NEX Group Shareholders Approve CME Group's $5.3 Billion Offer

18 May 2018 - 10:16PM

Dow Jones News

By Ian Walker

NEX Group PLC (NXG.LN) shareholders have approved CME Group

Inc.'s (CME) $5.3 billion takeover for the U.K. company at the

general meeting earlier Friday, with 99.98% of proxy votes cast in

favor of the deal.

The U.K. financial-technology company agreed to the takeover by

the Chicago futures-exchange giant on March 29. Under the deal's

terms NEX Group shareholders will get 500 pence in cash and 0.0444

new CME shares. The offer valued each NEX share at 10 pounds

($13.49), based on CME's closing share price of $158.84 on March

28.

The deal is expected to be completed in the second half of

2018.

"We are delighted that the proxy votes of our shareholders have

overwhelmingly voted in support of our transaction with the CME," a

spokesman for NEX said in an emailed statement. An official

statement will be made later Friday.

"The deal is expected to complete in the second half of this

year and we are continuing to work with the CME to obtain the

necessary regulatory and anti-trust clearances," the spokesman

said.

NEX owns the biggest electronic platform for U.S. Treasury bonds

trading, called BrokerTec, while CME dominates the market for

interest-rate futures linked to U.S. government bond prices.

Combining the two would put CME in a powerful position, as it would

control the plumbing that underpins both Treasury futures and a

swath of the underlying "cash" market.

Alexander Osipovich contributed to this article.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

May 18, 2018 08:01 ET (12:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

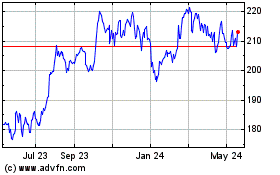

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

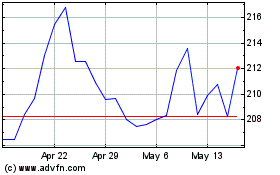

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024