Form 424B3 - Prospectus [Rule 424(b)(3)]

12 July 2024 - 6:05AM

Edgar (US Regulatory)

424B30001396277false

0001396277

2024-07-11

2024-07-11

Filed pursuant to Rule 424(b)(3)

File No. 333-257147

Calamos Global Dynamic Income Fund (the “Fund”)

Supplement dated July 11, 2024 to the Fund’s Prospectus and Statement of Additional Information each dated August 12, 2021, and as supplemented from time to time

Effective immediately, the following paragraph is added under the “Investment Policies” section beginning on page 3 of the Prospectus below the paragraph titled “Credit Default Swaps” on page 6:

Loans. The Fund may invest in loans, including senior secured loans, unsecured and/or subordinated loans, loan participations and unfunded contracts. The corporate loans in which the Fund may invest primarily consist of direct obligations of a borrower and may include debtor in possession financings pursuant to Chapter 11 of the U.S. Bankruptcy Code, obligations of a borrower issued in connection with a restructuring pursuant to Chapter 11 of the U.S. Bankruptcy Code, leveraged buy-out loans, leveraged recapitalization loans, receivables purchase facilities, and privately placed notes. The Fund may invest in a corporate loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a corporate or government borrower. The participations typically will result in the Fund having a contractual relationship only with the lender not the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may be unsecured. Such loans may be in default at the time of purchase. Loans that are fully secured offer the Fund more protection than an unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a risk of insolvency of the lending bank or other financial intermediary. The markets in such loans are not regulated by federal securities laws or the Commission. Unfunded contracts are commitments by lenders (such as the Fund) to loan an amount in the future or that is due to be contractually funded in the future.

Effective immediately, in the section titled “INVESTMENT OBJECTIVE AND POLICIES” the first paragraph under the heading “Loans” on page S-10 of the Statement of Additional Information will be deleted in its entirety and replaced with the following:

The Fund may invest in loan participations and other direct claims against a borrower. The corporate loans in which the Fund may invest primarily consist of direct obligations of a borrower and may include debtor in possession financings pursuant to Chapter 11 of the U.S. Bankruptcy Code, obligations of a borrower issued in connection with a restructuring pursuant to Chapter 11 of the U.S. Bankruptcy Code, leveraged buy-out loans, leveraged recapitalization loans, receivables purchase facilities, and privately placed notes. The Fund may invest in a corporate loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a corporate or government borrower. The participations typically will result in the Fund having a contractual relationship only with the lender not the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may be unsecured. Such loans may be in default at the time of purchase. Loans that are fully secured offer the Fund more protection than an unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a risk of insolvency of the lending bank or other financial intermediary. The markets in such loans are not regulated by federal securities laws or the Securities and Exchange Commission (“SEC” or the “Commission”).

v3.24.2

N-2

|

Jul. 11, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001396277

|

| Amendment Flag |

false

|

| Document Type |

424B3

|

| Entity Registrant Name |

Calamos Global Dynamic Income Fund

|

| General Description of Registrant [Abstract] |

|

| Investment Objectives and Practices [Text Block] |

Effective immediately, the following paragraph is added under the “Investment Policies” section beginning on page 3 of the Prospectus below the paragraph titled “Credit Default Swaps” on page 6:

Loans. The Fund may invest in loans, including senior secured loans, unsecured and/or subordinated loans, loan participations and unfunded contracts. The corporate loans in which the Fund may invest primarily consist of direct obligations of a borrower and may include debtor in possession financings pursuant to Chapter 11 of the U.S. Bankruptcy Code, obligations of a borrower issued in connection with a restructuring pursuant to Chapter 11 of the U.S. Bankruptcy Code, leveraged buy-out loans, leveraged recapitalization loans, receivables purchase facilities, and privately placed notes. The Fund may invest in a corporate loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a corporate or government borrower. The participations typically will result in the Fund having a contractual relationship only with the lender not the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may be unsecured. Such loans may be in default at the time of purchase. Loans that are fully secured offer the Fund more protection than an unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a risk of insolvency of the lending bank or other financial intermediary. The markets in such loans are not regulated by federal securities laws or the Commission. Unfunded contracts are commitments by lenders (such as the Fund) to loan an amount in the future or that is due to be contractually funded in the future.

Effective immediately, in the section titled “INVESTMENT OBJECTIVE AND POLICIES” the first paragraph under the heading “Loans” on page S-10 of the Statement of Additional Information will be deleted in its entirety and replaced with the following:

The Fund may invest in loan participations and other direct claims against a borrower. The corporate loans in which the Fund may invest primarily consist of direct obligations of a borrower and may include debtor in possession financings pursuant to Chapter 11 of the U.S. Bankruptcy Code, obligations of a borrower issued in connection with a restructuring pursuant to Chapter 11 of the U.S. Bankruptcy Code, leveraged buy-out loans, leveraged recapitalization loans, receivables purchase facilities, and privately placed notes. The Fund may invest in a corporate loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a corporate or government borrower. The participations typically will result in the Fund having a contractual relationship only with the lender not the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may be unsecured. Such loans may be in default at the time of purchase. Loans that are fully secured offer the Fund more protection than an unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a risk of insolvency of the lending bank or other financial intermediary. The markets in such loans are not regulated by federal securities laws or the Securities and Exchange Commission (“SEC” or the “Commission”).

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 8

| Name: |

cef_GeneralDescriptionOfRegistrantAbstract |

| Namespace Prefix: |

cef_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 8

-Subsection 2

-Paragraph b, d

| Name: |

cef_InvestmentObjectivesAndPracticesTextBlock |

| Namespace Prefix: |

cef_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

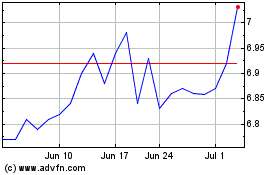

Calamos Global Dynamic I... (NASDAQ:CHW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Calamos Global Dynamic I... (NASDAQ:CHW)

Historical Stock Chart

From Nov 2023 to Nov 2024