0001630113

false

0001630113

2023-08-15

2023-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 15, 2023

BIOTRICITY

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40761 |

|

30-0983531 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

(Address

of Principal Executive Offices)

(650)

832-1626

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02 |

Results

of Operations and Financial Condition. |

On

August 15, 2023, Biotricity Inc. (the “Company”) issued a press release reporting its financial results for the period

ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Current Report, including the exhibits hereto, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or

Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying

Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed by the Company with the Securities

and Exchange Commission, whether made before or after the date of this report, regardless of any general incorporation language in such

filing (or any reference to this Current Report on Form 8-K generally), except as shall be expressly set forth by specific reference

in such filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date:

August 17, 2023

| |

BIOTRICITY

INC. |

| |

|

|

| |

By: |

/s/

Waqaas Al-Siddiq |

| |

|

Waqaas

Al-Siddiq |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Biotricity

Reports Strong Growth for its First Quarter Fiscal Year 2024 and Provides Financial Results and Business Updates

REDWOOD

CITY, CA / ACCESSWIRE / August 15, 2023 / Biotricity Inc. (NASDAQ:BTCY) (“Biotricity” or the “Company”),

a Technology-as-a-Service (TaaS) company operating in the remote cardiac monitor sector of consumer healthcare, today announced its financial

results for the first quarter of fiscal 2024 year ended June 30, 2023.

| ● |

Company

reports Q1-FY24 revenue grew by 46.9% YOY to $3.0 million; continuing to advance toward positive cashflow |

| |

|

| ● |

Recurring

technology fees and customer device sales, continue to trend higher |

| |

|

| ● |

Reduced

SG&A to $3.5 million, down 22% compared to same period last year |

| |

|

| ● |

Gross

margins improve to 63.5% from 59.6% in the same period last year |

| |

|

| ● |

Recurring

Technology Fee revenue - over 90% of total revenue with a 72% gross margin — rose a robust 47% YOY |

| |

|

| ● |

Net

loss improved 28% to $3.6 million |

| |

|

| ● |

Company

will host its Q1 Fiscal Year 2024 Financial Results Call on Tuesday, August 15th at 4:30 p.m. ET |

Dr.

Waqaas Al-Siddiq, Biotricity Founder & CEO, commented, “Our first quarter fiscal 2024 marked a strong start to the year. We

saw growth in our sales, encompassing technology fees and device sales. This achievement directly stems from our prudent fiscal management

aimed at bolstering our bottom line, and the effective execution by our team and sales channels. Given our consistent gross margin on

technology fees of approximately 70%, and an evolving revenue mix where technology fees are expected to comprise an increasing proportion

of revenue, we anticipate continued improvement in overall blended gross margin over time. Our AI segment has begun to demonstrate progress

and we’ve announced our strengthened relationships with Amazon and Google. We are committed to expanding our AI technology development

into remote cardiac care with a focus on predictive monitoring tools to enhance disease profiling, improve patient management, and revolutionize

the healthcare industry for disease prevention. In the future, we envision our cardiac AI model’s capacities will empower us to

assist healthcare experts in efficiently managing a significantly higher patient load while discerning the most vital data points. This

advancement will enable healthcare providers to enhance the caliber of care they deliver while catering to a more extensive patient base.Looking

towards the rest of CY 2023, our focus remains four-fold: to increase sales of our remote cardiac monitoring solutions, ramp-up of our

subscription-based service, accelerate our recurring revenue, and continue to draw a clear path to profitability.”

Dr.

Al-Siddiq continued, “Our products, biosphere platform model, and vertical sales strategy of complementary products, continues

to strengthen. Our Biocare app has received thousands of downloads and our BiotresTM- continues to attract industrywide interest

with new and existing customers.We will continue to innovate and leverage data intelligently and explore novel approaches for enhancing

healthcare outcomes. Through our ongoing commitment to cutting-edge research and development, we aim to redefine the landscape of medical

diagnostics and patient care. With each passing quarter, we continue to substantiate our approach of constructing a resilient growth

company through the expansion of subscription revenue, robust gross margins, and, over time, the establishment of a solid free cash flow

model.”

Q1-FY24

Financial Highlights

| ● |

Revenue

increased 46.9% to $3.02 million compared with $2.06 million in Q1 FY24 |

| |

|

| ● |

Gross

profit percentage was 63.5% for the three months ended June 30, 2023, as compared to 59.6% in the corresponding prior year quarter.

This increase in gross margin was largely attributed to an increase in margin related to technology fees |

| |

|

| ● |

Net

loss decreased 28% YOY to $3.6 million, or $0.069 per share, from a net loss of $5.0 million, or $0.098 per share, in Q1-FY23 |

Operating

Highlights for Q1-FY24

| ● |

Q1-FY24

recurring (TaaS) Technology Fees rose a robust 47% YOY to $2.8 million, representing over 10 times Device Sales revenue |

| |

|

| ● |

Company

maintains its impressive track record with a near-perfect customer retention rate of approximately 98%, consequently bolstering recurring

revenue from Technology Fees |

| |

|

| ● |

Increased

total addressable market from $1 billion to approximately $35 billion through the launch of its full line of cardiac monitors; and

increased total addressable market as AI in the healthcare market is projected to grow to $208.2 billion by 2030 |

| |

|

| ● |

Continued

to expand its sales force network, with geographic footprint across 35 states with over 2,500 cardiologists |

| |

|

| ● |

Growing

repeat sales to installed customer base with new complementary products and a lower cost of sales |

| |

|

| ● |

Company

is driven to reach positive cash flow, driving revenue higher while reducing or holding SG&A stable |

Full

details of the Company’s financial results will be filed with the SEC on Form 10-Q and available by visiting www.sec.gov .

Financial

Results and Business Update Conference Call

Management

will host a conference call on Tuesday, August 15, 2023 at 4:30 p.m. ET to discuss its financial results for the fiscal 2024 first quarter

and provide a business update. Additional details are available under the Investor Relations section of the Company’s website:

https://www.biotricity.com/investors/

Event:

Biotricity Q1-FY24 Financial Results and Business Update Call

Date:

Tuesday, August 15th

Time:

4:30 p.m. ET (1:30 p.m. PT)

Toll

Free: 877-405-1216

International:

+1 201-689-8336

Webcast

URL: https://event.choruscall.com/mediaframe/webcast.html?webcastid=I3WLbWnM

Investors

can begin accessing the webcast 15 minutes before the call, where an operator will register your name and organization. The call will

be in listen-only mode.

A

replay of the call will be available approximately 3 hours after the live call via the Investors section of the Biotricity website at

https://www.biotricity.com/investors/.

Toll

Free Replay Number: 877-660-6853

International:

201-612-7415

Replay

Access ID: 13740622

Expiration:

August 29, 2023, 11:59 PM ET

About

Biotricity Inc.

Biotricity

is reforming the healthcare market by bridging the gap in remote monitoring and chronic care management. Doctors and patients trust Biotricity’s

unparalleled standard for preventive & personal care, including diagnostic and post-diagnostic solutions for chronic conditions.

The Company develops comprehensive remote health monitoring solutions for the medical and consumer markets. To learn more, visit www.biotricity.com.

Important

Cautions Regarding Forward-Looking Statements

Any

statements contained in this press release that do not describe historical facts may constitute forward-looking statements. Forward-looking

statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use

of the words “may,” “should,” “would,” “will,” “could,” “scheduled,”

“expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,”

“project,” or “goal” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements may include, without limitation, statements regarding (i) the plans, objectives and goals of management for

future operations, including plans, objectives or goals relating to the design, development and commercialization of Bioflux or any of

the Company’s other proposed products or services, (ii) a projection of income (including income/loss), earnings (including earnings/loss)

per share, capital expenditures, dividends, capital structure or other financial items, (iii) the Company’s future financial performance,

(iv) the regulatory regime in which the Company operates or intends to operate and (v) the assumptions underlying or relating to any

statement described in points (i), (ii), (iii) or (iv) above. Such forward-looking statements are not meant to predict or guarantee actual

results, performance, events or circumstances and may not be realized because they are based upon the Company’s current projections,

plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other

influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ

materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence

or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired

results may include, without limitation, the Company’s inability to obtain additional financing, the significant length of time

and resources associated with the development of its products and related insufficient cash flows and resulting illiquidity, the Company’s

inability to expand the Company’s business, significant government regulation of medical devices and the healthcare industry, lack

of product diversification, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity,

and the Company’s failure to implement the Company’s business plans or strategies. These and other factors are identified

and described in more detail in the Company’s filings with the SEC. There cannot be any assurance that the Company will ever become

profitable. The Company assumes no obligation to update any forward-looking statements in order to reflect any event or circumstance

that may arise after the date of this release.

Contacts

Investor

Relations

Biotricity

Investor Relations

Investors@biotricity.com

SOURCE:

Biotricity, Inc.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

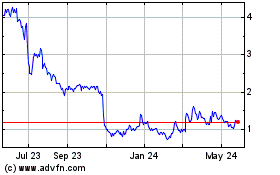

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

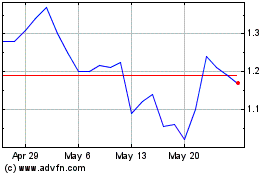

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Feb 2024 to Feb 2025