0001386570FALSE00013865702024-09-192024-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2024

CHROMADEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37752 | | 26-2940963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

10900 Wilshire Blvd. Suite 600, Los Angeles, California 90024

(Address of principal executive offices, including zip code)

(310) 388-6706

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | CDXC | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 19, 2024, the Board of Directors (the “Board”) of ChromaDex Corporation (the “Company” or “ChromaDex”) appointed Ozan Pamir as the Company’s Chief Financial Officer and Principal Accounting Officer, effective as of October 21, 2024 (the “Effective Date”). Mr. Pamir will replace James Lee, who is currently serving as the Company’s Interim Chief Financial Officer and Interim Principal Accounting Officer. Following the Effective Date, Mr. Lee will continue in his role as Controller of the Company.

Mr. Pamir, age 33, previously served as Chief Financial Officer of 180 Life Sciences Corp. since October 2018 and prior to that worked at Ventum Financial Corp. (f/k/a/ Echelon Wealth Partners Inc.) since June 2014. Mr. Pamir received his B.A in Economics from McGill University.

In connection with his appointment as Chief Financial Officer, ChromaDex, Inc. a subsidiary of the Company, entered into an offer letter with Mr. Pamir (the “Offer Letter”), which provides for the following compensation for Mr. Pamir, contingent upon and, unless otherwise noted below, effective upon his appointment as Chief Financial Officer: (i) an annual base salary of $400,000, (ii) a discretionary target annual bonus opportunity of 50% of Mr. Pamir’s annual base salary, based on the achievement of certain performance goals to be determined by the Board, which will be pro-rated for calendar year 2024 based on Mr. Pamir’s period of employment with the Company during the year, and (iii) eligibility to participate in Company benefit plans on the same basis as other senior executive officers of the Company generally. In addition, effective October 21, 2024 (the “Grant Date”), the Compensation Committee of the Board granted Mr. Pamir an option to purchase shares of the Company’s common stock (the “Option”) under the Company’s 2017 Amended and Restated Equity Incentive Plan, having an initial grant date value of $360,000 and with an exercise price equal to the closing price of the Company’s common stock on the Grant Date. One-third of the shares subject to the Option will vest on the one-year anniversary of the Grant Date, and the remaining shares subject to the Option will vest in 24 substantially equal monthly installments thereafter, subject to Mr. Pamir’s continuous employment through the applicable vesting date.

In connection with Mr. Pamir’s termination of employment without “cause” (as defined in the Offer Letter), the Offer Letter provides that Mr. Pamir will be entitled to nine months’ base salary continuation.

Mr. Pamir is party to the Company’s standard indemnification agreement for directors and executive officers, the form of which was previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 16, 2016. There are no arrangements or understandings between Mr. Pamir and any other persons pursuant to which he was selected as the Company’s Chief Financial Officer and Principal Accounting Officer. There are also no family relationships between Mr. Pamir and any of the Company’s directors or executive officers and other than as described herein he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The foregoing summary of the Offer Letter does not purport to be complete and is qualified in its entirety by reference to the complete Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

On September 20, 2024, the Company issued a press release announcing the hiring of Mr. Pamir. A copy of the press release is attached as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CHROMADEX CORPORATION |

| | |

| Dated: September 20, 2024 | By: | /s/ Robert Fried |

| | Name: Robert Fried |

| | Chief Executive Officer |

| | |

10900 Wilshire Blvd, Suite 600 | Westwood, CA 90024 USA | T: +1 310-388-6706 | www.chromadex.com September 10, 2024 Ozan Pamir ozanpamir@outlook.com CONFIDENTIAL RE: Offer of Employment as Chief Financial Officer for ChromaDex, Inc. Dear Ozan Pamir, We are pleased to extend you an offer of full-time employment for the position of Chief Financial Officer. ChromaDex, Inc. (“ChromaDex”), a subsidiary of ChromaDex, Corp., whose corporate headquarters is located at 10900 Wilshire Blvd., Suite 600, Los Angeles, CA 90024 and can be reached at (310) 388-6706. As Chief Financial Officer, you will be classified exempt under the federal Fair Labor Standards Act and applicable state and local law and will perform the duties and responsibilities assigned to you as it relates to your role. As an exempt employee, you are not entitled to overtime and your salary is intended to pay you for all hours you work. This position will report to the Chief Executive Officer of ChromaDex, Robert Fried. If you accept this offer, your employment will commence by or on October 21, 2024. Your salary will be $400,000 per year and paid biweekly every other Friday. Provided you accept this offer, you will be awarded a discretionary, pro rata bonus for work performed during calendar year 2024 , equivalent to 50% of the base salary paid out during calendar year 2024. The bonus shall be paid in accordance with ChromaDex’s customary payment schedule in 2025. Commencing in 2025, you will be eligible to receive an annual, discretionary bonus equivalent to 50% of your base salary. The bonus shall be paid in accordance with ChromaDex’s customary payment schedule In addition, upon the prior, written approval of ChromaDex’s Board of Directors or Compensation or Audit Committee, you will be awarded a one-time initial grant of an option to purchase shares of ChromaDex Corp. common stock, at an exercise price reflecting the market price of ChromaDex Corp. common stock on the date of the grant, with one-third of the shares vesting on the one-year anniversary and the remaining shares vesting in a series of 24 equal monthly installments thereafter. The value of the initial grant will be 1.5 x 60% of your annual salary which you will be eligible to receive under ChromaDex’s 2017 Equity Incentive Plan. EXHIBIT 10.1

10900 Wilshire Blvd, Suite 600 | Westwood, CA 90024 USA | T: +1 310-388-6706 | www.chromadex.com In addition, provided you accept this offer, you will be awarded a severance in the event your employment is terminated by ChromaDex without Cause. You will not be eligible to receive a severance if you voluntarily resign your employment. For the purposes of this offer, “Cause” shall mean (i) your conviction of or plea of guilty or nolo contendere to any felony; (ii) your willful and continued failure or refusal to follow lawful and reasonable instructions of ChromaDex or its Board of Directors; (iii) your willful and continued failure or refusal to follow any lawful, reasonable, material and internally published policies and regulations of ChromaDex; (iv) your willful and continued failure or refusal to faithfully and diligently perform the assigned duties of your employment with ChromaDex (other than on account of illness or excused absence); (v) unethical or fraudulent conduct by you that materially discredits ChromaDex or is materially detrimental to the reputation, character and standing of ChromaDex; or (vi) your material breach of this offer or any duty of confidentiality owed to ChromaDex. The severance shall be a continuation of your base salary for a period of 9 months, calculated at the time of your separation from ChromaDex. ChromaDex offers flexible time off and other benefits to eligible employees as outlined in the Employee Handbook. If you accept this offer, your employment will be “at-will.” This means that either you or the company can end the employment relationship at any time, for any reason, with or without cause or notice. Please understand that the offer contained in this letter is not a contract of employment and is not an agreement or contract of employment for a fixed or specified term. Due to the nature of this position, this offer is contingent upon satisfactory completion of a full background check. This offer is also contingent upon providing verification of your legal authority to work in the United States, as demonstrated by your completion of the Form I-9 upon hire and your submission of acceptable documentation (as noted on the Form I-9) verifying your identity and work authorization within three (3) days of starting employment. If you accept this offer of employment with ChromaDex, please sign this offer letter and return it back to the People Matter(s) Team at HR@chromadex.com as soon as possible. For any questions pertaining to this offer of employment, please contact Richard Llanes, HRIS Manager, People Matter(s) at Richard.llanes@chromadex.com or David Kroes, SVP, People Matter(s) at David.kroes@chromadex.com. Sincerely, /s/ David Kroes David Kroes SVP, People Matter(s) ChromaDex Inc. Signature: /s/ Ozan Pamir Original: People Matter(s) Team CC: Manager/Supervisor

ChromaDex Appoints Ozan Pamir as Chief Financial Officer

LOS ANGELES – Friday, September 20, 2024 – ChromaDex Corp. (NASDAQ:CDXC), the global authority on nicotinamide adenine dinucleotide (NAD+) research with a focus on healthy aging, announces the appointment of Ozan Pamir as Chief Financial Officer.

Mr. Pamir will oversee all ChromaDex corporate finance matters, including accounting, strategic financial planning, and engaging with public markets through investor relations. Effective October 21, 2024, he will report directly to Rob Fried, CEO of ChromaDex and Founder of Tru Niagen®.

Mr. Fried commented, "We are very pleased to welcome Ozan to the ChromaDex team. His ambitious work ethic and impressive professional background will help us to embark on this critical next phase of development.”

Prior to joining ChromaDex, Ozan Pamir most recently served as CFO of 180 Life Sciences, a NASDAQ-traded biotechnology company focused on the treatment of inflammatory diseases. He played a key role in completing the company’s NASDAQ listing and managed the majority of funding rounds. In addition to 180 Life Sciences, Mr. Pamir worked with two early-stage biotech companies as CFO and board member. Previously, Mr. Pamir was VP of Investment Banking at a leading independent investment bank, where he co-founded the Origination department and specialized in helping small and mid-cap life sciences companies define their corporate strategy and executive financing and advisory mandates. Mr. Pamir holds an Economics and Finance degree from McGill University and is a CFA Charterholder.

Mr. Pamir expressed his enthusiasm for joining ChromaDex, stating, “I am excited to be part of ChromaDex during this pivotal phase of its growth. My focus will be on enhancing the company’s financial strategies and ensuring sustainable value creation for our shareholders, while further improving ChromaDex’s already impressive fiscal discipline.”

For additional information on ChromaDex, visit www.chromadex.com.

Forward-Looking Statements:

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, including statements related to the company's financial position and potential future growth. Statements that are not a description of historical facts constitute forward-looking statements and may often, but not always, be identified by the use of such words as "expects," "anticipates," "intends," "estimates," "plans," "potential," "possible," "probable," "believes," "seeks," "may," "will," "should," "could" or the negative of such terms or other similar expressions, and include the statements regarding Niagen IV being available starting in August and nationwide thereafter; Niagen IV’s potential to reach the global intravenous hydration therapy and spa markets; the potential health benefits of Niagen IV; and the potential for Niagen IV to materially impact the overall NAD+ industry. These forward-looking statements are based on the Company’s current expectations and are subject to risks and uncertainties that may cause actual results to differ materially, including unanticipated developments in and risks related to the Company’s ability to secure adequate pharmaceutical grade quantities of Niagen IV in a timely manner; the Company’s ability to obtain appropriate contracts and arrangements with U.S. FDA-registered 503B outsourcing facilities required to distribute Niagen IV to IV clinics; the Company’s ability to remain on the U.S. FDA Bulk Drug Substances Nominated for Use in Compounding Under Section 503B of the Federal Food, Drug, and Cosmetic Act Category 1 list; the Company’s ability to maintain and enforce the Company’s existing intellectual property and obtain new patents related to Niagen IV; the Company’s ability to maintain sales, marketing and distribution capabilities; changing consumer perceptions of the Company’s products; the Company’s reliance on a single or limited number of third-party suppliers; and the risks and uncertainties associated with the Company’s business and financial condition. More detailed information about ChromaDex and the risk factors that may affect the realization of forward-looking statements is set forth in ChromaDex's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, ChromaDex's Quarterly Reports on Form 10-Q and other filings submitted by ChromaDex to the SEC, copies of which may be obtained from the SEC's website at www.sec.gov . Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and actual results may differ materially from those suggested by these forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement and ChromaDex undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof.

About ChromaDex:

ChromaDex Corp. (NASDAQ:CDXC) is the global authority on nicotinamide adenine dinucleotide (NAD+), with a focus on the science of healthy aging. The ChromaDex team, composed of world-renowned scientists, works with independent investigators from esteemed universities and research institutions around the globe to uncover the full potential of NAD+. A vital coenzyme found in every cell of the human body, NAD+ declines with age and exposure to other everyday stressors. NAD+ depletion is a contributor to age-related changes in health and vitality.

Setting the benchmark as the gold standard in scientific rigor, safety, quality, and transparency, ChromaDex is the innovator behind its clinically proven flagship ingredient, Niagen® (patented nicotinamide riboside, or NR), the most efficient and superior-quality NAD+ booster available.

Niagen is the active ingredient in ChromaDex’s consumer products, sold as the brand Tru Niagen®, the number one healthy-aging NAD+ supplement in the United States†. Clinically proven to increase NAD+ levels, Tru Niagen is helping people around the world transform the way they age (available at www.truniagen.com).

ChromaDex’s robust patent portfolio protects NR and other NAD+ precursors. ChromaDex maintains a website at www.chromadex.com, where copies of press releases, news, and financial information are regularly published.

†Based on the top-selling dietary supplement brands by revenue per the largest U.S. e-commerce marketplace (as of 3/1/2023-2/29/2024).

ChromaDex Media Contact:

Kendall Knysch, Senior Director of Media Relations & Partnerships

310-388-6706 ext. 689

kendall.knysch@chromadex.com

ChromaDex Investor Relations Contact:

Ben Shamsian

Lytham Partners

646-829-9701

shamsian@lythampartners.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

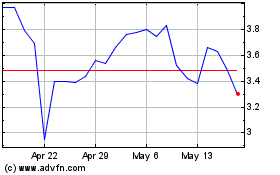

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Oct 2024 to Nov 2024

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Nov 2023 to Nov 2024