating broker-dealers would be deemed to be an “underwriter”

within the meaning of the Securities Act, and any commissions or discounts given to any such selling shareholder or broker-dealer may

be regarded as underwriting commissions or discounts under the Securities Act. To our knowledge, the selling shareholder listed below

is not a broker-dealer or affiliate of a broker-dealer.

The

table below lists the selling shareholder and other information regarding the beneficial ownership of the Ordinary Shares by the selling

shareholder. The second column lists the number of Ordinary Shares beneficially owned by the selling shareholder, based on its ownership

of the Ordinary Shares, as of the date set forth in the relevant footnote next to the selling shareholder’s name. The fourth column

assumes the sale of all of the Ordinary Shares offered by the selling shareholder pursuant to this prospectus.

In

accordance with the terms of the August 2024 Private Placement, this prospectus generally covers the resale of at least the number of

Ordinary Shares issued in the August 2024 Private Placement. Because the number of Ordinary Shares may be adjusted for reverse and forward

stock splits, stock dividends, stock combinations and other similar transactions, the number of Ordinary Shares that will actually be

issued may be more or less than the number of Ordinary Shares being offered by this prospectus.

The

term “selling shareholder” also includes any transferees, pledgees, donees, or other successors in interest to the selling

shareholder named in the table below. Unless otherwise indicated, to our knowledge, the selling shareholder named in the table below

has sole voting and investment power (subject to applicable community property laws) with respect to the Ordinary Shares set forth opposite

its name. We will file a supplement to this prospectus (or a post-effective amendment to the registration statement of which this prospectus

forms a part, if necessary) to name successors to the selling shareholder who is able to use this prospectus to resell the securities

registered hereby.

The

selling shareholder may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

| |

Shares

Beneficially Owned

Prior to Offering(1) | | |

Maximum

Number of

Shares to

be Sold

Pursuant

to this

Prospectus | | |

Shares

Owned

Immediately After Sale of

Maximum Number of

Shares in this Offering | |

| Name of Selling Shareholder | |

Number | | |

Percentage(2) | | |

Number | | |

Number | | |

Percentage(2) | |

| Alpha Capital Anstalt | |

| 1,542,290 | (3) | |

| 19.05 | % | |

| 1,000,000 | | |

| 542,290 | | |

| 6.70 | % |

| (1) |

Beneficial ownership is determined in accordance with SEC rules and

generally includes voting or investment power with respect to securities. Ordinary Shares subject to options or warrants currently exercisable,

or exercisable within 60 days of December 17, 2024, are counted as outstanding for computing the percentage of the selling shareholder

holding such options or warrants but are not counted as outstanding for computing the percentage of any other selling shareholder. |

| (2) |

The applicable percentage of beneficial ownership is based on 8,094,791

Ordinary Shares issued and outstanding as of December 17, 2024. |

| |

|

| (3) |

Includes 1,542,290 Ordinary

Shares issued and outstanding and 32,251 Ordinary Shares issuable upon the exercise of warrants exercisable within 60 days of

December 17, 2024, which contain a 9.99% beneficial ownership limitation. The address

for Alpha Capital Anstalt is Lettstrasse 32, Vaduz 9490, Liechtenstein. Nicola Feuerstein, a Director of Alpha Capital Anstalt, holds

voting and dispositive power over the securities held by Alpha Capital Anstalt. Based on information provided by Alpha Capital

Anstalt on December 12, 2024. |

PLAN

OF DISTRIBUTION

The

selling shareholder of the securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of the securities covered hereby on the principal trading market or any other stock exchange, market or trading facility on which

the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling shareholder may use

any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the selling shareholder to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling shareholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the selling shareholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling shareholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with Rule 2440 of the Financial Industry Regulatory Authority, or FINRA, and

in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities or interests therein, the selling shareholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling shareholder may also sell securities short and deliver these securities to close out his short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling shareholder may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling shareholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. The selling shareholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities.

The

resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Securities Exchange Act of 1934, as amended, or the Exchange Act, any person engaged in the

distribution of the resale securities may not simultaneously engage in market making activities with respect to the Ordinary Shares for

the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling

shareholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation

M, which may limit the timing of purchases and sales of the Ordinary Shares by the selling shareholder or any other person. We will make

copies of this prospectus available to the selling shareholder and have informed them of the need to deliver a copy of this prospectus

to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

Offer

Restrictions Outside the United States

Other

than in the United States, no action has been taken by us or the selling shareholder that would permit a public offering of the securities

offered by this prospectus in any jurisdiction where action for that purpose is required. The securities offered by this prospectus may

not be offered or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection

with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will

result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes

are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in

any jurisdiction in which such an offer or a solicitation is unlawful.

LEGAL

MATTERS

Certain

legal matters concerning this offering were passed upon for us by Sullivan & Worcester LLP, New York, New York. Certain legal matters

with respect to the legality of the issuance of the securities offered by this prospectus were passed upon for us by Sullivan & Worcester

Tel Aviv (Har-Even & Co.), Tel Aviv, Israel.

EXPERTS

The financial statements

incorporated in this prospectus by reference to the Annual Report on Form 20-F for the year ended December 31, 2023 have been so incorporated

in reliance on the report (which contains an explanatory paragraph relating to the Company’s ability to continue as a going concern

as described in Note 1C to the financial statements) of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm

of PricewaterhouseCoopers International Limited, an independent registered public accounting firm, given on the authority of said firm

as experts in auditing and accounting.

EXPENSES

The

following are the estimated expenses of this offering payable by us related to the filing of the registration statement of which this

prospectus forms a part. With the exception of the SEC registration fee, all amounts are estimates and may change:

| SEC registration fee | |

$ | 111.76 | |

| Printer fees and expenses | |

$ | 1,500 | |

| Legal fees and expenses | |

$ | 19,500 | |

| Accounting fees and expenses | |

$ | 2,000 | |

| Miscellaneous | |

$ | 1,000 | |

| Total | |

$ | 24,111.76 | |

ENFORCEABILITY

OF CIVIL LIABILITIES

We

are incorporated under the laws of the State of Israel. Service of process upon us and upon our directors and officers and the Israeli

experts named in the registration statement of which this prospectus forms a part, a substantial majority of whom reside outside of the

United States, may be difficult to obtain within the United States. Furthermore, because substantially all of our assets and a substantial

of our directors and officers are located outside of the United States, any judgment obtained in the United States against us or any

of our directors and officers may not be collectible within the United States.

We

have been informed by our legal counsel in Israel, Sullivan & Worcester Tel-Aviv (Har-Even & Co.), that it may be difficult to

assert U.S. securities law claims in original actions instituted in Israel. Israeli courts may refuse to hear a claim based on a violation

of U.S. securities laws because Israel is not the most appropriate forum to bring such a claim. In addition, if an Israeli court agrees

to hear a claim, if U.S. law is found to be applicable, the content of applicable U.S. law must be proved as a fact which can be a time-consuming

and costly process. Certain matters of procedure will also be governed by Israeli law.

Subject

to specified time limitations and legal procedures, Israeli courts may enforce a U.S. judgment in a civil matter which, subject to certain

exceptions, is non-appealable, including judgments based upon the civil liability provisions of the Securities Act and the Exchange Act

and including a monetary or compensatory judgment in a non-civil matter, provided that among other things:

| ● | the

judgment was obtained after due process before a court of competent jurisdiction according to the laws of the state in which the judgment

is given; |

| ● | the

judgment is final and is not subject to any right of appeal; |

| ● | the

prevailing law of the foreign state in which the judgment was rendered allows for the enforcement of judgments of Israeli courts. However,

the court may enforce a foreign judgment, even without reciprocity, based on the request of the Attorney General, under certain circumstances; |

| |

● |

the

liabilities under the judgment are enforceable according to the laws of the State of Israel and the judgment and the enforcement

of the civil liabilities set forth in the judgment is not contrary to the public policy in Israel; |

| |

● |

the

judgment was not obtained by fraud there was a reasonable opportunity for the defendant to present their case, the judgment was given

by an authorized court under the applicable international private law rules in Israel, and the judgement and does not conflict with

any other valid judgments in the same matter between the same parties, and an action between the same parties in the same matter

is not pending in any Israeli court at the time the lawsuit is instituted in the foreign court; |

| ● | the

judgment is enforceable according to the law of the foreign state in which it was granted. |

| ● | enforcement

may be denied if it could harm the sovereignty or security of Israel. |

If

a foreign judgment is declared enforceable by an Israeli court, it generally will be payable in Israeli currency. The conversion to Israeli

currency will be based on the latest official exchange rate published by the Bank of Israel before the payment date. However, the obligated

party will fulfill his duty for the judgment even if they choose to make the payment in the same foreign currency, subject to the laws

governing the foreign currency applicable at that time..

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

are an Israeli company and are a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. As a foreign private

issuer, we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements, and our officers,

directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16

of the Exchange Act.

In

addition, we are not required under the Exchange Act to file annual, quarterly and current reports and financial statements with the

SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. However, we file with the

SEC, within 120 days after the end of each fiscal year, or such applicable time as required by the SEC, an annual report on Form 20-F

containing financial statements audited by an independent registered public accounting firm, and submit to the SEC, on a Form 6-K, unaudited

interim financial information.

We

maintain a corporate website at http://www.bren-energy.com. We will post on our website any materials required to be so posted on such

website under applicable corporate or securities laws and regulations, including any notices of general meetings of our shareholders.

The

SEC also maintains a web site that contains information we file electronically with the SEC, which you can access over the Internet at

http://www.sec.gov. Information contained on, or that can be accessed through, our website and other websites listed in this prospectus

do not constitute a part of this prospectus. We have included these website addresses in this prospectus solely as inactive textual references.

This

prospectus is part of a registration statement on Form F-3 filed by us with the SEC under the Securities Act. As permitted by the rules

and regulations of the SEC, this prospectus does not contain all the information set forth in the registration statement and the exhibits

thereto filed with the SEC. For further information with respect to us and the securities offered hereby, you should refer to the complete

registration statement on Form F-3, which may be obtained from the locations described above. Statements contained in this prospectus

or in any prospectus supplement about the contents of any contract or other document are not necessarily complete. If we have filed any

contract or other document as an exhibit to the registration statement or any other document incorporated by reference in the registration

statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding

a contract or other document is qualified in its entirety by reference to the actual document.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus and

information we file later with the SEC will automatically update and supersede this information. The documents we are incorporating by

reference as of their respective dates of filing are:

| ● | Our

Annual Report on Form 20-F for the year ended December 31, 2023, filed on March 18, 2024; |

| ● | Our

Reports of Foreign Private Issuer on Form 6-K submitted on; March 19, 2024; May 17, 2024 (with respect to the first, second, third, and

fourth paragraphs and the section titled “Forward-Looking Statements” in the press release attached as Exhibit 99.1 to the

Form 6-K only); June 6, 2024 (with respect to the first, second, fourth and sixth paragraphs and the section titled “Forward-Looking

Statements” in the press release attached as Exhibit 99.1 to the Form 6-K only); June 10, 2024 (with respect to the first, second,

third, fourth, and sixth paragraphs and the section titled “Forward-Looking Statements” of the press release attached as

Exhibit 99.1 to the Form 6-K only); June 12, 2024 (with respect to the first, second, fourth and fifth paragraphs and the section titled

“Forward-Looking Statements” of the press release attached as Exhibit 99.1 to the Form 6-K only); June 25, 2024 (with respect

to the CEO Letter attached as Exhibit 99.1 to the Form 6-K only); June 27, 2024; July 15, 2024; July 18, 2024 (with respect to the first,

second and fourth paragraphs and the section titled “Forward-Looking Statements” of the press release attached as Exhibit

99.1 to the Form 6-K only); August 1, 2024; August 6, 2024 (with respect to Exhibit 10.1, Exhibit 99.1 and the first, second, third

and sixth paragraphs and the section titled “Forward-Looking Statements” of the press release attached as Exhibit 99.2 to

the Form 6-K only); August 8, 2024; August 12, 2024; August 14, 2024; August 19, 2024 (with respect to the first, second, third, and

seventh paragraphs and the section titled “Forward-Looking Statements” of the press release attached as Exhibit 99.1 to

the Form 6-K only); August 29, 2024 (with respect to the Form 6-K (other than the 2nd,

3rd, and 4th paragraphs of the press release attached as Exhibit 99.1 to the Form 6-K);

September 9, 2024 (with respect to the first, second and fourth paragraphs and the section titled “Forward-Looking Statements”

of the press release attached as Exhibit 99.1 to the Form 6-K only); September 23, 2024; September 25, 2024 (with respect to the first,

second, fifth, and sixth paragraphs and the section titled “Forward-Looking Statements” of the press release attached as

Exhibit 99.1 to the Form 6-K only); November 1, 2024; November 6, 2024; December 4, 2024; December 5, 2024; and |

| ● | The

description of our securities contained in our Form 8-A (File No. 001-40753), filed with the SEC on May 17, 2022, as amended by Exhibit

2.2 to the 2022 Annual Report, and including any further amendment or report filed or to be filed for the purpose of updating such description. |

All

subsequent annual reports filed by us pursuant to the Exchange Act on Form 20-F prior to the termination of the offering shall be deemed

to be incorporated by reference to this prospectus and to be a part hereof from the date of filing of such documents. We may also incorporate

part or all of any Form 6-K subsequently submitted by us to the SEC prior to the termination of the offering by identifying in such Forms

6-K that they, or certain parts of their contents, are being incorporated by reference herein, and any Forms 6-K so identified shall

be deemed to be incorporated by reference in this prospectus and to be a part hereof from the date of submission of such documents. Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also

is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We

will provide you without charge, upon your written or oral request, a copy of any of the documents incorporated by reference in this

prospectus, other than exhibits to such documents which are not specifically incorporated by reference into such documents. Please direct

your written or telephone requests to us at: Brenmiller Energy Ltd., 13 Amal Street, 4th Floor, Park Afek, Rosh Haayin, 4809249

Israel. Attention: Ofir Zimmerman, Chief Financial Officer, telephone number: +972-77-693-5140.

BRENMILLER

ENERGY LTD.

Up

to 1,000,000 Ordinary Shares

PROSPECTUS

,

2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

8. Indemnification of Directors and Officers

Indemnification

The

Israeli Companies Law 5759-1999, or the Companies Law, and the Israeli Securities Law, 5728-1968, or the Securities Law, provide that

a company may indemnify an office holder against the following liabilities and expenses incurred for acts performed by him or her as

an office holder, either pursuant to an undertaking made in advance of an event or following an event, provided its articles of association

include a provision authorizing such indemnification:

| ● | a

financial liability imposed on him or her in favor of another person by any judgment concerning an act performed in his or her capacity

as an office holder, including a settlement or arbitrator’s award approved by a court; |

| ● | reasonable

litigation expenses, including attorneys’ fees, expended by the office holder (a) as a result of an investigation or proceeding

instituted against him or her by an authority authorized to conduct such investigation or proceeding, provided that (1) no indictment

(as defined in the Companies Law) was filed against such office holder as a result of such investigation or proceeding; and (2) no financial

liability as a substitute for the criminal proceeding (as defined in the Companies Law) was imposed upon him or her as a result of such

investigation or proceeding, or, if such financial liability was imposed, it was imposed with respect to an offense that does not require

proof of criminal intent; or (b) in connection with a monetary sanction; |

| ● | reasonable

litigation expenses, including attorneys’ fees, expended by the office holder or imposed on him or her by a court: (1) in proceedings

that the company institutes, or that another person institutes on the company’s behalf, or by another person, against him or her;

(2) in a criminal proceeding of which he or she was acquitted; or (3) as a result of a conviction for a crime that does not require proof

of criminal intent; and |

| ● | expenses

incurred by an office holder in connection with an Administrative Procedure under the Securities Law, including reasonable litigation

expenses and reasonable attorneys’ fees. An “Administrative Procedure” is defined as a procedure pursuant to chapters

H3 (Monetary Sanction by the Israeli Securities Authority), H4 (Administrative Enforcement Procedures of the Administrative Enforcement

Committee) or I1 (Arrangement to prevent the Initiation of Procedures or to Conclude Proceedings, subject to conditions) to the Securities

Law. |

The

Companies Law also permits a company to undertake in advance to indemnify an office holder, provided that if such indemnification relates

to financial liability imposed on him or her, as described above, then the undertaking should be limited and shall detail the following

foreseen events and amount or criterion:

| ● | to

events that in the opinion of the board of directors can be foreseen based on the company’s activities at the time that the undertaking

to indemnify is made; and |

| ● | in

amount or criterion determined by the board of directors, at the time of the giving of such undertaking to indemnify, to be reasonable

under the circumstances. |

We

have entered into indemnification agreements with all of our directors and with all members of our senior management. Each such indemnification

agreement provides the office holder with indemnification permitted under applicable law and up to a certain amount, and to the extent

that these liabilities are not covered by directors’ and officers’ insurance.

Exculpation

Under

the Companies Law, an Israeli company may not exculpate an office holder from liability for a breach of his or her duty of loyalty, but

may exculpate in advance an office holder from his or her liability to the company, in whole or in part, for damages caused to the company

as a result of a breach of his or her duty of care (other than in relation to distributions), but only if a provision authorizing such

exculpation is included in its articles of association. Our amended and restated articles of association and our letter of exculpation

provide that we may exculpate, in whole or in part, any office holder from liability to us for damages caused to the company as a result

of a breach of his or her duty of care, but prohibit an exculpation from liability arising from a company’s transaction in which

our controlling shareholder or officer has a personal interest. Subject to the aforesaid limitations, under the indemnification agreements,

we exculpate and release our office holders from any and all liability to us related to any breach by them of their duty of care to us

to the fullest extent permitted by law.

Limitations

The

Companies Law provides that the Company may not exculpate or indemnify an office holder nor enter into an insurance contract that would

provide coverage for any liability incurred as a result of any of the following: (1) a breach by the office holder of his or her duty

of loyalty unless (in the case of indemnity or insurance only, but not exculpation) the office holder acted in good faith and had a reasonable

basis to believe that the act would not prejudice us; (2) a breach by the office holder of his or her duty of care if the breach was

carried out intentionally or recklessly (as opposed to merely negligently); (3) any act or omission committed with the intent to derive

an illegal personal benefit; or (4) any fine, monetary sanction, penalty or forfeit levied against the office holder.

Under

the Companies Law, exculpation, indemnification and insurance of office holders in a public company must be approved by the compensation

committee and the board of directors (and, with respect to directors and the chief executive officer, by the shareholders). However,

under regulations promulgated under the Companies Law, the insurance of office holders shall not require shareholder approval and may

be approved by only the compensation committee, if the engagement terms are determined in accordance with the company’s compensation

policy that was approved by the shareholders by the same special majority required to approve a compensation policy, provided that the

insurance policy is on market terms and the insurance policy is not likely to materially impact the company’s profitability, assets

or obligations. In addition, under regulations promulgated under the Companies Law, the insurance of office holders of a company in which

there is a controlling shareholder who is also an office holder, a board approval is also required, subject to meeting the aforesaid

conditions.

Our

amended and restated articles of association permit us to exculpate (subject to the aforesaid limitation), indemnify and insure our office

holders to the fullest extent permitted or to be permitted by the Companies Law.

Item

9. Exhibits

Item

10. Undertakings

(a) The undersigned Registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

provided,

however, that paragraphs (a)(1)(i), (a)(1)(ii) and a(l)(iii) do not apply if the registration statement is on Form S-3 or Form

F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with

or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated

by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the

registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F

at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by

Section 10(a)(3) of the Act need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective

amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information

in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration

statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section

10(a)(3) of the Act or Rule 3-19 of this chapter if such financial statements and information are contained in periodic reports filed

with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

that are incorporated by reference in the Form F-3.

(5)

That, for the purpose of determining liability under the Securities Act to any purchaser:

| (i) | If

the Registrant is relying on Rule 430B: |

| A. | Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and |

| |

B. |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference

into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

(6)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

| (i) | Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant; |

| (iii) | The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant

of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the

Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933, as

amended, and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirement

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

the City of Rosh Haayin, State of Israel on December 17, 2024.

| Brenmiller Energy Ltd. |

|

| |

|

|

| By: |

/s/ Avraham Brenmiller |

|

| |

Avraham Brenmiller |

|

| |

Chief Executive Officer |

|

POWER

OF ATTORNEY

The

undersigned officers and directors of Brenmiller Energy Ltd. hereby severally constitute and appoint Avraham Brenmiller and Ofir Zimmerman,

and each of them singly, with full power of substitution, our true and lawful attorney-in-fact and agent to take any actions to enable

the Company to comply with the Securities Act, and any rules, regulations and requirements of the SEC, in connection with this registration

statement on Form F-3, including the power and authority to sign for us in our names in the capacities indicated below any and all further

amendments to this registration statement and any other registration statement filed pursuant to the provisions of Rule 462 under the

Securities Act.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by each of the following persons in the

capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| |

|

Chief

Executive Officer, Director, |

|

|

| /s/

Avraham Brenmiller |

|

Chairman

of the Board of Directors |

|

December

17, 2024 |

| Avraham

Brenmiller |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Ofir Zimmerman |

|

Chief

Financial Officer |

|

December

17, 2024 |

| Ofir

Zimmerman |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Zvi Joseph |

|

Director |

|

December

17, 2024 |

| Zvi

Joseph |

|

|

|

|

| |

|

|

|

|

| /s/

Doron Brenmiller |

|

Director |

|

December

17, 2024 |

| Doron

Brenmiller |

|

|

|

|

| |

|

|

|

|

| /s/

Nava Swersky Sofer |

|

Director |

|

December

17, 2024 |

| Nava

Swersky Sofer |

|

|

|

|

| |

|

|

|

|

| /s/

Nir Brenmiller |

|

Director |

|

December

17, 2024 |

| Nir

Brenmiller |

|

|

|

|

| |

|

|

|

|

| /s/

Michael Korner |

|

Director |

|

December

17, 2024 |

| Michael

Korner |

|

|

|

|

| |

|

|

|

|

| /s/

Chen Franco-Yehuda |

|

Director |

|

December

17, 2024 |

| Chen

Franco-Yehuda |

|

|

|

|

SIGNATURE

OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities

Act of 1933, as amended, the undersigned, Puglisi & Associates, the duly authorized representative in the United States of Brenmiller

Energy Ltd., has signed this registration statement on December 17, 2024.

| Puglisi & Associates |

|

| |

|

|

| By: |

/s/ Greg Lavelle |

|

| |

Managing Director |

|

II-6

Exhibit 5.1

|

Sullivan & Worcester Tel Aviv

28 HaArba’a St. HaArba’a

Towers North Tower, 35th Floor

Tel-Aviv, Israel |

+972-747580480 sullivanlaw.com |

December 17, 2024

To:

Brenmiller Energy Ltd.

13 Amal Street,

Rosh Haayin, 4809249, Israel.

Re: Registration Statement on Form F-3

Ladies and Gentlemen:

We are acting as Israeli

counsel to Brenmiller Energy Ltd., a company organized under the laws of the State of Israel (the “Company”), in connection

with its registration statement on Form F-3 (the “Registration Statement”) filed with the Securities and Exchange

Commission pursuant to Rule 415 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), for

the registration of the re-sale by the selling shareholder identified in the Registration Statement (the “Selling Shareholder”)

of up to 1,000,000 ordinary shares, no par value per share, of the Company (the “Shares”), previously sold by the

Company to the Selling Shareholder pursuant to a securities purchase agreement, dated as of August 4, 2024, by and between the Company

and the Selling Shareholder (the “Securities Purchase Agreement”).

This opinion letter is rendered

pursuant to Items 601(b)(5) and (b)(23) of Regulation S-K promulgated under the Securities Act.

In connection herewith, we

have examined the originals or copies, certified or otherwise identified to our satisfaction, of (i) the Registration Statement, to which

this opinion is attached as an exhibit, (ii) a copy of the amended and restated articles of association of the Company (the “Articles”);

(iii) resolutions of the board of directors of the Company which have heretofore been approved and which relate to the Registration Statement

and the actions to be taken in connection with the entry into the Securities Purchase Agreement, and the offering of the Shares; and

(iv) such other corporate records, agreements, documents and other instruments, and such certificates or comparable documents of public

officials and of officers and representatives of the Company, as we have deemed relevant and necessary as a basis for the opinions hereafter

set forth. We have also made inquiries of such officers and representatives as we have deemed relevant and necessary as a basis for the

opinions hereafter set forth.

In our examination of the

foregoing documents, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals,

the conformity to original documents of all documents submitted to us as copies, the authenticity of the originals of such latter documents

and the legal competence of all signatories to such documents. Other than our examination of the documents indicated above, we have made

no other examination in connection with this opinion.

|

Sullivan & Worcester Tel Aviv

28 HaArba’a St. HaArba’a

Towers North Tower, 35th Floor

Tel-Aviv, Israel |

+972-747580480 sullivanlaw.com |

We have further assumed that