Current Report Filing (8-k)

29 December 2021 - 8:06AM

Edgar (US Regulatory)

0000034067

false

0000034067

2021-12-23

2021-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

Earliest Event Reported): December 28, 2021

(December 23, 2021)

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

0-8328

|

|

84-0608431

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification

No.)

|

11800 Ridge Parkway, Suite 300, Broomfield,

Colorado 80021

(Address of Principal Executive Offices, Including

Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including

Area Code)

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which

registered

|

|

Common Stock, $0.05 Par Value

|

|

BOOM

|

|

The Nasdaq Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

The information set forth in Item 2.01 and Item

2.03 below is incorporated by reference herein.

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On

December 23, 2021, DMC Global Inc., a Delaware corporation (the “Company”), completed its previously-disclosed acquisition

(the “Acquisition”) of 60% of Arcadia Products, LLC, a Colorado limited liability company resulting from the conversion of

Arcadia, Inc., a California corporation, following a tax reorganization (“Arcadia”). The Acquisition was completed pursuant

to an equity purchase agreement (the “Equity Purchase Agreement”) by and among the Company, Arcadia, the shareholders of Arcadia, Inc.

and certain other parties (the “Equity Purchase Agreement”) entered into on December 16, 2021. At the closing of the

Acquisition, the Company paid closing consideration of $284 million in cash (excluding $6 million in acquired cash) and 551,458 shares

of its common stock, par value $0.05 per share. A portion of the cash consideration was placed into escrow and is subject to certain post-closing

adjustments. As contemplated by the Equity Purchase Agreement, at the closing of the Acquisition, the Company entered into an Operating

Agreement for Arcadia, an Employment Agreement and a Restricted Covenant Agreement with James Schladen, President of Arcadia, and a Promissory

Note in respect of a loan made by DMC in connection with the Acquisition, all on terms described in the Company’s Current Report

on Form 8-K filed on December 21, 2021.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

|

On December 23, 2021, the Company entered into an Amended

and Restated Credit and Security Agreement with a syndicate of four banks, led by KeyBank National Association, amending and restating

its prior credit agreement dated March 8, 2018. The new credit facility has a 5-year maturity expiring on December 23, 2026

and provides for a maximum commitment amount of $200 million, which includes a $50 million revolving credit facility and a $150 million

fully funded term loan facility. The proceeds of the $150 million term loan were used to partially fund the acquisition. The amended credit

agreement has a $100 million accordion feature to increase the commitments under the revolving loan and/or by adding one or more term

loans subject to approval by applicable lenders.

The credit facility is secured by the assets of

DMC including accounts receivable, inventory, and fixed assets, as well as guarantees and share pledges by DMC and its subsidiaries, including

newly-acquired Arcadia and its subsidiary. Other significant changes in terms include: (i) a maximum leverage ratio of 3.50:1.00

through the quarter ended March 31, 2022, 3.25:1.00 from the quarter ended June 30, 2022 through the quarter ended March 31,

2023, and (c) 3.00:1.00 from the quarter ended June 30, 2023 and thereafter; (ii) replacement of all provisions and related

definitions regarding LIBOR with a Secured Overnight Financing Rate based benchmark rate; (iii) changes to certain of our covenants

relating to the Acquisition; and (iv) the elimination of the ability to borrow in alternate currencies.

The credit facility includes various covenants

and restrictions, certain of which relate to the payment of dividends or other distributions to stockholders; redemption of capital stock;

incurrence of additional indebtedness; mortgaging, pledging or disposition of major assets; and maintenance of specified ratios.

The above description of the amended credit

agreement is qualified in its entirety by reference to the Amended and Restated Credit and Security Agreement,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

|

|

Item 7.01

|

Regulation FD Disclosure

|

On

December 23, 2021, the Company issued a press release announcing the closing of the Acquisition, the text of which is furnished with

this Current Report on Form 8-K as Exhibit 99.1. The information furnished under this Item 7.01, including the press release,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by reference to such

filing.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(a) Financial Statements

of Business Acquired.

Financial

statements, to the extent required by this Item 9.01, will be filed by amendment to this Current Report on Form 8-K no later than

71 days after the date that this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial

Information.

Pro

forma financial information, to the extent required by this Item 9.01, will be filed by amendment to this Current Report on Form 8-K

no later than 71 days after the date that this Current Report on Form 8-K is required to be filed.

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Amended and Restated Credit and Security Agreement, dated December 23, 2021, DMC Global Inc., certain of its domestic subsidiaries as borrowers, the lenders party thereto and KeyBank National Association, as administrative agent, a swing line lender and an issuing lender. *

|

|

10.2

|

|

Amended and Restated Limited Liability Company Agreement of Arcadia Products, LLC, dated December 23, 2021, by and among Arcadia Products, LLC, DMC Global Inc., DMC Korea, Inc., and New Arcadia Holdings, Inc.*

|

|

10.3

|

|

Executive Employment Agreement, dated December 23, 2021, by and among James Schladen, DMC Global Inc. and Arcadia Products, LLC.

|

|

10.4

|

|

Restrictive Covenant Agreement, dated December 23, 2021, by and among James Schladen and Victoria Schladen, individually and as trustees of the Schladen Family Trust, Arcadia Products, LLC and DMC Global Inc.

|

|

10.5

|

|

Promissory Note, dated December 23, 2021, issued by Synergex Group LLC, trustee of the Munera Family ESBT to DMC Global Inc.

|

|

10.6

|

|

Management Services Agreement, dated December 23, 2021, between Arcadia Products, LLC and DMC Global Inc.

|

|

10.7

|

|

Consulting Services Agreement, dated December 23, 2021, between Synergex Group LLC, trustee of the Munera Family ESBT to DMC Global Inc.

|

|

99.1

|

|

Press Release dated December 23, 2021**

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained

in Exhibit 101)

|

* Certain schedules or similar attachments to this exhibit have been

omitted in accordance with Item 601(a)(5) of Regulation S-K. The registrant hereby agrees to furnish supplementally to the Securities

and Exchange Commission upon request a copy of any omitted schedule or attachment to this exhibit.

** Furnished but not filed.

SIGNATURES

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DMC GLOBAL INC.

|

|

|

|

|

Dated: December 28, 2021

|

By:

|

/s/ Michael Kuta

|

|

|

|

Michael Kuta

|

|

|

|

Chief Financial Officer

|

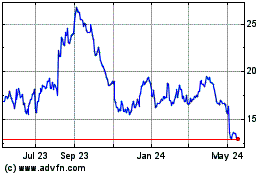

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

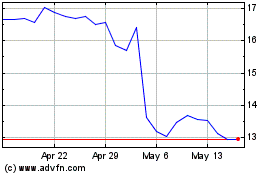

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Nov 2023 to Nov 2024