false

0001630113

0001630113

2023-10-31

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): October 31, 2023

BIOTRICITY

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40761 |

|

30-0983531 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

(Address

of Principal Executive Offices)

(650)

832-1626

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Class |

|

Trading

Symbol (s) |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.001 |

|

BTCY |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

Subscription

Agreement

On

October 31, 2023, Biotricity Inc. (the “Company”) entered into a subscription agreement (the “Agreement”) pursuant

to which the Company issued an unsecured convertible preferred note (the “Note”) in the principal amount of $1,000,000 to

an investor (“Investor”). The Note bears interest at a rate of 12% per annum, paid in cash monthly. The Note matures on the

earlier of 18 months or there is more than one closing pursuant to the subscription agreement by the Company, the 18 month anniversary

of the last closing date of the offering (the “Maturity Date”)

The

Note and accrued interest may be prepaid by the Company in whole or in part in cash or through a conversion by the Investor at a price

that is equal to a 15% discount to the 10-day VWAP. The Investor may at its option, convert all of the outstanding balance and accrued

interest on the Note, at any time subsequent to a Qualified Financing consumed through earlier of the Early Payout Date or the

Maturity Date, as such terms as defined in the Note, at a conversion price equal to a 20% discount to the lesser of (i) the actual price

per securities issued in the Qualified Financing or (ii) if there is no Qualified Financing as of the Maturity Date, by mutual consent

and election of the Company and the Investor, at a 15% discount to the average VWAP for ten (10) consecutive trading days immediately

prior to the Maturity Date .

The

Note includes standard Events of Default, including, but not limited to: (i) failure to issue and deliver shares upon conversion, (ii)

default in the payment of principal or interest, when same is due, (iii) the entry of a decree or order adjudging the Company as bankrupt

or insolvent; or approving as properly filed a petition seeking reorganization, arrangement, adjustment or composition of or in respect

of the Company, or appointing a receiver, liquidator, assignee, trustee or sequestrator (or other similar official) of the Company or

of any substantial part of its property, or ordering the winding-up or liquidation of its affairs, and the continuance of any such decree

or order unstayed and in effect for a period of 60 days; or (iv) institution by the Company of proceedings to be adjudicated as bankrupt

or insolvent, or the consent by it to the institution of bankruptcy or insolvency proceedings against it, or the filing by it of a petition

or answer or consent seeking reorganization or relief under the Federal Bankruptcy Code or any other applicable federal or state law.

The

Note was issued and sold in reliance on exemption from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended.

The

foregoing description is qualified in its entirety by reference to the full text of the Note and the Agreement, copies of each of which

are filed as Exhibit 4.1 and Exhibit 10.1 hereto, and each of which is incorporated herein by reference.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information under Item 1.01 is incorporated by reference into this Item 2.03.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

The

information under Item 1.01 is incorporated by reference into this Item 3.02.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date:

November 6, 2023

| |

BIOTRICITY

INC. |

| |

|

|

| |

By: |

/s/

Waqaas Al-Siddiq |

| |

|

Waqaas

Al-Siddiq |

| |

|

Chief

Executive Officer |

Exhibit

4.1

fTHIS

NOTE HAS NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR UNDER THE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION, AND MAY NOT BE SOLD, ASSIGNED, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED OF EXCEPT IN COMPLIANCE WITH, OR PURSUANT

TO AN EXEMPTION FROM, THE REQUIREMENTS OF SUCH ACT OR SUCH LAWS.

BIOTRICITY

INC.

CONVERTIBLE

PREFERRED NOTE

| Principal

Amount: US$[1,000,000] |

Issue

Date: October 31, 2023 |

BIOTRICITY

INC., a Nevada corporation (the “Company”), for value received, hereby promises to pay to [ ] (the “Subscriber(s)”)

or his permitted assigns or successors (the “Holder(s)”), the principal amount of [One Million Dollars] (US$[1,000,000])

(the “Principal Amount”), without demand, on the Maturity Date (as hereinafter defined), together with any accrued

and unpaid interest due thereon. This Note shall bear interest at a fixed rate of 12% per annum, paid in cash monthly. Except as set

forth in Section 3.1, payment of all principal due shall be in such coin or currency of the United States of America as shall be legal

tender for the payment of public and private debts at the time of payment.

This

Note is a convertible preferred note referred to in that certain Subscription Agreement dated as of the date hereof (the “Subscription

Agreement”), or series of like subscription agreements, among the Company and the Subscriber(s), pursuant to which the Company

is seeking to raise an aggregate of up to $1,000,000 (the “Offering”).

ARTICLE

1

DEFINITIONS

SECTION

1.1. Definitions. The terms defined in this Article whenever used in this Note shall have the respective meanings hereinafter

specified.

“Applicable

Laws” means any and all applicable foreign, federal, state and local statutes, laws, regulations, ordinances, policies, and

rules or common law (whether now existing or hereafter enacted or promulgated), of any and all governmental authorities, agencies, departments,

commissions, boards, courts, or instrumentalities of the United States, any state of the United States, any other nation, or any political

subdivision of the United States, any state of the United States or any other nation, and all applicable judicial and administrative,

regulatory or judicial decrees, judgments and orders, including common law rules and determinations.

“Common

Stock” means the common stock, par value $0.001 per share, of the Company.

“Conversion

Shares” means the New Round Stock issued or issuable to the Holder upon a Conversion Date pursuant to Article 3.

“Conversion

Date” shall have the meaning set forth in Section 3.1. “Event of Default” shall have the meaning set forth

in Section 6.1.

“Holder”

or “Holders” means the person named above or any Person who shall thereafter become a recordholder of this Note in

accordance with the terms hereof.

“Issue

Date” means the issue date stated above.

“Maturity

Date” shall mean the earlier of: (a) the eighteen (18) month anniversary of the date hereof or, if there be more than one closing

pursuant to the Offering, the eighteen (18) month anniversary of the last closing date of the Offering.

“New

Round Stock” means, in the event of a Qualified Financing, the securities (or units of securities if more than one security

are sold as a unit) issued by the Company in the Qualified Financing.

“Note”

means this Convertible Preferred Note, as amended, modified or restated.

“Person”

means an individual, corporation, partnership, limited liability company, association, trust, joint venture, unincorporated

organization or any government, governmental department or agency or political subdivision thereof.

“Qualified

Financing” means the next equity or debt round of financing of the Company in whatever form or type, that raises in excess

of $15,000,000 gross proceeds.

“Securities

Act” means the United States Securities Act of 1933, as amended. “Trading Day” means a day on which the

principal Trading Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New York Stock

Exchange (or any successors to any of the foregoing).

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30

a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the Common Stock is not then listed or quoted for trading on a Trading

Market and if prices for the Common Stock are then reported on the OTC Markets, Inc. (or a similar organization or agency succeeding

to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (c) in all other cases,

the fair market value of a share of Common Stock as determined by the Board of Directors of the Company in good faith.

ARTICLE

2

GENERAL

PROVISIONS

SECTION

2.1. Loss, Theft. Destruction of Note. Upon receipt of evidence satisfactory to the Company of the loss, theft, destruction or

mutilation of this Note and, in the case of any such loss, theft or destruction, upon receipt of indemnity or security reasonably satisfactory

to the Company, or, in the case of any such mutilation, upon surrender and cancellation of this Note, the Company will make and deliver,

in lieu of such lost, stolen, destroyed or mutilated Note, a new Note of like tenor and unpaid principal amount dated as of the date

hereof. This Note shall be held and owned upon the express condition that the provisions of this Section 2.1 are exclusive with respect

to the replacement of a mutilated, destroyed, lost or stolen Note and shall preclude any and all other rights and remedies notwithstanding

any law or statute existing or hereafter enacted to the contrary with respect to the replacement of negotiable instruments or other securities

without their surrender.

SECTION

2.2. Prepayment; Redemption. This Note may be prepaid by the Company in whole or in part, after providing fifteen (15) days written

notice to the Holder, either in cash or by the mutually consented conversion of the Note and any accrued interest thereon at a 15% discount

to the stock’s 10-day VWAP.

ARTICLE

3

CONVERSION

OF NOTE

SECTION

3.1. Conversion.

(a) Optional

Conversion Upon Qualified Financing or Maturity. At the option of the Holder at any time subsequent to the consummation of a Qualified

Financing (the “Conversion Date”) through to the earlier of the Early Payout Date or the Maturity Date, all of the

outstanding principal and accrued interest shall convert into New Round Stock based upon a conversion price equal to a 20% discount to

the lesser of (i) the actual price per New Round Stock in the Qualified Financing or (ii) if there be no Qualified Financing as of the

Maturity Date, by mutual consent and election of the Company and the Holder, at a 15% discount to the average VWAP for ten (10) consecutive

Trading Days immediately prior to the Maturity Date.

(b) Upon

and as of the Conversion Date, this Note will be cancelled on the books and records of the Company and shall represent the right to receive

the Conversion Shares.

SECTION

3.2. Delivery of Securities Upon Conversion.

(a) As

soon as is practicable after the Conversion Date, the Company shall deliver to the Holder (i) a certificate or certificates evidencing

the Conversion Shares issuable to the Holder.

(b) The

issuance of certificates for Conversion Shares upon conversion or maturity of this Note shall be made without charge to the Holder for

any issuance tax in respect thereof or other cost incurred by the Company in connection with such conversion and the related issuance

of securities. Upon conversion of this Note, the Company shall take all such actions as are necessary in order to ensure that the Conversion

Shares so issued upon such conversion shall be validly issued, fully paid and nonassessable.

SECTION

3.3. Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon conversion of this Note.

If any conversion of this Note would create a fractional share or a right to acquire a fractional share, the Company shall round to the

nearest whole number.

ARTICLE

4

STATUS;

RESTRICTIONS ON TRANSFER

SECTION

4.1. Status of Note. This Note is a direct, general and unconditional obligation of the Company, and constitutes a valid and legally

binding obligation of the Company, enforceable in accordance with its terms subject, as to enforcement, to bankruptcy, insolvency, reorganization

and other similar laws of general applicability relating to or affecting creditors’ rights and to general principles of equity.

SECTION

4.2. Restrictions on Transferability. This Note and any Conversion Shares issued with respect to this Note, have not been registered

under the Securities Act, or under any state securities or so-called “blue sky laws,” and may not be offered, sold, transferred,

hypothecated or otherwise assigned except (a) pursuant to a registration statement with respect to such securities which is effective

under the Act or (b) upon receipt from counsel satisfactory to the Company of an opinion, which opinion is satisfactory in form and substance

to the Company, to the effect that such securities may be offered, sold, transferred, hypothecated or otherwise assigned (i) pursuant

to an available exemption from registration under the Act and (ii) in accordance with all applicable state securities and so-called “blue

sky laws.” The Holder agrees to be bound by such restrictions on transfer. The Holder further consents that the certificates representing

the Conversion Shares that may be issued with respect to this Note may bear a restrictive legend to such effect.

ARTICLE

5

COVENANTS

In

addition to the other covenants and agreements of the Company set forth in this Note, the Company covenants and agrees that so long as

this Note shall be outstanding:

SECTION

5.1. Payment of Note. The Company will punctually, according to the terms hereof, (a) pay or cause to be paid all amounts due

under this Note, (b) reasonably promptly issue the Conversion Shares upon the Conversion Date.

SECTION

5.2. Notice of Default. If any one or more events occur which constitute or which, with the giving of notice or the lapse of time

or both, would constitute an Event of Default or if the Holder shall demand payment or take any other action permitted upon the occurrence

of any such Event of Default, the Company will forthwith give notice to the Holder, specifying the nature and status of the Event of

Default or other event or of such demand or action, as the case may be.

SECTION

5.3. Compliance with Laws and Filing Responsibilities. The Company will comply in all material respects with all Applicable Laws,

except where the necessity of compliance therewith is contested in good faith by appropriate proceedings. The Company will be responsible

for timely filing of all required documents including Form D, and blue sky filings, and will pay for all legal opinions of Company counsel

associated with all future sales of the Investor appropriately relying on Rule 144 with respect to the securities sold.

SECTION

5.4. Use of Proceeds. The Company shall use the proceeds of this Note for general working capital.

ARTICLE

6

REMEDIES

SECTION

6.1. Events of Default. “Event of Default” wherever used herein means any one of the following events:

(a) The

Company shall fail to issue and deliver the Conversion Shares in accordance with Article 3;

(b) Default

in the due and punctual payment of the principal of, or any other amount owing in respect of (including Interest), this Note when and

as the same shall become due and payable;

(c) Default

in the performance or observance of any covenant or agreement of the Company in this Note (other than a covenant or agreement a default

in the performance of which is specifically provided for elsewhere in this Section 6.1), and the continuance of such default for a period

of ten (10) days after there has been given to the Company by the Holder a written notice specifying such default and requiring it to

be remedied;

(d) The

entry of a decree or order by a court having jurisdiction adjudging the Company as bankrupt or insolvent; or approving as properly filed

a petition seeking reorganization, arrangement, adjustment or composition of or in respect of the Company under the Federal Bankruptcy

Code or any other applicable federal or state law, or appointing a receiver, liquidator, assignee, trustee or sequestrator (or other

similar official) of the Company or of any substantial part of its property, or ordering the winding-up or liquidation of its affairs,

and the continuance of any such decree or order unstayed and in effect for a period of sixty (60) calendar days;

(e) The

institution by the Company of proceedings to be adjudicated as bankrupt or insolvent, or the consent by it to the institution of bankruptcy

or insolvency proceedings against it, or the filing by it of a petition or answer or consent seeking reorganization or relief under the

Federal Bankruptcy Code or any other applicable federal or state law, or the consent by it to the filing of any such petition or to the

appointment of a receiver, liquidator, assignee, trustee or sequestrator (or other similar official) of the Company or of any substantial

part of its property, or the making by it of an assignment for the benefit of creditors;

(f) The

Company seeks the appointment of a statutory manager or proposes in writing or makes a general assignment or an arrangement or composition

with or for the benefit of its creditors or any group or class thereof or files a petition for suspension of payments or other relief

of debtors or a moratorium or statutory management is agreed or declared in respect of or affecting all or any material part of the indebtedness

of the Company; or

(g) It

becomes unlawful for the Company to perform or comply with its obligations under this Note.

SECTION

6.2. Effects of Default. If an Event of Default occurs and is continuing, then and in every such case the Holder may declare this

Note to be due and payable immediately, by a notice in writing to the Company, and upon any such declaration, the Company shall pay to

the Holder the outstanding principal amount of this Note plus all accrued and unpaid interest through the date the Note is paid in full.

SECTION

6.3. Remedies Not Waived. No course of dealing between the Company and the Holder or any delay in exercising any rights hereunder

shall operate as a waiver by the Holder. No failure or delay by the Holder in exercising any right, power or privilege under this Note

shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or

the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of

any rights or remedies provided by Applicable Law.

ARTICLE

7

MISCELLANEOUS

SECTION

7.1. Severability. If any provision of this Note shall be held to be invalid or unenforceable, in whole or in part, neither the

validity nor the enforceability of the remainder hereof shall in any way be affected.

SECTION

7.2. Notice. Where this Note provides for notice of any event, such notice shall be given (unless otherwise herein expressly provided)

in writing and either (i) delivered personally, (ii) sent by certified, registered or express mail, postage prepaid or (iii) sent by

facsimile or other electronic transmission, and shall be deemed given when so delivered personally, sent by facsimile or other electronic

transmission (confirmed in writing) or mailed. Notices shall be addressed, if to Holder, to its address as provided in the Subscription

Agreement or, if to the Company, to its principal office.

SECTION

7.3. Governing Law. This Note shall be governed by, and construed in accordance with, the laws of the State of New York (without

giving effect to any conflicts or choice of law provisions that would cause the application of the domestic substantive laws of any other

jurisdiction).

SECTION

7.4. Forum. The Holder and the Company hereby agree that any dispute which may arise out of or in connection with this Note shall

be adjudicated before a court of competent jurisdiction in the State of New York and they hereby submit to the exclusive jurisdiction

of the courts of the County and State of New York, as well as to the jurisdiction of all courts to which an appeal may be taken from

such courts, with respect to any action or legal proceeding commenced by either of them and hereby irrevocably waive any objection they

now or hereafter may have respecting the venue of any such action or proceeding brought in such a court or respecting the fact that such

court is an inconvenient forum.

SECTION

7.5. Headings. The headings of the Articles and Sections of this Note are inserted for convenience only and do not constitute

a part of this Note.

SECTION

7.6. Amendments. Any provision of this Note may be amended, modified or waived if and only if the Holder of this Note and the

Company has consented in writing to such amendment, modification or waiver of any such provision of this Note.

SECTION

7.7. No Recourse Against Others. The obligations of the Company under this Note are solely obligations of the Company and no officer,

employee or stockholder shall be liable for any failure by the Company to pay amounts on this Note when due or perform any other obligation.

SECTION

7.9. Assignment; Binding Effect. This Note may not be assigned by the Company without the prior written consent of the Holder.

This Note shall be binding upon and inure to the benefit of both parties hereto and their respective permitted successors and assigns.

SECTION

8.0. Registration Rights. If this Note is converted, shares underlying the Note will be subject to “piggy-back” registration

rights of the Qualified Financing.

IN

WITNESS WHEREOF, the Company has caused this Note to be signed by its duly authorized officer on the date hereinabove written.

| |

BIOTRICITY

INC. |

| |

|

|

| |

By: |

/s/

Waqaas Alsiddiq |

| |

Name:

|

Waqaas

Alsiddiq |

| |

Title:

|

CEO |

Exhibit

10.1

SUBSCRIPTION

AGREEMENT

THIS

SUBSCRIPTION AGREEMENT (this “Agreement”) is dated as of the date contained in the signature page hereto (the “Closing

Date”), by and between BIOTRICITY INC., a Nevada corporation (the “Company”), and the subscriber

identified on the signature page hereto (the “Subscriber”).

RECITALS

WHEREAS,

the Company seeks to sell Convertible Preferred Notes in the form annexed hereto as Exhibit B (the “Note” and

collectively referred to as the “Notes”), pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the

“Securities Act”) and Rule 506(b) of Regulation D (“Regulation D”) as promulgated under the Securities

Act (the “Offering”); and

WHEREAS,

the Subscriber wishes to purchase a Note with the principal amount as set forth on the Signature Page to this Agreement;

NOW,

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the

receipt and adequacy of which are hereby acknowledged, the Company and the Subscriber hereby agree as follows:

ARTICLE

I

PURCHASE

OF CONVERTIBLE PREFERRED NOTES

1.01 Subscription.

The Subscriber hereby subscribes (the “Subscription”) to purchase a Note in the amount set forth on the signature

page hereto (the “Subscription Amount”). This Subscription shall become effective when it has been duly executed by

the Subscriber and this Agreement has been accepted and agreed to by the Company.

1.02 Payment

For Subscription. The Subscriber agrees that the Subscription Amount to the Company for the amount of the Subscriber’s Subscription

is to be made upon submission of this Agreement in the form included in these Subscription Documents (as hereinafter defined).

1.03 Terms

and Conditions. The Company shall have the right to accept or reject the Subscription, in whole or in part, for any reason whatsoever,

including, but not limited to, the belief of the Company that the Subscriber cannot bear the economic risk of an investment in the Company,

is not capable of evaluating the merits and risks of an investment in the Company or is not an “Accredited Investor,” as

such term is defined in Rule 501 of Regulation D promulgated under the Securities Act, or for no reason at all. A closing may occur once

a Subscription is received by the Company and additional closings under the Offering may take place from time to time as subscriptions

are received by the Company.

1.04 Conversion.

At the option of the Holder at any time subsequent to the consummation of a Qualified Financing (the “Conversion Date”)

through to the earlier of the Early Payout Date or the Maturity Date, all of the outstanding principal and accrued interest shall convert

into New Round Stock based upon a conversion price equal to a 20% discount to the lesser of (i) the actual price per New Round Stock

in the Qualified Financing or (ii) if there be no Qualified Financing as of the Maturity Date, by mutual consent and election of the

Company and the Holder, at a 15% discount to the average VWAP for ten (10) consecutive Trading Days immediately prior to the Maturity

Date.

ARTICLE

II

REPRESENTATIONS

AND WARRANTIES

2.01 Representations

and Warranties by the Company. The Company represents and warrants to the Subscriber that:

(a) Authorization.

The Company has all corporate right, power and authority to enter into this Agreement and to consummate the transactions contemplated

hereby. All corporate action on the part of the Company, its directors and stockholders necessary for the: (i) authorization execution,

delivery and performance of this Agreement by the Company; (ii) authorization, sale, issuance and delivery of the Notes contemplated

hereby and the performance of the Company’s obligations hereunder; and (iii) authorization, issuance and delivery of the securities

issuable upon conversion of the Notes, has been taken. The securities issuable upon conversion of the Notes will be validly issued, fully

paid and nonassessable. The issuance and sale of the securities contemplated hereby will not give rise to any preemptive rights or rights

of first refusal on behalf of any person which have not been waived in connection with this offering. The Company is not in default of

any other obligations, including any promissory notes or debentures.

(b) Enforceability.

Assuming this Agreement has been duly and validly authorized, executed and delivered by the parties hereto and thereto other than the

Company, this Agreement as duly authorized, executed and delivered by the Company constitutes the legal, valid and binding obligations

of the Company enforceable against the Company in accordance with its terms, except as such enforcement is limited by general equitable

principles, or by bankruptcy, insolvency and other similar laws affecting the enforcement of creditors rights generally.

(c) No

Violations. The execution, delivery and performance of this Agreement and the Note by the Company and the consummation by the Company

of the transactions contemplated hereby and thereby (including, without limitation, the securities issuable upon the conversion of the

Note) will not (i) result in a violation of the Articles of Incorporation of the Company or other organizational documents of the Company,

(ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or

give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which

the Company is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree applicable to the Company

by which any property or asset of the Company is bound or affected.

(d) Litigation.

The Company knows of no pending or threatened legal or governmental proceedings against the Company which could materially adversely

affect the business, property, financial condition or operations of the Company or which materially and adversely questions the validity

of this Agreement or any agreements related to the transactions contemplated hereby or the right of the Company to enter into any of

such agreements, or to consummate the transactions contemplated hereby or thereby. The Company is not a party or subject to the provisions

of any order, writ, injunction, judgment or decree of any court or government agency or instrumentality which could materially adversely

affect the business, property, financial condition or operations of the Company. There is no material action, suit, proceeding or investigation

by the Company currently pending in any court or before any arbitrator or that the Company intends to initiate.

(e) Intellectual

Property. The Company owns or possesses sufficient legal rights to all patents, trademarks, service marks, trade names, copyrights,

trade secrets, licenses, information and other proprietary rights and processes necessary for its business as now conducted without any

known infringement of the rights of others. The Company has not received any written communications alleging that the Company has violated

or, by conducting its business as presently proposed to be conducted, would violate any of the patents, trademarks, service marks, trade

names, copyrights or trade secrets or other proprietary rights of any other person or entity.

(f) Title

to Assets. The Company has good and marketable title to its properties and assets, and good title to its leasehold estates, in

each case subject to no mortgage, pledge, lien, lease, encumbrance or charge, other than (a) those resulting from taxes which have

not yet become delinquent; (b) liens and encumbrances which do not materially detract from the value of the property subject

thereto or materially impair the operations of the Company; and (c) those that have otherwise arisen in the ordinary course of

business. The Company is in compliance with all material terms of each lease to which it is a party or is otherwise bound.

(g) Investment

Company. The Company is not an “investment company” within the meaning of such term under the Investment Company Act

of 1940, as amended, and the rules and regulations of the Securities and Exchange Commission thereunder.

(h) No

Solicitation. Neither the Company nor any person participating on the Company’s behalf in the transactions contemplated hereby

has conducted any “general solicitation,” as such term is defined in Regulation D promulgated under the Securities Act, with

respect to any of the Notes being offered hereby.

(i) Blue

Sky. The Company agrees to file a Form D with respect to the sale of the Notes under Regulation D of the rules and regulations promulgated

under the Securities Act. The Company shall, on or before the Closing Date, take such action as the Company shall reasonably determine

is necessary to qualify the Notes for sale to the Subscriber pursuant to this Agreement under applicable securities or “blue sky”

laws of the states of the United States (or to obtain an exemption from such qualification).

(j) The

execution, delivery and performance of this Agreement by the Company will not (i) violate any law, treaty, rule or regulation applicable

to or binding upon the Company or any of its properties or assets, or (ii) result in a breach of any contractual obligation to which

the Company is a party or by which it or any of its properties or assets is bound that would reasonably be expected to have a material

adverse effect on the ability of the Company to perform its obligations under this Agreement.

(k) There

is no civil, criminal or administrative action, suit, demand, claim, hearing, notice of violation or investigation, proceeding or demand

letter pending, or to the knowledge of the Company threatened, against the Company, which if adversely determined would reasonably be

expected to have a material adverse effect on the ability of the Company to perform its obligations hereunder. There is no civil, criminal

or administrative action, suit, demand, claim, hearing, notice of violation or investigation, proceeding or demand letter pending, or

to the knowledge of the Company threatened, against or affecting the Company or any of its subsidiaries that, if adversely determined,

would reasonably be expected to have a material adverse effect on the Company and its subsidiaries (taken as a whole). There are no outstanding

orders, writs, judgments, decrees, injunctions or settlements that would reasonably be expected to have a material adverse effect on

the Company and its subsidiaries (taken as a whole).

2.02 Survival

of Representations and Warranties. The representations and warranties of the Company shall survive the closing and shall be fully

enforceable at law or in equity against the Company and the Company’s successors and assigns.

2.03 Disclaimer.

It is specifically understood and agreed by the Subscriber that the Company has not made, nor by this Agreement shall be construed to

make, directly or indirectly, explicitly or by implication, any representation, warranty, projection, assumption, promise, covenant,

opinion, recommendation or other statement of any kind or nature with respect to the anticipated profits or losses of the Company, except

as otherwise provided with this Agreement.

2.04 Representations

and Warranties by the Subscriber. The Subscriber represents and warrants to the Company that:

(a) The

Subscriber is acquiring the Notes for the Subscriber’s own account, as principal, for investment purposes only and not with any

intention to resell, distributes or otherwise dispose of the Notes, as the case may be, in whole or in part.

(b) The

Subscriber has had an unrestricted opportunity to: (i) obtain information concerning the Offering, including the Notes, the Company and

its proposed and existing business and assets; and (ii) ask questions of, and receive answers from the Company concerning the terms and

conditions of the Offering and to obtain such additional information as may have been necessary to verify the accuracy of the information

contained in the this Agreement or otherwise provided.

(c) The

Subscriber is an Accredited Investor, within the meaning of Securities and Exchange Commission (“SEC”) Rule 501 of

Regulation D, and has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and

risks of investing in the Company, and all information that the Subscriber has provided concerning the Subscriber, the Subscriber’s

financial position and knowledge of financial and business matters is true, correct and complete. The Subscriber acknowledges and understands

that the Company will rely on the information provided by the Subscriber in this Agreement and in the Subscriber Questionnaire annexed

hereto as Exhibit A for purposes of complying with Federal and applicable state securities laws.

(d) Except

as otherwise disclosed in writing by the Subscriber to the Company, the Subscriber has not dealt with a broker in connection with the

purchase of the Notes and agrees to indemnify and hold the Company and its officers and directors harmless from any claims for brokerage

or fees in connection with the transactions contemplated herein.

(e) The

Subscriber is not relying on the Company or any of its management, officers or employees with respect to any legal, investment or tax

considerations involved in the purchase, ownership and disposition of Notes. The Subscriber has relied solely on the advice of, or has

consulted with, in regard to the legal, investment and tax considerations involved in the purchase, ownership and disposition of Notes,

the Subscriber’s own legal counsel, business and/or investment adviser, accountant and tax adviser.

(f) The

Subscriber understands that the Notes, or the securities into which either of them may convert or be exercised for, cannot be sold, assigned,

transferred, exchanged, hypothecated or pledged, or otherwise disposed of or encumbered except in accordance with the Securities Act

or the 1934 Securities and Exchange Act, as amended (the “Exchange Act”), and that no market will exist for the resale

of any such securities. In addition, the Subscriber understands that the Notes, or the securities into which they may convert, have not

been registered under the Securities Act, or under any applicable state securities or blue sky laws or the laws of any other jurisdiction,

and cannot be resold unless they are so registered or unless an exemption from registration is available. The Subscriber understands

that there is no current plan to register the Notes, or the securities into which they may convert.

(g) The

Subscriber is willing and able to bear the economic and other risks of an investment in the Company for an indefinite period of time.

The Subscriber has read and understands the provisions of this Agreement.

(h) The

Subscriber maintains the Subscriber’s domicile, and is not merely a transient or temporary resident, at the residence address shown

on the signature page of this Agreement.

(i) The

Subscriber understands that the Company has made available to the Subscriber and the Subscriber’s accountants, attorneys and other

advisors full and complete information concerning the financial structure of the Company, and any and all data requested by the Subscriber

as a basis for estimating the potential profits and losses of the Company and the Subscriber acknowledges that the Subscriber has either

reviewed such information or has waived review of such information.

(j)

The Subscriber is not participating in the Offering as a result of or subsequent to: (i) any advertisement, article, notice

or other communication published in any newspaper, magazine or similar media or broadcast over television or radio; (ii) any seminar

or meeting whose attendees have been invited by any general solicitation or general advertising; or (iii) any registration statement

the Company may have filed with the Securities and Exchange Commission.

(k) If

the Subscriber is an entity, the Subscriber is duly organized, validly existing and in good standing under the laws of its jurisdiction

of incorporation or organization, as the case may be. The Subscriber has all requisite power and authority to own its properties, to

carry on its business as presently conducted, to enter into and perform the Subscription and the agreements, documents and instruments

executed, delivered and/or contemplated hereby (collectively, the “Subscription Documents”) to which it is a party

and to carry out the transactions contemplated hereby and thereby. The Subscription Documents are valid and binding obligations of the

Subscriber, enforceable against it in accordance with their terms, except as enforceability may be limited by applicable bankruptcy,

insolvency, moratorium, reorganization or similar laws, from time to time in effect, which affect enforcement of creditors’ rights

generally. If applicable, the execution, delivery and performance of the Subscription Documents to which it is a party have been duly

authorized by all necessary action of the Subscriber. The execution, delivery and performance of the Subscription Documents and the performance

of any transactions contemplated by the Subscription Documents will not (i) violate, conflict with or result in a default (whether after

the giving of notice, lapse of time or both) under any contract or obligation to which the Subscriber is a party or by which it or its

assets are bound, or any provision of its organizational documents (if an entity), or cause the creation of any lien or encumbrance upon

any of the assets of the Subscriber; (ii) violate, conflict with or result in a default (whether after the giving of notice, lapse of

time or both) under, any provision of any law, regulation or rule, or any order of, or any restriction imposed by any court or other

governmental agency applicable to the Subscriber; (iii) require from the Subscriber any notice to, declaration or filing with, or consent

or approval of any governmental authority or other third party other than pursuant to federal or state securities or blue sky laws; or

(iv) accelerate any obligation under, or give rise to a right of termination of, any agreement, permit, license or authorization to which

the Subscriber is a party or by which it is bound.

(l) The

Subscriber acknowledges and agrees that the Company intends, in the future, to raise additional funds to expand its business which may

include, without limitation, the need to: fund more rapid expansion; fund additional marketing expenditures; enhance its operating infrastructure;

hire additional personnel; respond to competitive pressures; or acquire complementary businesses or necessary technologies.

(m) The

Subscriber acknowledges and agrees that the Company will have broad discretion with respect to the use of the proceeds from this Offering,

and investors will be relying on the judgment of management regarding the application of these proceeds.

(n) The

Subscriber understands the various risks of an investment in the Company, and has carefully reviewed the various risk factors described

in the Company’s various public filings, including but not limited to its 10Qs and 10Ks.

ARTICLE

III

MISCELLANEOUS

3.01 Indemnification.

(a) The

Subscriber will, severally and not jointly with any other Subscribers indemnify and hold harmless the Company and its officers, directors,

members, shareholders, partners, representatives, employees and agents, successors and assigns against any losses, obligations, claims,

damages, liabilities, contingencies, judgments, fines, penalties, charges, costs (including, without limitation, court costs, reasonable

attorneys’ fees and costs of defense and investigation), amounts paid in settlement or expenses, joint or several, (collectively,

“Company Claims”) reasonably incurred in investigating, preparing or defending any action, claim, suit, inquiry, proceeding,

investigation or appeal taken from the foregoing by or before any court or governmental, administrative or other regulatory agency, body

or the SEC, whether pending or threatened, whether or not an indemnified party is or may be a party thereto, to which any of them may

become subject insofar as such Company Claims (or actions or proceedings, whether commenced or threatened, in respect thereof): (a) arise

out of or are based upon any untrue statement or untrue statement of a material fact made by the Subscriber and contained in this Agreement

or (b) arise out of or are based upon any breach by the Subscriber of any representation, warranty, or agreement made by the Subscriber

contained herein. Provided, however, and notwithstanding anything to the contrary, in no event shall the liability of the Subscriber

pursuant to this Section exceed the amount of the Note that the Subscriber purchases pursuant to this Agreement.

(b) The

Company will indemnify and hold harmless each Subscriber and its officers, directors, members, shareholders, partners, representatives,

employees and agents, successors and assigns, and each other person, if any, who controls such Subscriber within the meaning of the Securities

Act against any losses, obligations, claims, damages, liabilities, contingencies, judgments, fines, penalties, charges, costs (including,

without limitation, court costs, reasonable attorneys’ fees and costs of defense and investigation), amounts paid in settlement

or expenses, joint or several, (collectively, “Subscriber Claims”) reasonably incurred in investigating, preparing

or defending any action, claim, suit, inquiry, proceeding, investigation or appeal taken from the foregoing by or before any court or

governmental, administrative or other regulatory agency, body or the SEC, whether pending or threatened, whether or not an indemnified

party is or may be a party thereto, to which any of them may become subject insofar as such Subscriber Claims (or actions or proceedings,

whether commenced or threatened, in respect thereof) arise out of or are based upon: (i) any blue sky application or other document executed

by the Company specifically for that purpose or based upon written information furnished by the Company filed in any state or other jurisdiction

in order to qualify any or all of the Notes (or securities issuable upon conversion of the Notes) under the securities laws thereof (any

such application, document or information herein called a “Blue Sky Application”); (ii) any untrue statement or alleged

untrue statement of a material fact made by the Company in this Agreement; (iii) arise out of or are based upon any breach by the Company

of any representation, warranty, or agreement made by it contained herein or in the Note; or (iv) any violation by the Company or its

agents of any rule or regulation promulgated under the Securities Act applicable to the Company or its agents and relating to action

or inaction required of the Company in connection with such registration; and will reimburse such Subscriber, and each such officer,

director or member and each such controlling person for any legal or other expenses reasonably incurred by them in connection with investigating

or defending any such Claim or action; provided, however, that the Company will not be liable in any such case if and to

the extent that any such loss, claim, damage or liability arises out of or is based upon an untrue statement or alleged untrue statement

or omission or alleged omission so made in conformity with information furnished by such Subscriber or any such controlling person to

the Company.

3.02 Addresses

and Notices. All notices, demands, consents, requests, instructions and other communications to be given or delivered or permitted

under or by reason of the provisions of this Agreement or in connection with the transactions contemplated hereby shall be in writing

and shall be deemed to be delivered and received by the intended recipient as follows: (i) if personally delivered, on the business day

of such delivery (as evidenced by the receipt of the personal delivery service), (ii) if mailed certified or registered mail return receipt

requested, two (2) business days after being mailed, or (iii) if delivered by overnight courier (with all charges having been prepaid),

on the business day of such delivery (as evidenced by the receipt of the overnight courier service of recognized standing). If any notice,

demand, consent, request, instruction or other communication cannot be delivered because of a changed address of which no notice was

given (in accordance with this Section 3.02, or the refusal to accept same, the notice, demand, consent, request, instruction or other

communication shall be deemed received on the second business day the notice is sent (as evidenced by a sworn affidavit of the sender).

All such notices, demands, consents, requests, instructions and other communications will be sent to the following addresses or facsimile

numbers as applicable:

| If

to the Company to: |

Biotricity

Inc.

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

Attention:

Waqaas Al-Siddiq |

| |

|

With

a copy (which shall not

constitute notice) to: |

Sichenzia

Ross Ference LLP

1185

Avenue of the Americas, 37th Floor

New

York, New York 10036

Attention:

David B. Manno, Esq.

Facsimile:

(212) 930-9725 |

If

to the Subscriber, to the address set forth on the signature page annexed hereto.

Any

such person may by notice given in accordance with this Section 3.02 to the other parties hereto designate another address or

person for receipt by such person of notices hereunder.

3.03 Titles

and Captions. All Article and Section titles or captions in this Agreement are for convenience only. They shall not be deemed part

of this Agreement and do not in any way define, limit, extend or describe the scope or intent of any provisions hereof.

3.04 Assignability.

This Agreement is not transferable or assignable by the undersigned.

3.05 Pronouns

and Plurals. Whenever the context may require, any pronoun used herein shall include the corresponding masculine, feminine or neuter

forms. The singular form of nouns, pronouns and verbs shall include the plural and vice versa.

3.06 Further

Action. The parties shall execute and deliver all documents, provide all information and take or forbear from taking all such action

as may be necessary or appropriate to achieve the purposes of this Agreement. Each party shall bear its own expenses in connection therewith.

3.07 Applicable

Law. This Agreement shall be construed in accordance with and governed by the laws of the State of New York without regard to its

conflict of law rules.

3.08 Binding

Effect. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, administrators,

successors, legal representatives, personal representatives, permitted transferees and permitted assigns. If the undersigned is more

than one person, the obligation of the undersigned shall be joint and several and the agreements, representations, warranties and acknowledgments

herein contained shall be deemed to be made by and be binding upon each such person and such person’s heirs, executors, administrators

and successors.

3.09 Integration.

This Agreement, together with the remainder of the Subscription Documents of which this Agreement forms a part, constitutes the entire

agreement among the parties pertaining to the subject matter hereof and supersedes and replaces all prior and contemporaneous agreements

and understandings, whether written or oral, pertaining thereto. No covenant, representation or condition not expressed in this Agreement

shall affect or be deemed to interpret, change or restrict the express provisions hereof.

3.10 Amendment.

This Agreement may be modified or amended only with the written approval of all parties.

3.11 Creditors.

None of the provisions of this Agreement shall be for the benefit of or enforceable by creditors of any party.

3.12 Waiver.

No failure by any party to insist upon the strict performance of any covenant, agreement, term or condition of this Agreement or to exercise

any right or remedy available upon a breach thereof shall constitute a waiver of any such breach or of such or any other covenant, agreement,

term or condition.

3.13 Rights

and Remedies. The rights and remedies of each of the parties hereunder shall be mutually exclusive, and the implementation of one

or more of the provisions of this Agreement shall not preclude the implementation of any other provision.

3.14 Counterparts.

This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of this Agreement and

all of which, when taken together, will be deemed to constitute one and the same agreement. In the event that any signature is delivered

by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding

obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile

or “.pdf” signature page were an original thereof.

[Remainder

of the Page Intentionally Blank]

IN

WITNESS WHEREOF, the undersigned has executed this Agreement on this 31_ day of Oct ,

2023.

| Signature of Subscriber: |

|

|

| |

|

|

|

| By: |

|

|

Print

Name of Subscriber |

| Name:

|

|

|

|

| Title: |

|

|

|

| |

|

|

| _ Social

Security Number(s) or EIN |

|

|

| |

|

|

| Mailing

Address of Subscriber(s) |

|

Residence

of Subscriber(s) |

| |

|

|

| _

Street |

|

Street |

| |

|

|

| City

State Zip Code |

|

City

State Zip Code |

If

Joint Ownership, check one:

| ☐ |

Joint

Tenants with Right of Survivorship |

| ☐ |

Tenants-in-Common |

| ☐ |

Tenants

by the Entirety |

| ☐ |

Community

Property |

| ☐ |

Other

(specify): __________________ |

| |

$

1,000,000 |

| |

Aggregate

Subscription Amount |

| |

|

| |

Method

of Payment: ☐ Wire Transfer ☒ Check |

| FOREGOING SUBSCRIPTION ACCEPTED: |

|

| |

|

|

| BIOTRICITY INC. |

|

| |

|

|

| By: |

|

|

| Name:

|

Waqaas

Alsiddiq |

|

| Title:

|

CEO |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

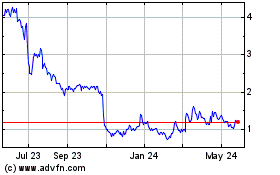

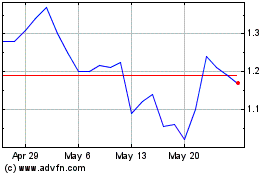

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Feb 2024 to Feb 2025