CME Swoops for U.K.'s NEX in $5.4 Billion Deal -- Update

29 March 2018 - 6:07PM

Dow Jones News

By Alexander Osipovich

CME Group Inc. has agreed to buy U.K. financial-technology

company NEX Group PLC for about $5.4 billion, a deal that would put

the Chicago futures-exchange giant in a commanding position in the

vast market for U.S. government debt.

The two companies said in a statement Thursday they had agreed

on a deal that values NEX at GBP10 a share ($14.08). Pending

approvals by regulators and NEX shareholders, the deal is expected

to be completed in the second half of 2018.

Earlier this month, the companies confirmed that CME had made a

preliminary takeover approach to NEX. The news set off speculation

that other bidders could emerge for NEX, such as Intercontinental

Exchange Inc., owner of the New York Stock Exchange, or London

Stock Exchange Group PLC. It also triggered a surge in NEX's stock

price, which is up 45% since reports of the talks emerged on March

15.

NEX owns the biggest electronic platform for U.S. Treasury bonds

trading, called BrokerTec, while CME dominates the market for

interest-rate futures linked to U.S. government bond prices.

Combining the two would put CME in a powerful position, as it would

control the plumbing that underpins both Treasury futures and a

swath of the underlying "cash" market.

"We believe combining the underlying cash securities with the

trading of the listed futures would be a first in the exchange

industry and...would set a unique precedent," Rich Repetto, an

analyst at Sandler O'Neill + Partners, said in March 19 research

note about the deal.

That could bring greater efficiencies to bond trading.

Currently, Wall Street firms active in both cash Treasurys and

interest-rate futures need to post cash to back their trades in two

separate places. Bringing BrokerTec and CME's futures under the

same roof could lead to one unified clearing system for both kinds

of trades, freeing up cash that traders could use for other

purposes.

U.S. government bonds are the world's biggest debt market, with

some $14.5 trillion in Treasury securities outstanding. About $535

billion of Treasurys traded each day on average in the week ended

March 14, according to Federal Reserve data.

If completed, such a deal would likely be the biggest

acquisition for CME since 2008, when it acquired the New York

Mercantile Exchange for about $10 billion. That deal helped cement

CME's status as the world's largest exchange operator, with markets

running the gamut from wheat to gold to crude oil futures.

The firm, whose roots date back to the mid-19th century, has

been periodically criticized for exerting its dominance over the

markets to increase fees and stifle competition.

Besides BrokerTec, NEX runs major electronic markets for

foreign-exchange trading and owns technology used to process

derivatives trades. Led by Chief Executive Michael Spencer, it

formerly was known as ICAP PLC.

For years, ICAP was the largest player in interdealer brokerage,

the business of brokering deals in complex derivatives products

between banks, often over the phone. But in 2016, ICAP sold its

brokerage business to rival Tullett Prebon to focus on electronic

trading and financial technology and rebranded itself as NEX.

Mr. Spencer, who founded the forerunner of ICAP in 1986, became

one of Britain's richest men with the expansion of the derivatives

markets. A well-known entrepreneur in the City of London, he was

the former treasurer of Britain's Conservative Party.

As part of the deal, CME will choose London as its European

headquarters.

--Daniel Kruger contributed to this article.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

March 29, 2018 02:52 ET (06:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

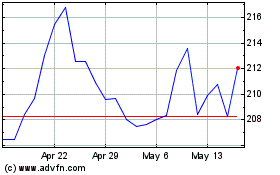

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

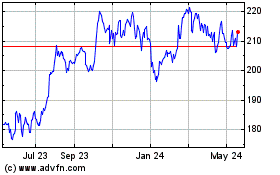

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024