BioXcel Therapeutics Announces Proposed Public Offering

22 November 2024 - 8:47AM

BioXcel Therapeutics, Inc. (the “Company”) (Nasdaq: BTAI), a

biopharmaceutical company utilizing artificial intelligence

approaches to develop transformative medicines in neuroscience and

immuno-oncology, today announced that it has commenced an

underwritten public offering of shares of its common stock, par

value $0.001 per share (“Common Stock”), and accompanying warrants

to purchase shares of Common Stock, and, in lieu thereof to certain

investors that so choose, pre-funded warrants to purchase shares of

Common Stock and accompanying warrants to purchase shares of Common

Stock.

Canaccord Genuity is acting as sole book-running manager for the

proposed public offering. The proposed public offering is subject

to market and other conditions, and there can be no assurance as to

whether or when the offering may be completed, or as to the actual

size or terms of the offering. All of the securities to be sold in

the offering are being sold by the Company.

The Company intends to use the net proceeds of this offering to

fund the SERENITY At-Home trial, prepare for the initiation of the

TRANQUILITY In-Care trial, working capital and general corporate

purposes.

The securities are being offered by the Company pursuant to a

shelf registration statement on Form S-3 that was previously filed

with the Securities and Exchange Commission (the “SEC”) on November

2, 2023 and which became effective on November 13, 2023. This

offering is being made only by means of a written prospectus and

prospectus supplement that form a part of the registration

statement. A preliminary prospectus supplement relating to and

describing the terms of the offering will be filed with the SEC and

will be available on the SEC’s website at www.sec.gov. The final

terms of the offering will be disclosed in a final prospectus

supplement to be filed with the SEC. When available, copies of the

preliminary prospectus supplement and the accompanying prospectus

relating to the offering may also be obtained by contacting:

Canaccord Genuity LLC, One Post Office Square, Suite 3000, Boston,

MA 02109, Attn: Syndicate Department, by email at

prospectus@cgf.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the securities, nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of such jurisdiction.

Forward-Looking StatementsThis press release

includes “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements

contained in this press release other than statements of historical

fact should be considered forward-looking statements, including,

without limitation, those regarding the terms and completion of the

proposed public offering, as well as the risks and uncertainties in

the Company’s business, including those risks discussed in the

“Risk Factors” section in the preliminary prospectus supplement

relating to the offering. When used herein, words including

“anticipate,” “believe,” “can,” “continue,” “could,” “designed,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,”

“plan,” “possible,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would” and similar expressions are intended to

identify forward-looking statements, though not all forward-looking

statements use these words or expressions. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking. All forward-looking

statements are based upon the Company’s current expectations and

various assumptions. The Company believes there is a reasonable

basis for its expectations and beliefs, but they are inherently

uncertain. The Company may not realize its expectations and its

beliefs may not prove correct. Actual results could differ

materially from those described or implied by such forward-looking

statements as a result of various important factors, including,

without limitation, the important factors discussed under the

caption “Risk Factors” in its Quarterly Report on Form 10-Q for the

quarterly period ended September 30, 2024, as such factors may be

updated from time to time in its other filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov. These and other

important factors could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management’s estimates as of the date of this press release. While

the Company may elect to update such forward-looking statements at

some point in the future, except as required by law, it disclaims

any obligation to do so, even if subsequent events cause our views

to change. These forward-looking statements should not be relied

upon as representing the Company’s views as of any date subsequent

to the date of this press release.

Contact Information

Corporate/Investors

BioXcel TherapeuticsErik

Kopp1.203.494.7062ekopp@bioxceltherapeutics.com

Media

Russo PartnersDavid

SchullT: 858-717-2310 David.Schull@russopartnersllc.comCopyright

© 2024, BioXcel Therapeutics, Inc. All rights reserved.

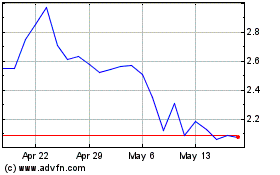

BioXcel Therapeutics (NASDAQ:BTAI)

Historical Stock Chart

From Dec 2024 to Dec 2024

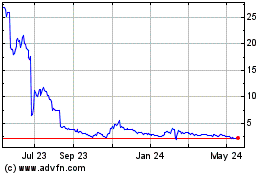

BioXcel Therapeutics (NASDAQ:BTAI)

Historical Stock Chart

From Dec 2023 to Dec 2024