0001050797false00010507972025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 4, 2025

COLUMBIA SPORTSWEAR COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Oregon | | 000-23939 | | 93-0498284 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

14375 Northwest Science Park Drive

Portland, Oregon 97229

(Address of principal executive offices) (Zip code)

(503) 985-4000

(Registrant’s telephone number, including area code)

No Change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each

exchange on which registered |

| Common stock | | COLM | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 4, 2025, Columbia Sportswear Company (the "Company") issued a press release reporting its fourth quarter and full year 2024 financial results, providing its full year 2025 financial outlook, and announcing a quarterly dividend. A copy of the Company's press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this report shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

Attached hereto as Exhibit 99.2 and incorporated by reference herein is the CFO Commentary and Financial Review presentation by Jim A. Swanson, Executive Vice President and Chief Financial Officer of the Company, on the Company's fourth quarter and full year 2024 financial results and its 2025 financial outlook, as posted on the Company's investor relations website, https://investor.columbia.com, on February 4, 2025. The information in this report shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

ITEM 7.01 REGULATION FD DISCLOSURE

In its February 4, 2025 press release, the Company announced that its Board of Directors declared a quarterly cash dividend of $0.30 per share of common stock to be paid on March 21, 2025 to its shareholders of record on March 10, 2025.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | |

| Press Release, dated February 4, 2025 (furnished pursuant to Items 2.02 and 7.01 hereof). |

| |

| CFO Commentary and Financial Review Presentation, dated February 4, 2025 (furnished pursuant to Items 2.02 and 7.01 hereof). |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| COLUMBIA SPORTSWEAR COMPANY |

| |

Dated: February 4, 2025 | By: | /S/ JIM A. SWANSON |

| | Jim A. Swanson |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Columbia Sportswear Company Reports Fourth Quarter and Full Year 2024 Financial Results;

Provides Full Year 2025 Financial Outlook

Fourth Quarter 2024 Highlights

•Net sales increased 3 percent (3 percent constant-currency) to $1,096.6 million, compared to fourth quarter 2023.

•Operating income increased 21 percent to $137.3 million, or 12.5 percent of net sales, compared to fourth quarter 2023 operating income of $113.1 million, or 10.7 percent of net sales. The prior year operating income included a $25.0 million impairment charge related to prAna.

•Diluted earnings per share increased 16 percent to $1.80, compared to fourth quarter 2023 diluted earnings per share of $1.55. Fourth quarter 2024 income tax expense includes a $6.4 million discrete tax valuation allowance expense, which negatively impacted diluted earnings per share by $0.11.

•Exited the quarter with $815.5 million of cash, cash equivalents and short-term investments and no borrowings.

•Exited the quarter with $690.5 million of inventories, a decrease of 7 percent compared to December 31, 2023.

Full Year 2024 Highlights

•Net sales decreased 3 percent to $3,368.6 million, compared to 2023.

•Operating income decreased 13 percent to $270.7 million, or 8.0 percent of net sales, compared to 2023 operating income of $310.3 million, or 8.9 percent of net sales.

•Diluted earnings per share decreased 7 percent to $3.82, compared to 2023 diluted earnings per share of $4.09.

•Repurchased $317.8 million of common stock during the twelve months ended December 31, 2024.

Full Year 2025 Financial Outlook

The following forward-looking statements reflect our expectations as of February 4, 2025 and are subject to significant risks and business uncertainties, including those factors described under “Forward-Looking Statements” below. Additional disclosures and financial outlook details can be found in the Full Year 2025 Financial Outlook section below and the CFO Commentary and Financial Review presentation.

•Net sales of $3.40 to $3.47 billion, representing net sales growth of 1.0 to 3.0 percent compared to 2024.

•Operating margin of 7.7 to 8.3 percent.

•Diluted earnings per share of $3.80 to $4.15.

PORTLAND, Ore. - February 4, 2025 - Columbia Sportswear Company (NASDAQ: COLM, the "Company"), a multi-brand global leading innovator in outdoor, active and lifestyle products including apparel, footwear, accessories, and equipment, today announced fourth quarter 2024 financial results for the period ended December 31, 2024.

Chairman, President and Chief Executive Officer Tim Boyle commented, “I’m encouraged that sales returned to growth in the fourth quarter, and we expect continued growth in 2025, across most brands and regions. During the year we made substantial progress on our inventory reduction efforts, achieved cost savings through our Profit Improvement Program, and returned meaningful cash to shareholders through share buybacks and dividends. We

also laid the foundation for Columbia’s ACCELERATE Growth Strategy, which will come to life in the seasons ahead.

“While we have made substantial progress slowing our rate of SG&A expense growth, we are continuing to pursue cost savings and enhanced profitability.

“Our balance sheet remains strong, with cash and short-term investments of approximately $815 million and no bank borrowings exiting the quarter. I am confident we have the right strategies in place to drive sustainable, profitable long-term growth and we are committed to investing in our strategic priorities to:

•accelerate profitable growth;

•create iconic products that are differentiated, functional and innovative;

•drive brand engagement through increased, focused demand creation investments;

•enhance consumer experiences by investing in capabilities to delight and retain consumers;

•amplify marketplace excellence, with digitally-led, omni-channel, global distribution; and

•empower talent that is driven by our core values, through a diverse and inclusive workforce."

CFO's Commentary and Financial Review Presentation Available Online

For a detailed review of the Company's fourth quarter and full year 2024 financial results, please refer to the CFO Commentary and Financial Review presentation furnished to the Securities and Exchange Commission (the "SEC") on a Current Report on Form 8-K and published on the Investor Relations section of the Company's website at http://investor.columbia.com/financial-results at approximately 4:15 p.m. ET today. Analysts and investors are encouraged to review this commentary prior to participating in our conference call.

ACCELERATE Growth Strategy

ACCELERATE is a growth strategy intended to elevate the Columbia brand to attract younger and more active consumers. It is a multi-year effort centered around several consumer-centric shifts to our brand, product and marketplace strategies, as well as enhanced ways of working. For more information on the ACCELERATE Growth Strategy, please refer to the CFO Commentary and Financial Review presentation.

Fourth Quarter 2024 Financial Results

(All comparisons are between fourth quarter 2024 and fourth quarter 2023, unless otherwise noted.)

Net sales increased 3 percent (3 percent constant-currency) to $1,096.6 million from $1,060.0 million for the comparable period in 2023. The increase was led by the Europe, Middle East and Africa ("EMEA") and Latin America, Asia Pacific ("LAAP") regions, partially offset by the United States ("U.S."). Canada was flat year-over-year.

Gross margin expanded 50 basis points to 51.1 percent of net sales from 50.6 percent of net sales for the comparable period in 2023. Gross margin expansion primarily reflects lower inventory clearance activity, partially offset by unfavorable FX hedging rates.

SG&A expenses were $430.6 million, or 39.3 percent of net sales, compared to $404.8 million, or 38.2 percent of net sales, for the comparable period in 2023. The largest changes in SG&A expenses were higher incentive compensation and direct-to-consumer ("DTC") expenses, partially offset by lower supply chain expenses.

There was no impairment of goodwill in fourth quarter 2024, compared to a $25.0 million charge related to prAna for the comparable period in 2023, which negatively impacted diluted earnings per share by $0.31.

Operating income increased 21 percent to $137.3 million, or 12.5 percent of net sales, compared to operating income of $113.1 million, or 10.7 percent of net sales, for the comparable period in 2023.

Interest income, net of $4.8 million, compared to $5.0 million for the comparable period in 2023.

Income tax expense of $37.3 million resulted in an effective income tax rate of 26.7 percent, compared to income tax expense of $26.6 million, or an effective income tax rate of 22.2 percent, for the comparable period in 2023. Fourth quarter 2024 income tax expense includes a $6.4 million discrete tax valuation allowance expense, which negatively impacted diluted earnings per share by $0.11.

Net income increased 10 percent to $102.6 million, or $1.80 per diluted share, compared to net income of $93.3 million, or $1.55 per diluted share, for the comparable period in 2023.

Full Year 2024 Financial Results

(All comparisons are between the full year 2024 and the full year 2023, unless otherwise noted.)

Net sales decreased 3 percent (3 percent constant-currency) to $3,368.6 million from $3,487.2 million for the comparable period in 2023.

Gross margin expanded 60 basis points to 50.2 percent of net sales from 49.6 percent of net sales for the comparable period in 2023.

SG&A expenses were $1,443.9 million, or 42.9 percent of net sales, compared to $1,416.3 million, or 40.6 percent of net sales, for the comparable period in 2023.

There was no impairment of goodwill in 2024, compared to a $25.0 million charge related to prAna for the comparable period in 2023.

Operating income decreased 13 percent to $270.7 million, or 8.0 percent of net sales, compared to operating income of $310.3 million, or 8.9 percent of net sales, for the comparable period in 2023.

Interest income, net was $27.7 million, compared to $13.7 million for the comparable period in 2023.

Income tax expense of $74.9 million resulted in an effective income tax rate of 25.1 percent, compared to income tax expense of $74.8 million, or an effective income tax rate of 22.9 percent, for the comparable period in 2023.

Net income decreased 11 percent to $223.3 million, or $3.82 per diluted share, compared to net income of $251.4 million, or $4.09 per diluted share, for the comparable period in 2023.

Balance Sheet as of December 31, 2024

Cash, cash equivalents, and short-term investments totaled $815.5 million, compared to $764.5 million as of December 31, 2023.

The Company had no borrowings as of either December 31, 2024 or December 31, 2023.

Inventories decreased 7 percent to $690.5 million, compared to $746.3 million as of December 31, 2023.

Cash Flow for the Twelve Months Ended December 31, 2024

Net cash provided by operating activities was $491.0 million, compared to net cash provided by operating activities of $636.3 million for the same period in 2023.

Capital expenditures totaled $59.8 million, compared to $54.6 million for the same period in 2023.

Share Repurchases for the Twelve Months Ended December 31, 2024

The Company repurchased 3,962,540 shares of common stock for an aggregate of $317.8 million, or an average price per share of $80.19.

At December 31, 2024, $627.6 million remained available under our stock repurchase authorization, which does not obligate the Company to acquire any specific number of shares or to acquire shares over any specified period of

time.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash dividend of $0.30 per share, payable on March 21, 2025 to shareholders of record on March 10, 2025.

Full Year 2025 Financial Outlook

(Additional financial outlook details can be found in the CFO Commentary and Financial Review presentation.)

The Company's 2025 Financial Outlook is forward-looking in nature, and the following forward-looking statements reflect our expectations as of February 4, 2025 and are subject to significant risks and business uncertainties, including those factors described under “Forward-Looking Statements” below. These risks and uncertainties limit our ability to accurately forecast results. This outlook and commentary does not include any potential impacts on the Company as a result of the recent U.S. administration change, other than the direct costs of tariff actions announced on February 1, 2025, or actions we may undertake as we review our cost structure and look to expand the Profit Improvement Plan.

Net sales are expected to increase 1.0 to 3.0 percent, resulting in net sales of $3.40 to $3.47 billion, compared to $3.37 billion in 2024.

Gross margin is expected to expand 80 basis points to approximately 51 percent of net sales from 50.2 percent of net sales in 2024.

SG&A expenses, as a percent of net sales, are expected to be 43.4 to 44.1 percent, compared to SG&A expense as a percent of net sales of 42.9 percent in 2024.

Operating margin is expected to be 7.7 to 8.3 percent, compared to operating margin of 8.0 percent in 2024.

Effective income tax rate is expected to be 24.0 to 25.0 percent.

Diluted earnings per share is expected to be $3.80 to $4.15, compared to $3.82 in 2024.

Operating cash flow is expected to be at least $250 million.

Capital expenditures are planned to be in the range of $60 to $80 million.

First Half 2025 Financial Outlook

•Net sales are expected to be $1,352 to $1,378 million, representing an increase of 1 percent to 3 percent from $1,340 million for the comparable period in 2024.

•Operating margin is expected to be 1.5 to 2.2 percent, compared to operating margin of 1.6 percent in the comparable period in 2024.

•Diluted earnings per share is expected to be $0.43 to $0.56, compared to $0.51 for the comparable period in 2024.

First Quarter 2025 Financial Outlook

•Net sales are expected to be $749 to $764 million, representing a decline of 3 to 1 percent from $770 million for the comparable period in 2024.

•Operating margin is expected to be 5.4 to 6.0 percent, compared to operating margin of 5.8 percent in the comparable period in 2024.

•Diluted earnings per share is expected to be $0.62 to $0.70, compared to $0.71 for the comparable period in 2024.

Conference Call

The Company will hold its fourth quarter 2024 conference call at 5:00 p.m. ET today. Dial (888) 506-0062 to participate. The call will also be webcast live on the Investor Relations section of the Company's website at http://investor.columbia.com.

First Quarter 2025 Reporting Date

The Company plans to report first quarter 2025 financial results on Thursday, May 1, 2025 at approximately 4:00 p.m. ET.

Supplemental Financial Information

Since Columbia Sportswear Company is a global company, the comparability of its operating results reported in United States dollars is affected by foreign currency exchange rate fluctuations because the underlying currencies in which it transacts change in value over time compared to the United States dollar. To supplement financial information reported in accordance with GAAP, the Company discloses constant-currency net sales information, which is a non-GAAP financial measure, to provide a framework to assess how the business performed excluding the effects of changes in the exchange rates used to translate net sales generated in foreign currencies into United States dollars. The Company calculates constant-currency net sales by translating net sales in foreign currencies for the current period into United States dollars at the average exchange rates that were in effect during the comparable period of the prior year. Management believes that this non-GAAP financial measure reflects an additional and useful way of viewing an aspect of our operations that, when viewed in conjunction with our GAAP results, provides a more comprehensive understanding of our business and operations. In particular, investors may find the non-GAAP financial measure useful by reviewing our net sales results without the volatility in foreign currency exchange rates. This non-GAAP financial measure also facilitates management's internal comparisons to our historical net sales results and comparisons to competitors' net sales results.

The non-GAAP financial measures should be viewed in addition to, and not in lieu of or superior to, our financial measures calculated in accordance with GAAP. The Company provides a reconciliation of non-GAAP measures to the most directly comparable financial measure calculated in accordance with GAAP. See the "Reconciliation of GAAP to Non-GAAP Financial Measures" table included herein. The non-GAAP financial measures presented may not be comparable to similarly titled measures reported by other companies.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws, including statements regarding the Company’s expectations, anticipations or beliefs about the Company's ability to realize growth opportunities and manage expenses, financial position, marketing strategies, inventory, full year 2025 net sales, gross margin, SG&A expenses, operating margin, effective income tax rate, diluted earnings per share, operating cash flow, and capital expenditures, as well as first half and first quarter 2025 net sales, operating margin, and diluted earnings per share. Forward-looking statements often use words such as "will," "anticipate," "estimate," "expect," "should," "may," "plan" and other words and terms of similar meaning or reference future dates. The Company's expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis; however, each forward-looking statement involves a number of risks and uncertainties, including those set forth in this document, those described in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q under the heading "Risk Factors," and those that have been or may be described in other reports filed by the Company, including reports on Form 8-K. Potential risks and uncertainties that may affect our future revenues, earnings and performance and could cause the actual results of operations or financial condition of the Company to differ materially from the anticipated results expressed or implied by forward-looking statements in this document include: loss of key customer accounts; our ability to execute our ACCELERATE Growth Strategy; our ability to execute and realize cost savings related to our Profit Improvement Plan; our ability to effectively execute our business strategies, including initiatives to upgrade our business processes and information technology (“IT”) systems and investments in our DTC businesses; our ability to maintain the strength and security of our IT systems; the effects of unseasonable weather, including global climate change; the seasonality of our business and timing of orders; trends affecting consumer spending, including changes in the level of consumer spending, and retail traffic patterns; unfavorable economic conditions generally; the financial health of our customers and retailer consolidation; higher than expected rates of order cancellations; changes affecting consumer demand and preferences and fashion trends; changes in international, federal or state tax, labor and other laws and regulations that affect our business, including changes in corporate tax rates, tariffs, international trade policy and geopolitical tensions, or increasing wage rates; our ability to attract and retain key personnel; risks inherent in doing business in

foreign markets, including fluctuations in currency exchange rates, global credit market conditions, changes in global regulation and economic and political conditions and disease outbreaks; volatility in global production and transportation costs and capacity and timing; our ability to effectively manage our inventory and our wholesale customer’s to manage their inventories; our dependence on third-party manufacturers and suppliers and our ability to source at competitive prices from them or at all; the effectiveness of our sales and marketing efforts; business disruptions and acts of terrorism, cyber-attacks or military activities around the globe; intense competition in the industry; our ability to establish and protect our intellectual property; and our ability to develop innovative products. The Company cautions that forward-looking statements are inherently less reliable than historical information. The Company does not undertake any duty to update any of the forward-looking statements after the date of this document to conform them to actual results or to reflect changes in events, circumstances or its expectations. New factors emerge from time to time and it is not possible for the Company to predict or assess the effects of all such factors or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

About Columbia Sportswear Company

Columbia Sportswear Company connects active people with their passions and is a global multi-brand leading innovator in outdoor, active and lifestyle products including apparel, footwear, accessories, and equipment. Founded in 1938 in Portland, Oregon, the Company's brands are sold in more than 100 countries. In addition to the Columbia® brand, Columbia Sportswear Company also owns the Mountain Hard Wear®, SOREL® and prAna® brands. To learn more, please visit the Company's websites at www.columbia.com, www.mountainhardwear.com, www.sorel.com, and www.prana.com.

Contact:

Andrew Burns, CFA

Vice President of Investor Relations and Strategic Planning

Columbia Sportswear Company

(503) 985-4112

aburns@columbia.com

- Financial tables follow -

COLUMBIA SPORTSWEAR COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | As of December 31, | | |

| (in thousands) | | 2024 | | 2023 | | |

| ASSETS | | | | | | |

| Current Assets: | | | | | | |

| Cash and cash equivalents | | $ | 531,869 | | | $ | 350,319 | | | |

| | | | | | |

| Short-term investments | | 283,608 | | | 414,185 | | | |

| Accounts receivable, net | | 417,539 | | | 423,079 | | | |

| | | | | | |

| Inventories | | 690,515 | | | 746,288 | | | |

| | | | | | |

| Prepaid expenses and other current assets | | 85,051 | | | 80,814 | | | |

| Total current assets | | 2,008,582 | | | 2,014,685 | | | |

| Property, plant and equipment, net | | 282,908 | | | 287,281 | | | |

| Operating lease right-of-use assets | | 399,669 | | | 357,295 | | | |

| Intangible assets, net | | 79,221 | | | 79,908 | | | |

| Goodwill | | 26,694 | | | 26,694 | | | |

| Deferred income taxes | | 104,203 | | | 105,574 | | | |

| Other non-current assets | | 73,988 | | | 67,576 | | | |

| Total assets | | $ | 2,975,265 | | | $ | 2,939,013 | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Current Liabilities: | | | | | | |

| | | | | | |

| Accounts payable | | $ | 385,695 | | | $ | 235,927 | | | |

| Accrued liabilities | | 273,330 | | | 272,058 | | | |

| Operating lease liabilities | | 75,857 | | | 71,086 | | | |

| Income taxes payable | | 31,663 | | | 17,556 | | | |

| | | | | | |

| Total current liabilities | | 766,545 | | | 596,627 | | | |

| | | | | | |

| Non-current operating lease liabilities | | 373,328 | | | 336,772 | | | |

| Income taxes payable | | 13,176 | | | 25,688 | | | |

| Deferred income taxes | | 310 | | | 66 | | | |

| Other long-term liabilities | | 41,867 | | | 41,250 | | | |

| Total liabilities | | 1,195,226 | | | 1,000,403 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total shareholders' equity | | 1,780,039 | | | 1,938,610 | | | |

| Total liabilities and shareholders' equity | | $ | 2,975,265 | | | $ | 2,939,013 | | | |

COLUMBIA SPORTSWEAR COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

(In thousands, except per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | | $ | 1,096,587 | | | $ | 1,059,994 | | | $ | 3,368,582 | | | $ | 3,487,203 | |

| Cost of sales | | 536,039 | | | 523,804 | | | 1,677,497 | | | 1,757,271 | |

| Gross profit | | 560,548 | | | 536,190 | | | 1,691,085 | | | 1,729,932 | |

| Gross margin | | 51.1 | % | | 50.6 | % | | 50.2 | % | | 49.6 | % |

| | | | | | | | |

| Selling, general and administrative expenses | | 430,645 | | | 404,823 | | | 1,443,906 | | | 1,416,313 | |

| Impairment of goodwill | | — | | | 25,000 | | | — | | | 25,000 | |

| Net licensing income | | 7,418 | | | 6,707 | | | 23,562 | | | 21,665 | |

| Operating income | | 137,321 | | | 113,074 | | | 270,741 | | | 310,284 | |

| Interest income, net | | 4,797 | | | 5,028 | | | 27,703 | | | 13,687 | |

| Other non-operating income (expense), net | | (2,287) | | | 1,867 | | | (257) | | | 2,221 | |

| Income before income tax | | 139,831 | | | 119,969 | | | 298,187 | | | 326,192 | |

| Income tax expense | | 37,274 | | | 26,629 | | | 74,914 | | | 74,792 | |

| Net income | | $ | 102,557 | | | $ | 93,340 | | | $ | 223,273 | | | $ | 251,400 | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 1.81 | | | $ | 1.55 | | | $ | 3.83 | | | $ | 4.11 | |

| Diluted | | $ | 1.80 | | | $ | 1.55 | | | $ | 3.82 | | | $ | 4.09 | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 56,656 | | 60,214 | | 58,333 | | | 61,232 |

| Diluted | | 56,890 | | 60,345 | | 58,502 | | | 61,424 |

COLUMBIA SPORTSWEAR COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| (in thousands) | | 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | | |

| Net income | | $ | 223,273 | | | $ | 251,400 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | | 55,944 | | | 58,063 | | | |

| Non-cash lease expense | | 77,378 | | | 68,989 | | | |

| Provision for uncollectible accounts receivable | | 2,555 | | | 3,142 | | | |

| Deferred income taxes | | (6,204) | | | (5,135) | | | |

| Stock-based compensation | | 24,777 | | | 23,051 | | | |

| Loss on impairment of goodwill | | — | | | 25,000 | | | |

| Other, net | | (11,002) | | | 1,374 | | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable | | (11,803) | | | 123,830 | | | |

| Inventories | | 39,131 | | | 283,826 | | | |

| Prepaid expenses and other current assets | | 6,792 | | | 29,840 | | | |

| Other assets | | (710) | | | (3,148) | | | |

| Accounts payable | | 155,176 | | | (85,862) | | | |

| Accrued liabilities | | 8,815 | | | (62,239) | | | |

| Income taxes payable | | 1,991 | | | (8,800) | | | |

| Operating lease assets and liabilities | | (78,627) | | | (73,718) | | | |

| Other liabilities | | 3,556 | | | 6,684 | | | |

| Net cash provided by operating activities | | 491,042 | | | 636,297 | | | |

| Cash flows from investing activities: | | | | | | |

| Purchases of short-term investments | | (669,093) | | | (528,491) | | | |

| Sales and maturities of short-term investments | | 816,232 | | | 121,279 | | | |

| Capital expenditures | | (59,805) | | | (54,607) | | | |

| | | | | | |

| Net cash provided by (used in) investing activities | | 87,334 | | | (461,819) | | | |

| Cash flows from financing activities: | | | | | | |

| Proceeds from credit facilities | | — | | | 837 | | | |

| Repayments on credit facilities | | — | | | (837) | | | |

| | | | | | |

| Proceeds from issuance of common stock related to stock-based compensation | | 6,120 | | | 7,354 | | | |

| Tax payments related to stock-based compensation | | (4,871) | | | (4,681) | | | |

| Repurchase of common stock | | (317,756) | | | (184,022) | | | |

| | | | | | |

| Cash dividends paid | | (69,732) | | | (73,440) | | | |

| Net cash used in financing activities | | (386,239) | | | (254,789) | | | |

| Net effect of exchange rate changes on cash | | (10,587) | | | 389 | | | |

| Net increase (decrease) in cash and cash equivalents | | 181,550 | | | (79,922) | | | |

| Cash and cash equivalents, beginning of period | | 350,319 | | | 430,241 | | | |

| Cash and cash equivalents, end of period | | $ | 531,869 | | | $ | 350,319 | | | |

| Supplemental disclosures of cash flow information: | | | | | | |

| Cash paid during the year for income taxes | | $ | 76,104 | | | $ | 90,507 | | | |

| Supplemental disclosures of non-cash investing and financing activities: | | | | | | |

| Property, plant and equipment acquired through increase in liabilities | | $ | 10,735 | | | $ | 10,125 | | | |

| | | | | | |

COLUMBIA SPORTSWEAR COMPANY

Reconciliation of GAAP to Non-GAAP Financial Measures

Net Sales Growth - Constant-currency Basis

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | Reported Net Sales | | Adjust for Foreign Currency | | Constant-currency Net Sales | | Reported Net Sales | | Reported Net Sales | | Constant-currency Net Sales |

(In thousands, except percentage changes) | | 2024 | | Translation | | 2024(1) | | 2023 | | % Change | | % Change(1) |

| Geographical Net Sales: | | | | | | | | | | | | |

| United States | | $ | 682,287 | | | $ | — | | | $ | 682,287 | | | $ | 689,440 | | | (1)% | | (1)% |

| Latin America and Asia Pacific | | 187,591 | | | (323) | | | 187,268 | | | 174,655 | | | 7% | | 7% |

| Europe, Middle East and Africa | | 161,551 | | | (3,919) | | | 157,632 | | | 130,743 | | | 24% | | 21% |

| Canada | | 65,158 | | | 716 | | | 65,874 | | | 65,156 | | | —% | | 1% |

| Total | | $ | 1,096,587 | | | $ | (3,526) | | | $ | 1,093,061 | | | $ | 1,059,994 | | | 3% | | 3% |

| | | | | | | | | | | | |

| Brand Net Sales: | | | | | | | | | | | | |

| Columbia | | $ | 945,446 | | | $ | (3,077) | | | $ | 942,369 | | | $ | 891,357 | | | 6% | | 6% |

| SOREL | | 97,669 | | | (481) | | | 97,188 | | | 116,294 | | | (16)% | | (16)% |

| prAna | | 22,427 | | | 2 | | | 22,429 | | | 22,826 | | | (2)% | | (2)% |

| Mountain Hardwear | | 31,045 | | | 30 | | | 31,075 | | | 29,517 | | | 5% | | 5% |

| Total | | $ | 1,096,587 | | | $ | (3,526) | | | $ | 1,093,061 | | | $ | 1,059,994 | | | 3% | | 3% |

| | | | | | | | | | | | |

| Product Category Net Sales: | | | | | | | | | | | | |

| Apparel, Accessories and Equipment | | $ | 868,823 | | | $ | (2,431) | | | $ | 866,392 | | | $ | 823,365 | | | 6% | | 5% |

| Footwear | | 227,764 | | | (1,095) | | | 226,669 | | | 236,629 | | | (4)% | | (4)% |

| Total | | $ | 1,096,587 | | | $ | (3,526) | | | $ | 1,093,061 | | | $ | 1,059,994 | | | 3% | | 3% |

| | | | | | | | | | | | |

| Channel Net Sales: | | | | | | | | | | | | |

| Wholesale | | $ | 459,859 | | | $ | (3,459) | | | $ | 456,400 | | | $ | 428,873 | | | 7% | | 6% |

| DTC | | 636,728 | | | (67) | | | 636,661 | | | 631,121 | | | 1% | | 1% |

| Total | | $ | 1,096,587 | | | $ | (3,526) | | | $ | 1,093,061 | | | $ | 1,059,994 | | | 3% | | 3% |

(1) Constant-currency net sales is a non-GAAP financial measure. See “Supplemental Financial Information” above for further information.

COLUMBIA SPORTSWEAR COMPANY

Reconciliation of GAAP to Non-GAAP Financial Measures

Net Sales Growth - Constant-currency Basis

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | Reported Net Sales | | Adjust for Foreign Currency | | Constant-currency Net Sales | | Reported Net Sales | | Reported Net Sales | | Constant-currency Net Sales |

(In thousands, except percentage changes) | | 2024 | | Translation | | 2024(1) | | 2023 | | % Change | | % Change(1) |

| Geographical Net Sales: | | | | | | | | | | | | |

| United States | | $ | 2,068,228 | | | $ | — | | | $ | 2,068,228 | | | $ | 2,241,437 | | | (8)% | | (8)% |

| Latin America and Asia Pacific | | 560,706 | | | 13,715 | | | 574,421 | | | 519,754 | | | 8% | | 11% |

| Europe, Middle East and Africa | | 511,778 | | | (5,300) | | | 506,478 | | | 469,237 | | | 9% | | 8% |

| Canada | | 227,870 | | | 2,332 | | | 230,202 | | | 256,775 | | | (11)% | | (10)% |

| Total | | $ | 3,368,582 | | | $ | 10,747 | | | $ | 3,379,329 | | | $ | 3,487,203 | | | (3)% | | (3)% |

| | | | | | | | | | | | |

| Brand Net Sales: | | | | | | | | | | | | |

| Columbia | | $ | 2,917,678 | | | $ | 10,521 | | | $ | 2,928,199 | | | $ | 2,935,145 | | | (1)% | | —% |

| SOREL | | 238,266 | | | (257) | | | 238,009 | | | 336,688 | | | (29)% | | (29)% |

| prAna | | 104,087 | | | 6 | | | 104,093 | | | 113,623 | | | (8)% | | (8)% |

| Mountain Hardwear | | 108,551 | | | 477 | | | 109,028 | | | 101,747 | | | 7% | | 7% |

| Total | | $ | 3,368,582 | | | $ | 10,747 | | | $ | 3,379,329 | | | $ | 3,487,203 | | | (3)% | | (3)% |

| | | | | | | | | | | | |

| Product Category Net Sales: | | | | | | | | | | | | |

| Apparel, Accessories and Equipment | | $ | 2,687,174 | | | $ | 8,048 | | | $ | 2,695,222 | | | $ | 2,676,597 | | | —% | | 1% |

| Footwear | | 681,408 | | | 2,699 | | | 684,107 | | | 810,606 | | | (16)% | | (16)% |

| Total | | $ | 3,368,582 | | | $ | 10,747 | | | $ | 3,379,329 | | | $ | 3,487,203 | | | (3)% | | (3)% |

| | | | | | | | | | | | |

| Channel Net Sales: | | | | | | | | | | | | |

| Wholesale | | $ | 1,734,358 | | | $ | 2,062 | | | $ | 1,736,420 | | | $ | 1,874,003 | | | (7)% | | (7)% |

| DTC | | 1,634,224 | | | 8,685 | | | 1,642,909 | | | 1,613,200 | | | 1% | | 2% |

| Total | | $ | 3,368,582 | | | $ | 10,747 | | | $ | 3,379,329 | | | $ | 3,487,203 | | | (3)% | | (3)% |

(1) Constant-currency net sales is a non-GAAP financial measure. See “Supplemental Financial Information” above for further information.

Exhibit 99.2

DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H# Q# YTD in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately First half, second half Quarter 1, 2, 3, 4 Year-to-date

W E C O N N E C T A C T I V E P E O P L E W I T H T H E I R P A S S I O N S

• • • • •

• • • (dollars in millions, except per share amounts) Q4'24 Q4'23 Change Net Sales $1,096.6 $1,060.0 +3% Gross margin 51.1% 50.6% +50 bps SG&A percent of net sales 39.3% 38.2% +110 bps Operating income $137.3 $113.1 +21% Operating margin 12.5% 10.7% +180 bps Net income $102.6 $93.3 +10% Diluted EPS $1.80 $1.55 +16%

• • • • • • • • • • •

• • • • •

• •

• • • • •

• • • • •

• • • • • • • • • • • • • • • • • • • • •

• • • • • •

(1) Constant-currency net sales is a non-GAAP financial measure. See “References to Non-GAAP Financial Information” above for further information.

v3.25.0.1

| X |

- Definition

+ References

+ Details

| Name: |

colm_CoverPageAbstract |

| Namespace Prefix: |

colm_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

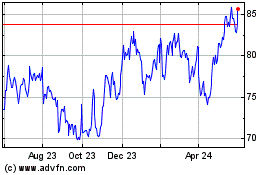

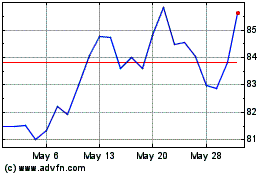

Columbia Sportswear (NASDAQ:COLM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Columbia Sportswear (NASDAQ:COLM)

Historical Stock Chart

From Feb 2024 to Feb 2025