UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

(Amendment

No.)

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of

the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under

§240.14a-12 |

CODA

OCTOPUS GROUP, INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of filing fee (Check the appropriate box):

| |

☒ |

No fee required. |

| |

|

|

| |

☐ |

Fee computed on table below

per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| |

(1) |

Title of each class of

securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities

to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate

value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

☐ |

Fee paid previously with

preliminary materials: |

| |

|

|

| |

☐ |

Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration

Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

CODA

OCTOPUS GROUP, INC.

3300

S Hiawassee Rd., Suite 104-105

Orlando,

Florida 32835

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Our Stockholders:

You

are cordially invited to attend the 2024 Annual Meeting of Stockholders of Coda Octopus Group, Inc. (the “Company”) to be

held at 12:00 p.m., Eastern Time, on Wednesday, September 4, 2024. This year’s annual meeting will be held via live audio webcast

on the internet. You will be able to participate virtually, vote and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/CODA2024.

You will not be able to attend the annual meeting physically. At the annual meeting, we will ask our stockholders:

| 1. |

To

elect seven directors to serve until the annual meeting of stockholders in 2025 or until their respective successors have

been duly elected and qualified; |

| |

|

| 2. |

To vote on a proposal to

ratify the appointment of Frazier & Deeter, LLC as the Company’s independent registered public accounting firm for 2024; |

| |

|

| 3. |

To vote, on an advisory

basis, on a proposal to approve the compensation of our named executive officers; and |

| |

|

| 4. |

To transact such other

business as may properly come before the meeting. |

Only

stockholders of record at the close of business on July 30, 2024, are entitled to notice of and to vote at the Annual Meeting or any

postponements or adjournments thereof.

YOUR

VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we encourage you to complete and return your proxy card

or voting instruction form at your earliest convenience.

| |

By Order of the Board of Directors |

| |

|

| |

|

| |

Annmarie Gayle |

| |

Chairman and Chief Executive Officer |

Orlando,

Florida

August

12, 2024

CODA

OCTOPUS GROUP, INC.

3300

S Hiawassee Rd., Suite 104-105

Orlando,

Florida 32835

PROXY

STATEMENT

General

We

are providing this proxy statement in connection with the solicitation by the Board of Directors of Coda Octopus Group, Inc. of proxies

to be voted at our Annual Meeting of Stockholders and at any postponement or adjournment of the meeting. Our Annual Meeting will be held

on September 4, 2024, at 12:00 p.m., Eastern Time.

This

year’s annual meeting will be a virtual meeting via live audio webcast on the Internet. You will be able to attend the annual meeting,

vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CODA2024 and entering the 16-digit

control number included in the Notice of Internet Availability or proxy card that you receive.

Our

proxy materials are being made available to our stockholders beginning on or about August 12, 2024.

Solicitation

of proxies on behalf of the Board of Directors may be made by our employees through the mail or in person. We will pay all costs of the

solicitation. We also will reimburse brokerage houses and other nominees for their reasonable expenses in forwarding proxy materials

to beneficial owners.

Outstanding

Securities and Voting Rights

Only

holders of record of our common stock at the close of business on July 30, 2024, the record date, will be entitled to notice of,

and to vote at, the Annual Meeting. On the record date, 11,178,933 shares of our common stock were issued and outstanding.

Each

holder of record of our common stock as of the record date is entitled to cast one vote per share. The presence, via the Internet or

by proxy, at the annual meeting of the holders of a majority of the outstanding shares of our common stock entitled to vote is necessary

to constitute a quorum at the Annual Meeting. Directors are elected by a plurality of the votes cast. Abstentions, although counted for

purposes of determining whether there is a quorum, will have no effect on the vote. In addition, where brokers are prohibited from exercising

discretionary authority in voting on a matter because beneficial owners have not provided voting instructions (commonly referred to as

“broker non-votes”), the broker-non-votes will have no effect on the vote. However, if shares are deemed represented for

any purpose at the meeting (for example, with respect to a matter for which a broker is permitted to exercise discretionary voting authority),

the shares will be counted for purposes of determining whether there is a quorum at the meeting.

Under

Delaware law, our stockholders are not entitled to rights of appraisal on any proposal referred to herein.

How

to Vote

Stockholders

of record holding shares of Coda Octopus Group, Inc. as of the close of business on July 30, 2024, are entitled to vote at the

Annual Meeting.

You

may submit a proxy to vote your Shares in advance of the Annual Meeting by any of the following means:

| |

● |

Internet: Please

log on to www.proxyvote.com and submit a proxy to vote your Shares by 11:59 p.m., Eastern Time, on September 3, 2024. |

| |

|

|

| |

● |

Telephone: Please

call 1-800-690-6903 until 11:59 p.m., Eastern Time, on September 3, 2024. |

| |

● |

Mail: If

you received printed copies of the proxy materials, please complete, sign, date and return your proxy card by mail so that it is

received by Coda Octopus Group, Inc., c/o Broadridge Financial Solutions, Inc., prior to the Annual Meeting. |

| |

|

|

| |

● |

Annual Meeting: You may

attend the Annual Meeting and cast your vote at www.virtualshareholdermeeting.com/CODA2024. |

Beneficial

Owners or Holders in Street Name

If

your Shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are a holder of Shares

in “street name” or a “beneficial owner.” The organization holding your account will have provided you with proxy

materials. As the beneficial owner, you have the right to direct the organization how to vote the Shares held in your account. You may

submit voting instructions by following the instructions provided to you by your broker, bank or nominee. You may also vote by attending

the Annual Meeting at www.virtualshareholdermeeting.com/CODA2024 and using your Control Number.

If

you are a holder of Shares in street name and you do not submit voting instructions to your broker, bank or other intermediary, the intermediary

generally may vote your Shares in its discretion only on routine matters. Intermediaries do not have discretion to vote their clients’

Shares on non-routine matters in the absence of voting instructions from the beneficial owner. At the Annual Meeting, only Proposal 2

(ratification of the independent auditor) is considered routine and may be voted upon by the intermediary if you do not submit voting

instructions. All other proposals on the Agenda for the Annual Meeting are non-routine matters, and intermediaries may not use their

discretion to vote on these proposals in the absence of voting instructions from you. These “broker non-votes” will not affect

the outcome of the vote with respect to Proposals 1 and 3. There will be no broker non-votes associated with Proposal 2, as the ratification

of our independent registered public accounting firm is a routine matter. As a result, if your Shares are held in street name and you

do not give your bank or broker instructions on how to vote, your shares will be voted by the broker in its discretion.

Changing

Your Vote or Revoking Your Proxy

If

you are a stockholder of record and wish to revoke your proxy instructions, you must either (1) subsequently submit a proxy via the Internet

or by telephone, which will be available until 11:59 p.m., Eastern Time, September 3, 2024; (2) sign, date and deliver a later-dated

proxy card so that it is received before the Annual Meeting; (3) submit a written revocation; (4) send a notice of revocation via the

Internet at www.proxyvote.com; or (5) attend the Annual Meeting and vote your Shares. If you hold your shares in street name,

you must follow the instructions of your broker, bank or other intermediary to revoke your voting instructions.

Vote

Tabulation

Votes

will be tabulated by Broadridge Financial Solutions, Inc.

Results

of the Vote

We

expect to announce preliminary voting results at the Annual Meeting and publish preliminary or final voting results in a Form 8-K within

four business days following the Annual Meeting. If only preliminary voting results are available for reporting in the Form 8-K, the

Company will amend the Form 8-K to report final voting results within four business days after the final voting results are known.

PROPOSAL

1. ELECTION OF DIRECTORS

Nominees

for Election

At

the annual meeting, seven directors are to be elected for a term expiring at our 2024 annual meeting or until their successors have been

duly elected and qualified.

The

Board of Directors believes that its nominees described below will be able to serve as directors, if elected. If any nominee is unable

to serve, proxies will be voted for the election of such other person as the Board of Directors may recommend.

Set

forth below is certain information concerning the nominees for election as directors:

| Name |

|

Age |

|

Position |

| Annmarie Gayle |

|

60 |

|

Chairman |

| Michael Hamilton |

|

77 |

|

Director |

| G. Tyler Runnels |

|

67 |

|

Director |

| Anthony J. Tata |

|

64 |

|

Director |

| Robert R. Harcourt |

|

79 |

|

Director |

| Gwenaël Rouy-Poirier |

|

50 |

|

Director |

| Dr.

Angus McFadzean |

|

59 |

|

Director |

Annmarie

Gayle has been our Chief Executive Officer and a member of the Board of Directors since 2011 and our Chairman since March 2017.

She is also our Chief Executive Officer for our flagship products business, Coda Octopus Products, Limited (UK) since 2013. Prior thereto,

she spent two years assisting with the restructuring of our Company. She previously served with the Company as Senior Vice President

of Legal Affairs between 2006 and 2007. Earlier in her career she worked for a leading City-London law firm specializing in Intellectual

Property Rights, the United Nations and the European Union. Ms. Gayle has a strong background in restructuring and has spent more than

12 years in a number of countries where she has been the lead adviser to a number of transitional administrations on privatizing banks

and reforming state-owned assets in the Central Eastern European countries including banking, infrastructure, mining and telecommunications

assets. Ms. Gayle, in the capacity of Team Leader, has also managed a number of large European Union funded projects providing

transitional support and capacity to the local transitional authorities. Ms. Gayle holds a Law degree gained at the University

of London and a Master of Law degree in International Commercial Law from Cambridge University and has completed her professional law

exams to practice law in England & Wales. Because of her wealth of experience in corporate governance, large scale project management,

restructuring, strategy, structuring and managing corporate transactions and her knowledge of the business, its technology and patent portfolio, we believe that she is highly qualified to be a member

of our Board of Directors.

Michael

Hamilton was our Chairman of the Board between June 2010 and March 2017. He is currently serving as an independent director of

our Board. Since 2014, Mr. Hamilton has provided accounting and valuation services for a varied list of clients. He was Senior Vice President

of Powerlink Transmission Company from 2011 through 2014. From 1988 to 2003, he was an audit partner at PricewaterhouseCoopers. He holds

a Bachelor of Science in Accounting from St. Frances College and is a certified public accountant and is accredited in business valuation.

Because of Mr. Hamilton’s background in auditing, strategic corporate finance solutions, financial management and financial reporting,

we believe that he is highly qualified to be a member of our Board of Directors.

G.

Tyler Runnels was elected as a director at the 2018 annual meeting. Mr. Runnels has over 30 years of investment banking

experience including debt and equity financings, private placements, mergers and acquisitions, initial public offerings, bridge financings,

and financial restructurings. Since 2003 Mr. Runnels has been the Chairman and Chief Executive Officer of T.R. Winston & Company,

LLC, an investment bank and member of FINRA, where he began working in 1990. Mr. Runnels was an early-stage investor in our company and

T.R. Winston & Company, LLC. Mr. Runnels has successfully completed and advised on numerous transactions for clients in a variety of industries,

including healthcare, oil and gas, business services, manufacturing, and technology. Mr. Runnels is also responsible for working with

high-net-worth clients seeking to diversify their portfolios to include real estate products through established relationships with real

estate brokers, accountants, attorneys, qualified intermediaries and financial advisors. Prior to joining T.R. Winston & Co., LLC,

Mr. Runnels held the position of Senior Vice President of Corporate Finance for H.J. Meyers & Company, a regional investment bank.

Mr. Runnels received a B.S. and MBA from Pepperdine University. Mr. Runnels holds FINRA Series 7, 24, 55, 63 and 79 licenses.

Brigadier

General Anthony J. Tata (U.S. Army, Retired) was elected as a director in June 2023. He has been the Chief Executive Officer

of Tata Leadership Group, a consulting firm, and the managing partner of Boundary Channel Partners since 2021. Prior thereto, he performed

the duties of Undersecretary of Defense for Policy, the number three position in the United States Department of Defense, where he implemented

the National Defense Strategy and worked closely with allies and partners to achieve strategic defense goals globally. His distinguished

military career includes commands in the 82nd Airborne and 101st Airborne Divisions and the 10th Mountain

Division. His military awards include the bronze star, combat action badge, ranger tab, master parachutist badge, and department of defense

award for distinguished public service. From 2009 to 2015, he served as North Carolina’s Secretary of Transportation, Superintendent

of Wake County Public School System (Raleigh, NC/Research Triangle), and Chief Operating Officer of Washington, DC Public Schools. As

Secretary of Transportation, he managed 72 airports, two seaports, three railroads, 22 ferries, 88,000 miles of highway, and 100 transit

systems. He was influential in changing state law to prioritize transportation projects that reduced congestion and travel time, increased

safety and multi-modal connections, and created jobs. As superintendent of the 15th largest public education system in the

country with 150,000 students, 170 schools, and 18,000 employees, he implemented innovative programming that led to the highest

gains in low-income student proficiency and growth in the history of the system. He serves as an advisor to The Franchise Consulting

Company where he participates in multiple franchising operations including the tech company Robot Labs. He is a West Point graduate with

a Bachelor of Science and he holds two master’s degrees from the U.S. Army’s School of Advanced Military Studies in operational

planning and from the Catholic University of America in international relations. He was also a distinguished national security fellow

at Harvard University’s JFK School of Government. Because of his broad operational experience in both the military and civilian

sectors, the Company believes that he is highly qualified to serve on the Board.

Robert

R. Harcourt was elected as a director in June 2023. He has been affiliated with Analysis Group and Cornerstone Research since

2018, where he provided consulting services to attorneys as a financial accounting and auditing expert on the appropriateness of accounting

matters and reporting and the adequacy of audit procedures. From 2011 to 2016, he was an Associate Director of the Division of Registrations

and Inspections at the Public Company Accounting Oversight Board, or PCAOB. From 1967 to 2011, he worked at KPMG, including as a partner

from 1978 and 2007, and as a consultant from 2007 to 2011. Mr. Harcourt is a certified public accountant. He holds a BBA in Accountancy

from Pace University and has completed course work at Harvard University and Stanford University, among others. Because of Mr. Harcourt’s

background in auditing, financial management and financial reporting, the Company believes that he is highly qualified to be a member

of the Board.

Gwenaël

Rouy-Poirier was elected as a director in April 2024. Since January 2024, he has been an independent consultant for companies

in the aerospace and defense sectors. From May to December 2023, he was Chief Financial Officer for SHL (Scandinavian Health Ltd.) Medical,

a private company backed up by private equity operating as a leading solutions provider in the design, development, and manufacturing

of advanced medical delivery devices such as autoinjectors and pen injectors. From April 2021 to December 2022, he was Chief Financial

Officer of GKN Aerospace, one of the world’s leading multi-technology Tier 1 aerospace suppliers, serving 90% of the world’s

aircraft and engine manufacturers. From 2019 to 2021, he was Chief Financial Officer of Nobel Biocare Systems, a premium dental implant

leader whose portfolio also included restorative solutions, dentist hardware equipment and digital treatment technologies. Prior thereto,

he worked for Honeywell mostly in the Aerospace division, as well as in the Homes & Building Technologies and Specialty Materials),

l’Oréal and Arthur Andersen, among others. He earned a Bachelor in Mathematics from Lycée Victor Duruy and a Master

of Management in Corporate Finance from EDHEC Business School in France. Because of his strong financial background and ties to the defense

industry, the Company believes that he is highly qualified to serve on the Board.

Dr.

Angus McFadzean became a director on July 1, 2024. He is one of the co-founders of the Company’s Marine Technology

Business and has been affiliated with the Company in various capacities since its inception in 1994. From 2013 until his retirement

in May 2024, Dr. McFadzean was the Research and Development Director of the Company’s Marine Technology subsidiary, where,

among other things, he was responsible for overseeing and managing the Marine Technology Business’ R&D Program including

developments relating to the Echoscope® and DAVD. He was also responsible for the Company’s Cyber Security Management

Program. Dr. McFadzean holds a master’s degree in electrical and electronic engineering as well as a Ph.D. from Heriot-Watt

University in Edinburgh, Scotland. Because of his deep knowledge of the Company’s technology, the Company believes that he is

highly qualified to serve on the Board.

Family

Relationships

None

of our Directors or Director nominees are related by blood, marriage, or adoption to any other Director, executive officer, or other

key employees.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF ITS NOMINEES FOR ELECTION AS A DIRECTOR.

CORPORATE

GOVERNANCE

Board

Leadership Structure

The

Board of Directors is currently chaired by the Chief Executive Officer of the Company, Annmarie Gayle. The Company believes that combining

the positions of Chief Executive Officer and Chairman of the Board of Directors helps to ensure that the Board of Directors and management

act with a common purpose. Integrating the positions of Chief Executive Officer and Chairman can provide a clear chain of command to

execute the Company’s strategic initiatives. The Company also believes that it is advantageous to have a chairperson with an

extensive history with, and knowledge of, the Company. Notwithstanding the combined role of Chief Executive Officer and Chairman, key

strategic initiatives and decisions involving the Company are discussed and approved by the entire Board of Directors. The Company believes

that the current leadership structure and processes maintains an effective oversight of management and independence of the Board of Directors

as a whole without separate designation of a lead independent director. However, the Board of Directors will continue to monitor its

functioning and will consider appropriate changes to ensure the effective independent function of the Board of Directors in its oversight

responsibilities.

Independence

of the Board of Directors and its Committees

After

review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its

senior management and its Independent Registered Public Accounting Firm, the Board of Directors has determined that all of the Company’s

directors are independent within the meaning of the applicable NASDAQ listing standards, except Ms. Gayle, the Company’s Chairman

and Chief Executive Officer, and Dr. McFadzean. The Board of Directors met _four___ times and acted by unanimous written consent

_four_ times during the fiscal year ended October 31, 2023. Each member of the Board of Directors attended all meetings of the

Board of Directors held in the last fiscal year during the period for which he or she was a director and of the meetings of the committees

on which he or she served in the last fiscal year during the period for which he or she was a committee member.

The

Board of Directors has three committees: the Audit Committee, the Compensation Committee and the Nominating Committee. Below is a description

of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable

rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with

his or her individual exercise of independent judgment with regard to the Company.

Audit

Committee

The

Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this

purpose, the Audit Committee performs several functions. The Audit Committee, among other things: evaluates the performance, and assesses

the qualifications, of the Independent Registered Public Accounting Firm; determines and pre-approves the engagement of the Independent

Registered Public Accounting Firm to perform all proposed audit, review and attest services; reviews and pre-approves the retention of

the Independent Registered Public Accounting Firm to perform any proposed, permissible non-audit services; determines whether to retain

or terminate the existing Independent Registered Public Accounting Firm or to appoint and engage a new independent registered Public

Accounting Firm for the ensuing year; confers with management and the Independent Registered Public Accounting Firm regarding the effectiveness

of internal control over financial reporting; establishes procedures as required under applicable law, for the receipt, retention and

treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential

and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements

to be included in the Company’s Annual Report on Form 10-K and the Company’s periodic quarterly filings on Form 10-Q, recommends

whether or not such financial statements should be so included; and discusses with management and the Independent Registered Public Accounting

Firm the results of the annual audit and review of the Company’s quarterly financial statements.

The

Audit Committee is currently composed of four directors: Michael Hamilton (Chairman), Robert Harcourt, Anthony Tata and Gwenael Rouy-Poirier.

The Audit Committee met four times during the fiscal year ended October 31, 2023. The Audit Committee Charter is available on the Company’s

website, www.codaoctopusgroup.com.

The

Board of Directors periodically reviews the NASDAQ listing standards’ definition of independence for Audit Committee members and

has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule

5605(c)(2)(A) of the NASDAQ listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act, as amended). The Board of Directors

has determined that Michael Hamilton qualifies as an “audit committee financial expert,” as defined in applicable SEC rules.

The Board of Directors made a qualitative assessment of Mr. Hamilton’s level of knowledge and experience based on a number of factors,

including his formal education and his service in executive capacities having financial oversight responsibilities.

Compensation

Committee

The

Compensation Committee of the Board of Directors reviews, modifies and approves the overall compensation strategy and policies for the

Company. The Compensation Committee, among other things, reviews and approves corporate performance goals and objectives relevant to

the compensation of the Company’s officers; determines and approves the compensation and other terms of employment of the Company’s

Chief Executive Officer; determines and approves the compensation and other terms of employment of the other officers of the Company;

and administers the Company’s stock option and purchase plans, pension and profit sharing plans and other similar programs.

The

Compensation Committee is composed of four outside directors: Michael Hamilton (Chairman), Robert Harcourt, G. Tyler Runnels and Gwenael

Rouy-Poirier. All members of the Compensation Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the

NASDAQ listing standards). The Compensation Committee met _three times during the fiscal year ended October 31, 2023. The Compensation

Committee Charter is available on the Company’s website at: www.codaoctopusgroup.com.

Compensation

Committee Interlocks and Insider Participation

No

member of our compensation committee has at any time been an employee of ours. None of our executive officers serves as a member of the

board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of

directors or compensation committee.

Nominating

Committee

The

Nominating Committee of the Board of Directors is responsible for, among other things, identifying, reviewing and evaluating candidates

to serve as directors of the Company; reviewing, evaluating and considering incumbent directors; recommending to the Board of Directors

candidates for election to the Board of Directors; making recommendations to the Board of Directors regarding the membership of the committees

of the Board of Directors, and assessing the performance of the Board of Directors.

The

Nominating and Governance Committee is currently composed of three outside directors: G. Tyler Runnels (Chair), Robert Harcourt and Michael

Hamilton. All members of the Nominating Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ

listing standards). The Nominating Committee met _three times during the fiscal year ended October 31, 2023. The Nominating Committee

Charter is available on the Company’s website at www.codaoctopusgroup.com.

The

Nominating Committee has not established any specific minimum qualifications that must be met for recommendation for a position on the

Board of Directors. Instead, in considering candidates for director the Nominating Committee will generally consider all relevant factors,

including among others the candidate’s applicable education, expertise and demonstrated excellence in his or her field, the usefulness

of the expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company,

the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment.

Other relevant factors, including diversity, experience and skills, will also be considered. Candidates for director are reviewed in

the context of the existing membership of the Board of Directors (including the qualities and skills of the existing directors), the

operating requirements of the Company and the long-term interests of its stockholders.

The

Nominating Committee considers each director’s executive experience and his or her familiarity and experience with the various

operational, scientific and/or financial aspects of managing companies in our industry.

With

respect to diversity, the Nominating Committee seeks a diverse group of individuals who have executive leadership experience and a complementary

mix of backgrounds and skills necessary to provide meaningful oversight of the Company’s activities. The Company meets the proposed

NASDAQ standards for diversity on the board of directors. The Nominating Committee annually reviews the Board’s composition in

light of the Company’s changing requirements. The Nominating Committee uses the Board of Director’s network of contacts when

compiling a list of potential director candidates and may also engage outside consultants. Pursuant to its charter, the Nominating Committee

will consider, but not necessarily recommend to the Board of Directors, potential director candidates recommended by stockholders. All

potential director candidates are evaluated based on the factors set forth above, and the Nominating Committee has established no special

procedure for the consideration of director candidates recommended by stockholders.

Board

Member Demographics

As

of the date of this proxy statement, the demographic background of the seven members on our Board of Directors is as set forth in the

matrix below. This information is provided in accordance with the Nasdaq’s new Board Diversity Rule.

Board

Diversity Matrix (as of August 2024)

| Total Number of Director |

|

7 |

|

| |

|

|

|

|

|

| Part I: Gender Identity |

|

Female |

|

Male |

|

| |

|

1 |

|

6 |

|

| Part II: Demographic Background |

|

|

|

|

|

| |

|

|

|

|

|

| African American or Black |

|

|

|

|

|

| White |

|

|

|

6 |

|

| Did not disclose demographic background |

|

1 |

|

|

|

Code

of Ethics

We

have a Code of Ethics applicable to all of our officers, other employees and directors. The Code of Ethics is available on the Company’s

website, www.codaoctopusgroup.com.

Employment

Agreements

Annmarie

Gayle

Pursuant

to the terms of an employment agreement dated March 16, 2017, the Company employs Ms. Gayle as its Chief Executive Officer on a

full-time basis and a member of its Board of Directors. The annual salary is $230,000 payable on a monthly basis. Ms. Gayle is also

entitled to an annual performance bonus of up to $100,000, upon achieving certain targets that are to be defined on an annual basis.

The agreement provides for 30 days of paid holidays in addition to public holidays observed in Denmark. Ms. Gayle’s cash

compensation was revised by the Compensation Committee to $305,000, effective July 1, 2019.

The

agreement has no definitive term and may be terminated only upon twelve months’ prior written notice by Ms. Gayle. In the event

that the Company terminates her at any time without cause, she is entitled to a payment equal to her annual salary as well as a separation

bonus of $150,000. The Company may terminate the agreement for cause, immediately and without notice. Among others, “for cause”

includes gross misconduct, a serious or repeated breach of the agreement and negligence and incompetence as reasonably determined by

the Company’s Board. The agreement includes a 12-month non-compete and non-solicitation provision.

Blair

Cunningham

Under

the terms of an employment contract dated January 1, 2013, our wholly owned subsidiary Coda Octopus Products, Inc. employs Blair Cunningham

as its Chief Executive Officer and President of Technology. He is being paid an annual base salary of $175,000 with effect from January

1, 2018, subject to review by the Company’s Chief Executive Officer. Mr. Cunningham is entitled to 25 vacation days in addition

to any public holiday.

The

agreement may be terminated only upon twelve-month prior written notice without cause. The Company may terminate the agreement for cause,

immediately and without notice. Among others, “for cause” includes gross misconduct, a serious or repeated breach of the

agreement and negligence and incompetence as reasonably determined by the Company’s Board. The agreement includes a 18-month non-compete

and non-solicitation provision. Mr. Cunningham’s cash compensation was revised by the Compensation Committee to $225,000, effective

January 1, 2022.

On

February 1, 2023, the Compensation Committee approved bonus payments to Mr. Cunningham of $30,000 for fiscal year 2023, subject to certain

performance milestones.

Gayle

Jardine

Pursuant

to an employment agreement with Coda Octopus Products Ltd., the Company’s wholly owned subsidiary, effective as of September 1,

2015, Gayle Jardine was appointed European Director of Finance for this entity. In that role she is currently being paid an annual salary

of £82,000 (or approximately $105,300). The employment agreement provides for 25 days of paid holidays in addition to public holidays

observed in Scotland. The Company also makes certain pension contributions prescribed by the laws of the United Kingdom. The Company

may terminate Ms. Jardine’s Employment Agreement upon eight weeks written notice.

In

February 2024, Ms. Jardine was re-appointed Interim CFO of the Company. As inducement for assuming the additional duties as Interim

Chief Financial Officer, in addition to her existing annual salary of approximately $105,000 she is being paid an additional short-term

incentive payment of £6,000 (approximately $7,700) for each month that she acts in such a capacity. Her total salary is approximately $197,400 per annum.

EXECUTIVE

OFFICERS

Executive

Officers

| Name |

|

Age |

|

Position |

| Annmarie

Gayle |

|

60 |

|

Chairman and

Chief Executive Officer |

| Gayle Jardine |

|

54 |

|

Interim Chief Financial

Officer, |

| Blair Cunningham |

|

54 |

|

President of Technology |

Annmarie

Gayle. For information regarding Ms. Gayle, please see Proposal 1 discussed above.

Gayle

Jardine has been our Interim Chief Financial Officer since May 2023 (except for a short period from November 27, 2023 through

February 13, 2024). She has been the Company’s European Finance Director since 2015. During this time, Ms. Jardine has been an

integral part and leader within our Finance Division. Prior to joining the Company, Ms. Jardine was the owner and director of Pentland

Accounting Limited and provided management accounting services to a range of commercial customers. She also previously served as the

operations & finance manager for Wireless Fibre Systems and has held management reporting leadership roles at both Scottish Water

Solutions and Honeywell. Ms. Jardine holds a bachelor’s degree with Honors from Robert Gordon University and has

held a Chartered Institute of Management Accounting qualification since 1996. Ms. Jardine began her career in financial analysis and

financial business consulting in Hewlett Packard’s electronic test and measurement business in both Scotland and Santa Rosa, USA,

focusing on supporting research and development, marketing, production, and procurement. Following the division’s spin-off to form

Agilent Technologies, she served as a planning and reporting manager within the firm’s Scottish division, and then as a financial

operations manager for a global product line across the U.K., U.S., and Germany.

Blair

Cunningham has been with the Company since July 2004 and has had a number of roles including President of Technology (current

positions), Chief Technology Officer since 2005 and Technical Manager of Coda Octopus Products Ltd between July 2004 and July 2005. Mr.

Cunningham received an HND in Computer Science in 1989 from Moray College of Further Education, Elgin, Scotland. Because of Mr. Cunningham’s

expertise in technology, systems software development and project management, the Company believes that he is highly qualified to serve

in his current roles.

SUMMARY

COMPENSATION TABLE

The

Summary Compensation Table shows certain compensation information for services rendered for the fiscal years ended October 31, 2023,

and 2022, by our executive officers. The following information includes the dollar value of base salaries, bonus awards, stock options

grants and certain other compensation, if any, whether paid or deferred.

| Name and Principal Position | |

Year | | |

Salary | | |

Bonus | | |

Restricted Stock Awards | | |

Option Awards | | |

All Other Compensation* | |

Total | |

| | |

| | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

($) | |

| Annmarie Gayle | |

| 2023 | | |

| 305,000 | | |

| 100,000 | | |

| -0- | | |

| -0- | | |

-0- | |

| 405,000 | |

| Chief Executive Officer | |

| 2022 | | |

| 305,000 | | |

| 100,000 | | |

| | | |

| | | |

-0- | |

| 405,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | |

| Gayle Jardine** | |

| 2023 | | |

| 95,204 | | |

| 23,801 | | |

| 20,275 | | |

| -0- | | |

32,922 | |

| 172,202 | |

| Interim Chief Financial Officer | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

- | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | |

| Kevin Kane*** | |

| 2023 | | |

| 200,000 | | |

| -0- | | |

| -0- | | |

| -0- | | |

21,876 | |

| 221,876 | |

| Divisional Chief Executive Officer | |

| 2022 | | |

| 200,000 | | |

| -0- | | |

| -0- | | |

| -0- | | |

19,601 | |

| 219,601 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | |

| Blair Cunningham | |

| 2023 | | |

| 225,000 | | |

| 30,000 | | |

| -0- | | |

| -0- | | |

21,854 | |

| 276,854 | |

| President of Technology | |

| 2022 | | |

| 225,000 | | |

| 6,000 | | |

| -0- | | |

| -0- | | |

22,541 | |

| 253,541 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | |

| Nathan Parker**** | |

| 2023 | | |

| 146,551 | | |

| -0- | | |

| (50,000 | ) | |

| -0- | | |

9,216 | |

| 105,767 | |

| Chief Financial Officer | |

| 2022 | | |

| 79,615 | | |

| 20,000 | | |

| 50,000 | | |

| -0- | | |

2,532 | |

| 152,147 | |

*The

amounts described in the category of “All Other Compensation” comprise Health, Dental, Vision, Short Term Disability, Long

Term Disability and Accidental Death and Dismemberment insurance premiums which the Company contributed to the officers’ identified

plan.

**

Ms. Jardine was appointed as Interim Chief Financial Officer of the Company in May 2023. She stepped down from this position on

November 27, 2023, and resumed her original position of European Director of Finance until she was re-appointed as Interim Chief Financial

Officer on February 13, 2024.

***

Mr. Kevin left the Company on March 6, 2024.

****

Mr. Parker vacated the role of Chief Financial Officer of the Company in May 2023.

Grants

of restricted stock awards as of October 31, 2023

| Name | |

Grant Date | |

All other restricted

awards; number of

securities underlying

restricted stock awards | | |

Exercise

or base price of

restricted stock awards | | |

Grant date fair value

of restricted stock awards | |

| Gayle Jardine | |

5/3/2023 | |

| 2,500 | | |

| 8.11 | | |

| 20,275 | |

| *Nathan Parker | |

5/3/2023 | |

| (9,506 | ) | |

| 5.26 | | |

| (50,000 | ) |

*Mr.

Nathan Parker vacated the role of Chief Financial Officer of the Company in May 2023. This resulted in the forfeiture of 9,506 units

of Restricted Stock Awards granted on June 1, 2022.

Outstanding

option awards as of October 31, 2023

| | |

Option Awards |

| Name | |

Number of

securities

underlying

unexercised

options

exercisable | | |

Number of

securities

underlying

unexercised

options

unexercisable

| | |

Exercise or

base price of

option swards | | |

Option

expiration

date |

| Gayle Jardine | |

| 3,334 | | |

| - | | |

| 4.62 | | |

3/23/2025 |

Option

exercises for October 31, 2023

| | |

Option Awards | |

| Name | |

Number of shares

acquired on exercise | | |

Value

realized on exercise | |

| Annmarie Gayle | |

| 32,291 | | |

$ | 290,619 | |

| Blair Cunningham | |

| 24,589 | | |

$ | 243,417 | |

DIRECTOR

COMPENSATION

The

following table sets forth the compensation paid to each of our directors (who are not also officers of the Company) for the fiscal year

ended October 31, 2023, in connection with their services to the company. In accordance with the SEC’s rules, the table omits columns

showing items that are not applicable. Except as set forth in the table, no other persons were paid any compensation for director services.

| Name | |

Fees Earned

or Paid in

Cash ($) | | |

Stock Awards

($) | | |

Total

($) | |

| Michael Hamilton | |

$ | 45,000 | | |

$ | 15,000 | | |

$ | 60,000 | |

| Captain J Charles Plumb* | |

$ | 26,667 | | |

| - | | |

$ | 26,667 | |

| Mary Losty** | |

$ | 26,667 | | |

| - | | |

$ | 26,667 | |

| Tyler G Runnels | |

$ | 45,000 | | |

| | | |

$ | 45,000 | |

| Robert Harcourt | |

$ | 16,667 | | |

$ | 50,000 | | |

$ | 66,667 | |

| Anthony Tata | |

$ | 16,667 | | |

$ | 50,000 | | |

$ | 66,667 | |

*Captain

J Charles Plumb retired from the Board of Directors on June 26, 2023

**Mary

Losty retired from the Board of Directors on June 26, 2023

Stock

Incentive Plans

The

Company has two active Stock Incentive Plan. 2017 Stock Incentive Plan and 2021 Stock Incentive Plan.

2017

Stock Incentive Plan

On

December 6, 2017, the Board of Directors adopted the 2017 Stock Incentive Plan (the “2017 Plan”). The purpose of the Plan

is to advance the interests of the Company and its stockholders by enabling the Company and its subsidiaries to attract and retain qualified

individuals through opportunities for equity participation in the Company, and to reward those individuals who contribute to the Company’s

achievement of its economic objectives. The Plan, which was adopted subject to stockholders’ approval, was approved by Stockholders

at its meeting held on July 24, 2018.

The

maximum number of shares of Common Stock that will be available for issuance under the Plan is 913,612. The shares available for issuance

under the Plan may, at the election of the Committee, be either treasury shares or shares authorized but unissued, and, if treasury shares

are used, all references in the Plan to the issuance of shares will, for corporate law purposes, be deemed to mean the transfer of shares

from treasury.

The

Plan is administered by the Compensation Committee of the Board of Directors which has the authority to determine all provisions of Incentive

Awards as the Committee may deem necessary or desirable and as consistent with the terms of the Plan, including, without limitation,

the following: (i) eligible recipients; (ii) the nature and extent of the Incentive Awards to be made to each Participant; (iii) the

time or times when Incentive Awards will be granted; (iv) the duration of each Incentive Award; and (v) the restrictions and other conditions

to which the payment or vesting of Incentive Awards may be subject.

During

the fiscal year ended October 31, 2023, pursuant to the terms of the 2017 Plan, the Company granted 100,428 restricted stock awards for

an aggregate share of common stock of 100,428 to various eligible individuals. During this period 13,006 restricted stock awards were

forfeited, and 1,932 units were converted into Treasury Stock and a further 108,568 vested and were issued to the holders of these by

the Company. During the fiscal year ended October 31, 2023, 199,496 Options were exercised, 3,000 were forfeited and no Options were

awarded during this period. As a result, as of October 31, 2023, there were 370,300 shares available for future issue under the 2017

Plan.

2021

Stock Incentive Plan

On

July 12, 2021, the Board of Directors adopted the 2021 Stock Incentive Plan (the “2021 Plan”), which was approved by the

Company’s stockholders at its meeting held on August 2, 2021. The 2021 Plan is identical to the 2017 Plan in all material respects,

except that the number of shares available for issuance thereunder is 1,000,000.

CLAW

BACK POLICY

We

have adopted a Claw Back Policy, effective September 7, 2023. The Claw Back policy applies to Covered Executive of the Company and provide

for the recovery of (i) Erroneously Awarded Compensation from Covered Executives, and (ii) Recoverable Amounts from Covered Executives.

This Policy is designed to comply with Nasdaq Rule 5608 and with Section 10D and Rule 10D-1 of the Exchange Act.

SECURITIES

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information as of August 12, 2024, regarding the beneficial ownership of our Common Stock, based on

information provided by (i) each of our executive officers and directors; (ii) all executive officers and directors as a group; and (iii)

each person who is known by us to beneficially own more than 5% of the outstanding shares of our Common Stock. The percentage ownership

in this table is based on 11,178,933 issued and outstanding as of July 30, 2024.

Unless

otherwise indicated, we believe that all persons named in the following table have sole voting and investment power with respect to all

shares of Common Stock that they beneficially own.

Name and Address of Beneficial Owner (1)

| |

Amount and Nature of Beneficial Ownership of Common Stock | | |

Percent of Common Stock | |

| Michael Hamilton | |

| 5,533 | | |

| * | |

| Annmarie Gayle (2) | |

| 2,367,952 | | |

| 21.2 | % |

| Gayle Jardine (3) | |

| 6,333 | | |

| * | |

| Blair Cunningham | |

| 38,211 | | |

| * | |

| Robert Harcourt | |

| 6,273 | | |

| * | |

| Anthony Tata | |

| 6,273 | | |

| * | |

| G. Tyler Runnels (4) | |

| 875,685 | | |

| 7.8 | % |

| Gwenael Rouy-Poirier (5) | |

| -0- | | |

| * | |

| Angus McFadzean (6) | |

| 17,411 | | |

| | |

Niels Sondergaard Carit Etlars Vej 17A 8700 Horsens Denmark | |

| 2,241,581 | | |

| 20.1 | % |

J. Steven Emerson (7) 1522 Ensley Avenue Los Angeles, CA 90024 | |

| 1,318,232 | | |

| 11.8 | % |

Bryan Ezralow (8) 23622 Calabasas Rd. Suite 200 Calabasas, CA 91302 | |

| 1,073,120 | | |

| 9.6 | % |

Tocqueville Asset Management LP (9) 40 West 57th Street, 19th Floor New York, NY 10019 | |

| 588,897 | | |

| 5.3 | % |

Touchstone Capital, Inc. 1001 McKnight Park Drive Pittsburgh PA. 15237 | |

| 612,433 | | |

| 5.5 | % |

All Directors and Executive Officers as a Group (Nine persons) (2)(3)(4)(5)(6): | |

| 3,323,671 | | |

| 29.7 | % |

*)

Less than 1%.

| 1) |

Unless otherwise indicated,

the address of all individuals and entities listed below is c/o Coda Octopus Group, Inc. 3300 S Hiawassee Rd, Suite 104-105, Orlando,

Florida, 32835. |

| 2) |

Consists of 95,038 shares

held by Ms. Gayle and 2,241,581 shares beneficially owned by Ms. Gayle’s spouse, Niels Sondergaard. Ms. Gayle disclaims any

beneficial ownership in those shares. |

| 3) |

Includes 3,333 shares issuable

upon exercise of currently exercisable options. |

| 4) |

Includes 609,331 shares

held by the G. Tyler Runnels and Jasmine Niklas Runnels TTEES of The Runnels Family Trust DTD 1-11-2000 of which Mr. Runnels is a

trustee; 227,700 shares held by T.R. Winston; 24,368 shares held by TRW Capital Growth Fund, Ltd.; and 14,286 shares held by Pangaea

Partners. The Company has been advised that Mr. Runnels has voting and dispositive power with respect to all of these shares. |

| 5) |

Does not include 7,898

shares that will vest on April 15, 2025. |

| 6) |

Includes 16,666 shares

of common stock issuable upon exercise of currently exercisable options. Does not include 6,107 shares of common stock

that vest on May 23, 2025. |

| 7) |

Includes the following:

217,081 held by J. Steven Emerson IRA R/O II; 350,000 shares held by J. Steven Emerson Roth IRA; 49,328 shares held by the Brian

Emerson IRA; 310,928 shares held by Emerson Partners; 230,250 shares held by 1993 Emerson Family Trust; 8,286 shares held by the

Alleghany Meadows IRA; 8,286 shares held by the Jill Meadows IRA; and 144,073 shares held by the Emerson family Foundation. The Company

has been advised that Mr. Emerson has voting and dispositive power with respect to all of these shares. |

| 8) |

Consists of 896,079 shares

held by the Bryan Ezralow 1994 Trust u/t/d 12/22/1994; and 177,041 shares held by EZ MM&B Holdings, LLC. According to filings

made with the SEC, Mr. Ezralow has voting and dispositive power with respect to these shares. |

| 9) |

The

reporting person’s most recent Schedule 13G/A was filed jointly by the following parties: Tocqueville Asset Management LP,

Taubenpost Capital L.P., Taubenpost Capital LLC and Donald Wang. The Reporting Persons disclaim beneficial ownership in the shares

reported therein except to the extent of their pecuniary interest therein. According to the filing, Taubenpost Capital L.P. is the

relevant entity for which each of Taubenpost Capital LLC and Donald Wang may be considered a control person.

|

CERTAIN

RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

None

that are required to be reported herein.

SECTION

16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the Exchange Act, our directors,

our executive officers, and any persons holding more than 10% of our common stock are required to report their ownership of the common

stock and any changes in that ownership to the SEC. To our knowledge, based solely on our review of the copies of such reports received

or written representations from certain reporting persons that no other reports were required, we believe that during our fiscal year

ended October 31, 2023, no reports relating to our securities required to be filed by current reporting persons were filed late.

We

will continue monitoring Section 16 compliance by each of our directors and executive officers and will assist them where possible in

their filing obligations.

AUDIT

COMMITTEE REPORT

The

Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements and compliance with legal

and regulatory requirements. Management has responsibility for preparing the financial statements and for the financial reporting process.

In addition, management has the responsibility to assess the effectiveness of the Company’s internal control over financial reporting.

Frazier & Deeter LLC, the Company’s independent registered public accounting firm, is responsible for expressing an opinion

on the conformity of the Company’s audited financial statements to accounting principles generally accepted in the United States

of America and on whether the financial statements present fairly, in all material respects, the financial position and results of operations

and cash flows of the Company.

In

this context, the Audit Committee has:

| |

(1) |

reviewed and discussed

with management and Frazier & Deeter LLC the audited financial statements and management’s evaluation of the Company’s

internal control over financial reporting. |

| |

|

|

| |

(2) |

discussed with Frazier

& Deeter LLC the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301, “Communications

with Audit Committees.” |

| |

|

|

| |

(3) |

received the written disclosures

and the letter from Frazier & Deeter LLC required by applicable requirements of the Public Company Accounting Oversight Board

regarding Frazier & Deeter LLC’s communications with the Audit Committee concerning independence and discussed with Frazier

& Deeter LLC that firm’s independence. |

Based

on the review and discussion referred to above, the Audit Committee recommended to the Board of Directors that the audited financial

statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2023, for filing with

the Securities and Exchange Commission.

Michael

Hamilton (Chairman)

Robert

Harcourt

Anthony

Tata

Note

that Gwenael Rouy-Poirier had not been appointed a member of the Audit Committee at the time that the foregoing recommendation was made.

PROPOSAL

2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

Audit Committee of the Board of Directors has selected Frazier & Deeter LLC (“Frazier & Deeter”) as our independent

registered public accounting firm for 2024. Although stockholder ratification of the appointment of our independent registered public

accounting firm is not required by our Bylaws or otherwise, we are submitting the selection of Frazier & Deeter to our stockholders

for ratification to enable stockholders to participate in this important decision. If our stockholders do not ratify the Audit Committee’s

selection, the Audit Committee may reconsider its selection. Even if the selection is ratified, the Audit Committee may select a different

independent registered public accounting firm at any time during the year if it determines that selection of a different firm would be

in the best interests of our company.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF FRAZIER & DEETER, LLC.

Fees

Paid to Independent Registered Public Accounting Firm

Audit

Fees. The aggregate fees billed by Frazier & Deeter, LLC, our principal accountants, for professional services rendered for the audit

and audit related services of the Company’s annual financial statements for the last two fiscal years and for the reviews of the

financial statements included in the Company’s Quarterly reports on Form 10-Q during the last two fiscal years 2023 and 2022 were

$381,987 and $390,100 respectively.

Tax

Fees. The Company did not engage its principal accountants to render any tax services to the Company during the last two fiscal years.

All

Other Fees. The Company did not engage its principal accountants to render services to the Company during the last two fiscal years,

other than as reported above.

Prior

to the Company’s engagement of its independent auditor, such engagement is approved by the Company’s Audit Committee. The

services provided under this engagement may include audit services, audit-related services, tax services and other services. Pre-approval

is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is

generally subject to a specific budget. Pursuant to the Company’s Audit Committee Charter, the independent auditors and management

are required to report to the Company’s audit committee at least quarterly regarding the extent of services provided by the independent

auditors in accordance with this pre-approval, and the fees for the services performed to date. The audit committee may also pre-approve

particular services on a case-by-case basis. All audit-related fees, tax fees and other fees incurred by the Company for the year ended

October 31, 2023, were approved by the Company’s audit committee.

PROPOSAL

3. ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

Section

14A of the Securities Exchange Act of 1934 enables our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation

of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. Specifically, these rules

address the information we must provide in the compensation tables and related disclosures included in this proxy statement.

As

indicated in the compensation tables included in this proxy statement, we have structured our compensation program to reflect the size

of our operations. While we believe that our executive compensation is modest, we design our compensation with a view towards retaining

our executives, motivating them to devote their efforts towards profitable growth of our businesses and aligning their interests with

those of our stockholders.

Accordingly,

the Board recommends that our stockholders vote in favor of the following resolution:

RESOLVED,

that the stockholders of Coda Octopus Group, Inc. approve, on an advisory basis, the compensation paid to our named executive officers,

as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables

and any related materials disclosed in the proxy statement for the 2024 Annual Meeting.

This

is an advisory vote, which means that the stockholder vote is not binding on us. Nevertheless, we value the opinions expressed by our

stockholders and will carefully consider the outcome of the vote when making future compensation decisions for our named executive officers.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

HOUSEHOLDING

OF PROXY MATERIALS

The

SEC has adopted rules that permit companies and intermediaries to satisfy delivery requirements for proxy statements and annual reports

to stockholders, with respect to two or more stockholders sharing the same address, by delivering a single copy of the materials addressed

to those stockholders. This process, commonly referred to as “householding,” is designed to reduce duplicate printing and

postage costs. We and some brokers may household annual reports to stockholders and proxy materials by delivering a single copy of the

materials to multiple stockholders sharing the same address, unless contrary instructions have been received from the affected stockholders.

If

a stockholder wishes in the future to receive a separate annual report to stockholders and proxy statement, or if a stockholder received

multiple copies of some or all of these materials and would prefer to receive a single copy in the future, the stockholder should submit

a request to the stockholder’s broker if the shares are held in a brokerage account or to our Corporate Secretary, Coda Octopus

Group, Inc., 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835, if the stockholder is a record holder. We will send additional

copies of the relevant material following receipt of a request for additional copies.

STOCKHOLDER

PROPOSALS

Any

stockholder who, in accordance with SEC rules, wishes to present a proposal for inclusion in the proxy materials to be distributed in

connection with next year’s annual meeting must submit the proposal to our Corporate Secretary, 3300 S Hiawassee Rd., Suite 104-105,

Orlando, Florida 32835. Stockholder proposals for inclusion in our proxy statement for the 2025 Annual Meeting must be received

on or before April 1, 2025, and must comply in all other respects with applicable SEC rules.

Any

stockholder who wishes to propose any business to be considered by the stockholders at the 2025 Annual Meeting of Stockholders

other than a proposal for inclusion in the proxy statement pursuant to the SEC’s rules, or who wants to nominate a person for election

to the board of directors at that meeting, must notify our Corporate Secretary in writing and provide the specified information described

in our Bylaws concerning the proposed business or nominee. The notice must be delivered to or mailed to the address set forth in the

preceding paragraph and received at our principal executive offices no later than April 1, 2025.

OTHER

BUSINESS

We

are not aware of any matters, other than as indicated above, that will be presented for action at the Annual Meeting. However, if any

other matters properly come before the meeting, the persons named in the enclosed form of proxy intend to vote such proxy in their discretion

on such matters.

Copies

of our Annual Report on Form 10-K for the year ended October 31, 2023, including financial statements and schedules thereto filed with

the SEC, but excluding exhibits, are available without charge to stockholders upon written request addressed to Corporate Secretary,

Coda Octopus Group, Inc., 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835. The Form 10-K includes a list of exhibits to the

Form 10-K. Copies of exhibits will be furnished to stockholders upon written request and upon payment of reproduction and mailing expenses.

Orlando,

Florida

August

12, 2024

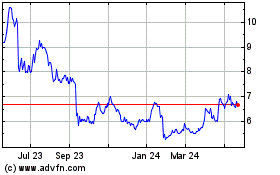

Coda Octopus (NASDAQ:CODA)

Historical Stock Chart

From Dec 2024 to Jan 2025

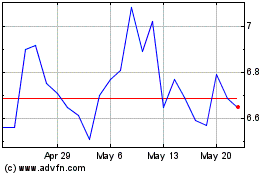

Coda Octopus (NASDAQ:CODA)

Historical Stock Chart

From Jan 2024 to Jan 2025