0001842952FALSE00018429522024-07-092024-07-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

_______________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 9, 2024

_______________________

Context Therapeutics Inc.

(Exact name of registrant as specified in its charter)

_______________________

| | | | | | | | |

| Delaware | 001-40654 | 86-3738787 |

| (State of other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2001 Market Street, Suite 3915, Unit #15

Philadelphia, Pennsylvania 19103

(Address of principal executive offices including zip code)

(267) 225-7416

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | | | | |

Title of each class | Trading | Name of exchange | |

| Symbol | on which registered | |

| Common Stock | | CNTX | | The Nasdaq Stock Market | |

$0.001 par value per share | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 9, 2024 (the “Closing Date”), Context Therapeutics Inc. (the “Company”) entered into an asset purchase agreement (the “Purchase Agreement”) pursuant to which the Company acquired (the "Transaction") CT-95 (formerly known as LNK-101), a mesothelin x CD3 T cell engaging bispecific antibody, from Link (assignment for the benefit of creditors), LLC (the “Seller”), which succeeded to the assets of Link Immunotherapeutics Inc. The U.S. Food and Drug Administration previously cleared the investigational new drug ("IND") application for CT-95 and the Company expects to initiate a Phase 1 trial to evaluate CT-95 in the first quarter of 2025. The Company funded the acquisition of CT-95 and intends to fund its advancement through the dose escalation portion of a Phase 1 clinical trial with the Company’s existing cash.

Pursuant to the Purchase Agreement, the Company purchased all of the assets of the Seller associated with CT-95, including patent rights, know-how, regulatory filings, and inventory of drug substance and drug product (the “Transferred Assets”), on an “as is” and “where is” basis. CT-95 patents are currently being prosecuted and/or maintained in the United States, Europe, Canada, Australia and Taiwan. The Company also assumed certain liabilities relating to the Transferred Assets. In consideration of the purchase of the Transferred Assets, the Company made a one-time payment to Seller of $3.75 million.

The Purchase Agreement contains limited representations and warranties, covenants, and closing conditions customary for a transaction of this nature, including, without limitation, confidentiality obligations.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On July 10, 2024, the Company issued a press release announcing the Transaction. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On July 10, 2024, the Company also updated its corporate presentation for use in meetings with investors, analysts and others. A copy of the corporate presentation is filed as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Item 7.01, and Exhibits 99.1 and 99.2 attached hereto, are being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

Item 9.01. Exhibits.

(d) Exhibits

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the inline XBRL document)

# Certain information has been excluded from the exhibit because it both (i) is not material and (ii) is the type that the registrant treats as private or confidential.

Forward-looking Statements

This Current Report on Form 8-K contains “forward-looking statements” that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, included in this press release regarding strategy, future operations, prospects, plans and objectives of management, including words such as “may,” “will,” “expect,” “anticipate,” “look forward,” “plan,” “intend,” and similar expressions (as well as other words or expressions referencing future events, conditions, or circumstances) are forward-looking statements. These include, without limitation, statements regarding (i) our expectation to initiate a Phase 1 trial to evaluate CT-95 in the first quarter of 2025, and (ii) our expectation that we can fund the advancement of CT-95 through the dose escalation portion of a Phase 1 clinical trial with our existing cash. Forward-looking statements in this Current Report on Form 8-K involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, and we therefore cannot assure you that our plans, intentions, expectations, or strategies will be attained or achieved. Other factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this Current Report on Form 8-K are discussed in our filings with the Securities and Exchange Commission, including the section titled “Risk Factors” contained therein. Except as otherwise required by law, we disclaim any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events, or circumstances or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Dated: July 10, 2024 | Context Therapeutics Inc. |

| |

| By: /s/ Martin A. Lehr |

| Name: Martin A. Lehr |

| Title: Chief Executive Officer |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL

Exhibit 10.1

EXECUTION COPY

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (the “Agreement”) is hereby entered into on July 9, 2024 (the “Effective Date”), by and between Link (assignment for the benefit of creditors), LLC, a California limited liability company (the “Seller”), in its sole and limited capacity as assignee for the benefit of creditors of Link Immunotherapeutics, Inc., with its principal office located at 3945 Freedom Circle, Suite 560, Santa Clara, California 95054, United States, and Context Therapeutics Inc., a Delaware corporation (the “Buyer”), with its principal office located at 2001 Market Street, Suite 3915, Unit #15, Philadelphia, Pennsylvania 19103.

RECITALS

A. By resolution of the board of directors (the “Board”) of Link Immunotherapeutics, Inc., a Delaware corporation (the “Assignor”), as memorialized in Assignor’s duly executed board resolution, Assignor has transferred ownership of all of its right, title and interest in and to all of its tangible and intangible assets (the “Assets”) to Seller, and, in so doing, has also designated Seller to act, pursuant to California law, as the assignee for the benefit of creditors of Assignor. The General Assignment agreement (the “General Assignment”) between Assignor and Seller, as assignee, is attached hereto as Exhibit 1.

B. Seller and Buyer have identified a subset of the Assets that Buyer desires to purchase from Seller (the “Purchased Assets”). The Purchased Assets are defined in Section 1.2 below. Seller desires to sell to Buyer, and Buyer desires to purchase from Seller, the Purchased Assets, on the terms and conditions set forth in this Agreement.

C. After consummation of the Closing contemplated under this Agreement, Seller intends to sell or otherwise liquidate any and all remaining non-cash Assets that are not Purchased Assets and will undertake the winding down of Assignor’s assignment estate, which shall ultimately include, but shall not be limited to, the distribution to Assignor’s creditors of the assignment estate’s net funds remaining after payment of all fees and costs associated with the liquidation of the assignment estate.

NOW, THEREFORE, in consideration of the above recitals and the mutual covenants hereinafter set forth, Buyer and Seller hereby agree as follows:

1. PURCHASE AND SALE OF THE PURCHASED ASSETS.

1.1 Agreement to Sell and Purchase the Purchased Assets. Subject to the terms and conditions of this Agreement, and in reliance on the representations, warranties and covenants set forth in this Agreement, Seller hereby agrees to sell, assign, transfer and convey to Buyer at the Closing (as defined in Section 2.2 below), and Buyer hereby agrees to purchase and acquire from Seller at the Closing, all of Seller’s right, title and interest in and to all of the Purchased Assets free and clear of all known pledges, liens, licenses, rights of possession, security interests, restrictions, encumbrances, charges, title retention, conditional sale or other security arrangements of any nature whatsoever (collectively, “Encumbrances”). The Purchased Assets will be sold, assigned, transferred and conveyed to Buyer (subject to Section 1.3) on the

Closing Date on an “AS IS” and “WHERE IS” basis, with no representations or warranties other than those specifically set forth below.

1.2 Purchased Assets Defined. As used in this Agreement, the term “Purchased Assets” means, collectively, Seller’s right, title and interest in and to the assets listed in Exhibit 1.2 attached hereto and includes all intellectual property rights related to Seller’s bispecific LNK101 drug development program (“LNK101”), all related governmental approvals and drug inventories and any other assets owned by Seller used or useful in the development of LNK101, provided, however, that the Purchased Assets specifically do not, under any circumstances, include any of Seller’s or Assignor’s (i) cash, (ii) accounts receivable, (iii) claims for preference or fraudulent conveyance recoveries under applicable law or any other litigation recoveries, (iv) state or federal tax refunds, (v) insurance refunds or recoveries, (vi) utility or leasehold security deposits, (vii) all corporate governance and human resource documents and business books and records (other than books and records relating to the ownership and operation of the Purchased Assets and conduct of LNK101 development program), or (viii) any of the “Excluded Assets” (defined below). Each party shall promptly execute and deliver to the other party any and all such further assignments, endorsements and other documents as such party may reasonably request for the purpose of effectuating the terms and conditions of this Section.

For the avoidance of doubt, it is the intent of the parties hereto that none of the Excluded Assets shall be transferred to Buyer. For purposes of this Agreement, the term “Excluded Assets” means any and all properties, rights, contracts, claims or other assets other than those specifically listed or described in Exhibit 1.2 or Schedule 3.1 hereto. For the avoidance of doubt, the [***] Agreement dated [***], between [***] and Link Immunotherapeutics, Inc., [***], is an Excluded Asset.

1.3 Asset Transfer; Passage of Title; Delivery.

(a) Title Passage. Except as otherwise provided in this Section, upon the Closing, (i) title to all of the Purchased Assets shall pass to Buyer; (ii) Seller shall make available to Buyer possession of all of the Purchased Assets as provided in subsection 1.3(b); and (iii) upon Buyer’s request, Seller shall execute assignments, conveyances and/or bills of sale reasonably requested to convey to Buyer title to all of the Purchased Assets free and clear of all known Encumbrances, in accordance with Section 1.1 of this Agreement, as well as such other instruments of conveyance as Buyer may reasonably deem necessary to effect or evidence the transfers contemplated hereby.

(b)Delivery of Purchased Assets. On the Closing Date (as defined in Section 2.2), Seller shall make available to Buyer possession of the Purchased Assets, provided, however, that the expenses of retrieving, removing and transferring the Purchased Assets shall be borne exclusively by Buyer, and provided further that in the event that any of the Purchased Assets are located outside of the physical control of Seller, such as in warehouses or foreign locations controlled by third parties, Seller is not making any representation or warranty to Buyer as to the quantities of Purchased Assets under the control of such third parties or the accessibility of such Purchased Assets; provided, however, that nothing herein shall limit Seller’s obligation

to attempt to take such reasonable actions requested by Buyer as are reasonably requested by Buyer or necessary to help facilitate Buyer’s access to such Purchased Assets, with Buyer having the obligation to pay Seller for any significant additional expenses incurred by Seller on account of Seller taking such additional actions.

(c)Retention of Documents. As assignee, Seller is responsible for maintaining business records during the assignment process and, among other things, will prepare and file final tax returns. To the extent Buyer requires business records of Assignor that Seller has retained to administer the assignment estate, Buyer shall, at its own expense, arrange to obtain copies of such records from Seller and Seller shall reasonably cooperate with Buyer regarding the foregoing.

2. PURCHASE PRICE; PAYMENTS.

2.1 Purchase Price. In consideration of the sale, transfer, conveyance and assignment of all of the Purchased Assets to Buyer at the Closing, Buyer shall, as of the Closing, assume only those liabilities, if any, expressly set forth as Assumed Liabilities in Section 3.1 of this Agreement and shall pay by wire transfer to Seller at the Closing the sum of Three Million Seven Hundred Fifty Thousand Dollars ($3,750,000) (the “Purchase Price”).

2.2 Closing. The consummation of the purchase and sale of the Purchased Assets contemplated hereby will take place at a closing to be held at the offices of Seller (the “Closing”), on July 9, 2024 (the “Closing Date”), or at such other time or date, and at such place, or by such other means of exchanging documents, as may be agreed to by Buyer and Seller. If the Closing does not occur on or prior to July 10, 2024, or such later date upon which Buyer and Seller agree in writing, this Agreement shall terminate upon written notice of termination given by either party hereto that is not in default of its obligations hereunder, and thereupon this Agreement shall become null and void and no party hereto will have any further rights or obligations hereunder, except that Section 6.1 shall survive such termination.

3. OBLIGATIONS ASSUMED.

3.1 Liabilities. Buyer agrees, upon consummation of, and effective as of, the Closing, to assume and be responsible to discharge when due those (and only those) obligations of Seller and of Assignor under contracts of Assignor listed in Schedule 3.1 (collectively, the “Assumed Liabilities”) that are effectively assigned to and assumed by Buyer.

3.2 Liabilities and Obligations Not Assumed. Except as expressly set forth in Section 3.1 above, Buyer shall not assume or become obligated in any way to pay or perform any liabilities, debts or obligations of Seller or of Assignor whatsoever, including, but not limited to, any liabilities or obligations now or hereafter arising from Assignor’s business activities that took place prior to the Closing or any liabilities arising out of or connected to the liquidation and winding down of Assignor’s business. All liabilities, debts and obligations of Seller and of Assignor not expressly assumed by Buyer hereunder are hereinafter referred to as the “Excluded Liabilities.”

3.3 No Obligations to Third Parties. The execution and delivery of this Agreement shall not be deemed to confer any rights upon any person or entity other than the parties hereto, or make any person or entity a third party beneficiary of this Agreement, or to obligate either party to any person or entity other than the parties to this Agreement. The assumption by Buyer of any liabilities or obligations of Seller under Section 3.1 shall in no way expand the rights or remedies of third parties against Buyer as compared to the rights and remedies such parties would have against Seller if the Closing was not consummated.

4. REPRESENTATIONS AND WARRANTIES OF BUYER.

Buyer hereby represents and warrants to Seller that all the following statements are true, accurate and correct:

4.1 Due Organization. Buyer is a corporation duly organized, validly existing, and in good standing under the laws of Delaware. Buyer has all necessary power and authority to enter into this Agreement and to execute and deliver all other documents that Buyer is required to execute and deliver hereunder, and Buyer holds or will timely hold all permits, licenses, orders and approvals of all federal, state and local governmental or regulatory bodies necessary and required therefore.

4.2 Power and Authority; No Default. Buyer has all requisite power and authority to enter into and deliver this Agreement and to perform its obligations hereunder. The execution, delivery and performance by Buyer of this Agreement, and the consummation of all the transactions contemplated hereby, have been duly and validly authorized by Buyer. This Agreement, when signed and delivered by Buyer, will be duly and validly executed and delivered and will be the valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, subject to the laws relating to bankruptcy, insolvency and relief of debtors, and rules and laws governing specific performance, injunctions, relief and other equitable remedies.

4.3 Authorization for this Agreement. To Buyer’s knowledge, except for the requirement to notify the Federal Drug Administration of the IND assignment, no authorization, approval, consent of, or filing with any governmental body, department, bureau, agency, public board, authority or other third party is required for the consummation by Buyer of the transactions contemplated by this Agreement.

4.4 Litigation. To the best of Buyer’s knowledge, there is no litigation, suit, action, arbitration, inquiry, investigation or proceeding pending or, to the knowledge of Buyer, threatened, before any court, agency or other governmental body against Buyer (or any corporation or entity affiliated with Buyer) which seeks to enjoin or prohibit or otherwise prevent the transactions contemplated hereby.

4.5 Funding. Buyer currently has available to it, and will have available to it at the Closing, sufficient funds to pay the Purchase Price to Seller at the Closing. Buyer’s ability to perform its financial obligations under this Agreement is therefore not subject to any financing contingency.

5. REPRESENTATIONS AND WARRANTIES OF SELLER.

Seller represents and warrants to Buyer that all of the following statements are true, accurate and correct:

5.1 Corporate Organization. Seller is a limited liability company duly organized, validly existing, and in good standing under the laws of the State of California.

5.2 Power and Authority; No Default Upon Transfer. As assignee, Seller has all requisite power and authority to enter into and deliver this Agreement and to perform its obligations hereunder and under the General Assignment. The signing, delivery and performance by Seller of this Agreement, and the consummation of all of the transactions contemplated hereby, have been duly and validly authorized by Seller. To the best of Seller’s knowledge, the General Assignment was duly authorized by Assignor’s Board and is a valid agreement binding on the Assignor and Seller. This Agreement, when signed and delivered by Seller, will be duly and validly executed and delivered and will constitute a valid and binding obligation of Seller (including to convey the Purchased Assets to Buyer), enforceable against Seller, as assignee, in accordance with its terms as governed by applicable law, regulations and rules. Neither the signing and delivery of this Agreement by Seller, nor the performance by Seller of its obligations under this Agreement, will (i) violate Seller’s Articles of Organization or Operating Agreement, or (ii) to the best of Seller’s knowledge, violate any law, statute, rule or regulation or order, judgment, injunction or decree of any court, administrative agency or government body applicable to Seller.

5.3 Title. To the best of Seller’s knowledge after reasonable inquiry, including, without limitation, competent assessment of the applicable UCC search in Assignor’s state of incorporation, Seller, as assignee, has good and marketable title to all of the Purchased Assets. This Agreement and the contemplated transaction documents will effectively transfer to Buyer good, valid and marketable title to, and ownership of, the Purchased Assets free and clear of all known Encumbrances. Seller sells, assigns, transfers and conveys the Purchased Assets to Buyer on an “AS IS” and “WHERE IS” basis, with no representations or warranties as to merchantability, fitness or use.

(a) AS-IS SALE; DISCLAIMERS; RELEASE. IT IS UNDERSTOOD AND AGREED THAT, UNLESS EXPRESSLY STATED HEREIN, SELLER IS NOT MAKING AND HAS NOT AT ANY TIME MADE ANY WARRANTIES OR REPRESENTATIONS OF ANY KIND OR CHARACTER, EXPRESS OR IMPLIED, WITH RESPECT TO THE PURCHASED ASSETS, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OR REPRESENTATIONS AS TO MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

(b) BUYER ACKNOWLEDGES AND AGREES THAT UPON THE CLOSING SELLER SHALL SELL AND CONVEY TO BUYER AND BUYER SHALL ACCEPT THE PURCHASED ASSETS “AS IS, WHERE IS, WITH ALL FAULTS.” BUYER HAS NOT RELIED UPON AND WILL NOT RELY ON, AND SELLER IS NOT

LIABLE FOR OR BOUND BY, ANY EXPRESS OR IMPLIED WARRANTIES, GUARANTEES, STATEMENTS, REPRESENTATIONS OR INFORMATION PERTAINING TO THE PURCHASED ASSETS OR RELATING THERETO MADE OR FURNISHED BY SELLER OR ITS REPRESENTATIVES TO WHOMEVER MADE OR GIVEN, DIRECTLY OR INDIRECTLY, ORALLY OR IN WRITING, EXCEPT AS EXPRESSLY STATED HEREIN. BUYER ALSO ACKNOWLEDGES THAT THE PURCHASE PRICE REFLECTS AND TAKES INTO ACCOUNT THAT THE PURCHASED ASSETS ARE BEING SOLD “AS IS, WHERE IS, WITH ALL FAULTS.”

(c) BUYER ACKNOWLEDGES TO SELLER THAT BUYER WILL HAVE THE OPPORTUNITY TO CONDUCT PRIOR TO CLOSING SUCH INSPECTIONS AND INVESTIGATIONS OF THE PURCHASED ASSETS AS BUYER DEEMS NECESSARY OR DESIRABLE TO SATISFY ITSELF AS TO THE PURCHASED ASSETS AND ITS ACQUISITION THEREOF. BUYER FURTHER WARRANTS AND REPRESENTS TO SELLER THAT BUYER WILL RELY SOLELY ON ITS OWN REVIEW AND OTHER INSPECTIONS AND INVESTIGATIONS IN THIS TRANSACTION AND NOT UPON THE INFORMATION PROVIDED BY OR ON BEHALF OF SELLER, OR ITS AGENTS, EMPLOYEES OR REPRESENTATIVES WITH RESPECT THERETO. BUYER HEREBY ASSUMES THE RISK THAT ADVERSE MATTERS, INCLUDING, BUT NOT LIMITED TO, LATENT OR PATENT DEFECTS, ADVERSE PHYSICAL OR OTHER ADVERSE MATTERS, MAY NOT HAVE BEEN REVEALED BY BUYER’S REVIEW AND INSPECTIONS AND INVESTIGATIONS.

(d) BUYER ACKNOWLEDGES THAT SOME OF THE PURCHASED ASSETS DESCRIBED IN EXHIBIT 1.2 MAY CONTAIN THIRD-PARTY INTELLECTUAL PROPERTY THAT MAY HAVE BEEN LICENSED BY ASSIGNOR OR OTHERWISE ACQUIRED BY ASSIGNOR. BUYER UNDERSTANDS THAT SELLER MAY BE UNABLE TO TRANSFER INTELLECTUAL PROPERTY BELONGING TO A THIRD-PARTY WITHOUT THE EXPRESS WRITTEN CONSENT OF THAT THIRD-PARTY, WHICH CONSENT SHALL BE A CONDITION TO CLOSING UNDER THIS AGREEMENT. BUYER SHALL ACCEPT FULL RESPONSIBILITY FOR COMMUNICATING WITH ANY SUCH THIRD PARTIES WHOSE INTELLECTUAL PROPERTY IS INCLUDED IN THE PURCHASED ASSETS TRANSFERRED HEREBY. SELLER HAS ADVISED BUYER THAT SELLER SHALL NOT PAY ANY LICENSING OR OTHER FEES, COSTS, EXPENSES OR CHARGES THAT MAY BE ASSOCIATED WITH USING ANY SUCH PURCHASED ASSETS.

5.4 Litigation. To the best of Seller’s knowledge, there is no claim, action, arbitration, inquiry, investigation, suit or proceeding pending or, to Seller’s knowledge, threatened, against Seller or Assignor that might affect in any way any of the Purchased Assets or the transactions contemplated by this Agreement, nor is Seller aware or have grounds to know of any reasonable basis therefor. To the best of Seller’s knowledge, there are no judgments,

decrees, injunctions or orders of any court, governmental body, department, commission, agency, instrumentality or arbitrator against Seller or Assignor affecting the Purchased Assets.

5.5 Authorization for this Agreement. To the best of Seller’s knowledge, no authorization, approval, consent of, or filing with any governmental body, department, bureau, agency, public board, authority or other third party is required for the consummation by Seller of the transactions contemplated by this Agreement.

5.6 Assignee. All rights of Seller with regard to the ownership and possession of the Purchased Assets are rights held as assignee pursuant to the General Assignment made by Assignor. Pursuant to the General Assignment, Assignor has informed Seller that it transferred to Seller all of Assignor’s right, title and interest in and to the Purchased Assets. Pursuant to this Agreement, Seller, solely in its capacity as assignee, will at Closing sell, assign, and transfer all of its right, title and interest in and to the Purchased Assets to Buyer.

5.7 Contracts. Seller has made available to Buyer a copy of each material contract related to LNK101 to which Assignor is a party that is in Seller’s possession.

6. COVENANTS OF BUYER.

6.1 Confidential Information. All copies, if any, of financial information, pricing, marketing plans, business plans, and other confidential and/or proprietary information of Assignor and/or Seller disclosed to Buyer in the course of negotiating the transactions contemplated by this Agreement, including the terms of this Agreement (“Seller Confidential Information”), will be held in confidence and not be used or disclosed by Buyer or any of its employees, affiliates or stockholders, except to any public or private lender, for a period of six (6) months from the Effective Date and will (at Buyer’s election) be promptly destroyed by Buyer or returned to Seller, upon Seller’s written request to Buyer; provided, however, that from and after the Closing, the foregoing covenant shall not be applicable to any Seller Confidential Information included in the Purchased Assets. It is agreed that Seller Confidential Information will not include information that: (a) is proven to have been known to Buyer prior to receipt of such information from Seller; (b) is disclosed by a third party having the legal right to disclose such information and who owes no obligation of confidence to Seller; (c) is now, or later becomes, part of the general public knowledge or literature, other than as a result of a breach of this Agreement by Buyer; or (d) is independently developed by Buyer without the use of any Seller Confidential Information.

6.2 Press Releases and Public Announcements. Seller acknowledges that Buyer is subject to reporting obligations under the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the rules and regulations of NASDAQ. Consequently, Buyer may, in its sole discretion, disclose to the public such information related to this transaction that Buyer deems necessary or appropriate.

6.3 Taxes and any Other Charges Related to the Sale. Buyer agrees to promptly pay all sales, transfer, use or other taxes, duties, claims or charges imposed on and/or related to the sale of the Purchased Assets under this Agreement by any tax authority or other

governmental agency and to defend, indemnify and hold Seller harmless from and against any such taxes, duties, claims, or charges for payment thereof by any tax authority or other governmental agency. Buyer agrees that it will pay to the appropriate governmental agency any sales tax resulting from the sale of the Purchased Assets under this Agreement when due. Notwithstanding the foregoing, Buyer shall not be responsible for any income tax payable by Seller to any tax authority or governmental agency resulting from the sale of the Purchased Assets under this Agreement.

6.4 Survival of Covenants. The covenants set forth in this Section shall survive the Closing. The covenants set forth in Section 6.1 above shall, in addition, survive the termination of this Agreement for any reason.

7. COVENANTS OF SELLER.

Seller covenants and agrees with Buyer as follows:

7.1 Confidential Information. All copies, if any, of financial information, pricing, marketing plans, business plans, and other confidential and/or proprietary information of Buyer disclosed to Seller in the course of negotiating the transactions contemplated by this Agreement, including the terms of this Agreement (“Buyer Confidential Information”), will be held in confidence and not be used or disclosed by Seller or any of its employees, affiliates or members for a period of (2) two years from the Effective Date and will be promptly destroyed by Seller or returned to Buyer upon Buyer’s written request to Seller. It is agreed that Buyer Confidential Information will not include information that: (a) is proven to have been known to Seller prior to receipt of such information from Buyer; (b) is disclosed by a third party having the legal right to disclose such information and who owes no obligation of confidence to Buyer; (c) is now, or later becomes, part of the general public knowledge or literature, other than as a result of a breach of this Agreement by Seller; or (d) is independently developed by Seller without the use of any Buyer Confidential Information. The Letter Agreement entered into by Buyer and Seller, as of [***] (the “Letter Agreement”) shall continue to apply with respect to information furnished by Buyer or its representatives until [***].

7.2 Further Assurances. From and after the Closing Date, Seller shall promptly cooperate with Buyer and promptly sign and deliver to Buyer any and all such additional documents, instruments, endorsements and related information and take actions as Buyer may reasonably request for the purpose of effecting the transfer of Seller’s and/or Assignor’s title to the Purchased Assets to Buyer, and/or carrying out the provisions of this Agreement provided, however, that Seller shall be reimbursed for any significant costs and expenses incurred in providing such documents, instruments, endorsements or related information, which additional documents, instruments, endorsements or related information shall be prepared solely by Buyer.

7.3 Press Releases and Public Announcements. Seller shall not issue any press release or make any public disclosure or announcement relating to the financial terms of this Agreement or identify Buyer without Buyer’s prior written approval, which shall not be unreasonably withheld. Notwithstanding the foregoing, Seller may disclose certain information relating to this Agreement if required to do so by law or applicable governmental regulation, and

Seller shall be permitted, at its discretion, to prepare and distribute a tombstone regarding the General Assignment and this Agreement without mentioning the identity of Buyer or the terms of this Agreement.

7.4 Data Room Documentation. As promptly as practicable, and in any event within ten (10) business days after the Closing, Seller shall deliver to Buyer complete and correct digital copies (recorded on a USB or similar medium) of all documents and other materials made available to Buyer in the data room established by [***] for the purpose of disclosing to Buyer information, data, contracts, documents, and other materials pursuant to this Agreement related to Assignor.

7.5 Specific Performance. Seller hereby acknowledges and agrees that (a) the covenants and other obligations set forth in this Agreement were specifically bargained for by Buyer, and (b) if Seller fails to comply with any such covenant or other obligation, then Buyer will have no adequate remedy at law, as money damages will not be an adequate remedy and Buyer will be irreparably harmed. Accordingly, Seller hereby agrees that Buyer shall be entitled to specific performance, injunctive or other equitable relief from any court of competent jurisdiction (in each case, without any requirement to post a bond or other security or to prove irreparable harm) to cause Seller to comply with its covenants or other obligations or to enforce specifically, or prevent the breach of, any other agreement set forth in this Agreement.

7.6. Survival of Covenants. Each of the covenants set forth in this Section 7 shall survive the Closing.

8. CONDITIONS TO CLOSING.

8.1 Conditions to Buyer’s Obligations. Buyer’s obligations hereunder shall be subject to the satisfaction and fulfillment of each of the following conditions, except as Buyer may expressly waive the same in writing:

(a) Accuracy of Representations and Warranties on the Closing Date. The representations and warranties made herein by Seller shall be true and correct in all material respects, and not misleading in any material respect, on and as of the date given, and on and as of the Closing Date, with the same force and effect as though such representations and warranties were made on and as of the Closing Date.

(b) Compliance. As of the Closing Date, Seller shall have complied in all material respects with, and shall have fully performed, in all material respects, all conditions, covenants and obligations of this Agreement imposed on Seller and required to be performed or complied with by Seller at, or prior to, the Closing Date.

(c) Delivery of Purchased Assets. Seller shall have made the Purchased Assets available to Buyer as set forth in Section 1.3 above.

(d) Delivery of Closing Documents. Seller shall have delivered, and Buyer shall have received, the documents described in Section 9.2 hereof.

8.2 Conditions to Seller’s Obligations. The obligations of Seller hereunder shall be subject to the satisfaction and fulfillment of each of the following conditions, except as Seller may expressly waive the same in writing:

(a) Accuracy of Representations and Warranties on Closing Date. The representations and warranties made herein by Buyer shall be true and correct in all material respects, and not misleading in any material respect, on and as of the date given, and on and as of the Closing Date with the same force and effect as though such representations and warranties were made on and as of the Closing Date.

(b) Compliance. Buyer shall have complied in all material respects with, and shall have fully performed, the terms, conditions, covenants and obligations of this Agreement imposed thereon to be performed or complied with by Buyer at, or prior to, the Closing Date.

(c) Payment. Buyer shall have transmitted by wire transfer and Seller shall have received payment of the Purchase Price.

9. CLOSING OBLIGATIONS.

9.1 Buyer’s Closing Obligations. At the Closing, Buyer shall deliver to Seller each of the following:

(a) Payment of Three Million Seven Hundred Fifty Thousand Dollars ($3,750,000) by wire transfer.

(b) The Assignment and Bill of Sale Agreement, in the form attached hereto as Exhibit 9.1 (b), signed by an authorized officer of Buyer on behalf of Buyer.

(c) The Intellectual Property Assignment Agreement, in the form attached hereto as Exhibit 9.1 (c), signed by an authorized officer of Buyer on behalf of Buyer.

9.2 Seller’s Closing Obligations. At the Closing, Seller shall deliver to Buyer each of the following:

(a) The Purchased Assets in accordance with Section 1.3.

(b) The Assignment and Bill of Sale Agreement, in the form attached hereto as Exhibit 9.1 (b), signed by an authorized representative of Seller on behalf of Seller.

(c) The Intellectual Property Assignment Agreement, in the form attached hereto as Exhibit 9.1 (c), signed by an authorized representative of Seller on behalf of Seller.

(d) Evidence, in a form reasonably acceptable to Buyer, of the assignment and assumption agreements, filings, authorizations, consents, notices, and approvals required for the consummation of the transactions contemplated by this Agreement set forth on Exhibit 9.2(d), with Buyer having the responsibility to prepare and deliver to Seller or to file any such additional documents at Buyer’s expense.

(e) A properly completed and duly executed IRS Form W-9 with respect to Seller.

(f) Such other documents and instruments as may be reasonably requested by Buyer to consummate the transactions contemplated by this Agreement and to carry out the obligations under this Agreement, with Buyer having the responsibility to prepare and deliver to Seller any such additional documents and instruments at Buyer’s expense.

10. SURVIVAL OF WARRANTIES AND INDEMNIFICATION.

10.1 Survival of Warranties. All representations and warranties made by Buyer and Seller herein, or in any certificate, schedule or exhibit delivered pursuant hereto, shall terminate effective as of the Closing.

10.2 Indemnified Losses. For the purpose of this Section 10.2 and when used elsewhere in this agreement, “Loss” shall mean and include any and all liability, loss, damage, claim, expense, cost, fine, fee, penalty, obligation or injury including, without limitation, those resulting from any and all actions, suits, proceedings, demands, assessments, judgments, award or arbitration, together with reasonable costs and expenses including the reasonable attorneys’ fees and other legal costs and expenses relating thereto.

10.3 No Indemnification by Seller. Seller is selling to Buyer the Purchased Assets defined in this Agreement on an “AS IS” and “WHERE IS” basis, with no representations or warranties as to merchantability, fitness or usability or in any other regard (except for the limited representations and warranties specifically set forth above), and Seller does not agree to defend, indemnify or hold harmless Buyer, any parent, subsidiary or affiliate of Buyer or any director, officer, employee, stockholder, agent or attorney of Buyer or of any parent, subsidiary or affiliate of Buyer from and against and in respect of any Loss which arises out of or results from the transactions described herein.

10.4 No Indemnification By Buyer. Buyer does not agree to defend, indemnify or hold harmless Seller, any parent, subsidiary or affiliate of Seller, and any officers, directors, members, agents, managers, representatives, employees or attorneys of Seller or of any parent, subsidiary or affiliate of Seller from and against and in respect of any Loss which arises out of or results from the transaction described herein.

11. MISCELLANEOUS.

11.1 Expenses. Each of the parties hereto shall bear its own expenses (including without limitation attorneys’ fees) in connection with the negotiation and consummation of the transactions contemplated hereby.

11.2 Notices. Any notice required or permitted to be given under this Agreement shall be in writing and shall be personally delivered or sent by certified or registered United States mail, postage prepaid, or sent by a nationally recognized overnight express courier and addressed as follows:

(a) If to Seller:

Link (assignment for the benefit of creditors), LLC

3945 Freedom Circle, Suite 560

Santa Clara, California 95054

United States

Telephone: [***]

Facsimile: [***]

Email: [***]

Attention: [***]

With copy to:

LEVENE, NEALE, BENDER, YOO & GOLUBCHIK L.L.P.

2818 La Cienega Avenue

Los Angeles, California 90034

Telephone: [***]

Attention: [***]

Email: [***]

(b) If to Buyer:

Context Therapeutics Inc.

2001 Market Street, Suite 3915 Unit #15

Philadelphia, Pennsylvania 19103

Attention: [***]

Email: [***]

With copy to:

Faegre Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, Pennsylvania 19103

Attention: Walter J. Mostek

Email: [***]

11.3 Entire Agreement. This Asset Purchase Agreement (including the Schedules), the Exhibits hereto (which are incorporated herein by reference), the Letter Agreement, and any agreements to be executed and delivered in connection herewith, together constitute the entire agreement and understanding between the parties and there are no agreements or commitments with respect to the transactions contemplated herein except as set forth in this Agreement. This Agreement supersedes any prior offer, agreement or understanding between the parties with respect to the transactions contemplated hereby.

11.4 Amendment; Waiver. Any term or provision of this Agreement may be amended only by a writing signed by both Seller and Buyer. The observance of any term or provision of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively) only by a writing signed by the party to be bound by such waiver. No waiver by a party of any breach of this Agreement will be deemed to constitute a waiver of any other breach or any succeeding breach.

11.5 No Third Party Beneficiaries. Nothing expressed or implied in this Agreement is intended, or shall be construed, to confer upon or to give any person, firm or corporation, other than the parties hereto, any rights or remedies under or by reason of this Agreement.

11.6 Execution in Counterparts. For the convenience of the parties, this Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument. Facsimile or electronically transmitted signatures to this Agreement shall be as valid and binding as a signed original.

11.7 Benefit and Burden. This Agreement shall be binding upon, shall inure to the benefit of, and shall be enforceable by and against, the parties hereto and their respective successors and permitted assigns.

11.8 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of California (excluding application of any choice of law doctrines that would make applicable the law of any other state or jurisdiction) and, where appropriate, applicable federal law. All claims and disputes arising under or in connection with this Agreement, whether for or in respect of, breach of contract, tort, equity, or otherwise, shall be adjudicated exclusively in federal or state courts located in Santa Clara County, California, and each party waives its right to a trial by jury of any such claims or disputes.

11.9 Severability. If any provision of this Agreement is for any reason and to any extent deemed to be invalid or unenforceable, then such provision shall not be voided but rather shall be enforced to the maximum extent then permissible under then applicable law and so as to reasonably effect the intent of the parties hereto, and the remainder of this Agreement will remain in full force and effect.

11.10 Attorneys’ Fees. Should a suit or arbitration be brought to enforce or interpret any provision of this Agreement, the prevailing party shall be entitled to recover from the other party the prevailing party’s reasonable attorneys’ fees to be fixed in amount by the Court or the Arbitrator(s) (including without limitation costs, expenses and fees on any appeal). The prevailing party will be entitled to recover its costs of suit or arbitration, as applicable, regardless of whether such suit or arbitration proceeds to a final judgment or award.

11.11 Limitation of Liability. BUYER HEREBY RECOGNIZES, ACKNOWLEDGES AND AGREES THAT UNDER NO CIRCUMSTANCE MAY BUYER OR ANY OF ITS AFFILIATES ASSERT ANY CLAIM AGAINST OR SEEK ANY RECOVERY FROM ANY OFFICERS, DIRECTORS, MEMBERS, AGENTS, MANAGERS, REPRESENTATIVES OR EMPLOYEES OF SELLER OR ANY OF THE

OFFICERS, DIRECTORS, MEMBERS, AGENTS, MANAGERS, REPRESENTATIVES OR EMPLOYEES OF ANY MEMBER OR AFFILIATE OF SELLER ON ACCOUNT OF ANY ACTION OR INACTION OR FOR ANY REASON WHATSOEVER RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT, INCLUDING, BUT NOT LIMITED TO, AS A RESULT OF, ARISING OUT OF, OR IN ANY WAY RELATING TO ANY BREACH OF ANY REPRESENTATION, WARRANTY AGREEMENT OR COVENANT MADE BY OR TO BE PERFORMED BY SELLER UNDER THIS AGREEMENT.

11.12 Limitation of Remedy in Favor of Buyer. BUYER HEREBY AGREES THAT ITS SOLE REMEDY RESULTING FROM ANY BREACH OF ANY REPRESENTATION(S) OR WARRANTY(IES) PROVIDED BY SELLER HEREIN IS TO ASSERT A GENERAL UNSECURED CLAIM AGAINST SELLER’S ASSIGNMENT ESTATE FOR DAMAGES INCURRED BY BUYER AS A RESULT OF SUCH BREACH, WITH ANY SUCH CLAIM, TO THE EXTENT AGREED TO BY SELLER OR ALLOWED BY A COURT OF LAW, TO BE TREATED IN THE SAME MANNER AS ALL OTHER GENERAL UNSECURED CLAIMS ASSERTED AGAINST SELLER’S ASSIGNMENT ESTATE. BUYER HEREBY FURTHER AGREES THAT UNDER NO CIRCUMSTANCE MAY ANY SUCH CLAIM(S) ASSERTED BY BUYER EXCEED, IN THE AGGREGATE, THE PURCHASE PRICE OR BE ASSERTED AFTER THE ASSIGNMENT ESTATE’S CLAIMS BAR DATE, WHICH IS MAY 7, 2024.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, Buyer and Seller have executed and delivered this Asset Purchase Agreement by their duly authorized representatives as of the Effective Date.

| | | | | | | | | | | | | | |

| SELLER: | | | BUYER: | |

| | | | |

| Link (assignment for the benefit of | Context Therapeutics Inc. |

| creditors), LLC, solely as assignee for the | | |

| benefit of creditors of Link Immunotherapeutics, Inc. | | |

| | | | | | | | | | | | | | |

| By: /s/ Michael Maidy | | | By: /s/ Martin Lehr | |

| Name: Michael Maidy | | | Name: Martin Lehr | |

| Its: Manager | | | Its: Chief Executive Officer | |

| | | | |

EXHIBIT 1

General Assignment

EXHIBIT 1.2

Purchased Assets

SCHEDULE 3.1

Assumed Liabilities

EXHIBIT 9.1 (b)

ASSIGNMENT AND BILL OF SALE AGREEMENT

EXHIBIT 9.1 (c)

INTELLECTUAL PROPERTY ASSIGNMENT AGREEMENT

EXHIBIT 9.2 (d)

Assignment Evidence

Context Therapeutics Acquires Phase 1-ready T cell Engager CT-95

CT-95 is a potentially first-in-class mesothelin x CD3 bispecific antibody

Acquisition expands Context pipeline with second clinical-stage T cell engager for solid tumors

PHILADELPHIA, PA— July 10, 2024—Context Therapeutics Inc. (“Context” or the “Company”) (Nasdaq: CNTX), a biopharmaceutical company advancing medicines for solid tumors, today announced that it has entered into an asset purchase agreement under which the Company has acquired CT-95, formerly owned by Link Immunotherapeutics, Inc. (“Link”), a mesothelin (“MSLN”) x CD3 T cell engaging (“TCE”) bispecific antibody with first-in-class potential that has received Investigational New Drug (“IND”) clearance from the U.S. Food and Drug Administration. CT-95 is on track for Phase 1 initiation in the first quarter of 2025.

“We are thrilled to add CT-95, formerly known as LNK101, to our pipeline. The successful acquisition of this MSLN x CD3 bispecific antibody is consistent with our focus on building a pipeline of TCE assets to treat solid tumors,” said Martin Lehr, CEO of Context. “Context identified MSLN as a target of interest due to its high prevalence in underserved solid cancers, including ovarian, lung, and pancreatic. Based on the compelling preclinical data generated to date, we believe that CT-95 has the potential to be both a first-in-class and best-in-class MSLN-targeting TCE.”

Mr. Lehr continued, “CT-95 is an IND-cleared asset that we plan to rapidly progress into clinical trials. We intend to fund the acquisition of CT-95 and its advancement through the dose escalation portion of a Phase 1 clinical trial with Context’s existing cash.”

About CT-95

MSLN is a membrane protein overexpressed by many cancers with limited expression in normal tissues. One challenge in developing MSLN-targeted therapies has been the presence of a shed MSLN sink found in both blood and the tumor microenvironment. CT-95 is a fully humanized bispecific TCE that employs an IgG-scFv architecture with an effector-silenced IgG1 backbone and has a relatively low affinity but high avidity for membrane-bound MSLN, minimizing the impact of the shed sink. CT-95 is being developed as a therapy for advanced cancers associated with MSLN expression.

About Context Therapeutics®

Context Therapeutics Inc. (Nasdaq: CNTX) is a biopharmaceutical company advancing medicines for solid tumors. The Company is building an innovative portfolio of clinical-stage T cell engaging bispecific therapeutics, including CTIM-76, a selective Claudin 6 (CLDN6) x CD3 bispecific antibody, and CT-95, a potential first-in-class mesothelin x CD3 bispecific antibody.

Context is headquartered in Philadelphia. For more information, please visit www.contexttherapeutics.com or follow the Company on X (formerly Twitter) and LinkedIn.

Forward-looking Statements

This press release contains “forward-looking statements” that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, included in this press release regarding strategy, future operations, prospects, plans and objectives of management, including words such as “may,” “will,” “expect,” “anticipate,” “look forward,” “plan,” “intend,” and similar expressions (as well as other words or expressions referencing future events, conditions, or circumstances) are forward-looking statements. These include, without limitation, statements regarding (i) our expectation to rapidly progress CT-95 into clinical trials, including Phase 1 initiation in the first quarter of 2025, (ii) our expectation to fund the acquisition of CT-95 and its advancement through the dose escalation portion of a Phase 1 clinical trial with our existing cash, (iii) the potential benefits, characteristics, safety and side effect profile of CT-95, (iv) the ability of CT-95 to have benefits, characteristics, manufacturability, and a side effect profile that is differentiated and/or better than third party product candidates, (v) the likelihood data will support future development of CT-95, and (vi) the likelihood of obtaining regulatory approval for CT-95. Forward-looking statements in this release involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, and we therefore cannot assure you that our plans, intentions, expectations, or strategies will be attained or achieved. Other factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this press release are discussed in our filings with the U.S. Securities and Exchange Commission, including the section titled “Risk Factors” contained therein. Except as otherwise required by law, we disclaim any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events, or circumstances or otherwise.

Media Contact:

Gina Mangiaracina

6 Degrees

917-797-7904

gmangiaracina@6degreespr.com

Investor Relations Contact:

Jennifer Minai-Azary

Context Therapeutics

IR@contexttherapeutics.com

July 2024 Corporate Presentation Advancing Medicines for Solid Tumors

Important Notice and Disclaimers Except for statements of historical fact, any information contained in this presentation may be a forward-looking statement that reflects the Company’s current views about future events and is subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or the Company’s actual activities or results to differ significantly from those expressed in any forward-looking statement. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “plan”, “predict”, “expect”, “estimate”, “anticipate”, “intend”, “goal”, “strategy”, “believe”, “could”, “would”, “potential”, “project”, “continue” and similar expressions and variations thereof. Forward-looking statements may include statements regarding the Company’s business strategy, cash flows and funding status, potential growth opportunities, clinical development activities, the timing and results of preclinical research, clinical trials and potential regulatory approval and commercialization of product candidates. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the Company cannot guarantee future events, results, actions, levels of activity, performance or achievements. Any forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the heading “Risk Factors” in documents the Company has filed with the SEC. Any forward-looking statements speak only as of the date of this presentation and the Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. This presentation discusses product candidates that are under preclinical and clinical study, and which have not yet been approved for marketing by the U.S. Food and Drug Administration. No representation is made as to the safety or effectiveness of these product candidates for the use for which such product candidates are being studied. While the Company believes its internal research is reliable, such research has not been verified by any independent source. All the scientific, preclinical and clinical data presented within this presentation are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such products. Forward Looking Statement Executive Summary Context Therapeutics Inc. - July 20242

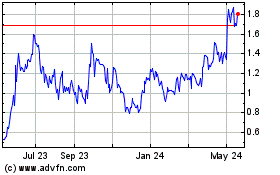

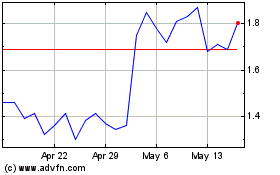

Building a T cell Engager (TCE) Pipeline Executive Summary Context Therapeutics Inc. - July 20243 TCEs are Gaining Momentum Recent TCE clinical data demonstrates promising efficacy and safety in solid tumors • Clinical activity across a broad range of targets, including Claudin 18.2, DLL3, PSMA, and STEAP1 • Responses in “cold” tumors, including neuroendocrine, pancreatic, prostate, and small cell lung cancer • Promising safety with low rate of Grade ≥ 3 cytokine release syndrome (CRS) Potentially Best-in-Class Assets CTIM-76: Claudin 6 (CLDN6) x CD3 bispecific antibody • CLDN6 is overexpressed in ovarian, endometrial, lung, and other solid tumors • CTIM-76 was designed to bind selectively to CLDN6 over similar claudin family members, including CLDN3/4/9 CT-95: Mesothelin (MSLN) x CD3 bispecific antibody • MSLN is overexpressed in ovarian, pancreatic, lung, and other solid tumors • CT-95 was designed to bind selectively to membrane-bound MSLN to enhance drug exposure and activity Well Capitalized Strong financial position with high quality investor base • $100M private placement in May 2024 • Anticipated cash runway into 2028

Executive Summary Pipeline Context Therapeutics Inc. - July 20244 PROGRAM TARGET ADDRESSABLE MARKET (U.S. ONLY) PRECLINICAL PHASE 1 PHASE 2 PHASE 3 RECENT & ANTICIPATED MILESTONES CTIM-76 Claudin 6 (CLDN6) > 50,000 patients IND cleared April 2024 First patient dose expected Mid 2024 CT-95 Mesothelin (MSLN) > 100,000 patients Asset acquisition July 2024 First patient dose expected 1Q 2025 CTIM-76: CLDN6 x CD3 CT-95: MSLN x CD3 • Highly selective for CLDN6 over CLDN3/4/9 • Potent CD3 induction without broad cytokine activation α-MSLN Fab α-CD3 scFv α-CLDN6 Fab α-CD3 scFv • Avidity optimized to avoid shed (soluble) MSLN sink • Sterically hindered CD3 to avoid T cell crosslinking

CT-95 Acquisition Rationale Executive Summary Context Therapeutics Inc. - July 20245 Portfolio Alignment • Bispecific T cell engager • Enriched in solid tumors High-quality Asset • Potentially first-in-class and best-in-class • Promising efficacy and safety in preclinical models Rapid Path to Clinical Proof of Concept • CT-95 is IND cleared • Drug product released and available for patient dosing Disciplined M&A • CT-95 asset purchase and Phase 1 dose escalation trial funded with existing cash

Rationale for T Cell Engagers Context Therapeut ics Inc . - Ju ly 20246

T Cell Engaging Bispecific Antibodies TCEs are engineered to activate an immune response against cancer Rationale for T Cell Engagers Context Therapeutics Inc. - July 20247 Mechanism of Action • T cell engagers are antibodies engineered to redirect the immune system’s T cells to recognize and kill cancer cells • They are designed to bind to a target antigen expressed on a cancer cell and to an immune activator on T cells, such as CD3 • These therapeutic molecules then engage T cells that are present in tumors but not capable of recognizing cancer cells, redirecting their activity toward the tumor T Cell Cancer Cell TCE Bispecific Antibody Target Antigen CD3 Cancer Cell Killing

Realizing the Full Potential of T cell Engagers (TCE) Rationale for T Cell Engagers Context Therapeutics Inc. - July 20248 Poor antigen selection Rapid T cell induction Short half-life Few TCE platforms; not customizable Tumor restricted antigens Premedication + step-dosing Therapeutic half-life Many TCE platforms; customizable 1 2 3 4 1 2 3 4 Historical Challenges Our Solution

TCE Bispecifics are Gaining Momentum Recent data supports promising efficacy with low rate of Grade ≥ 3 cytokine release syndrome (CRS) Asset Tarlatamab (AMG757) HPN328 IBI389 JANX007 Xaluritamig (AMG509) Bispecific Format HLE BiTE (truncated Fc) TriTAC (albumin) 1 +1 TRACTr (albumin) XmAb 2 x 1 Target x Effector DLL3 x CD3 DLL3 x CD3 CLDN18.2 x CD3 PSMA x CD3 STEAP1 x CD3 Indication Small Cell Lung Small Cell Lung Pancreatic Prostate Cancer Prostate Cancer Normal tissue expression Absent or limited Absent or limited Gastrointestinal (GI) Brain, endocrine, GI, pancreas, prostate, skin, marrow Brain, respiratory, prostate CD3 Detuning No No Moderate (~10x) Masked Moderate (~7x; 27 vs 4 nM) Stage Phase 2 Phase 1b Phase 1 Phase 1a Phase 1 Selected Cohorts 10 mg 1st step dose ≥ 6 mg 600 µg/kg (RP2D) 1st dose ≥ 0.1 mg 1st step dose ≥ 0.2 mg Target dose ≥ 0.75 mg Patients (n) 100 19 27 18 6 44 Efficacy ORR: 40% mPFS: 4.9 months ORR: 32% ORR: 29% (IHC 2+/3+ ≥10%) ORR: 38% (IHC 2+/3+ ≥40%) PSA50: 56% PSA90: 6% PSA50: 83% PSA90: 17% PSA50: 59% PSA90: 36% ≥ G3 CRS 1% 3% 0% 0% 0% 2% ≥ G3 TRAEs n.d. 25% 61% 28% 17% 55% Reference Ahn 2023 ESMO 2023 ASCO 2024 12 Feb 2024 data cutoff 12 Feb 2024 data cutoff Kelly 2023 Rationale for T Cell Engagers Context Therapeutics Inc. - July 20249 Information provided in the table above as of June 10, 2024 and is for illustrative purposes only and is not a head-to-head comparison. Differences exist between study or trial designs and subject characteristics, and caution should be exercised when comparing data across studies.

CTIM-76 CLDN6 x CD3 bispecific antibody Context Therapeut ics Inc . - Ju ly 202410

CLDN6 is an Oncofetal Protein Oncofetal proteins are considered favorable candidates for immunotherapy • Normally present at higher levels during embryonic development • Turned off or have low levels of expression in adult tissues • Increased expression across many solid tumors CTIM-76 Program Context Therapeutics Inc. - July 202411 Oncofetal Characteristics of CLDN6 Huan, Mol Med Reports, 2021

CLDN6 Therapies Have the Potential to Reach a Large Patient Population >50,000 patients per year in the US only in Relapse/Refractory (R/R) Setting CTIM-76 Program 12 Context Therapeutics Inc. - July 2024 Initial indications of interest based on: • CLDN6 prevalence • Patient population size • Observed clinical responses • Potential accelerated pathway Selected Cancer indications Incidence R/R Incidence CLDN6 Positive Patient Population Based on R/R Incidence Endometrial 65,900 14,000 51%1 7,140 Ovarian 19,900 12,800 44%1 5,632 Testicular 9,910 400 94%1 376 Non-Small Cell Lung 201,229 110,653 26%1 28,769 Breast 290,600 43,800 2-41%2,8,9 9,417 Gastric 26,380 11,090 13-55%6,7 3,771 Sarcoma 17,100 12,390 20%11 2,478 Glioma 19,000 10,000 21%6 2,100 Bladder 81,180 17,100 2-8%2,10 855 Small Cell Lung 35,511 19,527 2%2 391 Malignant Rhabdoid 50 500 29-44%2,3-5 183 1 Context internal data; 2 Reinhard, Science, 2020; 3 Wang, Diagn Pathol., 2013; 4 Micke, Intl J Cancer, 2014; 5 Soini, Pol J Path, 2022; 6 Antonelli, Brain Pathol., 2011; 7 Sullivan, Am J Surg Pathol., 2012; 8 Jia, Intl J Clin Exp Pathol., 2019; 9 Yafang, J Breast Cancer, 2011; 10 Ushiku, Histopath., 2012; 11 Mackensen, Nature Medicine, 2023. Incidences based on public estimates; Relapsed/refractory (R/R) or last-line patient population approximated by annual mortality; CLDN6 target prevalence is based on IHC or RNAseq from published reports. Patient population derived from midpoint of CLDN6 positive population multiplied by R/R incident population.

Developing a Highly Selective CLDN6 Antibody is Challenging CTIM-76 Program Context Therapeutics Inc. - July 202413 • CLDN6 antigen is conformationally dependent, which limits access to antibody-antigen binding • Antigen binding region is highly conserved with CLDN3, CLDN4, and CLDN9, making CLDN6- selective binding a challenge1 • CLDN6 selectivity is required to avoid off-target liabilities identified in murine knockout and knockdown studies with CLDN3 (intestine)2, CLDN4 (liver, pancreas)3, and CLDN9 (liver, ear)4 1 Screnci, Cancer Res, 2022; 2 Tanaka, J Hepatol, 2018; 3 Cordat, Physiology, 2019; Li, FEBS Open Bio, 2020; 4 Nakano, PLoS Genet, 2009 Human CLDN Family Tree

CTIM-76: Claudin 6 x CD3 T cell Engaging (TCE) Bispecific Antibody Established bispecific format • Highly selective CLDN6 binding fragment antibody-binding (Fab) arm • Immunostimulatory CD3 binding single-chain fragment variable (scFv) domain is functionally monovalent to avoid aberrant T-cell activation • The fragment crystallizable region (Fc region) is the tail region of an antibody that interacts with cell surface receptors called Fc receptors. A mutation has been inserted into the Fc domain to silence the Fc domain function and avoid T-cell activation by Fc-gamma receptor positive cells Potentially wide therapeutic window • T-cell dependent cellular cytotoxicity with no or minimal activation of circulating cytokines • Humanized CLDN6 and CD3 binding domains Ease of manufacturing • IgG1 backbone is highly stable and enables high yield CTIM-76 Program Context Therapeutics Inc. - July 202414 α-CLDN6 Fab α-CD3 scFv IgG1 backbone Silenced Fc

CTIM-76 Program CTIM-76: T cell engaging (TCE) CLDN6 x CD3 Bispecific Antibody Context Therapeutics Inc. - July 202415 Selectivity Potency In Vivo Efficacy • CTIM-76 CLDN6 EC50 of 3.41 nM (binding) • CTIM-76 preferentially binds to CLDN6 over CLDN3/4/9 • CLDN3/4/6/9 were transiently transfected in HEK-293F cells (4:1 Target:GFP) >10,000x • Potency assay provides a better assessment for a TCE bispecific than binding assays for off-target liabilities associated with CLDN3, CLDN4, or CLDN9 • CTIM-76 CLDN6 EC50 of 0.0004 nM (cytotoxicity) • CTIM-76 preferentially targets CLDN6, with minimal binding and cytotoxicity against CLDN9-expressing cells >500x 0 150 300 450 600 0 7 14 21 Tu m or V ol um e (m m 3) Day Vehicle 0.01mg/kg 0.1mg/kg 1.0mg/kg Tumor Regression • CTIM-76 effectively engaged systemically administered human PBMC cells to promote significant tumor regression and complete responses in OVCAR3 (~96,000 CLDN6 copies per cell) ovarian xenograft models in mice • CTIM-76 was well tolerated in OVCAR3 xenograft study • NSG-b2m knockout mice (n=14/arm) engrafted with human PBMCs and bearing advanced subcutaneous OVCAR3 tumor xenografts were treated twice per week

CTIM-76 Phase 1a/b Study An open-label, multi-center, dose escalation / expansion, safety, and PK study • Target population ̶ Platinum resistant ovarian cancer ̶ Endometrial and testicular cancer relapsed to standard of care • Biomarker stratification ̶ CLDN6+ positive (10% ≥ 1+) ovarian and endometrial ̶ Due to high CLDN6 prevalence, testicular cancer does not require prospective screening • Trial objectives ̶ Assess safety and tolerability at increasing dose levels ̶ Pharmacokinetic and pharmacodynamic data ̶ Evaluate preliminary anti-tumor activity • Dosing and Administration ̶ Weekly IV infusion starting at 22.5 µg, corresponding to MABEL dose ̶ Premedication (steroid + NSAID) and step dosing to manage cytokine release syndrome (CRS) CTIM-76 Program 16 Dose Escalation: Single patient with step dosing Dose Escalation: 3 + 3 with step dosing (3-6 patients per cohort) MTD or RP2D Cancer type to be selected based upon Dose Escalation data; Two doses to be evaluated ≥ Grade 2 AE Part 2 – Dose Expansion (30 patients) Part 1 – Dose Escalation (40 patients) Context Therapeutics Inc. - July 2024 MABEL = minimum anticipated biological effect level; MTD = maximum tolerated dose; RP2D = recommended Phase 2 dose

CTIM-76 Competitive Landscape CLDN6 x CD3 T Cell Engaging Bispecifics CTIM-76 XmAb541 AMG794 SAIL66 NBL-028 Undisclosed Company Context Xencor Amgen Chugai NovaRock Beigene Stage IND Open IND Open Ph 1 (active, not recruiting)1 Ph 1 Ph 1 IND filed Dec 2023 Bispecific Format 1 + 1 2 + 1 HLE Bite Dual Specific Fab 1 + 1 n.d. CLDN6 Selectivity High Moderate / High2 High3 Moderate4 Moderate5 n.d. Preclinical Tolerability Well tolerated Well tolerated Poor tolerability Poor tolerability n.d. n.d. Avidity Enhanced No Yes No No No n.d. Target:CD3 Affinity 1 7 10 ~1,000 n.a. (targets CD137) n.d. Half-life 1 week 2 weeks < 1 week 3 weeks 2 weeks n.d. CTIM-76 Program Context Therapeutics Inc. - July 202417 1 Clinical trials.gov accessed on June 10, 2024 2 Faber, AACR 2021; Patent US11739144 3 Rucker, SITC 2023; Pham, AACR 2022; Patent WO2022096700 4 Kamikawa, SITC 2023; Patent WO2021006328 5 Tong, AACR 2022 N.D.= not disclosed. Information provided in the table above is for illustrative purposes only and is not a head-to- head comparison. Differences exist between study or trial designs and subject characteristics, and caution should be exercised when comparing data across studies.

CT-95 MSLN x CD3 bispecific antibody Context Therapeut ics Inc . - Ju ly 202418

MSLN Therapies Have the Potential to Reach a Large Patient Population >100,000 patients per year in the US only in Relapse/Refractory (R/R) Setting CT-95 Program 19 Context Therapeutics Inc. - July 2024 Selected Cancer indications Incidence R/R Incidence MSLN Positive MLSN Med/High Patient Population Based on R/R Incidence Non-Small Cell Lung 201,229 110,653 55% 36% 60,859 Pancreatic 66,440 51,750 80% 61% 41,400 Ovarian 19,900 12,800 90% 80% 11,520 Mesothelioma 3,000 2,500 70% 60% 1,750 Colon 152,810 53,010 41% 17% 21,734 Esophageal 22,370 16,130 41% 26% 6,613 Endometrial 65,900 14,000 45% 23% 6,300 Gastric 26,380 11,090 49% 23% 5,434 Breast (TNBC) 62,054 15,500 30% 18% 4,650 Cervical 13,820 4,360 42% 21% 1,831 Incidences based on public estimates; Relapsed/refractory (R/R) or last-line patient population approximated by annual mortality; MSLN target prevalence is based on Simon et al, Biomedicines, 2021. Patient population derived from MSLN positive population multiplied by R/R incident population. Initial indications of interest based on: • MLSN prevalence • Patient population size • Potential accelerated pathway

MSLN Target Biology Fragmented (shed) MSLN in tumor microenvironment requires a creative solution to overcome CT-95 Program Context Therapeutics Inc. - July 202420 • MSLN is bound to tumor cells via a GPI-anchor • Like many GPI-anchored proteins, MLSN can be cut into smaller fragments1,2 • Fragmented MLSN serves as a competitive sink, preventing antibodies from binding to the tumor, which can lead to suboptimal drug exposure and efficacy Challenge 1 Zhang, Transl Oncol, 2022; 2 Liu, Commun Biol, 2020; GPI = Glycosylphosphatidylinositol • 1st generation MSLN antibodies bind to shed MSLN fragments (e.g., HPN-536) • 2nd generation MSLN programs target epitopes close to the cell surface (e.g., CT-95) Solution Tumor Cell Cleavage Precursor MSLN Protein MSLN Fragment GPI GPI

CT-95: MSLN x CD3 T cell Engaging (TCE) Bispecific Antibody Novel design to overcome mesothelin (MSLN) sink • Binds to membrane-proximal MSLN • Cooperative binding results in high affinity binding of CT-95 to tumor Potentially wide therapeutic window • No crosslinking with shed MSLN, mitigating off-tumor T cell activation • Cooperative binding of MSLN on tumor surface crosslinks CD3, activating T cells Ease of manufacturing • IgG1 backbone is highly stable and enables high yield • Drug product ready for Phase 1 trial CT-95 Program Context Therapeutics Inc. - July 202421 α-MSLN Fab α-CD3 scFv IgG1 backbone Silenced Fc

Two-Pronged Approach to Overcoming Soluble MSLN Sink Challenge CT-95 Program Context Therapeutics Inc. - July 202422 Binds MSLN Epitope Close to Cell Surface Activates T cells Through Cooperative Binding + CD3 Potent T cell activationNo T cell activation No crosslinking with shed MSLN MSLN on tumor crosslinks CD3Far From cell surface Close To cell surface Amatuximab MORAb-009 mAb Anetumab BAY 94-9343 ADC CT-95 Binds membrane- proximal epitope T cell Tumor

Medium MSLN Expression 4k copies per cell High MSLN Expression 27k copies per cell CT-95 Intended to Overcome MSLN Sink Competitor program (HPN-536, Harpoon Therapeutics) binds to MSLN fragments in a dose proportional manner, limiting therapeutic exposure CT-95 Program Context Therapeutics Inc. - July 202423 CT-95 +10nM MSLN +30nM MSLN CT-95 +10nM MSLN +30nM MSLN HPN-536 +10nM MSLN +30nM MSLN HPN-536 +10nM MSLN +30nM MSLN HPN-536 clones are not derived from the original manufacturer and were produced for this research study based on the published sequence of their antibody variable chains; thus, the clones used in this study are biosimilars and may not be identical to the antibodies formulated for clinical development. α-MSLN α-CD3 α-MSLN α-CD3 albumin

CT-95 is Highly Active and Well Tolerated Across In Vivo Models Complete tumor regressions in mice at doses ≤ 0.05 mg/kg CT-95 Program Context Therapeutics Inc. - July 202424 Primary Lesion Model Metastatic Lesion Model OVCAR3 pre-passaged in mice to generate aggressive, metastatic tumor model Ovarian cancer line OVCAR3 flank implantation tumor model Vehicle Control CT-95 0.05 mg/kg Day 1 Day 70 Day 2 Day 16 Day 37 Vehicle Control CT-95 0.05 mg/kg CT-95 0.1 mg/kg CT-95 0.5 mg/kg

CT-95 Program CT-95 Competitive Landscape Context Therapeutics Inc. - July 202425 2nd Generation 1st Generation Company Context Zymeworks3 Numab4 Navrogen5 Harpoon AbbVie Asset CT-95 ZW171 NM28-2746 NAV-003 HPN-536 ABBV-428 Format 2 + 2 2 + 1 Trispecific 2 + 2 TriTAC 2 + 2 PK Enhancement Fc Fc Albumin Fc Albumin Fc Avoids MSLN sink ✘ ✘ High potency TCE ✘ ✘ Consistent half life ✘ ✘ Program Status Phase 1 start Q1 2025 Phase 1 start 2H 2024 Preclinical Preclinical Phase 1 (discontinued) Phase 1 (discontinued) 1st generation MSLN T cell engagers (TCE) were discontinued due to poor efficacy – HPN-536: poor drug exposure due to binding to shed MSLN and albumin1 – ABBV-428: 0% overall response rate at highest dose tested (3.6 mg/kg)2 1 Harpoon Therapeutics Corporate Presentation, 4 June 2021; 2 Fong, J Immunother Cancer, 2021; 3 Piscitelli, PEGS Boston, 2023; 4 Urech, Oncoimmunology, 2023; 5 Kline, Eur J Immunol, 2023. Information provided in the table above is for illustrative purposes only and is not a head-to-head comparison. Differences exist between study or trial designs and subject characteristics, and caution should be exercised when comparing data across studies.

Corporate 26 Context Therapeut ics Inc . - Ju ly 2024

Corporate Experienced Leadership Team • Experienced team • Our management team is supported by a Board with strong public company operating and governance experience Focus on Execution Martin Lehr CEO and Director Alex Levit, Esq Chief Legal Officer Jennifer Minai, CPA Chief Financial Officer Chris Beck, MBA SVP Operations Context Therapeutics Inc. - July 202427

Corporate Investment Highlights (Nasdaq: CNTX) Solid Tumors Large Unmet Need Claudin 6 + Mesothelin High-Value Targets CTIM-76 first patient mid-2024 CT-95 first patient Q1 2025 Anticipated Milestones Oncology experience Strong Team Expected cash runway into 2028 Cash Runway Context Therapeutics Inc. - July 202428

Advancing Medicines for Solid Tumors © Context Therapeutics 2024

v3.24.2

Cover

|

Jul. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 09, 2024

|

| Entity Registrant Name |

Context Therapeutics Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40654

|

| Entity Tax Identification Number |

86-3738787

|

| Entity Address, Address Line One |

2001 Market Street,

|

| Entity Address, Address Line Two |

Suite 3915

|

| Entity Address, Address Line Three |

Unit #15

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19103

|

| City Area Code |

(267)

|

| Local Phone Number |

225-7416

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CNTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001842952

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |