Major Clearinghouses Can Avoid Liquidity Crunch in Crisis, CFTC Says

16 October 2017 - 3:30PM

Dow Jones News

By Gabriel T. Rubin

WASHINGTON -- Major clearinghouses for derivatives can withstand

substantial stress to the financial system and avoid a liquidity

crunch in a crisis, the Commodity Futures Trading Commission said

Monday in a report that marks the second time it has

"stress-tested" the entities and found they passed.

The CFTC's report came a day after National Economic Council

Director Gary Cohn said he was worried about whether clearinghouses

are being overused, adding that regulators don't have guidelines

for resolving a clearinghouse "in an orderly fashion." Mr. Cohn's

remarks Sunday at a Group of 30 banking seminar in Washington add

to calls from U.S. policy makers to keep a close eye on

clearinghouses.

The CFTC tested three of the largest U.S. clearinghouses -- CME

Group Inc.'s CME Clearing, Intercontinental Exchange Inc.'s ICE

Clear U.S. and LCH Clearnet Group Ltd.'s LCH Ltd. -- and found that

each would be able to generate sufficient liquidity to keep markets

functioning even if two of their major clearing member banks were

to default.

Clearinghouses, mostly used by banks and investment firms, are

meant to help avoid a marketwide collapse by making sure that

either party in a derivatives transaction is paid if the other side

falters. Their role has grown since the 2008 financial crisis as

regulators encouraged derivatives to be routed through them.

Clearinghouses conduct their own tests to determine how they

would function under extreme market conditions. While the CFTC

tests examined what would happen if two major clearing members

defaulted, some clearinghouses test what would happen if as many as

four member banks failed simultaneously. Given the size of clearing

member banks, such a situation would undoubtedly be in the midst of

a major financial crisis.

The supersizing of certain clearinghouses after the financial

crisis has gotten significant attention from U.S. policy makers in

recent months. The House Agriculture Committee held a July hearing

devoted to clearinghouse resolution, and Federal Reserve governor

Jerome Powell has said repeatedly in public remarks that stress

tests for clearinghouses must be more robust and reflective of the

risk they pose to financial stability.

"Central clearing will only make the financial system safer if

[clearinghouses] themselves are run safely," Mr. Powell, who is

said to be a top candidate for Fed chairman, said in a June

speech.

The Treasury Department has also taken an interest in stress

tests for clearinghouses, saying in its report on capital markets

earlier this month that regulators should build on existing tests

to make sure clearinghouses have plans for winding down in an

orderly fashion in the event of a major crisis.

Write to Gabriel T. Rubin at gabriel.rubin@wsj.com

(END) Dow Jones Newswires

October 16, 2017 00:15 ET (04:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

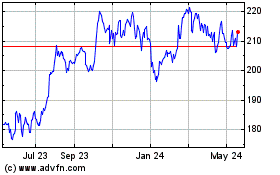

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

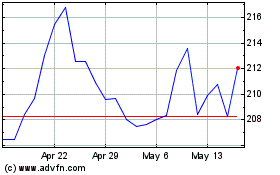

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024