Dynamic Materials Reports Second Quarter 2004 Financial Results

BOULDER, Colo., Aug. 12 /PRNewswire-FirstCall/ -- Dynamic Materials

Corporation, (NASDAQ:BOOM), "DMC", today reported second quarter

income from continuing operations of $564,931, or $.11 per diluted

share, versus income from continuing operations of $597,226, or

$.12 per diluted share, for the second quarter of 2003. DMC's

second quarter 2004 sales were $11,985,085, a 29% increase from

second quarter 2003 sales of $9,256,393. For the six months ended

June 30, 2004, DMC reported income from continuing operations of

$972,391, or $.19 per diluted share, versus income from continuing

operations of $1,009,735, or $.20 per diluted share, for the first

six months of 2003. Reported sales for the first six months of 2004

increased by 29% to $22,145,213 from $17,206,055 for the comparable

period of 2003. For the three months ended June 30, 2004, DMC

reported a net loss of $504,988, or $.10 per diluted share, as

compared to net income of $395,408, or $.08 per diluted share, for

the second quarter of 2003. For the six months ended June 30, 2004,

DMC reported a net loss of $296,773, or $.06 per diluted share,

versus net income of $549,113, or $.11 per diluted share, for the

first six months of 2003. The net loss for the three and six months

ended June 30, 2004 reflects a loss from discontinued operations of

$1,069,919, or $.21 per diluted share, and $1,269,164, or $.25 per

diluted share, respectively, including operating losses of $450,919

and $650,164 for the respective periods and an asset impairment

loss of $619,000 associated with the Company's decision to divest

of its Spin Forge division in El Segundo, California. The net loss

for the three and six months ended June 30, 2003 included losses

from discontinued operations of $201,818, or $.04 per diluted

share, and $460,622, or $.09 per diluted share, respectively,

relating to the combined 2003 operating losses of Spin Forge and

the former Precision Machined Products ("PMP") division, which was

sold on October 7, 2003. Explosive Metalworking Group Performance

DMC's Explosive Metalworking Group reported second quarter 2004

sales of $11,426,038, a 35% increase from sales of $8,478,766 for

the second quarter of 2003. For the three months ended June 30,

2004 and 2003, the Group reported income from operations of

$1,031,749 and $900,509, respectively. Group sales for the six

months ended June 30, 2004 were $21,086,472, an increase of 34%

from sales of $15,751,797 for the first six months of 2003. The

Group reported income from operations of $1,867,306 and $1,577,141

for the six months ended June 30, 2004 and 2003, respectively. The

18% increase in year-to-date operating income did not keep pace

with the 34% increase in sales due to lower gross margin levels

resulting from product mix changes and price competition in certain

markets and modest increases in operating expense levels. The

Explosive Metalworking Group's backlog, which had increased from

$11.7 million at the end of 2003 to $17.3 million as of March 31,

2004, increased further to $21.1 million as of June 30, 2004 and

should result in the Group reporting stronger sales and operating

income during the second half of 2004 than that reported for the

first six months of the year. Spin Forge Divestiture During the

second quarter, DMC reached a decision to divest of its Spin Forge

division under a plan that involves subleasing the Spin Forge real

estate and leasing the manufacturing equipment and tooling to a

third party. The division's inventory would be sold to this third

party who would also assume full responsibility for Spin Forge

business activities and operating expenses. With respect to the

Spin Forge manufacturing equipment and tooling, DMC recorded an

after tax impairment loss of $619,000 in its June 30, 2004

financial statements based upon the difference between the current

carrying value of the equipment and the present value of the future

minimum equipment lease payments from the third party plus

estimated liquidation proceeds at the end of the minimum lease

term. The Company holds a purchase option on the Spin Forge real

estate that allows it to purchase the real estate for $2,880,000, a

price that is significantly below the real estate's recently

appraised value. As part of the proposed divestiture transaction,

DMC will maintain control of the real estate purchase option but

the third party will have the option, through August 1, 2005, to

receive an assignment of the primary lease and real estate purchase

option from DMC for such reasonable consideration as the parties

may mutually agree. The value inherent in the real estate purchase

option is believed to be significant but was not considered in the

calculation of the reported impairment loss on the Spin Forge

equipment and tooling due to uncertainties surrounding its ultimate

realization. AMK Welding Performance Historically, DMC's Aerospace

Group was comprised of the AMK Welding ("AMK"), Spin Forge and PMP

divisions. Since PMP and Spin Forge are now reported as

discontinued operations due to the 2003 sale of PMP and the planned

divestiture of Spin Forge in 2004, the Aerospace Group no longer

exists and AMK is now being reported as a standalone business

segment. AMK contributed $559,047 to sales in the second quarter of

2004, a decrease of 28% from reported sales of $777,627 in the

second quarter of 2003. For the six months ended June 30, 2004,

AMK's sales decreased by 27% to $1,058,741 from the $1,454,258 in

sales that AMK posted for the comparable period of 2003. AMK

reported an operating loss of $34,311 for the six months ended June

30, 2004 compared to operating income of $355,373 for the first six

months of 2003. For the three months ended June 30, 2004 and 2003,

AMK reported operating income of $18,531 and $215,621,

respectively. AMK sales and operating results have declined as a

result of less development work during 2004 on a new product that

AMK's customer has experienced delays in transitioning from a

development phase into production. In commenting upon the Company's

second quarter 2004 results, Yvon Cariou, DMC's President and CEO,

stated, "While Explosive Metalworking Group gross margin levels

during the first half of 2004 were somewhat below our expectations,

the Group enters the second half of 2004 with a record backlog and

should report significant improvement in sales and operating income

during this period. Cariou continued, "AMK Welding, whose prospects

for 2005 and beyond appear to be excellent as its customer's new

product goes into production and demand for commercial and military

aircraft engines continues to improve, is expected to show modest

improvement in its sales and operating income during the remainder

of 2004. In conclusion, Cariou stated, "We look forward to

completing the divestiture of Spin Forge during the third quarter

so that the DMC management team can devote its full attention to

the Company's continuing operations." Except for the historical

information contained herein, this news release contains

forward-looking statements that involve risks and uncertainties

including, but not limited to, the following: the ability to obtain

new contracts at attractive prices; the size and timing of customer

orders; fluctuations in customer demand; competitive factors; the

timely completion of contracts; the timing and size of

expenditures; the timely receipt of government approvals and

permits; the adequacy of local labor supplies at the Company's

facilities; the availability and cost of funds; and general

economic conditions, both domestically and abroad; as well as the

other risks detailed from time to time in the Company's SEC

reports, including the report on Form 10-K for the year ended

December 31, 2003. Based in Boulder, Colorado, Dynamic Materials

Corporation is a leading metalworking company, and its products

include explosion bonded clad metal plates and other metal

fabrications for the petrochemical, chemical processing, power

generation, commercial aircraft, defense and a variety of other

industries. For more information on Dynamic Materials Corporation

visit the Company's web site at http://www.dynamicmaterials.com/

DYNAMIC MATERIALS CORPORATION & SUBSIDIARY CONSOLIDATED

STATEMENTS OF OPERATIONS FOR THE SIX MONTHS ENDED JUNE 30, 2004 AND

2003 (unaudited) Three months ended Six months ended June 30, June

30, 2004 2003 2004 2003 NET SALES $11,985,085 $9,256,393

$22,145,213 $17,206,055 COST OF PRODUCTS SOLD 9,098,241 6,634,587

16,931,035 12,322,822 Gross profit 2,886,844 2,621,806 5,214,178

4,883,233 COSTS AND EXPENSES: General and administrative expenses

895,911 733,175 1,684,498 1,449,259 Selling expenses 940,653

772,501 1,696,685 1,501,560 Total costs and expenses 1,836,564

1,505,676 3,381,183 2,950,819 INCOME FROM OPERATIONS 1,050,280

1,116,130 1,832,995 1,932,414 OTHER INCOME (EXPENSE): Other income

(expense), net 2,399 (3,879) 7,042 37 Interest expense (110,511)

(131,304) (234,022) (275,012) Interest income 7,448 287 11,619

1,628 INCOME BEFORE INCOME TAXES 949,616 981,234 1,617,634

1,659,067 INCOME TAX PROVISION 384,685 384,008 645,243 649,332

INCOME FROM CONTINUING OPERATIONS 564,931 597,226 972,391 1,009,735

DISCONTINUED OPERATIONS: Loss from operations of discontinued

operations, net of tax benefit (450,919) (201,818) (650,164)

(460,622) Loss on impairment of assets associated with discontinued

operations, net of tax benefit (619,000) -- (619,000) -- Loss from

discontinued operations (1,069,919) (201,818) (1,269,164) (460,622)

NET INCOME (LOSS) $(504,988) $395,408 $(296,773) $549,113 NET

INCOME (LOSS) PER SHARE - BASIC AND DILUTED: Income from continuing

operations $0.11 $0.12 $0.19 $0.20 Loss from discontinued

operations (0.21) (0.04) (0.25) (0.09) Net Income (loss) $(0.10)

$0.08 $(0.06) $0.11 WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING -

Basic 5,106,912 5,061,390 5,098,231 5,061,390 Diluted 5,192,276

5,077,351 5,180,286 5,078,785 DATASOURCE: Dynamic Materials

Corporation CONTACT: Richard A. Santa, Vice President and Chief

Financial Officer of Dynamic Materials Corporation, +1-303-604-3938

Web site: http://www.dynamicmaterials.com/

Copyright

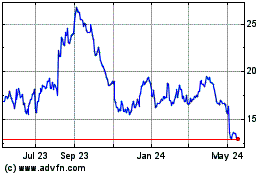

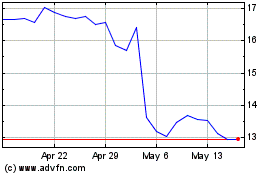

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024