CME Group Launches Ether Options

12 September 2022 - 11:21PM

Dow Jones News

By Will Feuer

Derivatives marketplace CME Group Inc. said it is launching

options contracts on futures tied to the cryptocurrency Ether.

The company said the new contracts will deliver one Ether

futures, sized at 50 Ether per contract, based on the CME CF

Ether-Dollar Reference Rate, which serves as a once-a-day reference

rate of the U.S. dollar price of ether.

"The launch of our new Ether options contracts is particularly

well-timed to provide the crypto community with another important

tool to gain access to and manage exposure to ether," CME Group

Global Head of Equity and FX Products Tim McCourt said. He said CME

Group's Ether futures have seen a 43% increase in average daily

volume from a year ago.

The move comes as developers prepare for an update to the

Ethereum blockchain that has been called the so-called merge, in

which the network is expected to shift from the current

proof-of-work model to a proof-of-stake model. The move is meant to

make the network faster and more energy efficient.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

September 12, 2022 09:06 ET (13:06 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

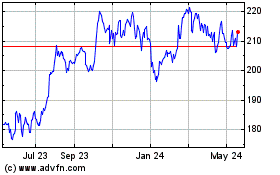

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

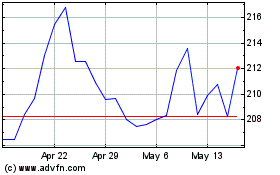

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024