UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

| COMTECH TELECOMMUNICATIONS CORP. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

January 10, 2025 |

|

0-7928 |

Date of Report |

|

Commission File Number |

(Date of earliest event reported) |

|

|

(Exact name of registrant as specified in its charter)

Delaware |

|

11-2139466 |

(State or other jurisdiction of |

|

(I.R.S. Employer Identification Number) |

incorporation or organization) |

|

|

| |

305 N 54th Street |

|

| |

Chandler,

Arizona 85226 |

|

| |

(Address of Principal Executive Offices) (Zip Code) |

|

| |

|

|

| |

(480)

333-2200 |

|

| |

(Registrant’s telephone

number, including area code) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange

on

which registered |

| Common Stock, par value $0.10 per share |

|

CMTL |

|

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

COMTECH

TELECOMMUNICATIONS CORP /DE/

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 13, 2025, Comtech Telecommunications Corp.

(the “Company”) announced that Mr. Kenneth Traub, who currently serves as the Company’s Executive Chairman, has been

appointed to serve as President and Chief Executive Officer (“CEO”) of the Company in addition to his current role,

effective as of January 13, 2025. Information regarding Mr. Traub’s age, background, experience and certain terms of Mr. Traub’s

existing employment agreement (the “Existing Employment Agreement”) can be found in the Company’s Current Report on

Form 8-K filed with the Securities and Exchange Commission on November 27, 2024, which is incorporated herein by reference.

In connection with Mr. Traub’s appointment,

the Company amended Mr. Traub’s Existing Employment Agreement to reflect his new positions and responsibilities. Pursuant to the

Amendment, Mr. Traub will receive an annualized base salary of $1,000,000 and will be eligible to receive a sign-on bonus equal to $650,000

(the “Sign-On Bonus”), payable as follows: $225,000 on the first regularly scheduled payroll date following February 28, 2025

and $425,000 on the first regularly scheduled payroll date following May 31, 2025. If the Company terminates Mr. Traub’s employment

for “Cause” (as defined in the Existing Employment Agreement) or if Mr. Traub voluntarily terminates employment without “Good

Reason” (as defined in the Existing Employment Agreement) prior to January 13, 2026, then Mr. Traub shall be obligated to immediately

return to the Company the full amount of the Sign-On Bonus paid through the date of termination. If the Company terminates Mr. Traub’s

employment without Cause (other than due to Mr. Traub’s death or disability) or Mr. Traub terminates his employment for Good Reason,

Mr. Traub will, in addition to the benefits set forth in the Existing Employment Agreement, be entitled to receive a pro-rata portion

of the Sign-On Bonus. The foregoing summary of the terms of the Amendment is subject

to the full and complete terms of the Amendment, which the Company expects to file as an exhibit to its periodic report covering the effective

date of the Existing Employment Agreement.

There are no transactions since the beginning of the

Company’s last fiscal year in which the Company is a participant and in which Mr. Traub or any members of his immediate family have

any interest that are required to be reported under Item 404(a) of Regulation S-K. No family relationships exist between Mr. Traub and

any of the Company’s directors or executive officers. The appointment of Mr. Traub was not pursuant to any arrangement or understanding

between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

The Company also announced the mutually agreed separation

of John Ratigan as President, CEO and member of the Board of Directors (the “Board”), effective as of January 13, 2025 (the

“Separation Date”).

The Company has entered into a separation agreement

and release (the “Separation Agreement”), dated January 10, 2025, with Mr. Ratigan. Pursuant to the Separation Agreement,

Mr. Ratigan will cease to serve as President, CEO and a member of the Board and has withdrawn his candidacy for election as a director

at the Company’s upcoming annual meeting. In addition, in exchange for a release of claims and continued compliance with the restrictive

covenants set forth in that certain employment agreement by and between Mr. Ratigan and the Company, dated as of October 28, 2024, and

the Company’s clawback policies and provisions in effect as of the Separation Date, Mr. Ratigan is entitled to receive (i) accrued

obligations through the Separation Date (which includes base salary, any unpaid or unreimbursed expenses, any benefits provided under

the Company’s employee benefit plans, including the Company’s 2023 Equity and Incentive Plan and related award grants, and

all rights to indemnification and directors and officers liability insurance coverage), (ii) a lump sum cash severance payment in the

amount of $750,000, which amount will be paid on the sixtieth day following the Separation Date (in both cases, subject to all withholdings

for applicable taxes and other authorized withholdings), and (iii) subject to his election of COBRA coverage, reimbursement of a monthly

amount equal to the monthly health premiums for such coverage paid by Mr. Ratigan for himself and his eligible dependents until the earlier

of (x) 12 months following the Separation Date, (y) the date Mr. Ratigan is no longer eligible to receive COBRA continuation coverage,

and (z) the date on which Mr. Ratigan becomes eligible to receive substantially similar coverage from another employer. The Separation

Agreement also contains customary restrictive covenants, including non-disparagement and confidentiality provisions.

The foregoing description of the Separation Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement, a copy of

which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

A copy of the Company’s press release announcing

the above is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: January 13, 2025

| |

COMTECH TELECOMMUNICATIONS CORP. |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Michael A. Bondi

|

|

| |

|

Name: |

Michael A. Bondi |

|

| |

|

Title: |

Chief Financial Officer |

|

| |

|

|

|

|

EXHIBIT 10.1

SEPARATION AGREEMENT AND RELEASE

This Separation Agreement and Release (“Agreement”)

is made by and between John Ratigan (“Executive”) and Comtech Telecommunications Corp. (“Comtech”), and its subsidiaries

(collectively, the “Company”) (Each of the Executive and the Company will be referred to herein as a “Party” and

jointly as the “Parties”):

WHEREAS, Executive was employed by the Company

pursuant to an Employment agreement, dated as of October 28, 2024, by and between the Executive and the Company (the “Employment

Agreement”) and Executive’s employment shall be terminated effective January 13, 2025 (the “Termination Date”);

WHEREAS, the Parties wish to resolve any and

all disputes, claims, complaints, grievances, charges, actions, petitions, and demands that the Executive may have against the Company,

including, but not limited to, any and all claims arising or in any way related to Executive’s employment with or separation from

the Company or any compensation due to the Executive, including pursuant to the Employment Agreement; and

WHEREAS, this Agreement will become effective

on the eighth day after it is signed by Executive (such date being the “Effective Date”), provided that Executive has not

revoked this Agreement by written notice to the President of the Company prior to the Effective Date, as provided herein.

NOW THEREFORE, in consideration of the promises

made herein, the Parties hereby agree as follows:

1.

Termination of Employment. Executive’s employment is terminated as of the Termination Date by the Company without

Cause (as defined in the Employment Agreement).

2.

Consideration. As consideration for the release of claims and all other covenants made

herein, the Parties agree that the Executive shall receive the following in accordance with the terms of the Employment Agreement:

| |

(a) |

The Accrued Obligations (as defined in the Employment Agreement), which shall include: |

| (i) | Base Salary (as defined in the Employment Agreement) through January 10, 2025, which is equivalent to $28,846.16 (subject to withholdings

for applicable taxes and authorized other withholdings); and |

| (ii) | Any unpaid or unreimbursed expenses properly incurred in accordance with Section 4.6 of the Employment Agreement through Termination

Date; and |

| (b) | Pursuant to Section 5.5 (d) of the Employment Agreement, an amount equal to one times Executive’s Base Salary to be paid in

one lump sum on the sixtieth (60th) day following the Termination Date (the “Payment Date”), which is equivalent to $750,000.00

(subject to withholdings for applicable taxes and authorized other withholdings). |

| (c) | Executive shall waive any right to a pro rata Annual Bonus under Section 5.5(c) of the Employment Agreement. |

| (d) | All granted but unvested equity in the Company, including but not limited to RSUs, Long-Term Performance Shares and Restricted Stock,

shall be terminated herewith pursuant to the applicable plan documents. For the avoidance of doubt, the Executive shall not be entitled

to |

receive any consideration for the equity incentives contemplated

under Section 4.3 of the Employment Agreement.

3.

Benefits. If Executive is currently participating in the group health insurance plans maintained by Comtech, Executive’s

participation as an employee and the participation of his qualifying dependents will end on the last day of the month in which the Termination

Date occurs; thus, January 31, 2025. If Executive timely and properly elects continuation coverage under the Consolidated Omnibus

Reconciliation Act of 1985 (“COBRA”), in accordance with and subject to Section 5.4(e) of the Employment Agreement, the Company

shall reimburse Executive for the monthly COBRA premium paid by Executive for himself and his dependents. Any such reimbursement for the

period prior to the Payment Date shall be paid to Executive in a lump sum on the Payment Date and any reimbursement for any month (or

portion thereof) on and after the Payment Date shall be paid to Executive on the tenth day of the month immediately following the month

in which Executive timely remits the premium payment. Executive shall be eligible to receive such reimbursement until the earliest of:

(i) the first anniversary of the Termination Date (the “Benefits Reimbursement Period”); (ii) the date Executive is no longer

eligible to receive COBRA continuation coverage; and (iii) the date on which Executive becomes eligible to receive substantially similar

coverage from another employer.

4.

Payment of Salary, Accrued Vacation and Expense Reimbursements. Executive acknowledges and represents that the Company has

paid all salary, wages, bonuses, annual incentives, expenses, accrued vacation and paid time off due to Executive as of the Termination

Date. Executive affirms Executive has been granted any leave to which Executive was entitled under the Family and Medical Leave Act or

related state or local leave or disability accommodation laws. Executive affirms that all of Employer’s decisions regarding Executive’s

pay and benefits through the date of Executive’s execution of this Agreement were not discriminatory based on age, disability, race,

color, sex, religion, national origin or any other classification protected by law. Executive represents and warrants that Executive has

no current on-the-job or occupational injury or incurred any wage, overtime or leave claims while working at the Company. Executive also

affirms that Executive is in possession of all of Executive’s property that Executive had at Employer’s premises and that

Employer is not in possession of any of Executive’s property.

5.

Confidential Information.

(a)

Executive’s fully executed Proprietary Information and Invention Assignment Agreement with the Company dated January 3, 2025

shall survive termination of Executive’s employment (the “Confidential Information Agreement”)]. Executive affirms Executive

has not divulged any proprietary or confidential information of Employer in violation of the Confidential Information Agreement and reaffirms

Executive’s obligation to comply with the terms and conditions of the Confidential Information Agreement. Subject to the exceptions

set forth in Section 9, Executive will hold in strictest confidence and will not disclose, use, lecture upon, or publish any of the Company’s

Proprietary Information. Executive hereby assigns to the Company any rights that Executive may have or acquire in Proprietary Information

and recognizes that all Proprietary Information shall be the sole property of the Company and its assigns. For purposes of this Agreement,

the term “Proprietary Information” shall mean any and all confidential and/or proprietary knowledge, data or information of

the Company. By way of illustration but not limitation, “Proprietary Information” includes (i) trade secrets, inventions,

mask works, ideas, processes, formulas, source and object codes, data, programs, other works of authorship, know-how, improvements, discoveries,

developments, designs and techniques; (ii) information regarding plans for research, development, new products, marketing and selling,

business plans, budgets and unpublished financial statements, licenses, prices and costs, suppliers and customers; and (iii) information

regarding the skills and compensation of other employees of the Company.

(b)

Executive affirms that Executive has returned all of the Company’s property and Proprietary Information in Executive’s

possession or control to the Company.

(c)

Executive understands, in addition, that the Company has received and, in the future, will receive from third parties confidential

or proprietary information (“Third Party Information”) subject to a duty on the Company’s part to maintain the confidentiality

of such information and to use it only for certain limited purposes. Subject to the exceptions set forth in Section 9, Executive will

hold Third Party Information in the strictest confidence and will not disclose to anyone other than Company personnel who need to know

such information in connection with their work for the Company.

(d) Executive

agrees not to cause or participate in the publication of any false or misleading information concerning the facts underlying the separation

of employment. This provision shall not prevent Executive from disclosing information consistent with Section 9 below, or to his spouse,

immediate family members, tax advisor, and/or an attorney with whom Executive chooses to consult, provided they are advised as to the

confidentiality of the information.

6.

Release of Claims. Executive agrees that the foregoing consideration represents settlement in full of all outstanding obligations

owed to Executive by the Company, any subsidiaries or affiliates thereof and all officers, managers, members, supervisors, members of

their board of directors, agents and employees thereof. Executive, on Executive’s own behalf, and on behalf of Executive’s

respective heirs, family members, executors, agents, and assigns, hereby fully and forever releases the Company, their affiliates and

subsidiaries, and all officers, members of their board of directors, employees, agents, investors, shareholders, members, administrators,

affiliates, divisions, predecessor and successor corporations, and assigns of the Company or any subsidiary or affiliate thereof (“the

Releasees”), from, and hereby waives and agrees not to sue concerning, any claim, duty, obligation or cause of action relating to

any matters of any kind, whether presently known or unknown, suspected or unsuspected, that Executive may possess arising from any omissions,

acts or facts that have occurred up until and including the Termination Date including, without limitation:

(a)

any and all claims relating to or arising from Executive’s employment relationship with the Company and the termination of

that relationship;

(b)

any and all claims relating to, or arising from, Executive’s right to purchase, or actual purchase of, equity of the Company

or any subsidiary or affiliate thereof, including, without limitation, any claims for fraud, misrepresentation, breach of fiduciary duty,

breach of duty under applicable state corporate law, and securities fraud under any state or federal law;

(c)

any and all claims under the law of any jurisdiction including, but not limited to, wrongful discharge of employment, constructive

discharge from employment, termination in violation of public policy, discrimination, harassment, retaliation, breach of contract, both

express and implied, breach of a covenant of good faith and fair dealing, both express and implied; promissory estoppel, negligent or

intentional infliction of emotional distress, negligent or intentional misrepresentation, negligent or intentional interference with contract

or prospective economic advantage, unfair business practices, defamation, libel, slander, negligence, personal injury, assault, battery,

invasion of privacy, false imprisonment, and conversion;

(d)

any and all claims for violation of any national, federal, state or municipal statute, including, but not limited to, Title VII

of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Age Discrimination in Employment Act of 1967, the Americans with Disabilities

Act of 1990, the Fair Labor Standards Act, the Employee Retirement Income Security Act of 1974, The Worker Adjustment and Retraining Notification

Act, the Older Workers Benefit Protection Act; The Virginia Human Rights Act – Va. Code § 2.2-3900 et seq., any regulations

thereunder, and any human rights law of any Virginia county or municipality; Virginia Statutory Provisions Regarding Retaliation/Discrimination

for Filing a Workers’ Compensation Claim – Va. Code § 65.2-308(A) and (B); The Virginia Equal Pay Act – Va. Code

§ 40.1-28.6; The Virginians With Disabilities Act – Va. Code § 51.5-1 et seq.; Virginia AIDS Testing Law – Va. Code

Ann. §32.1-36.1; Virginia Minimum Wage Laws – Va. Code § 40.1-28.8 et seq.; Virginia Wage Payment and Hour Laws, including

Virginia Overtime Wage Act –

Va. Code § 40.1-29 et seq.; Virginia Occupational Safety and

Health (VOSH) Law – Va. Code § 40.1-49.3 et seq.; Virginia Code § 8.01-40 regarding unauthorized use of name or picture

of any person; Virginia Code § 40.1-27 regarding preventing employment by others of former employee; Virginia Code § 40.1-28.7:2

regarding protection of crime victims’ employment; Virginia Code § 18.2-465.1 regarding protection of court witnesses’

and jurors’ employment; Va. Code 44-98, prohibiting interference with employment of members of Virginia National Guard, Virginia

Defense Force, or naval militia; Va. Code sections 18.2-499 and 500 (the Virginia statutory conspiracy statutes); Va. Code § 8.01-413.1

(Personnel Records Law); Virginia statutory provisions prohibiting discrimination against employees who serve as members of a local electoral

board, assistant general registrars, and officers of election –Va. Code § 24.2-119.1; Virginia statutory provisions prohibiting

discharge based on single indebtedness – Va. Code § 34-29; Virginia statutory provisions regarding leave for volunteer members

of Civil Air Patrol – Va. Code § 40.1-28.6; Virginia statutory provisions regarding prohibitions on an employer’s requiring

employees to disclose usernames or passwords for social media accounts – Va. Code § 40.1-28.7:5; Virginia statutory provisions

regarding genetic testing or genetic characteristics – Va. Code § 40.1-28.7:1; Va. Code § 40.1-28.01 regarding sexual

assault-related nondisclosure agreements; Va. Code § 40.1-28.7:7 and VA Code § 40.1-33.1 regarding independent contractor classification;

Va. Code § 40.1-28.7:8 regarding covenants not to compete for low wage workers; Va. Code § 40.1-28.7:9 regarding pay transparency;

Va. Code § 40.1-27.3 regarding whistleblower protection; Virginia statutory provisions regarding medicinal use of cannabis oil –

Va. Code § 40.1-27.4; Virginia statutory provisions regarding paid sick leave – Va. Code § 40.1-33.3 et seq.

(e)

any and all claims for violation of the federal, or any state, constitution;

(f)

any and all claims arising out of any other laws and regulations relating to employment or employment discrimination;

(g)

any claim for any loss, cost, damage, or expense arising out of any dispute over the non-withholding or other tax treatment of

any of the proceeds received by Executive as a result of this Agreement; and

(h)

any and all claims for attorneys’ fees and costs.

Executive is not waiving any rights Executive

may have to: (i) Executive’s own vested accrued employee benefits under the Company’s health, welfare, or retirement benefit

plans as of the Termination Date; (ii) benefits and/or the right to seek benefits under applicable workers’ compensation and/or

unemployment compensation statutes; (iii) pursue claims which by law cannot be waived by signing this Agreement; (iv) enforce this Agreement;

and/or (v) challenge the validity of this Agreement pursuant to the ADEA.

If any claim is not subject to release, to the

extent permitted by law, Executive waives any right or ability to be a class or collective action representative or to otherwise participate

in any putative or certified class, collective or multi-party action or proceeding based on such a claim in which Employer is a party.

The Company and Executive agree that the release

set forth in this Section shall be and remain in effect in all respects as a complete general release as to the matters released.

7.

Acknowledgement of Waiver of Claims Under ADEA. Executive acknowledges that Executive is waiving and releasing any rights

Executive may have under the Age Discrimination in Employment Act of 1967 (“ADEA”) and that this waiver and release is knowing

and voluntary. Executive and the Company agree that this waiver and release does not apply to any rights or claims that may arise under

ADEA after the Effective Date of this Agreement. Executive acknowledges that the consideration given for this waiver and release Agreement

is in addition to anything of value to which Executive was already entitled. Executive further acknowledges that Executive has been advised

by this writing that:

(a)

Executive should consult with an attorney prior to executing this Agreement;

(b)

Executive has up to twenty-one (21) days within which to consider this Agreement (after which time expires without signature,

the offer of this Agreement shall be deemed withdrawn);

(c)

Executive has seven (7) days following Executive’s execution of this Agreement to revoke the Agreement in writing by sending

written notice stating of the same to Jennie Kerr, 68 South Service Road, Suite 230, Melville, NY 11747, and, if mailed, postmarked within

seven (7) days of the date upon which Executive signed this Agreement;

(d)

this Agreement shall not be effective until the revocation period has expired with no written revocation received by the Company;

and

(e)

nothing in this Agreement prevents or precludes Executive from challenging or seeking a determination in good faith of the validity

of this waiver under the ADEA, nor does it impose any condition precedent, penalties or costs from doing so, unless specifically authorized

by federal law.

8.

No Pending or Future Lawsuits. Except as described below, Executive agrees and covenants not to file any suit, charge or

complaint against the Company or any other Releasee in any court or administrative agency, with regard to any claim, demand, liability

or obligation arising out of Executive’s employment with the Company or separation therefrom. Executive further represents

that no claims, complaints, charges, or other proceedings are pending in any court, administrative agency, commission or other forum relating

directly or indirectly to Executive’s employment by the Company.

9.

Governmental Agencies. Nothing in this Agreement prohibits or prevents Executive from filing a charge with or participating,

testifying, or assisting in any investigation, hearing, or other proceeding before the U.S. Equal Employment Opportunity Commission, the

National Labor Relations Board or a similar agency enforcing federal, state or local anti-discrimination laws. However, to the maximum

extent permitted by law, Executive agrees that if such an administrative claim is made to such an anti-discrimination agency, Executive

shall not be entitled to recover any individual monetary relief or other individual remedies. In addition, nothing in this Agreement, including

but not limited to the release of claims nor the confidentiality or non-disparagement clauses, prohibits Executive (or

Executive’s attorney) from: (1) reporting possible violations of federal law or regulations, including any possible securities laws

violations, to any governmental agency or entity, including but not limited to the U.S. Department of Justice, the U.S. Securities and

Exchange Commission, the U.S. Congress, or any agency Inspector General, including disclosing confidential information of the Company

to such agency or entity, without any requirement to notify the Company before or after making such reports or disclosures; (2) making

any other disclosures that are protected under the whistleblower provisions of federal law or regulations; or (3) otherwise fully participating

in any federal whistleblower programs, including but not limited to any such programs managed by the U.S. Securities and Exchange Commission

and/or the Occupational Safety and Health Administration. Moreover, nothing in this Agreement prohibits or prevents Executive from

receiving individual monetary awards or other individual relief by virtue of participating in such federal whistleblower programs.

10.

Non-Disparagement. Subject to the exceptions set forth in Section 9, Executive agrees, on behalf of himself and anyone acting

on his behalf, not to disparage the Company, and the Company’s officers, directors, managers, partners, employees, or agents, in

any manner likely to be harmful to them or their business, business reputation or personal reputation; provided that Executive may respond

accurately and fully to any question, inquiry or request for information when required by legal process. Executive agrees to refrain from

any defamation, libel, or slander of the Releasees, and any tortious interference with the contracts, relationships and prospective economic

advantage of the Releasees. Executive agrees that Executive shall direct all inquiries by potential future employers to the Company’s

Vice President of Human Resources.

11.

Resignation as a Director. As of the Termination Date, Executive confirms that he shall resign as a director of the Company

and all subsidiaries thereof and such resignation is voluntary and not due to any

disagreement with the Company as contemplated by such Item 5.02

of Form 8-K. Executive further confirms that he shall withdraw his candidacy for election to the Company Board of Directors at the regularly

scheduled Annual Meeting.

12.

Clawback Policies. Executive acknowledges that Executive shall remain subject to the terms of Company’s clawback policies

and provisions in effect as of the Termination Date and Executive acknowledges and agrees that all compensation recovery, forfeiture and

clawback related provisions in any policy, plan, program, award or award notice of the Company and which apply to Executive, will continue

in full force and effect after the Termination Date, including to the extent necessary to comply with applicable law as such may be adopted

or modified after the Termination Date. To the extent permitted by law, the amounts payable under this Agreement may be reduced

to enforce any repayment obligation of Executive to the Company.

13.

Breach. Executive acknowledges and agrees that, in addition to any other remedy that the Company may have in law or equity,

any material breach of this Agreement by Executive shall entitle the Company immediately to recover and/or cease the consideration payments

provided to Executive under this Agreement.

14.

No Knowledge of Wrongdoing. Executive acknowledges that, consistent with his fiduciary duties to the Company, Executive

has previously reported to the Company’s Board of Directors any facts or circumstances within his knowledge that could give rise

to any violation of any federal, state or local law, rule or regulation, and has no other knowledge of any wrongdoing that involves Executive

or other present or former Company employees. Executive further affirms Executive has not been retaliated against for reporting any allegations

of wrongdoing by Employer or its officers, including any allegations of corporate fraud.

15.

No Admission of Liability. No action taken by the Parties hereto, or either of them, either previously or in connection

with this Agreement shall be deemed or construed to be:

| | (a) | an admission of the truth or falsity of any claims made or any potential claims; or |

| | | |

| (b) | an acknowledgment or admission by either Party of any fault or liability whatsoever to the other Party or to any third party. |

16.

Costs. The Parties shall each bear their own costs, expert fees, attorneys’ fees, and other fees incurred in connection

with this Agreement, except as provided herein.

17.

Tax Consequences. The Company makes no representations or warranties with respect to the tax consequences of the payment

of any sums to Executive under the terms of this Agreement. Executive agrees and understands that Executive is responsible for payment,

if any, of local, state and/or federal taxes on the sums paid hereunder by the Company and any penalties or assessments thereon; provided,

however, that the Company shall withhold from the Separation Payment and other benefits due hereunder any taxes, charges, or other assessments

of any kind required under law to be withheld by the Company. Executive further agrees to indemnify and hold the Company harmless from

any claims, demands, deficiencies, penalties, assessments, executions, judgments, or recoveries by any government agency against the Company

for any amounts claimed due on account of Executive’s failure to pay federal or state taxes or damages sustained by the Company

by reason of any such claims, including reasonable attorneys’ fees.

18.

Mutual Dispute Resolution. The Parties agree that any claim, controversy, or dispute arising out of or relating to this

Agreement or Executive’s employment with Employer that otherwise could have been resolved in a court of law shall be resolved exclusively

by final and binding arbitration before one neutral arbitrator, administered by JAMS according to its then applicable Employment Arbitration

Rules. Each Party agrees to provide written notice to the other of any such claim, controversy, or dispute before initiating a claim at

JAMS.

This arbitration provision shall be governed by and interpreted

in accordance with the Federal Arbitration Act to the fullest extent permitted by law.

The arbitration shall take place in the JAMS office

located closest to the jurisdiction where Executive last worked for Employer. The arbitrator shall apply the substantive law-relating

to all claims and defenses to be arbitrated in the same manner had the matter been heard in court, including the award of any remedy or

relief on an individual basis (including awarding reasonable attorneys’ fees). Any award shall be in writing. Each Party shall have

the right to conduct discovery consistent with the streamlined nature of arbitration.

Claims not covered by this arbitration provision

are claims for workers’ compensation or unemployment insurance benefits; petitions or charges that could be brought before the NLRB

or EEOC; claims under employee pension, welfare benefit or stock option plans if those plans contain some form of alternative dispute

resolution; and claims which are not subject to arbitration pursuant to federal or state law. Either Party may seek from a court of competent

jurisdiction any provisional remedy pending the completion of arbitration consistent with applicable law. Covered claims must be brought

on an individual basis only, and no arbitrator has authority to resolve multi-Employee, class, collective or representative action claims

under this Agreement (“Class Waiver”). Any disputes concerning the validity of this Class Waiver will be decided by a court

of competent jurisdiction, not by the arbitrator. Otherwise, any disputes regarding the enforceability or formation of this arbitration

provision (including all defenses to contract enforcement such as, for example, waiver of the right to compel arbitration) shall be decided

by the arbitrator. The parties voluntarily and irrevocably waive any and all rights to have any dispute heard or resolved in any forum

other than through arbitration and this waiver specifically includes but is not limited to a jury trial. Provided, however in -the event

court determines that the class waiver is unenforceable with respect to any claim, it shall not apply to that claim, and that claim may

then only proceed in court as the exclusive forum (with no right to a jury trial).

19.

Authority. The Company represents and warrants that the undersigned has the authority to act on behalf of the Company and

to bind the Company and all who may claim through it to the terms and conditions of this Agreement. Executive represents and warrants

that Executive has the capacity to act on Executive’s own behalf and on behalf of all who might claim through Executive to bind

them to the terms and conditions of this Agreement, including the marital community, if any. Each Party warrants and represents that there

are no liens or claims of lien or assignments in law or equity or otherwise of or against any of the claims or causes of action released

herein.

20.

No Representations. Each Party represents that it has had the opportunity to consult with an attorney, and has carefully

read and understands the scope and effect of the provisions of this Agreement. In entering into this Agreement, neither Party has relied

upon any representations or statements made by the other Party hereto which are not specifically set forth in this Agreement.

21.

Severability. In the event that any provision, or any portion thereof, becomes or is declared by a court of competent jurisdiction

to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without said provision or portion of said

provision.

22.

Entire Agreement. This Agreement represents the entire agreement and understanding between the Company and Executive concerning

the subject matter of this Agreement and Executive’s relationship with the Company, and supersedes and replaces any and all prior

agreements and understandings between the Parties concerning the subject matter of this Agreement, including the Employment Agreement,

and Executive’s relationship with the Company; provided, however, this Agreement does not supersede the Confidential Information

Agreement or Executive’s restrictive covenants and other post-employment obligations contained in the Employment Agreement, except

that the Restricted Period applicable to Employment Agreement Section 9.2 (Non-Competition), Section 9.3 (Non-Solicitation-Employees)

and Section 9.4 (Non-Solicitation-Customers) shall be reduced to twelve (12) months.

23.

No Waiver. The failure of the Company to insist upon the performance of any of the terms and conditions in this Agreement,

or the failure to prosecute any breach of any of the terms and conditions of this Agreement, shall not be construed thereafter as a waiver

of any such terms or conditions. This entire Agreement shall remain in full force and effect as if no such forbearance or failure of performance

had occurred.

24.

No Oral Modification. This Agreement may only be amended in a writing signed by Executive and a duly authorized officer

of the Company.

25.

Governing Law. This Agreement shall be construed, interpreted, governed, and enforced in accordance with the laws of the

State of Virginia, without regard to choice of law provisions. Executive hereby consents to submit to personal jurisdiction of, and agrees

that any action arising out of or relating to this Agreement shall be brought and maintained exclusively in, the State of Virginia.

26.

Counterparts. This Agreement may be executed in counterparts and by facsimile, and each counterpart shall have the same

force and effect as an original and shall constitute an effective, binding agreement on the part of each of the undersigned.

27.

Binding Effect. This Agreement shall be binding upon and inure to the benefit of Executive and Executive’s heirs,

executors, personal representatives, assigns, administrators, and legal representatives. This Agreement shall be binding upon and inure

to the benefit of the Company and its successors, assigns and legal representatives.

28.

Voluntary Execution of Agreement. This Agreement is executed voluntarily and without any duress or undue influence on the

part or behalf of the Parties, with the full intent of releasing all claims. Executive acknowledges that Executive:

(a)

has read this Agreement;

(b)

has been represented in the preparation, negotiation, and execution of this Agreement by legal counsel of Executive’s own

choice or that Executive has voluntarily declined to seek such counsel;

(c)

at the time of considering or executing this Agreement, was not affected or impaired by illness, use of alcohol, drugs or other

substances or otherwise impaired;

(d)

is competent to execute this Agreement and knowingly and voluntarily waives any and all claims Executive may have against Employer;

(e)

is not a party to any bankruptcy, lien, creditor-debtor or other proceedings which would impair Executive’s right or ability

to waive all claims Executive may have against Employer;

(f)

understands the terms and consequences of this Agreement and of the releases it contains;

(g)

understands that Executive has seven (7) days to revoke this Agreement after signing it, and that any such revocation must be in

writing and delivered to the Company or postmarked within the revocation period to be effective; and

(h)

is fully aware of the legal and binding effect of this Agreement.

29.

Section 409A of the Code. Notwithstanding

any provision in this Agreement to the contrary:

(a)

Any payment otherwise required to be made hereunder to Executive at any date as a result of the termination of Executive’s

employment shall be delayed for such period of time as may be necessary to meet the requirements of Section 409A(a)(2)(B)(i) of the Code

(the “Delay Period”). On the first business day following the expiration of the Delay Period, Executive shall be paid, in

a single cash lump sum, an amount equal to the aggregate amount of all payments delayed pursuant to the preceding sentence, and any remaining

payments not so delayed shall continue to be paid pursuant to the payment schedule set forth herein.

(b)

Each payment in a series of payments hereunder shall be deemed to be a separate payment for purposes

of Section 409A of the Code.

(c)

Notwithstanding anything herein to the contrary, the payment (or commencement of a series of payments)

hereunder of any nonqualified deferred compensation (within the meaning of Section 409A of the Code) upon a termination of employment

shall be delayed until such time as Executive has also undergone a “separation from service” as defined in Treas. Reg. 1.409A-1(h),

at which time such nonqualified deferred compensation (calculated as of the date of Executive’s termination of employment hereunder)

shall be paid (or commence to be paid) to Executive on the schedule set forth in Sections 2 and 3 of this Agreement as if Executive had

undergone such termination of employment (under the same circumstances) on the date of Executive’s ultimate “separation from

service.”

(d)

To the extent that any right to reimbursement of expenses or payment of any benefit in-kind under

this Agreement constitutes nonqualified deferred compensation (within the meaning of Section 409A of the Code), (i) any such expense reimbursement

shall be made by the Company no later than the last day of the taxable year following the taxable year in which such expense was incurred

by Executive, (ii) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit,

and (iii) the amount of expenses eligible for reimbursement or in-kind benefits provided during any taxable year shall not affect the

expenses eligible for reimbursement or in-kind benefits to be provided in any other taxable year; provided, that the foregoing clause

shall not be violated with regard to expenses reimbursed under any arrangement covered by Section 105(b) of the Code solely because such

expenses are subject to a limit related to the period the arrangement is in effect.

(e)

While the payments and benefits provided hereunder are intended to be structured in a manner to avoid

the implication of any penalty taxes under Section 409A of the Code, in no event whatsoever shall the Company be liable for any additional

tax, interest, or penalties that may be imposed on Executive as a result of Section 409A of the Code for failing to comply with Section

409A of the Code (other than for withholding obligations or other obligations applicable to employers, if any, under Section 409A of the

Code) provided that the Company acted in reasonable good faith in connection with complying with Section 409A of the Code.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties have executed

this Agreement on the respective dates set forth below.

| |

|

|

EXECUTIVE |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Dated: |

1/10/25 |

|

/s/ John Ratigan |

|

| |

|

|

John Ratigan |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

COMPANY: |

|

| |

|

|

|

|

|

| |

|

|

Comtech Telecommunications Corp. |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Dated: |

1/10/25 |

|

By: |

/s/ Kenneth H. Traub |

|

| |

|

|

Name: |

Kenneth H. Traub |

|

| |

|

|

Title: |

Executive Chairman |

|

| |

|

|

|

|

|

[Signature

Page to SEPARATION AGREEMENT and Release]

EXHIBIT 99.1

Comtech Announces CEO Transition and Comprehensive

Transformation Initiatives

Appoints Kenneth H. Traub as President and Chief

Executive Officer, Effective Immediately

Commences Comprehensive Transformation to Immediately

Strengthen Company

CHANDLER, Ariz. – Jan. 13, 2025 – Comtech Telecommunications

Corp. (NASDAQ: CMTL) (“Comtech” or the “Company”), a global communications technology leader, today announced

that its Board of Directors (the “Board”) has named Ken Traub as President and Chief Executive Officer, replacing John Ratigan

effective immediately. Mr. Traub joined the Comtech Board on October 31, 2024 and became Executive Chairman on November 27, 2024.

Mr. Traub is leading a comprehensive transformation of Comtech. Some highlights

of this transformation include:

| · | Operational Discipline and Rightsizing. Comtech is taking decisive action to improve processes, streamline product lines, optimize

staffing and sharpen its organizational focus. These actions are expected to result in significant cost savings and working capital efficiencies,

particularly in the Company’s Satellite & Space Communications (“S&S”) segment, and position Comtech to generate

sustainable positive cash flow. |

| · | Support and Grow Successful Business Units. The Company’s Terrestrial & Wireless Networks (“T&W”)

segment is poised for continued strong growth, driven by the need for nontraditional methods to request emergency help from new devices

and the segment’s new initiatives in public safety technologies. The growth of the Company’s carrier business will be supported

by its latest cloud-agnostic 5G passive and emergency location, messaging and alerting services. In the S&S segment, Comtech is strong

in designing, manufacturing and supporting sophisticated communications equipment for both defense and commercial users that rely on the

Company to provide mission-critical communications infrastructure. Comtech will prudently invest in and support these successful businesses

and capitalize on opportunities to build and monetize these valuable assets. |

| · | Strategic Alternatives Process. The Comtech Board, under Mr. Traub’s leadership, will conduct a comprehensive review

of strategic alternatives and explore a range of potential transactions to enhance Comtech’s strategic focus and strengthen the

Company’s balance sheet. This process is a broadening of the previously announced review of strategic alternatives for the T&W

segment and will include various alternatives for the S&S segment. |

| · | Strengthening the Capital Structure. Comtech had available liquidity of approximately $30 million of cash and equivalents as

of both October 31, 2024 and January 10, 2025. The Company is positioned to generate positive cash flow over the coming months through

implementation of the initiatives described above and will consider opportunities to strengthen its capital structure. |

Mr. Traub commented, “While Comtech’s recent historical performance

has been unsatisfactory, the Company has great assets, including its people, technologies, reputation, customers and relationships. Since

I joined the Company as Executive Chairman about six weeks ago, I have learned a lot, which gives

me confidence that we can overcome the challenges and create new opportunities

to strengthen the business and drive value. We are implementing a comprehensive set of initiatives to better position Comtech for the

future including improving operational discipline, streamlining operations, supporting profitable growth initiatives, undertaking a broad

review of strategic alternatives and strengthening the capital structure. I am honored to expand my role as President and CEO today, and

look forward to leading the Company into a stronger and brighter future.”

“The Board is fully supportive of Ken's leadership and committed

to his strategy that will deliver immediate and necessary improvements for Comtech,” said former Army Chief Information Officer,

Lieutenant General (Retired) Bruce T. Crawford, Lead Independent Director of the Comtech Board.

There can be no assurance that the exploration of strategic alternatives

will result in a transaction or other strategic changes or outcomes. There is no timeframe for the conclusion of the process, and

the Company does not intend to comment further regarding this matter unless and until further disclosure is determined to be appropriate

or necessary.

First Quarter Fiscal 2025 Financial Results: Conference Call and Webcast

Information

In a separate press release issued today, Comtech announced its financial

results for the first quarter of fiscal 2025. That press release can be found on the Investor Relations section of the Company’s

website at www.comtech.com/investors.

Comtech will host a conference call with investors and analysts today at

8:30 am Eastern Time. Mr. Traub will lead the call, joined by Michael Bondi, Chief Financial Officer; Daniel Gizinski, President of the

Satellite and Space Communications segment; and Jeff Robertson, President of the Terrestrial & Wireless Networks segment. A live

webcast of the conference call will also be accessible at www.comtech.com/investors. Alternatively,

investors can access the conference call by dialing (800) 579-2543 (domestic), or (785) 424-1789 (international) and using the conference

I.D. "Comtech." A replay will be available for seven days by dialing (800) 839-9557 (domestic), or (402) 220-6089 (international).

About Kenneth H. Traub

Mr. Traub has served as a director on Comtech’s Board since October

2024 and was named as Executive Chairman in November 2024. He is a visionary and transformational corporate leader with a successful track

record of building sustainable shareholder value. Mr. Traub has over 30 years of experience as a Chairman, CEO, director and active investor

with a demonstrated record of accomplishment in driving strategic, financial, operational and governance improvements. Mr. Traub is adept

at managing business challenges, executing turnarounds, optimizing capital allocation, driving operational improvements, implementing

M&A and other strategic initiatives and capitalizing on strategic growth opportunities. Mr. Traub received a BA from Emory College

in 1983 and an MBA from Harvard Business School in 1988.

About Comtech

Comtech Telecommunications Corp. is a leading provider of satellite and

space communications technologies; terrestrial and wireless network solutions; Next Generation 911 (NG911) and emergency services; and

cloud native capabilities to commercial and government customers around the world. Through its culture of innovation and employee empowerment,

Comtech leverages its global presence

and decades of technology leadership and experience to create some of the

world’s most innovative solutions for mission-critical communications. For more information, please visit www.comtech.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this press release contains,

and oral statements made by our representative from time to time may contain, forward-looking statements. Forward-looking statements can

be identified by words such as: "anticipate," "believe," "continue," "could," "estimate,"

"expect," "future," "goal," "outlook," "intend," "likely," "may,"

"plan," "potential," "predict," "project," "seek," "should," "strategy,"

"target," "will," "would," and similar references to future periods. Forward-looking statements include,

among others, statements regarding our expectations for our strategic alternatives process, our expectations for further portfolio-shaping

opportunities, our expectations for other operational initiatives, future performance and financial condition, the plans and objectives

of our management and our assumptions regarding such future performance, financial condition, and plans and objectives that involve certain

significant known and unknown risks and uncertainties and other factors not under our control which may cause our actual results, future

performance and financial condition to be materially different from the results, performance or other expectations implied by these forward-looking

statements. Factors that could cause actual results to differ materially from current expectations are described in our filings with the

Securities and Exchange Commission. We urge you to consider all of the risks, uncertainties and factors identified above or discussed

in such reports carefully in evaluating the forward-looking statements. The risks described above are not the only risks that we face.

We do not intend to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise,

except as required by law.

Investor Relations Contact

Maria Ceriello

631-962-7102

investors@comtech.com

Media Contact

Jamie Clegg

480-532-2523

jamie.clegg@comtech.com

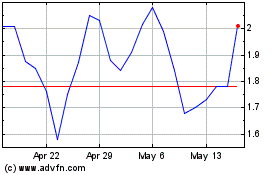

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Jan 2024 to Jan 2025