Nasdaq to Buy Options Exchange Operator ISE for $1.1 Billion

10 March 2016 - 9:40AM

Dow Jones News

Nasdaq Inc. agreed to acquire International Securities Exchange,

an operator of three electronic options exchanges, from Deutsche Bö

rse Group, for $1.1 billion.

ISE operates three electronic options exchanges: ISE, ISE Gemini

and ISE Mercury. ISE's exchanges serve as the venues for more than

15% of trading in U.S. options. The deal is expected to close in

the second half of 2016.

As part of the transaction, Nasdaq will gain an additional 20%

stake in the Options Clearing Corp., for a total of 40% ownership

in the world's largest equity derivatives clearing corporation.

"The equities options business has been core to our long-term

strategy, and we believe an essential component to the strength of

the Nasdaq franchise," said Nasdaq CEO Bob Greifeld.

The deal, which is expected to add to Nasdaq's earnings within

12 months of closing, comes amid a potential wave of deals among

exchanges. The London Stock Exchange has said it is in advanced

talks with Deutsche Bö rse about a so-called merger of equals that

would value the combined company at about $28 billion.

Intercontinental Exchange Inc. and CME Group Inc. are also

considering bids for the LSE.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

March 09, 2016 17:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

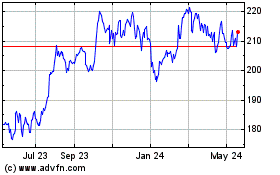

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

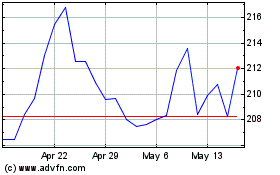

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024