false

0001630113

0001630113

2024-05-28

2024-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 28, 2024

BIOTRICITY

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40761 |

|

30-0983531 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

(Address

of Principal Executive Offices)

(650)

832-1626

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of

Class |

|

Trading

Symbol (s) |

|

Name of

each exchange on which registered |

| Common Stock, Par Value $0.001 |

|

BTCY |

|

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

May 28, 2024, Biotricity Inc. (the “Company”) and H.C. Wainwright & Co., LLC (“Wainwright”) entered

into an amendment (the “Amendment”) to that certain At The Market Offering Agreement, dated March 22, 2022, between the Company

and Wainwright, as sales agent, pursuant to which the Company may sell shares of its common stock (the “Shares”), from time

to time through Wainwright. Among other things, the Amendment gives effect to the Company’s filing of a new registration statement

on Form S-3 (File No. 333-279226) filed with the Securities and Exchange Commission on May 8, 2024, and declared effective on May 15,

2024 (the “New Registration Statement”), as supplemented by a prospectus supplement dated May 28, 2024, in connection

with the offer and sale of an aggregate offering amount of $2,684,644 of Shares. The Shares will be issued pursuant to the New

Registration Statement.

The

foregoing description of the Amendment is not complete and is qualified in its entirety by reference to the full text of the Amendment,

a copy of which is attached hereto as Exhibit 10.1 and

incorporated herein by reference.

In

connection with the filing of the Amendment, the Company is also filing the opinion of Sichenzia Ross Ference Carmel LLP regarding the

legality of the Shares as Exhibit 5.1.

Item

9.01 Financial statements and Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

May 28, 2024

| |

BIOTRICITY INC. |

| |

|

|

| |

By: |

/s/ Waqaas

Al-Siddiq |

| |

|

Waqaas Al-Siddiq |

| |

|

Chief Executive Officer |

Exhibit

5.1

May

28, 2024

Biotricity

Inc.

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

Re:

Securities Registered under Registration Statement on Form S-3 (File No. 333-279226)

Ladies

and Gentlemen:

We

have acted as legal counsel to Biotricity Inc., a Nevada corporation (the “Company”), in connection with the offering

and sale by the Company of shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (“Common

Stock”), having an aggregate offering price of up to $2,684,644 to be offered and sold from time to time pursuant to

a prospectus supplement dated May 28, 2024 (the “Prospectus Supplement”) and the accompanying prospectus dated

May 15, 2024 (together with the Prospectus Supplement, the “Prospectus”) that form part of the Company’s registration

statement on Form S-3 (File No. 333-279226) (together with the Prospectus, the “Registration Statement”) filed by

the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended

(the “Securities Act”). The Shares are to be sold by the Company through or to H.C. Wainwright & Co., LLC (the

“Manager”), as sales agent and/or principal, in accordance with that certain At-The-Market Offering Agreement, dated

March 22, 2022, as amended on May 28, 2024, by and between the Company and the Manager (the “Offering Agreement”),

as described in the Prospectus Supplement.

In

connection with this opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of (i) the

Registration Statement, including the Prospectus Supplement, (ii) a specimen certificate representing the Common Stock, (iii) the Offering

Agreement, (iv) the Amended and Restated Articles of Incorporation of the Company, as currently in effect, (v) the Company’s Amended

and Restated Bylaws, as currently in effect, and (vi) certain resolutions adopted by the Board of Directors of the Company with respect

to the Offering Agreement and the issuance of the Shares. We have also examined originals or copies, certified or otherwise identified

to our satisfaction, of such records of the Company and such agreements, certificates of public officials, certificates of officers or

other representatives of the Company and others, and such other documents, certificates and records, as we have deemed necessary or appropriate

as a basis for the opinion set forth herein.

In

our examination, we have assumed and have not verified (i) the legal capacity of all natural persons, (ii) the genuineness of all signatures,

(iii) the authenticity of all documents submitted to us as originals, (iv) the conformity with the originals of all documents supplied

to us as copies, (v) the accuracy and completeness of all corporate records and documents made available to us by the Company, (vi) the

truth, accuracy and completeness of the information, representations and warranties contained in the records, documents, instruments

and certificates we have reviewed; and (vii) that the foregoing documents, in the form submitted to us for our review, have not been

altered or amended in any respect material to our opinion stated herein. We have relied as to factual matters upon certificates from

officers of the Company and certificates and other documents from public officials and government agencies and departments and we have

assumed the accuracy and authenticity of such certificates and documents. We have further assumed that the Shares will be issued and

delivered in accordance with the terms of the Offering Agreement.

Based

on the foregoing, we are of the opinion that the Shares have been duly authorized and, when issued and sold in the manner described in

the Registration Statement, the Prospectus Supplement and the Offering Agreement, will be validly issued, fully paid and non-assessable.

1185

Avenue of the Americas | 31st Floor | New York, NY | 10036 T (212) 930 9700 | F (212) 930 9725 | WWW.SRFC.LAW

We

are members of the bar of the State of New York. We express no opinion as to the laws of any jurisdiction other than the laws of the

State of New York, and the federal laws of the United States of America. Insofar as the matters covered by this opinion may be governed

by the laws of other states we have assumed that such laws are identical in all respects to the laws of the State of New York.

We

hereby consent to the use of this opinion as Exhibit 5.1 to the Company’s Current Report on Form 8-K filed with the Commission

on the date hereof, which is incorporated by reference into the Registration Statement, and further consent to the reference to us in

the Registration Statement and any amendments thereto. In giving such consent, we do not hereby admit that we are within the category

of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

This

opinion is intended solely for use in connection with the offer and sale of the Shares pursuant to the Offering Agreement and Prospectus

Supplement and is not to be relied upon for any other purpose or delivered to or relied upon by any other person without our prior written

consent. This opinion is rendered as of the date hereof and based solely on our understanding of facts in existence as of such date after

the examination described in this opinion. We assume no obligation to advise you of any fact, circumstance, event or change in the law

or the facts that may hereafter be brought to our attention whether or not such occurrence would affect or modify the opinions expressed

herein.

| |

Very

truly yours, |

| |

|

| |

/s/

Sichenzia Ross Ference Carmel LLP |

| |

Sichenzia

Ross Ference Carmel LLP |

1185

Avenue of the Americas | 31st Floor | New York, NY | 10036 T (212) 930 9700 | F (212) 930 9725 | WWW.SRFC.LAW

Exhibit

10.1

May

28, 2024

Biotricity

Inc.

997

Lenox Drive, Suite 100,

Lawrenceville,

NJ 08648

Attention:

Waqaas Al-Siddiq, Chief Executive Officer

Dear

Mr. Al-Siddiq:

Reference

is made to the At The Market Offering Agreement, dated as of March 22, 2022 (the “ATM Agreement”), between Biotricity

Inc. (the “Company”) and H.C. Wainwright & Co., LLC (“Wainwright”). This letter (the “Amendment”)

constitutes an agreement between the Company and Wainwright to amend the ATM Agreement as set forth herein. Defined terms that are used

but not defined herein shall have the meanings ascribed to such terms in the ATM Agreement.

1.

The defined term “Agreement” in the ATM Agreement is hereby amended to mean the ATM Agreement as amended by this Amendment.

2.

The definition of Registration Statement in Section 1 of the ATM Agreement is hereby amended by deleting “(File Number 333-255544)”

and inserting in its place “(File Number 333-279226)”.

3.

The first sentence of Section 2(b)(vii) of the ATM Agreement is hereby amended and restated in its entirety as follows:

“Unless

otherwise agreed between the Company and the Manager, settlement for sales of the Shares will occur at 10:00 a.m. (New York City time)

on the first (1st) Trading Day (or any such shorter settlement cycle as may be in effect pursuant to Rule 15c6-1 under the Exchange Act

from time to time) following the date on which such sales are made (each, a “Settlement Date”).”

4.

The last sentence of Section 3(h) of the ATM Agreement is hereby amended and restated in its entirety as follows:

“The

Company meets the transaction requirements as set forth in General Instruction I.B.1 of Form S-3 or, if applicable, as set forth in General

Instruction I.B.6 of Form S-3 with respect to the aggregate market value of securities being sold pursuant to this offering and during

the twelve (12) months prior to such time that this representation is repeated or deemed to be made.”

5.

A new Section 3(bb) of the ATM Agreement is inserted as follows:

“Investment

Company. The Company is not, and is not an Affiliate of, and immediately after receipt of payment for the Shares from the Manager

pursuant to this Agreement, will not be or be an Affiliate of, an “investment company” within the meaning of the Investment

Company Act of 1940, as amended. The Company shall conduct its business in a manner so that it will not become an “investment company”

subject to registration under the Investment Company Act of 1940, as amended. The Company shall conduct its business in a manner so as

to reasonably ensure that it or its Subsidiaries will not become an “investment company” subject to registration under the

Investment Company Act of 1940, as amended.”

6.

The second sentence of Section 13 of the ATM Agreement is hereby amended and restated in its entirety as follows

“Notwithstanding

anything herein to the contrary, the letter agreement, dated April 15, 2024, by and between the Company and the Manager shall continue

to be effective and the terms therein shall continue to survive and be enforceable by the Manager in accordance with its terms, provided

that, in the event of a conflict between the terms of the letter agreement and this Agreement, the terms of this Agreement shall prevail.”

7.

The Company and Wainwright hereby agree that the date hereof shall be a Representation Date under the ATM Agreement and the Company shall

deliver the deliverables pursuant to Sections 4(k), 4(l) and 4(m) of the ATM Agreement on or about the date hereof.

8.

In connection with the amendments to the ATM Agreement set forth herein, the Company shall reimburse the Manager for the fees and expenses

of Manager’s counsel in an amount not to exceed $15,000, which shall be paid on the date hereof.

9.

Except as expressly set forth herein, all of the terms and conditions of the ATM Agreement shall continue in full force and effect after

the execution of this Amendment and shall not be in any way be changed, modified or superseded by the terms set forth herein.

10.

This Amendment may be executed in two or more counterparts and by facsimile or “.pdf” signature or otherwise, and each of

such counterparts shall be deemed an original and all of such counterparts together shall constitute one and the same agreement. Counterparts

may be delivered via electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic

Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or other transmission method

and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[remainder

of page intentionally left blank]

In

acknowledgment that the foregoing correctly sets forth the understanding reached by the Company and Wainwright, please sign in the space

provided below, whereupon this Amendment shall constitute a binding amendment to the ATM Agreement as of the date indicated above.

| |

Very

truly yours, |

| |

|

|

| |

H.C.

WAINWRIGHT & CO., LLC |

| |

|

|

| |

By: |

/s/

Edward D. Silvera |

| |

Name: |

Edward

D. Silvera |

| |

Title: |

Chief

Operating Officer |

| Accepted

and Agreed: |

|

| |

|

|

| biotricity

Inc. |

|

| |

|

|

| By:

|

/s/

Waqaas Al-Siddiq |

|

| Name:

|

Waqaas

Al-Siddiq |

|

| Title:

|

Chief

Executive Officer |

|

[signature

page to btcy Amendment to atm agreement]

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

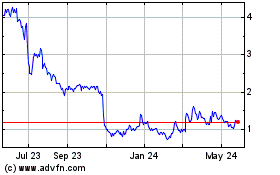

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Feb 2025 to Mar 2025

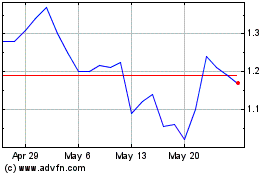

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Mar 2024 to Mar 2025