CompoSecure, Inc. (Nasdaq: CMPO), a leader in metal payment cards,

security, and authentication solutions, today announced its

operating results for the second quarter ended June 30, 2024.

“I am pleased to report another record quarter

of Net Sales and Adjusted EBITDA, driven by continued growth in our

domestic business and strong international demand from the launch

of new programs,” said Jon Wilk, President and CEO of CompoSecure.

We continue to support our customer’s ability to offer highly

attractive premium card programs such as the limited edition Amex

White Gold Card and the first Wells Fargo and Expedia co-branded

metal card, as well as driving growth with innovative products

through our Echo Mirror Card and LED card.

“I am also excited to announce an expansion of

our strategic partnership with Fiserv to include the marketing and

reselling of Arculus Authenticate. Building on our already

successful metal payment card collaboration, this partnership will

enhance the ability to bring FIDO 2 secure authentication

capabilities to Fiserv’s extensive customer base of financial

institutions and fintechs.”

As just announced in a separate press release,

the David Cote Family is investing $372 million through Resolute

and Dave Cote will become the executive chairman of the board of

directors of CompoSecure upon closing of the transaction. Resolute

will become the majority shareholder of the Company and will focus

on deploying operational and M&A best practices to drive

long-term value creation for all shareholders. Importantly, the

transaction will remove the dual-share structure, delivering higher

retained annual cash flow and better alignment of all shareholders

with the elimination of the tax distributions related to the Class

B units.

Mr. Wilk continued, “I am thrilled to have David

Cote serve as Executive Chairman of the Board of Directors. David’s

career and track record is unparalleled, setting the standard for

how organizations can simultaneously drive both short and long-term

performance to realize their full potential. We believe his

experience steering global public companies, such as Honeywell and

Vertiv, will be invaluable to CompoSecure as we enter a new phase

of growth and value creation for shareholders, employees, and

customers.”

Wilk added, “Today, we have also amended our

credit facility with lower rates, an upsized revolving line of

credit, a longer term and more flexible covenants. This reflects

the confidence our lenders have in our business and provides

capacity for continued growth and to retire our exchangeable notes

maturing in December 2026.”

Financial Highlights

(Q2 2024

vs. Q2

2023)

- Net Sales: Net

Sales increased 10% to $108.6 million compared to $98.5 million.

The increase was primarily driven by continued domestic growth and

improved international demand.

- Gross Profit:

Gross Profit was $56.1 million or 52% of Net Sales, compared to

$53.9 million or 55%. The decrease in gross margin was primarily

due to product mix, as well as inflationary pressure on wages.

- Net Income/EPS:

Net Income increased 3% to $33.6 million compared to $32.7 million.

Net Income per share attributable to Class A common shareholders

was $0.44 (Basic) and $0.32 (Diluted), compared to $0.31 (Basic)

and $0.29 (Diluted) in the year-ago period.

- Adjusted Net

Income/Adjusted EPS: Adjusted Net Income (a non-GAAP

measure) increased 10% to $25.2 million compared to $22.9 million

in the year-ago period. Adjusted EPS (a non-GAAP measure), which

includes both Class A and Class B shares, was $0.31 (Basic) and

$0.27 (Diluted) compared to $0.29 (Basic) and $0.25 (Diluted) in

the year-ago period (see reconciliation of non-GAAP measures shown

in table below).

- Adjusted EBITDA:

Adjusted EBITDA (a non-GAAP measure) increased 8% to $40.0 million

compared to $36.9 million, with the increase driven by net sales

growth.

Liquidity and Capital

Structure

Balance Sheet: At June 30,

2024, CompoSecure had $35.4 million of cash and cash equivalents

and $330.9 million of total debt, which included $200.9 million of

term loan and $130 million of exchangeable notes. This compares to

cash and cash equivalents of $41.2 million and total debt of $340.3

million at December 31, 2023, and cash and cash equivalents of

$22.6 million and total debt of $358.1 million at

June 30, 2023. CompoSecure’s secured debt leverage ratio was

1.29x at June 30, 2024 compared to 1.39x at December 31, 2023

and 1.60x at June 30, 2023.

Shares Outstanding: At June 30,

2024, CompoSecure had 81.7 million shares outstanding which

included 29.8 million Class A shares and 51.9 million Class B

shares. This includes the effect of the May 2024 underwritten

secondary offering of approximately 8.1 million shares of Class A

common stock, which were converted from shares of Class B common

stock (for more information on shares outstanding, both Basic and

Diluted, please refer to CompoSecure’s SEC filings and the earnings

presentation).

Operational Highlights

- Expanded partnership with Fiserv to

market and resell Arculus Authenticate capabilities to Fiserv’s

customer base

- Customer card programs launched include Wells Fargo Expedia

Onekey Card, the Amex White Gold Card, Turkish Airlines, and Atlas,

a leading fintech.

- Arculus highlights:

- Remain on track for Arculus total net investment to be lower

than 2023, with the expectation of turning positive for fiscal

2025

- Showcased Arculus innovation around

Web3 payment capabilities using digital assets for everyday

purchases at point of sale

- CompoSecure recognition:

- Won three 2024 International Card

Manufactures Awards Elan Award: Best Metal Cards, Best

Environmentally-Friendly Cards, and Best Secure Payment Cards

- Jon Wilk, CEO, Visionary CEO Award

from the Banking Tech Awards USA

- Steve Feder, General Counsel, NJBIZ

Leaders in Law Awards

- Released inaugural ESG Report

2024 Financial OutlookThe

Company has narrowed its previously issued fiscal 2024 guidance and

now expects Net Sales to range between $418-$428 million

(previously $408-428 million) and Adjusted EBITDA to range between

$150-$157 million (previously $147-$157 million).

Conference CallCompoSecure will

host a conference call and live audio webcast today at 5:00 p.m.

Eastern Time to discuss its financial and operational results,

followed by a question-and-answer period.

Date: Wednesday, August 7, 2024Time: 5:00 p.m.

Eastern TimeDial-in registration link Live webcast registration

link

If you have any difficulty registering or

connecting with the conference call, please contact Elevate IR at

(720) 330-2829.

A live webcast and replay of the conference call

will be available on the investor relations section of

CompoSecure’s website at

https://ir.composecure.com/news-events/events.

About CompoSecureFounded in

2000, CompoSecure (Nasdaq: CMPO) is a technology partner to market

leaders, fintech’s and consumers enabling trust for millions of

people around the globe. The company combines elegance, simplicity

and security to deliver exceptional experiences and peace of mind

in the physical and digital world. CompoSecure’s innovative payment

card technology and metal cards with Arculus security and

authentication capabilities deliver unique, premium branded

experiences, enable people to access and use their financial and

digital assets, and ensure trust at the point of a transaction. For

more information, please visit www.CompoSecure.com and

www.GetArculus.com.

Forward-Looking StatementsThis press release

contains forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These statements are

based on the beliefs and assumptions of management. Although

CompoSecure believes that its plans, intentions, and expectations

reflected in or suggested by these forward-looking statements are

reasonable, CompoSecure cannot assure you that it will achieve or

realize these plans, intentions, or expectations. Forward-looking

statements are inherently subject to risks, uncertainties, and

assumptions. Generally, statements that are not historical facts,

including statements concerning CompoSecure’s possible or assumed

future actions, business strategies, events, or results of

operations, are forward-looking statements. In some instances,

these statements may be preceded by, followed by or include the

words “believes,” “estimates,” “expects,” “projects,” “forecasts,”

“may,” “will,” “should,” “seeks,” “plans,” “scheduled,”

“anticipates” or “intends” or the negatives of these terms or

variations of them or similar terminology. Forward-looking

statements are not guarantees of performance. You should not put

undue reliance on these statements which speak only as of the date

hereof. You should understand that the following important factors,

among others, could affect CompoSecure’s future results and could

cause those results or other outcomes to differ materially from

those expressed or implied in CompoSecure’s forward-looking

statements: the completion of the transactions contemplated by

the proposed transactions with Resolute Partners; the ability of

CompoSecure to grow and manage growth profitably; maintain

relationships with customers; compete within its industry and

retain its key employees; the possibility that CompoSecure may be

adversely impacted by other global economic, business, competitive

and/or other factors; the outcome of any legal proceedings that may

be instituted against CompoSecure or others; future exchange and

interest rates; and other risks and uncertainties, including those

under “Risk Factors” in filings that have been made or

will be made with the Securities and Exchange Commission.

CompoSecure undertakes no obligations to update or revise publicly

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

Use of Non-GAAP Financial

MeasuresThis press release may include certain non-GAAP

financial measures that are not prepared in accordance with

accounting principles generally accepted in the United States

(“GAAP”) and that may be different from non-GAAP financial measures

used by other companies. CompoSecure believes EBITDA, Adjusted

EBITDA, Adjusted Net Income, Adjusted EPS, and Free Cash Flow are

useful to investors in evaluating CompoSecure’s financial

performance. CompoSecure uses these measures internally to

establish forecasts, budgets and operational goals to manage and

monitor its business, as well as evaluate its underlying historical

performance and/or to measure incentive compensation, as we believe

that these non-GAAP financial measures depict the true performance

of the business by encompassing only relevant and controllable

events, enabling CompoSecure to evaluate and plan more effectively

for the future. Due to the forward-looking nature of the financial

guidance included above, specific quantification of the charges

excluded from the non-GAAP financial measures included in such

financial guidance, including with respect to depreciation,

amortization, interest, and taxes, that would be required to

reconcile the non GAAP financial measures included in such

financial guidance to GAAP measures are not available, so it is not

feasible to provide accurate forecasted non-GAAP reconciliations

without unreasonable effort. Consequently, no disclosure of

estimated comparable GAAP measures is included, and no

reconciliation of the forward-looking non-GAAP financial measures

is included. In addition, CompoSecure’s debt agreements contain

covenants that use a variation of these measures for purposes of

determining debt covenant compliance. CompoSecure believes that

investors should have access to the same set of tools that its

management uses in analyzing operating results. EBITDA, Adjusted

EBITDA, Adjusted Net Income, Adjusted EPS, and Free Cash Flow

should not be considered as measures of financial performance under

U.S. GAAP, and the items excluded from EBITDA, Adjusted EBITDA,

Adjusted Net Income, Adjusted EPS, and Free Cash Flow are

significant components in understanding and assessing CompoSecure’s

financial performance. Accordingly, these key business metrics have

limitations as an analytical tool. They should not be considered as

an alternative to net income or any other performance measures

derived in accordance with U.S. GAAP or as an alternative to cash

flows from operating activities as a measure of CompoSecure’s

liquidity and may be different from similarly titled non-GAAP

measures used by other companies. Please refer to the tables below

for the reconciliation of GAAP measures to these non-GAAP

measures.

Corporate ContactAnthony

PiniellaHead of Global Communications, CompoSecure(917)

208-7724apiniella@composecure.com

Investor Relations ContactSean

Mansouri, CFAElevate IR(720) 330-2829CMPO@elevate-ir.com

|

Consolidated Balance Sheet Data(in thousands) |

| |

| |

June 30,2024 |

|

December 31,2023 |

| |

Unaudited |

|

|

| ASSETS |

|

|

|

| CURRENT ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

35,391 |

|

|

$ |

41,216 |

|

|

Accounts receivable, net |

|

39,648 |

|

|

|

40,488 |

|

|

Inventories |

|

57,514 |

|

|

|

52,540 |

|

|

Prepaid expenses and other current assets |

|

3,928 |

|

|

|

5,133 |

|

|

Total current assets |

|

136,481 |

|

|

|

139,377 |

|

| |

|

|

|

| Property and equipment,

net |

|

23,739 |

|

|

|

25,212 |

|

| Right of use assets, net |

|

6,449 |

|

|

|

7,473 |

|

| Deferred tax asset |

|

41,082 |

|

|

|

23,697 |

|

| Derivative asset - interest

rate swap |

|

5,182 |

|

|

|

5,258 |

|

| Deposits and other assets |

|

422 |

|

|

|

24 |

|

|

Total assets |

$ |

213,355 |

|

|

$ |

201,041 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS' DEFICIT |

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

Accounts payable |

|

9,431 |

|

|

|

5,193 |

|

|

Accrued expenses |

|

12,183 |

|

|

|

11,986 |

|

|

Commission payable |

|

5,010 |

|

|

|

4,429 |

|

|

Bonus payable |

|

5,473 |

|

|

|

5,616 |

|

|

Current portion of long-term debt |

|

13,437 |

|

|

|

10,313 |

|

|

Current portion of lease liabilities |

|

2,029 |

|

|

|

1,948 |

|

|

Current portion of tax receivable agreement liability |

|

1,425 |

|

|

|

1,425 |

|

|

Total current liabilities |

|

48,988 |

|

|

|

40,910 |

|

| |

|

|

|

| Long-term debt, net of

deferred finance costs |

|

186,244 |

|

|

|

198,331 |

|

| Convertible notes |

|

128,088 |

|

|

|

127,832 |

|

| Derivative liability -

convertible notes redemption make-whole provision |

|

544 |

|

|

|

425 |

|

| Warrant liability |

|

10,087 |

|

|

|

8,294 |

|

| Lease liabilities,

operating |

|

5,077 |

|

|

|

6,220 |

|

| Tax receivable agreement

liability |

|

43,060 |

|

|

|

23,949 |

|

| Earnout consideration

liability |

|

383 |

|

|

|

853 |

|

|

Total liabilities |

|

422,471 |

|

|

|

406,814 |

|

| |

|

|

|

| Commitments and contingencies

(Note 13) |

|

|

|

| |

|

|

|

| Redeemable non-controlling

interest |

|

516,489 |

|

|

|

596,587 |

|

| |

|

|

|

| Preferred stock, $0.0001 par

value; 10,000,000 shares authorized, no shares issued and

outstanding |

|

— |

|

|

|

— |

|

| Class

A common stock, $0.0001 par value; 250,000,000 shares authorized,

29,847,338 and 19,415,123 shares issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively. |

|

3 |

|

|

|

2 |

|

| Class

B common stock, $0.0001 par value; 75,000,000 shares authorized,

51,908,422 and 59,958,422 shares issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively. |

|

5 |

|

|

|

6 |

|

| Additional paid-in

capital |

|

36,258 |

|

|

|

39,466 |

|

| Accumulated other

comprehensive income |

|

4,848 |

|

|

|

4,991 |

|

| Accumulated deficit |

|

(766,719 |

) |

|

|

(846,825 |

) |

| Total stockholders'

deficit |

|

(725,605 |

) |

|

|

(802,360 |

) |

| TOTAL LIABILITIES AND

STOCKHOLDERS' DEFICIT |

$ |

213,355 |

|

|

$ |

201,041 |

|

| |

|

|

|

|

|

|

|

|

Consolidated Statements of Operations(in thousands, except per

share amounts)(unaudited) |

| |

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net sales |

$ |

108,567 |

|

|

$ |

98,527 |

|

|

$ |

212,577 |

|

|

$ |

193,843 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of sales |

|

52,495 |

|

|

|

44,590 |

|

|

|

101,292 |

|

|

|

86,552 |

|

|

Selling, general and administrative expenses |

|

24,279 |

|

|

|

23,588 |

|

|

|

48,357 |

|

|

|

47,532 |

|

|

Total operating expenses |

|

76,774 |

|

|

|

68,178 |

|

|

|

149,649 |

|

|

|

134,084 |

|

| |

|

|

|

|

|

|

|

| Income from operations |

|

31,793 |

|

|

|

30,349 |

|

|

|

62,928 |

|

|

|

59,759 |

|

|

|

|

|

|

|

|

|

|

| Total other income (expense),

net |

|

2,062 |

|

|

|

3,331 |

|

|

|

(12,836 |

) |

|

|

(16,605 |

) |

| Income before income

taxes |

|

33,855 |

|

|

|

33,680 |

|

|

|

50,092 |

|

|

|

43,154 |

|

| Income tax (expense)

benefit |

|

(258 |

) |

|

|

(970 |

) |

|

|

578 |

|

|

|

293 |

|

| Net income |

$ |

33,597 |

|

|

$ |

32,710 |

|

|

$ |

50,670 |

|

|

$ |

43,447 |

|

| |

|

|

|

|

|

|

|

|

Net income attributable to redeemable non-controlling

interests |

$ |

22,498 |

|

|

$ |

26,973 |

|

|

$ |

33,629 |

|

|

$ |

35,347 |

|

|

Net income attributable to CompoSecure, Inc. |

$ |

11,099 |

|

|

$ |

5,737 |

|

|

$ |

17,041 |

|

|

$ |

8,100 |

|

| |

|

|

|

|

|

|

|

| Net income per share

attributable to Class A common stockholders - basic |

$ |

0.44 |

|

|

$ |

0.31 |

|

|

$ |

0.74 |

|

|

$ |

0.45 |

|

| Net income per share

attributable to Class A common stockholders - diluted |

$ |

0.32 |

|

|

$ |

0.29 |

|

|

$ |

0.49 |

|

|

$ |

0.41 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares used

to compute net income per share attributable to Class A common

stockholders - basic (in thousands) |

|

25,438 |

|

|

|

18,537 |

|

|

|

23,003 |

|

|

|

18,087 |

|

| Weighted average shares used

to compute net income per share attributable to Class A common

stockholders - diluted (in thousands) |

|

96,641 |

|

|

|

35,528 |

|

|

|

96,438 |

|

|

|

35,155 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows(in thousands)(unaudited) |

| |

| |

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

|

Net income |

$ |

50,670 |

|

|

$ |

43,447 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

Depreciation and amortization |

|

4,601 |

|

|

|

4,171 |

|

|

Stock-based compensation expense |

|

9,635 |

|

|

|

8,415 |

|

|

Amortization of deferred finance costs |

|

669 |

|

|

|

700 |

|

|

Change in fair value of earnout consideration liability |

|

(470 |

) |

|

|

(4,221 |

) |

|

Revaluation of warrant liability |

|

1,793 |

|

|

|

7,968 |

|

|

Change in fair value of derivative liability |

|

119 |

|

|

|

513 |

|

|

Deferred tax (benefit) |

|

(2,922 |

) |

|

|

(1,770 |

) |

|

Changes in assets and liabilities |

|

|

|

|

Accounts receivable |

|

840 |

|

|

|

738 |

|

|

Inventories |

|

(4,974 |

) |

|

|

(6,515 |

) |

|

Prepaid expenses and other assets |

|

1,205 |

|

|

|

(272 |

) |

|

Accounts payable |

|

4,238 |

|

|

|

(492 |

) |

|

Accrued expenses |

|

197 |

|

|

|

612 |

|

|

Other liabilities |

|

399 |

|

|

|

(313 |

) |

| Net cash provided by operating

activities |

|

66,000 |

|

|

|

52,981 |

|

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Purchase of property and equipment |

|

(3,129 |

) |

|

|

(5,697 |

) |

|

Capitalized software expenditures |

|

(398 |

) |

|

|

— |

|

| Net cash used in investing

activities |

|

(3,527 |

) |

|

|

(5,697 |

) |

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Proceeds from employee stock purchase plan and exercises of equity

awards |

|

221 |

|

|

|

389 |

|

|

Payments for taxes related to net share settlement of equity

awards |

|

(8,482 |

) |

|

|

(2,483 |

) |

|

Payment of tax receivable agreement liability |

|

— |

|

|

|

(2,193 |

) |

|

Payment of term loan |

|

(9,375 |

) |

|

|

(5,017 |

) |

|

Tax distributions to non-controlling members |

|

(26,167 |

) |

|

|

(29,008 |

) |

|

Special distribution to non-controlling members |

|

(15,573 |

) |

|

|

— |

|

|

Dividend to Class A shareholders |

|

(8,922 |

) |

|

|

— |

|

| Net cash used in financing

activities |

|

(68,298 |

) |

|

|

(38,312 |

) |

| |

|

|

|

| Net (decrease) increase in

cash and cash equivalents |

|

(5,825 |

) |

|

|

8,972 |

|

| |

|

|

|

| Cash and cash equivalents,

beginning of period |

|

41,216 |

|

|

|

13,642 |

|

| |

|

|

|

| Cash and cash equivalents, end

of period |

$ |

35,391 |

|

|

$ |

22,614 |

|

| |

|

|

|

| Supplementary disclosure of

cash flow information: |

|

|

|

|

Cash paid for interest expense |

$ |

12,890 |

|

|

$ |

13,626 |

|

| Supplemental disclosure of

non-cash financing activities: |

|

|

|

|

Derivative asset - interest rate swap |

$ |

(143 |

) |

|

$ |

(373 |

) |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted EBITDA Reconciliation(in

thousands)(unaudited) |

| |

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands) |

| Net income |

$ |

33,597 |

|

|

$ |

32,710 |

|

|

$ |

50,670 |

|

|

$ |

43,447 |

|

| Add: |

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

2,380 |

|

|

|

2,131 |

|

|

|

4,601 |

|

|

|

4,171 |

|

| Interest expense, net (1) |

|

5,648 |

|

|

|

5,849 |

|

|

|

11,394 |

|

|

|

12,345 |

|

| Income tax expense

(benefit) |

|

258 |

|

|

|

970 |

|

|

|

(578 |

) |

|

|

(293 |

) |

| EBITDA |

$ |

41,883 |

|

|

$ |

41,660 |

|

|

$ |

66,087 |

|

|

$ |

59,670 |

|

| Stock-based compensation

expense |

|

5,238 |

|

|

|

4,393 |

|

|

|

9,635 |

|

|

|

8,415 |

|

| Mark-to-market adjustments,

net (2) |

|

(7,710 |

) |

|

|

(9,180 |

) |

|

|

1,442 |

|

|

|

4,260 |

|

| Secondary offering transaction

costs |

|

586 |

|

|

|

— |

|

|

|

586 |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

39,997 |

|

|

$ |

36,873 |

|

|

$ |

77,750 |

|

|

$ |

72,345 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes amortization of deferred financing cost for

the three and six months ended June 30, 2024 and 2023,

respectively.(2) Includes the changes in fair value of warrant

liability, derivative liabilities and earnout consideration

liability for the three and six months ended June 30, 2024 and

2023, respectively.

|

Non-GAAP Adjusted EPS Reconciliation(in thousands)(unaudited) |

| |

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands) except per share amounts |

| Basic and Diluted: |

|

|

|

|

|

|

|

| Net Income |

$ |

33,597 |

|

|

$ |

32,710 |

|

|

$ |

50,670 |

|

|

$ |

43,447 |

|

| Add (less): provision

(benefit) for income taxes |

|

258 |

|

|

|

970 |

|

|

|

(578 |

) |

|

|

(293 |

) |

| Income before income

taxes |

|

33,855 |

|

|

|

33,680 |

|

|

|

50,092 |

|

|

|

43,154 |

|

| Income tax expense (1) |

|

(6,982 |

) |

|

|

(6,190 |

) |

|

|

(13,387 |

) |

|

|

(11,771 |

) |

| Adjusted net income before

adjustments |

|

26,873 |

|

|

|

27,490 |

|

|

|

36,705 |

|

|

|

31,383 |

|

| (Less) add: mark-to-market

adjustments (2) |

|

(7,532 |

) |

|

|

(8,985 |

) |

|

|

1,323 |

|

|

|

3,747 |

|

| Add: Secondary offering

transaction costs |

$ |

586 |

|

|

|

— |

|

|

|

586 |

|

|

|

— |

|

| Add: stock-based

compensation |

|

5,238 |

|

|

|

4,393 |

|

|

|

9,635 |

|

|

|

8,415 |

|

| Adjusted net income |

$ |

25,165 |

|

|

$ |

22,898 |

|

|

$ |

48,249 |

|

|

$ |

43,545 |

|

| Common shares outstanding used

in computing net income per share, basic: |

|

|

|

|

|

|

|

| Class A and Class B common

shares (3) |

|

81,151 |

|

|

|

78,496 |

|

|

|

80,838 |

|

|

|

78,046 |

|

| Common shares outstanding used

in computing net income per share, diluted: |

|

|

|

|

|

|

|

| Warrants (Public and Private)

(4) |

|

8,094 |

|

|

|

8,094 |

|

|

|

8,094 |

|

|

|

8,094 |

|

| Equity awards |

|

2,490 |

|

|

|

3,991 |

|

|

|

2,600 |

|

|

|

4,068 |

|

| Total Shares outstanding used

in computing net income per share - diluted |

|

91,735 |

|

|

|

90,581 |

|

|

|

91,532 |

|

|

|

90,208 |

|

| |

|

|

|

|

|

|

|

| Adjusted net income per share

- basic |

$ |

0.31 |

|

|

$ |

0.29 |

|

|

$ |

0.60 |

|

|

$ |

0.56 |

|

| Adjusted net income per share

- diluted |

$ |

0.27 |

|

|

$ |

0.25 |

|

|

$ |

0.53 |

|

|

$ |

0.48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Calculated using the Company's blended tax rate.2) Includes

the changes in fair value of warrant liability and earnout

consideration liability.3) Assumes both Class A shares and Class B

shares participate in earnings and are outstanding at the end of

the period. 4) Assumes treasury stock method, valuation at assumed

fair market value of $18.00.5) The Company did not include the

effect of Exchangeable Notes in its total shares outstanding used

in diluted adjusted net income per share.

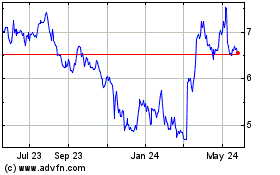

CompoSecure (NASDAQ:CMPO)

Historical Stock Chart

From Dec 2024 to Jan 2025

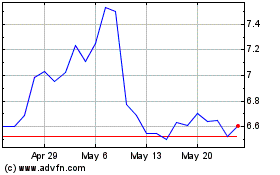

CompoSecure (NASDAQ:CMPO)

Historical Stock Chart

From Jan 2024 to Jan 2025