UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14f-1

INFORMATION

STATEMENT PURSUANT TO SECTION 14(f) OF

THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE

14f-1 THEREUNDER

CISO

Global, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-41227 |

|

83-4210278 |

| (State

or other jurisdiction |

|

(Commission

|

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

6900

E. Camelback Road, Suite 900

Scottsdale,

Arizona 85251

(Address

of principal executive offices) (Zip Code)

(480)

389-3444

(Registrant’s

telephone number, including area code)

Approximate

Date of Mailing: December 16, 2024

CISO

GLOBAL, INC.

INFORMATION

STATEMENT PURSUANT TO SECTION 14(f)

OF

THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 14f-1 THEREUNDER

NOTICE

OF CHANGE IN THE MAJORITY OF THE BOARD OF DIRECTORS

December

16, 2024

THIS

INFORMATION STATEMENT IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS OF

CISO GLOBAL, INC.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUIRED TO TAKE ANY ACTION.

Schedule

14f-1

You

are urged to read this Information Statement carefully and in its entirety. However, you are not required to take any action in connection

with this Information Statement. References throughout this Information Statement to “Company,” “we,” “us,”

and “our” refer to CISO Global, Inc.

INTRODUCTION

This

Information Statement is being mailed on or about December 16, 2024, to the holders of record at the close of business on December 16,

2024 (the “Record Date”) of our common stock, par value $0.00001 (the “Common Stock”). We are required to provide

you with this Information Statement by Section 14(f) of the Securities Exchange Act of 1934 (the “Exchange Act”), and Exchange

Act Rule 14f-1, in connection with an anticipated change in majority control of Company’s board of directors (the “Board”)

other than at a meeting of shareholders. Exchange Act Section 14(f) and Rule 14f-1 require that we mail the information included in this

Information Statement to our shareholders of record at least ten days before the date the proposed change in a majority of our directors

occurs. Accordingly, the change in a majority of our directors pursuant to the transaction described below will not occur until at least

ten days after we mail this Information Statement.

As

to be disclosed by the Company on Form 8-K to be filed with the U.S. Securities Exchange Commission (the “SEC”) on December

16, 2024, the Company entered into a Securities Purchase Agreement (the “Agreement”) with several purchasers (the “Purchasers”).

Pursuant to the Agreement, the Purchasers have agreed to purchase an aggregate of up to $8,125,000 of securities from the Company, including

certain convertible notes and certain common stock purchase warrants. Also agreed upon is the resignation of current members of the Board

and the addition of new members to the Board. Those changes are detailed herein.

The

change in the majority of the Board is contingent upon the regulatory filing and mailing of this Information Statement. The entry into

the Agreement did not effectuate a change in control of the Company.

THIS

INFORMATION STATEMENT IS REQUIRED BY SECTION 14(F) OF THE SECURITIES EXCHANGE ACT AND RULE 14F-1 PROMULGATED THEREUNDER IN CONNECTION

WITH THE APPOINTMENT OF THREE DIRECTOR DESIGNEES TO THE BOARD. NO ACTION IS REQUIRED BY OUR SHAREHOLDERS IN CONNECTION WITH THE RESIGNATION

AND APPOINTMENT OF ANY DIRECTOR.

CHANGE

IN MAJORITY OF BOARD OF DIRECTORS

Effective

as of the closing of the transaction contemplated by the Agreement and the expiration of all applicable waiting periods under Section

14(f) of the Exchange Act, each of Debra L. Smith, Ret. General Robert C. Oaks, Reid S. Holbrook, Brett Chugg, and Ernest M. (Kiki) VanDeWeghe,

III will resign as a director of the Company subject to the requirements of Section 14(f) of the Exchange Act. Further, David G. Jemmett

will be appointed as Chairman of the Board of the Company.

In

connection with the Agreement, three individuals, Phillip Balatsos, Mohsen (Michael) Khorassani, and Andrew Hancox, will replace Debra

L. Smith, Ret. General Robert C. Oaks, Reid S. Holbrook, Brett Chugg, and Ernest M. (Kiki) VanDeWeghe, III, as directors of the Company.

This change in the Board is expected to occur upon the expiration of all applicable waiting periods under Section 14(f) of the Exchange

Act and Rule 14f-1 thereunder and the full payment of the purchase price.

None

of these appointees, to our knowledge, has been the subject of any bankruptcy petition filed by or against any business of which an appointee

was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time, been convicted

in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses) five

years prior to that time, been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court

of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type

of business, securities or banking activities or been found by a court of competent jurisdiction (in a civil action), the SEC or the

Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been

reversed, suspended or vacated.

No

action is required by our shareholders in connection with this Information Statement. However, Section 14(f) of the Exchange Act and

Rule 14f-1 promulgated thereunder, require the mailing to our shareholders of the information set forth in this Information Statement

at least ten (10) days prior to the date a change in a majority of our directors occurs (otherwise than at a meeting of our shareholders).

VOTING

SECURITIES

Our

authorized capital stock consists of 300,000,000 shares of Common Stock, with $0.00001 par value, and 50,000,000 shares of preferred

stock, par value of $0.00001 per share. As of the Record Date, there were 11,821,866 shares of Common Stock issued and outstanding. Holders

of our Common Stock are entitled to one vote for each share on all matters voted on by our shareholders. As of the Record Date, there

are no shares of our preferred stock designated as issued and outstanding.

There

is no cumulative voting in the election of directors, and our directors are elected by a majority of the votes cast. Holders of our stock

representing one-third of the voting power of our capital stock issued and outstanding and entitled to vote, represented in person or

by proxy, are necessary to constitute a quorum at any meeting of our shareholders. A vote by the holders of a majority of the voting

power of our capital stock issued and outstanding and entitled to vote is required to effectuate certain fundamental corporate changes.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of the Record Date, the number of shares of Common Stock owned of record and beneficially by executive

officers, directors and persons who hold 5.0% or more of the outstanding Common Stock of the Company. Also included are the shares held

by all executive officers and directors as a group. Unless otherwise indicated, the address of each beneficial owner listed below is:

c/o CISO Global, Inc., 6900 E. Camelback Road, Suite 900, Scottsdale, AZ 85251. Each principal shareholder has sole investment power

and sole voting power over the shares.

| Name

and Address of Beneficial Owner: | |

Amount

of Beneficial Ownership | | |

Percentage

of Beneficial Ownership | |

| Jemmett

Enterprises, LLC | |

| 4,429,000 | | |

| 37.46 | % |

| Stephen

H. Scott, Jr. | |

| 1,203,335 | | |

| 10.18 | % |

| | |

| | | |

| | |

| David

G. Jemmett | |

| 4,629,001 | | |

| 39.16 | % |

| Debra

L. Smith | |

| 64,964 | | |

| * | |

| Kyle

J. Young | |

| 64,964 | | |

| * | |

| Ret.

General Robert C. Oaks | |

| 26,666 | | |

| * | |

| Reid

S. Holbrook | |

| 26,666 | | |

| * | |

| Andrew

K. McCain | |

| 571,884 | | |

| 4.70 | % |

| Ernst

M. (KiKi) VanDeWeghe, III | |

| 13,333 | | |

| * | |

| Brett

Chugg | |

| —— | | |

| —— | |

| | |

| | | |

| | |

| Directors

& Executive Officers as a Group (8 persons) | |

| 5,397,478 | | |

| 43.65 | % |

*

Less than 1% of the outstanding shares of common stock.

DIRECTORS

AND EXECUTIVE OFFICERS

The

Board has appointed Phillip Balatsos, Mohsen (Michael) Khorassani, and Andrew Hancox as new members of the Board to take effect upon

the later of (i) the expiration of all applicable waiting periods under Section 14(f) of the Exchange Act and Rule 14f-1 thereunder,

and (ii) the payment of the full purchase price in the amount of Eight Million One Hundred Twenty-Five Thousand USD ($8,125,000).

Under

the terms of the Agreement, upon the Company meeting its information obligations under the Exchange Act, including the filing and mailing

of this Information Statement, the Board will consist of five directors, until their successors shall have been duly elected or appointed

and qualified or until their earlier death, resignation or removal in accordance with the Company’s Amended and Restated Certificate

of Incorporation, as the case may be.

Our

directors, executive officers and key employees, and their ages as of the date of this Information Statement, are listed below.

| Name |

|

Age |

|

Position(s)

with the Company

|

| David

G. Jemmett |

|

57 |

|

Chief

Executive Officer and Director |

| Debra

L. Smith |

|

54 |

|

Chief

Financial Officer and Outgoing Director |

| Kyle

J. Young |

|

41 |

|

Interim

Chief Operating Officer |

| Ret.

General Robert C. Oaks |

|

88 |

|

Outgoing

Director |

| Reid

S. Holbrook |

|

77 |

|

Outgoing

Director |

| Andrew

K. McCain |

|

62 |

|

Director |

| Ernst

M. (KiKi) VanDeWeghe, III |

|

66 |

|

Outgoing

Director |

| Brett

Chugg |

|

56 |

|

Outgoing

Director |

| Phillip

Balatsos |

|

47 |

|

Incoming

Director |

| Mohsen

(Michael) Khorassani |

|

58 |

|

Incoming

Director |

| Andrew

Hancox |

|

53 |

|

Incoming

Director |

The

experience of our current directors and executive officers is as follows:

David

G. Jemmett has served as our Chief Executive Officer and a director of the Company since our formation in March 2019. He also

founded GenResults in June 2015, which we subsequently acquired in April 2019. From January 2014 to December 2014, Mr. Jemmett served

as Chief Executive Officer of NantCloud, LLC, a provider of secure cloud-hosted applications for healthcare customers, and Chief Technology

Officer of NantWorks, LLC, a parent company for the “Nant” family of companies. From 2005 to 2013, Mr. Jemmett served as

founder and Chief Executive Officer of ClearDATA Networks Corporation, a HIPAA compliant hosting company specializing in healthcare.

He has been a guest speaker on CBS, CNN, MSNBC and CSPAN, and has spoken before the U.S. Senate Subcommittee on Telecommunications and

Internet Security regarding internet technologies in 1998.

Debra

L. Smith has served as our Chief Financial Officer since June 2021. Ms. Smith served as our Executive Vice President of Finance

and Accounting from February 2021 to June 2021. Prior to joining the Company, Ms. Smith served as Executive Vice President of Finance

at Arrivia Inc. from January 2020 to February 2021 and Controller and subsequently, Chief Accounting Officer and Chief Financial Officer

at BeyondTrust from October 2016 to January 2020. Ms. Smith received a Bachelor of Science degree in Accounting, Summa Cum Laude, from

DeVry University and a Master’s degree in Counseling with Honors from Argosy University.

Kyle

J. Young has served as our Interim Chief Operating Officer since March 2023. Previously Mr. Young served as our Executive Vice

President, Operations from January 2022 to March 2023 and as our Vice President, Operations from February 2021 to January 2022. Mr. Young

served in various roles at BeyondTrust Software, a U.S.-based cybersecurity vendor, from December 2007 to February 2022, most recently

serving as its Vice President, Business and Sales Operations. Mr. Young holds a bachelor’s degree in Speech Communications &

Rhetoric from the University of Illinois Urbana-Champaign.

Ret.

General Robert C. Oaks has served as a director of the Company since May 2019. He is a retired U.S. Air Force general who served

as Commander in Chief of the U.S. Air Forces in Europe, and Commander, Allied Air Forces Central Europe, with headquarters at Ramstein

Air Base, Germany. He retired as a four-star General and Commander and Chief of U.S. Air Forces Europe and NATO Central Europe in 1994

after serving 34 years. Following his retirement, Ret. General Oaks was employed at U.S. Airways as Senior Vice President from 1994 to

2000. In 2000, Oaks resigned from this position when he was called to serve the LDS Church, where he served until 2009, when he was released

as a general authority. He earned a Bachelor of Science degree in Military Science from the U.S. Air Force Academy and a Master’s

degree in Business Administration from Ohio State University prior to graduating from the Naval War College. Ret. General Oaks currently

serves as the official Liaison for the Church of Jesus Christ to the U.S. Armed Forces.

Reid

S. Holbrook has served as a director of the Company since May 2019. Since 2013, Mr. Holbrook has been a Principal at Mountain

Summit Advisors, a specialty firm focused on mergers and acquisitions of primarily healthcare technology and services companies, and

a strategic advisor to Health Catalyst, a company focused on data analytics and warehousing primarily in healthcare. He served as the

Executive Vice President of Medicity, a population health management company with solutions for health information exchange, business

intelligence, and provider and patient engagement, from 2002 to 2013. In 1998, Mr. Holbrook founded KLAS where he remains as a board

member. He has served in executive positions at IHC, GTE, Sunquest Information Systems, Integrated Medical Networks and is a founder

of Park City Solutions. Mr. Holbrook is a HIMSS Fellow. He holds a Master of Science from Utah State University and a Bachelor of Science

from Brigham Young University.

Andrew

K. McCain has served as a director of the Company since May 2019. He has served as the President and Chief Executive Officer

for Hensley Beverage Company since January 2024, and previously served as President and Chief Operating Officer from 2014 through January

2024. He is a board member of the Arizona Super Bowl Host Committee, the Arizona 2016 College Football Championship Local Organizing

Committee, Chairman of Hensley Employee Foundation, and a Patrons Committee member of United Methodist Outreach Ministries’ New

Day Centers. He is past Chairman of the Board of the Fiesta Bowl, past Chairman of the Anheuser-Busch National Wholesaler Advisory Panel,

and past Chairman of the Greater Phoenix Chamber of Commerce. Mr. McCain received his Bachelor of Arts in Mathematics in 1984 and an

MBA in 1986 from Vanderbilt University.

Ernst

M. (Kiki) VanDeWeghe, III has served as a director of the Company since May 2021. He has served as the Executive Vice President,

Basketball Operations of the National Basketball Association since 2013. Prior to that, Mr. VanDeWeghe was the general manager of the

Denver Nuggets and the New Jersey Nets and a head coach of the New Jersey Nets. Prior to that he played professionally for the Los Angeles

Clippers, New York Knicks, Portland Trail Blazers, and the Denver Nuggets. Mr. VanDeWeghe attended UCLA where he received a degree in

Economics.

Brett

Chugg has served as a director of the Company since February 2024. He has most recently served as Senior Managing Director at

Koch Disruptive Technologies, a venture and growth equity investment group at Koch Industries and in other roles with Koch Industries

since 1998. Mr. Chugg has also served as a Director on several high-growth company boards. Mr. Chugg attended Weber State University

where he received a degree in English and received his MBA in 1998 from Bringham Young University.

The

experience of our 14F Directors is as follows:

Phillip

Balatsos is a seasoned Senior FX sales and trading executive with over two decades of experience in the financial sector. As

Vice President at XP Investments US LLC, he has significantly expanded the firm’s presence in North America and Europe, achieving

a 300% increase in FX revenue. Previously, Phillip was Director at Barclays Capital, where he managed high-value institutional relationships

and led joint ventures that boosted annual revenues by millions. He began his career at Credit Suisse, rapidly advancing to Vice President

supporting hedge fund sales. His entrepreneurial ventures include owning Thomas-Mackey Veterinarian Service, SeaPath Advisory LLC, and

TwoMacks Properties LLC, which demonstrate his diverse expertise. He also served on the Board of Directors for Sadot Group Inc., contributing

to the company’s strategic growth. Phillip holds a Bachelor of Science in Business Administration from Skidmore College and has

received leadership recognition in various roles.

Mohsen

(Michael) Khorassani, serves as founder and CEO of Orion 4, a corporate advisory firm, since March of 2019 where he has served

as capital markets, business development and marketing advisor for many public and private companies. Before founding Orion, he spent

nineteen years at Oppenheimer Private Client Division as Director of Investments focused on building and developing a successful wealth

management practice. He was responsible for advising both high net-worth and institutional clients. Prior to joining Oppenheimer, he

served as a Vice President at Oscar Gruss & Son, an institutional NYSE member firm where he was responsible for helping build the

firm’s retail division. His responsibilities included recruiting advisors, managing teams, and sales and trading. Prior to Oscar

Gruss and Son, he spent four years at Gruntal and Co. as V.P of Investments. He started his financial services career at Lehman Brothers

two years earlier. Mr. Khorassani has demonstrated extensive understanding of the capital markets over his thirty years of Wall Street

experience and brings with him a wealth of knowledge and deep bench of personal relationships.

Andrew

Hancox is a seasoned operating executive and investor with a strong entrepreneurial background, specializing in strategy, operations,

and finance. As the Founder and Managing Member of Block 8 Ventures, he has successfully invested in over 25 blockchain projects and

provided strategic consulting to high-growth companies. Previously, he co-founded Katapult (NASDAQ: KPLTW) and served as COO, raising

over $250M in capital and expanding the team to 100+ members. Andrew’s experience includes a role as an analyst at Permian Investment

Partners, where he evaluated and recommended equity investments, and as the Co-Founder and CEO of Anderson Audio Visual, growing the

company to $40M in sales. His educational background includes studies in Law and Mathematics from Victoria University (New Zealand) and

a Private Equity and Investment Banking Program from the Institute of Banking and Finance (New York). Andrew is also a lead mentor at

Entrepreneurs Roundtable Accelerator and Parallel 18, an accomplished skier, marathon runner, and avid traveler, having visited 107 countries.

Originally from New Zealand, he currently splits his time between New York, NY and San Juan, PR.

Family

Relationships

No

family relationships exist between any of our current directors or executive officers.

Involvement

in Certain Legal Proceedings

There

are no material proceedings to which any director or executive officer or any associate of any such director or officer is a party adverse

to the Company or has a material interest adverse to the Company.

Director

Independence

The

Board is comprised of a majority of independent directors, as “independence,” is defined by the listing standards of The

Nasdaq Stock Market and by the SEC. The Board has concluded that each of Andrew K. McCain, Phillip Balatsos, Mohsen (Michael) Khorassani,

and Andrew Hancox are “independent”, having concluded that any relationship between such director and the Company, in its

opinion, does not interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Mr. Jemmett

is an employee director.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Exchange Act requires our officers, directors and persons who beneficially own more than ten percent of our ordinary shares

to file reports of ownership and changes in ownership with the SEC. These reporting persons are also required to furnish us with copies

of all Section 16(a) forms they file. During the year ended December 31, 2023, there were no delinquent filers.

EXECUTIVE

COMPENSATION

Executive

Officer and Director Compensation

The

following table sets forth compensation for our Chief Executive Officer and our next two most highly compensated executive officers who

were serving as executive officers or interim executive officers, for the two completed fiscal years ended December 31, 2023, and December

31, 2022:

| Name

and Principal Position | |

Year | |

Salary ($) | | |

Bonus ($) | | |

Option

Awards ($)

(1) | | |

All

Other Compensation ($)

(2) | | |

Total ($) | |

| David

G. Jemmett | |

2023 | |

| 315,105 | | |

| 62,500 | | |

| — | | |

| 14,118 | | |

| 391,723 | |

| Chief

Executive Officer | |

2022 | |

| 250,000 | | |

| 116,651 | | |

| — | | |

| 225 | | |

| 366,876 | |

| Debra

L. Smith | |

2023 | |

| 280,642 | | |

| 53,125 | | |

| — | | |

| 7,576 | | |

| 341,343 | |

| Chief

Financial Officer | |

2022 | |

| 200,000 | | |

| 60,500 | | |

| 892,200 | | |

| 225 | | |

| 1,152,925 | |

| Kyle

J. Young (3) | |

2023 | |

| 274,392 | | |

| 48,000 | | |

| — | | |

| 12,168 | | |

| 334,560 | |

| Interim Chief Operating Officer |

|

2022 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| |

(1) |

The

amounts in this column reflect the fair value on the grant date of the option awards granted to the named executive officer, calculated

in accordance with ASC Topic 718. Stock options were valued using the Black-Scholes model. The grant-date fair value does not necessarily

reflect the value of shares which may be received in the future with respect to these awards. The grant-date fair value of the stock

options in this column is a non-cash expense that reflects the fair value of the stock options on the grant date and therefore does

not affect our cash balance. The fair value of the stock options will likely vary from the actual value the holder receives because

the actual value depends on the number of options exercised and the market price of our common stock on the date of exercise. For a

discussion of the assumptions made in the valuation of the stock options, see Note 10 to our consolidated financial statements included

in our Annual Report on Form 10-K for the year ended December 31, 2023. |

| |

|

|

| |

(2) |

The

amounts in the “All Other Compensation” column consist of certain benefits provided to the officers listed, which are generally

available to our similarly situated employees, including 401(k) company matching and technology stipend. For Mr. Jemmett, the amounts

in this column consist of 401(k) company matching contributions ($13,218) and a technology stipend ($900). For Mr. Young, the amounts

in this column consist of 401(k) company matching contributions of ($11,268) and a technology stipend ($900). |

| |

|

|

| |

(3) |

Mr.

Young was appointed to serve as our Interim Chief Operating Officer on March 31, 2023. |

RELATED

PARTY TRANSACTIONS

Transactions

with Related Persons

Except

as set out below, during the year ended December 31, 2023, there were no transactions, or currently proposed transactions, in which we

were or are to be a participant and the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets

at year-end for the last two completed fiscal years, and in which any of the following persons had or will have a direct or indirect

material interest:

| ● | any

director or executive officer of the Company; |

| ● | any

person who beneficially owns, directly or indirectly, shares carrying more than 5% of the

voting rights attached to our outstanding shares of common stock; |

| ● | any

promoters and control persons; and/or |

| ● | any

member of the immediate family (including spouse, parents, children, siblings and in laws)

of any of the foregoing persons. |

Independent

Consulting Agreement with Stephen Scott

In

August 2020, we entered into an Independent Consulting Agreement with Stephen Scott, a then director of the Company, with respect to

advisory and consulting services relating to our strategic and business development, and sales and marketing. Mr. Scott received a consulting

fee of $11,500 per month for such services.

In

July 2023, we entered into an Independent Consulting Agreement with Mr. Scott, to provide, on a non-exclusive basis, advisory and consulting

services relating to our strategic and business development, intellectual property development, banking relationships, and strategic

M&A for a period of one year. Mr. Scott will receive a consulting fee of $15,000 per month for such services under the terms of this

agreement. During the years ended December 31, 2023 and 2022, we paid consulting fees to Mr. Scott in the amounts of $159,000 and $138,000,

respectively.

Managed

Services Agreement with Hensley & Company d/b/a Hensley Beverage Company

In

July 2021, we entered into a one-year Managed Services Agreement with Hensley & Company d/b/a/ Hensley Beverage Company, an entity

affiliated with Mr. McCain, a director of the Company, to provide secured managed services. We also may be engaged by Hensley & Company

from time to time to provide other related services outside the scope of the Managed Services Agreement. While the agreement provides

for a term through December 31, 2021, the agreement will continue until terminated by either party. For the years ended December 31,

2023 and 2022, we received $1,417,398 and $850,445, respectively from Hensley & Company for contracted services and had an outstanding

receivable balance of $152,213 and $15,737 as of December 31, 2023 and 2022, respectively.

Convertible

Note Payable with Hensley & Company d/b/a Hensley Beverage Company

In

March 2023, we issued an unsecured convertible note to Hensley & Company in the principal amount of $5,000,000 bearing an interest

rate of 10.00% per annum. The principal amount, together with accrued and unpaid interest is due on March 20, 2025. At any time prior

to or on the maturity date, Hensley & Company is permitted to convert all or any portion of the outstanding principal amount and

all accrued and unpaid interest thereon into shares of our common stock at a conversion price of $18.00 per share ($1.20 on a pre-reverse

split basis). During the year ended December 31, 2023, we recorded interest expense of $388,888 and as of December 31, 2023, we had accrued

interest of $388,888. Andrew McCain, a director of the Company, is President and Chief Executive officer of Hensley & Company.

LEGAL

PROCEEDINGS

The

Company is not aware of any legal proceedings in which any director, nominee, officer or affiliate of the Company, any owner of record

or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, nominee,

officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries.

WHERE

YOU CAN OBTAIN ADDITIONAL INFORMATION

The

Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements

and other information including annual and quarterly reports on Forms 10-K and 10-Q, respectively, with the SEC. Copies of such material

can be obtained on the SEC’s website (http://www.sec.gov) that contains the filings of issuers with the SEC through the EDGAR system.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Information Statement on Schedule 14f-1

to be signed on its behalf by the undersigned hereunto duly authorized.

| CISO Global, Inc. |

|

| |

|

|

Dated: December 16, 2024

|

|

| |

|

|

| By: |

/s/ David G.

Jemmett |

|

| Name: |

David G. Jemmett |

|

| Title: |

Chief Executive Officer and Director |

|

| Date: |

December 16, 2024 |

|

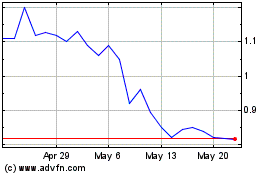

CISO Global (NASDAQ:CISO)

Historical Stock Chart

From Dec 2024 to Jan 2025

CISO Global (NASDAQ:CISO)

Historical Stock Chart

From Jan 2024 to Jan 2025